SBI SimplyClick Credit Card is one of the very few credit cards in India that has pretty good reward rate on regular spends for beginners.

While it used to be one of the most sought after entry-level credit card in the past because of the 10X rewards, it’s still a good pick in it’s current form. Here’s everything you need to know about the SBI SimplyClick Credit Card.

Table of Contents

Overview

| Type | Cashback Credit Card |

| Reward Rate | 0.20% – 2% |

| Annual Fee | 499 INR+GST |

| Best for | Online spends upto 2 Lakhs a year |

| USP | Milestone benefits |

SBI SimplyClick Credit Card has been the only best entry-level credit card until the launch of SBI Cashback Credit Card.

While SBI Cashback Credit Card is primarily meant for online spends with the possibility of getting devalued anytime, SBI SimplyClick Credit Card is evergreen and could get you a decent reward rate of over 2% on annual spends of 2 Lakhs, thanks to the milestone benefit, which we’ll see shortly.

Fees & Charges

| Joining Fee | 499 INR+GST |

| Welcome Benefit | 500 INR Amazon eVoucher |

| Renewal Fee | 499 INR+GST |

| Renewal Benefit | – |

| Renewal Fee waiver | Spend 1 Lakh |

While Amazon voucher takes care of the fee for 1st Year, annual spend of just 1 Lakh is sufficient for the renewal fee to be waived off, which is easy for most cardholders in the segment.

Design

SBI SimplyClick Credit card is probably one of the few entry-level cards that also looks good in terms of design.

Earlier it used to be in matt finish and now it’s being issued with a shiny front face that looks more appealing.

Rewards

| SPEND TYPE | CASHBACK % |

|---|---|

| Online Spends | ~1% |

| Offline Spends | ~0.20% |

| Select merchants (10X) | ~2% |

- Points Validity: 2 Years

- No points on discounted products on Flipkart/Amazon

Note that the point value on SBI SimplyClick Credit Card has dropped from 25ps to 20ps recently.

But the good thing is that we can redeem points for Amazon Pay eVouchers which is almost cash equivalent.

10X Rewards

- 10X Rewards = 10 * 0.20 = 2% Reward Rate

The SBI SimplyClick Credit Card was quite popular in the past because of it’s 10X rewards especially on Amazon for obvious reasons but that it no longer available.

While the current partners are decent, the drop in point value further makes it less attractive than it used to be.

Milestone

| SPEND REQUIREMENT | MILESTONE BENEFIT | VOUCHER TYPE |

|---|---|---|

| 1 Lakh | 2,000 INR | Cleartrip/Yatra |

| 2 Lakh | 2,000 INR | Cleartrip/Yatra |

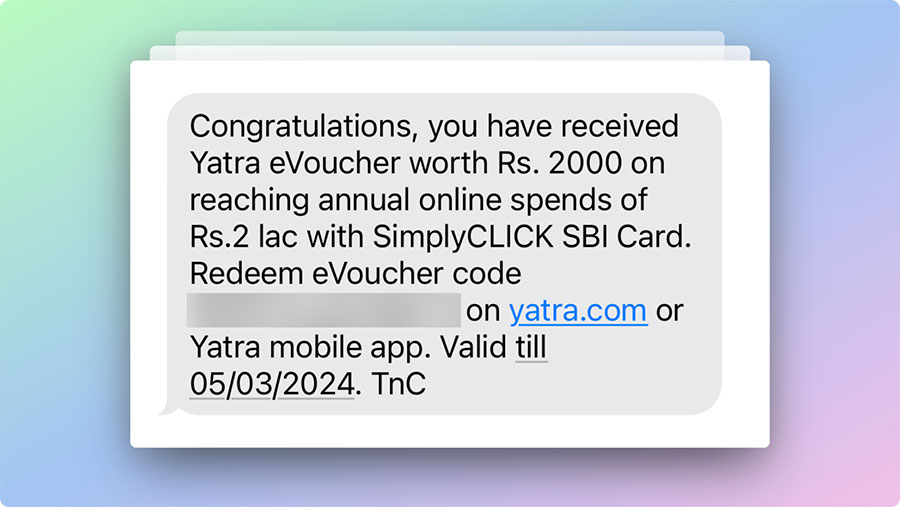

- Yatra Voucher: Can be redeemed for flights/hotels

- Cleartrip Voucher: Can be redeemed only for flights

- Voucher Validity: 4 months

- Voucher is usually triggered in ~2 weeks of reaching the milestone.

This is a neat and simple benefit which is useful for travellers. While they used to have only Cleartrip Voucher in the past, it seems they’re now offering Yatra Vouchers.

So by reaching the milestone through typical online spends, one could easily get a sweet reward rate of 3% which is great for this segment.

My Experience

I was using SBI SimplyClick Credit Card in the past, before moving to SBI Prime for few years and then to Aurum.

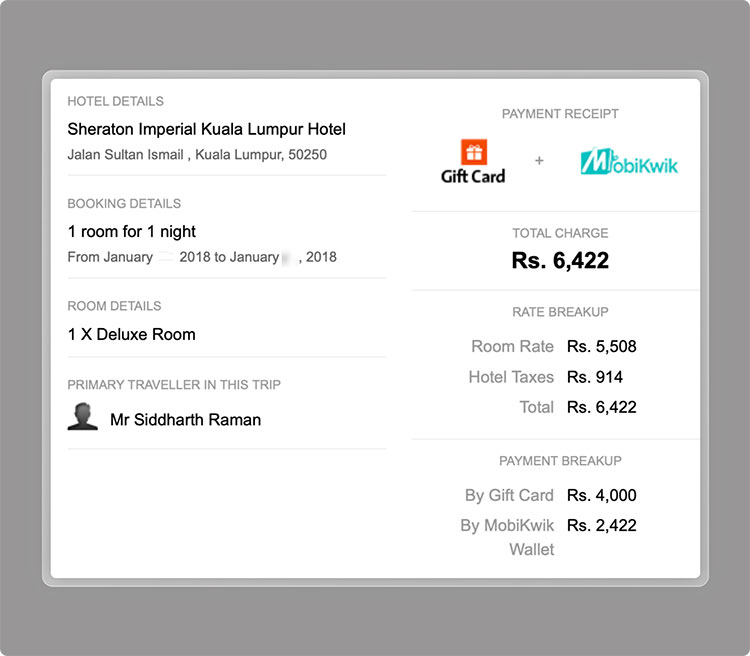

Back in time I got the Cleartrip vouchers which I used for a stay in Malaysia. The redemption was quick and simple.

And I recently downgraded my Aurum to Simplyclick once again to primarily retain the credit limit on the card.

And for the milestone spends, this time I got the Yatra Vouchers. Hope the redemption is as simple as it used to be on Cleartrip.

While I haven’t used the Yatra voucher, from t&c it appears to be a straightforward process to redeem them as well.

How to Apply?

SBI SimplyClick Credit Card can be applied online which uses the latest sprint application system for quicker processing.

If you’re new to the sprint application process, this article may help: SBICard Sprint Credit Card Application Process.

Bottomline

- Cardexpert Rating: 4/5

The SBI SimplyClick Credit Card is great for beginners who can spend 1L (or) 2L a year, at offline stores or online.

If your annual spends are over 2 Lakhs and if they’re primarily online then you should instead go for the SBI Cashback Credit Card that offers lucrative 5% Cashback on online spends.

While the Cashback Card is the hot pick for beginners since 2022, it may anytime go for the next round of devaluation.

Nevertheless, SBI SimplyClick Credit Card also serves as a solution to hold the credit limit until the next premium credit card arrives.

Do you hold SBI SimplyClick Credit Card? Feel free to share your thoughts in the comments below.

Must say Sid has been extremely generous with his ratings of late, SimplyClick has really lost much value of late. Not only are the points value downgraded, SBI no longer provides reward points for any transaction that involves any instant discount. With the points lapsing in 2 years, and redemption requiring multiples of 2500 points at least, one may not actually derive much actual value from the card particulary if you have multiple cards. SBI is also adding all kinds of new fees and charges, and the list of excluded categories for which rewards are not provided, are increasing.

SimplyClick was good once upon a time, not any more. Nothing more than a 3.2 I suppose.

I see it as a “spend 2L and forget” card which works even for those holding multiple cards. But yes, not for regular spends.

I’ve dropped the rating a bit. 🙂

The elephant in the rewards is the deduction of points which are issued in 10% discount Amazon and Flipkart sales. The reward rate becomes ultra poor.

Quite surprised to see that SBI has the tech in the place to track those discounted sales.

And yes, I see it’s good only for 1L/2L spend, else it gives ultra low rewards as you said.

Hi Sid,

Like to add few more insights.

1. SBI has withdrawn RPs for transactions offering instant discounts quite long ago but now they’ve made it tricky (can be termed as fraud as well).

They provide RPs for such transactions and it stays for months. When you wonder if they’ve started providing RPs for those transactions and redeem those available points, 2-3 days later (or in next statement) you’ll find charges mentioning ‘RP FORFEIT FOR CBK OFFER’. The charges are most probably @25ps/point.

2. To redeem the Cleartrip/Yatra vouchers, you MUST use the same card to pay the balance amount, else the transaction won’t go through. Previously any other card (or payment methods) could be used.

Thanks for the info Pranab.

Never knew they started charging as well. #2 seems not fair either. I’ll redeem in a week and update my experience here as well.

For redeeming yatra,you can use any payment mode..For clear trip ,you must use the same simply click card.. personally tried and tested

Also one needs to be always ready to face the shock of reward points forfeit from the statement even if you never redeemed any reward points..Worst customer support

Till now I thought this forfeiting is only for SBI CB card.

Waiting for your best CC for 2024 list 🙈

It’s finally up.

The best part of this credit card for me has been the ‘10% off on SBI’ offers that Amazon has during their Great Indias Festival and other sales.

SBI seems to be reading the signals at last. Have introduced Swiggy vouchers for reward redemption at Rs 0.25 per point, bringing the reward value back to 0.25, 1.25 and 2.50 for the different categories of transactions. Amazon is still at Rs 0.20 per point only, but Swiggy is a practical enough option for many.

However, the rules about no rewards for transactions with any card discount remains, and as the base reward rate isn’t great, and as the points are valid only for 2 years, redeeming points on the card still is a tough ask, particularly as SBI doesn’t have a policy of letting points plus card payment option…

Thanks for this update.

I just went ahead and redeemed some Swiggy vouchers @ 25ps/point. 🙂