One of the most important benefit that I’ve been looking for in the world of banking and credit card is the ability to view my credit report as a part of credit card/banking benefit. Banks have started giving importance to it and recently we’ve also seen HDFC Bank giving free CIBIL Report.

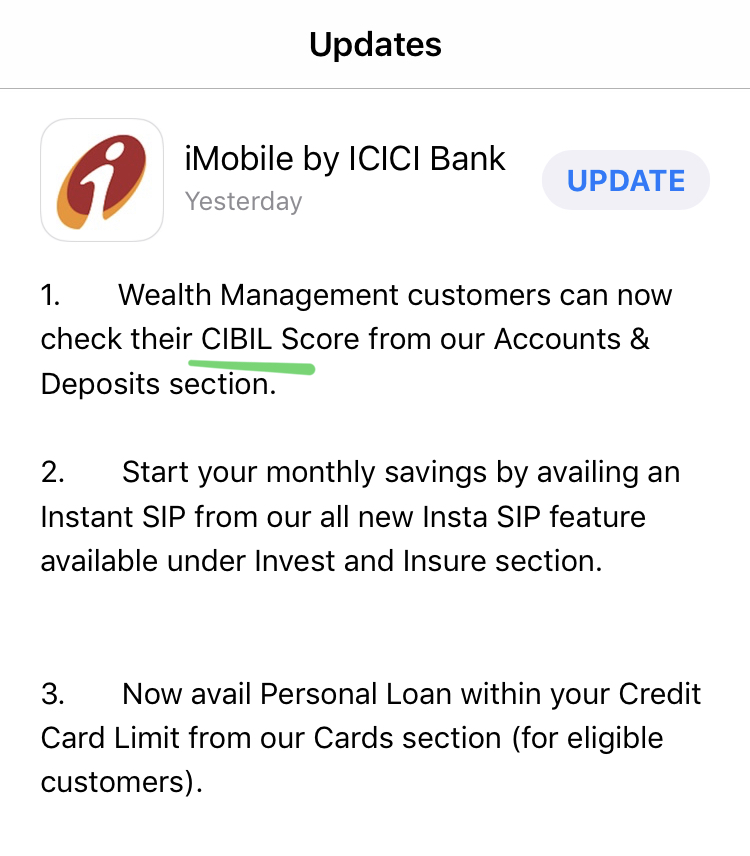

Now ICICI BANK has took this one step ahead and integrated it into their mobile banking app. While HDFC bank allows anyone to view the report online for Free, ICICI allows only its Wealth Management Customers to access this benefit as complimentary, right on the app.

Though, its weird that the free report is not available on ICICI net banking interface. Maybe its not integrated that way yet but we may expect it to happen soon. Here’s how to get your free CIBIL report,

Table of Contents

How to Check CIBIL report via ICICI App

- Update your ICICI iMobile app, if not already

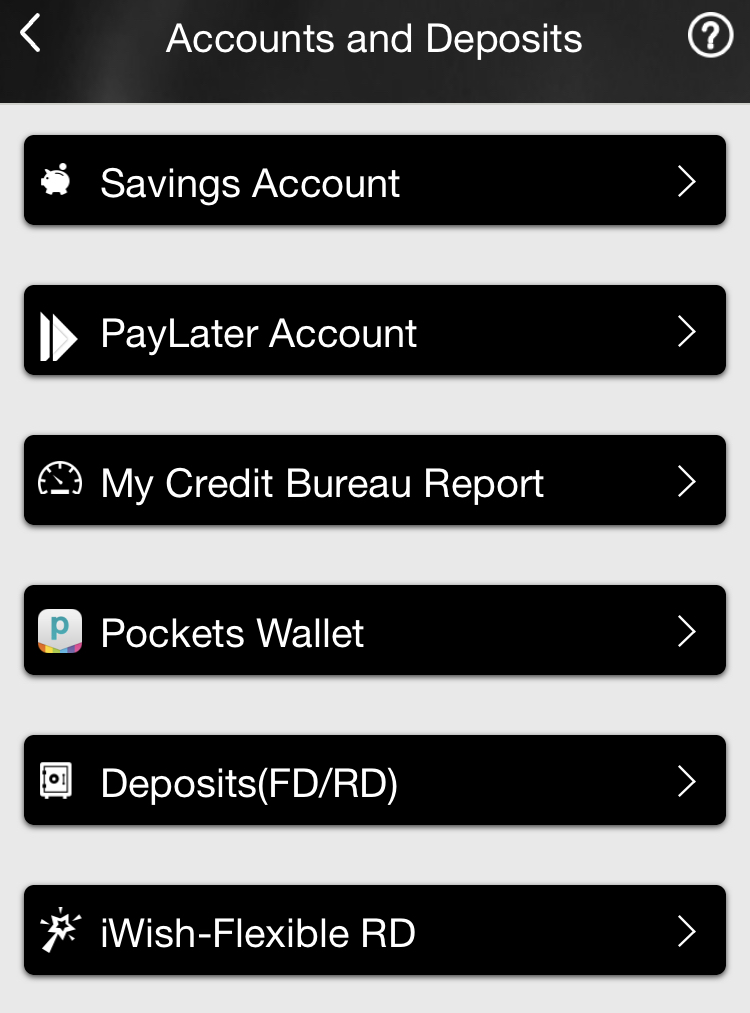

- Goto Accounts & Deposits section

- Tap on “My Credit Bureau Report”

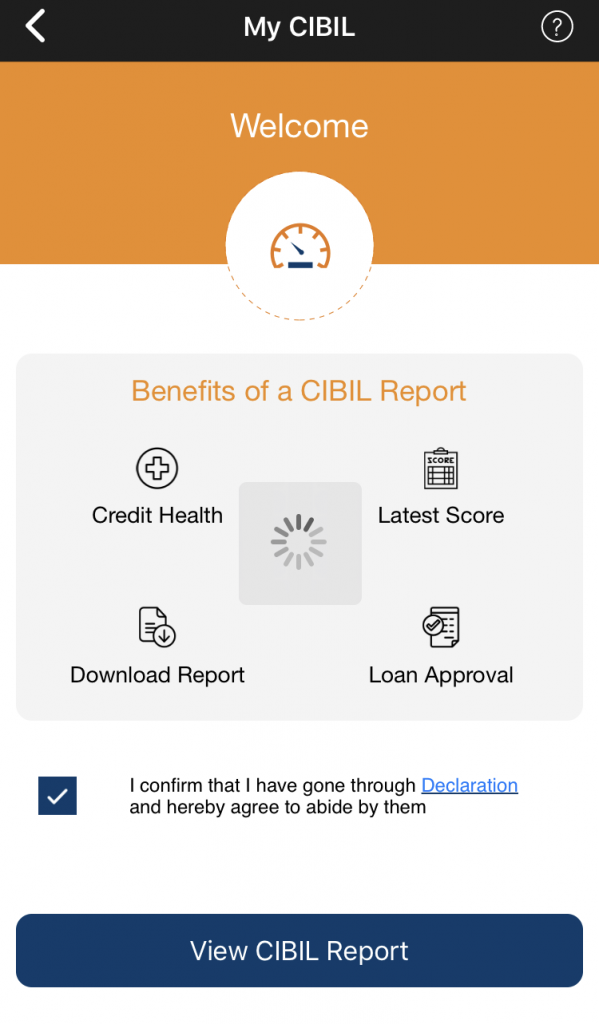

- Tap “View CIBIL Report” on next page

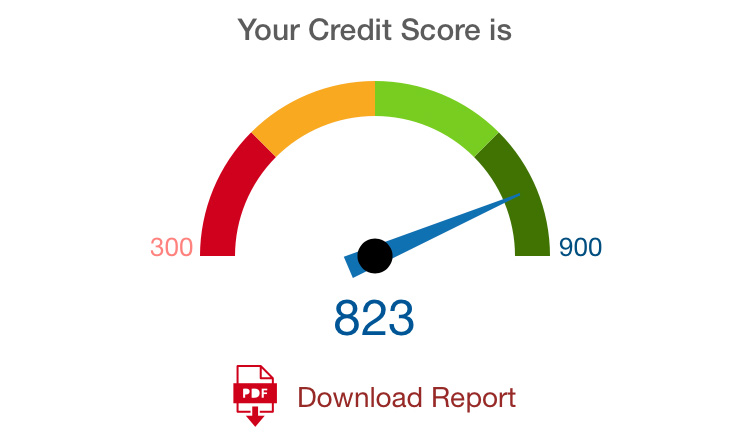

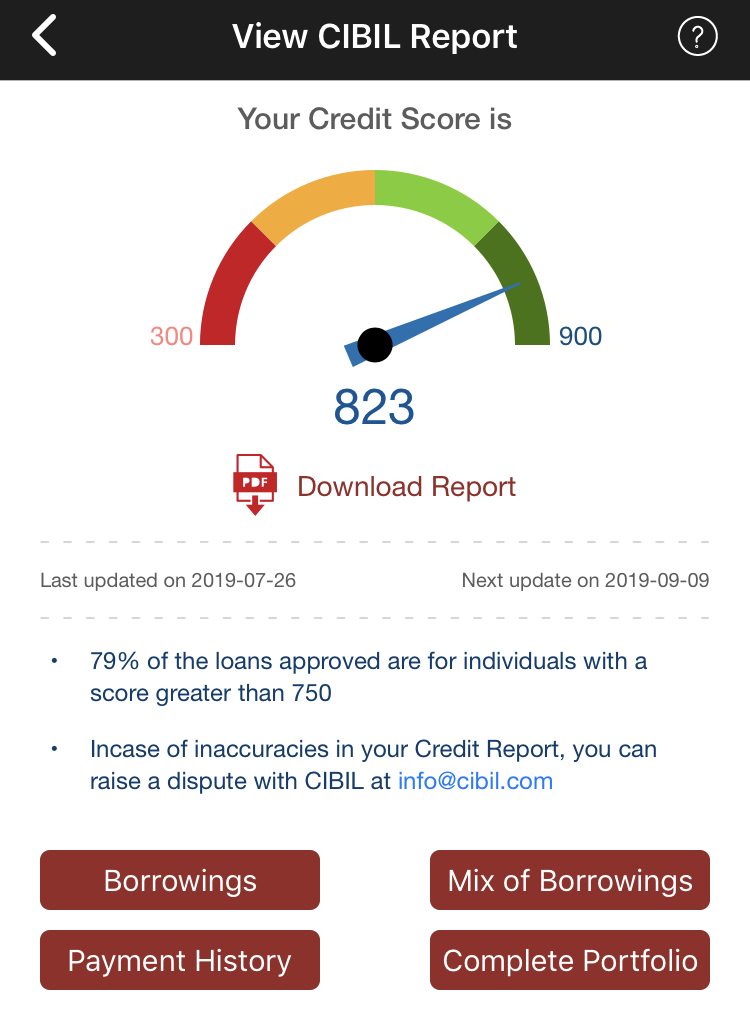

- Tada, your CIBIL score is in front of you.

You may also choose to download the full report or check the important parameters, which are well integrated into the app (verified on iOS). Here are some of the snapshots,

Note: You may face error at times, especially in the last step. Just keep trying every few mins. I got it 5th time or so. never give up 😀

Who Can avail?

This feature is only for ICICI Bank’s Wealth Management customers (NRV 25L) at the moment. Remember, you can also get wealth status as a reciprocal banking benefit by opting for one of the premium credit cards from ICICI: Sapphiro, Emeralde & Diamant.

I personally hold wealth status with ICICI via Emeralde Credit Card. Earlier, the major advantage of Wealth status used to be quick connect without IVR while calling customer care. Now its good to see this additional benefit.

Things to know

- Report Refresh Period: ~45 Days.

Which is more than enough for a typical user. Also note that this fetch also refreshes your report on your regular CIBIL login (if you have one already). So you can also login to CIBIL to check the updated report. Though, I see slight variation in the data between these two.

Pro Tip: Time your HDFC/ICICI fetches properly, so you may view your reports even more frequently.

If you’re currently using paid membership plans from CIBIL, this is going to save you about Rs.1000 a year.

What could be better?

- Would be nice if they include other reports too like Experian.

- More details of the a/c’s (limits, etc) on screen, without downloading the report.

Bottomline

This is an amazing feature to see it live, as it fulfils 1 out of my 10 wishes that I have for 2020 🙂

Hope to see such features on app & net banking with other banks and credit card issuers, as complimentary for their Premium/Super-premium banking & Credit card customers.

Okay, so that’s just me enjoying the small wishes going live within a week of wishing.

How about you? Do you like this feature? Feel free to share your thoughts in the comments below.

@Sid

Another great & informative article.

Thanks for giving us cardexpert.in, a super platform to discuss cards and related topics. Wish all your wishes come true in 2020 & beyond.

Regards.

ICICI Netbanking (wealth management) gives CIBIL report free @ 1 per year if you hold an active ICICI credit card. It’s under “Exclusive Offerings” Tab > “Cibil Report”. I have been using this feature for the past 3 years.

It asks me Rs.300 even now. But yes, few other have reported this in the past. Maybe its for select accounts/card variants.

Yeah, wealth customers do get free CIBIl report in the ICICI netbanking also. This feature is there since many years. Moreover, as you said – “While HDFC bank allows anyone to view the report online for Free”

but HDFC charges me for getting a CIBIl report in netbanking.

Hi Sid! Getting ICICI Saphiro did not convert my ICICI savings account to Wealth Management. Are you sure it is still applicable? Also is it applicable on Emeralde card? I couldn’t find any info in ICICI website regarding this. But it was given under ICICI bank benefits last year.

It happened to everyone with Jet Sapphiro in the past. Now sure how things work now, but Customer care is aware of it.

Note that it wont get you full wealth benefit like wealth debit card as they’re deny for me for past 2 yrs.

I had read somewhere that you can open a zero balance account under ICICI Wealth if you hold a Sapphiro Card. I hold Sapphiro Duo Card ( AMEX + MC) and I have called the customer care twice enquiring about the same. They kept saying that I cannot open the savings account until the system throws an eligibility notification on their system for same.

My account was upgraded to wealth management after I upgraded to jet sapphiro. Recently, I swapped my jet sapphiro for sapphiro and it remains the same. I don’t have any other relationship with icici.

Remember, you can also get wealth status as a reciprocal banking benefit by opting for one of the premium credit cards from ICICI: Sapphiro, Emeralde & Diamant.

Could you please explain how this works. If i have 3 accounts which one gets converted

If any of them get converted to wealth, all of them will be considered as wealth.

Hi

Dear OP,

what is your opinion / comment on the “declaration” before agreeing to download this free report?

Is it worth giving full unconditional agreement for sharing our report to this “agent” to use in whatever manner they find appropriate?

.@ Sky – That depends how paranoid one is regarding the use of information.

Am I the only one here experiencing problem with ICICI in viewing cibil report?

For me, forever it showing try after sometime.

Just close & try again.

It did not work before and its not working now 🙁

Thanks Sid for this info. It was a breeze to get the report.

Hello Siddharth, thanks for the info. I have subscription for the official CIBIL website too and when I check the score no the ICICI App, its much higher than whats on the CIBIL website. Even after a refresh.

Wonder how the App is showing a different figure. Also, when I download the report from the App, it just shows one credit card details and nothing else.

@ Harish:

1) “Wonder how the App is showing a different figure” – It’s not only the difference between ICICI App and CiBiL, there’s also a marked difference between personal CiBiL score/report and the one that banks get when you go to them for the approval of loan etc. Use the Personal/App CibiL report for analysing your financial health and/or reporting any errors. For everything else, it’s the bank’s CiBiL that has more weight.

2) “Also it just shows one credit card details and nothing else” – It shows me all my present and past card/loans. If your card is recent (less than 3 months old), it takes time to reflect in the CiBiL)

Am I the only one who don’t have that option? The one you show to view cibil score.

Re-install the app or update it

Hi All,

I am existing ICICI PRIVILEGE banking costumer and I have an Sapphire credit Card.

Any suggestions how to get an Wealth Management Account Upgrade?

Suggestion Appreciated.

Cheers,

Kiran

Hi guys,

Any suggestions?

Cheers,

Kiran

NRV 25 Lakhs needed for WM upgrade

HI,

I saw today a mail from ICICI Wealth Management, made be inquisitive. Logged in to internet banking and I see, I have been upgraded to Wealth Management.

Had a word with Customer care, they say its been done based on track record and free of cost.

Surprise from ICICI for me.

Regards,

Balpreet

Enjoy their dedicated customer service desk.

Have you received any Wealth management Welcome kit like Cheque Book, Wealth Debit card post upgrade?

Also any Wealth RM mapped to your account in netbanking?

Hi Sid,

I do have Axis Select credit card by virtue of Burgundy wealth account holder. Recently I opened Wealth account with ICICI. I already have ICICI Coral , HDF Regalia as Life time free.

Please guide, whether I am eligible for Saphhiro.

Ask ICICI Bank!

The free CIBIL report is now also available on ICICI net banking interface. Refresh period of 1 and a half months.

I will watch my cibil score sir

Refresh CIBIL report via ICICI WM reduced to 15 days. Means you can get upto 4 CIBIL reports per month through Webpage and iMobile

Any one received Visa Infinite Variant debit card with Wealth account?

Wealth Customer care is saying only Master Card variant is issued by bank to Wealth customer & Visa Infinite variant to Private relationship customer.

If yes, please share steps how to get the Visa variant.

@Siddharth, your views please?

No idea on visa infinite. I did not even get MC world as mine is not real wealth ac but in wealth “segment”

There is no Visa Infinite variant with the Wealth Account

Yes , i got wealth select visa infinite card. I opened wealth account last month and got this card.

But dont know benefits of visa infinite over mc.

Anyone pls tell?

how you got this card is is your account wealth management or wealth select?and how much you maintain and how to get one?

Free report option is available in Net banking for Privilege status customer though not for Wealth customers. Wierd thing from ICICI 😛

@Siddharth I was upgraded to wealth management after getting the ICICI Sapphiro Credit Card and 2 Days ago my account was downgraded to Privilege account. Has this happened to anyone?

I hold icici sapphiro for 2+ yrs and last month my account also got downgraded to privelege. Is wealth management now only available for emeralde and above?

Sapphiro credit card is being given as LTF for active WM accounts

Hi Shivi,

How do we apply for this? I have an HPCL fuel card, and I dont see any option to request for an upgrade on the Web portal.

Cheers.

Close all existing cards with ICICI. Wait for a month or so. This offer pops up

Hi,

Is family wealth management account possible, without any requirement to have maintaining any NRV with the bank. For the Wealth Management account upgraded by virtue of holding a Sapphiro card ?

Anyone who has got it done?

Cheers,

Kiran

No RM, no BM has any solution to this in my experience.

Basically the card linked benefit gives you only the “Segment” benefit and doesn’t update the “account code”.

This is bit complicated and so I’ve avoided the attempt as it may affect the WM benefit.

But yeah, would be good to see if anyone else have tried it.

Thanks for the response Sid, I had called my RM asking for the same, she said an cust ID has to be created and all the family accounts can be upgraded using that and since I said will not be able to visit the branch she did courier me the filled form where I have to just sign and send it back to her.

But I do not want to send it and lose my existing WM relationship, so I have kept on hold until someone confirms me if its safe to do so. Any experienced ppl sharing the views would be appreciated.

Cheers,

Kiran

@ Kiran –

Afaik – This backward linking was possible before Covid induced lockdown of 2020. An acquaintance got upgraded to WM from regular 10K MAB account due to her holding Sapphiro (around mid 2019). She was denied Sapphiro at first as she did not have a better account variant (at least Privilege was needed as per BM) but then she was automatically upgraded to WM soon afterwards.

The account variant was downgraded automatically too in August 2020.

You yourself got this benefit in 2017, Siddharth (and wrote about it too)! You got upgraded to WM as you were holding Jet Sapphiro Amex Card.

Yeah that’s on my ac. But he was asking about extending this WM benefit to family accounts, which I haven’t tried.

Ah, I missed that part.

@ Kiran – Your RM is right; all family members will be clubbed under Primary WM account holder’s ID & WM benefits will be extended to all under that ID.

It’s pretty much the same across all banks.

Yes, that will copy the account code, assuming not WM. The doubt though is whether it will copy the WM segment. It’s complicated 🙂

Had a strange experience with my new ICICI Sapphiro Cibil Reporting. My CL of 10Lac is Reported as 1 Lac in cibil. I had reduced my sub limit to 1lac for safety but I guess that should have nothing to do with Cibil reporting. Tried contacting icici customer care but they say it’s fine from their end. Tried raising dispute with CIBIL but they closed on not getting any response from Icici. Finally wrote an email to Icici Customer care and waiting for their response. Any Suggestions how to rectify this error.

You can’t rectify this “error”. This is how ICICI cards work; they report that limit which you manually set from Netbanking & which is there on their day of reporting.

My sister reduced her 10L credit limit to 10K for safety purposes & after 6 months of keeping 10K, ICICI made 10K as her new maximum credit limit without any way of going back to 10L!

It’s better to temporary block/lock icici cards than to reduce the limit on your cards in such manner.

@ shivi, Thanks for the response.

Yes, Sid is right would not like to lose the existing status by extending it to family members. Just wanted to check with people who have already had WM status with Sapphiro card and have extended it to family members without any issues. If anyone successful that way will go ahead otherwise will hold it.

Cheers,

Kiran

Today my refresh was available and I got a shocker when I fetched the report. I have a dip of 50 points!!!

While digging in, found my defunct (received a message almost 10-12 months ago, mentioning the card is deactivated due to non-usage) Union Bank Card reported continuous 4 months (Mar-Jume’21) of ‘Days past due’ by 30 days each!! The last bill generated on this card was almost 2 years ago (Oct’19).

Immediately logged in on CIBIL to rise dispute; but to my surprise, I can’t raise dispute on the basis of such third party (ICICI/HDFC/Bazaars) reports. My luck favored though, as I found I can get my free yearly (direct) report since I last got it 17 months ago. Fetched it and raised the dispute. Received mail confirmation mentioning ‘We will get back to you shortly’. Let’s see.

Standard answer you can expect , please resolve the issue with the bank , CIBIL does not have control over information that banks provide… since last 2 years , some bank has out some random landline number in my credit report, cibil not only refused to correct it but also refused to tell me which bank had put that information

Yesterday evening, after talking to CC executive, mailed to UBI mentioning their ‘Irresponsible act’ (disputed at CIBIL 2 weeks ago). Today received mail from CIBIL mentioning all 4 months ‘Days past Due changed to STD’ from 30 days. It’s also mentioned ‘Note that CIBIL cannot modify any information in the database without confirmation from the relevant credit institution/s’.

‘STD’ I believe is ‘Paid within 90 days’ which is also wrong, it should be ‘0’.

Will my CIBIL score increase after the correction?

My CIBIL score is back to normal.

Hi Siddharth, How long are you using Emeralde credit card?

I have sign up for Emerald credit card August 2020 and paid joining fee of Rs.12,000+2160 tax. I have reached the target of Rs.16,66,368 as per credit card statement, having enough proof still they charge me annual fee of Rs.12,000+2160 I have been calling almost last 20days calling customer care and they keep telling me that their system shows I spent only 12,00,000.

More over they charge me Rs.14,250 as late payment interest for the month of May, June 2021 difference of Rs.10,000 missed on time.

I really don’t know what to do next. Thinking of taking this to court.

Used for 2 years and had to close.

Usually reversals mess-up the system. If you’ve made >15L spend without reversals, just keep escalating along with stmts as proof.