AU small Finance bank – one of the popular small finance bank in the country has come up with a range of credit card offerings to the public. It’s probably the only small finance bank in the country to provide independent credit card services. Here’s everything you need to know about the recent credit card launch.

Table of Contents

The Cards

AU small finance bank has launched 4 different credit card variants to cater various set of customers. Here’s a quick look into those cards with the respective joining fees:

- Zenith (Fee: Rs.7,999+GST – waived on 1.25L spend)

- Vetta (Fee: Rs.2,999+GST – waived on 40K spend)

- Altura+ (Fee: Rs.499+GST- waived on 20K spend)

- Altura (Fee: Rs.199+GST- waived on 10K spend)

The good news about AU Small finance bank credit cards is that they do have joining fee waiver on spends within 90 days, along with annual fee waiver based on annual spends, similar to Bank of Baroda credit cards.

So ideally these cards are all free for you, as long as you could meet their respective spend criteria, which is pretty good in my opinion.

Are they good?

- The card names somehow doesn’t sound like a finance product. It sounds more like the names of household accessories. For ex: Marvella RO, AO Smith, Elgi Ultra, Elgi Ultra Grind+, etc. Do you feel so too?

- The design is average in my opinion. Their debit card design (AU Royale Debit Card) is far better.

- The benefits are decent on premium variants but not competitive enough in that price range. The purchase protection benefit on Zenith is a good one.

- The rewards are good on specific type of spends on premium cards. For ex, Zenith gives 5% back on Dining, 2.5% on grocery. Even Vetta is good with 2.5% back on utility spends. Reward rate on regular spends are poor across all cards, but milestone benefits makes up for it, to an extent.

Overall, the premium variants are pretty good, especially because it comes with fee waiver on spends apart from decent benefits.

The entry-level cards are nowhere closer to the aggressive competition in that space. So its better to skip them for good, even if you’re offered for free. But this might change once their merchant offers goes aggressive, just like BOB cards in recent times.

If you’re looking for options, do check out the best credit cards article for 2021.

We may have a detailed review of above cards later sometime, if required.

How to Apply?

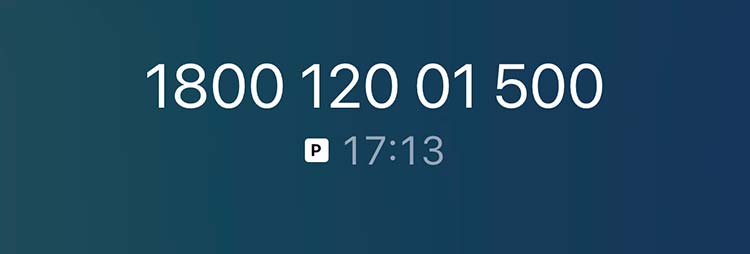

I don’t see any live application process for now, so you may show interest via call/email/website and take it from there.

I did a quick call to check whether they issue cards across India – YES is what I heard. But the rep. on call put me on a long hold without any reason. Hmm, strange!

I was said that I should get a callback in 24-48 hrs and fortunately the above line connects directly to the human and they’re decent in handling the call.

Bottom line

It’s impressive to see credit card offerings from a small finance bank. Hope their products and services gets better in the coming years.

Speaking of new credit card launches, the country is waiting for DBS & Federal bank credit cards to join the game soon.

What’s your thoughts on the new AU Small Finance Bank credit cards? Feel free to share your thoughts in the comments below.

Federal bank credit card details are already revealed

MITC – federalbank.co.in/credit-cards-mitc

Celsta card – federalbank.co.in/celesta-credit-card

Imperio card – federalbank.co.in/imperio-credit-card

Signet card – federalbank.co.in/signet-credit-card

These cards are not that interesting.

Thanks. Disappointed indeed!

They should be launching anytime now, their internal employee testing with 15,000 cards is complete and are ready to roll out.

Federal soft launch was done last month if i am not wrong and should be in the market by June.

Au bank has been active on giving offers on Amazon and other e commerce websites on their debit cards, hopefully the same continues with the CC segment too.

Vetta, Altura+, Altura sounds like Car model names.

Zenith sounds bit different.

@Siddharth

Bandhan bank also issuing credit cards. I think through SCB.

I cannot see any page for it.

You will find it on SCB page

Hi Sid

Thanks for the review. I agree with your point that design of the cards are not good, especially when their AU Royale Debit Card design looks super premium.

As regards Federal Bank, They are yet to launch their credit card commercially. However, more than 80% of their staff have been carded with their new credit card.

Need enough marketing skills to cope up with other players. Don’t know about the approval process? Very vague ideas on this bank!

Annual Fee Waiver spends are pretty high compared to the card features.

Zenith = 5L

Vetta = 1.5L

Altura+ = 80k

Altura = 40k

Although this is welcome news that newer and smaller banks are offering Credit Cards now. This would ensure better penetration of financial products overall in the country. However, banks should follow GOI/RBI guidelines and promote India’s own RU Pay credit card system over Visa and Mastercard. The (points/value) benefits are not comparable but from overall financial data security point of view this is invaluable in the long run.

Private banks like ICICI, Axis bank already announced they are not interested to issue RuPay credit cards because govt levy zero MDR on RuPay debit cards. Now Private banks are in fear what will happen if govt impose zero MDR on RuPay credit cards.

Next year maybe Reliance, TATA and other companies will get NUE license.

Reliance already announce to be pitted against Visa, Mastercard. if granted an operating licence, is going to be positioned against global payments giants such as Mastercard and Visa in some markets including India.

Zenith looks good for fee waivers..

Perhaps, a review is in order Sid. Would look for more info on benefits of the different cards, but your word is important…

I am also looking forward to the Federal Bank Card, have a long-term banking relationship with them…

Nah, not home appliances. They sound like scooter brands.

Anyone know about taj epicure membership with zenith on spending 8 lakh. So can you confirm complimentary night in this taj membership. @ sidharth

I’m waiting for an update on the same as well. I’ll update once I get to know.

It is Available the Taj Epicure Membership.

Sid, In a hurry ? Nothing much about the cards ? (Detail reward rates, milestone benefits etc) Just asking, since we usually see that.

Because there is: Nothing much about the cards 🙂

Anyway if things go well with these cards, detailed review should follow.

Sid, small finance banks cannot offer credit cards. AU small finance bank is no longer a smallest finance bank just that they have not changed their name for some reason. So you might want to edit the first para.

I see that they are one of the “Scheduled commercial bank” and so they were able to do it. But are you sure they no longer come under “small finance bank”?

AU small finance bank is small finance bank only as on date. Small finance bank can apply for full fledge commercial bank after 5 and 8 year of starting operation subject to fullfulling fit and proper criteria.

Hello Sid,

I contacted AUSFB, the person told me that the CC is being offered only to the Bank customers as on date. Nevertheless, it will be opened to general public quite soon.

yes due to corona ( lockdown), bank dose’nt open thier policy, mostly bank stop the sale of any credit assets, but very soon, it will be available for you, i also belong from banking, thats by, i am telling you

I had dropped an email, got response that they would reach out. Looks like they would prefer account holders for now, just spoke to cc.

Is it good idea to open account and apply for Zenith, is it worth it?

You would get 16500 points for spends of 1.25L within 60 days (25k you might do later too) which is roughly 4k.

They contacted over call and mentioned they noted request. They didn’t indicate any timeline on processing though!

Anyone got through?

Got a call from the Bank for the application details maybe they’ll give pre-approved (I think you can’t select the variant) near about June end.

Hi Harsimran, you hold account with AU?

Hi,

Just got a call from my au bank branch at 12 pm. The person came to my place and applied the card from their tab and it showed that I am eligible for a Zenith card. The application took 10 min to complete.

I activated the virtual card from netbanking and will receive the physical card in few days.

I asked the person about the criteria for offering cards and they are saying as of now they are only giving cards to au bank customers with pre-approved offers.

All digital only application process? Sounds interesting.

Yes, I do

You would be in the first list, congratulations. Pls share experience once you receive. 👍

Yes, I got the card Today, totally smooth onboarding process, it was all pre-approved just like IDFC.

Cool 👍

on website its written fee waiver on retail spend ? so online/wallet not included i suppose

Not sure but gives rewards points in wallet reloads as well and recently got a 5% upto 500 offer on Non wallet online retail transactions

Au credit card is really good specially vetta and zenith. Smooth onboarding process . The other services like priority pass card is delivered along with the kit not like other bank card where we have to apply for the same . Fairly good .. highly recommended

Can someone please tell me the value of reward points of AU Small Finance credit cards?

4 points=1Rs

I got Zenith variant Card yesterday, had applied through their website.

Applied online Thursday followed by Video KYC the same day, card dispatched on Sat and delivered on Sunday. Overall quite a smooth process.

Card got delivered in a fancy green box with a faux leather card holder. The box reminded me of Yes First Bank Exclusive packaging.

Further, there are some complimentary memberships provided like 3 months of Amazon Prime, 1 month of EasyDiner etc

PS: In Mumbai atleast, AU Bank has started sourcing card through sales team and offering Life Time Free too. Not valid for online card application 🙁

Gagan,

Do you have a banking relationship with AU. IF yes, do you have to pay fees?

My dad has Royale banking relationship and he has been offered this card. But no details on whether its LTF/FYF/paid card.

I am based in Mumbai. How do i reach out to the sales team of AU?

My friend got a altura credit card with 70k limit. No income documents. Just VKYC and its done. Done VKYC on Saturday, got approved on Monday. He took it as just a credit line.

Applied for Vetta card 2 days ago on AU Bank website, Video KYC happened on the same day.

Was offered Zenith, Vetta & Altura+ variants based on Income details provided.

No documents were required to be uploaded, it fetched all the details via PAN & Aadhar automatically.

Currently Application under review, waiting for Final decision.

No existing relationship with AU Bank.

Due to WFH scenario, applied from hometown which is Tier 3 City but luckily have branch of AU Bank. Lets see if card gets approved or not.

Yes – they are going basis CIBIL report.

They have rejected my application citing the same stupid reason common across banks “Doesn’t met Internal Policy Parameters”.

Don’t understand what criteria didn’t met inspite of good CIBIL score.

Disappointed with such experience and worst part is new lender enquiry added under CIBIL which will hit my score by some points.

Can only think of one reason for rejection is having no relationship with AU Bank like Saving Account, etc

Dear Rishabh

I and my friends have gone through such instances. My friend got this card approved with any prior relationship with AU Bank. The main reason type of rejection is the address verification guy. The give a unknowingly absurd reports about you and your workplace.

If with company, your company should be registered or as self employed, be careful to hang a board or go with a profession like Agriculture or housewife where verification of workplace is not applicable.

Applied Vetta card for my Wife, and it got approved next day itself after VKYC. So definitely prior relationship is not required as she don’t hold any saving account with AU.

So only reason I can think of rejection for my card is my Company is not part of their listed companies to which cards are getting issued without banking relationship.

Even i recieved call for the card application. But they don’t have Card to Card basis option yet

They are offering LTF to certain listed companies employees

Yes – they offer LTF to selected corporate employees, through online applications only when one asks.

But I understand for offline applications, via their sales team, they are offering LTF to many people.

I tried to apply for Zenith credit card from a Tier 2 city but it says the area pin code is not serviceable. Tried near by pin code but same error.

Although there is branch in my city and when checked I can open my savings account there. Any workaround available to apply and also get it LTF.

Dear Varun

Only possible way for you is to open an account and maintain good relationship with the bank.

Pre-approved credit card offer (likes LTF) might just kick in within 3-6 months.

Offcourse card variant and limit offered will be basis NRV till card services are not launched officially in your city.

Hi Everyone

Just talked to their credit card CS. Other than big companies employees, they are offering cards to any Government employee on LTF basis. If you want their cards, only check if you are in their card service cities.

How to check if they are serviceable or not ? Is there a link you can perhaps provide ? They I am guessing is still NOT serviceable in Kolkata as far as their Credit card offering in concerned !

Got Vetta card Life Time Free based on employer as per confirmed by Bank on email. Applied online and got it approved in 1 day with only VKYC process.

No documentation.

Was not aware of this earlier else could have got Zenith as LTF, skipped applying for Zenith at the time of application online due to annual fees displayed.

Currently no process in place to apply for Upgrade as per update received from Bank guy.

Still Vetta variant also offers good value on spends so happy to get it as LTF.

Do They Ask Office Mail Address?

With the dining benefits on Infinia gone away and HDFC not letting me have DCB for weekend dining benefit I am looking into the Zenith variant due to its 5% dining benefits.

The card seems to have a FYF possiblity with BBH approval so I have asked the BM to see if he can issue it FYF at least and then we will see from there. While one might think the Zomato RBL white card gives the same 5% dining benefit it does not get issued here and I have not received any invite from Zomato as well.

Got Zenith FYF with a 8Lac limit on a 13lac C2C specifically for 5% dining benefit. I had tried to get Zomato Edition Black instead but found out that it only gives 2% CB for food outside of Zomato.

RBL did followup and offered World Plus SuperCard which has 5% CB for dining and at a lower fee but there is a monthly limit secondly given its not VISA Infinite and as such has no associated benefits.

Sharing my experience of using AU Zenith Credit Card for last 6 months

Got it Life Time Free because of my employer being in their list of approved ones

Card came in a nice big green color box though with a small card holder 🙂

Customer Care service team is good, clearly they hire energized folks and train them well

Rewards / Offers are delivered within the TAT. Didn’t need to follow even once for the offers like Rs 1000 voucher on first physical POS transaction, 10000 bonus on reaching Rs 1 lakh spends etc

Add-on cards can be issued only to those who has existing relationship with AU Bank

Dedicated Rewards Portal provide lot of details like point expiry schedule, type of transaction (ECom, POS etc), calls out the applied reward ratio transaction wise etc. For eg. in Feb they had 2X offer for ECom. So above the Feb ECom transactions it shows “10 Reward Points earned per INR 100”

Other Notes:

Cred doesn’t read AU Card Statement, though we can may payment

Mobikwik doesn’t support payment to AU Cards

Overall, happy to have this card in my wallet.

How to know if my employer is in their approved list for LTF Zenith? Can you elaborate the process to get one

Calling them works 🙂

CAREFUL – The biggest problem with AU at the moment is that they are NOT serviceable pan India, including some of the metro cities.

However the moment you enter you PAN details it pulls you credit report (TransUnion) & you end up with a hard search even before you realise they are actually NOT issuing card in your city !!

This is something they need to fix asap ! Only God knows why on why on earth they do a hard pull even when they are not serviceable in a certain location !! –

No wonder for this kind of practices by banks, NBFC’s & other lenders the bureaus (at least TU) have an algo in place which actually seldom makes your score drop for a hard pull !!

Mine experience is different, whereas many of the affluent existing credit card issuing banks(idfc, kotak, indusind,yes) does not issue cards in my area, the largest district in India, AU says all pin codes are servicable throughout the state, and the application process, probably the smoothest in the industry, the person came with the tab, took kyc number(not even xerox), click a photo of mine and the ltf vetta card was approved within five minutes with more than the limit of any of my existing cards, and probably will be delivered within 3-4 days.

Recently applied and V-KYC done 2 days ago. How many days it takes for the decision?

I haven’t received any application reference number and the best part is, I am not able to contact the sales executive.

Please confirm if your card is approved ?

Applied for Zenith, vkyc done 2 days ago- have to see if it gets approved.

Seems they are not serviceable in Lucknow. My office which is their approved list for LTF card and its address which is in Bangalore is serviceable but currently I am in hometown so how to apply and get it approved.

Complimentary priority pass lounge entry on vetta & zenith are withdrawn from 15.05.2022.Any lounge visit on these cards in India & abroad shall be chargeable.Devaluation is on the lines of other banks.

Thanks, Rupesh for the update. Was planning to replace my sbi prime card with this but now it doesn’t seem worth it.

Hi Rupesh,

Where have you read this? I don’t see it mentioned anywhere. For domestic airport lounge access VISA card would suffice and Priority Pass is needed only for Airports outside India / International Airport Lounge.

If PP is used in any lounge in India, $27 would be charged anyways. Its a common practice with all the PP issuing banks.

Card got declined in March.

But yesterday i received the email.

Applied again and was approved immediately.

Received Vetta LTF with decent limit. inspite of company not listed in LTF category

No relation with Bank

Late to the party but am in a conundrum. I had applied for the Vetta variant and the application page showed a fee waiver on 1.5 lakh annual transaction.

Received the card today and the welcome letter states Annual Fees- Nil and Joining Fees- Nil.

Now, what to do??

Am holding on to the letter if they charge any fees later on.

It’s LTF.

And I managed my Vetta to upgrade to Zenith.

How did you manage to upgrade? Any tips?

Hey Siddarth,

Any comments on new AU LIT credit card ?

Would love to hear your review

Applied for it today

Hi Manikanta,

Did you choose only the vanilla variant or opted for different add on service like lounge access etc? I started applying few months back, but the add on features seemed much confusing and basic card hardly had any feature apart from bank specific offer on specific websites. So didn’t complete the vkyc and dropped the application. They pre approved with limit matching highest existing limit of my other bank’s card.

A big devaluation has been announced it seems, on this card starting July 5. 1 RP was equal to Rs 0.25 earlier but after the devaluation it will only be Rs 0.20. So the Zenith will now return 4% on dining, 2% on grocery and dept stores and 1% for other transactions. Earlier these were 5%, 2.5% and 1.25% respectively.

Just received my AU Zenith LTF today. My first real premium card. Came in a rather fancy package, had the Priority Pass in the package itself.

BTW, the devaluation necessarily do not affect all categories of redemption. You can still get 1.25 and 2.5 and 5 percent returns if you use it for recharge/bill pay options. So fair enough I’d say.

AU ZENITH+ metal card was introduced by AUSFB which is better than Zenith card. I have requested for card upgrade from Vetta LTF card to Zenith+ metal card paid version(4999+GST). Even though the reward rate is low(just 1% for regular spends, 2% for travel and dining), we will get reward points equivalent to card fee. We can covert reward points to amazon or Flipkart vouchers with 1:1 ratio.

we will get 1000 reward points equivalent to Rs.1000 on spending 75000 per month(except special merchant categories).