IndusInd Bank has some of the best Co-brand Credit Cards in the country at the moment that includes EazyDiner & Vistara Credit Cards. Now with Qatar & British Airways as international airline partners the bank has launched a multi-brand Credit Card called IndusInd Bank Avios Credit Card as announced few months ago.

The card works on the Visa Infinite platform and it enables one to earn and redeem Avios across Qatar & British Airways as it’s the shared reward currency of both the airlines.

While the card might look complex at a quick glance, this article would make it simple for you to decide if you need to take one. Here’s the detailed review of the card,

Table of Contents

Overview

| Type | Multi-brand Credit Card |

| Reward Rate | ~3.5% |

| Joining Fee | 40,000+GST |

| Best for | Frequent travellers |

| USP | International Meet & Greet benefit |

While sharing the same plastic, technically the IndusInd Bank Avios Credit Card works like two different credit cards, depending on the preferred loyalty program you choose:

- Qatar Airways Privilege Club

- British Airways Executive Club

Note that Avios remain the same on both variants and one can also transfer Avios between the partners at 1:1 anytime.

Hence the difference ideally comes with the joining/renewal benefits linked to the respective variant.

Fees & Benefits

| Joining Fee | 40,000 INR+GST |

| Welcome Benefit | Qatar: Gold tier + 20,000 Avios British Airways: 55,000 Avios |

| Renewal Fee | 10,000 INR+GST |

| Renewal Benefit | Qatar: 5,000 Avios + Gold tier (3L Spend on Qatar Airways Website or mobile App) British Airways: 10,000 Avios |

| Renewal Fee waiver | Nil |

Note: Qatar variant also comes with 10% off on Qatar flights originating from India.

While the joining fee is quite high to begin with, the renewal fee is fortunately very much affordable for the benefits it comes with.

That aside, I wish the spend requirement for Gold tier renewal on Qatar variant is not just limited to spends on Qatar.

Design

The design not only looks neat, elegant and simple but also the designer is quite clever to place the chip on flight’s windshield. Otherwise, it feels like a typical heavy metal credit card while holding in hand.

Rewards

| SPEND TYPE | Avios (per 200 INR) |

|---|---|

| Regular Spends (Domestic & Intl) | 3 |

| Spends on Qatar & British Airways | 5 |

| Spends at Preferred international destination (POS) | 5 |

| Spends on Utilities, Govt services, Education and Insurance | 1 |

| International Spends (Online – Preferred region) | 3 |

| International Spends (POS – Preferred region) | 6 |

Note:

- Avios would be credited to the account within 10 days of statement generation.

- Avios will be earned only for spends up to the assigned credit limit in every statement cycle.

For International POS spends, the card comes with a concept called “preferred destination” which not only comes with better earn rate but also a lower forex markup fee of 1.5% instead of regular 3.5% which applies to all other destinations.

This preferred destination has to be chosen while applying for the card.

While the rewards on “regular spends” are on the lower side (even after the recent change), the milestone benefit gives a good push to these numbers, let’s see that now.

Milestone Benefit

| SPEND REQUIREMENT | MILESTONE BENEFIT | MILESTONE BENEFIT (Cumulative) |

|---|---|---|

| 8 Lakhs | 18,000 Avios | 18,000 Avios |

| 16 Lakhs | 18,000 Avios | 36,000 Avios |

The milestone benefit certainly gives a good push to the overall reward rate on the card. So if you’re considering rewards, hitting milestone spends is essential to get maximum value out of the product.

Spending 16L on the BA variant would give you a total of 60K Avios (36K via milestone spends + 24K via regular spends) which is about 3.7% in return as Avios and can get one closer to 2 economy tickets (or) 1 Business Class ticket from Mumbai to London.

The downside is that Qatar and BA are known for their high taxes. However, this is also one of the reasons why availability tends to be better compared to others.

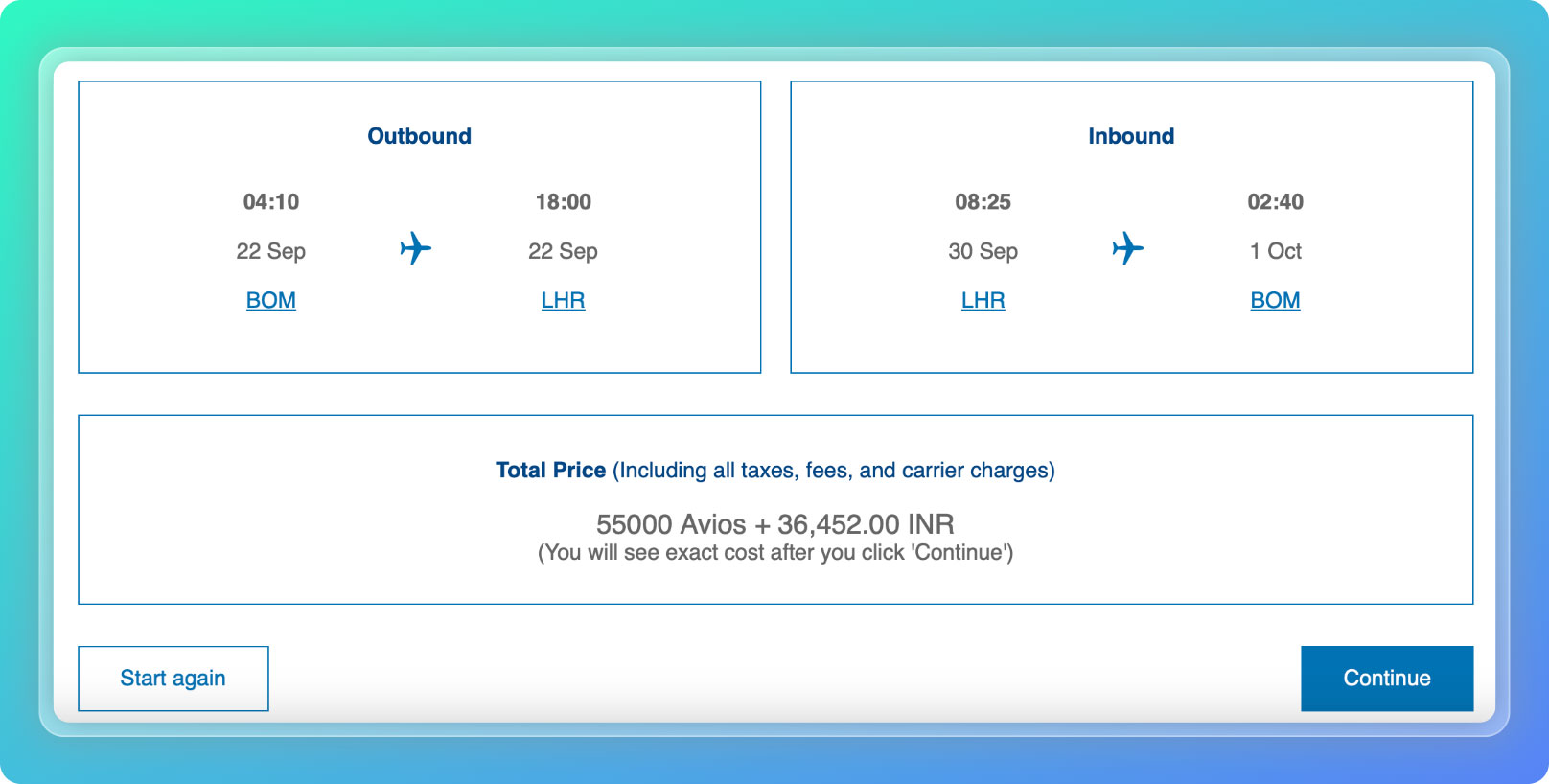

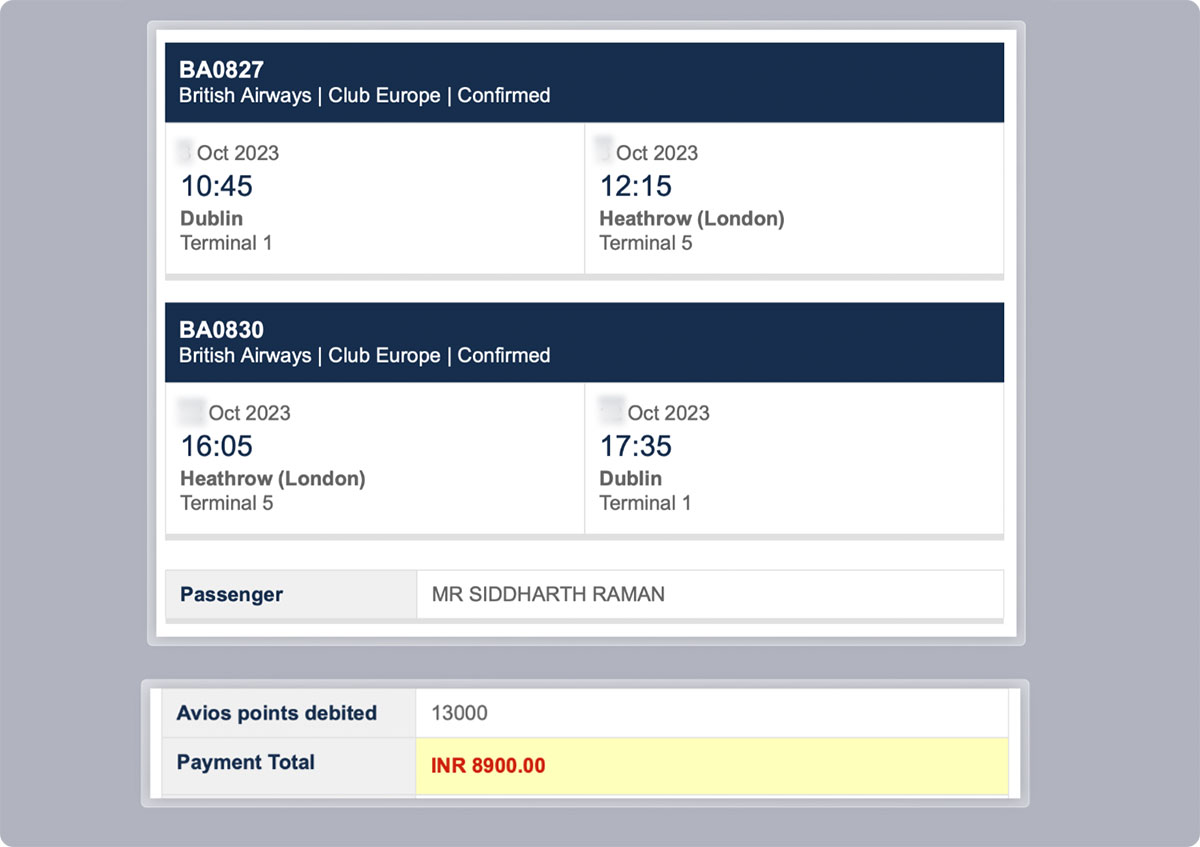

That said, intra-Europe redemptions offer good value with relatively low taxes. Here’s an example of a round-trip business class redemption on BA which I did in Oct 2023 between Ireland and the UK:

Qatar Gold Benefit

Here are the benefits we get via Qatar Gold membership when one chooses Qatar Airways Privilege Club as preferred loyalty program.

- Meet & greet Service in Qatar for self +1 (at Hamad International Airport)

- Priority Check-in at business class counters

- Complimentary Seat Selection

- Extra Baggage Allowance

- Access to Business Class Lounges

- Invite friends to lounge at Hamad International Airport, 4 per year

- Receive 40 Qcredits to redeem for upgrades, extra baggage, etc

- 5% Off on Avios redemptions

- Better award seat availability

- Change or cancel your booking free of charge

For frequent travellers on Qatar, this is a wonderful benefit without a doubt as getting Qatar Gold is not easy by any means.

On top of that, with Qatar Gold one gets the “Oneworld Sapphire” status which gives access to additional travel benefits across all Oneworld partners.

Airport Lounge Access

| ACCESS TYPE | VIA | LIMIT |

|---|---|---|

| Domestic Lounge Access | Visa / Mastercard | 2/Qtr |

| International Lounge Access (Primary) | Priority Pass | 2/Qtr |

While the limits are bit low, I think it makes sense for this card, as it’s quite obvious that one might not do over 1 (or) 2 international trip in a quarter ideally.

Nevertheless, 8/Yr would have looked much better as lounge access at connecting airports consumes the limit faster.

Airport Meet & Greet Service

- 2 complimentary service per year (Card anniversary year)

- Value: ~10,000 INR per service

With IndusInd Bank Avios Credit Card we get complimentary International Airport meet & greet service across the globe. Here are the list of airports covered.

IndusInd Avios Credit Card is one of the very few cards in India that provides international meet & greet services with no strings attached.

With this service, we get access to fast track security lane and quicker immigration clearance all while being accompanied by the airport staff & a porter.

While I’ve covered the domestic airport meet & greet experience in India before, I’ve also recently experienced the international meet & greet service at Dubai – Arrivals and Dubai – Departures using the IndusInd Avios Credit Card benefit.

Having used the meet and greet services over 20 times across domestic/international airports in the last 5 years, I can say that it will be of immense value in a foreign country as international meet & greet services are “essential” at times.

Should you get it?

There could be various reasons one would get the IndusInd Bank Avios Credit Card. Here are few reasons as to why you would need this card:

- If you fly Qatar economy often, Qatar variant with Qatar Gold tier benefit is a blessing, as it enhances your travel experience a lot.

- If you’re an airmiles enthusiast, spending 16L on the BA variant would give you a handsome 113K Avios to play with.

For most of us here, the #2 will be the reason and if you value international meet & greet service as much as I do, then it’s no brainer.

Getting the Card

- Fresh Card: Can be applied via RM/branch or on the website.

- Upgrade: If you already hold an IndusInd Bank Credit Card, call customer support and request for an upgrade. Minimum credit limit for upgrade keeps changing from time to time.

IndusInd Bank takes 1-2 weeks to process the digital applications and upgrades are lot faster.

Note: While applying for the card, you’ll need to mention: card variant, preferred destination & Qatar/BA loyalty account number (if you’re already a member).

My Experience

I recently applied for “IndusInd Bank Avios Credit Card – BA” Variant as an upgrade from IndusInd Bank EazyDiner Credit Card and got the card delivered in a week.

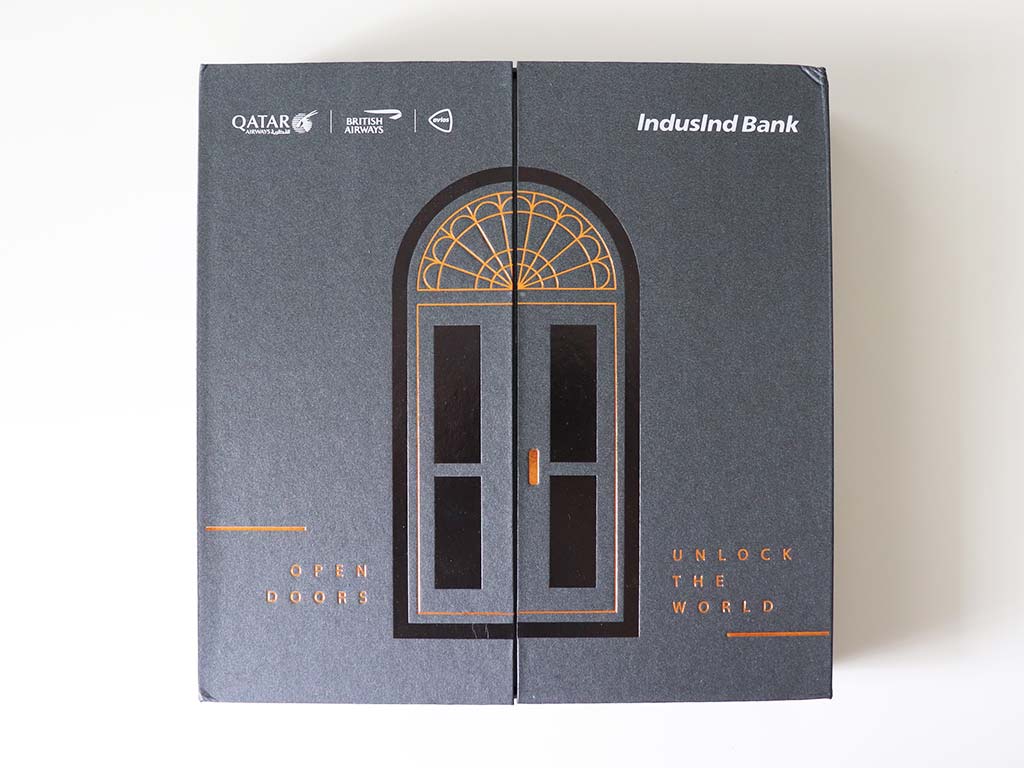

The card comes in a premium package, securely covered in a layer of bubble wrap. I’m seeing such a care given to the outer card package for the first time.

The package contains the Card, welcome letter, card benefits guide & a wallet. Here are some unboxing pics:

The card wallet in matt finish looks good, as you can see in the above image.

Bottomline

- Cardexpert Rating: 4/5

Overall the IndusInd Bank Avios Credit Card is a decent card to earn Avios and explore the unique card linked benefits like: Qatar Gold & meet and greet service.

The International meet and greet benefit on the card is quite a surprise to me and I hope to see it on other IndusInd Super Premium Credit Cards as well in the future.

What’s your take on IndusInd Bank Avios Credit Card? Feel free to share your thoughts in the comments below.

Great review. Is this metal card profile similar to Axis Magnus ? does it look good in hand ?

It’s heavy, more like Infinia or Amex Plat.

Magnus is quite light and people can easily assume it to be plastic.

How do you compare it with Axis Atlas?

They both are totally different type of cards.

Atlas Card – anyone can have it and explore so many transfer partners, serves to wide set of profiles

Avios Card – very few have the ability to spend & fly with Avios on BA (or) fly often on QR to take value out of it.

meet and greeet outside india , at least in Abu Dhabi is very different. no like what you get at indian airport with Axis. In Abu dhabi, they bring land cruiser for you once you arrive at regular terminal, take you to VIP terminal in that and make you sit in a lounge there and complete your immigration and other formalities and fetch your baggage for you in lounge itself and than you are good to go. you just have to sit in lounge. meet and greet will do everything for you in lounge itself, that is service. what they are doing in India , is just giving you a helping hand, a costly helping hand.

That’s very interesting. Thanks for sharing. But isn’t it applicable only to the airline initiated meet & greet services?

Also, are you aware of any other country with meet & greet services like this?

No, you can pay for it and have the service. I guess it was 100$ per head.

Most of middle east destinations have this.

Good review Sid.

I had applied for the card on their website and they sent me the Qatar variant by mistake and the form never asked for the preferred airline.

I am completely new to IndusInd and they opened a free zero balance account(optional) along with this card application. I would suggest not applying online but going to a branch and applying for it.

Thankfully customer care is taking care of this and I should be getting the correct card this week.

55000 avios is good value for the expensive first year fee though. BA and India taxes are crazy high. Going via Colombo can help reduce taxes a bit for redemption bookings.

What preferred destination did you pick?

Good to see you here Varun.

“Europe and North Asia” is what I took, but ideally I would use IndusInd Vistara Explorer card at 0% markup when in need.

Hi Siddharth , That’s a great review of the card as you have done it previously for other cards . I currently own IndusInd club Vistara explorer credit card and I am interested in this newly launched card . So do you think , IndusInd will provide me a second card with different limit ? As I came to know that they will provide second card only on split basis of existing card limit ? Your help is appreciated 😊

Ideally you’ll have to split the limit and get the 2nd one. Should be possible to get 2nd if there is sufficient limit and good banking relationship.

Comprehensive and excellent article!

Few clarifications:

1. If we take BA variant, do we get Qatar gold?

2. And if don’t get Qatar Gold then how can you avail the Meet & Greet service in Europe? Coz Meet & Greet service comes with Qatar Gold.

Correct me if I’m wrong.

3. To retain Gold status we need to spend 3L on Qatar website, but if you spend the same 3L on Atlas you get 30000 Airmiles. Isn’t this a better option?

1. No

2. both are different, please go through the article.

3. 2nd Year for QR variant is not lucrative indeed.

I understand there is 10% discount at Qatar website on Qatar variant if the card. So there should be no loss as compared to Atlas for purpose of spending 3 lacs. Also any idea if card holder has to travel to get 10% discount on Qatar fare?

10% on Qatar is tricky, for ex, it doesn’t was with connecting flights.

So it’s better to go with Atlas if that’s your only requirement.

Was your BAEC number correct ? For mine they generated a brand new BAEC membership even after me providing my existing BA FFP number.

I got a diff BA number as well and I’m told to call BA and merge the accounts which I’m yet to do.

Hi Sid, don’t u think the point is very very low. People take cobrand cards to earn miles when not flying. If I use it for regular spends and yearly spend is less than 8 lakhs then it’s of no value.

Also at 40k Fee point, we can take infinia/aurum/magnus/au bank zenith and scb ultimate

Certainly too low if 8L/16L is not hit. They’ve done it on purpose perhaps.

Nevertheless these milestone points + meet & greet certainly gives good value.

But the fee is certainly high. I’m assuming we may have a lower fee variant eventually after few months, just like it happened with Vistara card.

Hi Sid, can we transfer BA avios points to Qatar account?

Well we can convert BA to QR Avios right?

Or does this have nay restriction ion welcome points?

This card gives another benefit of Flat Rs 3000/- off for Premium hotels for Dining ( Lunch or Dinner)booking through EasyDiner App. Yearly Twice

For eg If you dine in premium restaurants for a lunch or dinner and the bill value is 3000 means you need not to pay a single rupee. 3000 will be discounted by using this card

Are you sure about this?

Are Govt spends , fuel , utilities etc all counted towards the spends milestones ?

How many days does it takes to get the 55000 Avios Credited as welcome benefit?

Got this LTF in place of InterMiles Odyssey Credit Card.

Siddharth,

Are addon card users eligible for lounge access?

Can you please confirm. There’s no clarity anywhere.

So we take this card and get Qatar gold immediately. Supposed we are not able to hit the milestone for 3L, would we be downgraded to Qatar Silver or the total basic tier?

Hello,

have they stopped giving gold membership? is it still worth it?

Has the joining and renewal fees changed for this card ? I keep seeing messages that it’s revised to Rs. 10000 / Rs. 5000. I believe its value for money if so.

Yes, your figures are right. However, they have taken away the Qatar Gold status. So, I am not sure how anyone would want this card. (Unless you want to buy avios at 59 ps because you get 20K avios on paying the joining fee of 11,800).

Does government spends count towards milestone benefits?

My experience with this card is extremely bad. They have not provided the Qatar privileges (Gold tier, 20 K avios, etc.) even 6 months after issuing the card. Be careful when you apply. Indusind Customer support is below par and doesn’t provide any resolution. So, be prepared to lose your time and patience.