Marriott has finally stepped into Indian Credit Card space through HDFC Bank on Diners Club network and launched HDFC Bank Marriott Bonvoy Credit Card, a semi-premium co-brand travel credit card.

As you might have seen the highlights of the card under the launch article, here’s the detailed review of the Marriott Bonvoy Credit Card,

Table of Contents

Overview

| Type | Co-brand Travel Credit Card |

| Reward Rate | ~2% |

| Joining Fee | 3,000+GST |

| Best for | Joining/Renewal benefits |

| USP | Free Night Awards |

As most Marriott hotels accept Diners Cards it’s logical for the Marriott Bonvoy Credit Card to be launched on Diners Club platform but it may have acceptance issues otherwise depending on where you intend to use the card.

Fees & Benefits

| Joining Fee | 3,000 INR+GST |

| Welcome Benefit | 1 Free Night Award (valued upto 15,000 Points) |

| Renewal Fee | 3,000 INR+GST |

| Renewal Benefit | 1 Free Night Award (valued upto 15,000 Points) |

| Renewal Fee waiver | Nil |

The welcome/renewal benefit is easily valued at 7500 INR or more and so undoubtedly lucrative for anyone to get the card without thinking a bit.

Design

You’re seeing one of the first few Marriott Bonvoy Cards printed in the country.

Looks beautiful isn’t it?

The design looks neat, elegant and simple and give vibes of a super premium / invite only credit card because of it’s black colour and golden prints on it, somewhat similar to the SBI Aurum Credit Card.

I wish it’s bit colourful though and rather save this design for later, for a “hopefully” next super premium variant.

Rewards

| SPEND TYPE | Marriott Bonvoy Points (PER 150 INR) | Reward Rate % (assuming 1 Point = 50Ps) |

|---|---|---|

| Regular Spends (Domestic & Intl) | 2 | 0.66% |

| Travel, Dining, Entertainment | 4 | 1.33% |

| Marriott Hotels | 8 | 2.66% |

- Reward Rate is calculated assuming 1 MB point = 50ps but it can go as high as 1 INR (or) even beyond based on various factors. Yet, with most hotels in metro cities & holiday locations, its usually valued at only 50Ps.

- Excluded spends for Rewards: Fuel, wallet load, Gov spends, EMI & Rent.

- It takes 12 weeks following the Credit Card billing cycle for Points to be added to the Marriott Bonvoy Member Account.

The reward rate on the on-going spends is poor even for the spends at Marriott Hotels, which I wonder why!

Ideally one can just go with 5x/10x rewards on HDFC Super Premium Cards and enjoy much more savings.

However, if you wish the nights to accumulate on Marriott and get closer to Gold/Platinum/Titanium, then booking direct and paying at hotel is the only option.

That aside, asking 12 weeks for points transfer in 2023 is unacceptable.

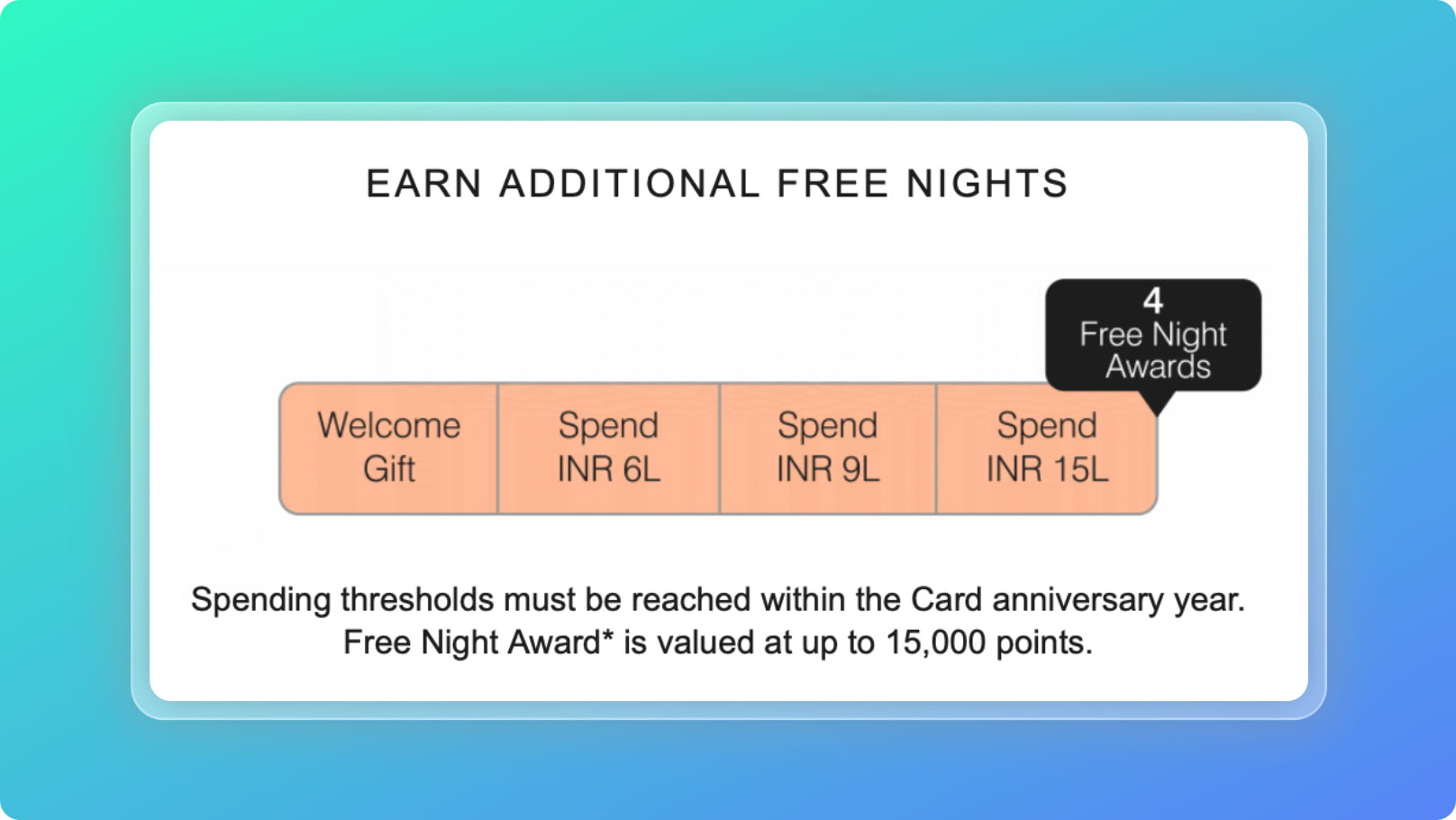

Milestone Benefit

| SPEND REQUIREMENT | MILESTONE BENEFIT (Cumulative) | Reward Rate (Cumulative) |

|---|---|---|

| 6 Lakhs | 1 Free Night (1 Night) | 1.2% (1.2%) |

| 9 Lakhs | 1 Free Night (2 Nights) | 2.5% (1.7%) |

| 15 Lakhs | 1 Free Night (3 Nights) | 1.2% (1.5%) |

- Free Night Award (FNA) booking capped at 15,000 Points

Above calculation is done by considering the complete 15K points at 50ps. Ideally some would redeem at even 10K points, in which case the reward rate would drop even further.

So even if one combines both milestone & regular rewards, the maximum reward rate is hardly ~2% and that’s too low in the industry that easily gives over 4% on travel cards like Axis Magnus (for burgundy), Axis Atlas, Amex MRCC & Amex Platinum Travel.

Free Night Award

- Value: Upto 15,000 Points

- Validity: 1 Year

- Fulfilment: 12 weeks, upon payment of fee or meeting spend thresholds.

While Free Night Award’s (FNA) can be used to redeem for hotels that requires 15K or lower, you may also redeem them at hotels requiring beyond 15,000 Points by clubbing the points (upto 15K more points) available on your Marriott Bonvoy Account.

Let’s say a hotel requires 20,000 Points for redemption, you may use 1 FNA + 5,000 points from your Marriott Bonvoy Account. This way one can utilize the complete 15,000 points of the Free Night Award.

However, note that how above actually works will be known only when we experience it in reality. I’ll update this section once I get my FNA.

Elite Night Credits

- 10 Elite Night Credits

- Fulfilment: within 60 days of the joining/renewal fee payment

If you’re new to Elite Night Credits, it’s basically a complimentary night given to you by Marriott which is useful to get closer to the next tier under Marriott Bonvoy Loyalty program like Gold/Platinum/Titanium.

It’s as good as getting nights for your stay without actually staying. It’s also eligible for lifetime status of the Marriott Bonvoy Member.

Silver Elite Status

- Priority Late Checkout

- 10% more on points than regular member

One needs to spend 10 nights at Marriott hotels to ideally get to the Silver Elite Status. However, with this card it would be given as complimentary.

Honestly, Silver Elite is not a big deal for hotels and so there is no major advantage to really get some value out of it.

Airport Lounge Access

- 12 Domestic complimentary lounge access (per year)

- 12 International complimentary lounge access (per year)

One of the major advantage of this card is it’s generous annual lounge access limits without any quarterly capping, which makes life lot easier.

On top of it, as it’s issued on Diners Club platform, cardmembers can access the lounges directly by swiping the card at the lounges without having to carry another Priority Pass.

Golf Benefit

- 2 Games/Lessons per Quarter

While booking Golf games/lessons on HDFC Bank Credit Cards are bit of a process over email, 2 access per quarter on a card at this price point is certainly good to have.

The Concerns

- While the card comes with a wonderful value for it’s welcome/renewal benefit & other lifestyle benefits like lounge/golf, it’s a poor card for ongoing spends. Hence chances of people getting the card and not using them would be high. Hope the banks runs some offers to keep them active.

- The FNA on welcome benefit is expected to be issued in 12 weeks post clearance of the payment. That’s too much time in 2023. I wish they speed up the system like in USA where one gets the welcome benefit activated in a week or so.

Should you get it?

There could be various reasons one would get the HDFC Bank Marriott Bonvoy Credit Card. Here are few reasons as to why you would need this card:

- Joining Benefit can give 2x, 3x or even more value, so its no brainer to get one for it’s joining/renewal benefit

- If you’re short of few elite nights to hit Gold/Platinum/Titanium, the 10 free Elite night credits can get you there faster.

- If you’re finding higher value for points than 50ps/point, then even the milestone benefit would be quite rewarding.

You would need to take a call based on above factors to see if it really suites your profile.

Getting the Card

You can apply on:

- On Marriott Website (or)

- On HDFC Bank website

and choose Marriott Bonvoy Credit Card among the options shown post authentication of your details.

If you’re already holding HDFC Bank’s Credit Card, then you may request your RM to get you one more card as a floater card, the decision of which is not in RM’s hands. Imperia Banking with a good standing relationship & existing credit limit usually helps.

It’s being setup as a floater card for existing credit card customers just like the Tata Neu Credit Card because I can see a 5000 INR Credit limit which is expected to reflect the actual credit limit in a week or so.

Bottomline

- Cardexpert Rating: 4.5/5

Overall the HDFC Bank Marriott Bonvoy Credit Card has very good value proposition for the fee it comes it.

However, given that all three brands making the card are into premium segment, they could have easily gone for a 5K/10K fee variant.

That’s said, something is better than nothing. Yet I would continue to hope India soon gets a Marriott Bonvoy Credit Card with instant platinum benefit!

Anyway, it’s a wonderful beginning of probably a lifelong relationship with the Marriott Bonvoy Credit Cards in India.

Have you applied for the HDFC Bank’s Marriott Bonvoy Credit Card? Feel free to share your experiences in the comments below.

I was really waiting for a Marriott Bonvoy Credit Card for quite some time, but Marriott & HDFC bank really chose to disappoint me!

It’ll take FOREVER to acquire some quantity of points!

Additionally, I don’t think even the welcome benefit is lucrative, because even the cheapest marriot properties are much more expensive than 15000 pts per night!

Totally Disappointed!

” I don’t think even the welcome benefit is lucrative”

– You got to explore a bit. There are SO MANY under 15K that gives good value but yes may not be in metro cities or holiday destinations like Goa.

I was able to book westin in Pune for 10K points and used suite upgrade voucher.

So in 10K, i got suite in westin 🙂

Which is a better option: getting the HDFC Marriott Bonvoy card or using the Amex MRCC to redeem points for hotel stays?

Both. 🙂

P.S. Welcome back!

No value in my view. Only things just pay to get 10 elite nights otherwise why you will spend to get such loo value

Do we get 10 status nights which will stack with our existing elite status or for existing status folks the silver benefit is useless

It has to stack up ideally.

Applied for the card, got rejected.

Hesitant to go with RM way. Every time I called them, he/she is totally unaware of my query rather tries selling useless products.

Hi Sid. They’ve put my application on hold just like yours. And I don’t have Imperia RM. What should I do?

Do they apply any Foreign Transaction fee on this card if used outside India?

How long it took them to approve the card? I hold Infinia and it’s been 3 days since I applied for Marriott and it’s INPROCESS with no updates.

I have preferred banking relationship with hdfc bank, recently moved my salary account to hdfc bank, closed neu rupay card as well, but still it’s not allowing me to apply for this card

How do I get this card?

Is anyone able to get this card as second card? I have dcb and 6 months ago my application for tata neu infinity was rejected

Pretty useless for Gold elite members. Waiting for a super-premium version to fasttrack to platinum!

I got a message that the application is rejected when I applied for this card. I already have DCB & Tata Neu Infinity cards. Sobi thought they are not going to approve third card. But yesterday I fot a message that it’s approved and cars will be delivered in 4 days. Also I got the card visible online. It’s a split credit limit with primary card.

Same story with the same cards. Got a message about application rejection, but another message saying card will be delivered. Received the card today

I have earlier transferred my Amex Corporate card points to Bonvoy. I have got about 39K points left now. Whats the best value I can get out of these?

Applied this card from HDFC website, card didn’t show at first. after few days card got listed, but when applied it said – I am not eligible.

Then after few days, I applied via Bonvoy website, It was approved. Got mail from Bank for Limit Enhancement to sign few forms, etc. I mailed bank saying I am holding Infinia, so my Limit must be enough for this card, plus HDFC is my salary account so Bank has all details, why to submit payslips again. Then they replied saying, I do not meet internal guidelines and card was declined. Even on application status tracked it showed Declined. Suddenly after few days I saw an SMS saying, card is approved. Today got the card. Suddenly HDFC is behaving like Axis 😛

Does elite silver status of marriot has some advantage when amex points are being transferred to marriot ?

I applied for the card on 27th Aug. I am existing HDFC customer holding Diners Privilege card with 4.4 limit.

Received the Marriott card yesterday, shared limit ofcourse, although there is a temporary 5k limit. Looks premium.

Hi Siddharth, is your Marriott Bonvoy membership number printed on your card? I provided my MB membership number during online application but it’s not printed on my card (assuming it is printed by HDFC). How do I check if my card is linked to my MB account? I don’t have any trust in HDFC and wouldn’t be surprised if they create another MB account for me despite having provided my existing MB number during application!

While there’s a massive push for RuPay and a seeming press to devalue existing most appealing cards on other platforms and to junk new releases (yes, the Infinia Reserve is likely to be an unrealised dream unless it goes on RuPay platform), I was wondering how this card came through. And it’s apparently because of this. RuPay doesn’t have international presence by itself. Instead it works with Discover Intl to allow international transactions. Dinersclub Intl is owned by Discover Intl for more than a decade now. This card being on the Dinersclub platform, I am no longer surprised.

Coming to the question of whether another super premium card with Marriot Bonvoy benefits will be released, we can’t be too confident about it. If it does, it’s most likely to be on Dinersclub platform too. But I am not sure if that would be good for HDFC because I am not sure it would be as beneficial as releasing it on Visa/Mastercard platform. Only time will tell.

Update: I got the third HDFC Card(Marriott Bonvoy) a cpl of weeks back and still waiting for the realisation of the joining fee to receive the silver tier status and free night credit. I was quite surprised to receive this as the third card from HDFC.

Marriott cards are treated as floater cards like Swiggy/Tata Neu and hence don’t have the multi-card restriction.

So all applications has to go through ideally. Might be on hold initially but they’re clearing it eventually. It’s just a poorly implemented tech.

I got Silver Elite on card approval, w/o paying the fees. I believe only the FNA and ENC are dependent on fee realization.

Hi Sid,

I finally received my Bonvoy card today – after some confusion of application on hold due to me holding a DCB card – they suggested me to enhance limit rather than applying for a new card 🙂

I have 2 queries – pls see if you can help!!

1. How long does it take for the 10 elite nights to be added to my Bonvoy account? (there is no reference to my bonvoy no also in the card)

2. they have set an intial limit of Rs. 5000 – Does it get increased over a call to CC?

Thanks in advance.

1. I believe I read 2 months after fee realization – I can stand corrected.

2. On the letter I received with the CC, it is mentioned limit of INR 5000 is temporary, and shall be revised after 5 days.

Kindly merge my comments if required – one more query please – I am already a Silver Elite member with around 12 nights – so will this become 22 nights with the free nights from this card – is that how it works?

Hi Sid,

For some reason, all my queries disappear after 2 days (under moderation) – guess they were not worthy enough!! 🙁

I have now received the HDFC Bonvoy card – but it has no mention / reference of my Bonvoy no.

Both HDFC Bonvoy Customer support and Bonvoy Customer support are clueless if my card is tagged already or will take some time to get linked.

Can you please guide how I should check this?

Hi, can the 12 complimentary International lounge access be used for guests too?

Have to pay the lounge charges + gst + 3.5% currency conversion charge if its an international lounge). And as confirmed by hdfc phone banking, the 12 domestic + 12 international lounge facilities can be avail by the primary cardholder only, addon cardholders will be unable to use this facility.

Got my card last month. Initial limit was 5000 for a week, which was automatically updated to my current hdfc limit. 1st month statement got generated already, with no mention of joining fees. As its my 2nd hdfc card, the total limit is shared within both cards. Got 2nd marriott account, as hdfc forgot to add the required marriott membership in their cc form. Hdfc IT team got lazy. This means i have to wait 30+ days for being able to merge my 2 marriott accounts. Hdfc got a dedicated number for this card, and unfortunately they have no idea what is going on. I had a talk with hdfc cc dept, they said the joining fees will be added in my 2nd month statement instead. And the marriott dedicated number agent said only then, i will receive my 10 nights + 1 free stay night added to my 2nd account (after joining fees realization). And once i apply, it will take another 10 to 12 weeks for my marriott account to get updated (with the 10 nights + 1 free night stay). So for now, i am using the card with swiggy as it allows diner cards, getting 4 points.

@bala, hope my comment above will answers most of your queries, as for the merging, there is a form available on the marriott website. You need to fill your old membership and new membership and click on merge, will take 5 working days as told by the marriott staff. Do remember to keep the new membership, and delete the old membership. As all new points will get added from hdfc to your new membership.

One thing surprise me the most, my rm have never heard about this card and asking me how to get this card.. jeez. And then she started asking me to invest, same old same old.

So as for this new card, services are damm slow and time taking. You need to have a lot of sabar. I got frustrated few times while talking with these agents on phone, who have no idea which is what. But all my anger cool down whenever i hold this card in my hand, feels super premium indeed. I just hope the lounge access will work, i will be happy with that feature alone going forward with this card.

After 2 bill generations, HDFC still hasn’t charged me the annual fee.

Expect it to happen in 90 days (3rd bill ideally) and another 60 days for fulfilment of welcome benefit. Worst system indeed!

@Siddharth,

If that really the case, that would be ideal, since i saw in marriott website somewhere that its membership is valid till 31st dec each year, irrespective of when you become a member. Since i got my card in sep, and if i get the free night on jan 2024, then i would have 1 full year to redeem, and the 10 free silver night also. Gotta find some good in the worst also haha. I was using my hilton membership since the last 2yrs, now that i got the marriott card, i can get to gold status easy, but i dont see any real value of this card yet, other than 12 international lounge entries.

@Taj dhillon,

LTF literally means LIFE TIME FREE. But if you really want to make sure, that question must be answered by hdfc credit card deparment agent. And it actually depends on if you are using your card in the past one year, and in good standing, else the bank can degrade your card from LTF to FYF.

That means my nights will arrive in 2024. I’m not even sure at this point if Marriott will credit it to 2024 count or they will just add it to my 2023 nights total.

If credited by 2024, it will be considered for 2024 only for sure.

Thanks @Amarnath B for the detailed reply and clarification…. HDFC keeps proving their technical inefficiency in every interaction/ relationship we have with them…

My case is almost similar to yours, RM doesnt have a clue, infact the HDFC Bonvoy support team is clueless of the associated Bonvoy no (while I had clearly included that in my application)

Now I have received a new HDFC Bonvoy card with a 9 digit no below my name – I guess that would be my new bonvoy no. 🙁

I will start that adventure of merging the account now…

I have 2 nibling questions though:

1. My existing status is already Silver and I have 13 nights this year in my kitty already and I have booked 2 more for next week already – would make it 15 nights in the existing account…

Now once I merge and get these 15 nights to the new Bonvoy no. and get the 10 additional welcome nights also – it will become 25 nights – So will they be able to upgrade me to Gold with that??

2. What will happen, come 1st Jan, 2024 – Will I be retained in Gold itself?? post the yearly refresh??

And oh, to check your new marriott membership number, go to marriott website, go to login page, click forgot membership, input your email address (same email with hdfc), and you will get your new membership number in your email. You can then choose to continue register,change passport etc in order to access your new marriott account.

What will happen if someone doesn’t have extra points and no hotel available for 15k points? can it be transferred to other marriott member?

Respected members i will be highly thankful to you if anyone can answer my query. I have ltf diner black card which is going to expire in Jan 2024. If they renew it automatically whether will it be still ltf? Please let me know

Thank you and regards

Yes, it will be ltf.

Yes, you will get a renewed card automatically on your registered address and it will continue to remain LTF.

Thank you for information

Regards

Suddenly this marriott bonvoy co-branded card seems of value after the downfall of regalia series. I think i will be closing my RF card in the coming months.

@Baalakrishnan M S

1+2. Yes, you will get 25 nights = gold membership. Suggest you apply end of dec, that way your merge account will be active AFTER 1st jan (hopefully), so you will continue to reap the gold perks for 1 full year.

The points and membership validity are 2 different things.

@Rags

Points can be transferred to other members ******. Visit the marriott website for detailed info on this.

2nd month statement got generated and auto-emailed.

Some concerns:

1. They not cut the joining fees yet. As Siddharth mentioned earlier, maybe 3rd month.

2. No breakdown of bonvoy points, they just do the total points calculation and posted on page 2 of the statement. And my current point balance is 0, as its stated, points has already been credited to my marriott account. Which is not true. I called hdfc phone banking, they said need to wait 24 to 48hrs for your points to get added. Lets see after 3 days.

So as of now, my old and new acc has been merged. Old points has been transferred to my new acc. Account is showing as silver elite, with 10 free nights missing, plus 1 free hotel night missing.

Got my welcome email from marriott – showing features etc (after 2 months of using this card, marriott got slow LOL).

My 2nd month statement shows some mb points and said that it was already added to my mb account. But it has not. So after 5 days, i wrote a long email to support [at] marriotthdfcbank [.] com This is the reply i got from them –

Greetings from HDFC Bank’s Marriott Bonvoy!

With regards to your query below, we request that you allow us 72 hours of time to escalate this case to our concerned team to assist you further with the query. Also, please be informed that the joining fees will be included in your third-month bill cycle statement. The free night award will be credited within 8–12 weeks in your account, and the 10 elite night credits will reflect after 60 days post-joining fee realisation.

For more information or any feedback, please contact us at our toll-free number, 1800-309-3100, or mail us at [email protected].

Warm Regards,

Team: HDFC Marriott Bonvoy

—–

Hope this info helps others here regarding the timeframe of things. So for now Im still waiting on my mb points. Seems it will take almost 5-6 months to get the welcome benefits of this card.

Update on my oct 19th post regarding 12 domestic + 12 international lounges facilities for primary cardholder only :-

I went to my branch today and talked with the cc staff. She told me that addon are allowed both domestic and international lounge access. I showed her my phone call recording where the phone banking staff said it wasnt allowed.

So we called the marriott bonvoy hotline and rep did confirmed that addon card holders are allowed on both domestic and international lounges and share the quota with primary holder, which is 12 each on domestic and international lounges.

So if thats the case, they must have updated this internally. Can anyone else confirm on this ?

If this is true, this card score some more points.

Regarding my missing mb points from 1st and 2nd statements, the bank cc staff informed me that they will be available in my mb account after 3rd statement (thatis, after payment of annual fees).

This is seriously slow but almost time for my 3rd statement, so fingers crossed.

Anyone else here have this slow dealing with this card ?

Diners sometime back confirmed that lounge access is available on Add-on’s as well on Diner’s Black. As this works on Diners platform and as they treat it as premium card for now, ideally same should apply here.

Basically HDFC is building the systems after launching the product, which is worst part of this, but anyway hope to see all coming at once. Speaking of which, not to forget that reward rate is not great on this card.

This is the reply I received today from the REAL marriott bonvoy customer support, after I send them a big email mentioning the reward promises and the delays of the bank –

Dear Amarnath.

All this rewards that you mentioned, are coming from the credit card company, they give you this depending of the kind of credit card and promotions you have with them, for this matter, since the credit card account is different than your Marriott Bonvoy account, you need to contact directly the bank in order to get the status of those benefits and rewards.

Best regards

—

So for co-branded cards, its upto the bank. I had some free time on my hands, so I wrote an email hoping for atleast a quicker timeframe on things. But that doesnt seem to happen.

Can we make insurance payments and earn MB points as the exclusions don’t mention insurance spends specifically?

1800 3093100

Support at marriotthdfcbank dot com

Do call them and confirm, as of eight now i use this card solely for food @ 4mbp per 150.

I have taken this card as I was on the international tour .. and this card helped a lot with no caping in qtr and with add on card.. I used it on national and international lounge easily .. best card for lounge access .. ADD ON CARD GET SHARED Benefit .. WE CAN USE PRIMARY AND ADDON TOGETHER for lounge