It was a revolutionary moment in India when RBI decided to allow use of Credit Cards on UPI (on 09 June 2022), starting with Rupay Credit Cards. Purpose is to widen the scope of UPI significantly. While HDFC is live with Rupay Credit Cards, not all credit card issuers are live on Rupay.

As such, going ahead, this facility of UPI on credit cards may be extended for Visa/ Mastercards, but we don’t know when that would happen.

This stresses the need for having a good Rupay Credit Card. What better than being one issued on HDFC Bank platform? Also with this launch, HDFC scrapped the policy of issuing only a single card to an individual (maybe limited to Tata Neu cards). Earlier individuals could take 2nd HDFC card on approval basis high NRV and via branch only.

Fee Structure

HDFC Bank launched two co-branded credit cards with TATA Neu on 24th August 2022. Entry level TATA Neu Plus & a more premium TATA Neu Infinity credit card. Both are available in Visa & Rupay platforms as per customers choice.

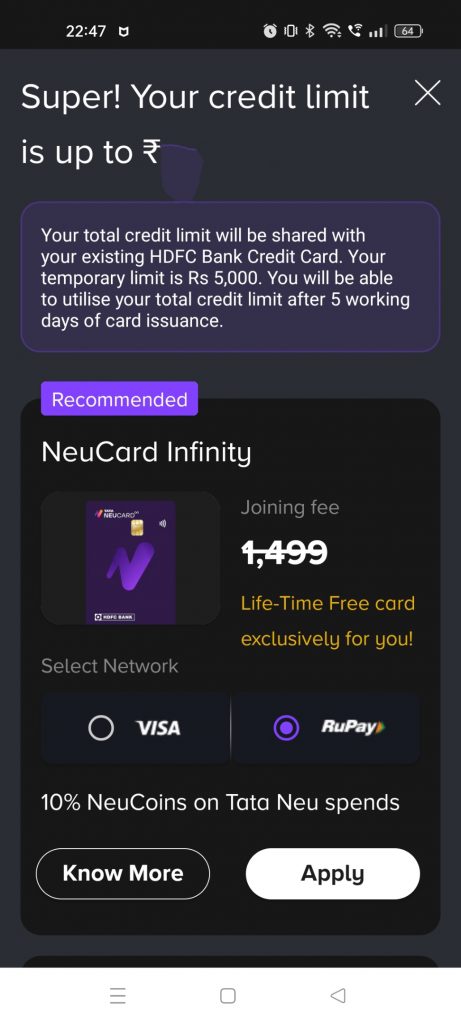

Currently on Invite model, will be available to everyone sometime later. Many are getting the Invite albeit at different Fee points as shown in the table below.

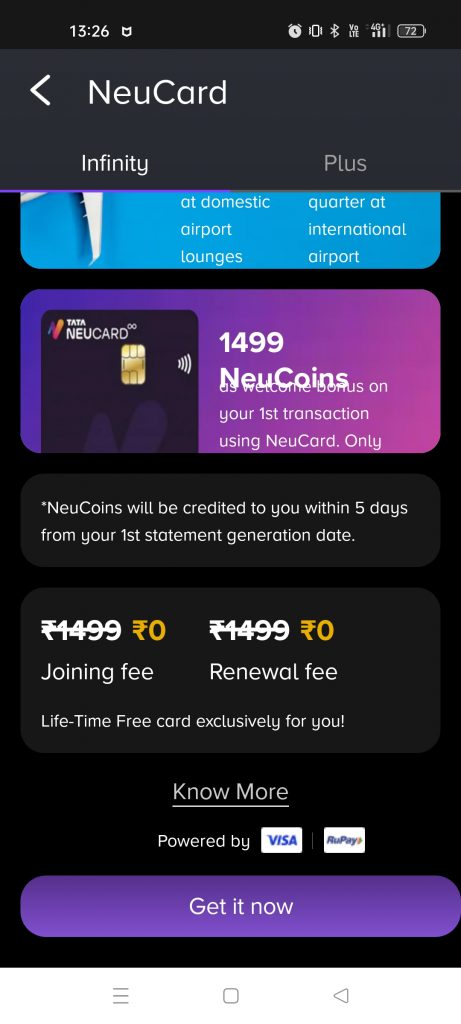

| Joining Fee | Joining Benefit | Renewal Fee | Renewal Benefit |

| 1499+ GST as Joining Fee | 1499 Neucoins | 1499+ GST, Waived upon spending 3L in previous year | NIL |

| FYF | NIL | 1499+ GST, Waived upon spending 3L in previous year | NIL |

| LTF | NIL | NIL | NIL |

Currently TATA Neu Infinity Credit Card is offered at above 3 tiered Joining/ Renewal Fees to customers.

1 Neucoin = INR 1 each, can be redeemed via TATA Neu app for shopping on its platform.

My Experience

Received the Paid offer in September 2022, didn’t accept.

Was using the TATA Neu app (mainly for Bigbasket & twice for Croma) regularly. Received the FYF offer sometime in November 2022, again didn’t accept it.

Received the LTF offer first on 15th Jan 2023. Upon proceeding was shown Neu Plus Credit Card with a very low limit of 1.09L, hence didn’t go ahead. Understandable as this number isn’t linked with HDFC bank & less transactions via it on TATA Neu as well.

Received the LTF offer again, but this time on my HDFC bank registered mobile number. Immediately applied and shown both Visa & Rupay options. Opted for Rupay Select variant with the intention of being able to use it on UPI one fine day & also because it will be my first credit card on Rupay platform.

NOTE: If you are an existing HDFC credit card holder, limit will be on shared basis. Card is issued with temporary limit of 5000 and gets shared within 5 days.

Also to get TATA Neu Infinity, your existing HDFC bank credit card limit should be in excess of 1.5L. Below this, in all likelihood you will be offered TATA Neu Plus only.

PRO TIP: If you want this card as LTF, spend regularly on TATA Neu app via HDFC Bank Credit Card (if existing HDFC Credit Card holder) & wait for the offer to kick in.

In all probability, both these cards are likely to be offered LTF to almost everyone sometime or another (Thanks to the launch of SBI Cashback Credit Card).

If you have high NRV with HDFC bank and received the card FYF, push them to get it converted to LTF.

Application Process & Image

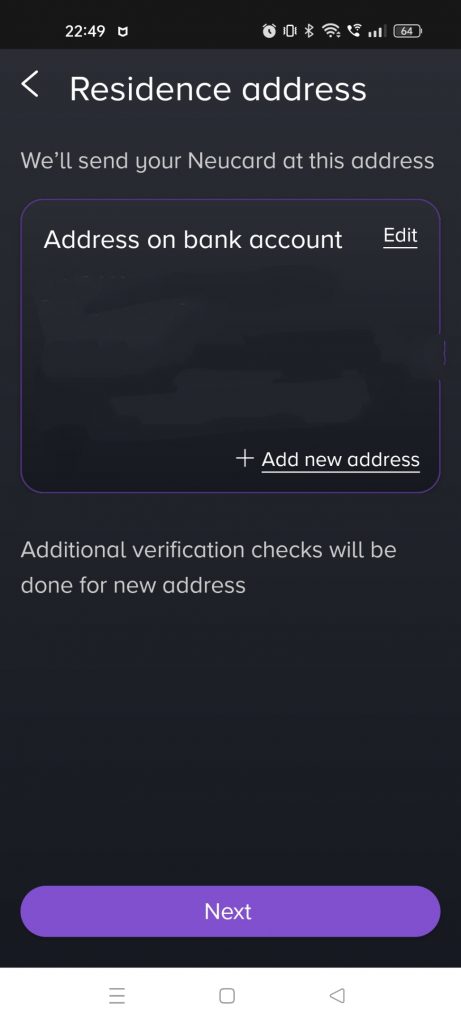

- 03.02.2023- Opened TATA Neu app to see LTF Invite

- 03.02.2023- Applied & opted for Rupay Select variant. Credit score enquiry made

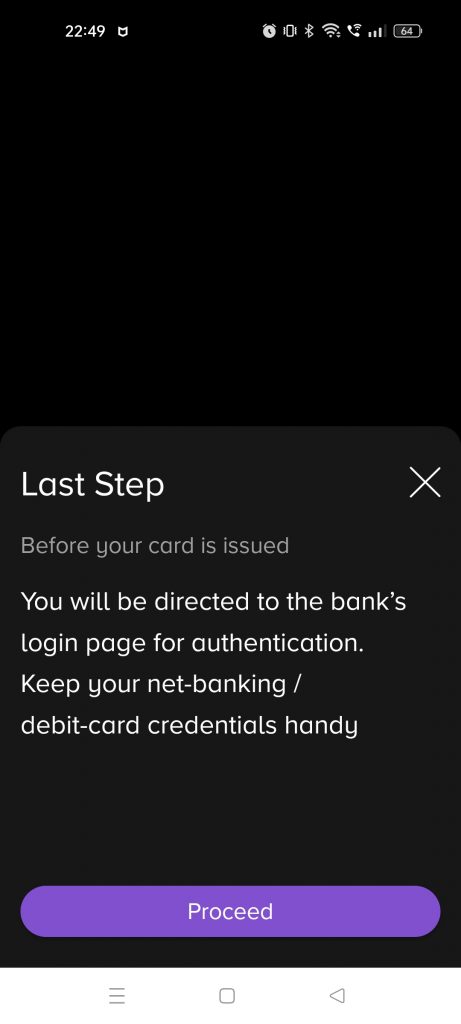

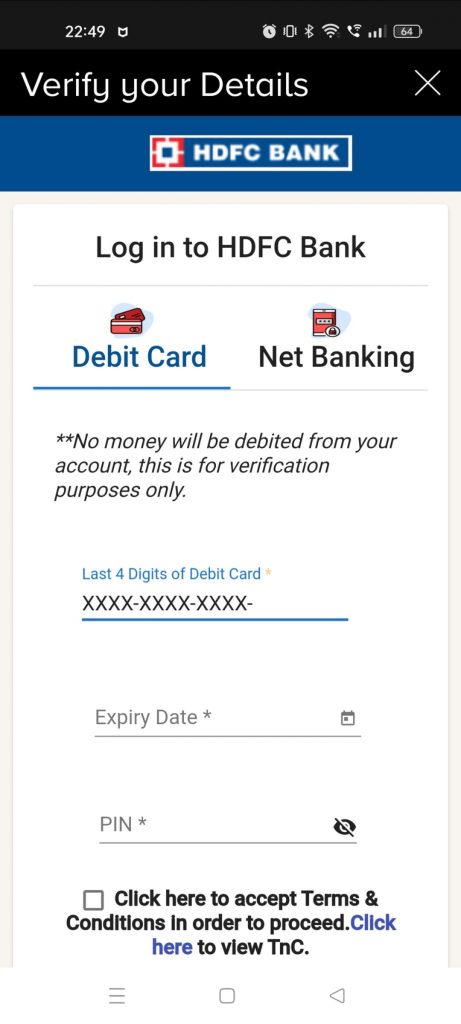

- 03.02.2023- Verification done via Debit Card. Netbanking also an option to verify

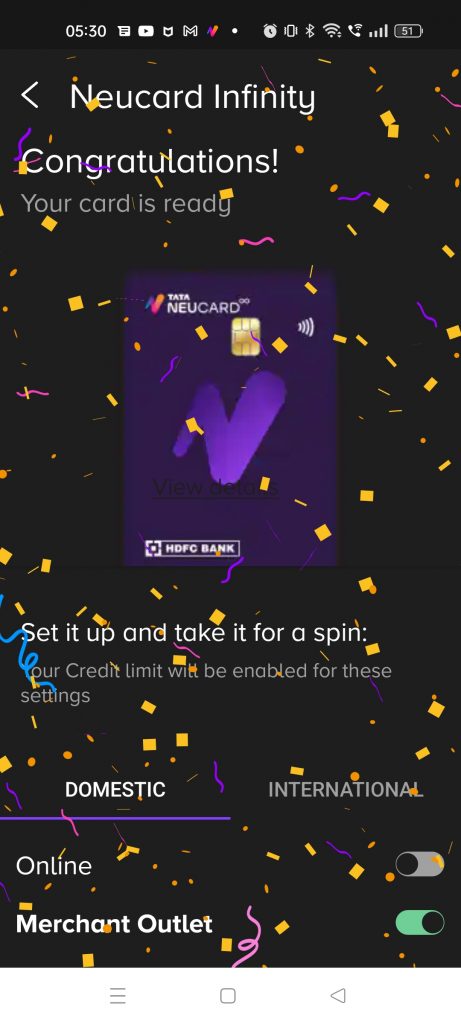

- 09.02.2023- Received SMS of Card approval. Opened Neu app & Card shown

- 10.02.2023- Card dispatched via Bluedart

- 11.02.2023- Card delivered

- 14.02.2023- Card LIVE on UPI

Bottomline

Exciting times ahead for Credit Card holders in India. Integration from HDFC/ NPCI/ TATA Neu to get this card Live on BHIM UPI comes at most opportune occasion of Valentines day.

UPI linking now Live on TATA Neu & Freecharge app as well. Here’s my detailed coverage on UPI Experience with a Credit Card.

As per my talk with dedicated HDFC TATA Neu Credit Card customer support yesterday, Neucoins earning rate will be as applicable category wise, whether transaction is done via UPI or POS/ Online. Also capping per transaction/day will be regular as applicable for UPI like 1L etc. and not restricted to 2K/5K as feared by some.

Disclaimer: Being latest entrant, tnc’s are still not very clear and can’t be relied 100%. Will take some time for them to be stable.

TATA Neu customer support too fares just ok. Can’t be relied upon easily if something goes wrong.

This article will be Dynamic in near future, as per the feedback received by users & based upon my personal usage experience. For those curious about UPI transactions & its rewards, expect a separate article on that by this weekend.

Got it without doing any transaction on Tata Neu app. I just downloaded the app and did some browsing. It was showing FYF earlier and the moment it showed LTF applied. Process was smooth. Holding a millenia card with 2 lakhs plus limit and the same is shared with the new one.

I got the LTF offer for TATA Neu Plus, should I apply or wait for some time to get HDFC TATA Neu Infinity as LTF?

wait for some time to get the LTF offer

If existing HDFC cardholder with less than 1.5L limit, Infinity approval chances are very less unless limit increases above it.

So does it mean UPI payments like the scan and pay UPI QR codes at small shops will fetch regular rewards on this card?

It should, until more guidelines come post mass onboarding of people. Will be more clear with time.

Already used HDFC bank RuPay Regalia credit card on UPI (Regalia RuPay was live on UPI 2 months ago).

Got Rewards points on all UPI spend and Regalia milestone benefit also count on UPI spend.

you can also visit NPCI website and then RuPay card merchant category code page. Choose few months old date, you will see “UPI merchant category code” list.

latest month “UPI merchant category code” is not updated yet.

Important Info – RuPay credit card link UPI limit is 1 lakh per day, First time UPI register on UPI apps – limit is Rs5000 for next 24hrs on Android and 72hrs for IOS users (sometimes banks also take few more hours or day to reset your UPI limit to full 1 lakh per day).

No, their is a catch here, only merchants that except credit card with POS will be available for upi linked card payment. For routine payments of small ticket size it says that UPI payment through card will not work for current account holders . Meanwhile any card which allows UPI payment directly ?

Where did you read this? I am unable to find any such info.

Thanks Satish for your inputs.

I’ve received the email for LTF Tata Neu Card, however while checking in App it shows as FYF. Then I approach their CS team via WhatsApp then got the answer as my card as LTF then I applied via App and received digital card as FYF only. Again I chat with CS team then get the reply via call as my card is LTF. Now waiting for Physical card to be on hand.

Thanks to all our community 🙂

Thanks Jaishankar for your kind words.

Hi Sidarth, please let us know more about rewards on upi spends. Thank you.

I have been using the infinity variant of the card for the last 2 months. I have been loving it! I have got 5% on 1mg, Croma and Big Basket for all my transactions. I tried it on Bill payments and got 5% on that as well. I don’t think even Infinia gives this benefit. I called up their customer care and the 5% rewards are also available on Tanishq. Redeeming the points is super simple and can just be selected while doing a payment. I already got my January Grocery Free via the Tata Neu app! 🙂

If I can double dip SBI CashBack card on this, it would be great.

You can, if SBI doesn’t mess with MCC.

Share the feedback if successful.

How can that be done?

Could you please elaborate on how that can be done?

does the statement has breakup. for me currently its showing very less points on unbilled transactions. first statement is yet to be generated.

I too got the infinity variant Rupay card as 2nd HDFC credit card. Honestly, the reward program is fabulous for Tata ecosystem transactors like I am regular on bigbasket and 1mg. I infact got heavy neucoins on offline Tanishq transaction. 5% cashback on jewellery is a very big deal. More than 90% wallet share of mine belongs tk this card.

Bro. Did you received 5% cashback neu coins for Tanishq. Looks amazing. Initially they told , not applicable for Jewellery purchase.

Mandatory to hold hdfc bank account?

No. Not mandatory. In fact you can get this card in addition to your existing hdfc bank card

I have saved 12K already (NeuCoins) in about 6 months on the Infinity card. BigBasket, Cliq, Air Asia were brands which I anyway used regularly. For me, a portion of apparel, entire bill payments, and some part of relatives’ spends have come to Neu now. I’m looking forward to more exclusive offers on commerce brands apart from Tata brands so that 5% savings contributes even more. I love the sale periods on Neu when there is a 10% offering. Go for it, Neu!

Have been getting offer since 4 months and during third week of Jan 2023 got an SMS that I am eligible for LTF card and offer is valid till Feb 8th. Also , received a email (registered mail Id of Big basket) with same details. On Feb 5th applied through neu app and had opted for Rupay variant of Infinity card. Immediately received a prompt for Video kyc and completed that. On Feb 9th card reflected in app, but yet to receive card.

Have been using Big basket since 3 years, paying bills on Neu app since 6 months and have Regalia card with a high limit.

I have been using this card now for a month now. Onboarding process was pretty smooth. Neucoins rewards are super helpful and redemption process is very easy. Card can be used on Tata brands ecosystem as well as normal purchase. Dashboard is superhelpful. Limit given was higher than my other current credit card . Definitely a long term permanent primary card upgrade option for users. Kudos

The extremely bad UX of this card is the fact that on the OTP page, no merchant name or amount is visible, similarly when the OTP is delivered, I couldn’t figure out the amount, I feel like this is an extremely basic feature they should deliver

I think that issue is due to RuPay

I was applied card today and wrongly applied visa card and process is completed.if I will change card to rupay after delivery..anyone know please answer @sid

The table is unclear. Could you please simplify it ?

Which part you found unclear. Please elaborate.

The table refers to which card?

This is the Review of HDFC TATA Neu Infinity CC bro.

Obviously the table is for the same.

Will UPI transactions on Tata Neu Infinity Rupay Credit card earn us Neu Coins(ie do we get rewards) ?

Though I am using TAT NEU app since beginning but unfortunately, not able to get any of HDFC-Tata credit card as LTF. Only option coming is FYF only with renewal fee from 2nd years. I tried speaking with my RM as holding HDFC preferred relationship but didn’t get help. HDFC-Tata neu customer care also didn’t help.

Can anyone advise how to get it LTF?

Thanks for the informative post.

My question, do we need to buy using existing HDFC card to receive LTF card offer.

Seems to me that LTF option will likely be triggered by TATA Neu more than HDFC Bank (can’t be sure though).

Spending on TATA Neu app via HDFC card should expedite this.

Today, got the call from HDFC regarding Millenia LTF. On checking found Milennia and Neu Infinity as LTF but the Agent mentioned that Neu is only FYF and then renewable is chargeable. I didn’t trusted the agent did my own analysis and it turns out Millenia was more useful to me as there was 5% cashback on 10 different vendors out of which I buy frequently from 8 vendors compared to Neu where I have use for 2 vendors so ultimately applied for Millennia. This simplified my card usage as well.

Now I will stop using Amazon and Flipkart (already closed ) CC and use this as Millenia actually covers benefit of both the cards and more.

Millenia has a monthly cap of up to 1000 cashback, meaning any combined spends over 20000 across the 10 merchants will give you nothing. Always a good idea to keep the Flipkart and AmazonPay cards if you have it. The Amazon card is LTF, and the Flipkart would give you 1.5 percent for other spends as well. I have all 3 cards, and find them all handy and worth keeping.

There is a hard limit of Rs 1000

I am getting only FYF offer. Holding Infinia with 10L+ limit. How do I get ltf offer?

I have Infinia with 10L + limit and I am getting FYF offer since 1.5 month. How do I make it ltf?

what is the points earning structure. how many neu points on what spend?

I am getting Infinity LTF offer for sometime but reluctant to apply. I use BigBasket frequently and get 13-14% value back by purchasing BB gift cards using SBI Cashback card (shopping through neu app).

How are you getting 13-14% value? Where do you purchase the BB gift cards ?

Can you explain a little bit more how do you get 13% percent? where do you purchase bb gift cards ?

Step 1: Login to SBI yono app, go to ‘Shop & Order’. Find gyftr and buy BigBasket E-Gift (Instant Voucher). You’ll get 4-5% upfront discount and if you pay using SBI Cashback card, followed by another 5% cashback on paid amount.

Step 2: Login to Big Basket app, click My Account> My Profile> My Gift Cards. Redeem your gift cards here by entering card no and PIN received from gyftr. It will reflect in bb wallet balance. Close Big Basket app.

Step 3: Login to Tata Neu app, shop in Big Basket (under Grocery), choose Tata Pay as payment option. BB wallet balance would be utilized by default and you will get 5% neu coins on your shopping amount (assuming if you have an active NeuPass). I am using neu app from very beginning and got this NeuPass. This 5% neucoins are credited few days after delivery and can be used in the next purchase.

By this way we can extract much more value back than Infinity Card.

To use sbi yono, do we need sbi bank account? I don’t have one and I am unable to use it.

A bank account seems essential to register. I used the credentials for my SBI bank account closed 4 years ago to complete the registration even though it no longer has a bank account associated with it. Thereafter, I was able to link my SBI Cashback card using my SBI Card credentials.

After reading this article I checked the app and I have ltf offer. Don’t know whether to apply or not as have all top cards.

Hi, i am a Tata Employee and got invite for this card on my Neu registered number in Dec as first year free. Didn’t join.

Then got LTF offer on official email id but after processing, card was given as FYF only.

Being Tata Employee, i get Neu pass which gives me 5% neu points on every transaction and the infinity card give me additional 5%. So in all i get 10% neu points on every transaction done using this infinity card.

I am holding Visa variant form past 2 months and after reading this article, i will follow up with the Neucard support team to get it LTF.

In the Tata Neu app, if I use SBI CC, will I get 5% cashback of SBI and 5% neu coins as I have tata neu pass?

I applied tata card on 2nd Feb and my kyc completed by physical on 7th Feb ,still it is showing card is under bank review. May I know is any one facing same issue.

I already have two HDFC Cards : Millenia and Moneyback. Can I apply Third one ( Shown Eligible for LTF Tata Neu Infinity Card) ? or should I close Moneyback Card. It is my oldest credit card .

got preapproved FYF offer ,got rejected , already have regalia any idea how to get it ?

1. Incase of Visa Variant do we get Priority pass?

2. Incase of Rupay Variant i think no separate card required for International Lounge access. Hope we’ll get also all other offers under offered under Rupay Select as well like Health Checkups, Spa vouchers etc

When I try to apply for card right now, it throws error that something wrong as happened, please try again later. I have LTF free offer but not able to apply card

Please check your details under profile and address

Both should be the same

Hope this helps

Hi, I was also getting this error. Now it’s working. They may have fixed it.

I now hold 3 credit cards of hdfc – intermiles, neu and Regalia. i applied throug the NEU app and my limit was raised to 10 L from 6 L right after this card got issued.

Your limit is common across three cards?

yes they divide that to 10/3 i.e., 3,33,333 per card

How to add the card and where for UPI usage?

Same as bank account, just search for “credit card” ..it will show up all supported credit cards and select the one which you have and done. Tata Neu app I added this way.

Download BHIM Upi app from Google play store. First add a bank account which is a must.

Then add your Rupay credit card also. Credit card payment can be done by scanning any phone pe/ G pay/ paytm that are registered under merchant category and by selecting credit card from drop down that can be seen below scanned merchant name.

Have read an article that this can be done through PAYTM also.

Have been using since a week any its very convenient

Thanks was able to add in BHIM App and able to transact also on UPI QR code.

However, only Tata Neu app allows to add credit card, apart from BHIM and unfortunately facing an error when I attempt to scan and pay using CC from Tata Neu itself.

Only able to do it from BHIM App so far.

Paytm, Gpay, Amazon not allowing to add rupay card for UPI. Havent checked freecharge.

UPI was my only spend apart from credit card, hardly use cash. Now even that will be taken care of by this card. Awesome.

I got the invite for Tata Neu Infinite as LTF. I applied & even the verification was done. Today received a message stating application is rejected due to internal policy. I do not understand for what joy they approved and rejected later?

Wait for few days. Many people including myself experienced this and after few days they process it

Had to apply again?

I got multiple invites but finally decided to opt for it for LTF. Applied on Feb 20, 2023. Digital Card issued on Feb 21, 2023. Super Quick. No verification nothing. I have HDFC Bank account and Regalia First Credit Card. As mentioned above, 5000/- limit initially, later will be increased to existing card credit limit.

But still unable to figure out how to add UPI payment using CC on TataNeu app as mentioned in original post (**UPI linking now Live on TATA Neu & Freecharge app as well.). BHIM App is asking Card PIN which yet to generate.

Register credit card via hdfc netbanking/Cards section and then set the card pin via netbanking/cards or phonebanking.

Then go to UPI setting section in (TataNeu/Paytm/Mobikwik) and select add bank/add rupay credit card.

Done.

Netbanking – Cards – Instant PIN generation. If card not showing in netbanking, add new card.

I did it the moment my digital card appeared.

Can this card be used to do UPI payment on GPay too?

When I am doing UPI payment with my Rupay credit card I am getting this error “you cannot send money from CREDIT to CURRENT account “

You can only do merchant payments and not send money. But your Bhim Id while shopping and in the UPI request choose to pay with the credit card.

My observation. Tried using this card for merchant payment yesterday. However BHIM app could not even scan the QR code after multiple trial. Same code was scanned by Gpay in a second.

Has others also experienced the same?

Regards,

Balpreet

My problem resolved after updating the app.

I also got the LTF offers, got virtual card after 3 days of my application date.

Has anyone received Priority Pass with Infinity Rupay credit card? How does one access complimentary lounge access at international locations?

Finally i applied today for the infinity card LTF. Gave into the offer.

Received as paid variant initially as FYF and later on converted to LTF.

How did you manage to convert the card to LTF?

I request for LTF conversion via email but didn’t get any response even after two weeks. Contacted customer support, but they denied LTF conversion. Since I have other cards, I didn’t find value in paying 1.5K and requested to close the card. Card closing request was taken and card is closed from their end.

Later on, I got a reply for my old mail that they have taken an exception and issued a new LTF card to me.

did you get an email with the FYF and LTF? My account has been showing FYF for few days, I am waiting for the LTF offer though

Hi

How did you manage it to get converted to LTF? Mine is FYF only, would like to make it LTF somehow

Someone please tell me how much rewards on doing Bill Payments on TATA PAY, as even after having NeuPass and Tata Neu Infinity Card, I am getting only 1.5% coins as return on bill payments made on Tata Neu App using TATA Neu credit card.

Bill payments on Tata Neu App using this card will fetch 5% NeuCoins. 1.5% base reward will reflect in statement, and further 3.5% reward will be credited after 7 days of statement generation date. In statement there is a different section for bonus NeuCoin earning summery. I paid few bills and got 5% NeuCoins. Additional 5% NeuCoins from NuePass membership is not received or visible anywhere yet .

What is the total Neu points earned with Infinity + Neu Pass 5% or -10% considering if I buy something from Croma on Neu app

yes are people getting 10% for spends on Croma through Tata Nue. Need to make some large purchase.

Thanks Satish for the article.

I have a query, doesn’t it make more sense to use SBI Cashback on Tata Neu app, to get 5% from Tata Neu and then 5% from SBI?

Doesn’t it make it equivalent to the Infinity Neu Card (max 10% on Neu app)? Plus the SBI Cashback also gives 5% CB throughout other online purchases.

With limitation coming on SBI cashback, using Neu card makes more sense for Tata brands. Keep using SBI card elsewhere

If it is online spend within the earn limit, irrespective of the brand SBI earns 5%.

The USP of this card is lounge accesses and gold purchases.

+ 1.5% cashback on UPI which is highest for the UPI payments as of now

5% on gold coin purchases too?

Did you receive a free priority pass along with Tata new infinity credit card?

Has anyone applied for Add on Card. Made some payments on UPI and it was seamless.

What about insurance premium payments to Tata Pay? Does it earn 1.5% or no points?

I paid insurance premium using Tata Neu app. I got 5% neuncoins on my card.

Hi Aditya,

When did you pay the insurance premium? Who was the insurer…was it TATA AIA or someone else? thanks

where can we see the unbilled transactions?

My Tata Neu card was rejected as I already have a HDFC Card. I had a lifetime free offer on my app.

I hold HDFC infinia card

The application process is odd. For HDFC customers, the limit is shared. Okay. Then they fetch every correct detail. Okay. Then they do Aadhaar verification to protect impersonation. Okay. Then they want VideoKYC? Umm, what? You’re not even offering me more limit, it’s shared with Infinia. What’s the VKYC for?

I wish this card well and it will arrive soon for me. But it’s a deadly combination of incompetence of TATA and HDFC.

What about insurance premium payments to Tata Pay? Does it earn 1.5% or no points?

With this card finally, I am also holding 3 cards from HDFC with a shared limit.

Millenia, Club Miles, and Neu Infinity. But very disappointed with HDFC as having a corporate salary account and holding club miles for 6+ years still not getting any offer for Privilege LTF. And the limit is too low on HDFC ~1.7 lakh

whereas having ICICI cards with 7-8 lakhs limit.

First statement generated. This card is so good. Points have been credited as per the structure. Paying through card on upi is really convenient as one doesn’t have many entries now on the bank statement. No one gives 10% back on grocery and on top now Tata nue has frequent offers. The return will be much more than 5 or 10%. Reap the benefits till they last. And now Tata being commuted to fund tata nue this thing is gonna last for some time now.

Have an LTF offer for the card. But on clicking the same on the Tata Neu app, it invariably gives the ‘Something Went Wrong’ error! Very irritating… If I try applying through the HDFC site, will the LTF offer hold?

Seeing FYF offer since months, and they keep extending FYF offer. Not sure in recent weeks if anyone’s FYF offer ever changed to LTF in the Neu app.

Applied for the Infinity Rupay variant on April 7th. I already have a Regalia card, so it showed the limit would be shared and initial offer was approved. It was FYF not LTF unfortunately.

Anyway, couldn’t complete video KYC that day as it was late and VKYC wasn’t available. Tried it next morning and it was successfully completed. No update after that.

Sure, it was a holiday weekend, but not sure if it’s expected. The Tata Neu app says application is under processing and would take 5-7 days. Will wait and see.

I had selected a different delivery address than what is in the HDFC records, so they had to do a physical address verification. The person came for verification few days after and the same day the virtual card was issued.

Few days later the limit etc got updated. I had to wait a day or two after getting the virtual card details to set the UPI PIN. Once PIN was set, could make UPI payments. Initially had more success with BHIM, but in the last few days, PhonePe is catching up. The initial problem with PhonePe was that, it wouldn’t show the option to pay with Rupay CC for most merchant payments, whereas BHIM would allow.

So far so good and everything is working well.

For a 1MG transaction, the transaction was shown as Paytm Payments, for this I did not get the 5% points.

Now you can get this card as LTF if you pass the final of the Tata Neu Rewards League. Basically min 9 orders with min 15000 total order value. After that your existing card will get converted to LTF, or if you don’t have the card, you’ll get an invite to apply for LTF card.

Thank you Suhasa, I have completed the IPL task, within 2-3 days I got call for LTF offer, applied and got approved and card number generated on the same day. I have Diners Club Black and limit is shared.

Great and helpful review. I literally applied for the card after reading this post.

Two quick questions.

1. Is it possible to link Tata Neu Infinity Credit Card (Rupay variant) to UPI on the Tata Neu app itself?

2. I got my digital card today. I presume I will get the physical card in a week or so. Until then, can I set the PIN and use the card?

Thanks in advance.

1. Not possible to link on Neu presently, but I was able to link the card with Bhim, Paytm & Phonepe

2. You will need the physical card to set the PIN, as it requires expiry date & CVV

Expiry date and CVV can be seen on the Tata Neu app itself, in the card details tab. That’s how I did. I setup transaction/ATM pin and UPI pin before I received the physical card.

Yup. Noticed that now.

What will be the UPI ID for hdfc neu rupay card? How to get this information..pl update

Regards

RK

Link the card on Phonepe to get dedicated UPI ID for this card.

If I pay insurances thru neu app using infinite card. How much will I get as cashback ? 10% or 5%

5%

Only payments upto Rs 50000 per month would fetch 5% rewards though. There is a fair use policy which is explained in their document.

Seems like I am the only one with not good luck with the process. Had ltf offer on infinity in neu app. 2days After whole process and verification received mail that your card couldn’t be processed as you already have a hdfc card. 😐

You must escalate your case to their credit card grievance redressal team…May be your request would be considered.

Can we pay to an UPI (lets say small vendor) using those Neu coins ?

No. Neu coins can only be redeemed against purchases from Tata brands

a deal breaker.

Very poor experience with Tata Neu HDFC Card application. I guess most of the users are already having one HDFC card and hence they should clearly mention that the card is applicable only if the customer does not have HDFC card. 1 month and after continuously providing documents asked by HDFC, the card gets rejected wasting time and energy. Most pathetic experience ever for me (have had credit cards from most banks in India) 🙂

Unlike ICICI, the HDFC process of issuing a 2nd card to a customer is primitive. Though I am an HDFC card holder, and got the LTF offer Tata Neu card, They want another round of KYC! And since I happen to be visually impaired, they want offline KYC! And after 2 days, nobody has even contacted for the same! Got my AmazonPay card generated within 1 minute as I had an existing relation with ICICI. Terrible from HDFC! Think I’ll have to rely on PNB with whom I am forced to have a salary account to get that UPI enabled Rupay card!

So I finally got my Tata Neu Infinity card after 3 weeks since card approval. Beside the KYC, HDFC also had an address varification as well before processing the card. Then it took them another 4 days to set the limit at par with my Millenia. But its all set now, have added it on UPI payment on both Paytm and Google Pay.

In the mean time, I got the PNB Rupay Select card as well. It has more of the Rupay offers available as it is a Rupay Select Wellness card and thus score a bit over the HDFC card.

Is there any restriction on earning nue coins for gold purchases on non-tata stores ?

Hi

What’s the minimum transaction amount required for UPI Scan and Pay for acquiring Neu coins?

I did 2 transactions on Paytm Scan and Pay UPI, using my Tata Neu Infinity LTF card in April, got my statement on May 2 but the neu coins for UPI is not appearing in the statement as well as in app!

Even after clicking around the Tata Neu app for months now and also making many purchases my offer is still FYF. No chance taking this card if it is not LTF as 1.5% returns and Rs.500 cap is way too low. I am mainly aiming at using it for UPI payments.

Another huge drawback of course is that you are locked into the Tata ecosystem. Who wants to buy from them alone. BigBasket doesn’t even deliver in my area. Also hearing many bad reviews about the Tata Neu experience. Thinking if it is worth it taking this card.

What’s this Neu Pass? From the text that’s there it seems to be some kinda membership like Amazon Prime or so. But I see no way to subscribe to it?

Need a clarification. This card offers 5% back on purchases from Croma even if it’s from the physical store. However it says that on the Tata Neu app it gives 10% totally with Neu Pass. So is it like I’ll get only 5% back if I do a purchase physically at a Croma store but 10% back if I do it on the Tate Neu app?

Thats correct. 5% on Croma directly (online or at store) and 10% on Neu

Alright, I managed to speak to the Tata Neu customer care and get info related to it. If you go and buy physically at Croma store then if your mobile number registered or you are gonna register with, if it’s the same as that on Tata Neu app then you’ll be rewarded 1 Neu Coin for every Rs 300 you spend on Croma. Instead if you choose to buy from Croma using the Tata Neu app then you get 5% back as Neu Coins but there’s a cap of 2000 coins.

And if you’re making this purchase on the Tata Neu app using the Infinity Plus credit card then that entitles you to another 5% back as Neu Coins.

Just wanted to share this here so it will be beneficial for others too.

Okay, I wanna talk about something that not many others have touched upon though have hinted and that’s about this app.

Every new app will be buggy initially but this app is on another level. Calling it buggy is a gross understatement. From my experience on this app for the past couple of weeks I am now questioning myself as to whether I made a wise decision in applying for this card and whether I will be able to make use of it well.

I tried to recharge a BSNL prepaid mobile on this app. When I clicked on the contacts icon next to where I must fill the number it asked me for permissions to read contacts and I gave it. I immediately noticed something odd. It was able to present only one number per contact. And this is not the first or the last number but any random number for that contact. If you had 3 numbers for a contact what you’ll see can be any 1 of these 3. It didn’t display multiple numbers for any contact. This is the first time any app has done this. It shouldn’t be a difficult thing and this app faltering in this makes me wonder what kinda testing they did.

It doesn’t matter as I can always copy paste the number or even type it manually. Now comes the major issue. After providing the number, unlike other apps, Tata Neu is not able to detect the carrier. It instead presents us with only 4 options to choose from. And these 4 are Airtel, Jio, MTNL Mumbai and Vi. The number I was trying to recharge was BSNL and after many attempts I gave up. I selected some other numbers from my contact to see if it wasn’t able to detect the carrier only for BSNL. It couldn’t for any number.

A week before I was trying to order eggs from Big Basket from inside this app. When I added the specific items to the cart it says the items are not in stock. When I go back I could still see the items available in multiple counts. I checked on the website and was able to add the item to the cart and proceed with the checkout. But this app kept telling me that the items were out of stock for almost every item I tried adding to the cart.

I alredy have the Axis Ace CC too. But GPay seems to not allow payment via credit card for BSNL mobile recharges and so I thought I could use this app. It doesn’t work. For almost every other recharge I’ve been using Ace on Gpay only. Now that the Ace card has been devalued a bit I thought this app with the Infinity card would be a great alternative. But with the experiences I’ve had over the past 2 weeks I now seriously doubt that.

Yes, the Tata Neu app is buggy. But is extremely rewarding. You can do double dip or triple dip with ongoing offers. Tata Neu rewards league during IPL was a grand rewards fest.

wow.. the best thing is even for payments less than 100rs (~66.66rs) do earn 1 rs cb thru upi.

UPI spend of Rs50 has also earned 1 RP.

I just checked now … even for transactions of 40rs I got. so it seems they are rounding to near. 40rs -> 1.5% -> 0.6rs -> 1rs.

When will the points be credited ? I had the statement generated 2 days ago, still those points are not shown in the app for usage.

As per tncs, they can take upto 7 days for transfer of NeuCoins to your Neu account. In reality mostly I receive in ~ 5 days.

yeah .. receive on 6th day from the statement generation date.

TATA Neu app, I gave a 1 star rating and gave them my piece of mind in the review. By far the worst experience for me with any app so far. With a 40+ Mbps connection it would say things are slow at random times and very often and will offer to try again. Their payment interface is left hanging in the middle and I am afraid it’s incomplete. I’ve already listed it in a previous comment how after entering the OTP in the banks page this app can’t complete the payment. It happened to me again, this time with the TNEB bill payment. Tried thrice already and the same issue. Keeps saying payment failed while I doubt it even attempted properly. After entering the OTP it will just redirect to this app and throw this error message.

So, if you’re planning on getting this card, remember that the success rate on the Tata Neu app is under 10% and for me it has been under 5% even. Other than for a couple of Croma orders out of at least 7 attempts, and some successful UPI payments at the rate of 20-30%, this card just add weight to my wallet. Not able to extract much value out of it due to the extremely high rate of failure.

Tata Neu has its more than fair share of problems, but I have not experienced problems to the extend you seem to have faced. Big Basket was missing for a few days and it took them a week to get back on fully. Then I have faced some payment issue on 1MG through the app, a few payment failures, specific to the Rupay card. Had to do one order through SBI Visa card, and waited for them to fix for the other order couple of orders so that I could use the Infinity Rupay. The bill payment section I guess has got more issues than others.

Alright, I am afraid the Tata Neu cards are just a big scam. I tried making the payment for my TNEB bill again. This time it said waiting for biller confirmation. Then I received an SMS saying it was unsuccessful but the status on the page still said it was pending confirmation from the biller. Soon afterwards I received another SMS stating that the refund has been initiated and then another saying the payment was unsuccessful. When I went to the app again it says biller declined the payment. I checked the TNEB site and there’s no indication of the attempt I made to pay.

Bottom line, they don’t even have proper interface to make most bill payments. I already explained about how it’s only recognizing one number per contact. It doesn’t even have the capability to distinguish between a mobile and landline number. And it can’t recognize the carrier from the number. Only provides a limited selection of carries, just 4 to be specific. And now this.

So far the only useful thing for me with this card is the UPI scan and pay, which at a success rate of about 60% is still useful. Other than that I made use of this card for a couple of purchases from Croma through the Tate Neu app. Total attempts made were almost 10 and success was just 2 times.

I totally understand that any new app will have hiccups. But this is half baked. They seem to have just the front end for many things they claim to offer with no actual mechanism or interface to make sure it can be utilised.

Is there any capping on earning neu coins by paying insurance premium through Tata Neu app and using infinity rupay card?

Now it is not rewarding any points for insurances. In fact they remove cc payment option in app. It is 0 even if you pay in the insurance portal.

After using the Tata Neu Infinity card for four months I can say that the UPI scan and pay feature for (RuPay) credit cards isn’t what it is hyped up to be.

This is because a large number of merchants especially nearly all the smaller ones have put up their own personal accounts to be scanned via QR code rather then their business accounts. This means that these scans are P2P transfers and you cannot use your credit cards for that. You still need to pay using your bank account. A majority of my UPI scans in the past four months since getting the card have been in this manner. Nobody talks about this.

My returns from overall UPI scans has been less than 0.7% and that too only because one large UPI payment of Rs.1800 was done using the Tata Neu card. All smaller payments like Rs.80, Rs.129, etc. were all P2P transfers.

Of course, as a rule, I do UPI payments only when there is option to pay by card.

There is no way I am going to recover the Rs.1499 for next year by the end of this year. I will close the card unless they offer to convert it to LTF.

Hi all I got hdfc tata neu infinity credit card through tata neu app. I want to know if I buy ipad will we get 10 percent neu coins or there is limit on the cashback. or it is unlimited cashback like flipkart axis bank. It would be very helpful to me to make the purchase.

I suppose you are buying via Croma. So you will get 5% upto 750 NeuCoins via Neu app per transaction.

You will also get 5% via Neu Infinity card. Though it’s not unlimited but limit is fairly high. For Croma 5% capping is 6L/18L Monthly/Annually.

Hope it helps.

Thank you Satish for your reply. Yes I was trying to buy from croma and was comparing with flipkart for ipad 10 gen where I can save more money.

If you buy from Croma through the Tata Neu app then you get 5% value back on your card as New Coins as usual. This is unlimited. But you get an extra 5% as Neu Coins again and this is for using the all for the purchase. This however is capped at 2000 per purchase.

For example, if you were to make a purchase with 1L this way then you get 2000 New Coins in a few days from the purchase and this is for the second thing I spoke about. Then a few days after the bill is generated you get the 5000 Neu Coins for using the card. So in total you get 7% value back in this scenario. Up to a purchase value of 40k you will get the full value of 10% back. Beyond that it will be reduced.

Very well explained thank you Vikram.

Do we get Neucoins for bill payments via the HDFC Tata Neu credit card on Tata Neu app? It mentions about the Neucoins on Tata Neu App but nothing about it on the HDFC website

Yes. 5% NeuCoins via TATA Neu app as per Fair Usage Policy

I have HDFC credit card, If i apply for this card will they fetch the CIBIL score again or they will provide it on the basis of shared limit without fetching cibil score?

CIBIL was hit again as per my experience, in same situation as yours.

Are we getting rewards on insurance payments through Tata pay?

If yes, is there any capping on earning neu coins by paying insurance premium through Tata Neu app and using infinity card e.g. 200 points per day.

Yes.

Few weeks back it was upto 50K pm & 6L py.

Yes. 50K pm & 6L py spend limit.

What about emi payments on say Croma? Will I get neucoins if I go for 6 months emi offer on Croma?

You should get Neu Coins at 1.5 percent for merchant EMIs.

I currently hold 2 Credit Cards from HDFC, The Infinia PVC and the Tata Neu Infinity. I am eyeing a 3rd card now which is their Swiggy offering. I already have the Ace but with the Rs 500 cap it’s not too useful as there’s not even base cashback offered after reaching Rs 500 on the 5% and 4% categories.

Given this I have 2 questions.

(1) Would I be able to get this card given that I already hold 2 of their Credit Cards?

(2) Is this card useful? I know the kickbacks are as some kinda Swiggy money/points. Are they prompt and useful enough?

Existing HDFC Cardholders (having 2 HDFC Cards already) have got it, but not much useful

Thank you. I had called up customer care and checked with them too. Seems the Tata Neu Infinity is a floater card and shares the limit with the card that I already held, which was the Infinia. This Swiggy card is a separate card and so they said I could apply, provided I am eligibe.

Just now applied for it. I am quite a heavy Swiggy user. So much that Ace’s Rs 500 only cashback is too restrictive for me as I already lost some last month. Besides this Swiggy HDFC card gives 5% cashback on all online transactions and so would definitely be of more use than the Ace. Planning to get rid of the Ace after I get this card as I find no use for the Ace anymore. All Gpay spends have moved to Tata Neu and there’s currently no limit on the max benefits. Swiggy will move to this new card. So the Ace has no value anymore.

I don’t know how much you spend on Swiggy. If you need 5k more, you can get Axis Airtel as it gives 10% upto 500 (so 5000 spend).

I spend upwards of 15k mostly. Spending that much on the Airtel card or the Ace only gives me 500 but I get 1500 on the Swiggy card, which would be more than both those cards combined and for half the spends. Also I use Zepto, Urban Company, Dunzo a lot too. These all give me 5% on the Swiggy card. That was why I am taking it.

I checked my Neu app and received No Joining Fee + 1499 Annual (waived on 3L spends).

However, I had to look for other cards, due to the limit being an useless 50k, due to my decade old HDFC moneyback card, since existing HDFC users get a shared limit of their existing HDFC cards.

Just had an extraordinary experience applying for the Swiggy HDFC CC. After posting here and asking if it was okay to apply and whether I’d be allowed to as I already have the Infinia and the Tata Neu Infinity. I called up customer care too and they said the Tata Neu is a floater card and shares limit with the Infinia but the Swiggy card will be a separate card and I can apply if it shows up in the list of eligible cards for me.

I went ahead with the application and this card was the only one that showed up for me as a recommendation. I applied immediately and got an SMS with a link that said I can use it to track the status after 2 days. Out of curiosity I clicked the link the next day itself and it said the card has been dispatched already. I was shocked as I got no SMS confirmation of the approval.

When I checked email today it says that as I already have a CC from HDFC this application has been put on hold and they’ve sent me a form to do a limit enhancement on my current card instead.

This is classic HDFC, customer care (Infinia priority) says something, SMS says something and then emails says something else. 🙂

I do not have an HDFC Bank account. I do not have any other HDFC credit card. I have an ICICI and SBI credit card though. When checking my eligibilty on the app. I can only see an option for tata neu Plus with limit of 1lk. I want the infinity. My cibil score is 871. Is there any reason why I can’t get the infinity to show?

Do I need to be an existing card holder of HDFC to be able to get infinity?

If so, what are the next steps I can take? Because I really want this card. Will I have to get another HDFC card first and just hope for the infinity one to pop up in my neu Plus app one day?

The most sophisticated supercomputers and AIs can’t understand the logic behind the criteria based on which HDFC approves or disapproves a card application. Let me narrate my recent ordeal with them.

I wanted to get the Swiggy card from them. I already hold an Infinia and the Tata Neu Infinity cards. I wasn’t sure if I can apply for a 3rd card and so I called Infinia priority care to check. I was told I can apply as the Tata Neu is a floater card that shares limit with Infinia and this Swiggy card is a separate card which I can apply if shown in my list of eligible cards after I enter details.

When I did that I saw only the Swiggy card as my eligible card which was surprising. Anyway I applied for it. It gave me an application number and whenever I tried to retrieve the status with it, I instead got the status of my previous application which was for the Infinity card. A few days later I got an email from HDFC stating that the application has been put on hold as I already have a HDFC card and I can’t get another. It also suggested that I increase the limit on my current card instead of applying for a new card.

I called the Infinie priority care again and I was asked to forward the email to them so they can act upon it. I did that and in response I was sent an email that stated “Thank you for your interest in our cards. Please use the below link to apply for this card or visit a branch.”. I was planning to call the customer care again but I got a call from the person I had earlier spoke to and he told me that it is not possible to apply online and I should go to a branch. I told him about the email I got and he asked me to just ignore it.

I went to the nearby branch the very next day. The branch official kept insisting that I can’t apply for a new card when I already have one. I showed him my Infinia and Infinity cards and he said it’s because the Infinity is an Rupay and is a floater card. He again insisted that I can’t hold multiple visa/mastercard variants from HDFC. I told him about the conversation with the priority customer care and he said he’ll have to check with someone. He tried reaching 2 of his superiors over the phone in my presence and neither of them was reachable. He suggested that I leave home and he’d send someone to get the application done in case his seniors confirm it can be done.

After about 4-5 hours I called again to check and they had not yet answered his call apparently. He offered to do it the next working day and it has been mover 3 weeks since and I’ve not heard yet.

Last week I received another email from HDFC about my application. I was surprised, or rather not so surprised, to see the details of Infinity card in the attached application.

The only reason I stick with HDFC is that they have some of the best card offers and cards too. Their customer care makes me wanna break it up with them. But I hold back. I even was about to do so once but my RM called me and spoke to me over half hour to convince me to stay back.

If I were to pick a bank for their customer service alone, it would be Amex. I don’t remember having to call them twice for any single thing. Citibank was awesome too, but I no longer have any relationship with them and so can’t comment. If Amex had better offers and acceptance, I’d stick with them and let go of most others.

The biggest issue for me with HDFC is that they just deny something that everyone knows for sure. I know people holding at least 2 Visa/Mastercards from them, both individual ones and not corporate. But they want to blatantly and adamantly deny it.

Most banks have weird systems in place for applications processing.

But for any bank’s co-branded card like this one, always apply(if provision to apply) via the app/website of the brand website/app. In this case, you being an infinia cardholder would have easily got Swiggy card if applied via Swiggy app.

Are you sure trying through Swiggy will work? I did that too and am waiting for the status. Anyway Swiggy still asked me to login to HDFC Bank to complete the application process. So I am likely to get the same message from HDFC again. Let’s see. Can you confirm if you or anyone else you know got this card successfully this way?

Ah, you know what? HDFC customer care is here, on this site. You guys are all far more well informed than even the Infinia Priority Customer Care. I guess I must stop relying on them and just go by my own instinct or as per suggestions here. After your reply I went ahead and applied on the Swiggy app and it got approved in a day. I can’t believe this. I had just applied a couple of weeks back and it got rejected. I was sceptic as usually they say we can only reapply after 6 months at least.

Glad that it worked for you.

Can you please suggest why don’t you use infinia to buy swiggy money voucher from smartbuy and add it to Swigggy money balance ? Do you end up hitting 15k additional rewards limit every month outside Swiggy ?

I am replying to your previous message as I didn’t see reply option to your latest message.

I didn’t know that I could do that with the Infinia. Ah, my bad. Moreover the I want to have a spread of points. I already have a good amount of points on the Infinia, points which I use exclusively for book travel mostly. But I guess I’ll still use it now as my Swiggy Insta card has come with a credit limit of 5k. LOL. I don’t know what I am gonna do with just 5k credit limit. 🙂

The credit limit will be updated after a few days. It will be same as your infinia card and will be shared limit among all 3 HDFC cards you have. If that doesn’t happen within 10 days, you can contact customer care and they will help.

It was updated. So this is a floater card too? LOL. I was told this was a co-branded card and the Infinity was a floater card. When I asked what the difference was, they said floater cards share the limit but co-branded cards don’t. 🙂 🙂 🙂 Doesn’t matter to me either ways because I have a enough limit on the Infinia to share with 3 cards (my own that is :-)).

Is there any cash back capping for insurance spends.

I have one question?

What if we select Visa instead of Rupay?

Will the Tata Neu Infinity be issued on Visa Signature Platform or Visa Infinite as the name similarity??

Anyone?

Visa Signature