AU Small Finance Bank launched the Ivy Metal debit card on Visa Infinite platform a few months ago. It’s a Life Time Free debit card designed specifically for customers who are part of AU Bank’s Ivy Premium Banking Program. Here’s everything you need to know,

Table of Contents

Eligibility Criteria

- AMB: 25L+ (or)

- TRV: 2 Cr+

AU Bank requires you to join its Ivy premium banking program by maintaining either AMB of 25L or TRV of 2 Cr, in order to be eligible for this card. Requirements are usually strict, but may vary a bit with location & time

TRV (Total Relationship Value) includes Savings AQB+ FD balance+ Life Insurance Premium paid per FY+ Mutual Fund AUM

USP

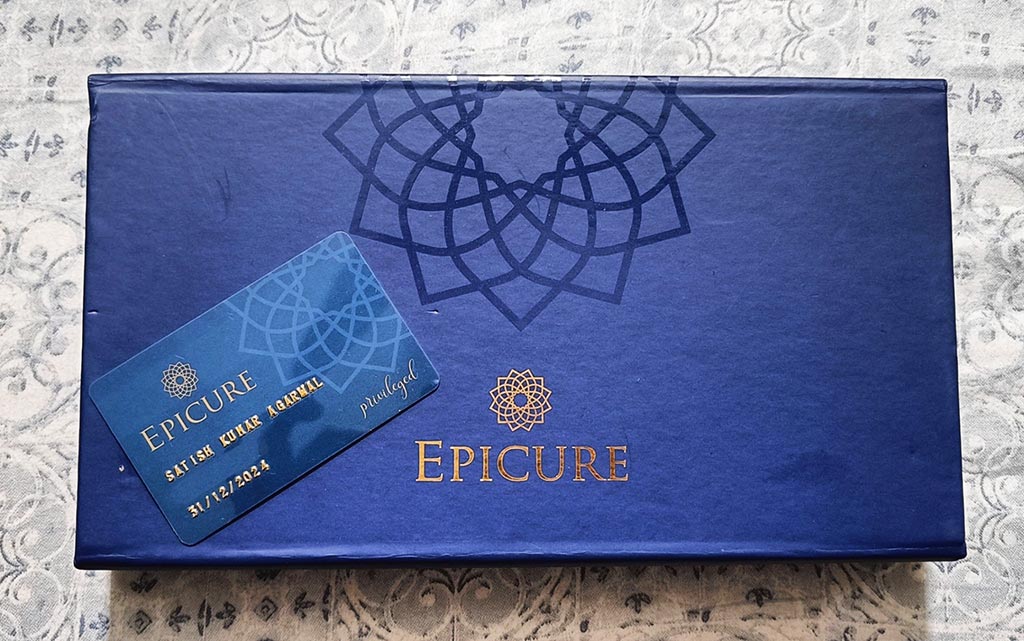

AU Ivy entitles numerous lifestyle benefits. Primary USP being Complimentary TAJ Epicure Privileged membership to Primary account holder worth ~59K INR

TAJ Privileged membership with AU Ivy gives (at select participating hotels):

- Complimentary stay for 2 nights (base category for 2 people)

- Complimentary 60 minutes of Spa to 1 person with access to sauna & steam

- TAJ experience all day dining voucher for 2 people

- Exclusive access to any TAJ club lounge

- One time one level room upgrade for one night etc. as noteworthy benefits

- 25% on F&B, 20% on Spa, etc

Caution: To avail above, spend >= 2L on Primary account holder’s Ivy debit card, via Ecommerce/POS on or before 31st May’24 (for accounts opened in April’24) & maintain AMB/TRV in May’24. TAJ Privileged membership will be activated by 30th June’24 upon fulfilment of these criteria

Note: Till 31st March’24, above spend requirement was 10K only, which has now gone significantly high at 2L. Very bad!

My Experience: Membership email notification came within 2-3 days of fulfilling the spend criteria & physical TAJ Privileged membership card got delivered in ~ a week

The membership is valid for 1 year from the date of issuance. Renewal tncs aren’t well defined currently & could be renewed on the basis of customer maintaining the program criteria as per bank policy.

Features & Benefits

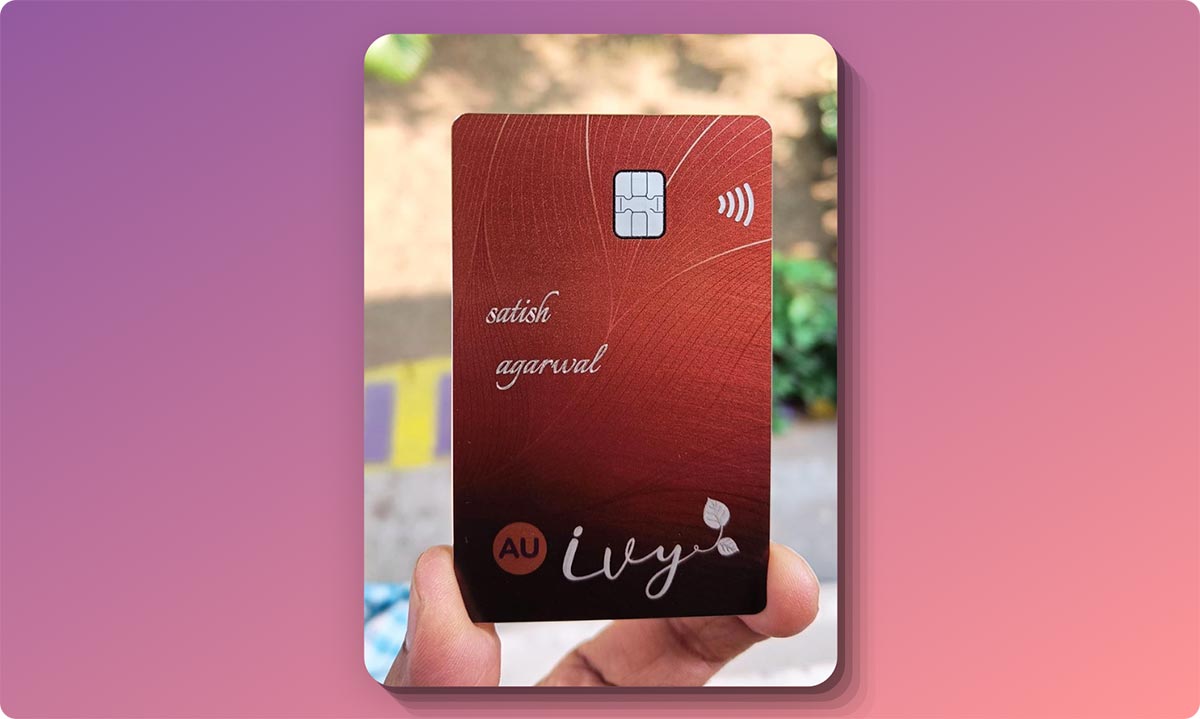

- Exquisitely crafted AU Ivy Metal Debit Card

- 1% Cashback upto INR 1000 every month, posted within 60 days from the end of the txn month (on min. non-fuel spends of INR 2500 pm)

- Zero cross currency mark-up (for txns done in foreign currency only)

- B1G1 on BookMyShow: 8 free tickets (6 movies, 2 events) every month, no quota & max. INR 500 per ticket

- Complimentary Eazydiner Prime annual membership @ INR 2

- Complimentary Domestic airport lounge access: 4 per Qtr (covers almost every lounge)

- Complimentary International airport lounge access: 4 per Qtr via Ivy debit card itself. Authentication charges gets reversed within 7 working days

- Complimentary digital annual subscription of Livemint & Wall Street Journal @ INR 1

- 2 Complimentary Lockers (per group, subject to availability)

- 2 Complimentary Golf Lessons per quarter

- NIL AMC on demat account

- No Charge program on almost all banking services

Note: AU topmost Credit Cards like Zenith/Zenith+ will likely be pre-approved basis Ivy relationship, provided city is serviceable for credit cards

Family Banking

Group upto 9 extra family members under Ivy Premium Banking Program. Each grouped member gets same Ivy metal debit card & enjoy all of the above benefits, without the requirement to maintain Ivy program eligibility criteria. Initial opening cheque of 1L is required though

Note: TAJ Privileged membership won’t be issued to Family Banking accounts of the group. Kids can also be grouped under Ivy program, but debit card will be issued if they are 10 years+

Welcome Kit Unboxing

Welcome kit is big n solid with jewellery kinda box, having exterior faux-leather & interior suede finish. Even family banking welcome kit is same & feels premium

Card look & feel

The card is beautifully crafted & finished, in shades of saffron-maroon. Name is etched in unique italic style on the front, whereas card numbers are at the back (red tone)

Note: Being a card with metal form factor, be ready to keep your hand/card super straight in ATM else there will be operating issues as the card is stiff enough. You may think card is thick, but this is normal with operation of any metal card.

What could have been better

- No milestone benefits on Ivy debit card. Less premium AU Royale (Eligibility: 1L AMB) debit card gives good milestone benefits. Ivy should have enhanced milestone benefits

- 1% Cashback limit of INR 1000 pm is too low for the UHNI account category

- AU Royale welcome kit contains a nice faux-leather cardholder, Ivy doesn’t

- AMB/TRV requirements are ultra high. AMB range 10-15L & TRV range of 30-45L should have made Ivy a segment killing proposition

- Eligibility criteria could also have included net salary credit in the range of 3L

- Spend requirements at 2L for TAJ Epicure Privileged membership is way too high. 50K would have been far better

- More serviceable locations, as Au SF Bank is limited to only few cities at the moment

Note: Royale Debit Card Milestone benefits discontinued wef 01.04.2024

Bottomline

The association with TAJ group for the AU Ivy program was originally valid until 31st March 2024 & now extended till 30th April’24. Likely to be extended further in future

TAJ Epicure Privileged membership is the only distinguishing USP which can justify Ivy’s high AMB/TRV requirements over IDFC Wealth/Private & Indusind Pioneer programs having similar (or) less eligibility criteria.

Is the Taj epicure member ship for year 1 only, or renewable every year ?

Tncs doesn’t mention clearly. Could be extended if relationship criteria is maintained is written in tncs

AU Royale debit card milestone benefits are gone now.

Got the email with the below details.

As an AU Royale Debit Card cardholder, you are entitled to a wide range of offers and benefits. However, we would like to inform you that Milestone Spends Benefits are being discontinued starting from 1st April, 2024

Does TRV include amount in demat?

As of now, No. MF taken via AU does count

Can we use the debit card for paying the credit card bills and get the cashback of 1% plus fulfilment of 2 lacs spending criteria?

What is the offer on Royal account debit card? Never heard about it.

Yes, I use CRED to make payments larger than 50K as it allows debit card for those payments. You technically receive 1.25% back. 1% cashback. Takes roughly 25-30 days in the following month. You also receive 0.25% as points that can be redeemed against vouchers. So essentially 1.25% extra rewards on CC spend. I use mine with Citi Prestige and DCB and now earning is 4.58% – 5.25%. I also use HDFC Preferred debit card 1% cash back up to 75000 spend. Covers all my expenses mostly.

we dont have AU small finance branch in our city. Are we eligible to apply?