If you’re a frequent flyer, you might already know that Air Travel is not so a luxury thing to do unless you travel Business/First Class. Most of the time when you travel economy, you end up losing energy by the time you land. Added to this, you go through an unpleasant experience at the airport with never ending noise, expensive food, not so great Wi-fi and not so comfortable seats.

But what if I say there is a way to enjoy unlimited food, juices, comfortable chairs and a calm atmosphere with premium Wi-fi at FREE of cost? That’s what you get in an Airport Lounge. And to access such airport lounges, you need the right credit cards in your wallet with complimentary lounge access benefit.

Let’s have a look at some of the widely used credit cards for airport lounge access. I’ve listed the cards from low fee to high fee range, so you can make a wise decision. Feel free to check the links under each card to check the detailed review.

Table of Contents

Domestic Lounge Access

1. Amex Platinum Travel Card

- Variant: American Express

- Limits: 4/Yr

- Joining Fee: R

s.3500+GSTFirst Year FREE (Limited Period Offer)

The reason why this card is the most relevant for lounge access is because it not only gives you Lounge benefit, but also comes with amazing ~7% reward rate. Not to forget the Amex merchant travel offers which is one of the best in the industry.

2. Axis Flipkart card

- Variant: Mastercard

- Limits: 4/Yr

- Joining Fee: Rs.500+GST

- Read Full Review

This is one of the newly launched credit card that serves the purpose with one of lowest joining fee, yet decent rewards. Currently an invite only card though.

3. ICICI HPCL Coral Amex

- Variant: Visa/Mastercard/American Express

- Limits: 2/Yr

- Joining Fee: Rs.199+GST

- Read Full Review

Note that different Coral variant has different limits. Do verify bank’s link before going for it. The HPCL coral Amex variant is the cheapest one though.

4. Indusind Iconia Amex

- Variant: American Express

- Limits: 2/Quarter

- Joining Fee: Rs.3000+GST

- Read Full Review

This card has been devalued recently for various reasons but this card still gives you decent lounge benefit not only for primary but also for Supp. cards. Good thing is there is no renewal/annual fee.

Domestic & International Lounge Access

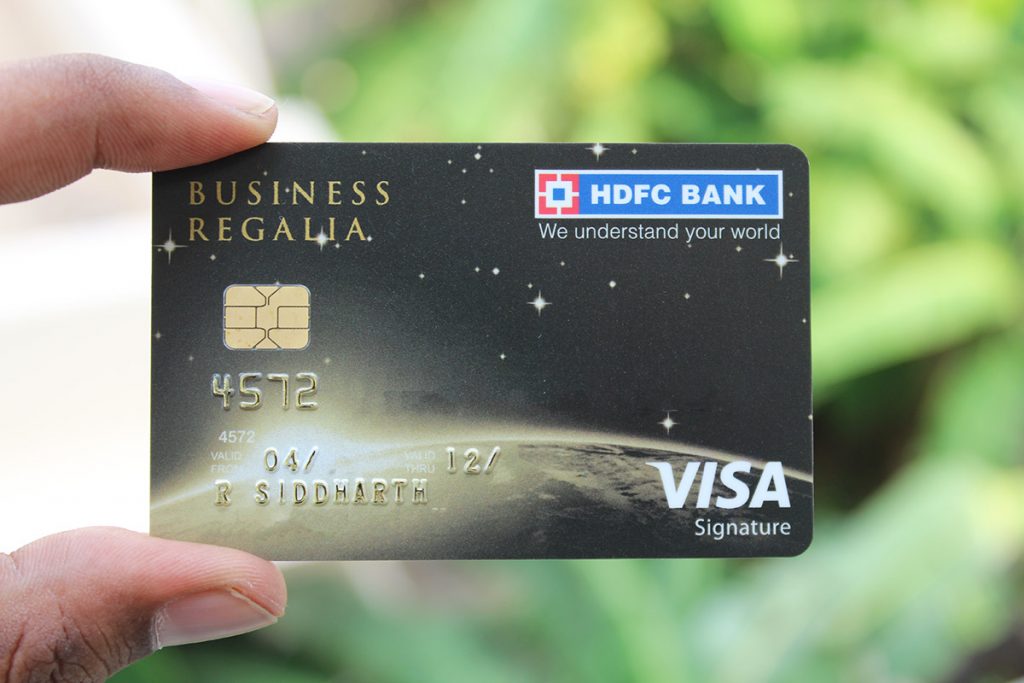

1. HDFC Regalia

- Domestic Limits: 12/yr (Mastercard/Visa)

- International Limit: 6/Yr (Priority Pass)

- Joining Fee: Rs.2500+GST

- Read Full Review

If you find Regalia is expensive, you may also consider Regalia First which is the entry level variant for Regalia. Moreover, its the cheapest card with international lounge access, for supplementary cards too.

2. SBI Prime

- Domestic Limits: 2/qtr (Mastercard/Visa)

- International Limit: 4/Yr (Priority Pass)

- Joining Fee: Rs.3000+GST

- Read Full Review

3. SBI Elite

- Domestic Limits: 2/qtr (Mastercard/Visa)

- International Limit: 2/qtr (Priority Pass)

- Joining Fee: Rs.5000+GST

- Read Full Review

4. Yes First Preferred

- Domestic Limits: 3/qtr (Mastercard)

- International Limit: 4/Yr (Priority Pass)

- Joining Fee: Mostly Free

- Read Full Review

5. ICICI Sapphiro

- Domestic Limits: 4/qtr (Mastercard/Amex)

- International Limit: 2/Yr (Dreamfolks DragonPass)

- Joining Fee: Mostly Free

Just incase if you’re asked for a fee for this ICICI card, don’t ever get it.

Unlimited Lounge Access

If you’re a frequent traveller or have a big family to take vacation, then you may need one of these below credit cards that comes with unlimited lounge access. Not to forget, most cards below allow you to get a supplementary card too with unlimited lounge access benefit.

1. HDFC Diners Black

- Network: Diners Club

- Joining Fee: Rs.5,000+GST

- Read Full Review

2. HDFC Infinia

- Network: Visa / Mastercard & Priority pass

- Joining Fee: Rs.10,000+GST

- Read Full Review

3. Yes First Exclusive

- Network: Mastercard & Priority Pass

- Joining Fee: Mostly Free

- Read Full Review

4. ICICI Emeralde

- Network: American Express / Mastercard & DragonPass

- Joining Fee: Rs.12,000+GST

- Read Full Review

5. Citi Prestige

- Network: Visa & Priority Pass

- Joining Fee: Rs.20,000+GST

- Read Full Review

6. Amex Platinum Charge Card

- Variant: American Express & Priority Pass

- Joining Fee: Rs.60,000+GST

- Read Full Review

So which one should I get?

Okay, I understand that the above list is quite exhaustive. So to answer your query, you need to ask yourself “how many times do I travel Domestic/international ?”. Match that number with the # of complimentary lounge visits available as above.

For ex, if you just travel once a year, any credit card with low fee that gives you 2 access/qtr would do. Remember, you’ll need 2 access for a trip as you’ll also return back.

If you travel quite often, like once or more every month, you either need multiple credit cards with lounge access or one credit card that gives you unlimited lounge access benefit as above.

Note: Also remember you maybe limited by the network as not all lounge network allows you to access all lounges. Try to choose Mastercard over others for domestic & Priority Pass for International.

Which card do I use for lounge access? As I’ve at least 10 cards in my wallet most of the time, I usually have this confusion in the past as to which one to swipe for lounge access.

But now, the thumb rule I follow is: Swipe the card whichever costs me annual fee, or whichever that gives me less returns, so as to make sure the bank spends something for charging me the fees.

In the past, I used the ICICI Jet Sapphiro credit cards as they charged me annual fee (and I never used those Jet codes). Now, going forward I plan to use ICICI Emeralde.

Which card do you usually swipe for airport lounge access? Feel free to share your thoughts in the comments below.

There is Diners Club Miles, 6/yr free, Domestic or International.

Got it for my wife just due the access.

Comes with NO annual fee

Will add it shortly. Thanks.

I recently got federal Bank celesta credit card with domestic and international lounge access with it, but how to apply fr priority pass as it’s required for international lounge access??

You forget to mention kotak Mahindra Bank royale

Let’s not expand the list, with less known cards.

Very useful information. Thanks for sharing. But i have a question- is the lounge access available in visa or mastercard same in all card issuing banks or does it vary from bank to bank. For example- Does sbi visa elite offer free lounge access in same airports as hdfc regalia Visa or are they different?

Is free lounge access applicable for supplementary cards also?

Sir

Can you share the link for this facility

Is separate card required for husband and wife

Is it accepted in india and overseas as well

icici hpcl coral has lounge access only in Amex variant and Not in visa or MC variant

Thats a good list. But you missed out Stan C Ultimate card which is quiet affordable with good points value. Apart from above yes bank lower cards like yes prosperity edge also provide lounge access and are ltf…

Flipkart Axis is Amex??

Mastercard I think.

Please correct.

Done. Thanks.

Regalia offers 12 domestic per year, with no qtrly/monthly cap

Regalia First also offers Domestic and International lounge access and is a great semi-premium card to have.

It is the ideal card for people who travel abroad twice a year.

Suggest some card in which add-on member is also allowed

HDFC Regalia is now offering 8 airport launge access per annum not 12 nos as mentioned above.

Please verify with Bank and upload updated information.

Regalia offers 12 where Regalia First offers 8

Now a days HDFC Regalia/ Regalia First cards provides lounge access only to Delhi T3, Kolkata, Mumbai, Chennai, Bangalore and Hyderabad to be precise. If anybody flies frequently to other cities like Pune, Ahmedabad, Nagpur, Cochin, Chandigarh etc, HDFC cards except Infinia/ DCB will not serve the purpose.

If you are the one who falls in 2nd category, please research before applying for suitable cards that will serve the purpose.

Which ones provide complimentry lounge access on addon or supplementary cards?

Infinia, Amex Plat, Amex Plat Reserve.

SCB Ultimate

citi prestige, hdfc infinia, yes first exclusive, hdfc regalia

But now, the thumb rule I follow is: “use the” card whichever costs me annual fee, or whichever that gives me less returns or whichever bank that charges me some kind of fee for the banking needs.

I think it should be “do not use”

It was correct. I reframed it now for better understanding.

That’s an excellent articly again . Might be adding Railway lounge access will also be worth it as many of us still travel by train sometimes for last mile connectivity and having cards like ICICI Rubyx helps to get free lounge facilities with food at railway stations like Delhi , Agra etc

You have not mentioned about paytm rupay card. It provides access to airport lounge @₹125 per annum and ₹100 for subsequent years. 2/qtr visits are allowed. I think this is the best card at minimum cost and max visits.

Its a debit card. And we’ve a separate article on it, which includes it.

Standard Chartered Ultimate card – MasterCard Variant has unlimited domestic lounge facility. I’ve personally seen multiple times that the charge slip shows “Visits Remaining” as n/a.

Lounge access is available for supplementary card holders as well.

I am pretty happy with my YFE card…now for almost more than years and still enjoying it, despite the relatively reduced reward points 2019 onwards, but hey the reward points given are competitive to any other card if looked at minutely in its segment, barring Hdfc card 10x schemes or other special offers and also the rewards offered.

To put it in perspective if one has this card LTF its literally worth it if only for its airport lounge access even if used a few times. I have visited few airports in europe, india and singapore with the priority pass provided and never had any problems in access. So i will definitely recommend this for airport lounge access.

can a person with no relationship with yes bank but with 50L ITR (eligibility) expect to get it as LTF?

Might be a bit tough but worth a try, probably easier than getting a DCB or HDFC Infinia.

@SG

Start with Yes First Preferred (can be sourced LTF with other card statement of more than 3L limit). Then upgrade YFP to Yes First Exclusive after atleast 6 month decent usage.

When i applied I didnt know that YFP can be sourced LTF with other card statement >3L and was mentally prepared to pay the fee, later in the process came to know about this and got LTF YFP.

Its possible, i had LTF YFP then upgraded to LTF YFE without any other relationship with Yes Bank. Iam thankful to @Sid and cardexpert.in for guidance, and thoroughly enjoyin the card. This is my fav card as of now. Recently used PP at Colombo on my return trip from KL.

Wishing you all the best dear..!

Hey Praveen

I am having 3.3 lakhs limit on Amex Platinum Travel card can I show this statement and get Yes First Preferred Card ? If yes how ?

Please let me know. TIA

SBI Platinum ( Visa and Masters ) also have lounge access once in 3 month.

What about Debit Card Ruppay of Allahabad Bank. It’s not valid in Domestic Airport lounges??.

I cannot understand why didnt you add icici sapphiro to your review. It gives 32 lounge access per year with amex and master having 4/quarter each. Golf and everything. Dragonpass is also great for International lounges. I have this card. I got 10k vouchers after paying joining fee. 3500 annually for such a card hereafter. I shell out 3500 payback points every month. I get bonus points on milestone points. I earn double points from amazon and icici in a single transaction. Also great benefits on movies as i get 24000inr worth movie tickets pa. This is one of the best card if you know how to use it. I shell out 10k inr worth of points every year.

What are the options for that 10k GV?

Shoppers Stop Voucher worth ₹ 3000

Yatra Vouchers worth ₹ 4000 (Four vouchers worth ₹ 1000 each)

Ola Vouchers worth ₹ 1000 (Four vouchers worth ₹ 250 each)

Vouchers from Specialty Chain of Restaurants worth ₹ 1000

Croma Voucher worth ₹ 1000

hello arnab,

can you please tell me what all vouchers you got for 10k? is it worth paying 6500 joining fee??

i was planning to go for sapphiro!!

also are those vouchers usefull??

thanks

Citi PM Visa card has generous 8/qrtr and MC has 6/qrtr. Should definitely be on the list

My experience says have two cards one with master and one with visa as now days most lounges don’t accept Visa and have only limited access to few high end visa credit cards

I would even say now good banks give free access to lounges on their debit cards also ..Like axis burgundy …

Specially small towns accept more of master than visa and also debit cards are as good as free

Since Yes First Exclusive is not offered (mostly) free anymore, is there any other way to subscribe to it without having to shell too much/?

Jst few days back I got upgraded from YFP to YFE life timee free

How did you manage to upgrade.. Did you received any upgrade message.?

Even I’m holding YFP for 2yrs and looking for upgrade..

@anoop,

I did not get upgrade offer. But I got 3 LE offers. And this year I met elig for YPE. During my 3rd LE, I requested for YPE and sent payslips, after 7days they approved my request

SCB ultimate Master card is best for domestic lounge. Unlimited domestic lounge access.

@Govid

Try taking Yes First Preferred by submitting 3L+ statement of any other card. This way u wud probably get LTF. Keep n use it for atleast 6months and request LTF Yes First Exclusive.

I worked for me. Hope the same for u.

HDFC Regalia First is worth for the Domestic/International lounge accesses, cashbacks and 10x rewards points. You can get it for free with a Preferred or Imperial HDFC Bank account I think (check with bank). You can also use that debit card for lounge access. Likewise, ICICI, Axis, HSBC, etc offers free cards for Priority accounts.

HDFC regalia lounge acceptance has drastically reduced. In delhi it is not accepted in domestic plaza premium at T3, International also is restricted to Lounge B only and not Lounge A. (personal experience of last week). T2 and T1 doesnt accept. Anyways PP associated with regalia is paid in domestic lounges. Diners club has better lounge acceptance in india.

Correction: Regalia is getting accepted at Delhi Domestic T3 (used last week).

Just incase if you’re asked for a fee for this ICICI card, don’t ever get it.

what does this mean??

It means ICICI cards are not worth it unless you get them LTF

Dears please let me know if I have a hdfc regalia primary and an add on card for my wife. Besides this I have some platinum debit cards. Can i access free master lounge for me and wife on regalia primary and add on card and for son on my platinum hdfc debit card.

Regards

Regalia lounge access is for primary account holder only.

Primary & add on share the complimentary lounge access so if you have 2 free access remaining the yes, you can use them for you & your wife. If you son is younger than 5 years he can get free access but if older. You can use the plat debit card for free access..

Raul are you sure both can use the same lounge at same time? You are correct that they share the total yearly access, but whether it can be done simultaneously?

@ Taj – technically you cannot, but if you request them and be polite they will swipe your Regalia twice and allow 2 people in. I have done this many times.

Can we use add on card for lounge access? Let’s suppose I have a credit card along with add on which has some lounge access remaining can add on cardholder use that benefit. if primary card holder is not availing that benefit.

@Sid,

Is there any card in India that allows guest access to lounge apart from amex platinum which does so only at Amex lounges?

Axis Magnus provides free guest access

Hi sir, i m using sbi prime since last 3-4 years. Due to not much usage they have decreased the limit to 25000 from 100000. But they are taking annual fee is 3000 every year. And the annual fee will wavier off if i spend 3lakh per year. So it means i have to spend 25000 everymonth i.e full limit of card ..and they are not increasing the limit also. So please advise what should i do? How they can charge same annual fee with reduced limit to 25000. Who uses the full limit.

Hi Sid, just would like to know, are there affordable cards providing free lounge access to guest as well, from the total quota?

Which AmEx lounge(s) does ICICI Sapphiro provide access to?

Can we revisit/update the list for 2022, please? 🙂

I am not a frequent flyer and not possible to note on usage and hold many cards. Is there a way we can check ourselves the availability of access on various cards before entering the lounge to avoid embarrassment of getting told ‘this card is not eligible ‘ and instead of trying with many other cards