If the success of Chandrayaan 3 is #1 news for Indians this week, #2 is the successful launch of Marriott Bonvoy Credit Cards in India. That’s right, HDFC Bank today (24th Aug 2023) launched the Marriott Bonvoy Co-brand Credit Card in India on Diners Club Platform.

I’ve been waiting for this to happen for over 7 years and it’s certainly an event in the Indian Credit Card Industry which will revolutionise the way travellers look at travel credit cards in India, as this is the first co-brand credit card with a hotel chain.

While we’ll have a detailed look into the product sometime later, here’s a quick glance of what to expect from the newly launched Marriott Bonvoy Credit Card in India.

Features & Benefits

- Joining/Annual Fee: 3000 INR+GST

- Welcome/Annual Benefit: 1 Free Night Award (valued upto 15,000 Points)

- Card Network: Diners Club

- Lounge Access (per year): 12 Domestic access + 12 international access

- Elite night credits: 10 Nights to get closer to Gold

- Elite status: Silver Status

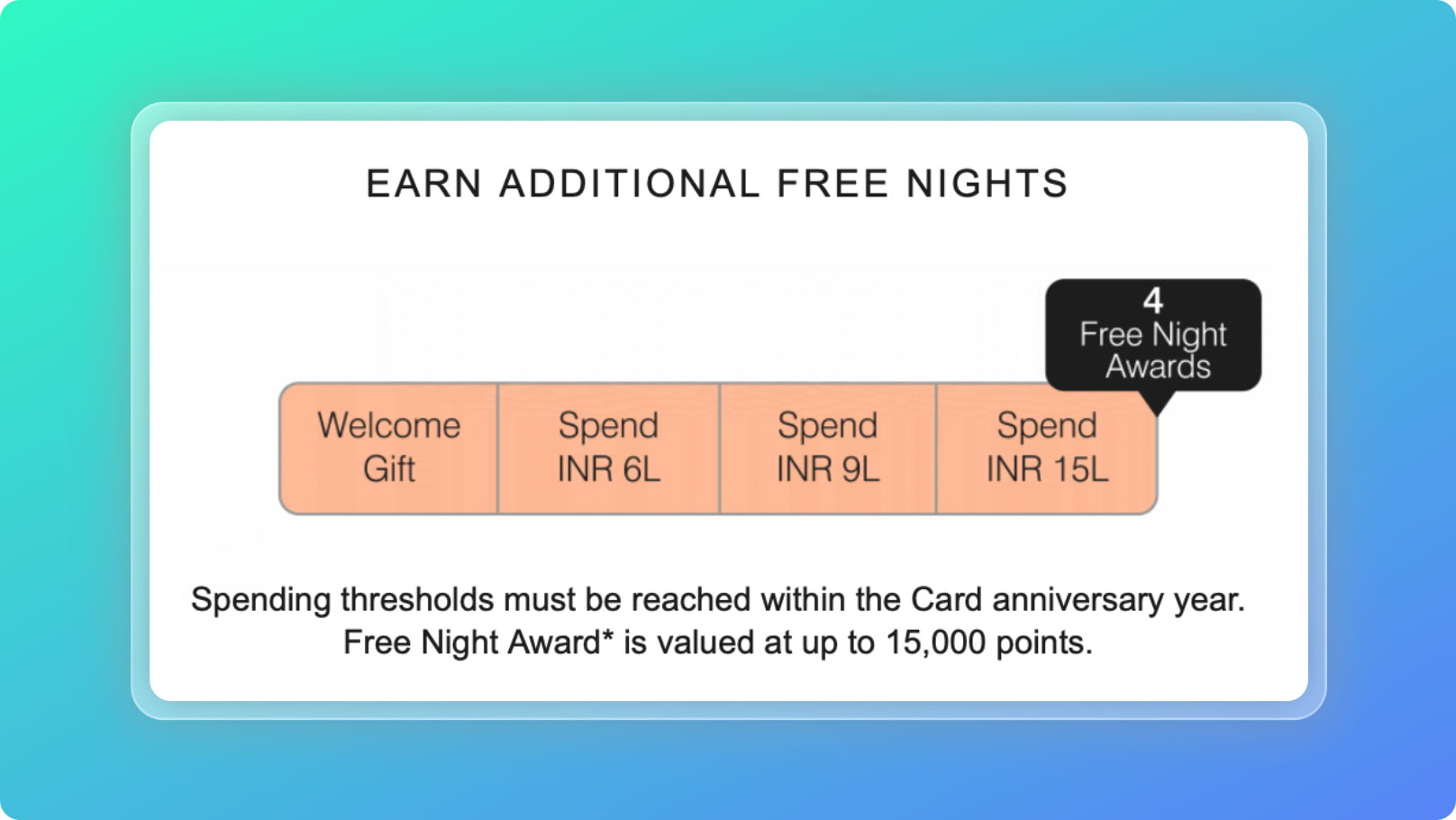

- Milestone Benefits: 1 Free Night Award for every 6L/9L/15L spend

- MB points on Spends: 8/150 INR on MB Hotels; 4/150 INR on travel/dining/entertainment; 2/150 INR on regular spends

- Golf: 2 Per quarter

My Thoughts

This is going to be a super-hit card in the country without a doubt, perhaps one of the best cards travel credit cards in India going forward as it has the perfect set of benefits for beginners getting into travel.

For the annual fee of 3K INR, one can actually get well over 40K INR just with a single stay if one redeems the Free Night Award at the beautiful Westin, Himalayas which is incidentally from where I’m writing this article, with a view like this. (not today though, as it’s rainy and cloudy).

Given that HDFC Bank has massive network in the country, I honestly wish every eligible Indian gets this credit card and enjoys a vacation in the Himalayas at one of the Marriott’s finest luxury resort.

I can’t stress that enough because the time is ticking and this outstanding benefit at Westin won’t last long. Yet, there are also decent enough properties across the country and even beyond (like SE Asia) to easily get 2x-3x value for the joining fee paid even otherwise.

Having said that all, I’m equally disappointed that they’ve not focused on a super premium variant at the moment. While Marriott is probably testing waters with this product, I see no point in not going straight for a Super Premium Variant.

Bottomline

While this is a AMAZING credit card for beginners, it’s not attractive enough for super premium card holders (except for the welcome benefit & 10 elite nights) as the regular earn rate is poor along with not so attractive milestone benefits, as in, it would have been lot better if milestones are set at 3L/6L/9L instead which will also fit in the target group extremely well.

But well, at 3K fee, we can’t ask too much, so it’s fine. I’ve quickly gone ahead and applied, outcome of which will be known in few days.

I hope HDFC bank makes it easy going forward to get multiple cards, just like they did so with Tata Neu Co-brand cards with shared credit limits. We’ll have to wait and watch on this as it’s the “most important” factor of this card’s success.

So just like most us here, I would be eagerly waiting for the day when they launch a super premium variant, perhaps at 50K fee or so and give instant Marriott Bonvoy Platinum status as that’s when the real value kicks-in.

I wish I don’t need to wait for another 7 years for that to happen!

Until then, enjoy the free night awards at some of the finest hotels in the country with the HDFC Bank Marriott Bonvoy Credit Card!

Hi Sid,

Seems you are excited by seeing this card. Really it’s great card for travellers.

“This is going to be a super-hit card in the country without a doubt” – Just want to ask one question how many people use marriott hotels?

I’m unsure of numbers but think about it as perfect replacement for regalia range of cards with an aspirational value of a stay at Marriott.

This is for bringing more Indians into MB program instead of making existing MB members happy, which might happen later.

Please explain about the 10 elite nights

It’s the free elite night credit given for members to get closer to their next tier. It’s like getting the stay night count without actually staying.

Do you know if the elite nights count towards lifetime status too?

I am close to lifetime silver status (230 nights out of 250). For me Silver status from this card does not really help.

The reward points for money spent on this is not very high either. I currently use Amex MRCC card excluseivley for Marriott points where I get 1 MR/Bonnvoy points for Rs50 spent (and 2x if used on reward multiplier).

Ideally yes, but please do check with Marriott’s support.

What if someone is already part of Marriot bonvoy and have silver foe current year. Also when applying do we need to make sure they use current marriot account or newly created one can be merged afterwards.?

How can we include meals in stays using points? Doesnt seem to be possible. I usually like to include most meals while booking hotels

in the world only “Marriott Bonvoy Brilliant American Express Card” gives the platinum status with a fee of $650. expecting that type of card coming to Indian market is a tall dream

I don’t think it is. India has far better cards than US (except for miles focused ones) and India has much more potential in the coming decade for Marriott. So why would they not?

We in India already pay $900 USD in fees for AmEx Plat charge India and get only Marriott Gold status.

The cheap US version of the card you are talking about priced at $650 and provides Plat status. So welcome to reality from the American dreams.

Its high time AmEx offered in India the value we deserve for the fee paid else someone else is going to offer the Platinum status at a lower fee (cheaper US version $650 levels) for SURE.

Sid,

What is important to know is what is the points mutliplier on SmartBuy for this card given the low reward rate.

I guess it won’t be applicable.

#2 News was Pragg getting into the chess World Cup finals..

Sorry..😜

Quicks Qs.

Is the MB Silver status / 10 nights credit only the first year offer..Or do we get the credit every year we renew?

Thanks.

In my world, I don’t know who is Pragg. Sorry. 😉

I’m sure the benefits will be renewed.

3000 for the 1 free night is good enough, plus the Silver status on MB. That seems the only plus point.

But as your rightly said, only if they are allowing to hold multiple hdfc cards.

Reward rate is terrible with only 1.33% and thats if you can get 1 Re value per point for MB. in most cases its 0.5 Re per point on MB.

1 free night for 6L spend is also terrible. assuming they will have a hotel with point value upto 15000 . That would probably be a 1% value .. Rs.6000 room on 6 Lac spent.

Hi Siddharth

One free night valued at 15k points..does it mean, if the hotel costs more than 15k points, then I will bot be able to use that night in the hotel?

Westing Himalayas cost 22.5k points for 2 persons if I check for September 2023. Fyi..

You can top it with 7.5K points in that case.

As someone with US Amex Marriott cards, I get 30 Elite Nights through those cards. Do you know if the 10 nights from this card will stack with those (taking me to 40 nights)?

Thanks.

That’s tough to answer. Only trying it hands on would give you an answer, as otherwise support won’t be very sure of this.

I tried to apply for the card but it says that I am currrently ineligible, I wonder why. I have a HDFC prefeered account, Diners Black, Tata Neu Infinity with a shared limit of 10L. I am sure I qualify the monthly income criteria as well – wish HDFC’s application process clearly tells you where exactly problem lies instead of leaving customers guessing.

Bonvoy is awesome program, but the catch is, you will really see its benefits only when you become platinum member. It gives access to complimentary hotel lounge, suite upgrade vouchers, free night awards and many more.

But you wont get much benefit with Silver or gold status.

Silver only allows you to earn bonus points and gold increase some chances of your room upgrade

From my point of view, this is good deal who wants to enjoy one free night benefit + airport lounge.

For platinum level you will need 50 night credit, which is very difficult to achieve by this card.

How do we get 1 night free , as i am checking its 20k points per night at the Westin Himalayas .

Please explain

Thanks .

Unfortunately seems they’ve hiked the points rate few hrs later after the article went live. 😶

It will go up further in a month as the peak season is coming up.

Which card would you say is a better value – this card or the Diners Club Privilege Credit Card?

Usage is going to be primarily for travel and lounge access.

Sidharth, in terms of eligibility I qualify. But when I apply online on their website it’s not showing in my offer cards. How can I get this card?

Thanks for the great article, yet again!

I was also waiting for an MB credit card. But this card is a disappointment. In the US they give 100,000 points as joining bonus (For a card with $100 fees). We definitely need a super Premium variant as that is the category this card should be targeting.

Have a couple of questions:

I have Infinia and Tata Neu cards. Can this be a third card I can apply for?

I am already a platinum member, is there any use of the silver status? Can it mess up my existing level ?!

Can I book a 20k points room using these 15k award and 5k regular points?

Westin Himalayas requirements has gone up to 20k 😢

Yes you could. But man yeah, sad to see it go up to 20K points.

Elite Night Credits expire on 31st December each year, irrespective of which month the Cardmember has acquired the Card…. Is it worth applying in January?

Depends on the profile but yes ideally that helps better in a way.

I have Infinia and Tata Neu already. I applied for this card and I got an email saying that you already hold a hdfc credit card so we recommend you go for credit limit enhancement asking to send my income documents. I am confused what limit enhancement will do with me getting this card. My current limit is in already in seven digits. Should I send the income docs and will that help me get this card or do they not allow to get another card when I already have Infinia and Tata Neu card. Thanks in advance

It’s a regular template email. You’ll now need to ask branch to see if they can offer you as 3rd card, ideally rare. I would instead switch Tata Neu to Marriott.

Thanks for the revert, also I have MB Gold , if I go for this card and share my membership number will they downgrade my account to silver?

Thanks in advance.

Downgrade wouldn’t happen. If elite nights are higher, that would be applied ideally for status.

I’m hoping there won’t be any drama on this with Marriott as they have experienced with such concerns in other countries.

Thanks for the revert, tracked the application status it shows decline, so should I just get in touch with branch for the same or is there a way to get this card by giving up my tata neu card online without getting in touch with the branch?

Seems Tata Neu on Rupay is differently setup (as floater card) but Marriott wouldn’t be so as far as I know.

So checking with branch would help.

Same situation here!! I got exactly the same mail (and the application status shows DECLINED). So, I called the Infinia customer care to inquire. They are totally clueless but suggested I drop a mail to customer service anyway. I wrote to them (Infinia customer care) with screenshots of the mail and the card application status. Let’s see.

BTW, I have Infinia for over 4 years now (with more than 11L limit) and recently got the Tata Neu card as the second HDFC card on a limit-sharing basis.

I also got the same template mail after the card application. I kept quiet as the card declined mail had come. But after 4-5 days, I got an SMS about card tracking details. Now the card is on the way. Looks like, the mail is auto-generated if we already have existing HDFC cards, especially the Dinners type.

I finally got my card approved after a couple of email exchanges with Infinia customer care! It took about a week. Suddenly, I got a text informing me that my application got approved. I received the card after a few days. This is

Another interesting thing to mention here: HDFC guys never asked for my Marriott Bonvoy membership number. However, after the approval of the card, I checked my Bonvoy account, and it shows that I am a silver elite member now!! I guess they just track the Bonvoy membership through email id/mobile number of the cardholder. Not sure though!

Hey sid,

I already have an infinia, do you think I need to talk to the branch manager for a second card? or shall I just apply online? as im not sure if they would issue a second card…

Apply online. You’ll most likely get it. If not then you may ask branch to intervene. Only 3rd card is an issue these days.

Hi Sid,

Received Swiggy card few days back. I had NeuInfinity/DCB/Infinia already.

Not sure how they plan etc. I am only worried if I won’t be able to get Apple Card once launched (if at all 🙂 ) as I hold these..

4 Cards, great!

I’m sure you won’t need the 2% Apple card but ya I wish they go for premium segment.

True Sid 🙂

does this card give points on rent payments? if yes then by which rent app?

Hi Sidd,

Can you review the newly launched Regalia Gold Credit Card. And how does it differ from Regalia or Regalia First….Is it a good move to migrate from Regalia to Regalia Gold…..I have read about it but I value your reviews the most

Will cover in next few days. Thanks!

I already have HDFC Infinia and ICICI Bank Emerald Card. Also I am a bonvoy Titanium member, is this card still worth for me ?? I wanted to have AMEX Platinum Charge card which provides Marriott Bonvoy Gold Status but I live in a city that is not covered by AMEX. I have a very good credit history and good ITRs, is there a way I can get it ??

It’s worth it for anyone because of it’s welcome benefit.

But why care about Gold while you have titanium? Neverthless, Amex is expected to go Pan India shortly. You might need to wait for that.

Because you need to spend 75 nights annually to attain Titanium status, I did spend that much night last year so I have it, but I might not be spending this year so I might be downgraded to Platinum status next year .. well if AMEX is going Pan India it’s really good news as it comes with elite status of many other hotel chains other than Marriott ..

Got it. And are you finding any major advantage with Titanium over Platinum?

Major difference is the points bonus. In platinum its 50%, in titanium its 75%.

Not as such, it’s mostly the points, they give you 50% bonus point as Platinum and 75% as Titanium. I think while upgrading the room at checkin chances of getting a suite upgrade are higher with titanium than platinum.

Also they have a 48 hour guarantee feature for titanium member which guarantees a room 48 hour prior to arrival or they will compensate, I’ve never used this feature.

Kindly upgrade once AMEX Platinum is available Pan India.

Hello Sir,

I tried applying but it is not asking for Bonvoy Number in entire application process

Thanks,

Pravin

can you do points transfer from marriot bonvoy to airlines for air miles ? lots of american cards offer this 1:1 transfer to good star alliance or oneworld airlines. does this card offer that ,i have amex plat(travel) but annoyed with the utlities,fuel,grocery not counted towards reward points thing looking to switch.