Looking for the best credit card in India to suit your needs? You’re at the right place. Whether you need cashback, lounge access, complimentary hotel stays or business/first class tickets, you can find everything here.

I’ve analysed 200+ credit cards in India across various banks and compiled a list of best credit cards for 2024 & 2025 based on various user segments.

With about 10+ active credit cards in my wallet, below list covers most of the cards that I personally use and even more.

Table of Contents

Entry Level Credit Cards

- Suggested income: 5 Lakhs+

- Suggested spend: 1 Lakhs+

Entry-Level credit cards, also called as credit cards for beginners are those cards that are targeted at first-time credit card users.

SBI Cashback Card

- Best for: Upto 5% Cashback on Online spends

- Read Review & Apply: SBI Cashback Credit Card

SBI Cashback Credit Card is the HOT pick of the year for entry-level cardholders as 5% Cashback on online spends is lucrative even after the recent devaluation. With a pretty good max cap of 5,000 INR a month, it equates to 1L monthly spends.

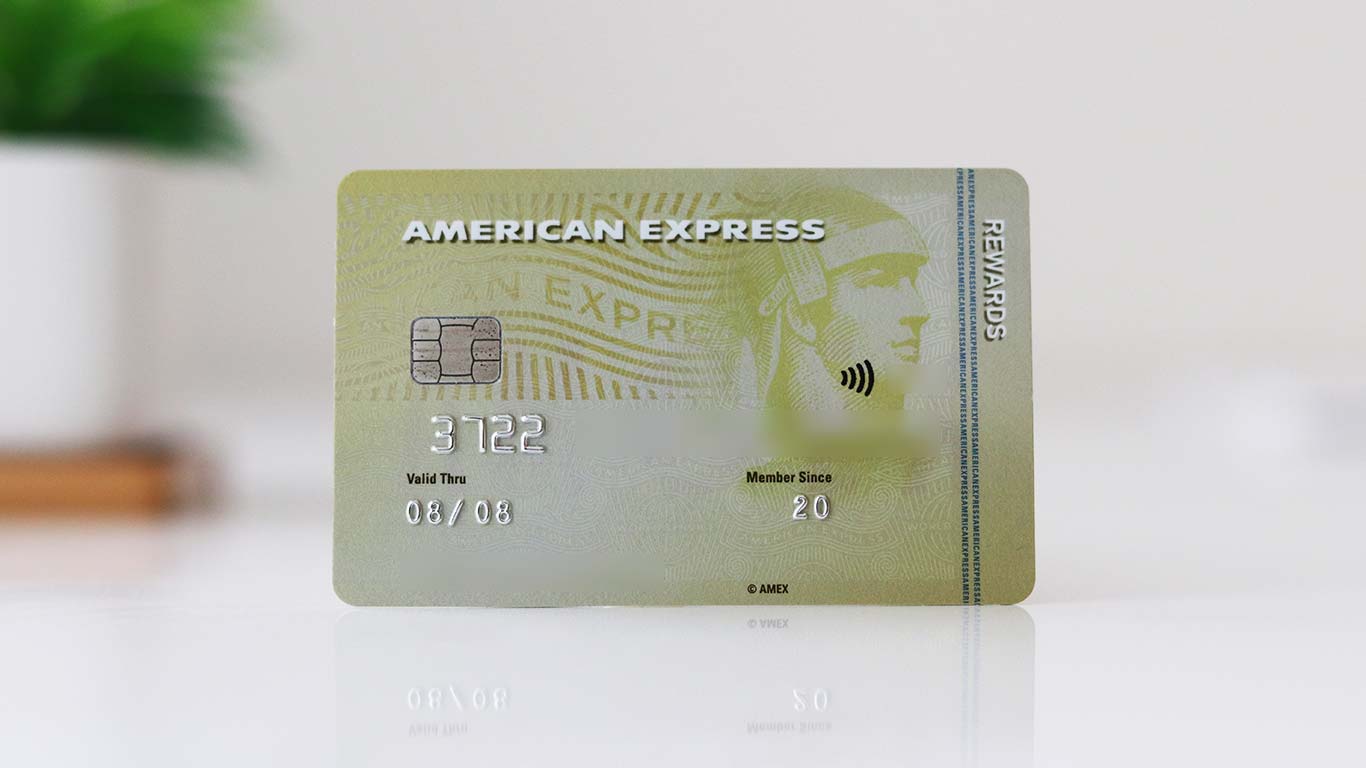

Amex MRCC

- Best for: Gold Collection & Points Transfers

- Read Review & Apply: American Express MRCC Review

American Express Membership Rewards Credit Card (MRCC) is the best way to get into the world of Amex. If you use this card just to get the 2000 MR bonus points monthly (20K spend), you can easily get a return of 6% on spends.

Apart from that, you will also get access to the amazing Amex Offers (merchant offers & spend linked offers) which are quite good most of the time.

ICICI Amazon Pay

- Best for: 5% return on Amazon spends

- Apply from Amazon App

If you shop frequently on Amazon and if you’re an Amazon Prime customer, you cannot afford to miss this wonderful card as it’s anyway a lifetime free credit card.

Premium Credit Cards

- Suggested income range: 12 Lakhs+

- Suggested spend range: 6 Lakhs+

Premium credit cards comes into picture when your lifestyle has pinch of luxury factor to it. It comes with more travel benefits like domestic and international lounge access, better reward rate, etc.

HDFC Regalia Gold

- Best for: Airport Lounge access & Milestone Benefits

- Read Review & Apply: HDFC Regalia Gold Credit Card

The most important benefit of this card apart from rewards & merchant offers is the ability to get add-on cards with Priority Pass for all family members, which shares the generous complimentary lounge access limit with the primary card.

For those who can’t get HDFC Super Premium credit cards, this is a wonderful alternative, especially for lounge access.

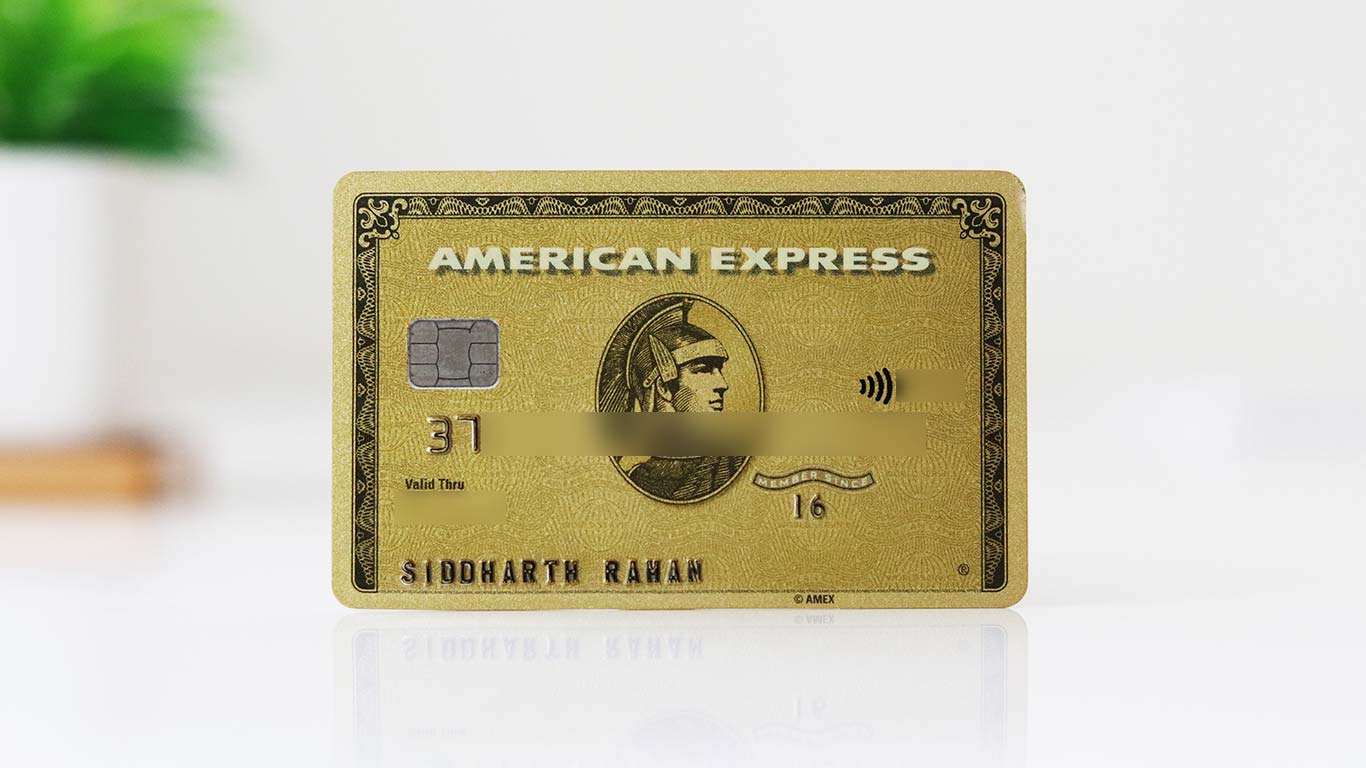

Amex Gold Charge

- Best for: Higher Credit Limit & Gold Collection rewards

- Read Review & Apply: American Express Gold Charge Card Review

If you’re looking for a higher credit limit but unable to get it via any other credit card, this is the one for you.

On top of that, You also get rewards on fuel/utility spends unlike most other credit cards in the segment. This is best used along with Amex MRCC to speed up the 24K gold redemption.

Yes First Reserv

- Best for: Online / Travel spends with 3X/5X subscription

- Read Review: Yes First Reserv Credit Card

Yesbank’s rebranded Reserv Credit Card (previously called as Yes First Exclusive) is a pretty good product when it’s coupled with the subscription plan that gives 3X/5X rewards on select categories depending.

HDFC Tata Neu Infinity Rupay

- Best for: UPI Spends & utility payments

- Apply Now (Review coming soon)

If you’re looking for a single UPI Credit Card, HDFC Bank Tata Neu Infinity Rupay Credit Card is the one that you need.

It not only gives decent rewards on UPI spends, but also offers lucrative 5% return on utility bills. On top of that, you also get targeted offers from Tata Neu, like the recent promo where a good discount was offered on booking your car with Tata Motors.

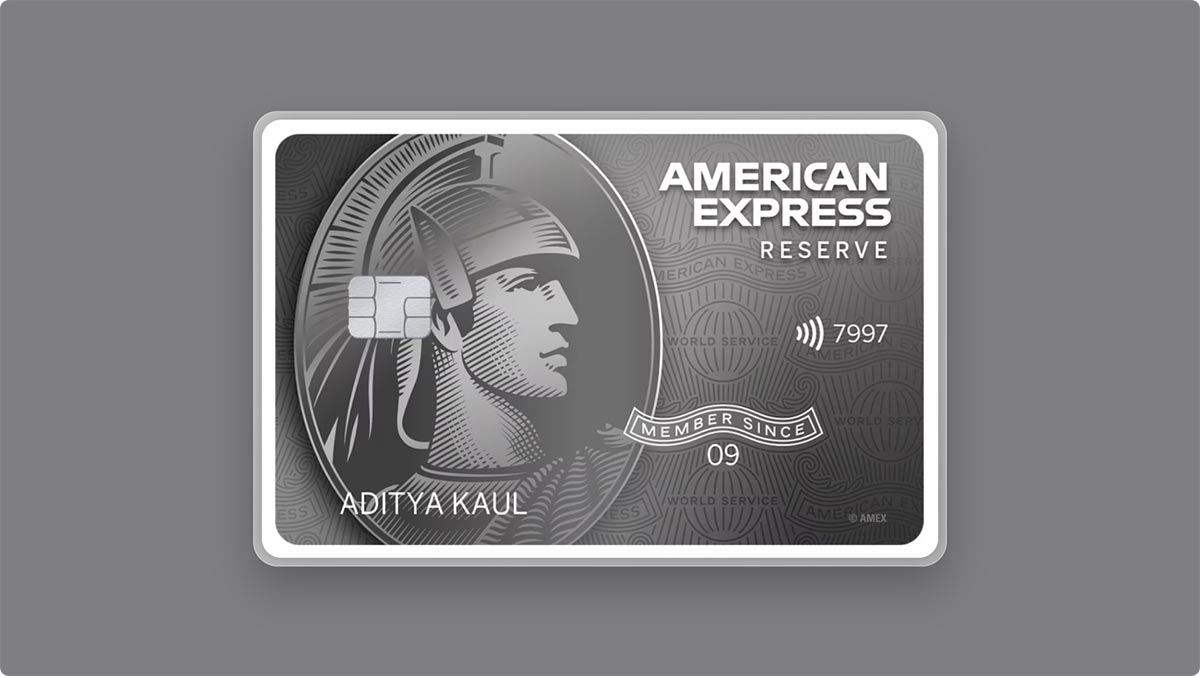

Amex Platinum Reserve

- Best for: Accor Plus Membership, monthly milestone.

- Read Review & Apply: Amex Platinum Reserve Credit Card

This is the first time Amex Reserve has made it to the list, thanks to the latest refresh on the credit card benefits, out of which Accor Plus benefit is a noteworthy one that gives up-to 50% off on dining.

Travel Credit Cards

When your life has good amount of travel, that’s when you need to have these exclusive Travel credit cards.

Travel & airline credit cards are designed in such a way that you get travel vouchers/points/miles instead of cashback.

Axis Atlas

- Best for: Accor, ITC & other airline transfers partners

- Read Review & Apply: Axis Atlas Credit Card Review

Axis Bank Atlas Credit Card comes with an amazing reward rate on regular spends and much more on select categories like direct hotels/airlines. It’s a hot pick for 2024 & 2025 and stands good even after it’s recent devaluation.

Amex Platinum Travel

- Best for: Taj Vouchers & access to premium airport lounges

- Read Review & Apply: Amex Platinum Travel Review

American Express Platinum Travel card is the best travel credit card in the country, hands down! It retains it’s name and fame for alomost a decade now.

I personally enjoy using this card as it helps me to stay at one unique Taj property every year by using the complimentary Taj Vouchers that comes with it.

HDFC Marriott Bonvoy

- Best for: for its lucrative joining/renewal benefits

- Review: HDFC Marriott Bonvoy Credit Card

While HDFC Bank’s Marriott Bonvoy Credit Card has poor reward rate on ongoing spends, it stands good for its incredible welcome and renewal benefits which can easily fetch twice or thrice the value of the joining fee.

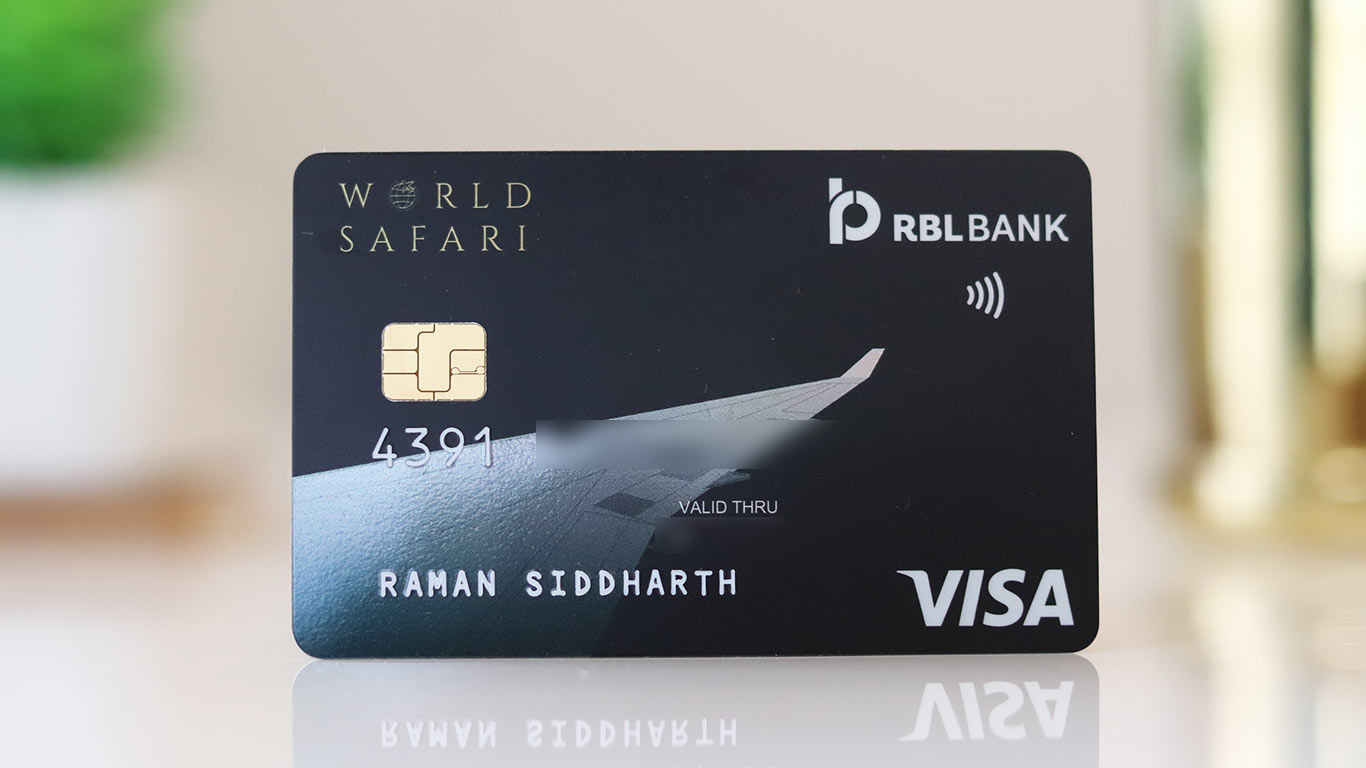

RBL World Safari

- Best for: 1 Yr Worldwide travel insurance, 0% Forex markup Fee

- Review: RBL World Safari Credit Card

RBL World Safari Credit Card is a hidden gem for frequent travellers as it not only offers the compete 1 Year international travel insurance but also comes with a 0% markup fee on international spends.

This solves the need for most international travellers without needing to get super premium credit cards or other forex cards for international travel.

Airline Credit Cards

If you’re a frequent traveller, you might also need to get one or more of the best Airline Credit cards. Airmiles/Airlines credit cards makes sense if you fly frequently with the specific airline. Here are some of the best:

SBI Air India Signature

- Best for: Flying Air India & select star alliance partners

- Read Review & Apply: SBI Air India Signature Credit Card

If your travel involves flying Air India for whatever reason, you shouldn’t be skipping this credit card. It demands high spends, but rewards very well on most type of spends.

Also, with the change in ownership and merging of airlines I’m hoping things with Air India to get better in 2024 and beyond.

Update: Currently banks aren’t taking applications for Air India & Vistara Credit Cards.

Super Premium Credit Cards

- Suggested income range: 20 Lakhs+

- Suggested spend range: 10 Lakhs+

Super premium credit cards are those that comes with higher reward rate, higher credit limit, unlimited lounge access, better card linked benefits & many more perks that you would need to enjoy a luxury lifestyle.

Axis Magnus for Burgundy

- Best for: Airport meet & greet services, miles transfer

- Read Review & Apply: Axis Magnus Review

Axis Magnus for Burgundy is the upgraded version of the previous “Magnus” with the ability to transfer points at 5:4 to the airline/hotel partners.

It also gives you new airport experiences with their complimentary airpot meet & greet service, which is useful for many.

If your spends are over 2 or 3 Lakhs a month even for few months in a year, this is perhaps the ONLY card you would ever need.

HDFC Infinia

- Best for: 5X Rewards with decent reward rate on regular spends

- Read Review & Apply: HDFC Infinia Review

Infinia is everyone’s dream for ages without an exception. If you are looking for a single credit card for all your spends beyond Axis Magnus, then Infinia will serve the need.

If you couldn’t get Infinia, Diners Black (pvc) is equally good with same reward rate, only the capping on accelerated rewards is lower.

HDFC Diners Black Metal

- Best for: 5X Rewards with quarterly milestone benefit

- Review coming soon

The primary difference from the old Diners Black (pvc) is the metal form factor along with higher smartbuy capping and the additional quarterly milestone benefit which is useful for regular high spenders.

If you’re into business, you should instead go for the HDFC Diners BizBlack Credit Card to earn lucrative rewards on tax and bill payments.

Only downside though is the lower acceptance of Diners cards in India compared to Visa/MasterCard, which means you have to keep a backup card handy.

ICICI Emeralde Private

- Best for: Welcome benefit & decent ongoing rewards

- Read Review: ICICI Emeralde Private metal Credit Card

ICICI Bank’s Emeralde Private Credit Card, an invite only card at the moment, is perhaps the first ever credit card in the history of ICICI Bank credit cards to carry a good reward rate of 3% on regular spends.

Yes Bank Marquee

- Best for: rewards as shopping vouchers

- Read Review: Yes Bank Marquee Credit Card Review

Yesbank’s newly launched Marquee Credit Card is a pretty good Super Premium Credit Card especially if your spends are largely focused online, as it gives you amazing 4.5% reward rate on online spends.

Ultra Premium / UHNI Cards

The ultra premium credit cards are generally different from other type of cards because these cards not only gives rewards but also intend to give you returns via card benefits.

Some of the benefits include: hotel privileges, concierge, meet & greet, airport transfer, first class upgrades, premium support, etc.

Amex Platinum

- Best for: hotel benefits & concierge

- Read Review & Apply: Amex Platinum Charge Card Review

Most of the Amex Plat cardholders that I know have it for the Marriott Bonvoy Gold membership benefit which is quite useful in India.

Other than the tangible benefits, their “Do Anything” platinum concierge is worth it for those who have the lifestyle to make use of it.

The expensive metal card makes sense if you know how to get equivalent value out of the joining fee. The newly introduced luxury redemption options are quite useful as well.

Axis Burgundy Private

- Best for: Very high spends, miles transfer

- Review coming soon

If your spends are very high for Magnus and can hold a relationship of 5Cr with Axis Bank, then Axis Burgundy Private is the option.

While it requires high NRV with bank, the rewards and benefits that comes with it for very high spenders are phenomenal.

HSBC Premier

- Best for: Rewards on all kinds of spends

- Read Review: HSBC Premier Credit Card Review

HSBC Premier Credit Card with it’s upgraded features and benefits is certainly useful for those who prefer to enjoy rewards on all kinds of spends.

While it’s primarily a good card for existing HSBC Premier customers with medium spends, one should consider Magnus for Burgundy if the spends are high.

Choosing the right Card

Choosing the best credit card is lot simpler than how it used to be in the past, thanks to all the aggressive credit card offers around.

#1 If you’re new to the game and have relatively low annual spends (<5L) with significant online spends, get the SBI Cashback Credit Card and you’re done.

#2 If you spend >15L a year, get Axis Atlas along with one or two more cards that would suit your lifestyle.

#3 If you spend over >30L a year, you likely need Axis Magnus for Burgundy along with HDFC Infinia among others.

FAQ’s

Which is the best credit card in India for 2025?

Calculate your annual spend and choose the cards from the list above. The best card varies from one person to another.

How many Credit Cards can I have?

As many as you need. Start with 2 cards if you’re new to the system and increase the count gradually based on your spends. 5 cards is sufficient for most.

Which Credit Card has best customer service?

Amex is known for their premium customer support. You may also enjoy a similar treatment with any bank, as long as you take their super-premium cards.

Which Bank’s Credit Card is best in India?

HDFC Bank is the market leader and has very good merchant offers as well. So start with HDFC and add others as per your requirement. Consider having one Amex card for a mix.

Which is the best fuel credit card?

That’s a million dollar question as it’s quite a complicated subject that deserves a long answer. There is a modern method to save well over 10% on fuel spends, checkout Best Fuel Credit Cards in India article for a detailed coverage on that.

Bottomline

After few years of making short lists, now the list has got bigger just as it used to be before, thanks to the devaluation of Magnus.

The list will be updated from time to time to keep it relevant. So feel free to bookmark the page for quicker access.

What’s your thoughts about the above list of best credit cards for 2025? Feel free to share your opinion in the comments below. We shall amend the list if required.

Can you please elaborate on upgrade process for emeralde private?

What limit is required for upgrade?

Preferably ~10L on Sapphirro/Emeralde. Upgrades from lower end cards may not work even if limit is like 15L, as I did see one such case recently.

I’ve around 10+L limit on my existing ICICI Emeralde but I’m not getting upgrade reflecting on my imobile app. Have 4 CC’s with them.

Any update on 10L limit @siddharth??

which credit card best for utility or govt spends

Thanks Sid. Great post as usual. My thoughts on two card:

I do not see HSBC Premier a good fit that too in UHNI Cards even for someone with HSBC Premier relationship as the effective reward rate is just 1.5% (not everyone wants Apple voucher).

I think Citi Prestige needs to be in the list even with the uncertainty about Axis replacement card as this gives no-nonsense 4% miles earning opportunity (8% on international spent), overseas medical insurance of USD 50,000 and unlimited use of priority pass in domestic lounges as well. The annual fee is well compensated by miles and Taj/ITCvoucher.

Have you received the reward points for Yes Reserv card?

Not yet fulfilled.

What’s unique this year is almost every bank has something to offer in for one or the other segment, last year was dominated by Axis and Amex. Noticeable dropouts are Idfc wealth and Axis Reserve, while SCU is less super premium than it used to be.

Yeah and will likely remove SCU and add IDFC Wealth in sometime.

Thanks for adding Idfc wealth. It stands out for being LTF and providing spa access as well as railway lounges.

Hai Siddarth,

I am a biggest fan of ur blog for the genuine and crisp review. I will be grateful if your reply me back.

I am currently using non metal version of HDFC Infina credit card and being offered paid metal upgrade. Is it wise to deny the upgrade or better to upgrade please suggest.

Thanks for the kind words.

Upgrades are usually FYF and I don’t see a reason to pay for it unless you’re looking for upcoming Infinia Reserve, as metal with good spends may get quicker access to it.

nice list. But really looking forward to a good premium card with good reward structure. The market as of now has matured no major shaker card in the market now.

We are like mr.bean waitiiiiiiiiiiiing on the road (for infinia reserve) 😛

Hey Sid, I am following your blogs since 2 years now and your website is goto channel for getting reviews on any credit card.

Now coming back to my question, I did do so much of enquiries and I heard from HDFC staff that Infinia Reserve is already live but only 20 to 50 in numbers. Do you have any news about it? Really looking forward to know about the Infinia Reserve card.

Thanks!

From what I know, Reserve is still in “test” phase ever since I reported about it since “galaxia” rumours. While I’m expecting to go fully live in the next 2-4 months, they may or may not meet my expectations. 🙂

Nice post Sid. Thank you

Hi Sid,

Like to add some insights on ICICI Emeralde Private Metal Card.

I’ve LTF Sapphiro. Few months ago, I could see pre-approved ‘Paid’ Emeralde PVC on iMobile, obviously gave it a pass.

In Nov last year, came to know about the Private metal card. Contacted ‘Wealth Management’ customer care and response from them to contact RM. But since (both of my HDFC &) ICICI RMs are useless (the least I can term them), again contacted customer care and surprisingly this time got it approved (paid).

That’s interesting. May I know when it was approved by the support? As the functionality was not enabled a month ago.

It was approved in mid Dec (probably 18th).

Initially support staff mentioned, I can’t assure you but I can try for it. Surprisingly 2 days later, I got it approved.

Nice, so then it seems anyone can raise this SR, just like they do at the branch and it’s probably upto the backend to decide. Nice info.

Hi Pranab. Even I am getting the Paid Upgrade offer for Emerald PVC. I have two CCs with ICICI. Was your limit above 10L with your existing CCs with ICICI. ?

And since I don’t have any other Banking Relationship with ICICI can you suggest a better way for Emerald Private Upgrade.?

Hi Anubhav,

Yes, my existing limit is above 10L.

I’ve 19 years of Salary account (Wealth management) with ICICI. But don’t think that helped me to get the card. Only plus I’ve got is getting the support executive directly (without any IVR or queue).

IMO, the most important part is to get connected with a good support executive.

The first one and also my RM expressed his/her inability (rather my ineligibility) but the second one (after approx 10 days) got me the card. You can try the same.

Any specific upsides to ICICI Emerald private? compared to Infinia or similar cards.

Great card list. International airlines cards need to up their game. I guess no point in getting ethiad, emirates or qatar/ba card as rewards are low on ongoing basis.

Hi Sid,

Does HDFC still gives good merchant offers in 2024 other than official Apple store purchase?

Nowadays I’ve hardly found HDFC giving discounts also if someone is buying Apple products they’re available at lesser price at both Amazon/ Flipkart.

Last big billion sale, SBI/ ICICI/ Kotak lead the way and no where HDFC was found.

Thanks

I actually meant the Apple offer with that line, I’ll update the same shortly.

Superb list as always !

Can you please elaborate on “load your ICICI Fastag using Amazon Pay balance and enjoy 5%-15% on fuel depending on the cards you hold.”

Does it work with ICICI fastag only and if it’s same or different from Amazon ICICI fastag ?

How does it work ? you mean purchase gift card, add in amazon pay and then recharge fastag.

Hi Sid, have been looking forward to this for a while.

The Infinia has regained the top card in India spot I guess. Magnus B isn’t the easiest to get and after Axis’ hit job on the regular card, think the 2 HDFC cards are back on top… SC Ultimate is not worth considering a super premium card in my view. The lounge access isn’t extraordinary, nor are the other benefits. What makes it worse is the absolutely godawful reward redemption options. That SCB Reward portal has to be the most pathetic such portal in the world. Have been receiving Ultimate offers on my Super Value Titanium, the Titanium with the little cashback it gives on fuel and bill pay, is a much better card. The only cards worth it from the SCB lineup would be the SC Smart and Titanium.

Bit surprised to see none of the AU cards in there, the AU Zenith is in reality, a far better card than the SC Ultimate.

Noticed the IDFC cards don’t even make it to the entry level options, yes, ICICI AmazonPay has to be the king there along with SBI Cashback, but the IDFC Wealth/Select, and even Flipkkart Axis, despite recent devaluation, can earn a place there.

Alright, so I’ve removed SC Ultimate and added IDFC Wealth.

AU LIT card probably is good in entry-level but given that their issuance is limited, we couldn’t suggest it as a mainstream card for now.

Any USP you see with Au Zenith?

Well said Mahesh . My thoughts exact and thanks Sid for updating.

After lots of thought I got IDFC Wealth CC, few weeks ago and seeing it in your list makes me proud of my decision. Currently for non-premium cards, IDFC Wealth is the only one which rewards edu fee.

Zenith gives one of the best in the market return on offline dining. Useful as every restaurant isn’t covered by Eazydiner/Dineout/Zomato Gold. The card also has a fairly decent lounge access program, the list of exclusions when it comes to rewards are minimal. Decent returns on Zomato/ Swiggy/grocery in general. For high spenders, there is the Accor membership as well. Miles better than Ultimate. SC Ultimate, India’s best no-nonsense card for the longest time, is now missing the No.

I actually still like SCU even after the downgrade last year. The voucher list has diminished but still gives flexibility with a decent set of options . i only use this for those vouchers. be it Marriott or ITC and even decathlon. Also got some good samsonite luggage where price was same as Amazon.

Also i consider it as a INR 900/- card .

Last but not the least 5% cashback on duty free has worked for me as i travel internationally few times a year.

I think AU Zenith+ should be there. I got it the moment it was launched last year and honestly love it.

And the reason being?

Zenith or Zenith Plus?

Zenith

For 75K pm spend, Zenith Plus gives 1500 RP plus 1000 bonus, so combined value is 3.33% . Whereas Zenith gives 5% on dining but it’s 2.5% and 1.25% on other categories. Quarterly milestone is another 0.5% but still doesn’t add upto 3.33% . Railway lounge is there with Zenith, while Zenith Plus gives Airport meet & greet.

One can ignore Epicure benefit on both, and annual fee is not an issue either. Overall felt Zenith Plus has a slight edge.

Agreed. Also the initial fee of 5000+ GST , I have got 5000 reward points which is equal to 5000 rupees which I redeemed for Amazon gift card. And apparently I will get 5000 points each year . So the only fee for the card is 900 GST. Also last December I was able to use the card extensively in Hong Kong thanks to the 0.99% foreign currency markup.

My Application was rejected as per the message Zenith card is not available in Bangalore. [December, 2024]

Hey Siddharth,

I also wanted to know more about your comment regarding “load your ICICI fastag using Amazon pay balance and enjoy 5%-15% on fuel”.

I’m unable to establish any connection between the fastag and savings/cash back on fuel, unless of course there’s a feature I’m not aware of.

Could you please elaborate on that point and explain clearly what you meant??

Also, I wanted to know if you have a recommendation in terms of getting a credit card for fuel. I only go to Indian Oil petrol pumps and have tried getting the Citibank card, but got denied because of the location I’m in (the pincode is blacklisted I guess).

Really appreciate what you do man and thanks in advance.

What is this hidden trick that every Apay card holder needs to know?

You can use your Fastag for fuel payments at certain fuel pumps.

Hi Sid,

I think SC smart deserves to be in the list, with its 2% cashback on all spends (including insurance, rent, tax payment etc) except fuel, card user need not remember it while using it. Your thoughts?

Getting the card is the problem for most. But good to know that they’re still giving points on all spends while they don’t on Ultimate.

Another card which I find interesting is HSBC cashback card for its 10% cashback on dining and grocery spends and 1.5% cashback on other spend.

Hi Sudip,

I must correct you, StanC Smart CC doesn’t give RP’s on Rental payments anymore instead they have started charging 1% additional fee on such payments. I have this card and recently got LE from 2.64L to 7.92L, such a big leap. With this limit, is it worth to take StanC Ultimate with the limited redemption options it has?

@Siddharth- What’s your take on this?

Hi Rohit,

Agree with you however even post charges you can get .82% reward rate on rental payments.

Hi Rohit,

I couldn’t find what categories it rewards 2%. Will it reward for edu fee, taxes, govt. services ?

Hi Balaji,

SC Smart CC gives 2% upto Rs. 1000/- on all Online spends, there is no category excluded. But Rental transactions will attract 1% processing fee + GST.

Offline spends will give 1% upto Rs. 500/-

Nice article. Can we have a category for Forex Spend cards.

I guess you missed the bracket of 5L to 15L while recommending the best cards… Can you update this please?

Also, how to make use of Amazon pay for rewards? Loading up the wallet from Atlas gives edge miles?

Great article, Sid.

I have one query, though. Is it advisable to upgrade a LTF HDFC DCB (PVC) to ‘paid’ Infinia (FYF)?

Mostly yes. But also if –

1)smartbuy per day limit causing an hindrance

2)you use your card at stores and diners not supported at your places

3)you travel outside india and diners has poor acceptance

Certainly with eyes closed.

But this is how I look at it. You can answer the following questions for your answer:

1. Do you often exhaust your smartbuy 3x/5x/10x limit on DCB ?

2. Do you ever face acceptance issues for DCB?

3. Can you meet the spend limits for a fee waiver?

Many of the DCB users (few I know personally) would love to get this option.

Do let us know what you chose.

I mainly found that 5x v/s 3x benefit on Vouchers for Infinia and the fact that they have higher monthly capping at 15K v/s 7.5K for DCB base version, Infinia paid is a good proposition. For most high spenders, anyway the annual fees will get waived off due to annual threshold being reached. Worst case, HDFC will anyway give you equivalent points for the annual fees.

Net net Infinia upgrade is ALWAYS worth it, especially given it’s a Visa card.

I think LTF Diner is still best option. Diner is accepted in lounges around the world easily without hassles. You don’t need PP for lounges as well. Lounges are unlimited, even for add-on card holders.

If you spend more than 80,000 INR in a month then you will get more monthly benefits of 1000Rs and if you spend 7lacs in a year then their is annual Milestone benefits as well.

You can redeem your rewards 1:1 on flights as well through smartbuy.

Also 3.3% hassle free rewards are there always on all spends. Most metro cities accept Diners black card. Diner is father of credit cards if you see through past. they only started credit card system.

So if you have LTF then it’s no nonsense credit card with 3.3% rewards.

Can somone please suggest which card in the above list give reward points for payment of Income Tax?

Your best bet would be Axis Atlas. Amex Gold, SBI Air India Signature and ICICI Amazon Pay cards also give rewards on govt transactions. Choose as per what your goal for redemption is: Miles or Amazon vouchers.

IDFC Wealth CC 1.5% for the first 30K of the billing cycle, later 2.5%.

I payed advance tax recently and did receive.

Post of the Year. Excellent article

Dear Sid,

As usual a great post. One that most of us wait and keep looking for, all year round.

This opens my eyes to upgrading my strategy for my bouquet of cards.

How is your experience, (if any) of moving from Citi cards to Axis cards? Are they doing it now?

I never have a Citi card to experience this but from what I hear, it is not happening yet.

Neucard is not that great as far Utility bill payments are concerned. It has max cap of 25K for a bill payment transaction. Insurance premium less than 25K only will enjoy 5%. However the Rupay varient of the card is best since it gives 1.5% cashback on UPI transaction.

Sid,

Is there anyway to convert Axis ACE to LTF ?

Not that I’m aware of. First I see many having trouble in getting ACE. 🙂

Hi Sid,

Its true. When ACE was introduced, every other person was interested in getting that card. When I applied for that card, bank person told me due to mad rush for this card, bank is very selective in giving the approval. As it was a game changer that time. But now, with many conditions in place, this card is not so good. But yes, much better than SBI Cashback at least it has transparency in giving cashback per transaction. ACE & LTF, no ways. Not until further devaluation.

Hi Sid,

I have been trying to get wealth card upgrade for more than 1 year now. IDFC is neither increasing my limit nor upgrading my card.

Any tips to get my IDFC SELECT card upgraded to WEALTH card.

Thanks Sid. Wanted to check if any good alternative to Axis Magnus for flight reward points. The booking system on Travel Edge portal is extremely slow and cumbersome.

Best as always. 🙂

I am wondering why Axis Airtel, HDFC Swiggy, IndusInd Eazydiner couldn’t fit in the list of 25 best credit cards 🤔

Hi Sid

If considering a card for milestone benefits with a spend of ~10L/annum of government transaction/tax payments and rent, which of the below is recommended:

a) SBI Air India

b) SBI Vistara Prime

c) IDFC Club Vistara

Does sbi vistara prime give point for rent spends? And does it consider rent spends for annual spends calculation?

I want to apply for INDUSIND tiger cc but indus ind site has no option for selecting this card .

Bajaj says I can apply only only through indus ind

Pl guide

Hi Siddharth

I currently have a HDFC Infinia and Axis Reserve. Does it make sense to switch the Axis Reserve for Amex Platinum? I have a lot of international use also.

Holding Amex Plat Travel recently got a offer to Upgrade to Platinum Travel Reserve card doesn’t seem useful as long as utilities/fuel are not covered for points plus half the places i have shopped/dined at have rejected amex that too in Mumbai due to high seller/business charges would have hit 4lp bonus milestone easily. wondering if renewing this card will be worth it,did get my milestone bonus of 1.9 that too because i paid college fees with it but beyond that idk how useful.

Any Mid range variant card for paying rents without any additional charges and also suggest me some sites to pay. Currently I’m paying via CRED which is charging me 1% as service charge and apart from that the cards I’m holding (HDFC regalia, ICICI Amazon pay, SBI) are no longer providing any benefits for paying. I would appreciate if anyone could suggest me for one card for utility payments with some benefits in either reward points or cashback.

Even it is in premium segment cards are also fine.. I’m ready to explore!

Rent – forget it . Even milestones are not considered now.

Bills – Axis ACE 5% upto 500 INR. later 2% .

You may also explore wallet rewarding cards like Kotak White or others (used Emeralde Private earlier, now they stopped rewarding Wallet loads from 5th Feb I guess), load PayZapp and pay via no broker where you won’t end up rent surcharge, however no broker charges their fee

Pay on Redgirraffe.com using tata neu infinite for rent

Hello Sid,

Excellent article and thanks for providing all the details. I recently revamped my CC portfolio and your article certainly helped a lot.

Based on this, I current have a 5 card strategy

1) ICICI Amazon Pay LTF

2) ICICI Sapphiro Master Card LTF

3) ICICI Sapphiro Amex LTF

4) HDFC INFINIA

5) IDFC Wealth LTF

So planning to use (4) as primary, (5) for backup on large spends, (2) and (3) for Festive offers in each network from ICICI and (1) for large >20K spends on Amazon.

Please share your thoughts and suggest if any additional cards could be useful.

Thanks,

Rudra Chowdhury

You are the best!!

Hello Sid,

As usual amazing post with updated card variants, their details & respective conditions.

I would like you to take some time and start giving reviews for best debit cards as well.

To start with – AU ROYALE Banking visa signature DC, HSBC Savings account DC etc has unmatched advantages like a decent CC.

Hoping to see the DC vs CC debates as well.

I am a simple man with simple needs.

What is the one card that will help me most with free movie tickets and good dining offers? I have PVR and Cinepolis near my place and use both BMS as well as Paytm movies. For dining out, I use Easydiner/Zomato/Swiggy.

Helps if the recommended card is lifetime free 🙂

Thanks in advance.

Hi Sid,

Amex gold collection is revised from today and its mostly a devaluation for people who are into amazon/ flipkart vouchers, etc. Croma is removed, reliance digital voucher is added.

Can you update the same in your AmEx MRCC review.

Thanks.

Will do something this week.

Hey Siddharth,

Just had a word with Axis people and got to know that Axis Vistara Cards are being phased out and no info on new cards with Air India. Your Thoughts?

IndusInd also stopped issuance.

While I’m unsure of any developments, I’m assuming that they might alter the features little bit and start issuing soon.

Reward points on Grocery via HDFC Gyftr now restricted. Only ₹1,500/- each worth Big basket and Blinkit vouchers can now be purchased in a calendar month, as per pop-up while trying to add more to cart. This seems to have happened from 1st March as I recently purchased 5k worth vouchers in February. Huge devaluation of sorts as points restricted to ~300 in this category.

Is there any card which still provide any benefits on Rental payments?

Use tata neu infinite on redgirraffe.com

Any thoughts on using credit card to pay down payment of house/flat. I have come across deals where we can directly pay the builder say dlf or godrej the initial 10% amount of the flat via credit card. Hence, such transactions can be 10 lakh worth easily. Which set of credit do you think can be used to make best use of it? Say like doing 2L worth transactions from say 5 different cards?

I have amex mrcc, tata neu infinity, idfc select, SBI cashback, ICICI Amazon, hdfc regalia, hsbc platinum, kotak myntra

Hi Sidharth,

Great article but I can see that there are no cards on AU bank present. I believe AU Ixigo card is also a great card for international spends as it offers zero forex markup. And it is being offered LTF right now, which makes it a better pick than RBL world safari card.

AU is still not issued in many cities is a concern, will probably add AU cards to list by mid 2024.

does it provide international travel insurance, like the RBL SAFARI?

Thanks for good Article. I’m holding Axis Magus Credit for couple of years.

Magnus Monthly milestone benefit 25,000 points on 1L spend (per calendar month) discontinued from 1st Sep 2023. After changes, i feel the card is not useful.

Can you suggest some good premium credit card like Magnus.

I’m not frequent traveller. The reward points i like to redeem as gift voucher or cash. FYI – I’m also holding HDFC Diners Black Credit card (Non Metal)

Most of the premium cards are targeted for travel categories. The reward rate when redeemed against GVs will not be as good as in travel category. Magnus was good till it lasted as it gave about ~9% against AGVs.

Now, if you are not a frequent traveler SBI CashBack is good enough. You can try to upgrade HDFC DCB to Infinia by mailing to grievance addressal. Even with Inifina if you buy AGVs and redeem against AGVs via SmartBuy, your effective rate is just 6.9%. And you can buy a max of 20K AGVs per month.

LTF DCB to infinia is not free upgrade.

Hi Siddharth, any card for government transactions (advance tax) from which we can benefit after paying the gateway transaction charges?

Even me too want to know for Government Payments like Income Tax, Tally TSS Renewals etc.

I use Standard Chartered Ultimate. It gives 3.3% return on govt payments (correct me if I’m wrong).

Hi Sid,

Is HDFC bank working on a credit card in collaboration with Apple? Is it true?

Axis murder*d the Magnus and finally buried the reserve!

Well said!

Just received Mails from axis bank, Devaluation on both ACE and Airtel Cards

Update regarding your Axis Bank ACE Credit Card

While you continue to make the most of your Axis Bank ACE Credit Card, we would like to update you regarding a few changes to the features on your Credit Card, effective 20th April 2024:

Unlimited cashback on all eligible spends other than transactions on Google Pay or preferred partners has been revised from 2% to 1.5%.

Utility spends on any other platforms except Google Pay will not be eligible for cashback.

Update regarding your AIRTEL AXIS BANK Credit Card

While you continue to make the most of your AIRTEL AXIS BANK Credit Card, we would like to update you regarding a few changes to the features on your Credit Card, with effect from 20th April 2024:

The maximum cashback on Airtel Mobile, Broadband, Wi-Fi and DTH bill payments via Airtel Thanks App in a statement cycle has been revised from Rs. 300 to Rs. 250.

The maximum cashback on other utility payments such as gas, electricity, etc., via Airtel Thanks App in a statement cycle has been revised from Rs. 300 to Rs. 250.

Utility spends on any other platform except Airtel Thanks app will not be eligible for cashback.

For Both Cards :

Effective 1st May 2024, access to domestic airport lounges will be based on a minimum eligible spend of Rs. 50,000 in the previous 3 calendar months. In the case of a newly issued card, the minimum spend criteria is waived for the month of card issuance as well as for the following 3 calendar months. For more details, please click here.

Similar email for Axis MyZone card as well.

Need suggestions.

Considering the devaluation with Axis ace card, please suggest the next best card specially for offline transactions. (with preferably non-travel benefits)

Faced problems with MRCC at many places, Amazon icici and sbi cashback has only 1% points for offline transactions.

Any good paid card with similar benefits may also work.

Also, is there any way to get the axis card fees waived off or get a better card ?

I would suggest you take a look at HSBC cashback credit card. It offers good benefits if your top spends revolve around grocery shopping and Dining

Can you suggest one or two good UPI credit cards. Not sure if its already in the list, I was not able to find one. Thanks you

Hdfc tataneu infinity, first year free.

I have around 9 cards – all in good standing and around 20 years of history. Limits 1L to 14L on card. Recently, AU Bank, Scapia, SBI Cashback all denied me a card without explanation. Housing loan prepaid in advance and closed.

Scores are also 780ish depending on the bureau.

One card offering me a secured card??

Anyone has any clue why these denials?

Maybe they are being cautious. They may be looking at customer who has low number of cards like a customer with more than 4 cards won’t use their card as primary card. Even I was rejected AU LIT which is a pretty basic card without explanation even after approval from their portal.

i have a yearly spend of over 50 lac but 35L out of that is utility bills for my business which i was paying via my axis magnus card. i also have a diners black. Both cards have been devalued and my rewards have crashed badly. plz suggest the best card for me and which one would yield best rewards. thankyou

Hey Sid, which card is good for insurance these days? have around 2lakh premium to be paid.

On a side note I recently got yes private debit card, used it to pay education fees. reward rate is horrible. only 10 basis point or 0.1%

HDFC Infinia is good with decent daily cap on points.

Thank you Sid.

There’s some buzz today that CV miles will be transferred to FR at 1:1 when vistara merges with airindia. Validity will be 1yr or existing CV miles validity, whichever is higher. If verified, this is going to be a dilution for CV miles holders for most of the travel segments. For eg, DEL-BLR requires 7500 CV miles compared to 13500 FR miles. Moreover vistara used to offer bonuses on points to miles transfers every year, so the value was even better. Only in few segments, such as international biz class or higher, does FR provide better value than CV. Overall disappointing as they should have given a one time bonus on the migration.

Hello

Me & My parents live in different city & I transfer monthly amount to them.

Is there any way I can do this via credit card & get Mile stone benefit?

I have AMEX Platinum travel card & HDFC Regalia Gold

Nope.

Hi Sid,

Nice query.

As i was going through other comments in this article itself, an idea crossed my mind.

People are saying they get reward (or atleast milestone benefit) by using Redgiraffe for rent payment on their HDFC Tata Neu card. Since i have never used Redgiraffe, i cannot comment. But if it does give benefit, pay your parents rent through it.

Hope it works, others using it please add/comment.

Yes .pay them rent via tataneu card via redgiraffe

Hi Siddharth,

What could I replace my Citi Prestige card with, as I think it will be discontinued soon? My spending is mostly for business expenses, amounting to upwards of 50 lakhs a year. I have used most of my rewards on flights.

Some little buzz has started about Axis Primus, beats Plat with a whopping 1.8L+gst fee, only below Centurion. Very little is disclosed so far, but another decent and affordable variant from Axis is Olympus, replacing Citi Prestige, same fee of 20K +gst pa.

Axis Primus Credit Card is nothing but a replacement of Citi Ultima. 🙂

Could we possibly have a review of Citi to Axis cards, and their main features, and how new customers can get hold of the migrated cards?

Hey, Can you post or do you have a post on best card which provide complimentary Golf?

Icici emeralde metal

HDFC Infinia

Hi Siddharth,

I was introduced to your blog recently and I have been loving the content here.

I am currently using Axis My Rewards card and HDFC Regalia. I also had a CITI Rewards card which I deactivated ~2 years ago.

My needs are being met by these cards as my annual spending is not that high. I have the priority pass for international lounge visits and prefer using my reward points for gift vouchers or hotel specific points.

I wanted to check if you would suggest a premium card to replace both of these which would grant me better privileges while keeping the above as the same?

Thanks!

Hi Harsh,

Keep using regalia for upgrade or atleast being in HDFC ecosystem. HDFC knows the industry well.

With benefit of my experience I would put most spends on Regalia (using it for accelerated rewards on Smartbuy) and pray for upgrade to Infinia.

MRCC can be another addition.

As you said total spends are not high, this would have been my strategy. (In absence of a number telling total spends).

Hope it helps.

Hsbc cashback card is now rebranded as Hsbc live plus .

Is it any better? I felt that the old design was good.

the same but rebranded.

Hi Sid

Thank you for such elaborate comparison and recommendation.

I would like to know , is SBI elite card not worthy a comparison or much better rewards exist in other cards of same segments?

Thank you in advance!

The latter.

Bookmyshow and Eazydiner offers on HSBC Premier Credit Cards are a wow!

IMPORTANT NOTE ABOUT ICICI AMAZON PAY CREDIT CARD:

I shop a lot on Amazon and am a Prime customer too and so this card was a huge boon for me. But a recent change has made this look less attractive, at least for me. It’s not bad but I believe what I felt like the USP of this card is now gone. I’ll explain in detail.

So far we could to split payments for Amazon orders, use whatever balance we have on Amazon Pay and pay the rest from this card. For example if I had Rs 500 as Amazon Pay balance and the cart value is Rs 1000, then I can use this balance and pay the remaining Rs 500 from my card.

For the past couple of months this has not been possible. It says that the balance is too low and I should top it up if I want to use it or else pay through other means (like this card). So if with the Rs 500 sitting in my balance, I should either opt to use it to checkout a cart of Rs 500 or lesser only. Otherwise I must top it up to the required amount and use it, like Rs 500 in this example. The best option here I could see is buy GV and add it to the balance as there’s no extra charges at this point for that if paid through CC too. But I’ll only get 2% back instead of 5%.

This seems to be a policy change by Amazon. But I was given conflicting information, totally uncharacteristic of Amazon. I had their customer care tell me it’s a defect in the payment gateway they’re trying to fix, that they’re going to rollback the policy change etc. Finally after more than a month I heard that it’s a policy change and there’s no possibility of rolling back.

With every other app it’s possible to use the balance and do a split payment. So this is a pain. Now it’s like you have to wait and accumulate points for a purchase or just buy something of lesser cost. It may not be a deal breaker for many but for me it is. I am thinking if I should use some other card instead for purchases on Amazon. I have the Infinia anyway.

I am in a peculiar situation, kind of. I have many cards now, but only 1 super premium. I hold Infinia, Tata Neu Infinity, Swiggy from HDFC bank with shared limits, ICICI Amazon Pay, Axis Ace and Amex MRCC. The Amex I mostly use for loading HP Pay app and fill in petrol or directly pay in HP bunks that accept it. My main target is to reach the required 4 transactions of at least 1.5k every month for the 1k MR points bonus. Some months I can even reach the 20K spend and earn an extra 1k MR points bonus.

Had the SCB Ultimate but closed it as my significant use fell in the 2% category vs the 3.3% and I thought Ace was better for lesser. Now I use the Ace only on the Urban Company app because HDFC doesn’t give points for this category as UC is registered as home cleaning/servicing.

Only when HDFC had an outage one day (OTPs weren’t coming for almost half a day), their planned maintenance, and when I wanted to split a big purchase across cards, did I realise that I better have another premium or super premium card.

Had the Axis Magnus in mind and even thought of trying and upgrading the Ace to Magnus but I think it’s lost it’s sheen now. In fact I am not even thinking of any Axis card right now. ICICI Emeralde Private is in mind but it being invite only and me not holding any other ICICI card except Amazon Pay will be a hindrance I guess. Have had the Rubyx, later upgraded to Saphiro, in the past.

Thought about the Yesbank Marquee but it’s more for online use but I’d do a good bit of offline purchases too. In fact for expensive things I am not comfortable buying online. For example home appliances, I’ve never once bought them online. And Croma is not always the best choice for it as their stock sucks, at least in Chennai.

Is there no option other than ICICI Emeralde Private?

What are the latest AGV and ASV purchase limits on Infinia. Heard that both are reduced to 10K respectively ?

Hi, thanks for your detailed card reviews. I use a HDFC Infinia card with usage of ~ 20 – 24L a year. With the recent tightening of Smartbuy redemptions and multiplier points I am forced to look at another card to maximise my gains. I do bulk of my monthly purchases by using the smartbuy coupons (Limited to 15,000 points now), I accumulate my points for a year and use the points to redeem smartbuy hotel & flight tickets (Limited to Rs 1.5L a month). Please advise if i actually need to add another card, if yes which one would you suggest, and when do you suggest i use the card.

Suggest Amex Platinum Travel, to divert 4L pa of your spends there. It provides multiplier as well as redemptions for travel.

Thanks

Thanks Sid for the refresh! But do you still vouch for some cards like SBI air india and axis magnus burgundy?

They still hold good for high spenders.

“Or just load your ICICI Fastag using Amazon Pay balance and enjoy 5%-15% on fuel depending on the cards you hold.”

Can you please explain how to get 5-15% on fuel via ICICI fasttag

Hi,

Axis Ace doesn’t gives 2% CB anymore, it is 1.5%.

Thanks

Yes, recently it has devalued. Also adding cap to the 5% cashback category.

Credit cards in india isn’t as exciting as it used be. Lot of limitations. Even top tier cards from axis and hdfc have major capping ; even with points after earning them; Expiry of points after their validity makes no sense. Top tier cards should not have expiry date of points. If one wants to hold on to points 5years or 7years. They should be able to. After exit of Citibank there are no standards left; only AMEX is the one which has value. To earn more points we have to buy thru there own personal portal Infinia and olympus card. Restrictions.

As a credit card enthusiast, I completely agree with you but Banks are not saints, they want to earn money from credit card. They deliberately expire points so that you use them for lesser value options. Credit card were issued like toffy in the recent past in order to capture maximum market share. The more the number people got and there came apps for rent payment, education payment and utility payment which could transfer money to your account. Banks felt the heat and are now restricting the credit card points, even genuine utility and education payment users are feeling the heat.

Hi Sid,

I and my brother hold 1 Infinia each and rake in about 1.30 lac points together every month since 2018. Majority coming from utility bill payments as I use my card to pay for my business electricity bills.

Now, With Infinia, putting a cap on them, Which card would you suggest which pays 3% or higher for utility payments without caping.

Regards,

VK

I am using using HDFC DCB since 2019. I asked once somewhere in 2022 during renewal of DCB and again next year 2025 it would renew. Shall i ask now for Infinia update since DCB is useless now with lots of devaluation or wait till infinia Reserve launch.

Also my second thought is if i dont get Infinia shall i surrender DCB and try for ICICI emerald private metal . I dont even know i would get. But if i move my preferred account to ICICI then i might get is what i am thinking. ALso i have ICICI wealth account and have icici account from last 15 years.

The only thing i like with DCB is Unlimited airport lounge access for family.

I also tried lounge twice a day at differnt cities which i am not sure i can do with ICICI.

Please advice guys shall i ask for infinia now or wait till next year till my card is due for renewal. As of now my DCB is paid and i get fee waiver because of 5 lakh spend in a year.

ask for infinia now only DNT wait for renewal. or get dcb metal

I am also in the same boat like you. I am using DCB since 2017 but they haven’t upgraded to infinia yet. I have requested the RM. If it doesnt work out, will closed the card. have the ICICI Saphhiro card. Will ask upgrade to Emeralde because I have home loan account with ICICI.

For lounge access, get some other cards along with ICICI.

@sourav

Wish good luck for us :)I have RM since 5 years and trust me they are the worst. Initially they used to call me regularly only for investments and when i said them not interested with any of the products they stopped calling. Will keep you updated if some miracle happens 🙂 Anyways DCB is good enough .Not sure whether I would be forced to upgrade to DCB metal next year when it renews.

“If you use this card just to get the 2000 MR bonus points monthly”, writing this way gives us no idea how much to spend monthly. Why can’t you write clearly “If you spend just ₹XXXX monthly, you can easily get a return of 6% on spends”.

Makes sense, added now.

I have a spend of 8-12 lakhs per annum. Mostly in groceries, shopping , travels (domestic + international) and very little in dining & movies.

Currently, I have HDFC Regalia gold card for all spendings.

Also, I am using Axis Airtel CC for 10%-25% CB on my Phone, wifi, electric bills only.

If I want to keep one card for all, what will be the best one for my expenses.

If not which cards can be clubbed together for maximum benefit in my 8-12 lakhs expenses budget.

Hdfc infinia is the best card for all of expenses. Thought I will suggest to have one for fuel and 1 tata nue card and 1 amazon pay.

Dear Sir,

Axis Burgundy Private credit card is not being issued even after DMAT holdings of over 5 Cr., though online this is the only condition.

Please, can you clarify the requirements?

Thanks & Regards

Is it? I’ve seen many get it without any issues.

May I know what’s the reasoning the bank is giving?

Dear Sir,

Reasoning of Bank is, the investment should be through them. For example if I have Mutual Fund investment dematerialised in my Dmat A/c, it should not be Direct Mutual Fund. I told them that how I will change my direct Mutual Fund investment, it will incur tax liability & in addition if I buy Mutual Fund through you then I am paying 1% extra which is much more than your yearly charges for Burgundy Private card. In addition, they are also not considering shares investment in my Dmat for TRV calculation.

@Mahesh Agrawal

Generally staff do this to get extra commission/target. Mail higher management and if they still say they cant then its not worth to bank with them also tell those higher officials that you would close down your account and they will get you card.

Any bank/card still giving good rewards for Rent payment? I am paying 50K rent via Redigraffe with SC-Ultimate (Redgirraffe charges Rs. 230 and on the Rs. 50230, then SC charges Rs. 593 i.e. 1%+18% GST). So practically I am paying Rs. 50823 for a rent of Rs. 50000. And then getting 50823/150 * 3 = 1014 in points. Which is like <200 Rs (not worth, giving the bad reward catalogue of SC).

Is there any bank/card, where either the 1% is not charged? Or the points are high?

rent payment is almost dead now AFAIK. You may try vistara co-branded credit cards like IDFC vistara for milestone benefits.

A lot of people have mentioned HDFC Tata Neu Infinite for Rent. What charges does that take for Redgirraffe payment and what points or milestone benefits do we get? With 6-7L per annum rent payments, any 1-2% benefit would also be good enough.

You should consider adding Yes Private metal credit card to this list.

Great blog – very sharp writing and no-nonsense info. Liked it. 🙂

If the Axis Burgundy Private review coming up soon? Also, some Citi cusomters are being migrated to Axis Horizon … review of that coming up as well?

Hey Sid,

That’s a wonderful list.

However, I must add that you have missed one very wonderful entry level card i.e., Axis Airtel Card

Capping is too low but still a wonderful card especially for Airtel users.

Benefits like:

500 Amazon voucher on joining.

Complimentary domestic lounge access

25% on Airtel Recharge like wifi, mobile

10% on Utility

10% on swiggy Zomato Big basket

1% on all offline spent

Best part: You don’t have to worry about redemption and reward redemption charges as they credit it directly to the Credit statement every month.

Only 500 annual renewal fee which can be waived off on spent of only 2 lakhs.

Value chart shows that if optimally used, it can give a total benefit of Rs. 16130 on an spent of Rs. 2 lakhs.

AU LIT is another good one in the Entry level, if one manages to spend about 10K per month.

Sir

As a credit card enthusiastic I have been loving the content here.

I am currently using Axis ace and airtel axis card for my utility bill payment and sbi cashback for online spends I also have amazon icici and yes bank kiwi UPI credit card . my annual spending is around 10 lac, mostly electricity bill around 4.5 lac and online spends around 4 lac and offline or others spends around 1.5 lac. Can you suggest one reward base card which will give me the best return. I am confused between sbi air india signature and amex platinum travel credit card. if you would suggest a premium card to replace all of these which would grant me better return in terms of percentage. I am also curious about hdfc regalia gold credit card but don’t know if it is giving any reward point for electricity or utility payment, if not then is these spends countable for milestone achievement??

I am looking for credit card which offers reward points on high value electricity bill (>5lac per month) payments.

I am already holding axis burgandy private card but they have stopped giving points on utility bill payments.

Take a business credit card, I don’t think this spend should be done using any retail credit card.

Hi Sid

Came across your website today searching for BOB ETERNA RUPAY. Seems i should skip that. Can you please suggest best RUPAY card to get now.

Will be used for regular UPI transactions majorly.

Thanks

Lovish

Which card should one take for domestic lounge entry..need atleast like 30-40 visits in a year… and if a person is not eligible for super premium cards like infinia…then what are the options ?

HDFC Regalia gold is easy to get .

12 visits is too less i guess !!

Try getting HDFC Diners Club Black. It gives unlimited lounge access both domestic & international for add-on card members too. As per your requirement for 20-30 lounge visits, no normal card would ever give it you. You have to have a super-premium with Unltd lounge option.

Go for

1) BoB Eterna – Unlimited domestic lounge

2) HDFC Diners Black – Unlimited domestic and international lounge

3) HSBC Premier – Unlimited domestic and international lounge PLUS 8 guest entries at domestic/Intl lounge

Thankyou

Hey Sid,

I have been having ICICI Rubyx LTF card for a long time and it has limit in excess of 10L, I see an option to upgrade to Emeralde which is not LTF, but they dont upgrade to even Sapphiro. Have you come across this sort of a thing?

All,

I hold an Axis Magnus card. After the devaluation this year, this card has lost its charm. However, I have an option to shift to Axis bank and get Burgundy account as part of my salary account. Should I grab it? The yearly fees for Magnus post-Burgundy will be 35K. Is it worth upgrading?

Hi Sid,

I need to buy Air India int’l travel for approx 3 Lacs. I have 2 questions:

1. Which card is better to use: Infinia or Magnus for Burgundy?

2. I have about 2 Lac points in Infinia. Is it safe to book with points + cash on SmartBuy considering this is Int’l travel and I may (5% chance) need to reschedule flights?

Thanks

Better to use Magnus for Burgundy. Smartbuy isn’t suggested if you’re expecting to reschedule.

Thanks Sid.

My M4B is LTF. Should I get Axis Atlas for this? I have it pre approved. I will anyways transfer edge points to Air India FFP.

Is it tru that Axis started charging for reward redemption? 99 for edge reward and 199 for miles conversion?

That is correct. They have started charging from 20 Dec 24.

Hi Sid, Is there going to be any change in the list for 2025?

No major chances would be there, as I refreshed it only few weeks ago. I guess same list would stand good for sometime.

Infinia:

There seems to be more devaluation coming. Coupons get you 40% value now instead of 50%. Example – Reliance Digital

On another note, has anyone seen iPhone 16 Pro on rewards portal? I have Infinia Plastic and am wondering if lesser items are available as compared to Infinia Metal.

Choosing the right card section mentions 3 categories :

A) Less than 5 lacs

B) Greater than 15 lacs

C) Greater than 30 lacs

What card is best between 5-15 lacs annual spend?

Don’t you think SBI cashback card is best upto 12 lac online annual spends ? You have currently placed it under 5 lac section

Hi,

I am holding HDFC Infinia. I have spends of 30L annually on my card. I have a basic SBI Cashback card. But hardly spend 1.5L on it annually.

1. Could you recommend another premium card? Not certain what to take especially after the Axis Magnus concierge service removal from Apr’24.

2. I don’t travel very often so never was attracted to Amex!

3. Do you think I can get HDFC Diners Metal?

Hi, I’m looking for a card with low forex markup and with better redemption options. I’ve Dcb, Magnus and Emeralde with low forex markup but as Dcb is not acceptable everywhere need a 3rd back up card and mostly for international spends. Recently closed my Sbi elite card as in a year 3 times the card was blocked due to fraudulent transactions. Please suggest a 3rd card with good point redemption option and low forex markup. Thinking to apply for yes bank marquee. But need your suggestion. My annual spends all together is not more than 3000k.

Currently I’m holding following cards

Scb ultimate

Diner black plastic

Emeralde plastic

Amex reserve

Axis magnus, horizon, miles and more

Hi Sid – I have an Axis Atlas Card and my annual spend would be around 7-8 lakhs. Do I need any other card like Platinum Travel Credit Card, etc.

Thanks

.

The first sign of devaluation is when complexity is introduced in the product features.

Note: referring to TATA Neu Infinity with the upcoming tier based benefits

It just got complicated but Tata Neu Infinity Variant will continue to earn 5%+5% as usual without even the legend status as confirmed with Tata Neu.

Hi Sid ,

Any card equivalent to SBI prime for rewards on expenses