HDFC Bank has recently come up with a new lifestyle credit card for the premium segment under the name Regalia Gold Credit Card. It’s no wonder that HDFC Bank is once again taking advantage of the “Regalia” brand which is known in the industry for its decade long fame.

HDFC Regalia Gold Credit Card stands above Regalia & Regalia First and is one of the best premium credit card to hold at the moment. Here’s everything you need to know.

Table of Contents

Overview

| Type | Premium Credit Card |

| Reward Rate | 1.3% – 13.2% |

| Annual Fee | 2,500 INR + GST |

| Best for | Airport lounge access |

| USP | Priority Pass for Add-on cards & milestone benefits |

At this fee point, HDFC Bank’s Regalia Gold Credit Card is fully loaded with travel benefits and rewards.

Do note that Regalia Gold Credit Card is different from Regalia & Regalia First Credit Cards which were devalued recently.

Even-though it’s been a while since Regalia Gold Credit Card was launched, it never felt like a card to hold until recently when the bank devalued the lounge access benefits on other Regalia variants.

Joining Fees

| Joining Fee | 2,500 INR + GST (Issued as FYF at times) |

| Welcome Benefit | 2,500 INR voucher (on paid cards) |

| Renewal Fee | 2,500 INR + GST |

| Renewal Benefit | Nil |

| Renewal Fee waiver | On spending >4 Lakhs |

While renewal fee waiver is easy to hit for most holding this card, I wish they had a renewal benefit as well on paid cards.

Nevertheless, HDFC Bank’s Regalia Gold Credit Card is undoubtedly the best lifestyle credit card in the segment for what it offers.

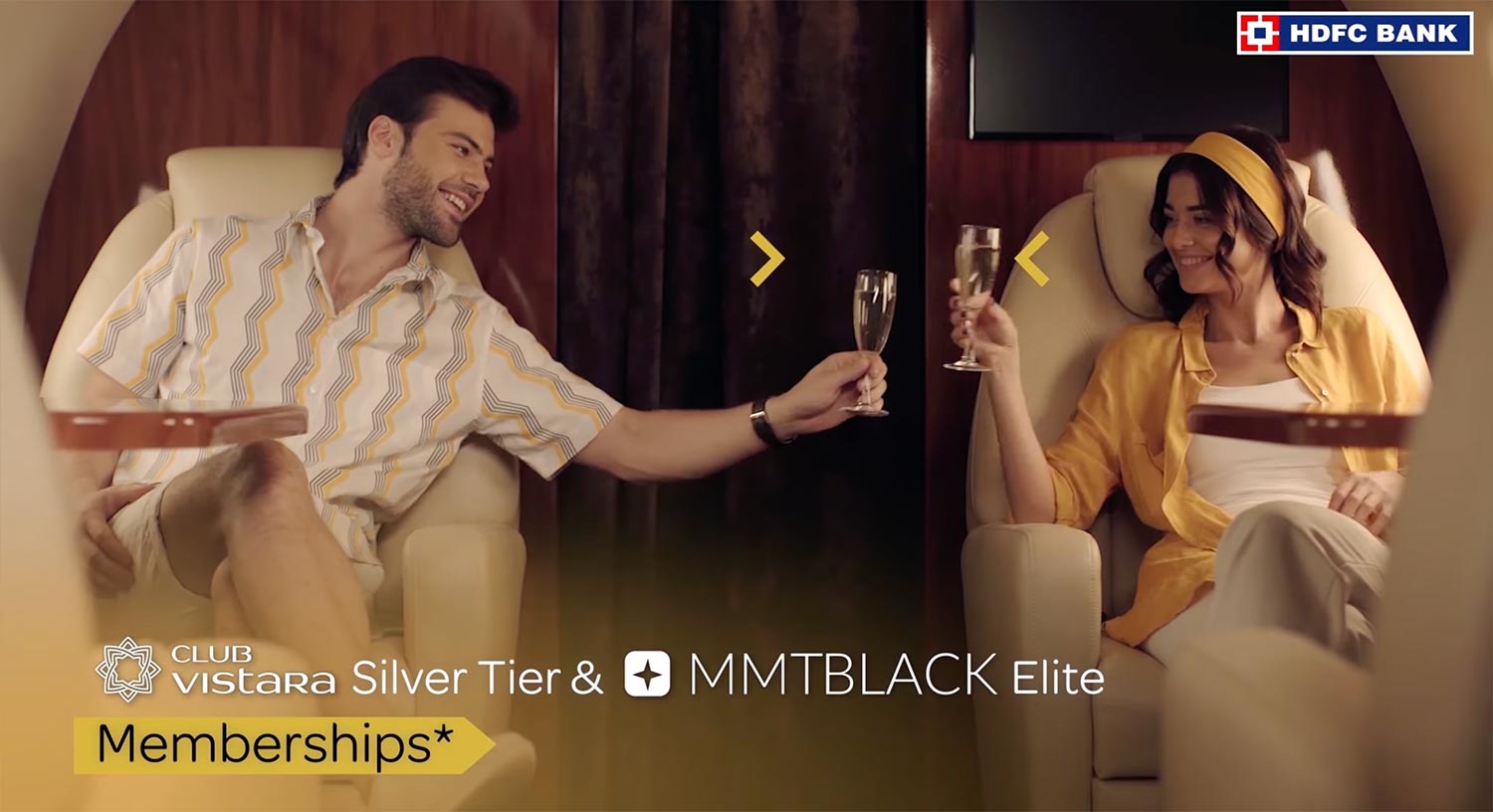

Membership Benefits

- Club Vistara – Silver Tier

- MMT Black Elite Membership

Above memberships are provided as a part of welcome benefit for the first year but it doesn’t “seem to” renew every year.

Looking at the memberships, I wonder who’s using MMT Black these days, but Club Vistara Silver Tier is certainly a good one to hold as it gives one upgrade voucher, priority check-in, increased 5Kg baggage allowance and more.

Note that you would need to spend 1L INR in the first 90 days of card issuance for the membership benefits to be activated.

Benefits will be unlocked within 48 hours on achievement of the spend criteria. This applies to all milestone benefits as well which we’ll see shortly.

Rewards

| SPEND TYPE | Reward Points | REWARD RATE (POINTS TRANSFER) |

|---|---|---|

| Regular Spends | 4 / 150 INR | ~1.3% |

| Accelerated Spends (5X) | 20 / 150 INR | ~6.6% |

| Smartbuy Flights / Vouchers (5X) | 20 / 150 INR | ~6.6% |

| Smartbuy Hotels (10X) | 40 / 150 INR | ~13.2% |

- Brands for Accelerated Spends: Marks & Spencer, Myntra, Nykaa & Reliance Digital. Capping: 5000 Reward Points/month

- Smartbuy Cap: 4000 RP’s monthly / 2000 RP’s daily

- Grocery Reward Capping: 2000 reward points in a month for grocery purchases.

- No rewards on fuel, wallet, rent and tax payments.

The regular rewards on the card is quite low for the segment and so the accelerated rewards are not exciting either.

But that’s decent for this segment and the milestone benefits are there to boost the overall reward rate.

Milestone Benefits

| SPEND REQUIREMENT | MILESTONE BENEFIT | Voucher Type |

|---|---|---|

| 1.5 Lakhs per Qtr | 1,500 INR | Brand Vouchers |

| 5 Lakhs | 5,000 INR | Flight Vouchers |

| 7.5 Lakhs | 5,000 INR | Flight Vouchers |

- Vouchers Brands: Marriott, Myntra, Marks & Spencer or Reliance Digital

- Flight Voucher is meant for “one” flight as per the t&c.

- Quarterly spends are calculated every “Calendar” Quarter

I’m happy to see that HDFC Bank is moving to Quarterly milestone system which I’ve been hoping to see for many years, as monthly milestones are quite taxing to the mind.

So assuming you’re able to spend 7.5L with required Quarterly spends, the milestone reward rate would be 2.1% on top of 1.3% regular reward rate, hence giving a net reward rate of 3.4% which looks quite lucrative on paper.

However, remember that these are flight/brand vouchers and not regular reward points, so it might be tricky to enjoy the full reward rate as per the calculations, as you would need to “effectively” redeem these vouchers on “time”.

Redemption

There are multiple options to redeem rewards, as below:

- Flights / hotel bookings: 1 RP = Rs 0.5 (via Smartbuy portal)

- Airmiles conversion: 1RP = upto 0.5 airmiles (via Smartbuy portal)

- Exclusive Gold Catalogue: 1 RP = Rs 0.65 on premium brand vouchers (via Smartbuy portal)

- Statement Credit: 1 RP = Rs 0.20 (never do it)

Exclusive Gold catalogue redemption looks good with better value and it includes products from premium brands such as Apple, Samsung, Bose, etc.

However, note that accumulating points on Regalia Gold is not easy as the regular earn rate of the card (excluding milestone benefit) is quite low.

Airport Lounge Access

| ACCESS TYPE | ACCESS VIA | ACCESS LIMIT |

|---|---|---|

| Domestic | Visa / Mastercard | 12/Year |

| International (Primary) | Priority Pass | 6/yr (shared) |

| International (Add-on) | Priority Pass | 6/yr (shared) |

For domestic access, 12 visits a year without any quarterly limits are more than enough for most.

For international access, each add-on card gets a separate priority pass card.

HDFC Bank Regalia Gold Credit Card is an amazing card for family travellers as you can get Add-on cards for your family members which allows access not only to domestic airport lounges but also international lounges.

Do note that the list of domestic lounges eligible for Regalia Gold is better than other Regalia variants and is now in par with Infinia.

If you’re looking for the lounge access benefit only for primary cardholder and if you’re okay to be on the Diners Club network (relatively less acceptance), then you might as well explore the HDFC Marriott Bonvoy Credit Card.

You can apply for Priority Pass for self and add-on members once you complete minimum 4 retail transactions on your HDFC Bank Regalia Gold Credit Card.

Airport Transfers

- 2 complimentary airport transfers per Quarter

- Requirement: flight tickets must be booked via Regalia Gold Smartbuy portal

You can generate 1 voucher per flight booking on smartbuy portal and upto 2 vouchers in a quarter.

The voucher appears to be a 300 INR Uber gift card which can be used for airport pick / drop journey.

Airport transfer benefit is one of the most important benefit on the card in my opinion but it’s quite surprising to see that HDFC neither promotes this benefit nor lists the benefit on the main HDFC portal due to which the Imperia support says “It’s Smartbuy benefit and so call them”. Hmm!

I tried to call Smartbuy Support to check more details on this but went on a long hold and couldn’t connect with any. But fortunately they confirmed the benefit on email after writing to Smartbuy email support.

Forex Markup Fee

- Forex Markup Fee: 2%+GST = 2.36%

- Reward rate on Intl. Spends: 1.3% (same as domestic)

- Net gain: ~1% (loss)

- Net gain: ~1% (gain) if we include milestone benefit as well.

So, HDFC Regalia Gold credit card is OKAY for international spends depending on how much you spend on the card. Yet, there is no substantial gain.

However, you may as well activate Global Value program to get additional 1% cashback on international spends.

Eligibility

- Income: >1L INR per month (or) 12L per annum for self employed

- Upgrade: ~3 Lakh credit limit on existing HDFC Bank Credit Card

Upgrade offers were rolled out recently for most of the existing LTF Regalia & Regalia First Cardholders.

Should you upgrade? If you’re holding other Regalia variants, then it’s the right time to move on to Regalia Gold Credit Card as this gives access to superior lounge access benefit, better reward rate, airport transfers and other benefits.

If you’re afraid of loosing the LTF benefit, remember that lifetime free credit cards are designed to be devalued. If you’re new here, you may need to read this old truth about lifetime free cards for more gyaan.

How to Apply?

The easiest way to apply for an HDFC Bank’s credit card is by applying online, you may use this link to apply.

You may as well apply offline from the branch but offline applications takes more time than online applications, for all the known reasons.

Bottomline

- Cardexpert Rating: 4.5/5

Overall HDFC Bank’s Regalia Gold Credit Card is a decently rewarding Credit Card in the segment and can be used as a family travel card as this is the only card that gives Priority Pass for add-on card holders too officially at this fee point.

While the card is loaded with many benefits, the challenge is that you’ll need to keep few things in mind (redemption/expiry of vouchers, etc) to make sure you’re availing all the benefits as expected.

Have you taken the Regalia Gold Credit Card recently? Feel free to share your thoughts in the comments below.

Do add-on card members also get 12 exclusive domestic lounge access or is it shared amongst all

Yes. Need this info.

Thanks for this wonderful article…..I have been holding LTF Regalia since last many years….Currently I have two offers from HDFC…..

1 is to upgrade to Regalia gold with all the benefits you have mentioned above along with the 2500/- annual fees…..

2 is to get a 2nd card which is HDFC Diners Club Privilege Card which is being offered LTF…..

I’m not a frequent traveller (maybe 2-3 times a year max)…..Yes with the change of Regalia Lounge Access rules it will not be possible for me to access lounge thru regalia but it seems thru Diners Club Privilege I will be able to access lounge. But lounge these days have become so crowded, it doesn’t feel great. Whats your take between the 2 offers I’m currently holding? Any suggestions is highly appreciated.

If it’s me, I would go for Regalia Gold as it is still better with milestone benefit and would take some time for devaluations as it’s a new card.

I am not sure about the dynamic value. I used it only once till now. But that makes more sense if it is based on flight fare as well as cities traveled. I can confirm when I get a chance to use it again since I am not a frequent air traveler.

I used airport transfers on Regalia Gold few months back. You get ₹300 Uber voucher which can be used in the app for basically any Uber ride. It was a pretty smooth process from Regalia Gold portal. You need to do it before the flight and you get the voucher text in few hours after application.

Thanks Saurabh for sharing.

When asked Smartbuy support they said that it has dynamic value. Are they setting the voucher price based on flight rate by any chance?

They activate GVP on Regalia Gold. Ha activated it recently. It’s certainty a good benefit to have.

I recently tried purchasing Amazon voucher on smartbuy portal for regalia. But it seems they now charge some convenience fee as well. So you just get about 3% only.

“as you can get Add-on cards for your family members” Is this specific to the Gold variant? Because for the Regalia first variant, an addon card was available only if the family member also had an HDFC account.

It’s for all Regalia variants but as others are devalued, Gold is now superior.

I hold Regalia & DC Previlage,both LTF. My regalia limit was reduced drasticlaly, below the Regalia Gold minimum limit, despite good usage and CIBIL score few months back. This may be to avoid upgrade to Gold.

In a recent Int’l trip I used DC to access longe in India and Priorty pass outside India.

Is it worth to upgrade to Gold, or use DC/PP for lounge access Internationally and use Visa Signature debit cards within India.

Though my limit has not been reduced for LTF Regalia, I too have Regalia and newly issued DC privilege both LTF…… but it looks easier to spend 15K per quarter on DC Privilege to avail 2 complimentary lounge visit than spending 1 lac per qtr on Regalia……the catch is 12 visits under regalia gold which is not split by qtrs, provides more flexibility I think….IDFC First select provides 4 complimentary Domestic airport lounge visits per quarter, on minimum monthly spends of Rs.5000 which i think is fair.

I’m using Regalia LTF from Past so many years. Now HDFC Bank had offered Infinia as Upgrade but not LTF. I had asked for LTF Upgrade and they denied saying any upgrades would be Chargeable. I’m HDFC account holder from the past 13 years and I have many products from HDFC. I still have 1 year for my Credit Card to expire. Will see if they offer any upgrade or send the same Regalia variant after expiry of current Card.

LTF on HDFC premium cards are gone for now. Infinia paid makes sense for sure as you anyway get equivalent points on renewal as well.

If the existing card is about to expire and if you wish to keep card LTF for longer period, just block and replace which would extend the validity usually.

Thank You Siddarth, will do that.

I have Regalia Gold as LTF. It was offered to me during the application process without me asking. Tata Neu Infinity too was given LTF. They rejected my Infinia application too.

How come you’ve got Regalia Gold as LTF?

Is there any other criteria from upgrading to Regalia Gold from Regalia as LTF?!

1)Do regalia gold also have spend 1 lakh crieteria to access airport lounges like normal regalia?

No

I always stay on HDFC Business regalia which is the only card gives reward points for tax payments from HDFC. I need to pay a lot of tax every year including property tax, water tax and income tax.

Will reward points be applicable on electricity bills payment through PayTM? My spend in this category is over 2 lakhs+ a month for a commercial property.

You need better cards if you have that amount of spend

Please do an article on diners black metal and upgrade process

This is the by product when bank issues tonns of LTF regalia card. HDFC is not a trust able bank. First they launch Infinia metal now recently with DCB Metal now regalia gold. Devaluing older cards will mean loosing your old customer. Very soon i will move my account from preferred to classic or even 10k account.

Close your Regalia and Apply Regalia Gold LTF on card to Card basis. Downgrade to Savings Max Account which is 25k variant.

Thanks for the great review!

Is domestic lounge access available for add-on card holders ?

I am also looking for this infor mation but cudnt find anywhere clearly.

anyone can shed some light on this?

Usually one of the card works at a time, either add-on or primary. Not sure if their systems have improved to accept both at same lounge, same day.

I hold a Diners privilege card. Should I ask for an upgrade to Regalia Gold?

I travelled from Delhi to Mumbai a few days ago.

Regalia+add-on cards gave access to Encalm lounge at T2 on the same day.

Cool. Thanks for reporting!

Thanks Sid for another great article.

I couldn’t find Grocery Reward Capping anywhere on the HDFC website.

Pls elaborate more on this.

I am holding HDFC Millennia Credit Card. Now, they are offering me Regalia gold Credit Card with no joining fees. Please advise if I should opt for this upgrade or not.

I’m not a frequent traveler but redeem reward points periodically.

Think you are better off sticking to Millennia. You get good value on reward redemption to card statement on the card, overall reward rate decent, and then there are the 5 percent categories. Also, you earn points on EMI transactions. Regalia Gold, that too only FYF, is just not worth it, particularly if you are redeeming for options other than travel booking on Smartbuy. Only the lounge program is better on Gold for a typical Millennia user.

Hello,

I have been a silent reader here for long time and appreciate the tips discussed here.

I have Regalia Gold with no fee, was upgraded from Regalia with 10L + limit. I am barely able to cross spends of 5L annually so will be able to get one flight voucher

My question is we get MMT Black Elite with this. If we activate MMT black Elite and Regalia Gold 360 gives 10× on MMT, will spend also get counted for MMT black elite. When you buy through Regalia 360, you don’t log in MMT. Mmt black elite offers 10% extra on hotel booking.

Thank

I’m holding Regalia as LTF and they’re offering me Regalia Gold as FYF! Should I need to go grab it or ask for LTF? Does anyone got Regalia Gold as LTF if yes kindly mention the simplest way to follow?

If you can spend 4 lacs in a year, annual fees will be waived making it free for next year like LTF. Many people have been upgraded to Regalia Gold LTF. It is worth to upgrade from Regalia to Regalia Gold if you can reach milestones.

My views.

Hi Sekar

I am a first-time user of HDFC credit cards, and they offered me Regalia Gold LTF after I applied for it on their website. Not very sure how banks decide on LTF cards vs paid cards. They gave me a good credit limit also.

Hey, Siddharth! HDFC has offered me an upgrade on my Millennia card- a Regalia gold credit card. And it’s free. Should I go for it?

Hi, can we use Regalia gold milestone flight vouchers for any airlines like indigo & spicejet? Or it’s specific to Vistara?