Standard Chartered provides Priority Banking services in India, a premium banking solution tailored for the affluent customers. As a part of this service, they issue the Standard Chartered Priority Infinite Debit Card with attractive benefits.

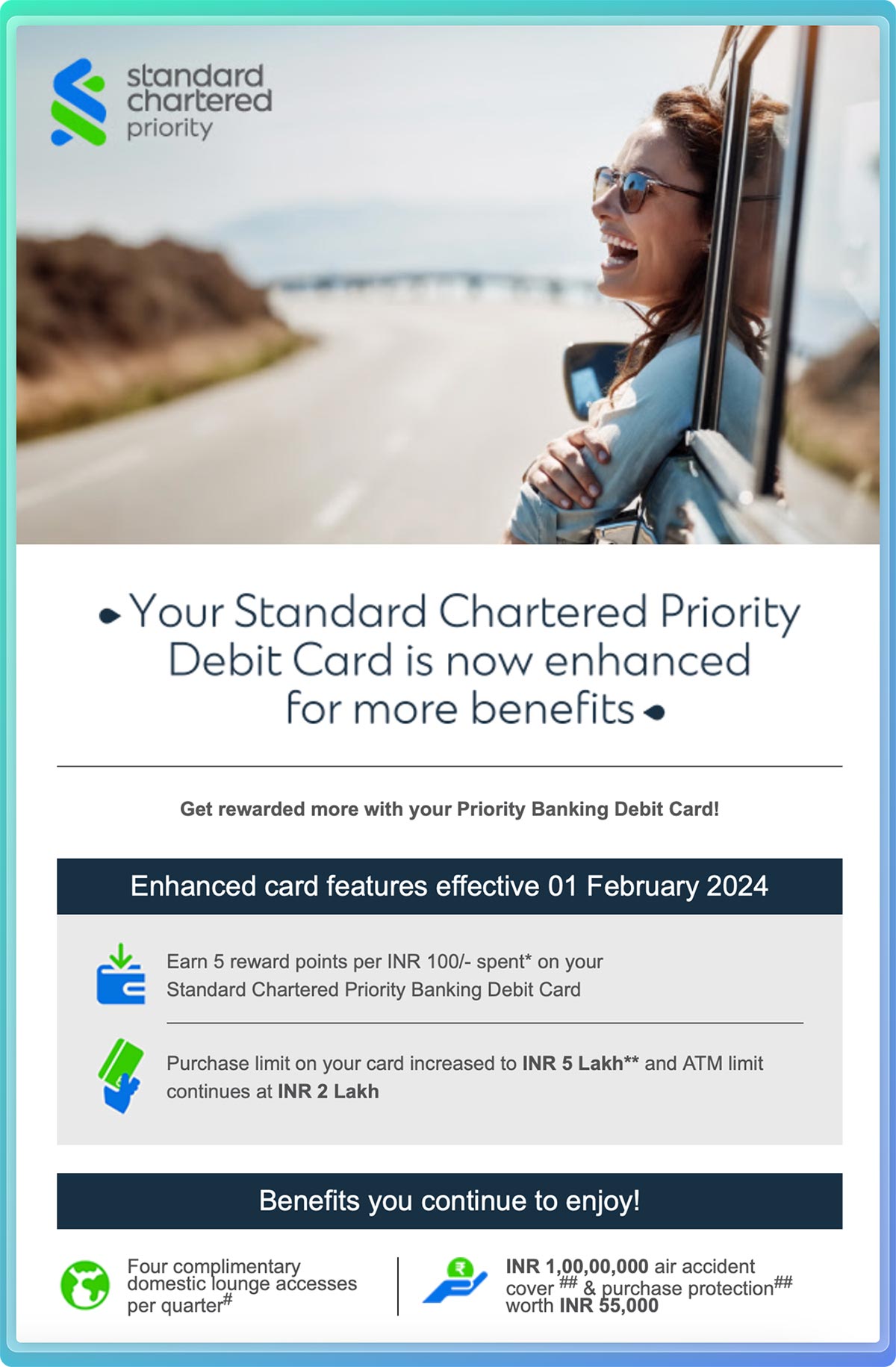

Now, the bank has enhanced its features and benefits making it the most rewarding debit card in the country for High Net Worth Individuals (HNIs). Here’s everything you need to know:

Table of Contents

Rewards

- 5 Point / 100 INR spend (Eff. 1st Feb 2024)

- Reward Rate: 1.25% [1 Point = 0.25 Ps]

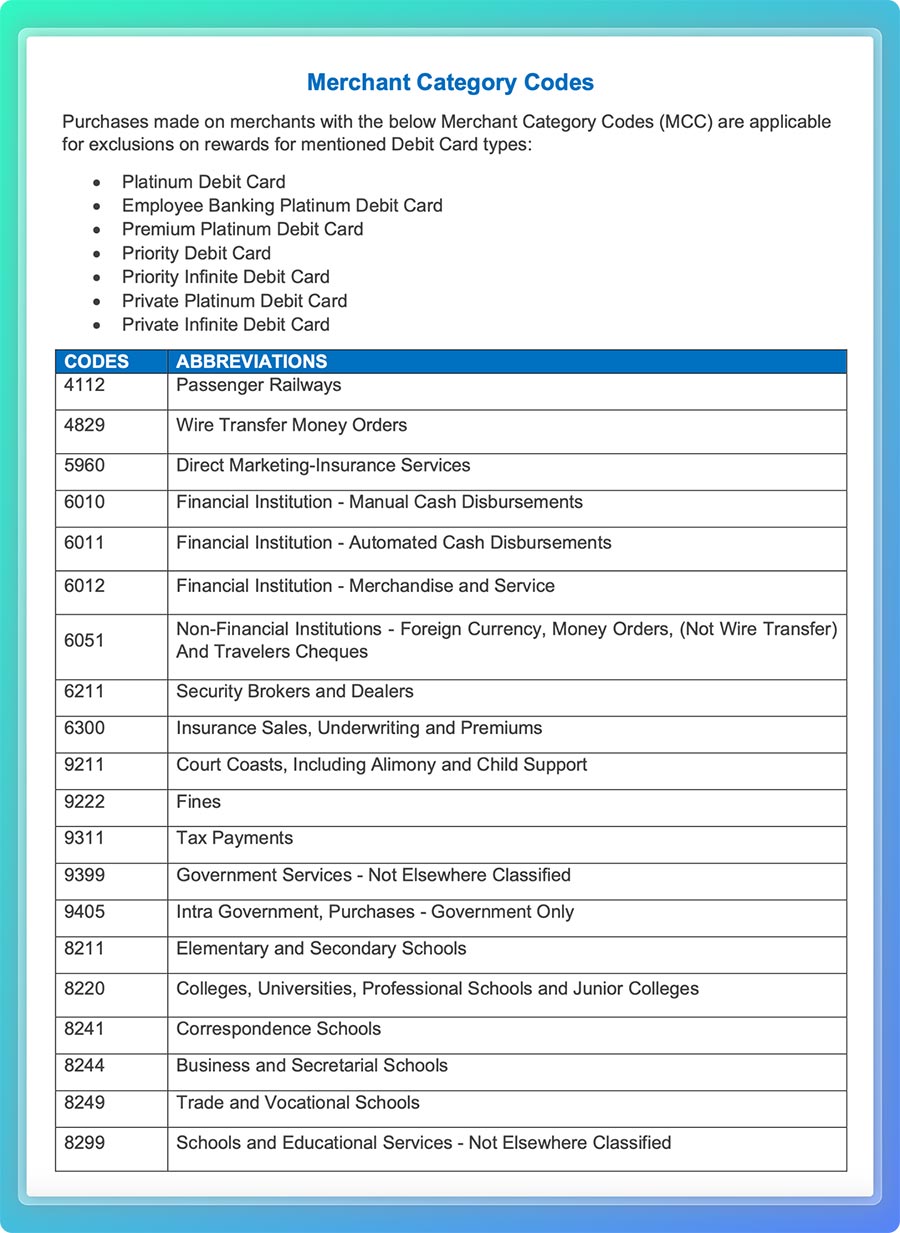

- Excluded MCC: Insurance, Education, Government spends and few more.

Just incase if you’re wondering, here’s the email communication on the revision of benefits and the t&c link to excluded MCC list.

For high value spends, even the IDFC First Wealth Debit Card can get you close to 2.5% reward rate however it not only has the capping but also poor reward rate on low spends.

So Standard Chartered’s offering is relatively better for low spends.

Redemption

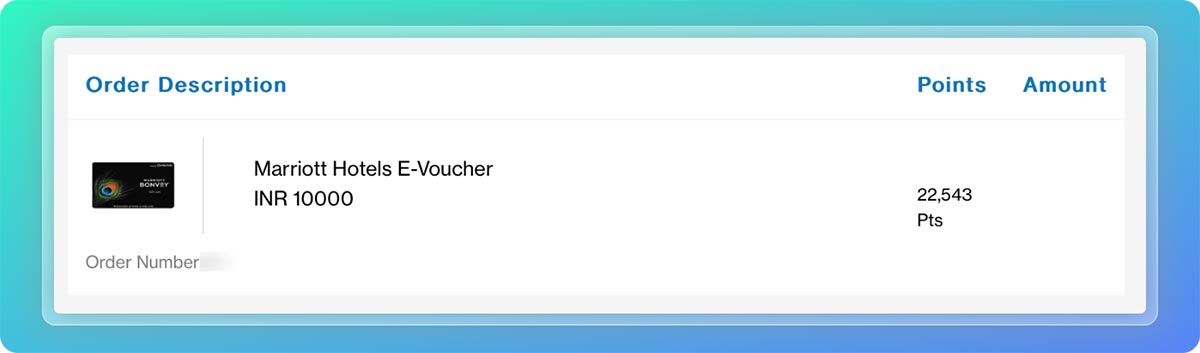

While I’ve personally redeemed for Marriott Hotel eGift Cards, there are other options as well. Here’s a quick look at the options:

- Marriott hotels

- ITC Hotels

- Uber

- Spar

- Urban ladder

- Luxe

- Levi’s

- Petter England

- Louis Philippe

- Fab India

- Lakme Fashion & few more

Benefits

- Joining/Annual Fee: Complimentary

- Complimentary airport lounge access: 4 / Qtr (domestic)

- Daily POS limit: 5 Lakhs

- Daily ATM limit: 2 Lakhs

- INR 1,00,00,000 air accident cover

- Purchase protection worth INR 55,000

While the debit card doesn’t have capping on rewards, it does have POS spend limit, which will technical cap the rewards as well, but it’s fair enough for most.

Eligibility

- Total Relationship value: 30 Lakhs (Savings, FD, Investments)

- Salary Credit: 3 Lakhs

- Mortgage: >2 Cr

Customers has to maintain one of the above criteria to get hold of the Priority Banking relationship with Standard Chartered bank.

That said, it is to be noted that the bank also offers Private Banking services for UHNW individuals at ~8 Cr TRV and that comes with a reward rate of 2.5% on a debit card.

Bottomline

Standard Chartered Priority debit card is perhaps the best ever debit card in the country for HNI who want’s to spend a lot on a debit card.

But why would anyone want to spend on a debit card while we can get lot more on a credit card?

Well, some have their own reasons but for most others one may get a Credit Card, perhaps from Standard Chartered itself with their Standard Chartered Ultimate Credit Card that gives 3.3% reward rate on most spends.

Nevertheless, it’s a good sign that the bank is still focusing on their premium cards and I hope someday they come up with a super/ultra premium credit card positioned about the Ultimate Credit Card.

Until then, enjoy the lucrative rewards on the debit card.

Make hay while the sun shines!

Will credit card payment using Priority Infinite Debit Card give reward points?

It used to get and they recently excluded. But now I’m surprised why they haven’t included in the MCC exclusion.

Yet still says the exclusion on the t&c of the debit card landing Page. So only testing it can give the actual answer. Will do sometime and report.

Has anyone tried credit card payments using SC pirority card?

Looks like a good card for wallet loads. Ah but paytm just died..

What are the redemption options?

I usually redeem for Marriott Gift Cards. I used to see Taj and others but not Amazon/Flipkart for sure. Let me update that on article shortly.

It’s no more 0.44 paise per point. Can you check the vouchers section? It shows 40k points for 10k worth of voucher..

Oops, yeah I do see only 25ps point value now unfortunately. Looks like they updated few hrs ago.

This means. Return value is 1.25% only..but still a up from earlier 0.8%

Yes, fair enough.

Sir, they have reduced the value of the reward points. Until 31st Jan I was getting 15k voucher in 32k(approx points) now I am getting same in 60k points. Can they reduce the value of the reward points without giving any notice? I have 60k points, value has reduced to 50%. Please suggest what should I do.

Unfortunately they’ve done it without notice. You may raise a complaint with bank and if not solved, go for RBI complaint.

Anyone tried cc payment via any means? Does sc provide rewards?

Wallet load is giving points, FYI – tried over Mobikwik.

Hey bro, are you getting any rp for wallet loads from 1st April? How do I connect with you?

Hey, I am not getting rp since 1st April for wallet loading

Hey Utkarsh, even last few days of Mar and Apr month I noticed that points are not credited for Mobikwik, I’ve raised this to Customer care and waiting for the resolution.

Got those rewards, cc had arranged call back and they credited pending rewards, not sure if this would work automatically or I need to raise each month or so.

Uber is gone. Can anyone tell best way to burn points?

For Ultimate though (same collection), used to get 5k Peter England, they had 750 off on 5999, so got to use it better

The lowest of Indian banks is better than this british bank. SC’s tech is worst than the tech ICICI had in 2012.

Makeshift website, slow mobile app, and largely untrained staff should be sufficient to not to bank with them. Let aside risk keeping that much amount of money in the hands of a sleeping bank.