SBICard recently launched the super premium credit card named AURUM which is positioned one step above SBI Card Elite. The card and the benefits makes it clear that SBICard designed AURUM for the high net-worth individuals by giving a premium touch.

But does that mean the card also rewards good on spend? Let’s see it in detail below,

Table of Contents

Overview

| Type | Super Premium Credit Card |

| Reward Rate | 1% to ~3% |

| Annual Fee | 10,000 INR + GST |

| Best for | Monthly spends of 1 Lakh & Golf lessons |

| USP | Bookmyshow Movie Voucher |

Aurum is the first ever attempt by SBICard to explore the super premium credit card segment and it’s a decent one. It’s a worthy upgrade for those holding SBI Elite Credit Card.

Joining Fees

| Joining Fee | 10,000 INR + GST |

| Welcome Benefit | 40,000 Points worth 10,000 INR |

| Renewal Fee | 10,000 INR + GST |

| Renewal Benefit | Nil |

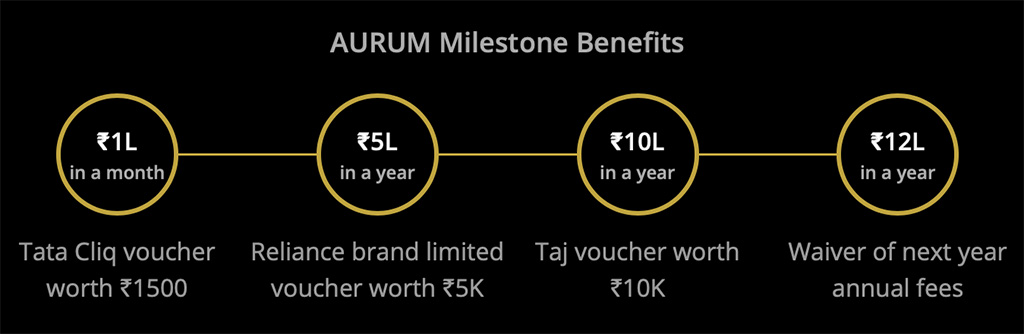

| Renewal Fee Waiver | Annual spends of Rs.12 Lakhs |

The reward points can be redeemed for hotels/flights or e-vouchers and can be considered as an equivalent to 10K INR. But the GST part (1,800 INR) is payable and is the only out-of-pocket expense.

Having no renewal benefit is a sad news though, meaning it holds good only for 1 yr if you don’t intend to spend ~12 Lakhs a year.

Design

On a quick research I found that the name Aurum is the latin word for gold and is also the source of its chemical symbol “Au“. Good work on naming!

So obviously you can see some touch of Gold in the card design. AURUM comes in a metal form factor and it looks very neat and clean in black colour with horizontal dotted golden strip.

Rewards

Regular Rewards

- Rewards on all spends: 4 points/100 (Reward Rate: 1%)

- Reward Point Value: INR 0.25 per point

Earn rate of 1% is definitely too low on a super premium card. But not to worry, you also get milestone spends to lift the reward rate a bit.

Note: Wallet loads will not fetch rewards on any of the SBICards.

Milestone Rewards

- Spend Rs.1 Lakh (monthly): Get Rs.1,500 TataCliq Voucher

- Spend Rs.5 Lakhs (annually): Get Rs.5,000 TataCliq Luxury voucher

- Spend Rs.10 Lakhs (annually): Get Rs.10,000 Taj Voucher

About milestone vouchers:

TataCliq vouchers are lately smooth when it comes to redemptions. There are no limitations whatsoever.

LUXE voucher may not be considered as cash equivalent for most, as it falls under LUXURY segment with products at inflated costs. Click here for the list of luxe brands. I wish they instead have Amazon/Taj vouchers for 5L spends. Luxe voucher is now replaced with TataCliq Luxury Voucher.

Taj Vouchers are great for travellers and that easily adds up 1% to the reward rate – a welcoming move. Very happy to see Taj vouchers with SBICard!

Speaking of the monthly benefit, I would rather wish it had a quarterly benefit like SBICard Prime – which a lot of cardholders love.

Rewards Redemption

- Dedicated Aurum rewards portal: Redeem for e-gift vouchers, flights, hotels, experiences & more

- Statement Credit: Not applicable.

- Redemption Charge: Rs.99+GST per redemption

So redemptions for statement credit is not possible with AURUM card. But I’m very happy to see Amazon / Flipkart and most other digital vouchers are also available for redemption.

I would any-day take e-vouchers instead of stmt. credit as they’re almost cash equivalent and it also keeps the statement clean. So this is a welcoming move, assuming we’ve Amazon/Flipkart vouchers all the time.

As of writing this article we do have Amazon vouchers available for redemption and I’ve redeemed one as well. Redemption experience is super smooth.

Memberships

Complimentary annual memberships with various brands as below:

- Dining: Zomato Pro (Domestic, All India),

Eazydiner Prime - Lifestyle: Amazon Prime, Discovery Plus,

Lenskart Gold, BBStar (6 months)

I’m not seeing a significant value out of the memberships except Amazon Prime and Zomato Pro (for metro cities). I wonder how they came up with Discovery Plus though – anyone here using it? – If so what’s special there?!

The biggest problem however is that these benefits are only for first year and that too you need to redeem them in a short time.

Airport Lounge Access

| Service | Complimentary Limits | Serviced by |

|---|---|---|

| Domestic Lounges | 4 / Quarter | Visa / Mastercard |

| International Lounges | Unlimited | Dreamfolks |

| Airport Spa (Domestic) | 1 / Quarter | Dreamfolks |

While unlimited international lounge access sounds generous, you know the pandemic math behind it. 😀

The Dreamfolks membership is a digital only card that can be used for international lounge access, spa and many other airport services (paid). To avail the complimentary lounge visits & spa’s you’ve to generate a QR code from AURUM Dashboard.

Update: Now physical Dreamfolks Cards are also being issued.

Its good to see the inclusion of airport spa benefit but I hope they’re not targeting just the solo travellers. I mean 1/qtr is too low, at-least 2/qtr or maybe 4/yr would have been nice.

But never mind, spa’s at Indian airports are not worth it from my experience. I would highly prefer to have airport meet & greet (or) airport transfer services instead.

Apart from that, fortunately the international lounge access membership doesn’t expire in 1Yr like those that comes with SBI Prime or SBI Elite.

Golf

- Complimentary Games: 4 / calendar year

- Complimentary Lessons: 12 / calendar year

The Golf benefit on SBI Aurum credit card is slightly superior than most other banks in certain aspect, as long as you’re playing within the above limits.

However, the downside is that its not unlimited, unlike in other cards like HDFC Infinia.

Movie Benefit

- Bookmyshow Offer: 4 free movie tickets a month (1K INR value)

- Max. Cap: Rs.250/ticket

- T&C: Max. 2 tickets can be booked at a time, with a cooling period of 24 hrs for next booking.

This is a very good benefit borrowed from SBI Elite. As you might know, this is not a Buy 1 Get 1 offer, but you get the ticket completely free + pay the convenience fee.

I used to avail these tickets when I used to hold SBI Signature credit card (now SBI Elite) and it works flawlessly.

But remember that you’re actually saving only 250 INR per booking as you can anyway get Buy 1 Get 1 benefit with other cards or through Visa. Though, you’re not limited to any Quota with Aurum, which is convenient for most.

Flight Cancellation Benefit

| Ticket Type | Coverage |

| Refundable Ticket | Rs.3,500/ticket |

| Non-Refundable Ticket | Rs.3,000/ticket |

Above benefit can be availed upto twice a year and the refund amount excludes taxes & convenience fees on the flight ticket.

This is a good benefit which I found by exploring the catalog. It is basically part of the Air accident insurance that comes with the card, but not to worry, they’re not expecting the flight to crash to avail this benefit.

Dedicated Services

- Secretarial Access: Let your secretary (or) personal assistant access the a/c on your behalf.

- Concierge: Dedicated lifestyle concierge service for AURUM cardholders.

Good to see these small yet useful features like secretarial access on AURUM. FYI: Secretarial access is also available on HDFC Infinia and all Amex cards.

Concierge Services are lot better than I expected. After testing them with couple of requests, I would say that AURUM concierge services are as good as Amex Plat Concierge services, to an extent.

Well, in-fact they are lot better when it comes to email response speed & follow-up’s.

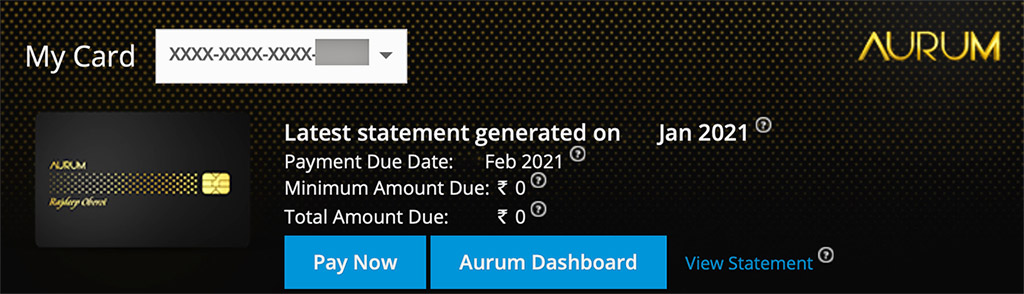

AURUM Dashbaord

SBICard has developed a beautiful dashboard for AURUM cardholders that lists all the benefits of the card, along with how to avail them. You can navigate to this dedicated Aurum dashboard from Card summary page on SBICard net-banking or even directly.

Amex also has a similar one page dashboard for activating Amex Plat Charge benefits but this one is pretty much like another website, and also shows you personalised details of your a/c.

For ex, it will show the Dreamfolks membership details once you’re enrolled. (Note: This section is not visible on MacOS Safari, for now)

Overall, this is a wonderful feature that lets you have a better idea of the card, all in one place.

Maximising AURUM

- Power User: If you use all the benefits the card offers, you will net at 4.7% reward rate, assuming you avail movie benefit every month and spend average ~1L a month for a year to avail monthly milestone benefit.

- Moderate User: But not all are power users, so practically speaking you should at least get 3% reward rate, assuming you use movie benefit (for 5 times a year) and spend over 1L a month (thrice a year).

Ideally ~3% is very much doable for most who might get this card, so this goes pretty close to HDFC Infinia (upto 12L spend) when it comes to reward rate.

Note that I haven’t put a value on other membership benefits here. So that’s an added advantage if you would want to find the total value you may get out of it.

Eligibility

- Income: >30 Lakhs p.a.

- Existing other bank Credit Card Limit: >5 Lakhs

While the above eligibility criteria is not “strict” per se, it largely revolves around the above numbers.

How to Apply?

Here are some of the ways to get this “invite only” credit card:

- Applying Online: Look out for an “upgrade” offer on SBICard website and app. You may also “show interest” via net-banking on Aurum website.

- Applying Offline: Metro cities are expected to have an AURUM RM to handle AURUM applications. You can connect with offline SBICard team to apply for one, through Aurum RM.

If you wish to check the eligibility online, navigate to the SBICard Net banking: Click on Benefits > Card upgrade. If eligible, it will show you a banner like this:

I was eligible for the AURUM credit card upgrade (from Prime) during the initial roll-out and I’ve applied and received the card. Check out my hands on experience with SBICard Aurum.

You “may” still upgrade offline without the Aurum RM as one of the reader said so but it may-not be easy to know a person know the existence of this card.

Also it seems SBICard doesn’t want to promote it to the mass segment as we cannot see the card listed on their website among other cards.

Is it worth an Upgrade?

SBICard AURUM could potentially give a lot of value to the cardholders, as good as ~4.7% if used well. But extracting that value is not easy unless you use it as a primary card!

Thumb rule to follow is: If a card makes you to think too much to juice value out of it, then it’s not worth it.

If you’re holding multiple cards like HDFC Infinia, Amex Platinum or Stan. C Ultimate then AURUM may not look attractive, but if you don’t hold any of these and need a super premium credit card then AURUM is definitely the card for you.

Ideally all those who’re holding SBI Elite with spends (>12L) may go for AURUM as you get enhanced value along with annual fee waiver.

Bottomline

- CardExpert Rating: 4/5

It’s quite surprising to see that SBICard has put in a lot of effort in building AURUM as seen through the attention to finer details to improve cardholder “convenience”.

But yeah, it would have been a killer product if it had come with better regular/base rewards, as 1% or even 2.5% is bit low on a super premium product without a major differentiating factor.

Overall, it’s a good card but could have been better when compared to the “rewarding competition”. However there is no harm in taking AURUM for an year, just for an experience – just like what I’ve done!

What’s your thoughts on this new super premium credit card by SBICard? Feel free to share your thoughts in the comments below.

Taking for a year and closing a card, guess it hits credit scores??

I had over 15 cards, so closed 3 of them last year and saw my score taking a dip despite punctual repayments. Then I randomly enquired for a home loan and they are no longer offering me the lowest rate.

Doesn’t affect much. Everyone saw a dip in the scores post lockdown which was caused by some complications in moratorium. How much was the dip btw?

Agree with Sid. The methodology to calculate CIBIL score had changed (I heard, it was around Jan-Feb 2020) causing dip for everyone.

I too hold multiple credit cards (around 15 right now) & had closed couple one-year-only cards previously, dint find any issue with my CIBIL score.

Dip of 43 points, to a score below 800. No new enquiries, no new card obtained, so no other major hits. Even the cards I closed didn’t have very high credit limits. A leading bank will now charge me 0.1 percent higher if I take a home loan with this slab.

I saw a dip of around 30 PTS. if I remember correctly. Is that normal?

It is. Most saw a dip between 20-30

Siddharth prior to Aurum you had which SBI card ?

Prime.

While the Amazon vouchers does it not make more sense to pay with Amazon ICICI CC for that sweet 5% Cashback. Other than this the Rs.99 for redemption is crazy for such a high end card and lets not forget the NO statement credit option “Thanks @Siddharth for confirming this earlier and in this article”

I do agree that SBI CC is required with all the Amazon linked discounts that come along. I had downgraded my Elite to a SimplySave exactly due to this and maybe will side grade to SimplyClick but even that does not have statement credit and there is confusion if any EMI I take on it will go for the milestone benefit or not.

Why did you say that you’d rather get vouchers instead of cashback? I’m curious to know.. All the cards I own don’t give equivalent vouchers to cashback against statement.

If I have to take a family of 4 members to a movie and try to use the 4 free tickets for a single show then it is practically not possible because of the requirement of keep a gap of 24 hrs between the booking of 2 tickets. If I book 2 tickets first and 2 tickets later then perhaps we all (4 members) will not be able to sit together as the adjacent seats will get occupied in this gap of 24 hrs. Thus, the free ticket offer is having restricted use.

Small question regarding redemption for evoucher.

To redeem voucher of Rs 5000 Amazon you have to pay Rs 5000 in points. So you pay 20000 pts or is the amount different.

In elite redeeming for Amazon gives Rs 2500 voucher for 20k points. Wanted to clarify this.

Also please tell which are the best value for points vouchers in Aurum as we can’t redeem for statement credit.

Hi why do you redeem 20000 points on elite for Rs 2500 Amazon voucher? For 20000 elite points, you get Rs 5k statement credit.

Hello Siddharth! I do hold a SBI Elite Card (Secured) with a credit limit of 2.4L. Last year my spend was 15L+ so is there any way to upgrade it to Aurum?

Another thing, what’s the forex markup fee? Is it 1.99% like Elite or more? As most of my spends are international, so this a big thing for me.

Was waiting for the review, glad you posted.

try for indusind metal card, mark up charge is 1.8% and reward rate is better

Hi Sir,

I tried placing request for upgrade from SBI Prime to Aurum via app but got response saying “Regret to inform that there is no offer available for upgrade”. My current limit is 8L and I have no savings account with SBI and holding this card for last 2years.

I know this is an invite only card but Is there any other way to get my card upgraded to SBI Aurum. Please suggest.

Does this card offer add-on credit cards?

2 free add on cards only

Any tricks to get this card? I currently hold SBI Elite and SBI Prime card. I’d prefer upgrading one of them to Aurum or getting another new Aurum card. Its been on offer only as invite only basis for quite sometime now.

May likely send the next wave of invites in few months. Not sure what’s stopping them from giving those who need it now though.

Aditya, Why are you planning to get not so lucrative SBI Cards. I see very little value in them. SBI Prime is of no use after they stopped birthday benifit and reward points for Wallet loads. SBI Elite too is a very low rewarding card. I have got my SBI Prime card downgraded to Simply Click. What’s your logic in keeping them?

The only reason I still have my SBI prime card hanging around is in the hope that one day I can get it upgraded to Aurum. I want to have one SBI card around with me and having the best card in their catalogue helps. Also I do watch a lot of movies in theatres too.

Hi siddharth, I have an hdfc infinia card. I have an annual income of rs. 50 + lakh. How can I get Sbi Aurum card . I don’t have any existing relationship with sbi or sbi cards

Just express interest on their Aurum website and pray you get an invite…I expressed interest for 4 different family members but only my wife got an invite call…It’s a very classy way SBI is doing this after solid profiling.

Already have the Diners Black Card from HDFC.

Do you think it makes sense to go for this credit card or just keep on using the Diners one?

SBI Credit card department said we can apply for SBI Elite and at the time of final verification call if we say like I need Aurum and do not want Elite, they will proceed with Aurum it seems. And the application processor from SBI said this very confidently and did few like this it seems.

Did anyone ttied that trick ? Pleass let me know.

I tried this and it doesn’t work

If I take Aurum for an year, can I roll back to Elite after that or will have to just surrender it?

HOW I GOT LTF SBI CARD

I had gotten this card as an upgrade for my SimplySAVE 5L CL ‘ELITE downgrade 8L CL’ last year but as my one year will get over in April I asked them to cancel the card.

Now comes the unexpected part the guy from the cancelation desk told me that I should not cancel the card and that they will reduce the fee but he did not say how much since it will depend on the review team. Reduced fee was not of interest to me since the use case for this card is very low and I could not spend enough to get fee waiver.

After my denial for the same he offered depending on approval to reinstate my old SimplySAVE as a LTF card 😉 Yes that’s right a LTF SBI CARD. The process is simple he will first downgrade my AURUM to SimplySAVE and then raise a request for LTF.

From what I understood the following is required for fee reduction & LTF SimplySAVE/CLICK :-

9ish Lac spending in a year

4-5 year old relationship

Request for cancellation of current card

Some other pointers:

The normal customer care don’t know anything just talk directly with the cancelation team.

There is a chance that if you don’t have a SimplySAVE class low end card in your history or active they won’t give any LTF offers.

They don’t give PRIME/ELITE/AURUM as LTF I tried very hard for ELITE for LTF even wrote a email with my INFINIA statements attached but nothing. I got a call from their back team today that the SimplySAVE is now LTF but you will have to apply for a new paid ELITE and that PRIME/ELITE/AURUM are paid only for customers other than SBI employees.

LTF is indeed new with SBICards. Thanks for sharing your experience.

I am ex SBI and I have both prime and Elite ltf

Hi

My SBI AirIndia Signature card has been dispatched.

I got a call from the Aurum team asking if im interested in the Aurum Card.

there are 2 option-

1. Cancel Air India card and upgrade to Aurum

2. Wait for 3 months and then apply for Aurum. This way i can also retain Air India card.

looking for suggestions from experts.

Regarding the cancellation benefit on airlines offered under AURUM, is it just restricted to the individual holding the card or for any other person, as long as you follow the basic steps of booking through travel agency websites.

I just got Aurum card today. I had a PRIME card with limit less than 2.5L prior to applying for this. I applied through the website and got a call back within a week. Here are the criteria that the person told me (verified with 3 different sources):

1. The existing card should have a 2.5L+ limit

2. Your monthly net salary should be 1.75L+ (They did not know the ITR limit for the same)

3. You can either apply for Aurum as a new card or upgrade the existing card.

In my case, the executive processed the CLE along with the upgrade so I got a higher limit along with Aurum upgrade. The card process was done in less than 4 working days.

Hi Chinmay,

What are the documents you provided for CLE nd Upgrade?

Just the salary slips!

Do you get a single Taj voucher of Rs.10,000 or in smaller denominations totalling up to Rs.10,000. Can it be redeemed against Hotel Stay only or room dining too?

You get one single voucher of Rs. 10000/-

Received the voucher few days ago.

i will update regarding the usage once i redeem it.

Hey Sid!

Are you still holding onto Aurum or downgraded it to some other card?

Renewal is yet to happen.

Hey Sid, How is this card better than the Axis? Also, does owning both Axis & Aurum would benefit.

How’s the limit assigned for this card? When other banks are offering higher limit on card like Infinia etc? Does this card provide higher limit or nsl like Infinia?

Limit assigned is not that great.

i was assigned 2.5L when i got the card in Feb2022.

RM said that it can be increased only after 6 months, so im waiting for that.

I had a 9L limit on my HDFC Clubmiles at that time.

Does this card provide higher credit limit or no spending limit like Infinia card? Any idea on minimum and maximum CL ?

Hey Siddarth,

Does it make sense to have both Aurum and Diners Black?

Depends on how you use it. I have both.

I get Rs. 2000 TataCliq voucher from both of them.

Bookmyshow offer is great on Aurum.

It all depends on how much ur spending monthly.

Does SBI consider spend made on 30th June in June milestone or July? (like HDFC).

How long after reaching the spend milestone does one receive the voucher?

Aurum got a devaluation from 2nd July. Zomato Pro is not given anymore as a first year benefit. Seems like this card is only worth keeping for a year at most.

Also you can get the physical dreamfolks pass by ordering from aurum helpline/mailing aurum team.

call customer care or contact ur Aurum RM.

You will receive it in a few days.

Dear Siddharth, is your gross above Rs 40 lakhs? On Aurum, it is mentioned that we should be above Rs 40 lakhs gross to get Aurum or is there any other way to get the card?

Hey guys, when I applied for an SBI Aurum card, the RM told me that I will get 40K reward points after paying the joining fee, which I can redeem in exchange for 10K amazon voucher. But now, I checked rewards portal and found that 5K amazon voucher costs 38K RPs!!!! I feel cheated now. How to maximize Points redemption for SBI Aurum? Help would be really appreciated!!!

What’s the status?

you got 10K amazon voucher or its still 5k?

Club Marriott membership is now a welcome gift.

What are the new changes?

20L spending – 20K Apple vouchers

New membership to Mint/WSJ

Anything worthwhile?

What is the conversion ratio from aurum points to Amazon pay?

Hi,

I have an offer to upgrade to Aurum from SBI Elite that I currently hold and hardly ever use.

Most of my spending is divided between my life time free HDFC Diners Club Black card ( where I also have an option to upgrade to the metal version, with 10k annual fee) and Axis Magnus.

Does it make sense for me to upgrade to Aurum? If I upgrade then I would have to shift my spending from Diners Club Black to Aurum. If I don’t opt for Aurum then I will surely surrender the SBI Elite card soon.