American Express is known for their premium credit card services across the globe. If you’re looking forward to experience the most premium credit card offering from such an elite credit card issuer, you’re at the right place.

American Express Platinum Card which is issued as a “metal” card in India is an Ultra Premium Credit Card known for its premium lifestyle and travel benefits. It’s a “charge” card, hence it comes with no pre-set credit limit.

Here’s everything you need to know about this prestigious metal card that comes with a status symbol,

Table of Contents

- Overview

- Annual Fees

- Credit Limit

- Design

- Reward Points

- Redemptions

- Forex Spends

- Airport Lounge access

- Birthday Benefit

- Travel Spend Benefit

- Hotel Elite Tier Benefits

- Golf Benefits

- Dining Benefits

- Platinum Concierge

- American Express Invites®

- Airport Fast Track

- Companion card

- Supplementary Cards

- Unboxing

- Renewal

- Is it Worth 70,800 INR?

- Bottomline

Overview

| Type | Ultra Premium Credit Card |

| Reward Rate | 1.25% – 2.5% |

| Annual Fee | 60,000 INR+GST |

| Best for | Hotel benefits & Concierge services |

| USP | Hotel Memberships |

American Express Platinum Charge Card is one of the very few cards in India like Axis Reserve, the value of which has to be decided based on the lifestyle benefits it offers and not just by looking at the reward rate.

Apply through the above link & you’ll be rewarded 10,000 Referral Bonus Membership Rewards® points (spend INR 5,000 within 90 days) + stay vouchers worth INR 45,000* from Taj [Limited Period Offer].

Annual Fees

| Joining/Annual Fee | Rs.60,000+GST = 70,800 INR |

| Welcome Benefit | |

| Renewal Benefit | Varies depending on the spends |

| Eligibility | 15L for Self Employed / 25L for Salaried |

With 100K points one can get a value >50K INR by transferring them to Marriott Bonvoy, among other options. While only Taj vouchers are available as regular welcome benefit there is a way to still get 100K points, more on that shortly.

Note that, every once in a while American Express also sends targeted upgrade offers for the platinum card with lucrative welcome bonus, upto 135K MR points like the one we recently got in Jan 2024.

These upgrade offers are usually sent to existing cardholders with good spends. You’re lucky if you get one.

Credit Limit

- Minimum Credit Limit: 10 Lakhs

Even-though its a charge card and comes with no-preset limit, it still has internal limit or shadow limit which is more like a credit limit, except that it keeps increasing based on your re-payments.

Usually the limit starts at north of 10 Lakhs, however that will be usually available for use only post ~3 months of card issuance as the system needs some time to get in line with your spend pattern.

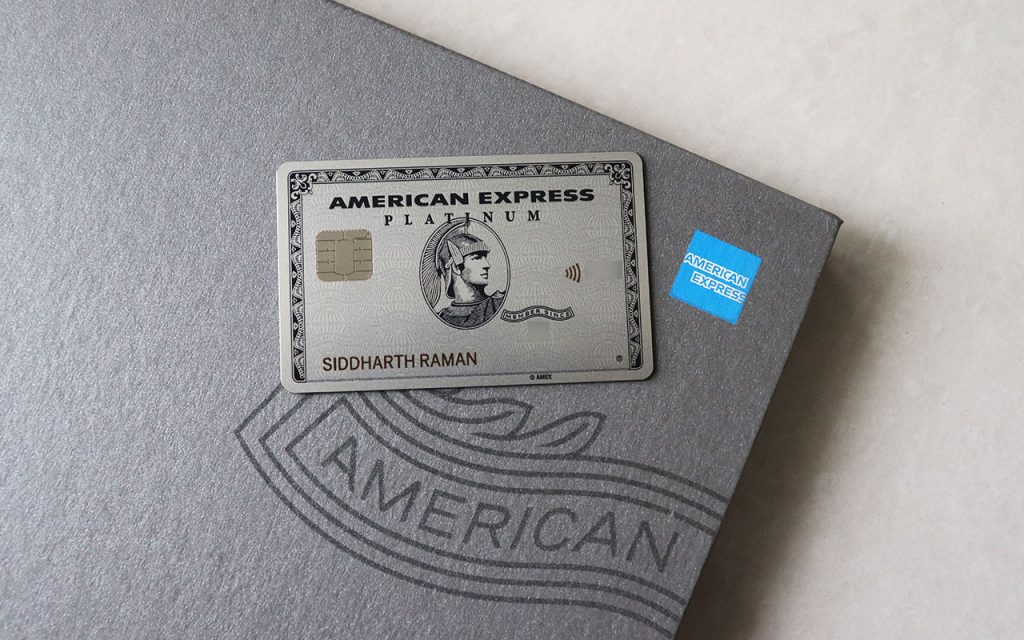

Design

The Amex Platinum Charge Card carries the iconic design all over the world with minor changes to the design elements then and there.

In real life this card provides a genuine metal feel that sets it apart from other metal credit cards issued in India, thanks to its authentic metallic colour.

Reward Points

- Earn Rate: 1 MR Point per Rs.40 Spent

- MR Point Value: ~50Ps to 1Rs

- Reward Rate: 1.25% to 2.5%

The above reward rate is calculated based on the “minimum point value” that one can get with Marriott Bonvoy Points Redemptions.

If you’re exploring new properties (or) those located in not-so touristy/business locations (or) then the value could be in the range of 1 INR/point.

On top of that, if you’re Marriott Bonvoy Platinum or above, you also get breakfast & lounge access, which changes the game altogether.

Redemptions

While there are very many ways to redeem Amex MR points, I’ve personally redeemed them mostly for Marriott.

I have got a value of well over 1 INR / point at times, like my recent redemption at the beautiful Westin, Himalayas as you can see below:

But most of the time I’ve got 1 INR / point like those at JW Marriott Prestige Golfshire, Bangalore (or) Sheraton Grand, Mahabalipuram and its tough to put a static value on it as even the above keeps changing.

That said, most Platinum cardholders transfer the points to Marriott to extract maximum value out of them, as you can as well transfer MB points further to Airlines and get a better value through airmiles, among which United is quite popular.

Forex Spends

- Forex Markup Fee: 3.5%+GST = 4.13%

- Reward rate on Intl. Spends: 3.75% – 7.5% (3X rewards)

- Net gain: ~3.3% (only if you can get 1 INR per 1 MR)

It’s a decent credit card for international transactions as you gain over 3% of the spend. However, this is only for those who can extract a value of 1 MR = 1 INR as mentioned in above examples.

It’s not for everyone! I personally prefer to use other cards for international transactions unless the merchant is new & of low profile.

Having said that, considering the peace of mind that Amex gives you with their Zero lost Card liability, it maybe better to swipe Amex over other cards when in foreign land.

Airport Lounge access

| Lounge Type | Access Limit |

|---|---|

| Domestic Lounges | Unlimited |

| Amex Lounges | Unlimited |

| Priority Pass Lounges | Unlimited |

| Delta Lounges | Unlimited |

- Domestic Lounges: Both primary and supplementary card holders get unlimited lounge access to most of the domestic airport lounges located in India. These are affiliated lounges and not owned by Amex.

- Amex Lounges: You get unlimited lounge access to the Amex lounges across the globe like Mumbai Amex Lounge. You also get access to the Centurion lounges across the globe.

- Priority Pass Lounges: You get unlimited access to the 1200+ priority pass lounges across the globe. Note that only one supplementary cardholder can be enrolled for priority pass lounge access benefit.

- Delta Lounges: Apart from the regular lounges, the additional advantage of this card is, you can also access Delta lounges when you fly with Delta Airlines. This may come handy if you’re flying inside USA.

Note: You may need to request for a Priority Pass after getting the card. However, I was told that a digital priority pass will be available instantly, if required.

Birthday Benefit

- 10,000 INR Taj Voucher

Since 2021 American Express has been sending out 10K Taj voucher on the cardmember’s birthday. This is a wonderful benefit which I’ve been enjoying since past 3 years.

The voucher is sent a month prior to the birthday month, ideally sent by the end of the previous month.

Travel Spend Benefit

- Spend 1L on International travel and get 15,000 INR Taj Voucher

This travel benefit is applicable every year and they keep shifting it between 30K/15K vouchers from time to time. Quite lucrative for those doing revenue travel spends on cards.

Hotel Elite Tier Benefits

The American Express Platinum Charge Card gives you grand set of elite tier benefits that you can enjoy as long as you hold the platinum card. To avail the tier benefits,

- Login to your Amex a/c

- Visit this URL

- Signup for respective benefits

| Hotel Loyalty Program | Tier | Value |

|---|---|---|

| Marriott Bonvoy | Gold | ~ 20,000 INR |

| Hilton Honors | Gold | ~ 20,000 INR |

| Radisson Rewards | Premium | – |

| Taj Epicure | – | – |

Marriott Bonvoy (Gold):

This is the most important benefit that you can get with the platinum card. The combination of Gold Elite status & 100K welcome bonus points makes this card highly valuable.

Considering you stay 10 nights a year with 5 successful upgrades, you can get minimum of 20K INR value out of Marriott Gold tier but there are many who could get more than 50K INR a year just with this single benefit.

I enjoy this benefit quite often as you can see it on my Marriott hotel reviews. This usually gets me upgrades, breakfast and few other benefits.

Hilton Honours (Gold):

This is yet another amazing hotel loyalty program which I recently explored at Austria & Ireland. The complimentary breakfast benefit has a good value especially in countries like Europe where the breakfast rate is easily like 50 EUR for two.

If you do 5 nights a year, you can easily get over Rs.20k value with breakfast benefit alone. If you put a value on upgrades, then you could save much more.

Taj Epicure:

It’s usually beneficial for those who avail the Spa and Salon services at Taj properties as the services are discounted at 20% on the bill.

The enhanced version of Taj Epicure membership now in 2024 also gives you 1 birthday cake & 2 access to the Taj Club Lounges which alone is well worth of over 5K INR.

Radisson Rewards

If you’re someone who’s already loyal to Radisson it does help you with room upgrades & more.

The gold tier helped me to request for an upgrade at Radisson Blu Guwahati but well no one cared about the tier at Radisson Blu Bangalore Outer Ring Road, so it all depends.

Golf Benefits

- Complimentary Games: 4 per month

- Complimentary Lessons: 2 per month

Enjoy complimentary games and lessons across 30+ domestic Golf Courses in India. Limiting lessons to 2 per month along with many other restrictions is actually not so good for a card that costs this high.

Dining Benefits

- EazyDiner Prime

- Taj Epicure

Eazydiner Prime is a solid benefit to have without a doubt as it could help us save ~45% on the bill easily when coupled with PayEazy offers.

Platinum Concierge

American Express Concierge service is one of the most under-rated and under-utilized benefit on this card.

Nope, you don’t need to use it for collecting sand from the sea. It can also be used for all the regular day-to-day needs. But the new challenge is that we need to call them for all requests, previously they used to handle over email which used to be so handy for me.

Amex Concierge Service is broadly divided into travel & lifestyle. More about the respective services here:

Travel Concierge

Typically all concierge requests related to travel goes through this team. The services includes but not limited to:

- Visa Services

- Travel Itinerary Planning

- Complimentary First Class Upgrade on Etihad

Lifestyle Concierge

They can do pretty much anything under the sun with their Do-Anything Platinum Concierge. In most cases you need a lifestyle of its own to get value out of it.

However, you can also use them to delegate small tasks that could save you time. That’s how I use them.

My Concierge experience: I’ve sent them over 100 requests in last 3 years and what I’ve noticed is that they under-perform during peak travel season.

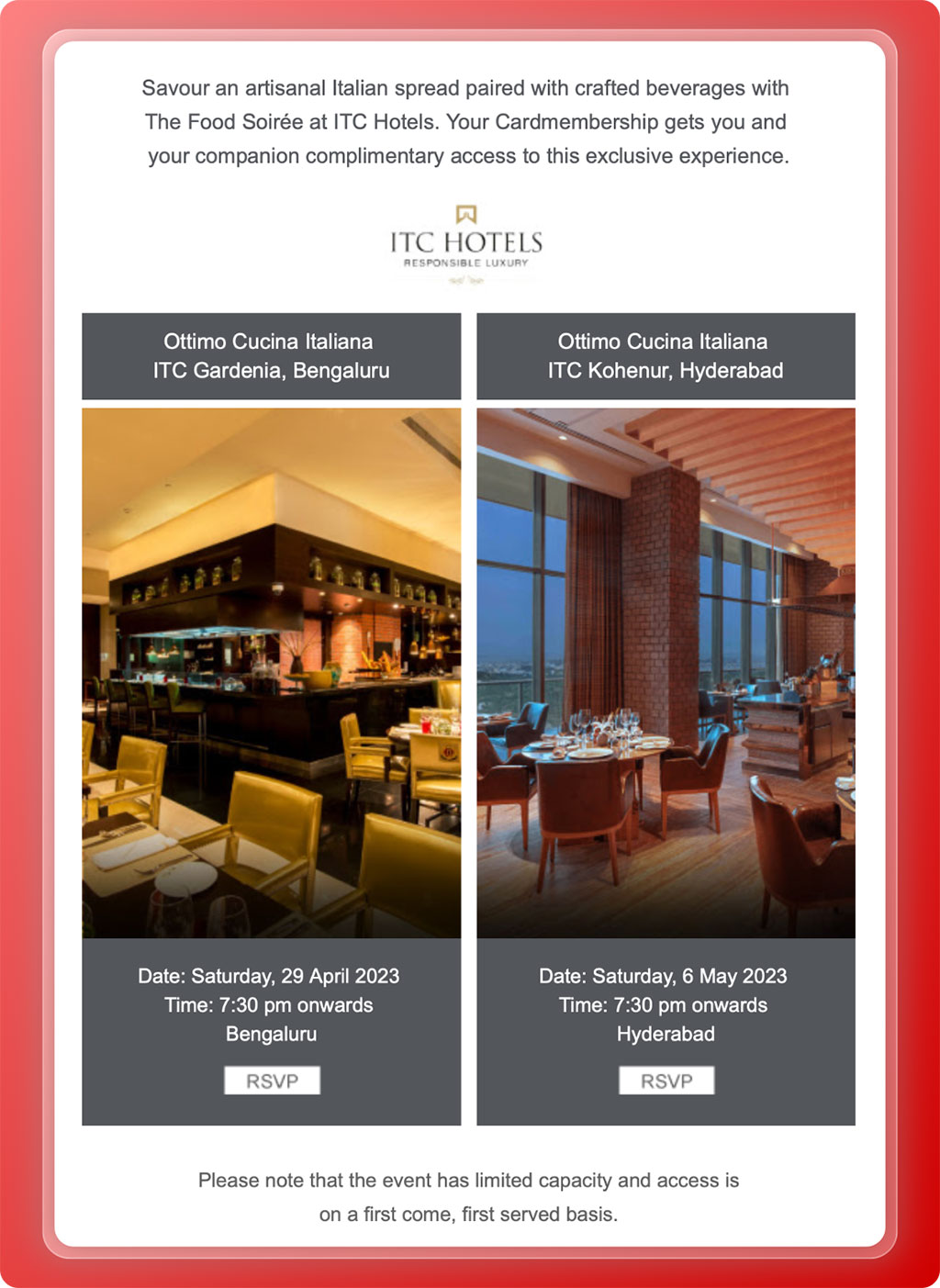

American Express Invites®

A unique programme that gives Platinum Cardmembers a chance to purchase tickets to some of the most popular events, often before they go on sale to the general public.

Apart from this, Amex also occasionally invite the cardmember+1 for a “complimentary meal” at ITC/Taj hotels located in metro cities. Here’s the recent one:

These kind of dining experiences are great, except that I wish that they could do it more often and in more cities.

Airport Fast Track

American Express Platinum cards issued in certain countries comes with the ability to access the fast track security lanes in respective countries and fortunately this applies to all American Express Platinum cards issued globally as well.

If you’re interested in this benefit, do check out the Amex landing pages in these respective countries: Amex Canada, Amex Italy, Amex Sweden. This benefit is also applicable at Austria & Belgium airports.

That’s not a great coverage indeed but if you’re flying to these countries, it’s worth knowing.

Companion card

With Amex Platinum, you can choose one of the other Amex credit cards as a companion card which remains free for life as long as you hold the Platinum Card.

Usually Amex Reserve is given as a companion card but if you would like to maximise the value, Amex Platinum Travel card is the best one (assuming you like plat travel card benefits).

Supplementary Cards

- 4 Supplementary cards

- 1 additional card for Business Expenses

You can get up to 4 supplementary cards, which are also metal cards with your American Express Platinum charge card.

Supplementary card holders can also enjoy most of the above benefits that a primary cardholder enjoys, including the hotel privileges.

Don’t forget to apply supplementary cards during the offer period as they run some wonderful offers like: you can get Rs.1000 – Rs.2000 Amazon Voucher per Supp. Card on the Platinum Card.

Unboxing

I’ve unboxed 2 Amex Platinum cards, one in 2019 (supp. card) and the other in 2020 (primary card). Feel free to check out both the links for the detailed unboxing. The packaging remains the same even now in 2024 as well.

Renewal

The welcome benefit for the first year takes care of the fee without a doubt. But from 2nd year onwards, it depends on the renewal/retention offer you receive.

As of early 2024, the retention benefit on Plat Charge with moderate spends of 5-10L a year can get retention benefit anywhere between 30K Taj vouchers to 80K MR points but of-course with higher spends there could be even a better offer.

Is it Worth 70,800 INR?

So now we’re coming to the tricky question!

Tricky because I’ve spoken to over 50+ Amex Platinum Cardholders in the past 7 years during my credit card consultation sessions and each one has their own reason to hold on to the card because it has given them memorable “experiences”.

While we can’t put a value on those experiences as it’s different for each, let’s see what the card can offer with it’s primary benefits.

Let’s analyse the total value of the card by placing an “average” price on each of the benefit we saw above. Here we go,

| BENEFIT | DESCRIPTION | VALUE (INR) |

|---|---|---|

| Welcome benefit | 45K Taj Voucher | 45,000 |

| Birthday benefit | 10K Taj Voucher | 10,000 |

| Marriott Bonvoy Gold | 20K INR value | 20,000 |

| Total | 75,000 |

- Total Value: 75,000 INR + Lounge + Golf + Concierge

So you get bit more than what you pay, assuming you make use of the Marriott Bonvoy Gold benefit (or Hilton for that matter) just as most other card holders do.

Travel spend benefit is also another lucrative benefit to look at.

And then if you play golf 10 times (or) use lounge 10 times (or) avail concierge services often, that’s another 20K INR savings easily for “each” of the services mentioned.

If you avail all these services, then the overall value you get is huge!

To sweeten this deal, you can also get another 10K Referral Bonus Points by applying through the link below. That’s 5K INR value (or) one extra night at select Marriott hotels!

Apply through the above link & you’ll be rewarded 10,000 Referral Bonus Membership Rewards® points (spend INR 5,000 within 90 days) + stay vouchers worth INR 45,000* from Taj [Limited Period Offer].

Bottomline

- Cardexpert Rating: 4.2/5

Overall, it’s a nice card for someone who loves luxury experiences in life. The downside is that the joining benefit shown publicly is restricted to Taj Vouchers, which not everyone would like.

However, do note that you may request for 100K points instead of 45K Taj voucher after receiving the card simply by calling the support. They “mostly” approve such requests from what I’ve seen. But remember that it has to be done before activating the card.

That aside, it’s not only a card for you, but also for the entire family, as you may share 4 supplementary cards with your family & friends so they too can enjoy almost all the benefits as you do.

So if you love Amex and want to experience this metal at-least once, then nothing gonna stop you from getting it. Enjoy the Platinum Life!

What’s your take on the American Express Platinum Charge card? Feel free to share your thoughts in the comments below.

Isn’t it excessive even for upper-middle class credit card users to pursue this card? I personally feel paying a high joining fee to get this card makes a lot of sense for entrepreneurs who can afford to write off the joining fee as an expense and those who get reimbursed for corporate travel wherein they can rack up nights with one of the international chains at the their employer’s cost. This is just my two cents. I am sure that others would view this card from different perspectives.

Totally depends on one’s lifestyle.

It does work for Salaried too. You can consider like paying for a vacation and you get the card for free, as a super premium card member would anyway spend 70K a year on hotels if they do 2/3 short vacations. Again, yes, its only for very small target group.

How to use the card as in case of booking Hilton properties from India ?? Is there any hidden charges that are needed to take care of??

I guess no offical renewal offer ?

What offer people got give some idea

Thank You & Good Day

Dear Poornith,

How can the joining fee on American Express be written off as an tax deductible expenses, have you personally done this? I would like to add it to my ITR if this is possible!

Thanks in advance.

Regards,

Venkatesh

Well, i got welcome points of 1,25,000 points. I transferred 80k points to marriott. I got Rs 1,12,000 value in 80k points. I booked in Dubai. During new year time, dubai hotels get extremely costly, but NOT when you book in points. In point booking, rate remains the same for a hotel. I still have 45k points left.

It totally depends on timing, tours you do etc.

how did you get 125K welcome points? Any specific referral link?

Sometimes such offers do come for people who are already having American Express cards. I got such an offer too, but I did not take it as I do not find this card worthwhile for me. HDFC Infinia is enough for me.

Additional value drivers:

Golf lessons – This can fetch you between Rs 1500 to Rs 3000 in value per month (if you were to avail the two complimentary lessons). Green fee waivers can increase the value a lot.

Taj Innercircle is actually Gold, as you can status match with Shangri-La Golden. Also you will get Silver status in Singapore Airline (with a promise of Gold after three flights with them).

Adding to your note on ITC culinaire membership. This comes with a set of vouchers (typically 50% off on buffett, 25% to 20% off on a-la-carte, and some more vouchers for Wills Lifestyle). What more the ITC membership gets you 25% as ITC Green points for dinning at ITC and 37.5% points on Fridays, and your birthday week. You can get at least Re 1 value of the ITC Green Points, or can convert to Marriott Bonvoy and get 1.5 Marriott points. Additionally you will get Rs 4000 worth discount codes at Wills LifeStyle for your birthday and anniversary months (not sure what happens if they are in the same month). That’s not all, you will often get 5X points on your purchases at WLS. That is 25% off. Last Diwali I used this to get 58% off on fresh merchandise (5X from ITC, and 33% from HDFC DCB for shopping between 5 pm and 9 pm).

Also there are dinning benefits: ‘Taste of Platinum’ that has been discussed before and IAP (Amex Guy has great documentation on the same)

Thanks for additional inputs. Looks like you’re visiting ITC often. 🙂

wow! amazing list of benefits of ITC. Thanks

I just paid my son’s education fee through this card and enjoyed 2x the points. Had initially faced a lot of hiccups with this card and had escalated it….Issues were resolved to an extent. Used this card to get a 25% discount on Taj Room Nights and the offer is still valid till 30th Sept 2019

Big jackpot for you to get all the elite hotel and dining membership benefits as a supplementary card holder 🙂 Would be a huge benefit since you travel a bit.

Yet, I prefer only Marriott where I’m already Gold Elite. So not a big benefit unless I stop being loyal to Marriott. Let’s see 🙂

Sid,

you may want to expedite to BonVoy Platinum by calling the helpline & taking up the Plat challenge.

16 nights in 3 months gets you to BonVoy Platinum.

Cheers

Neo

Yes, thinking about it for a while.

Pretty sure supps do not get dining memberships. Taj is for main card holder only, and ITC is for main card holder and his/her spouse (doesn’t have to be a supp). EazyDiner/Taste of Platinum/Amex Network Dining are for everyone.

Considering how hard it is to review this card, great job! While some things that I’d like to add:

1. Taste of Platinum is very handy and does add a lot to the already decent dining options — ITC + Taj + EazyDiner.

2. Shang Jade is much more valuable than I initially thought. 3 welcome drinks, and those things are expensive at their hotels! Shang hotels are great outside India.

3. You completely missed FHR. On average, Plat members save $550 a year. But essentially, guaranteed room upgrade, $100 credit/dinner, guaranteed late checkout and early check in at an insane collection of upper end hotels. They also have a hotel collection that gives $75.

4. Accelerated *A gold. You can match Shang to Singapore Air and get silver status. Take 3 flights and you have gold.

5. I would not value Bonvoy status at 20K anymore. Personally, Hilton Gold is far more valuable than Bonvoy. It used to be much more valuable with SPG still around.

6. There are a lot of interim offers. Currently they have 25% off (up til 1.5 lac per transactions) at 29 luxury brands. Depending on your lifestyle, that’s a lot of cash value.

7. The new dining reservation program with concierge is great, especially if you’re booking high demand places.

8. Plat Emergency services. If you are traveling, this includes emergency airlift, legal advice and counsel support, $8K emergency medical cash, $1K emergency cash anywhere. On top of that if you withdraw cash and call amex that it was an emergency, they bill it as spend not cash advance. You also get travel insurance 5 times a year (pointless if one also has Prestige).

9. Priority Pass, unfortunately, does not allow free usage domestically. Which is why I never carry it. It is, though, issued directly by PP and is not bank managed, so you can download a digital version on Apple Wallet and always have a backup card on you that way.

10. Discounts with Platinum Travel are available on economy and PE as well, not just business and first. Depends on airline. It’s on the website.

11. Golf program has a minimum flight of 1 on weekdays. Which means on weekdays you do not need to know a member to book. A glaring difference between Amex and others.

12. Emergency home services. Amex covers two home repair visits, up to 1500 INR in case of broken appliances, repairs or other home emergencies.

That’s just of the top of my head.

Yes indeed. It needs a shift in mindset to review this card 🙂

Thanks again for adding valuable points.

3. I’ve been exploring this during my last trip to Vietnam but couldn’t find much of a value, and so I skipped. Will probably add it. Do you have any specific hotels in mind where you get exceptional value in SE Asia with FLR?

5. But I find a lot of options with Marriott in the places I travel over Hilton and so I’m sticking to Marriott.

8. Emergency services applies even if we don’t book flights on the card?

12. This is surprise. Never even heard of it. Have you tried it?

Thanks again!

It is there in the Card Agreement document. And for item #12 it is 1,200 INR. It is available online and I had read the card agreement end to end before signing up..:-)

I need to print this in bigger text to read all of it. 😛

3. Yes, it is a hit and miss on revenue comparison. Usually you derive lesser value on FHR in Asia because hotels are cheaper and offer a dinner instead of $100 property credit. But it’s still always worth checking. I use it now to book St. Regis Mumbai for example. FHR rate is usually 700-800 more, but I get a breakfast for 2, dinner for 2, upgrade to suite and late checkout, none of which Bonvoy Gold any longer fetches me. So a win there. I do have some options in mind, which city are you looking into?

5. It depends on loyalty, yes. But Gold status itself is not much valuable. It does not give you guaranteed 4 PM (it did with SPG), guaranteed breakfast, guaranteed upgrade to next cat(it did with SPG) nor the exec lounge access. All of which Hilton Gold does. So, status to status comparison, Bonvoy Gold doesn’t have inherently as much value as Hilton, which is more comparable to Bonvoy’s Platinum now.

8. Yes.

12. Have not tried it. Waiting for summers and the AC to do it’s thing lol. Here is how one learns about all emergency protection

Emergency services are insane. If you’re traveling alone and need medical supplies, they are there. If you get hospitalized or seriously injured, they can fly your family member to your bedside, or your doctor in extreme cases. If your trip delays due to sickness, they cover a hotel room up to $200 a night.

Amex also just went in partnership with CPP which insures every card in your wallet, not just Amex. The usual plan you can buy for fraud protection up to 3 lacs (for 3K a year). The one you get with Plat is up to 25 lacs. They also have emergency cash and more India related services. Haven’t explored or activated it yet.

3. Okay, I get it.

Any city. If the hotel is good enough, with good tourist attractions around, I’ll go there 🙂

12. Interesting, will check them out.

Amex Guy that’s a helpful link regarding the emergency platinum assist.

Is it the same concierge folks who will handle these requests, or is there a dedicated team for this or is it outsourced?

Hello Amex Guy, like sid; I just got the plat charge card. Could you give your take on this versus ICICI’s Emeralde card?

PS: Sid, you should do a new comparison with such exclusive cards. I feel ICICI Emeralde is a good card with respect to cost benefit ratio.

I’d love your and Amex guys take on this.

Cheers

Hi Amex Guy,

Thanks for the valuable inputs. Could u clarify that if one books a Marriott hotel(say St. Regis Mumbai) through FHR, does one accrue Marriott Bonvoy Points? Also, the same question for the Hotel Collection.

I too enjoy Marriott service and being a Platinum member since last 3 years able to retain it. Luckily during lockdown they extended my Platinum status till Dec 2021.. They always upgrade to suite and also give complimentary BF or welcome drinks/platter with personal hand written note by Hotel manager. They really make you feel special.

In south east asia, hotels are dirt cheap. So save the points for exotic locations. Mauritius LeMeridien ile maurice, St Regis..Dubai year end, Maldives, Moscow St Regis

Hi Sid/Amex Guy,

thanks for the review. I was/am considering getting the amex plat just noticed that trf partners both airlines and hotels for the India card have far poorer transfer ratios than the US e.g. US Amex MR trf to airlines at 1:1 and to hotels like hilton at 1:2. For India,apart from fewer options, ratio is 2MR:1mile and hilton at 1MR:0.9. Only MR>Marriott is 1:1 both places. This probably makes redemption of MR for airline mile fairly poor value (half of the US values). Wondering how best to utilize the MR rewards that I will get since I’m a leisure traveller and will never stay in a cat1 hotel anyway (probably cat5 or higher). Also seems shangri-la, taj epicure and taj warmer welcomes gold tie ups/ cascading benefits are due to end by 1apr21? How does one then get any value from the card?

Amex guy,

Ah, was waiting for your comments..:-)

I had the platinum charge card for two years. Cancelled it and staying loyal to my Infinia. Hands down the Infinia is better. While I do travel a lot and stay in many of the hotels Amex has tie ups with, upgrades and deals are “subject to availability”. I have been a victim to this and booked a stay at St.Regis abroad but didn’t get the upgrade as planned.

With Infinia I know that my returns are guaranteed in my kitty, with Amex there is a lot of ambiguity. I am averaging close to 8% rewards every month on Infinia by utilising 10x,5x sort of offers regularly. Moreover, whenever I had checked with Amex concierge for hotels and flight deals, I found that my travel agent had better deals and if I evaluated smartbuy 10x it also beat it hands down.

Plat is definitely not for rewards game but for experiences that are generally out of our reach. Leaving aside the returns you mentioned, it is sad to see that Amex is not consistent is providing those experiences to all customers.

I purxhased Marriott Bonvoy 1 lakh points for USD 1250. I got 50k bonus points. If you are planning to go on exotic locations, Marriott Bonvoy is best.

But dont always use points. Use it on year end etc.

I have to agree. I use the Infinia and the Platinum and the rewards I get out of the Infinia give me much better value. My Amex is up for renewal this month for the 3rd year and I am wondering if I should renew it at all given that no specific benefits are provided for the renewal and some of the benefits I received when I signed up initially (Vistara Gold Tier and ITC Culinaire) are no longer available.

Would you recommend getting the corporate version since that gives points for utility spends as well ? Assuming benefits would remain the same except for the earning rate

Yash,

You can get points on utility (or insurance spends for that matter), by just paying through PayTM (or other wallets that accept Amex). Amex sees it as a PayTM expense and gets you the points. You don’t even have to load PayTM beforehand – just use the PayTM gateway. Also you can do the same trick to get MRs for fuel transactions too.

Cheers!

SH

Hey amexguy,

I have been following you and Sid for a while. Really have come to strongly dislike the amex plat. After your advice on using the plat charge as my primary card I was hoping their conceirge improves. Yet again they delivered …. absolute utter failure. Ask wasn’t astronomical. Just a few tickets to Avengers that too 2 weeks in advance.

The conceirge lady called me up and explained why she could not book tickets on book my show!!! Obviously there weren’t any and hence the request. Request remained unfulfilled.

I am definitely not renewing it next year. Prestige and diners provide far better value and service.

‘ targeted upgrade offers for the platinum card’ – the link is of Platinum Travel Card and not the Charge card. You’ll have to update.

Changed. Thanks.

“The only reason that you need to consider is the new soft rule by Amex that don’t let you be eligible for the Amex spend based offers once you’re a Plat Card holder.” – Are you sure about this one?

Yes. But this may change anytime as a lot of cardmembers don’t like it.

Due to many indirect benefits, I guess this is one of most complicated card to consider and review.

I personally don’t think would be able to take advantage of this card much due to my lifestyle and considering that I more often than not book via OTA with discounts.

But i am sure for many others, this gives insane value.

Anyway, loved the review..

I bought this card and gave it back in less than a months time, I was misinformed by the sales manager about the card features, I was told that if I go for the 100k points I can book flights and hotels worth 45k, what i was not told that only 25k can be used for international air tickets and hotels while 45k is for domestic use. When I called the concierge sercive for a hotel while I was in Kashmir, I need a room in Gulmarg and they gave me an option of ₹ 1.2 lacs per night at Khyber property in Gulmarg, I mean are you really serious? Can someone spend 1.2 lacs on one night stay? It’s a very hyped card from Amex and their service network is poor as compared to their boasting on the same. The ideal fee of the card should not be more than 15-20k. 60k + taxes could be someone’s one year salary folks, why would anyone waste their hard earned money even if you are a rich? The metal card is all a gimmick and it fools you. I hold Amex platinum and Amex reward card.

Also they bluffed me about the 100k points by saying that it would be credited to my Amex card account after first swipe, I waited for a week and called them back and they said that after I spend 25k it will reflect within 45 days, i mean what did you charge me the fee for? Which means I pay them 60k + gst which is 70,200 then an additional 25k which makes it 95k almost a lac and they i will get maximum benefit worth 45k? Where is the remaining 45k gone? 45k fee for a piece of metal and hopeless service promises?

Just to inform you ICICI bank has launched similar card with 90% same facilities and it’s called the Emerald card with a joining of just 12k which you can pay 1k monthly as an EMI. I took this up with senior manager of Amex and they didn’t have a word to say as my above points were valid.

It’s only a big name so please don’t get fooled by the metal card gimmick please. Just not worth it.

I got the card and thanks for enlightening everyone here about the 25k swipe required. I realized the same when I saw the application popup asking me to spend 25k within a month or 45 days. I do feel this is a downer!

Sid whats your take on this?

It used to be on first swipe, but the 25K requirement has been on the website for over 6 months now. It is also the first sentence on the new paper application, followed my a disclaimer that if you have any other charge cards, they will be cancelled.

You don’t have to book the first hotel they tell you. They have booked even OYOs and FabHotels for me, which they technically cannot, but were courteous enough to call the hotel and book because I wanted to not spend much. Ask. It’s your travel desk, they will help you.

It is also a really bad idea to burn MR points on Amex travel vouchers. You could have booked 1 lac worth of Marriott hotels at the very minimum, especially if booking within India, thanks to GST. Ideally, you should look for 2 years worth of fee back with bonus. Even basic business hotels like Courtyards in India will give you 1.5 INR/MR point.

I can appreciate the fact that Emarald might be a better card for your situation, but you cannot seriously compare Emerald with Plat. It appears to me that you signed up without looking, and are now ready to give it up without looking. The God is in the details. 🙂

Card being metal is not a factor by anyone I know who seriously uses this card. This card could be made of cardboard and I’ll still pay for it every year.

What Amex desperately needs is more training for Plat. Both with sales as well as service teams. Citi has this nailed pretty well. Prestige simply isn’t sold, but sought after with a dedicated team, which also provides service. Amex is making a deep mistake of letting Plat handling in wrong hands.

Kudos your love for Amex and I say that respectfully. Maybe the card has been immensely useful for you. and I’m happy for that. Could you guide others on how you’ve maximized from the card?

I liked this part :

“You don’t have to book the first hotel they tell you. They have booked even OYOs and FabHotels for me, which they technically cannot, but were courteous enough to call the hotel and book because I wanted to not spend much. Ask. It’s your travel desk, they will help you.” — This is functional statement providing applied guidance as opposed to theoretical one. I’ve asked Sid in other thread to collaborate with you to give everyone on this platform a more comprehensive use case for plat charge card.

I must apologise and respectfully disagree with your statement about: “Amex is making a deep mistake of letting Plat handling in wrong hands.” While income is one criteria, it is up to the applicant to understand the benefits of the card and prudence of the sales representative to guide the customer (this can be enforced by Amex). What is for sure is that there is lack of clear applied guidance on how to best use this card. I’ve read blogs where people have claimed they saved ~4,00,000 INR using this card or they have ~2,50,000 accumulating points on their spends. What they easily and sadly purposely miss out is “how”?

I got my plat charge card 2 days after the article went online, I was given an upgrade from Gold Charge and Jet Airways card as I wished to close Jet and consolidate. I have E-Mail from Amex representative who is now my account manager explaining in writing benefits of the cards. He does mention 1,00,000 MR points but has no where mentioned a swipe of 25,000 to get those points. While it is subjective as to on whom does the responsibility fall for checking criteria, I personally in my humble opinion feel Amex rep should have told me about it in the interest of transparency, given the premium placement of the card. Is this a downer for me, personally? No. I had to spend for predefined reasons and I did. Just my two cents there.

Lastly, when Sadiq Dastagir mentioned his experience with Amex plat and pointed towards ICICI Emralde (I am not sure and intrigued as to why ICICI has misspelled it) card, I read up on it. Now based on my limited knowledge (especially in comparison to hobbyist like Sid and passionate person like you) I found Emeralde a more useful “ROI” card. Maybe I’m wrong, heck; let us assume that I am wrong but how do general population who’re getting in to the nick of points, travel and credit cards understand this?

I’d deeply love your and Sid’s views on this. Also, if I may humbly ask Sid to add your points to his review, it may make it more comprehensive.

I think this needs a separate article, as you’ve mentioned and that only “Amex Guy” can write more in detail. Will do comparison article too shortly. In my perspective, If you’re a “real spender” especially on luxury travel & Dining, you’ll get a lot of value.

Reg. 25k spend criteria, Even-though it shouldn’t be a problem for those who are eligible for this card, it’s Amex mistake indeed and they should probably fix that. Infact they can better remove it or, I’ll be more than happy if they give 200k points on 2L spend in 90 days 🙂

Hey Sid, I hope I’m not being interpreted incorrectly. I meant an article by you and Amex guy in conjunction and did not wish you directly or indirectly imply that he should be writing it solely. 🙁

Noted, noted!

Dear Sid, my only concern is that when you pay a hefty joining fee of Rs 70,200 what is the value we as customers are getting from it, at least we should get the entire joining fee back in some form which justifies that kind of amount.

I hold Citi prestige for 3 years now. Never saw a better service. They beat Infinia guys hands down. Magnus guys don’t even stand a change in customer service.

I’m yet to explore Reserve (just ordered in July’23) & Platinium.

After reading this I won’t even think of going for it. Unless you are filthy rich, fee of 60k plus GST doesn’t make sense at all. In these days of COVID 19 when travelling anyway is at an all time low, MRCC is the best card of Amex. Once things normalise, we can go for travel card. Platinum card may be ok for show off or if you travel abroad frequently in business class and stay in five star super deluxe hotels.

I m self employed and going to file my ITR for this year above 6 lakhs.. Now I m planning to apply Amex cards since the eligibility is 6 lakhs for self employed.. do they go with this year Itr or will they ask for prev years too ? I don’t have 6 lakhs itr for previous years… btw I have few more credit cards since couple of years..

Latest would do.

Should I apply for Amex Platinum Charge Card and I want to know it’s eligibility and I already hold Diners Club Black( Life Time Free), ICICI Diamant Credit Card and recently got ICICI Emeralde for free.

So would Amex give me this card at discounted annual fee or regular annual fee…..

The only way to get Plat free is if you have a private banking relationship with one their partner private banks. Usually the ones who requires 25-30 crore minimum are their partners. If you have a really large portfolio with IL&FS you can try for IL&FS cobranded Plat. Not sure if they will waive the fee, but worth a try.

Other than than, you will be paying the first year fee. Reconsideration will happen on at least 40-60L spend in the first year, depending on their mood. Over 60L, they usually always waive the fee. But there are no promises.

Amex Guy – how do you get so much inside info? Not that I am complaining about all the knowledge that you share so generously, but sometimes I just wonder..:-)

Cheers

SH

My company is on Amex Corporate, just know too many RMs within Amex. Also, Amex HQ is next to my office in cyber city, too many friends there. Can’t say more than that publicly. 😛

Seems amex is withdrawing boingo benefit for plat cards.

That’s enough to do some serious OSINT on you. :p

PS: light humor and in good faith.

@kiran: Indian issued personal Plat never had it. Boingo was always on Corp Gold and Corp Plat.

Hi Shiv

Can you please comment on LTF for diners black (apparently being Imperia doesn’t cut it).

And how do you obtain icici emeralde LTF, (high nrv with ICICI?)

Sidharth.. how stringent is Amex on the eligibility parameters for charge card? I would have income to the tune of 22L this ITR. Would that suffice, or are they stringent on the 25L eligibility factor?

It’s strict for fresh applications. But you could pass through if you get an upgrade offer.

Thanks. I did apply as an upgrade to my existing plat travel card and they approved the card without any documentation.

Please tell how did u get upgrade offer ?

I am using Platinum travel credit card from 1 year .

Any chances that I can upgrade offer for PLATINUM CHARGE CARD

Any tips ?

Got an email. You could call them and ask.

Just call them on customer care and request , they will be more than happy to give you

Amex considers an annual income of above 15 Laks or if you open any of super premium cars . I have the list with me I’ll mail to sid!

What are the renewal benefits on this card. Do we get 100k points on paying renewal fee. If not, how does it make sense to renew by paying 60k plus tax.

Hey Sid, could you please confirm which memberships will continue to be at elite tier until we hold the card? Will it be all of them (six) which are offered as part of the registration page?

I have asked this to Amex, and they said all of them will continue to be at Elite tiers as long as one holds the card.

Not many would know but Amex has this “One Annual Fee” policy (not sure if feature is available for India) where Platinum Charge cardholders will only pay one annual fee of Rs 70.8K and hold a maximum of 3 cards –2 credit and 1 charge. In other words, there is no annual fee for up to 2 more cards so long you pay the annual fee of Platinum Charge card. MRCC+Plat Travel + Plat Charge for Rs 70.8k! Not bad at all especially during renewal where we don’t get any renewal benefits. 🙂

It is there in India as well.

You cant hold Plat Travel with Plat charge and MRCC unless one is a companion card.

Amex allows one companion card with Plat Charge. In most occasions it is the Reserve one, but for some folks (me included) it is Plat Travel. So I don’t need to pay Plat Travel fee as long as I hold the Plat Charge. They refunded the fees on pro rata basis once I got the Plat Charge. Not sure about the second card (MRCC) that you have mentioned. What is the source of your info?

Did you get it with companion card offer? Or, you get got Plat and later added Plat Travel as companion?

Doesn’t matter, Sid. Amex sends companion offer to everyone once a year, if you were not given one on onboarding. Wait for it to pop up in online account if not already given. Or, as in my case, an absolutely useless Reserve card will show up in the mail without asking. (Wasn’t the worst thing though as I got it without CIBIL hit)

If you get it on onboarding, they always ask which card you’d like as companion. Has to be a platinum variant, gold cards like MRCC and Everyday cannot be a Plat companion.

Got it. Btw, I never got the companion card offer till date and I was said once that it was because I’m already holding 2 Credit + 1 charge card.

The companion is only for Primary Plat holder (not add on holders). Also if you have exhausted the 2+ 1 quota, you can still chose one of the existing plat credit card to be complimentary for you.

Dear Sid

In that case, you can ask Amex to make Plat travel card you already hold to be free (as long as you hold Plat Charge card). Please pardon me if I sounded foolish, bcoz I am novice in the world of Amex cards, as I can’t get one here.

Whats the benefit of the Plat travel as a companion card ..only Taj vouchers i guess ?

That and the 7.5k and 10k bonus MR at 1.9 lac and 4 lac spend level respectively. Additionally the Amex spend based offers, and lounge access (one every quarter).

They have the concept of companion card. No offer needed. Platinum travel fee reversed on pro rata basis.

I had the Plat travel card but as soon as fees got charged I asked them to cancel it as had moved all my spend to the Plat Charge Card…They very politely reversed the fee and cancelled the card. I hold the Plat Jet card and the person also told me as Jet is no longer operational we would come out with a new offer as well and the team would help me cancel the card as and when the expiry is near or I can cancel it right away. His ending statement was a little surprising. “As long as you have the Plat Charge Card you do not need any other card”

Does anyone have any data points on how they managed to make use of the International Airline Program with the Platinum card? While the programme has plenty of top-flight airlines in the US, the ones listed for the Indian version of the card aren’t all that hot, if my memory is correct.

I hold the US version of the Amex platinum charge card, I also hold the Diners club Black and Standard Chartered Ultimate cards and the Amex platinum travel card, in India.

To be really honest, the Amex platinum charge card in India is a terrible deal compared to what the card offers in other parts of the world. I hold on to the US version of this card just for that reason, despite being based largely out of India for the last couple of years. For instance, the same card in the US has

1. Travel expense credit on a major airline of choice, up to $200

2. Monthly Uber credits, totaling up to $200 every year

3. Saks 5th avenue credit of $100 per year

4. Reimbursement for TSA global entry membership: about $100

5. Unlimited lounge access: Amex Centurion and Priority pass

6. Doubling manufacturer warranty on all purchases up to an extra two years

7. Purchase protection for damage or theft for up to 120 days after a purchase

8. Primary rental car insurance for all rentals

9. A generally excellent concierge service which has even managed last minute bookings in Michelin starred restaurants booked out months in advance

10. Amex offers on a wide variety of brands and stores

11. Amex FHR benefits

12. Gold status on Hilton and Marriott

13. Free Boingo Wifi

14. Free Shoprunner 2day shipping membership

15. 5X points on travel

16. Zero foreign transaction charge

17. Signup Bonus of around 60k to 100k points

etc.

The fee for the card is $550, but this is routinely offset a bit on calling, as a statement credit for around 250-$300 or so, making the cost around $300 or approx Rs 20k. If you count the benefits, you easily make thousands of dollars on the card every year.

The Indian version of the card though is almost criminally overpriced and offers only a tiny fraction of benefits the same card offers in the US and other parts of the world. I have tried asking AMEX India about the disparities and never really got a satisfactory response.

The differences are so massive that it seems pretty fair for discerning Indian credit card users to boycott the card completely till AMEX India gets its act together, reduces price and increases benefits on its most premium offering to Indian customers. I also hope Indians who have the card already, call out AMEX India and pressure them into making the card better.

That is not quiet right. Here is what the Indian version has that is missing from the US version:

1. Golf benefits

2. Shang, Taj, Hilton, Radisson statuses

3. ITC and Taj dinning programmes

4. Add on cards up to 4 for no additional cost

The IAP and FHR are there for the India version as well.

You can get a lot of benefits from the first four items by strategically using them.

Free Boingo wifi is cut in US.

I agree that the fees are higher in India, and the airline transfer ratio is half of that in US. But if you are transferring to Marriott then the transfer ratio is double that of US. In am saying because here you get 2.5MR for every Rs 100 spend.

But overall with all the credits (travel, Uber etc) the actual cost of holding the US version is significantly lower. But there are pockets of values in India as well.

Hi SH,

How valuable is the FHR on the Indian card? I was researching hotels in Tokyo for an upcoming vacation & found FHR was listing hotels which I had already eliminated due to the budget :P. Also, are there any preferential airline fares for non-business class tickets for airlines not part of IAP?

Looking forward to your inputs on the same

Cheers

Neo

Yet to use FHR. May be others can comment on that.

There are preferential rates for non-business class tickets as well. Discount range is between 5% to 25%, and for SkyTeam carriers the range is up to 30%. Remember discounts will increase as the cost of ticket goes up. From what I know expect 5% to 10% discount on non-premium tickets.

I held the US version too for years before global transferred to India, it used to be $450 then. I think Indian version is better, and I currently hold Aspire Hilton which has been fantastic.

— Indian variant comes with 4 supplementary cards free. You need to pay $175 extra for 3 supplementary members. So the fee of equivalent offering is $725. That’s 50K INR. And you’d still be 1 supplementary and 1 A/C card short.

–All status benefits are same. Indian one is better here actually.

— Indian version comes with 24 golf lessons every year.

— Much stronger service. You know what I’m talking about, Plat line in US has become unbearable now. Concierge in US uses Expedia to book travel. It’s an absolute joke. In India, they are savvy and use a real GDS.

— 52 green fees waivers on golf every year, with minimum flight of 1.

— There is no $39 booking fee for taking advantage of IAP bookings on flights. If you book even 10 flights with Amex to get IAP discounts, you need to add $390 to your annual fee.

–Every card in Amex offerings come with TSA..could never take advantage of it but I can’t imagine this being special to anyone who has Plat.

–There are additional status on Indian card — Taj Gold, Shangri-La Jade, Radisson Gold. This should alone be worth the extra 10K in fee.

–There is practically no dining advantage of US plat anymore. There is enough free wine in India for Indian variant.

— Indian version gets 3X on forex. 5X on airlines would be super though.

— Car rental advantage of US version has been the highlight feature for me, except that CSR simply has better offering for over 2 years now. And Amex didn’t change anything.

–Out of express cash and emergency cash, all Plat emergency services are withdrawn from US card. A sure sign that in US, Amex sees it as a mass market card.

Honestly, I’d rather keep CSR (present version) + Amex Gold (new one) + Hilton Aspire as my personal fav US trifecta. The reality is that to compete with CSR, Amex Plat is now just another card in US when it comes to offerings and service. And the benefits they provide are not for lifestyle, but to entice people who should not have the card in the first place. And the customer service reflects that attitude.

For what Plat is meant for, Indian version is more value offering than US. At least for me.

Re the $39 fee for booking via the Platinum Travel desk, I think they’ve just introduced an online portal for these IAP bookings, which does not involve the fee, and importantly, the hassle of calling the travel desk and feeding them itineraries one by one as they check them out.

And don’t forget the list of airlines you have access to via the US IAP is far better than here in India. The Indian list is heavy on Skyteam and Star Alliance carriers, which, apart from SQ, are not worth shouting about in business class. The US version has top-line One World airlines like JAL, QR, CX and QF, plus the usual *A suspects.

As far as Centurion lounges go, in India, you have just the two, if I’m not wrong, and one in HKG. Unlike in the US, where there are plenty.

The 5x on travel spends is also a massive benefit.

Add it all up and it’s hard to see how the Indian Amex plat is better value at over twice the annual fee, unless you’re maxing out the supplementary card benefits and golf benefits all the time. I guess I’m not considering them a whole lot because they’re not benefits I personally would make much use of.

> Re the $39 fee for booking via the Platinum Travel desk, I think they’ve just introduced an online portal for these IAP bookings, which does not involve the fee, and importantly, the hassle of calling the travel desk and feeding them itineraries one by one as they check them out.

While limiting IAP discounts to only 2 redemptions per year for US Plats. Indian Plat, like US Cent is unlimited redemptions without any fee. But hey, they got Saks socks for free 🙂

>> While limiting IAP discounts to only 2 redemptions per year for US Plats. <<

I don't think this is the case. I've looked at the IAP pages and the Amex Plat t&c for IAP and it does not seem to say this anywhere.

The IAP has 3 faces:

1. BOGO on First/Business class.

2. Auto upgrade to first/business on buying business or premium economy. Usually second to highest fare.

3. Discount ranging from 10-25% on base fare, on flights originating (including round trips) from one’s issuing country.

On US personal plat, option 1 is not available to begin with. Option 2 is available only to be used twice a year with $39 booking fee per ticket (not per use), and in practice always unavailable to plats die high number of cents. Option 3 is available to be used any number of times and also has an option to book online to save $39 fee.

On US Cent, all options re available, with no booking fee, any number of times.

On Indian Plat, all options are available, with no booking fee, any number of times.

You are only looking at option 3 documentation, which only became a part of IAP in mid-2017, and most Plats and Cent who actually had the card before 2017 even associate IAP with it.

One thing I’d want to come to India is bonus points on booking through Amex. Can’t believe they don’t have that yet.

my amex account has been suspended for financial review..been 3 days..review still to be finalized..any idea how much time they take and what is the general outcome?

@Amex Guy, Hi

Can you kindly guide towards BOGO offer, couldn’t see it anywhere on the IAP page or the membership page of platinum. Travel desk doesn’t know about it too.

Aside, can you also please help with the difference of fraud protection of Amex platinum form other premium cards like DCB and Infinia. apart from amount they cover is there any other difference

Thanks in advance

Hello AmexGuy!

I would like your inputs if Amex Plat India has any trip interruption benefits. travel insurance, baggage delay, lost baggage, delayed flights etc etc.

Trying to determine if I should be putting flight charges on Amex Plat India vs. Chase Sapphire Reserve.

Sid & Amex Guy,

After reading your reviews, opted and went in for AMEX PLAT. But within few days, I realized that it’s a much over-hyped card. The true sense of value is somewhat missing. Like I tried booking through FHR, but the prices on FHR were far more expensive than regular travel sites like Yatra. Please shed some light on this .

How do you book some less expensive hotels??? FHR shows only the luxury premium hotels.

Along-with the card came two forms. One for primary card holder and one for spouse. When the primary one asks us the spouse details then why a separate form?.

The priority pass is valid only for Primary holder & 1 additional supplementary card holder.

Further, the sales rep is not at all interested in clarifying or giving information. He considers as deal done and please call customer support.

P.S. The card does feel premium in it’s metal avatar but still 60k + for metal ?????? Think one has to really crack the puzzle to reap the benefits. For me, I am going to return. A tough nut for me to crack !!!!

I also got the upgrade offer and in dilemma whether to go for it or not ?,what is FHR?

Even if you return the card now,will you get back the joining fee?

Received invite to apply for amex platinum charge card, with 1.25 l reward points, any suggestions , I’m not sure if I can apply.

Personally I see lot of people being invited for platinum charge card. I dread to say this but Amex Guy is right that American Express is selling it blindly. Unless you can find good return on investment of 70000 service fees, DO NOT go for the card. There is no point going for something with enthusiasm only to regret it.

Personally, I have gone for it and working on capitilising on the service fees.

@amex guy , BOGO on any airline any sector any biz/F fare ?

ITC club culinary is going way from June 22

amex guy, :

is BOGO available even if you book for others like your parents

I got invited with 125K point and 4×2000/- amazon vouchers for supplementary cards.

My review after using the card.

Only for the people

1. Business people, who spend at least 60lakhs per year

2. Travelers, who travels abroad or across India and stayed in hotels at least 4 trips per year

3. Luxury people, who can enjoy the amex platinum status at airports, golf and hotels etc.

Monthly on avg I used to spend more than 50lakhs to my business with credit cards, In this spends I shared 10 lakhs per month to amex platinum which are large spends more than 3lakhs at single swipe.

The reward rate good, but acceptance of this card is very limited.

My personal suggestion anyone

If annual spends more than 50lakhs

Amex platinum card

If annual spends more than 20lakhs

SBI air India Signature card

If annual spends more than 10lakhs

SBI elite card

If annual spends above 5 lakhs

there are many cards , but choose wisely as per your nature of spends

Amex platinum Travel card (best rewards 20 thousand flight tickets+10k Taj hotel voucher)

SBI Prime card

ICICI Shappiro Card

HDFC Business First

Amex Gold charge

The above cards have best reward rate as per the usage, remaining cards like, Axis, Yes, HSBC, Citi, RBL, IndusInd all are best on special offers

SBI and HDFC has more online shopping offers compared to the remaining banks.

Recently I used the Home Assist service of Amex Plat. For those who are not aware, Amex, through the Platinum Concierge, offers Home Assist for repair works like AC, fridge, plumbing, electrical works etc. They also allow a credit of Rs 1,200 for repair services. My AC needed a repair, so I triggered the Home Assist. The Concierge team got back to me the next day with a list of vendors available for the repair work. Then I randomly picked one vendor and asked them to liaise with them to get the repair work done – with a note saying that per my understanding service worth up to Rs 1,200 was to be paid for by Amex.

This is when the stuff hit the fan. What followed was a frantic series of calls from the Concierge Manager trying to understand where I got the notion that up to Rs 1,200 of the cost was to be borne by Amex. I told them that it is part of the card holder agreement and that information is publicly available. However she asked me to have the documentation sent to her – which I did. There was radio silence for a day – then after almost 36 hours they called me to say that they had spoken top their marketing team and that they would reimburse me for up to the said amount that I was eligible for.

They they took two days to schedule an appointment with the vendors. They called one vendor, and that vendor asked why the client cannot call them directly (“is he such a big shot?”). So they struck that vendor out. Finally they got hold of one and asked me to pay the service charge to him, which Amex would then transfer to my account. The date was set (and I was ready with the flower and the wine), but the vendor failed to show up, and was not reachable over phone.

I escalated the matter , and Amex came back to me requesting me to get the repair done from anyone and they would reimburse anyway. So I got UrbanClap to do the repair. My repair cost was over Rs 6K (I had to get the condenser replaced and refill the gas). I sent Amex the invoice copy, and after seven days the Rs 1,200 popped up in my account.

I am a tad dismayed that Concierge team is not conversant with all the services that Amex has promised in the card holder agreement.

A big thanks to you for sharing this information.

I wish they had higher limit, say Rs.3K & trained employees.

That is news to me…

Is it only for the Platinum Charge or is it applicable for the Platinum Reserve as well?

Thanks SH,

I think you & Amex Guy can hold a refresher training course for the Amex plat team to understand the card benefits in great detail 🙂

Cheers

Neo

Hahahha..

I fully agree and upvote it..

So much hassle for the 1200 credit with the so-called super-premium card. Thanks for sharing your experience, SH. You are probably the first person in the whole country to have used this benefit.

😀 😀 😀 😀 ! Good one! Was considering the plat, now i’m reconsidering…

Hi Guys,

Great review and comment. Really helpful. I recently got an upgrade offer to the AMEX Plat. I negotiated the fees and got it at INR35K+Tax. But instead of reward points i’m going for INR30K of Taj Vouchers. I travel extensively but most of my travel is corporate business class so lounge access comes along with that.

I am planning to evaluate it for 1 year from the perspective of intangible services that they offer.

I have one question: What all privileges are extended to the Supplementary card holders i.e Do they get the same lounge access, do they get Hotel privileges? Can they use the concierge services?

It would be great if you can shed some light on the above or point me to any documentation where i can find more information.

As an aside: when traveling abroad, me and my wife will get access to lounge courtesy AMEX Plat. Do i need to pay for my 4 yr old kid or is there a way to get that access complementary as well

Many Thanks

35k + tax on upgrade from a non jet airways variant card ? Or from a jet variant card ? And even at this price , you were offered 125k bonus points or a 30k taj voucher and all benefits of the card ? , 35k for first year or 35k as long as you hold the card ?

I had cancelled my jet airways card long back, but for extending this offered they reactivated it and upgraded it to Platinum. Post that they cancelled the Jet card again.

35k+taxes is locked as long as I hold the card.

After negotiating they only offered 30k Taj voucher

I too took the 35k offer and plan to evaluate it for a year. I hold the Citi Prestige card as well, so a few of the benefits like priority pass, more points on international spends and Taj membership are similar for both cards. I look forward to the Platinum Travel Services and FHR. The metal card is really nice no doubt.

@GGM, from what I know, supplementary card holders do get all the hotel membership and lounge access to the Amex lounges (including Centurion lounge). Priority Pass is limited to one supplementary card holder.

I also think that if you or you wife visit an Amex Centurion lounge, you can each bring along two guests.

Did you negotiate or were your offered this fee?

I was offered this fee.

I negotiated it, having said that I’m a heavy user of Amex travel Platinum for almost last 10 years

So I understand that it is only possible with Centurion Lounge. For other priority pass enabled lounge it would be accessible for just 2 of us.

Thanks

GGM,

I think you got a great offer in terms of fees.

As per your question, all the supp cards get concierge access and hotel statuses. But only one supp card gets the Priority Pass access. So this means that all supp cards can get lounge access within India for free. But only the primary and one supp card holder (who has the PP) will get overseas lounge access for free.

Thanks!

Hey,

I also received the Plat charge card upgrade offer however, couldn’t negotiate discounted fees.

I already own SBI AI Signature, Vistara Infinite & DC Black – All reward points are largely accumulated on these cards.

I don’t see a real world benefit for Platinum Concierge for a regular Joe like me and FHR is practically useless since I’m a Bonvoy Amb Elite & IHG spire.

I only value the Golf Lessons which I’ve been waiting for since DC Black removed this feature but in Mumbai the only Golf Course they have registered for lessons is the one in Thane which isn’t so great and so so far!

Considering my travel patterns, I barely use the Amex India lounges and I don’t see myself using the Centurion lounges more than a couple times during a year.

Also, I don’t see spending 60L or more in a year to be even considered for the renewal waive off !

However, I can’t deny the sheer joy of holding this metal card, it’s more than a subtle flex!

What do you guys suggest I do, should I go ahead nonetheless and try it out for a year or continue my spending on the DC Black?

Not related to your question, but what’s your strategy for the DCB apart from the 10x and 5x partners? Do you put most of your spends on it?

Personally, I find earning and transferring to CV points via the DCB a better proposition than earning CV points through the Vistara Infinite directly. Although the Gold and milestone benefits do help with the Vistara Infinite card.

Nikhil, I use the CV Infinite only for Gold Status benefits. Since 9W grounding, I’ve been left low and meagre ;/

I understand your pain! I’ve been looking to use up my JP miles at the base redemption value of 8500 on Indigo or Air India whenever I can

Hi,

I have used twice the target amount and when I had requested for fee waiver they plainly refused it stating they haven’t given the waiver to anyone till date and she also challenged that it’s a recoded line and I wouldn’t tell something bluntly.

So as far my expierence they would not waive the fees for the 2nd year onwards you have to pay ₹70,800.

Cheers,

Kiran

If you get the 35k offer (for still holding an Amex Jet Airways card) that fee is locked in, meaning your renewal fee will be 35k every year.

For the welcome bonus, you only get 30k of Taj voucher, no points. You do get all the other benefits.

Hi,

Just wondering, what happens if you get the card & decide to cancel it say, 2-3 months down the line ?

is the full fee refunded ?

Also, what happens to elite hotel status? Do we lose that as well.

~Neo

Is it possible to use the Plat Charge to make a discounted booking at Taj hotels and then use a voucher from the Plat Travel offer to make partial payment?

Also, the Plat Taj offer is for the room-only-rate, right? What is the best deal on breakfast/meals?

That 10k voucher can be setoff against room charges and charges to room(room service,spa,etc) except taxes… they dont really care which amex card you book the room through , I suggest using your Plat charge , take a deal on the taj booking , then at reception counter , present the plat travel gift card at the reception , enjoy best of both worlds

Thank you!!

The upgrade process was quite quick.

Accepted the 125K offer on Aug 1. Got no email/sms confirmation so checked with them on Aug 2. They said my offer had expired 30/6, and I had to forward them the email that had the offer valid till 30/9. They approved it on Aug 2. Received the card on Aug 7. Didn’t see a CIBIL hit.

It seems enrollment to the hotel programs is going to take forever in comparison 🙂 The official turnaround, I’m told is upto 6-8 weeks, although apart from Radisson, others are expected to come sooner.

Typo: *Did* see a CIBIL hit. On Aug 5

Hilton Gold and Shangri-la Jade upgrade was indeed fast, and was reflected in 5 days (Aug 9 — Aug 14) on the respective membership pages, not updated on the Amex status page yet. Radisson not processed yet.

Radisson took 2.5 weeks (Aug 9 — Aug 27).

Hi Siddharth,

I recently got a request to upgrade my gold charge card to platinum charge card since my spends in a year exceeds 25 lacs across my three amex cards. I am really skeptical of taking the upgrade offer for 125k bonus points with 60k+ GST as joining fee.

dont upgrade if you are skeptical… i have received upgrade to Plat Charge on my Amex Plat Travel card with hardly 5-6 lakhs spend annually….they keep renewing the offer every month….only take when you feel you can take advantage of the vast perks the Plat Charge offers

I think they are randomly sending upgrade offers, not based on spends. I already hold a plat, and got an upgrade offer to plat based on my plat reserve (which is an LTF companion to plat) on which I have spend Rs. 15 till now.

I hope the offer stays till renewal time. Then I’ll actually take it, and get 125K bonus points for essentially paying the same renewal fee. 😀

I see that many of the Amex (and in particular, plat charge) offers expire around september. Is this a usual trend? Do these typically renew in the next year, or do they change year to year?

(looking at taj, air india, some of the wellness benefits, etc.)

Hi,

I just received my primary and supplementary platinum cards.

I want to find out that can I (primary card godler) and the supplementary card holders all get the Morriot Bonvoy Gold Membership?

I.e.:

-Primary Card holder

-Supplementary card holder 1

-Supplementary card holder 2

It says above the supplementary card holders will receive the hotel benifits too, So i suppose this should be the case?

Thanks for your help.

Aman

I got instant discount of Rs. 10,000/- from Tanishq yesterday upon purchase of gold jewellery. Tanishq informed that they were running this scheme from 06th September itself but the value of jewellery should be minimum Rs. 1,10,000/-. Two pieces of jewellery were purchased and separate billing was done and paid vide Amex Platinum Charge card and Amex Platinum Reserve Card and got discount of Rs. 10,000/- on each card i.e. totaling Rs. 20,000/- . Happily sharing with you. Thanks. 🙂

Hey guys,

I have an upgrade offer to Amex Platinum with 125K points.

So I called up the customer care to ask about the benefits that are extended to the supplementary card.

Apparently, it’s only the lounge access and priority pass(1 additional) that the supplementary cards get.

I was hoping that the Dining benefits, Taste from Platinum would be available on the supplementary cards as well.

Can someone who’s already using a supplementary card comment?

i am currently working in Brunei where AMEX does not operate . is it possible for me to apply for this card as an NRI ? anyone who is an NRI and holding this card ?? i am currently holding a HDFC infinia.

What happens at the renewal ?

No renewal mr points?

Your hotel statuses go away if you haven’t met the criteria?

No renewal MR points , statuses stay as long as you hold the card

I recently got the Amex Plat card after using the Reserve for a year. I got the 125k targeted offer and the 50% Marriott transfer seemed really good, plus I have upcoming travel to the USA and Asia. Thanks to this blog and comments for enlightening me on the card benefits.

Aside from the excellent marriott conversion offer, my experience has been nothing short of harrowing:

1. I emailed concierge on how to get to the Centurion lounge in SFO considering that my flight might be in a different terminal. Concierge told me that plat card holder doesnt have access to centurion lounge. What!? I was directed to travel desk, who transferred me to card customer care, who also told me plat doesnt have centurion access. Additionally, they couldn’t be bothered to research whether I can traverse between different SFO terminals to get to the lounge. Can anyone add to this?

2. I called the travel counsellors to book flights and cruise in Asia and requested Visa details, he sounded very annoyed/disinterested about my request and said he is on leave for next two days, and would respond after 3 days. I requested him to expedite if possible, since tickets fluctuate. I never heard back from him. I ended up having to book on my own 🙁

Travel planning is stressful and a lot of work. This is one area I hoped the famed “Senior Travel Counsellors” would be able to help. It was a major let down.

3. I asked travel desk to research for me hotel quotations for Marriot, hilton etc and the points required, so that I can plan my stay accordingly. Travel desk simply gave me link to Fine hotels and Resorts without doing any of the research. I had to email concierge, who only responded after 4 days, despite multiple follow ups, and did not deliver on my request. Is there no SLA to respond to member emails?

4. Many more unfortunate experiences: concierge, travel team and customer care keep passing the buck amongst themselves. What a waste of my time.

Can other readers share their stories here regarding the Amex customer service, travel and concierge respectively? At this point, I don’t see it as a lifestyle card, it seems to be more of a high end rewards card, with excellent Marriot rewards points with Marriott Gold and ofcourse other great tangible perks.

I don’t understand why American express is heavily compromising on service standard. Perhaps I expected too much from the “Do Anything” concierge and famed travel counselors and need to temper my expectations.

Anonymous,

That is true, Amex Platinum’s travel desk is just premium for namesake. Last night I gave them a call for price check between DEL and Munich just to test the waters. There is an ongoing offer on Etihad from some time now where you get upto 10% off on the fare for Amex card holders (not just Platinum). However the travel desk did not have any clue about that and they were just repeating general fares which you can beat with any OTA.

One time I requested if they can help me to book a cab between 2 cities in Europe and right of the bat they told me to check at the taxi stand of the airport for fares and booking!…….. … …. Enlightening isn’t it?

These are just few instances where Amex team has shown complete lack of knowledge for any offers which can reduce the fare or provide any other benefit. Somehow most of the the time I end up calling them around midnight, I am not sure if that could be one of the reason for such kind of service.

There is a big disconnect between the Amex offers/promotions and the knowledge of the same with Amex line, you have to go extra mile if you want any benefit with this service. Unfortunately Citi Prestige is on the same page with Amex but at least it has a better ROI for the fee you pay. Best option is google, the first few results will give you a complete pictures if there is any offer worth going for.

PT, thanks for the insights.

Calling at midnight shouldn’t be a problem. I recommend you try emailing them too, and escalate if responses are unsatisfactory, there is a paper trail as evidence.

Regarding Citi Prestige, my experience has actually been great.

I’ve been using their concierge very regularly and frequently for close to a year now. With citi you have to be very specific with your request and they will get it done. What I like is that they respond very promptly to emails, they do not drop the ball on any request.

They don’t seem to have airline or hotel offers(except 4th night free) so they aren’t great for booking flights or hotels. But they are excellent with unconventional requests, things I would expect a concierge to do. Researching hard to get items for me, research hotels or cruise based on specific requirements, things requiring multiple phone calls to research. Granted these services aren’t “discounts” or “offers” most people look for, but for me its my favourite perk of the card, saves me a lot of time and it’s great to know that there’s concierge that you can actually rely on to do most things, much unlike the Amex plat card.

Citi and Amex,

Mailing them I feel is actually too much of a hassle for simple things like flight booking where prices can change any minute.