For the first time in the history of ICICI Bank Credit Cards, the bank has introduced a rewarding super premium credit card named Emeralde Private Metal Credit Card. Essentially, ICICI Bank has taken feedback on the previously launched regular Emeralde Credit Card and addressed those shortcomings, such as the reward rate, by making a few changes and launching a new product.

Here’s a detailed review of the newly launched ICICI Emeralde Private Metal Credit Card, which is currently being offered on an invite-only basis.

Table of Contents

Overview

| Type | Super Premium Credit Card |

| Reward Rate | 3% |

| Annual Fee | 12,499 INR + GST |

| Best for | Welcome Benefits |

| USP | Taj Epicure Membership with 1 Night Stay |

ICICI Bank Emeralde Credit Card is a wonderful credit card not only for it’s welcome benefits but also for it’s attractive reward rate.

Joining Fees

| Joining / Annual Fee | Rs.12,499+GST |

| Welcome Benefit | – 12,500 Points (12,500 INR value) – Taj Epicure Membership with 1 Night Stay |

| Renewal Fee | Rs.12,499+GST |

| Renewal Benefit | 12,500 Points (12,500 INR value) |

| Renewal Fee Waiver | Spend Rs.10L in the card anniversary year |

As you can see, all of a sudden ICICI Bank has become quite generous. I’ve never seen any other Credit Card Issuer being this generous on the welcome benefit. It’s almost 2X the value of what we pay.

Taj Epicure is heavily loaded as you might know and if you use all those benefits you might even get 3X of what you’ve paid.

And fortunately there is also a renewal fee waiver condition of 10 Lakhs p.a. which is very much feasible for most in this segment.

Note: I didn’t receive the welcome points automatically despite receiving an email alert. However, raising a request with wealth support got the points added the same day.

Design

The design is beautiful just like the regular Emeralde Credit Card and it is being issued only on Mastercard network as of now.

While the design looks elegant, I wish they increase the brightness of Mastercard logo a bit as it looks dull now, as you can see above.

It’s a metal card and so don’t forget that the card comes with a 3,500 INR card replacement fee just incase you missed it.

Reward Points

| SPEND TYPE | REWARDS | REWARD RATE (FLIGHTS/HOTELS) | Max. Cap ( Per Stmt Cycle) |

|---|---|---|---|

| Regular Spends | 6 RP / 200 INR | 3% | Nil |

| Grocery | 6 RP / 200 INR | 3% | 1000 RP (Max: 33K INR spend) |

| Utilities | 6 RP / 200 INR | 3% | 1000 RP (Max: 33K INR spend) |

| Education | 6 RP / 200 INR | 3% | 1000 RP (Max: 33K INR spend) |

| Insurance Spends | 6 RP / 200 INR | 3% | 5000 RP (Max: 1.67L spend) |

- Redemption Fee: Nil

- Tax, Fuel & Rent payments are excluded for Reward Points

- 1% fee on Rent Payments

- All Capping are set as per Statement Cycle

You get to enjoy 3% reward rate on most of the spends and those that have limits are quite sensible. Note that Grocery, Utilities & Education Spends will have SEPARATE 1000 RP cap for EACH category.

We’ll have to thank the one who designed this reward system limits because this is probably one of the few cards in the industry that follows the common sense on max caps. Though, I feel Education could have had better limits.

It’s sheer stupidity of some banks to just keep on adding MCC’s every other quarter to exclusion list, instead, setting such decent caps is a good move as most regular spenders wont be affected this way. Well done ICICI Bank!

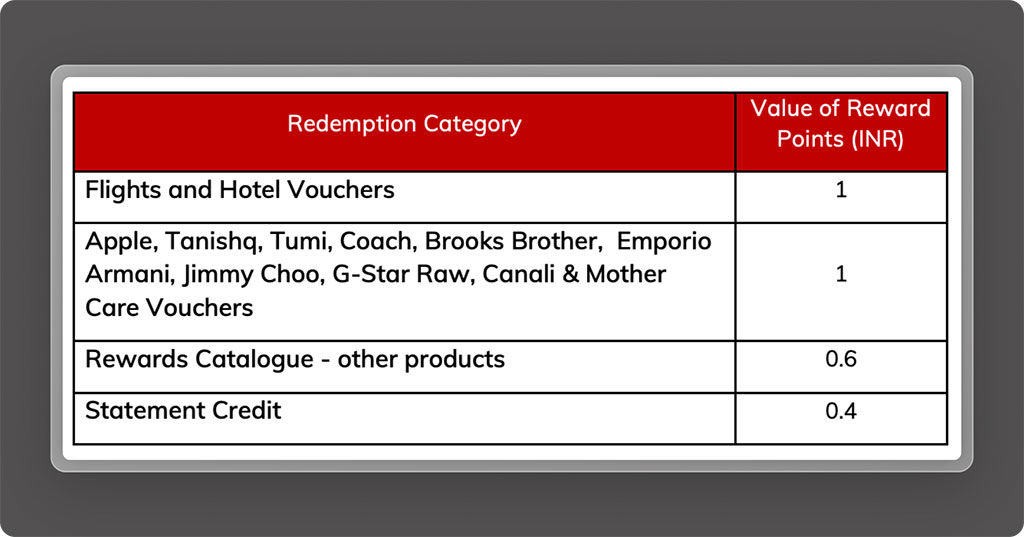

Redemption

Just like most other super premium credit cards, ICICI Emeralde Private Credit Card is also focused on Flight & Hotel redemptions to extract higher value of 1RP = 1 INR.

So if you’re not interested in travel redemptions, your reward rate will go for a toss. Though, it is to be noted that some branded vouchers like US Polo, Allen Solly, etc are still at 1:1 if redeemed for a higher amount like 10K INR.

Milestone Rewards

| SPEND REQUIREMENT | MILESTONE BENEFIT (EaseMYTrip Voucher) | REWARD RATE (AS POINTS) |

|---|---|---|

| 4 Lakhs | 3,000 INR | 0.75% |

| 8 Lakhs | 3,000 INR | 0.75% |

- EaseMYTrip Voucher can be used for Flights Only as per t&c

The milestone benefit is well-designed to provide an additional boost to the reward rate. When combined with regular rewards, it amounts to an impressive 3.75%, which is unheard of in ICICI Bank’s Proprietary Credit Cards portfolio.

The Milestone Voucher was triggered for my account within about a week of completing the transaction. So the milestone fulfillments are pretty quick too.

Points Transfer Partners

- Air India: 1:1

ICICI Bank has started coming up with an option to transfer your points to Air India. You can find the option on the home page of rewards portal.

This is good news, and I hope it leads to partnerships with many other international partners in the future. However, the transfer ratio is not exciting for Air India, as I rarely value Air India Miles at 1 Rs/mile.

Airport Lounge Access

| ACCESS TYPE | VIA | LIMIT | GUEST ACCESS |

|---|---|---|---|

| Domestic Lounge Access | MasterCard | Unlimited | – |

| International Lounge Access | Priority Pass | Unlimited | – |

The Domestic & International airport Lounge access benefit is not only for the primary cardholder but also extends to all Add-on cardmembers as well. Upto 3 Add-on Cards are complimentary with ICICI Bank Emeralde Private Credit Card.

Golf Benefit

- Complimentary Games/Lessons: Unlimited

- Coverage: 20 Domestic Golf Courses & 90 International Golf Courses

It’s rare to find Credit Cards with access to international golf courses, so it’s good to see that with a coverage of 90 International Golf Courses.

However, remember that only 1 booking can be held at any point in time. So, practically it’s not unlimited, that’s fine though.

Forex Markup Fee

- Foreign Currency Markup Fee: 2%+GST = 2.36%

- Rewards: 3% (3.7% if you hit milestone)

- Net Gain: 3% – 2.36% = 0.4% (minimum gain)

Similar to most other super-premium credit cards, the ICICI Emeralde Private Metal Credit Card also offers a discounted forex markup fee of 2%, resulting in a net gain of close to 0.5%, leaving a lot of room for improvement.

Other benefits

- Cash Advance Fee: Nil

- Late payment Fee: Nil

- Over-limit Fee: Nil

- Bookmyshow: Buy one ticket and get up to 750 off on the second ticket on movies/sport events/theatre/concert tickets, twice per month

- EazyDiner Prime Membership

My Experience

I asked my new ICICI Wealth RM to inform me about the steps to upgrade as soon as the card goes live. Once it went live, the RM patiently followed up with me almost every week for over a month, which was a bit surprising from ICICI RM’s.

One day, I decided to go for it.

The RM connected me to the representative who handles credit cards at the branch. She took the request for an upgrade from my recently issued ICICI Sapphiro Credit Card, which previously replaced my Intermiles Sapphiro card.

The service request was approved within 3 days and I was able to see the card on my app. I received the physical card in the next few days. All of this happened within a week, and it was super smooth.

Tip: For those who’re stuck with an upgrade, all you need is to find the person who can take the request. Surprisingly it can as well be done by the phone banking officers but maybe not all are aware of it.

I did use the same route to apply for an upgrade for some of my clients and most of them went through successfully, except for one, which we’ll discuss below.

Eligibility

- For Fresh Applications: Invite Only as per Bank

- For Upgrade, Credit Limit on Existing ICICI Bank Credit Card: ~10 Lakhs

Ideally, such invite-only cards are issued to existing customers with a good relationship with the bank. However, the bank may change its requirements from time to time.

For fresh applications, ICICI Bank may not issue the card easily. However, if you have other bank cards with a credit limit of over 10 lakhs, you may give it a try.

For existing ICICI Bank credit card customers, the expected credit limit on the existing card for an upgrade is in the range of 10 lakhs. However, one might need to hold premium cards like Rubyx/Sapphiro to increase the probability of an upgrade, as I’ve seen 1 case getting declined with a 15 lakh limit on the Coral Card.

If you already have the Emeralde Card, you might as well see the upgrade option on the app.

If you couldn’t get the card for any reason, you should first try to get the regular ICICI Emeralde Credit Card and then go for the upgrade, which will be lot easier.

Devaluation Meter

- Devaluation meter reading: Low

Except for the lucrative welcome benefit, all other benefits are well capped, so I’m not expecting any major devaluation. However, since they’re new to a high-rewards card, they might keep optimizing the redemption value for vouchers.

Also, as of now, the bank isn’t issuing the card easily for everyone, which is a good sign. If that continues, it may take well over 2-3 years for any major devaluation to happen.

Bottom line

- Cardexpert Rating: 4.8/5

With the Emeralde Private Credit Card, ICICI Bank has finally introduced a rewarding super premium credit card for those who have been waiting for it. Part of the reason for this achievement is likely because ICICI Bank has exited Payback Rewards and launched its own rewards program.

With pretty good rewards and wonderful joining benefits, it’s certainly one of the best credit card in India for 2024.

While this is a good start, I hope the bank soon brings in more airline/hotel transfer partners and an accelerated reward system like HDFC Smartbuy’s 5X/10X rewards in the future to compete well with the King of Super Premium Credit Cards.

Wow. Good to know about this card.

I’ve been seeing upgrade option to the normal Emeralde in the app for a while now. I’d assume if I reach out to my RM they’ll check the possibility for this card as well?

Yes, of-course!

I have got a limit of INR 20.90 L on my ICICI Sapphiro. In my iMobile app I can see the offer to upgrade to the normal emeralde. But I am not interested in that.

Same here. Did you try checking for upgrade through customer care?

How are you giving such high rating to this card?

It is way behind Infinia or even DCB metal. 3.3% vs 3%. No accelerated rewards, no Airline transfer partners

Things like unlimited lounge access and all is common for a super premium card. Even Yes Marquee has it. There is no guest access on this as well

Some how this card does not standout to be honest. Only differentiator is exclusivity factor as it is little hard to get. Thats all

– Upto 3.75% Reward Rate

– 2X-3X Welcome benefit

– Rewards on most type of spends for regular users

– Can be treated as good as 100% redemption

Nevertheless, I keep adjusting the rating from time to time based on updates/devaluations/feedbacks etc. Thanks for your feedback.

I must say i agree with the above comment. This card has 2x welcome benefit (which no doubt is great), but beyond that, there is absolutely nothing. Over multiple months, my spend on it is easy. I see no good reason to spend on this over Infinia.

Hi,

Will add on cards for emeralde metal also comes along with primary card if we upgrade from plastic emeralde ( i have 3 addon with plastic).

Or we have to apply again for addon

Most upgrades with ICICI are usually separate requests even though they call it as an upgrade, so I doubt about that.

It means , old cards will remain active with upgraded card. Both card will be charged.

Yes, ICICI doesn’t close old cards on upgrade unless you request to close.

I don’t have any relationship with ICICI.

Is there a way I can directly apply for this card ?

monthly salary ~2.5L pm

Hold HDFC diners black metal with ~9.25L credit limit, and few other cards

You may check with the branch.

You may want to correct that 2% plus taxes would be 2.36% not 2.2%.

Thank you, updated.

I have the LTF Emeralde card with 10L limit. Has anyone got the metal card as a free upgrade or LTF Emeralde Metal card? Looks like a long shot. Emeralde has 4 BMS p.m. offer as opposed to 2 BMS p.m offer on Emeralde Metal.

They’re not giving it as FYF or LTF as of now.

How to apply for this card? can we apply C2C basis? Got a wealth account but its in dormant condition

They gave rewards on wallet spends (short lived) and removed it during Feb 2024. If they would have continued, it would have been go to card

If they have continued, they might have to follow Axis like devaluations. 🙂

So i’m glad they found and fixed early.

🙂 Agree. But devaluing too early gives less confidence on bank for someone getting the card. Nevertheless my usage was prior period and covered!

Hi, in eligibility you’ve mentioned “For Upgrade, Credit Limit on Existing ICICI Bank Credit Card: ~10 Lakhs”. Is this from the bank? I don’t think this is true. If it is an invite-only card, how does this make sense?

It means they’ll invite you if you’ve above 10L CL with other banks. 🙂

In a way, no card is pure invite only.

New transfer partner, Air India, 1:1 .

For other Icici cards having transfer feature, it’s 6:1 .

Big question : will AI revamp it’s FR miles program to the level of CV!

Yeah I did notice it on the rewards portal. Updated, thanks.

The thing is that all these super premium cards are insanely gatekeeped by the banks. All the Infinia, Emeralde, M4B etc. get all offered to the same very narrow set of customers. They aren’t accessible even for people who will regularly do high spends on them and more than have the capability to pay back in full what they spend. Even if they are willing to pay annual fees.

In fact, many people who get these high premium cards don’t even use them as they don’t see the need to and keep them as trophies. Indian banks should mature in their approach to credit cards as a business vertical and stop being so scared of offering cards to high spending customers who otherwise don’t see the value of uselessly parking high amounts of money in their FDs and ULIPs.

I disagree with that approach.

Deep Devaluation of Axis Magnus & Reserve are the proof of giving super premium cards to anyone easily.

That said, it’s not that tough to get these super premium cards in 2024 as long as there are good spends with decent relationship with the bank.

Agree 100% with you Siddharth. Just because of a select few people, all the other genuine users of Axis Cards had to let go of such good benefits. Indians will find out a way to exploit and game the system no matter what and the genuine users will be left stranded.

So I think it’s not a good idea to give these premium cards to every Tom, Dick and Harry. Just my 2 cents.

Does icici emeralde private has complimentary spa benefit?

No

I checked with RM and I was told you need 2 cr FD or equivalent relationship with bank. I have 49 lac limit on sapphiro and salary account still denied card upgrade to metal emaralde

Hi,

I have 15L CL with LTF Sapphiro. 30L in FD and salary account with ICICI. Still ain’t getting an upgrade. RM is outright useless. Doesn’t even bother to push the case.

Call Center tells me, only the RM has to make a case around this.

Any workaround?

Thanks

Nandh

If they giving an emeradle pvt upgrade at 10L CL, I have to see how to get my rubyx CL increased from 8.8 to 10L, have a wealth relationship with icici. Rubyx was a very good card with reward in the range of 2.8% but ever since it moved from handpicked rewards to icici rewards, the reward rate has plunged to 0.87% . Right now app is only showing upgrade to one dual network MC/Amex Sapphiro LTF, and Makemytrip visa signature at 2.5K +gst joining free and no annual fee. There’s very little info on the dual network Sapphiro, seems it’s reward rate is 0.5 to 0.75% . Emeralde pvt seems to be the only serious card from icici, besides amazon.