AU bank started operating in India as a vehicle financing company since 1996 and later converted to a Scheduled Commercial Bank in 2017 upon getting license from RBI. It is a listed entity on NSE & BSE having its origin from Rajasthan.

AU ROYALE is a premium banking programme by AU small finance bank offering various lifestyle benefits and value to its affluent customers.

AU bank has already launched 4 credit cards to extend its bouquet of services, though there are hardly any industry leading features (like IDFC First Bank credit cards) to be excited with. Here’s my experience with the AU Bank Royale Savings A/c,

Table of Contents

Eligibility

- Eligibility criteria: 1 Lakh or above AMB on Savings A/c

It allows you to add upto 6 extra family members at no extra requirement. Penalty charges applicable if AMB is not maintained.

As told by bank executive AU Bank Royale account holders will most likely be pre-approved for LTF Vetta/ Zenith AU Bank credit cards basis their relationship value.

This we will know in the coming months. I’m expecting the LTF offer to kick-in in 3-6 months. Let’s see if it does.

Opening Account

Visited one of its branch in my city (currently 2 running) and talked to an executive regarding AU Royale account.

Next day an executive visited my house for Royale account opening formalities on an Integrated Tablet kind of instrument (containing camera n biometric reader) and the account was live in 4 days.

Here’s a quick look at the timeline,

- 30 Nov 2021- Account opening formalities completed at home

- 03 Dec 2021- Email confirmation of account opening

- 06 Dec 2021- Welcome kit delivered via Bluedart

Welcome Kit

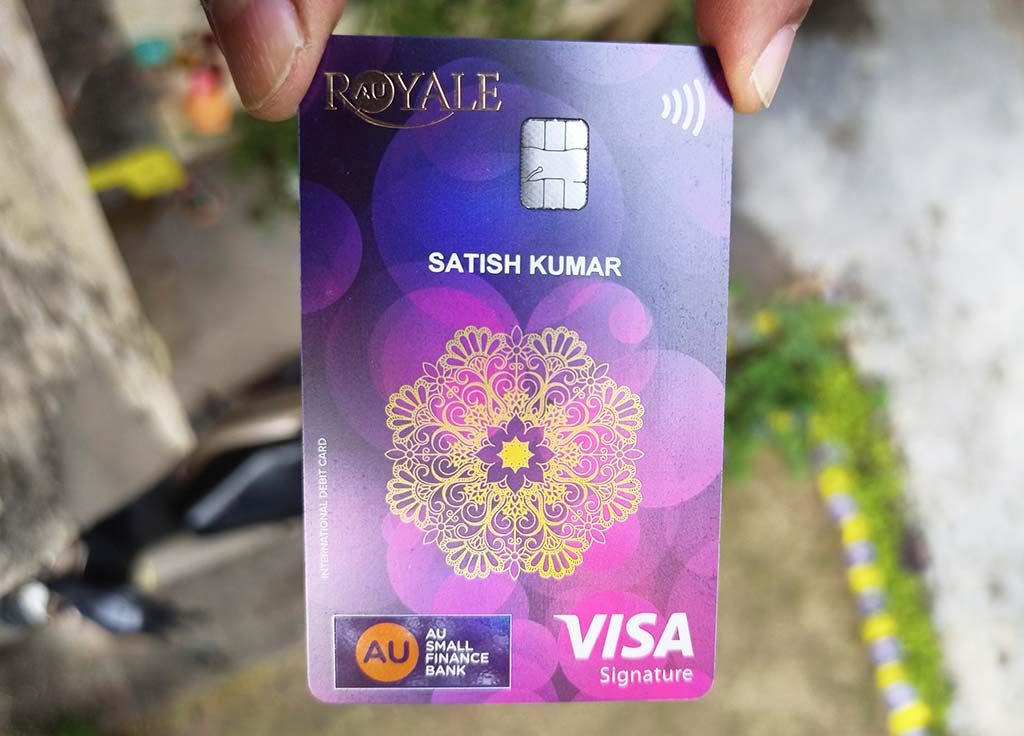

You get a very nice looking AU Royale Visa Signature debit card having decent features & benefits, details of which are mentioned below:

Card Features & Benefits

Welcome Benefits

- Upto 10% cashback at booking.com (Unlimited cashback)

- 15% off at Titan, Hamleys, Bata

- Upto 25% cashback at Samsung online store

- 25% off at Crocs online store

- 20% off on Gold making charges at Joyallukas & 3000 off on Diamond jewellery

- 10% off at Tanishq, AND, House of Masaba

- Welcome benefits are applicable for 1st year only

Welcome benefits are nothing great and only few customers would be able to make use of it. Would have been far better if useful memberships like amazon prime, disney hotstar, zomato pro or timesprime were given instead.

Note: Welcome benefits discontinued for accounts opened 01.04.2024 onwards

Regular Benefits

- Visa Signature debit card enables Visa Signature benefits

- Domestic airport lounge access: 2 per quarter

- 1% monthly cashback on non fuel spends upto 200 per month (min. monthly spend of 2500 required for cashback & posted to ac 45 days post the end of transaction month)

- Buy 1 get 1 offer on bookmyshow twice every month upto 250 each ticket

- Cross currency markup fee of 1.5%

- 30% discount on green fees at select golf courses globally

- Fuel surcharge waiver, nil debit card annual fee, higher ATM & POS limits (4 lacs per day)

- Complimentary insurance coverage (Card liability cover- 4 lacs, Purchase protection- 25K, Bag loss- 2 lacs, Air/ Personal accident- 1 crore/ 5 lacs)

- 75% discount on locker charges for 1 per group

- Demat annual charges waived off (if you decide to open one though !!!)

- Regular monthly offers at Bigbasket and frequent popular online offers (Cleartrip, Yatra discount on flights)

- Annual vouchers on high spends (as mentioned below)–

| Annual Spends* | Milestone Benefits | Voucher Details |

| INR 100,000 | INR 500 Voucher | INR 500 Amazon Voucher |

| INR 200,000 | INR 1,250 Voucher | INR 500 Amazon Voucher + INR 750 BookMyShow Voucher |

| INR 500,000 | INR 2,250 Voucher | INR 500 Amazon Voucher + INR 750 BookMyShow Voucher +INR 1,000 Taj Hotel Voucher |

| INR 1,000,000 | INR 4,750 Voucher | INR 500 Amazon Voucher + INR 750 BookMyShow Voucher +INR 1,000 Taj Hotel Voucher + INR 2500 MakeMyTrip Voucher |

Milestone benefits will be provided within 90 days after the end of financial year. Not valid for ATM withdrawals, fuel & cancelled transactions.

Note: Royale Debit Card Milestone benefits discontinued wef 01.04.2024

[Note: As always, read the tncs of each offer carefully if you are planning to join the programme. If in doubt, ask customer care (better to have an email reply)]

NRI NRO Account

AU Royale also has an account for NRI/NRO with 5L AMB, which they call it as “AU Royale World”. It has some additional features, one of it being: Zero Markup Fee on the debit card.

That’s quite interesting and aggressive for a small bank to offer Zero markup fee benefits as its only offered by the banks like IndusInd. But unfortunately this benefit is only for the NRI accounts and not for the resident Indians.

Bottomline

As a new entrant AU bank offers high interest rate on savings & fixed deposits compared to PSU/ bigger private banks. (Slab wise, from 3.5% to 7% on savings).

But remember that you are protected by RBI only upto 5 lacs / account in case bank goes bankrupt.

AU Bank’s Royale account looks like a good one (USP being very good looking Royale debit card) in the premium banking segment at low AMB requirement with its USP, as this enables you to get family banking benefits with lounge access for all.

Do you bank with AU Small Finance Bank, either with savings a/c or credit card? Feel free to share your experiences in the comments below.

They charge for lack of AMB very crazily every month. For example I had 70-80k for 2 weeks and the overall balance went below 1lac for two months they charged me Rs.400 twice for it. I had a word with the BM to reverse the charges, he requested me to put 5-6lacs in but even after doing the charges have not been reversed. It has been 2 months since I had requested him.

This is different and bad than other banks because there the reduction in status and then charges get levied.

I faced similar situation with AU credit card, My statement o/s was INR 10300,

But I mistakenly paid 10100, 200 less, they charged me 600+ tax for this,

I called CC and requested to waive off the charges but they were reluctant so i cancelled the card

This is poor bank. AU

Overriding even many RBi rules,

AU bank just need proper face to face in consumer court with huge penalty Than only they will understand the trust

Posted on another thread, thought of mentioning here, RBL visa signature+ debit card has NIL markup fee (even for resident Indian customers). Even indusind has that on their Visa signature debit. Since AU has this as well, wonder if it is a standard visa signature debit card feature?

Hi Abhi

It’s not a standard Visa Signature card feature as there are many who doesn’t have. It’s bank specific feature which varies among their cards as well

I am using Royale account since April 2021. Opened a joint account with my dad and mom and dad being primary to earn senior citizens savings interest. I got 3 debits card for me, mom and dad and the agent actually reversed rs 200 per debit card charges for secondary holders.

The experience has been good so far. Monthly interest credits, consistently getting Rs 200 cashback/month on debit card spends and 20% cashback upto 200 on Dominos and I recently got the pre approved Altura Plus Card. I had maintained close to ~20 L for first 3 months and then reduced it to ~1L as I needed money for other purposes.

There were instances when the MAB was < 1L during the month and no charges were levied. I ensured that MAB was always above 1L by end of the month.

With the new Altura plus credit card, I can earn Rs 1400(7%) by spending Rs 20k online in the form of welcome rewards, monthly milestone and regular rewards in the first month. If the spends are offline then the reward rate will go down to 6%.

Post this, will avoid using this card. As I get 2% from Ace & 2% on Legend Signature on weekends.

DID YOU GET ALTURA PLUS PRE APPROVED LIFE TIME FREE? ALSO WHAT WAS THE LIMIT?

WHAT LIMIT DID YOU GET IN ALTURA PLUS. AND DID YOU GET IT LIFE TIME FREE?

It is pre-approved LTF. 50k is the limit which is much lower than my other cards (I have 6L limit on ICICI)

Hai thanks for the reply

Thanks Vikas for sharing your experience.

After looking at your review as well as of Satish, decided to open one joint Royale account.

Quick questions:

Did they charge Debit Fees for Primary Holder too? I was told by customer care that issurance fee is for all, so confused. Whereas the agent who came to open account on tab didn’t tell me of any such charge.

Also is there any TRV based option…like if you maintain Rs 3 lacs of FD, no need for AMB?

No Debit Card Fee for primary holder.

The charges were waived for two secondary holders excluding the GST.

I am not aware of the TRV option.

@SATISH KUMAR – THE VETTA AND ZENITH BEING OFFERED LTF – CAN YOU POST SOME MORE DETAILS ON THIS.

Dear SMV

I didn’t say it will be offered LTF. What I meant was likely LTF Vetta/ Zenith basis NRV maintained with bank.

As I myself is quite new to the bank, expect an offer in next 3-6 months.

But my understanding after informal discussion with their executive concludes following–

For Vetta LTF- They might like to see around 5 lacs AMB,

For Zenith LTF- Minimum 10 lacs AMB,

Less than that- Altura/ Altura +

Again it’s all verbal. You can never know the algorithm behind these things exactly as it varies widely within bank too and from branch to branch.

@satiahkumar thanks for the reply.

I’ve heard another news about the credit cards.

Lifetime free for Govt employees.

Also, lifetime free for employees of big companies like Sbi card, Jio etc

Can you confirm both these?

What Gagan said is right. Contacted the RM and he was also on similar line. Card is offered LTF to Big Corporates (List is not available with RM) and Salary ac holders apart from being Pre-approved to Savings ac holders.

Thanks for the info , any update on the list ?

can you find the list of companies to whom au is offering LTF CC

No dear SMV. What I know is Government employees, some big corporate employees, as well as salary ac holders of AU Bank are getting LTF cards offer.

Even if card service team have the list, no bank would like to share the list with prospective customers.

May be its true.

My friend got ltf altura plus as state govt. Employee.

@SMV -I got the Zenith Card LTF because of my employer. So you are right – they do offer the card free to employees of big corporate but list is not known.