SBICard recently came up with a pure cashback credit card that gives upto 5% cashback on online spends which beats any existing cashback credit card in the country. Looking at the way it is designed, it’s not only a great card for beginners but also for super premium cardholders to spread their spends. Here’s everything you need to know about this must-have cashback credit card.

Table of Contents

Overview

| Type | Cashback Credit Card |

| Reward Rate | Upto 5% |

| Annual Fee | 999 INR+GST |

| Best for | 5% Cashback on online spends |

| USP | Higher max. cap. on monthly Cashback |

SBICard Cashback Credit Card is the best Cashback Credit Card in the country hands down. If you’re into entry-level cards and looking for optimising online spends, this is the only card you ever need.

At 5% earn rate on online spends, its even better than the super premium credit cards if you just look at the reward rate on online spends.

*** Best Cashback Card of 2023 ***

Fees

| Joining Fee | 999 INR+GST |

| Welcome Benefit | – |

| Renewal Fee | 999 INR+GST |

| Renewal Benefit | – |

| Renewal Fee waiver | Spend 2 Lakhs |

The not so attractive thing about SBICard in general is that there is no renewal benefit even on payment of the joining fee.

While that’s a problem with most SBICards, it shouldn’t matter much for the Cashback Card, as you can anyway get the renewal fee back just with 20K INR online spend. Though the renewal fee waiver is easy to hit for most.

Note: The joining fee gets temporarily waived off from time to time.

Rewards

| SPEND TYPE | Cashback % |

|---|---|

| Online Spends | 5% |

| Online Spends (>1L per stmt cycle) | 1% |

| Offline Spends | 1% |

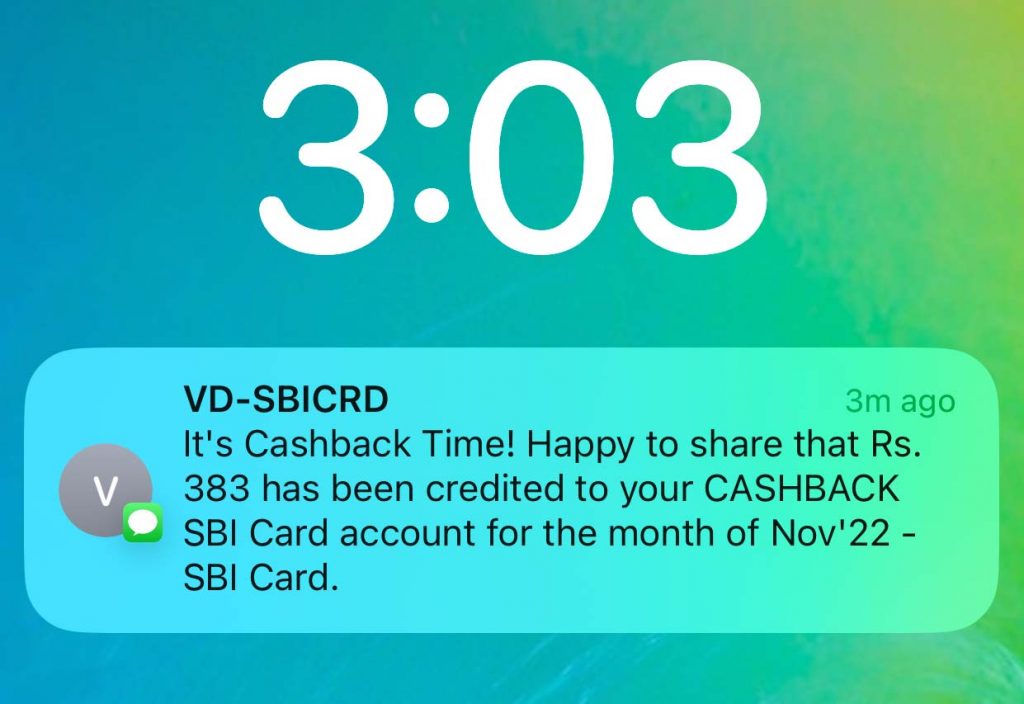

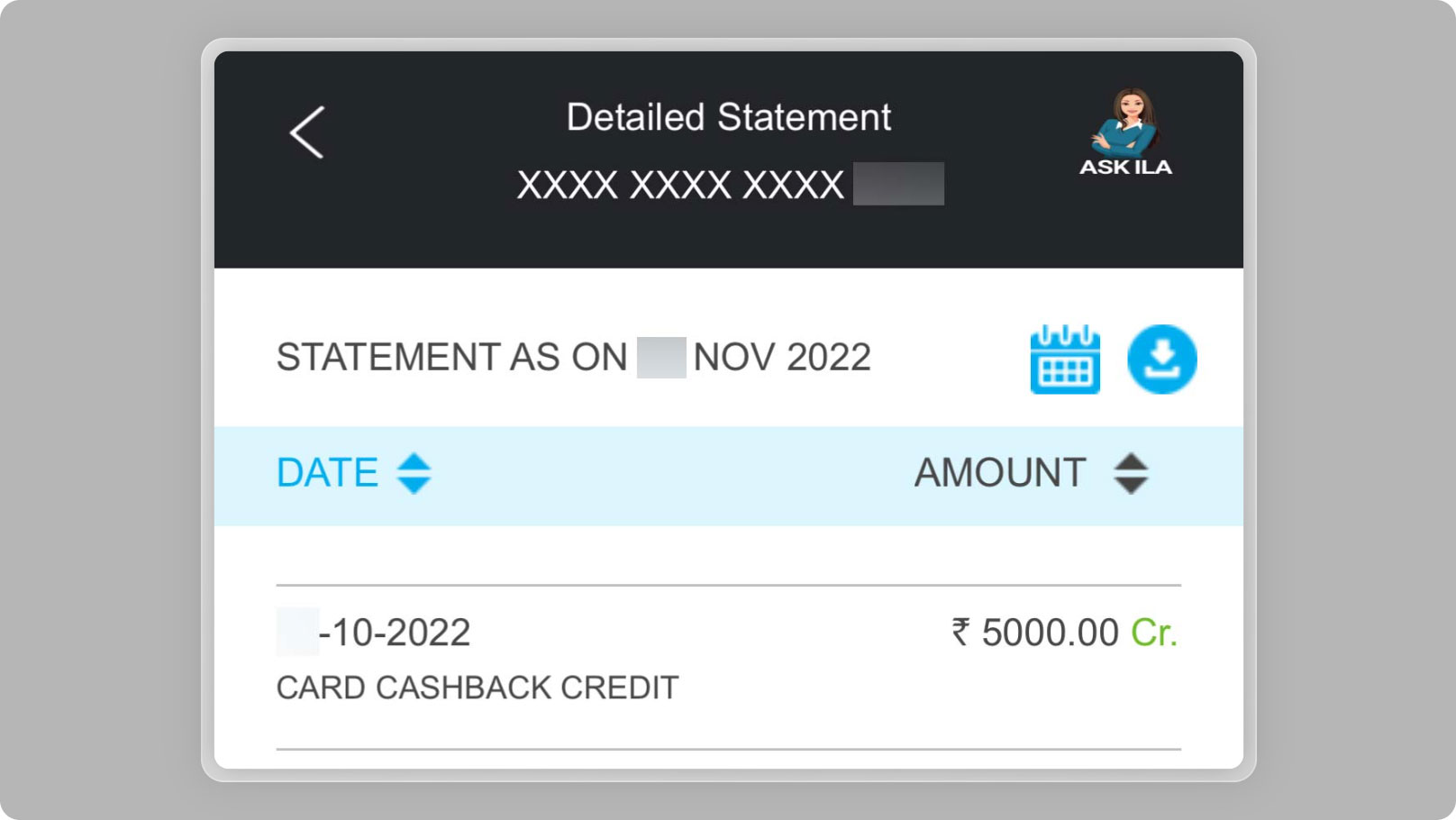

- Cashback gets credited within 2 days of stmt. generation

- Max Cap: 5,000 INR Cashback per stmt cycle (Spend equivalent: 1L Online)

Note: Cashback not applicable on Rent Payments, Fuel Spends, Wallet loads, Insurance, Jewellery, Utilities, gift shops and lot more as mentioned here. (eff. 1st May 2023)

The max cap is now reduced to 5K not only on online spends but also for offline / all kind of spends.

5% reward rate on most regular online spends is great without a doubt as the competition hardly gives 2% max.

This is not only the best cashback credit card in India but in the entire world, even after the devaluation, as no one ever launched a 5% cashback card in the entire planet.

For utility/insurance spends, you may anyway buy “Amazon Pay” vouchers and pay via Amazon bill payment system, as they have almost all bill payment services under the sun, limits applicable though.

Note that gift vouchers bought on gift card portals will no longer fetch cashback.

If you’re into super premium cards, you may benefit even better, as you can buy vouchers at 3X/5X rewards on Axis/HDFC gift voucher portals using Axis credit cards that may give you much more than 5% return on spend.

With all that said, it’s like a combination of Axis Ace & ICICI Amazon Pay credit cards on a single card.

Airport Lounge Access

- Update: Lounge access benefit has been revoked on this card, eff. 1st May 2023

| ACCESS TYPE | VIA | LIMIT | GUEST ACCESS |

|---|---|---|---|

| Domestic Lounge Access | Visa | 1/Qtr | – |

While you just get one access per qtr to domestic airport lounges, the advantage is that it’s accepted at over 40+ lounges in India, including the beautiful 080 lounge in BLR.

As most entry levels cards with HDFC and Axis doesn’t give access to all lounges in India, this card may help when other cards are unable to give access.

Credit Limit

One of the rumours about the Cashback card is that it gives ultra low credit limits, as low as 10,000 INR.

This usually happens when you have multiple SBI Credit Cards, as SBICard isn’t generous with credit limit since past few years. So it applies to all SBI Cards when you apply for a 2nd card and it’s not limited to just Cashback card.

I’m sure of this because I myself got <50K INR credit limit on Cashback card (2nd card) while my friend got ~3L Credit limit (new to SBICard).

If you’re already holding a SBICard and getting closer to 5L credit limit on it, expect a very low limit on the 2nd SBICard.

But you may anytime call SBICard support and ask to transfer some of the limit from the existing card to the new one. I did the same by transferring some limit from Aurum Card and the updated limit reflects instantly.

My Experience

I applied online and got the card approved in about 10 days (with virtual card ready to use) and it took another 7 days for physical card delivery.

The cashback system is quite simple and works flawlessly, as expected. If you wish to cross verify the txn type and cashback, you may find it via spend analyzer on desktop. Note that the spend analyser on SBICard mobile app shows wrong txn type, for unknown reasons.

The only downside is that you can’t use it on Amazon/Flipkart to avail the instant cashback, like with other SBICards.

How to Apply?

SBI Cashback Credit Card can be applied only online through their newly developed Sprint onboarding system. If you’re new to it, this article may help: SBICard Sprint Credit Card Application Process.

Here’s the referral link to apply online which will also give you additional 500 INR voucher on 1000 INR spend done within 30 days.

*** Best Cashback Card of the Year 2023 ***

Bottom line

- Cardexpert Rating: 4.5/5

With 5% Cashback literally on almost all online spends, lounge access to all airport lounges and improved onboarding, SBI Cashback Credit Card is indeed the best cashback credit card in India.

I never thought SBICard would go this aggressive on entry-level cards. While this is great, I wish to see such aggressiveness on their super premium cards as well. 😉

However, remember that 5% cashback upto 5K INR a month is not going to last long. It’s more of card acquisition model and so expect it to be “trimmed” as soon as the issuer gets sufficient users on the platform.

So we’ve already seen the 1st round of devaluation eff. 1st May 2023 and looking at how lucrative the card is, we may expect the 2nd round of devaluation in a year or so.

Make hay while the sun shines!

Do you have SBI Cashback Credit Card? Feel free to share your thoughts & experiences in the comments below.

Thanks for the useful article, Siddharth. I also got SBI cashback card with 10k limit. But despite repeated requests they did not re-assign credit limit from my club vistara card to Cashback card.

Also I noted that 5% cash back was not awarded on transactions like payment of maintenance fee to housing society, insurance, education, NPS (given 1% only). These transactions are not covered in MCC codes excluded by the Bank in terms and conditions. My experience with customer care has been hopeless. The worst part is the statement does not give break up of cashback and one has to just guess about it.

Any clue about why these should not be eligible for 5% cashback?

Txn wise summary would be great for sure.

But we can’t demand much with this card and have to bend to how their system works, which is all based on MCC given by payment gateway. It’s quite obvious anyway, as giving 5% on most txns is not something a listed company would risk themselves in.

Try Amazon ICICI. Gives 5% on all transctions

education – I got when I paid my kid’s school fee.

Hi Siddharth,

My SBI vistara CC was rejected couple of months back stating cant have multiple cards, Just have IRCTC card for over 7-8 years now, so was hesitant to apply this one initially.

Anyways gave a try with your link and gave all the required details and got the cashback card approved with limit of just 10k, will have to transfer some limit form other card now.

However was asked to perform an additional step where my bank details were asked where they credited Re.1 and in next step asked me to deposit it back with net banking, haven’t seen this with any other process earlier.

Just had one doubt, is there any minimum transaction amount for 5% cash back or 5% cashback will be on the total cumulative amount in next bill.?

Thanks.

Thanks for sharing your experience. Seems the Sprint has multiple verification flows.

There is no minimum txn amount.

They ideally calculate the Cashback per txn and credit all the Cashback at once.

Minimum order for 5% cb is Rs. 100 per transaction. Anything below Rs. 100 won’t fetch any cashback.

Hi Siddharth,

You should have highlighted about rounding down and separate calculation of cashback into 1 and 4%. With these, the effective CB% may be around 4%.

Example please?

Hi Siddharth,

As per their T&C, fractional paise will be rounded down to for cashback calculation. Like in case of Rs. 7.99, cashback will be posted as Rs.7 instead of Rs. 8. Flipkart axis card also follows the same but Ace card will be different. They round up if the paise is above 0.50, like in this case, it will be Rs. 8.

Coming to cashback calculation, sbi not calculating 5% directly. First they are calculating 1%, rounding down and 4% calculation again and again rounding down. We can observe this for any paisa based transactions instead of round figure. For example, transaction of Rs. 1,354.99 would fetch cashback of Rs. 67 instead of Rs. 68 due to rounding down and separate calculation. This may be small but in long run, definitely good chunk of amount!

Your calculation holds good only for transactions that are not multiples of 100. for higher transactions it hardly matters.

ex – 100 -> 5% cashback

90 -> rnd(4.5 ) -> 4 rs cashback

irctc, even apsrtc gives 1%; maybe all govt related pays i expect it to be 1%only

i tried buying amazon pay gift card for 2k from gyftr, card got immediately blocked citing suspicious activity. maybe SBI will block all spends which it deems not beneficial for them

swiggy gives 5%

Buying from Amazon is smooth always. But any reason to buy from Gyftr? Hope it’s not permanent block?

Gyftr gives 1.5% upfront discount for Amazon voucher, so we can get almost 6.5% benefit. But the card would invariably be blocked in the first attempt, one has to unblock, wait for 2 yrs (or do some other transaction) and try again in Gyfrt portal. However I used the card in yono app and faced no problem to purchase vouchers.

I have SBI credit card and have been using it for a while. But unable to use yono app. Does it need an SB or loan account to use it ?

thanks siddarth.. i am such a tubelight, never thought of buying from amazon itself :—)

after the card was blocked , received an automated call from sbi and after my certifyng , card was activated again

Gyftr.com/sbiyono gives extra 1.5 % discount on Amazon voucher

Thanks for the tip Naveen!

Sbiyono is giving 3% off on amazon vouchers but cashback cards gets blocked on gyftr/yono..

I bought 10k they blocked, then got it unblocked and bought 5k. My limit is 1 lakh.

This is my first SBI CC and i got 20K limit!

I already had another SBI card with 5 L limit. Got 10K limit on SBI Cashback and got the first card’s limit reduced to 4.9L. Spoke to CC for limit increase and he couldn’t help. Will try to use your method and get some limit transferred. Literally using the SBI Cashback card as pre-paid one. Good thing is they also give 5% cashback on school fees paid online.

Can you please tell me how you are getting 5% cash on school fee payment, directly paying online on school websites or by using any other application

I have paid through the school’s portal early this month and cashback is reflected in the cashback earned since the last statement field.

Through the school website.

They have Payment Gateways of TechProcess and Paytm.

I always choose TechProcess over Paytm.

Sir

Try paying through CRED. you should be getting 5% cashback

Got the Limit transferred from the older SBI card to the new SBI Cashback card. Thanks for the guidance.

My sister got this card for herself and I thought of getting an add-on card for me so that I don’t have to pay annual fee after a year. The card’s page clearly states you get free add-on card and I applied on September 20, but still haven’t received it. We escalated it to SBI Support, then to Nodal Officer and then to Customer Support Head (PNO) and after almost 3 months, the PNO responded asking me for Application reference number and if I submitted KYC, if not please resubmit. This is horrible customer support as the application reference number was given, and I also explained to them that no one came to collect KYC documents for add-on card holder at the scheduled time.

Same happened with me, got 10k limit because my other card has 5L limit, did a Amazon Pay Translation worth 9850 and card blocked. Called helpline and their point is since my limit is 10k and trans amount 9850 is very close to my credit limit hence they suspect a suspicious activity! Like seriously dumb. Asked the executive to transfer some limit from my other card, but he refused citing that cashback card is new so it’s not eligible so soon. As for unblocking the card he said I will receive a verification call in 24-72hrs and then they shall unblock the card. So much hassle for a mere 9850 transaction! God save sbi

I got 20k limit. Dropped an email to Customer care Head requesting it to increase it to 2L by transferring some limit from Octane Card. They did it in 2 days. Try dropping an email

I recently got this card, I never known that purchasing Amazon Pay voucher will give 5% Cashback, I done a mistake by paying my insurance premium of 75K with this card directly and got only 1% as cash back, from my next premiums i will try to purchase Amazon gift cards, so i can get better cashback.

“Insurance Paid directly” means you paid thru insurer’s site or directly from Amazon? Pls. clarify

Paid directly on insurance website. I did the same.

We need to buy cash vouchers of Amazon pay and then use Amazon pay for utilities to gain 5%, else its just 1%

I got cashback card as soon as it was launched and was also able to transfer limit (50:50) from my BPCL card which had a limit of 5lacs all this was done via calling customer care on a single call no issues whatsoever.

Initially got limit of 10K , transferred 4.5L from another card by calling customer care which reflected instantly showing 4.6L as limit now. Using it for last couple of months. Card look and feel is pathetic, cheap plastic! But who cares about look when you get handsome rewards 😜

I got my SBI Cashback Card with 10K limit. I have another SBI Card with 3.5 Credit Limit. Called customer care to transfer the limit equally and it was done over the call itself.

How to connect to SBI credit card customer care on call? Everytime I call I am put on IVR with no option to talk to a person.

One thing to note.. SBI calculates 5% in weird way. 1% ( rounded down) + 4 % (rounded down) which gives 4-5% if you spend more than 100. and 2-5 % if you spend less than 100.

Eg. if you spend 124 rs. 1% of 124 rounded down is 1 and 4% of 124 rounded down is 4 so you get total 5 rs cashback which is 4%

Eg.2 if you spend 99 then you get only 3 rs cashback which is 3%

and if you spend 49 you get 1 rs cashback which is 1%

its very small difference when you spend higher amount and significant in lower amounts.

Just to keep in my mind..

In axis cards if you spend <200, you get zero.. Thats how it is in multiples of 100/125/150/200 for different banks. Amex has multiple of 40

You will always lose some points/cashback.

Applied through the CE Link yesterday night. Done the biometric verification today at office. No documents collected. I am told card has been approved and dispatch team will call tomorrow to verify all the details once again.

Is it absolutely necessary to have an account with SBI to apply for this card?

Not required.

SBI Cashback Card is my first card from SBI stable. I got it within couple of weeks of application as well. I got a limit of ₹4.1L! Just loving it and it nicely compliments Infinia for those online spends not covered by Instant Vouchers from Smartbuy.

I hold an Amazon Pay ICICI card, Flipkart Axis & DigiSmart for Myntra. Since most of the online purchases will be from these sites, I dont find any reason for getting the cashback card. Do you think the same?

Everything is relative in this universe. The answer maybe YES for you but not for all. 🙂

Lounge Access also considerable if the existing cards don’t have the access to your requirement.

Are you sure this card gives access to 080 BLR lounge? Even many super-premium cards like Infinia, DCB, IDFC Wealth, etc., are not accepted there.

Sure ! I have used it and got access in dec 2022 only

Also amex travel platinum works as well

Yes, sbi cashback card gives access to 080 Lounge at level-1 Bangalore airport. Used in October/2022 month.

Wanted to get this card on upgrade from my Simplyclick but was told that the bank is not offering any upgrade/downgrade to the Cashback card. Initially they weren’t even sure whether one could apply for this card if your other SBI card isn’t a co-branded one. Seems one can after all, but as a separate application. Would give another try soon. Thanks for the review Sid, has been really looking forward to your take…

I tried applying through the link provided by you but Journey is not proceeding further & is showing to remove the referral code

Please retry by EOD.

Also note that SBICard don’t actually fulfil this referral benefit. I’ve not got any till date either. But you can escalate and get it done, most likely.

Thank you Sid!

I was just looking for a card for income tax payment as Infinia is not going to give any reward points on it from next year.

Saw this review and applied through your link. Verified through Digilocker, and was asked to check back within 12-24 hours.

However within 4 hours, I got an SMS saying the card application has been successfully submitted. I just followed the ‘track’ link from the SMS to fill up some more details, including VKYC, and the virtual card was generated within few minutes !! No paperwork, No phonecalls. Never expected it to be so quick :-).

Now, the limit is just 10K. I don’t have any other SBI card. What can be done to get the limit increased?

Thanks in advance.

Oops, looks like Sprint is drunk!

Please try escalating.

Otherwise, getting another regular SBICard after few months and moving the limit here is the only option.

Hi PM

Infinia stopped giving the points on government spends since 1st January 2023. Infact, when I spoke with them, there was even some confusion as to whether they would give points on transactions that were “settled” post 31st January.

Have you heard anything on that?

Also, post 1st January, I’ve begun making all government payments through my Stan C Ultimate card which still gives 3.33% on government spends. I am looking for more options though as my government payment volumes are fairly high – have you chanced upon any better options?

what is the best way to redeem sc rewards? I don’t see amazon gift vouchers.

What about Gold purchase?. Whether 5% is applicable for online gold purchase or online subscription to Gold purchase scheme.

I’ve been using this card to pay for monthly gold deposit scheme and been getting the cashback 🙂

Yes I am getting it for the monthly schemes of GRT

Hi thala. I tried applying through your referral link (using my spouse’s credentials). But during the last step of step 1, sprint is throwing out an error message “Sorry, we are unable to validate referral code. You can continue without it.”. I’ve tried copy pasting the code manually as well but in vain. Please suggest. Need that ₹500 referral voucher.

Seems some were facing this issue past few hrs. But no idea on when it would get fixed. Please feel free to retry by EOD.

It failed for me as well couple of weeks ago when I tried to use my friend’s referral code.

This is the smoothest and fastest card application process ever experienced. Literally card was generated within 5 minutes of authentication. Got limit of 1.17L as I already had 2 cards from SBI. Time to close some other cards.

Can I apply for this card? I already hold 3 cards from SBI.

No!

I didn’t know that limit on one card could be transferred to other card! Can I request SBI to transfer 50-60% of limit from Prime to CB card as I am planning to close the Prime card soon?

Leave 10K on prime and move all to CB card before closing maybe. 🙂

No restriction on % as of now.

That is right because the limit on the closed card may be lapsed and not transferred by default to the primary or active card. SBI shares the limit at the time of issuing new card but doesnt transfer back when that card is closed.

5% CB is not applicable to online transactions made in forex.

Hi Siddharth,

Thank you for mentioning the option of transfer of limit from one existing card to another. I was able to transfer from Simplyclick to Cashback.

Do merchant emi conversion is considered in annual spend for waiver of annual fees

I have been thinking how come you didn’t review this amazing card yet. I was almost about to mail you as well . Finally you reviewed it. Thanks!

What do you mean by “The only downside is that you can’t use it on Amazon/Flipkart to avail the instant cashback, like with other SBICards.” – I used it on Flipkart on Dec 16 sale and I got 1500/- instant discount. By instant cashback, do you mean something else ?

I believe he meant about the 5% cashback on online transactions. Instant cashback is something that comes from Amazon/Flipkart and is visible before the transaction is completed.

Just completed the card application process in under 5 mins and got a very handsome limit.

I run a small business and have a substantial spend on rent and utility payments. I got the CB card last month and was experimenting with various apps. For utility, Amazon pay is giving 1 % while PAYZ gives 5 % (useful if more than 25k). But havent found any profitable rent pay app. I use redgirrafe as its the cheapest. Please let me know if any advises.

Thanks Siddharth

Seek your guidance for a weird problem I’m facing with my SBI cashback card

They have levied rent processing charges on some online shopping transactions (like urban company, shopping from Nest Asia) and the customer care team is adamant that these are rent transactions and that they have no option for waiver of rent processing charges once applied.

Have tried escalating to principal nodal officer but no luck. Any credible email i can mail to for getting support on this?

Who ever has this card and intermiles(earlier jetmiles) don’t redeem the miles directly for a voucher like 2900 points for 500₹, instead buy voucher using this cards and use intermiles for discounts like i used for 500₹ amazon pay voucher ₹475 from this card and 61 miles for ₹25 discount and got ₹23 cash back on this card. Just checked my transaction cashback and i am happy to share this. Even gyftr yono discount has only 3% discount, but this miles is better for few persons who can use for these cards

As noticed in SBI Card spend analyser it shows gyftr transaction as stationary, intermiles transactions as travel in categories

I think the credit limit can be managed using the app. I had a simply save card but offline purchases reduced to almost nil. So I applied for simply click card through the app and it was approved instantly but with 20000 credit limit. I have 3.8lac limit on simply save card. I found out that I could increase the limit to 3.8 lac for simply click card but this will reduce the limit on simply save proportionately.

A big drawback is this card is excluded for several sbi offers. During big billion days I could not get the 10 % general cash back on sbi on one of the sites. Saw it excluded on a few of the sites. Bad part is they don’t provide part Cashback also

Just one question.

I did a transaction of 1057₹ while paying my bill of simpl (BNPL). Now statement hasn’t been generated yet, but it shows the cashback earned as 1% of it as 10.57₹

So does it count simpl bill payments as wallet load and only going to give 1% cashback, or does this thing happen for every online transaction and after statement generation they add 4% more cashback on online transactions.

Getting 1% cashback on online grocery instead of 5%. I had transactions on Zepto & Bigbasket- both got 1%. Unable to get through SBI support.

Is anyone else also facing this?

They keep blocking the card on gyftr due to Payu as a gateway.. I have written to senior management as well

Hi Rahul,

I am also facing the same issue.

You received any response from them?

Yes and gyftr is actually shown as an option in the sbi app itself but the card is blocked even if used thru the SBI app link of gyftr. Very strange.

how much cb (in %) we get for purchase of amazon gift voucher in amazon app?

5%. As of now the gift cards bought in Amazon is considered as ecommerce goods.

5%

5%

Card gets blocked at Gyftr. Payments get declined on JioMart and DMart. Card got blocked on JioMart. Customer care answers that you are using third party website. I understand if they have issues with Gyftr, but what’s the problem with Jiomart and DMart? Its hassle to unblock the card and the card app gets blocked (if you have other SBI Card to access) till the time this card is blocked.

Only works smoothly on Flipkart and Amazon where ICICI Amazon / Flipkart Axis already provides 5% cashback. ICICI Amazon is free and Flipkart Axis is Rs. 499. Why pay 1000 bucks for this if it gets rejected at majority sites as of now? They seriously need to improve acceptability of this card, else they shouldn’t advertise the product as “Use it anywhere online and get cashback of 5% / 1%”

Even I faced issues with jio art and dmart and till date not a single payment was successful on either of these portals. Escalated issue to nodal officer but no solution.

It’s working on Jiomart. First time the card got blocked, but did 2 successful transactions later. Currently Jiomart sale is going on and while making payment, it provided additional Rs. 100 discount on this card.

There was no success on DMart. Although the card was not blocked, the payment failed.

Just to get this straight: If we want to pay our insurance premium using this card

1. Purchase Amazon Gift vouchers on Amazon/Sbi Yono/Gyftr for the amount (5% cb or maybe 6.5% cb).

2. Pay the bill for renewal premium for the insurance policy.

For my mom’s LIC policy which is more than 30 days away I don’t see the option to pay the premium (see other posts online that mention that LIC advance premium payment is not possible more than 30 days before due date). I was thinking of using Amazon pay balance UPI to pay the premium on LIC’s website.

Can I purchase the Gift card and add to my Amazon pay balance and then use that amount through UPI to pay the advance premium on LIC website?

first add the LIC policy no in amazon pay. see if you get option to pay via giftcard balance. if it is, then purchase giftcards and add it to the amazon pay balance . then pay.

Can anyone share the Toll Free sbi customer care number?

18001801290 is not working (only ring goes, no one answer).

Stdcode+39020202 is also not working since past 1 month.

How to use yono app ? it is not allowing me to use it. i don’t have sb account with sbi. i have only the CC.

I have this question too.

How much cash back (in %) do we get for LIC premium payment from the amazon app? Any other way to get more than cashback???

all bills give you 1%. so better buy amazon gc and pay with it. so you effectively get 5%.

I purchased Amazon Gift Card of Rs.5000 * 3 times.

Upon contacting Customer care team, I got to know the first 2 gift voucher earned 5% (Rs.200) cashback, but third one earned only 1% (Rs.50). Strange but I think they are restricting Amazon gift voucher purchases also. Customer care lady told me that it is considered as bill pay.

Seems to be a newly introduced change. How did you contact CC? I never get past thru the IVR .

I never found it difficult to connect to CC. Dial 18601801290. Press 1 for 4 times as the answer for the questions. press 2 if asked for WhatsApp banking or missed call banking. Then date of birth in ddmmyyyy format. Then I guess press 9 for connecting to agent.

Regarding Amazon GV, I think they are giving 1% now on purchase on Amazon. NPS giving 1%. FTHdaily wallet loading giving 5%. Now I have purchased Amazon GV from Yono sbi. Let me see how much cashback that I am going to receive on this transaction.

How to use yono app ? it is not allowing me to use it. i don’t have sb account with sbi. i have only the CC.

Hi, if I buy Amazon gift card value 25K ,4 times in single order will I get 5000rs cashback ?

I got this card with mix of offline and online mode. 5% cashback seems more of gimmick but lets uncover this truth and lets not over rate this specially since we have Infinia and Ultimate and MRCC in my bucket

Lets in this chat/comments try to list those website which donot give 5% despite purely online. This will give other users to avoid these website. I am making first attempt here

1. URBAN CLAP I got 1% (infact less than 1% due to rouding off logic) only after 3 days of transaction. Will extra 4% appear after statement generation?

2. I have did Redgirrafe ( coupon purchase not rent) yet to get casback

3. Airtel Bill pay yet to get

Pls list those website where yiu are sure you got 5% so we collaborate better as group

Check the MCC for 5% in the TnC. I haven’t faced any issues. Moreover during Amazon fest I got double dip, i.e., 10% cashback offer and the regular 5% over it.

1. UC -> Not clear. it might be considered as bill or wallet loading.

2 Red -> .Most of the rents don’t yield any rewards these days.

3. Airtel -> bills and standing instructions give just 1%

4. NPS Tier 1 payment –> 1%

I prefer SC Ultimate and will close SBI cashback card.

Why ? SC is just 3.3% reward.

Yes, 3.30% but unconditional. You don’t have to worry about merchant category 🙂

Didn’t you get penalised for this double dip eventually. SBI is literally silently adding debits to every card statement since months and for cashback since December without highlighting the exact transactions they are re billing users over.

I had a similar experience with SBI Card. At the time of closing the Prime card they even forfeited all the remaining reward points (small number

though) against some cashback offer.

This month’s statement had it. It seems double dips are not allowed.

Yes, even this happend with me.

As per their reply any transaction which has got instant discount during sale/offer will not be eligible for cashback.

However they missed to include this any T&C.

I think its important to understand that we should be comparing similar kinds of card and infinia and ultimate is not same category.. Lot of people may not have access to infinia and ultimate or may not be interested in paying annual charge or using reward points to buy shopping vouchers at full price. This card gives reward in the form of monthly cashback without having to do anything further so its super convinient. Also its free for first year and gives 100% fee waiver options. So it works well for most people. I have been using since only a month and have got more than 1500 cashback already which is a pretty good deal.

MRCC – I have this as well and its food till certain limit but issue is low acceptance of amex in offline mode and also few online mode and also the number of transaction and value of transaction needs to be managed so it becomes complicated.

Ultimate – I already have LTF titanium which gives 4% on fuel so decided to get sbi cashback instead of ultimate.

Infinia – haven’t tried.

So far have got (around) 5% on all the usual online transactions like amazon, amazon shopping voucher, offline store shopping voucher, food delivery, eazydiner, myntra, online medicine, uber etc . Haven’t tried urban company or bill payment though.

I applied using your referral link and got the card yesterday..

🙏

I applied using your referral link and got the virtual card with limit of 20000.

Will ask customer care to transfer limit from other SBI card to this one.

One question

Will it give 5% cashback on bill payment via amazon?

With immediate effect, Reward Points accrued on transactions eligible for Instant Discount and Cashback offers will be forfeited, as per offer Program Term and Condition.

Reward Points will be forfeited for all transactions done during offer period and considered for Offer Computation.

In case Cardholder does not have adequate Reward Points balance at the time of forfeiture, an amount equal to the deficit in the reward points will be debited from the card account.

So if u buy during 10% discount then what gets reversed in the next month…. Is it the 10% discount or 5% card cashback?

The forfeiting logic is strange.

I bought a product priced about 29,000. with instant cashback offer it was discounted by 1,200 . and i got 5% cashback on 27,800.

But they forfeited 600rs which is the 5% on the discount (1,200)not on the billed amount.(27,800)

600 is 5% of 12,000 – not 5% of 1,200

Typo. But again the forfeiting was not on the full purchase amount but some cryptic amount.

Hi Balaji,

This card is excluded from all promotions in all websites. You will get only 5% cash back.

Hey I already have a SBI Prime credit card that I have been using since end of 2021. I have approx. 12000 points at the moment in SBI Card Reward Points but it seems like I can only redeem it in the SBI Portal? And the rewards/vouchers are so terrible.

For ex: A Blaupunkt SBA20 Soundbar is for 9950 Points (of 5000 points + ₹2000), whereas the product is available for ₹1500 online.

Should I close the SBI Prime card, it feels pretty useless with such redemption of points.

For Prime, you could redeem them for cash and get a statement credit (12000/4 –> Rs 3000). Redemption charges of Rs 99 + GST would apply.

Are you sure it’s possible with prime?

Yes Siddarth, I had done it when I had the card a year back. Then I promptly closed it.

SBI Allows for Credit to Card Account redemption for Prime cards, did that just before closing the card a few months back.

Hi Siddharth,

yes, that’s how I used to redeem all my points on Prime before closing it. I used to call customer care for this.

Thanks

Your SBI Card Application is in progress. We will get back to you soon.

This message comes from last two days(may be due to weekend off) while checking to status. How many more days to approve application. Can anybody experienced the same or guide in this regards?

I applied and just after doing digilocker verification got message that card in progress with some credit limit.

I am not able to fill professional details after that as it is giving error.Is it required to fill professional details

New users are getting Card Instantly, I had a SBI Card it took 7 days for my approval the Limit got split between the old and CB.

The card is cutting some loose ends. Additional cashback is not offered anymore and is getting forfeited if rewarded. Also Simpl bill payment used to 5% earlier, now its only 1%.

Hi Sid,

I applied for this card in sep and got rejected for unkown reason. After you provided referral link , i applied again on Jan 3rd. Now its approved with 95000/- limit. I have SBI Prime already with 4.05Lac.

I will transfer that balance to SBI Cashback card and close prime card as Pizzahut gift cards not valid in stores as SBI didn’t settle dues.

I gave your referral code while applying. You will get bonus.

For online insurance payment they are not giving 5% CASHBACK customer care initially said yes it is there wrong information during marketing

Chec the TnC pdf from their website. It was clear since the inception of the card that insurances are 1% cashback. Don’t rely on CC.

Hi

I got my SBI cash back card approved, and I got the card added to my internet banking. But nowhere I can see the full card number or “Virtual Card”. I can only see the last 4 digits. Where can I see the full card number or virtual card number?

Will user get 5% cashback for Tuition fee payments in below 2 cases.

If Tuition fee paid 50k through paytm for the first time and Tuition fee 50k paid through cred for second time?

I paid tution fee from the school’s website and razor pay was the PG. I got 5% cashback.

May be in your case CRED will give 5% as CRED transactions are registered as ECOMM.

Dear sir, I applied for SBI cash bank card. Received within a week. It was all smooth and fine. I have used your reference code and received the card in my wife’s name Latha Patil. But so many ambiguities are there. can I use it on Amazon and Flipkart? Anyone please clarify it.

I used it for IRCTC train booking and received 5% cashback. Thank you.

Shivanand Bewoor

Hi Shivanand Bewoor ,

You can use in Amazon and flipkart. However, if those sites running any SBI specific offers like 10% discount, those offers not applicable to cashback card.

🙏thank you.

Do we get 5% cashback for flight and/or hotel bookings? Or is this available only for shopping sites?

Hi Siddharth

Thanks for the review. I just applied online and the process took about 5-7 minutes and my card was approved. This is my first experience with SBI.

I was wondering, is there a possibility of getting the add on card in the name of our company for company expenses?

Probably this is the best card in India right now. We can literally get 7-8% reward on most things. Buying Gyftr Amazon vouchers at 2% off, 1% reward using letyshop link and 5% cashback from this card . My 1st txn attempt of Rs.1960 on Gyftr declined and card got blocked. After calling customer care got it enabled again and now it’s working smooth. Got this card after 15 days of online application and transferred 4L limit from SimplyClick. Already spent 1.8L and able to see full 5% cashback in app.

Has sbi put klook on restricted merchant list? My transaction got declined with reason that transaction was attempted on a restricted/ forex trading/ gambling merchant?

Got onboarded today, got a limit of 103000. Siddharth you gonna get one more voucher bro:)

Now my questions are, it took the address from my aadhar but the address with radio button was incomplete ( but in my aadhar its complete and not missing the place ). Now I didn’t select the other radio button because that said my address is changed.

I would want to check if they mentioned complete address before dispatching my credit card. How can I Check?

Also the first spend for voucher is 500 or 1000 now ?

Also somewhere I read that max cashback earned per month is 10000 for that 2 lakh spend monthly, how is that possible when max limit they give us around 1 lakh. Did anyone get limit more than 103000?

Also I am planning to pay for my car, some payment via sbi cashcard. Will I get 5 percent ( payment on online link generated by tata)

Also if I want to pay 2 lakh can I do 1 lakh first and pay bill in few mins to get ready for another one. Is it possible?

Did you really think they set a nonsensical maximum limit of ₹1,03,000 for everyone and that you were given the maximum possible limit?!

Ofcourse higher limits exist. ₹10,000 is the maximum cashback you will be given. This could be 1% for a ₹10 lakh offline purchase or 5% for multiple online eligible purchases of ₹2,10,000 or ₹2,20,000, or anything depending on round-off. ₹2,00,000 is simply a crude estimation.

Yes to both of your other questions, but the card can be blocked in between.

what gift voucher do we get ?

I got onboarded through referral link but didn’t get any gift voucher of 500rs

Also received message that if I do first transaction of minimum 1000 I get 100 points. What is that?

Is Wallet Reload considered for Annual Fee waiver criteria, or is it excluded?

Yesterday i purchased amazon pay vouchers from amazon using sbi cashback credit. But no 5%cashback received. Any one have idea?

Note :earlier days I have received 5%cashback.

Please update whether you got 5% subsequently.

The above poster might maxed out the 5% cashback category. I got 5% CB on amazon e-gift cards yesterday.

My first bill is generated, and 73 cashback is posted as well. So do I need to pay all amount mentioned in bill or can I deduct 73 rs and pay?

You have to pay the “amount mentioned in the bill”. The cashback will be for the next cycle.

are you sure, because it says rs 73 is paid. If the amount is credited then we don’t have to pay full amount

You must always pay full amount as per bill unless they explicitly state that you don’t have to.

the cashback is posted to your account already so u only need to pay remaining amount after deducting the cash back.

I applied for this card yesterday and got it approved instantaneously. Only gripe is that I got a credit limit of 20K. My monthly spends are much higher. The joke is that they are expecting you to pay 1K annual fee for 20K credit limit. I will cancel this card as it does not meet my needs.

Hi sam,

Keep the card, use for 6 months and apply for limit enhancement. Lot of people waiting for this card and getting rejected with unknown reason. If you have other sbi card, u can transfer to this card by calling CC. This is best card for all online sites.

How much cashback can i earn when i pay to a seller via paywith indiamart?

How much cashback can i expect on paying to a seller via paywith.indiamart?

I didn’t get my 500 rs Gift voucher, when I applied through your link I was promised as a referral 500 rs voucher. I even have complained to the sbi customer care. What is the issue Siddharth

Issue is with SBICard. They aren’t honouring their system. I don’t get the voucher for most either.

Hi Sid,

I didn’t get even either initially. However, I send mail to CC. They send amazon gift voucher after 30days.

What details did they ask you on email before sending voucher because I have been trying over email and they are asking for referral details. Point is, that they are not able to verify or they don’t want to verify that I applied the sbi card via referral link. What should I do in this case?

Hi Nikhil,

In app I am able to see refferal success. I send same screenshot to them. They didn’t ask anything else.

They are asking me to wait for 90 days after that I get eligible. I don’t understand what kind of thing sbi guys smoke

I am not even sure if they think that I referred someone and they did join. I hope they know that I was referred by Sid. What should I do now, one major reason to get this credit card was for 500 voucher. Rest I don’t think this credit card deserves an yearly fee. I have LT free icici amazon pay which gives 5percent

and LT free hdfc cc which again gives 5 percent on rest of websites . Why should I pay for this

you have mentioned that “you can anyway get the renewal fee back just with 20K INR online spend”

where is this mentioned, i can only see that renewal fee will be waived on spending 2 Lakh while card application

What is 5% of ₹20,000?

while i am applying through sbicard sprint portal , it got struck in the 2nd step, ie in the professional details page. After filling the data and when pressing the next button, iss shows “Something wrong here. Please try again”

this is repeating again and again

What to do?

Hi All,

Anyone tried to apply add-on card? I am getting “you are not eligible to apply this card”. I have SBI prime and 2 add-on cards too.

Hi Siddharth – I applied for SBI cashback card using your above referral link on 28-March. Before applying on main SPRINT page, it says NIL Annual fees and Rs. 999 Renewal fee. But after doing entire process, on final ‘Submit your application’ page it says:

Annual Fee : ₹ 999 + Taxes

Renewal Fee : ₹ 999 + Taxes

Hence I did not submit my application. Any idea how can I get the 1st year Annual fee waved off?

The 5% cashback on Amazon Gift card seems to be inconsistent. I purchased 2 gift card on same day and 1 got 5% cashback and other 1 got 1% cashback (confirmed by contacting CC). But only once it happened. All other occasions, I got 5%.

Did SBI YONO stope providing Amazon GV through Gyftr? I am not able to find any!!

Seems like Devaluation has started on this card.

They have removed cashback on below categories from May 1st onwards.

Jewellery, utility, school& education services,

Card, gift, Novelty,Railways etc.

Maximum cashback that can be earned in statement cycle is 5000/-, reduced from 10,000/-

This was bound to happen.

This is effective from 1May.

My statement generates on 24 of every month. So if i do eligible spends from 25 April to 30 April, will i be eligible for 10000 cashback?

Yes

Are you sure ?

Through cred it’s not allowing to make school/tution fee payment to grab 10k in same month saying monthly limit reached. Please do let me know if you have any alternative solution for this.

Even domestic lounge access will be removed. @Siddharth kindly update.

No Cash Back on:

Jewelry

School & Educational Services

Utilities

Insurance Services

Card, Gift, Novelty & Souvenir Shops

Member Financial Institution/Quasi Cash

Railways

and others, that were already included.

Monthly capping of 5000 now

Same updated and the rating has been dropped as well.

Yes, even I received the same message. They restricted all available ways to earn 5%,now for what kind of transactions user can earn 5%?

If atleast they award 5% for amazon GC, we can use those to pay insurances and other bills. Else it is useless.

D’oh.. the card is no more attractive.

@Siddharth What do you mean by the rating has been dropped?

It’s Cardexpert rating.

Dropped it from 4.9 to 4.2

Hi Sir,

Not sure why you gave 4.2. one can’t use this card for more than 1 lac online spends. Because after 1lac spend sbi not providing single penny cash back. They mentioned in total cashback earned in billing cycle can be 5000/-

1L spend is sufficient for this segment. 🙂

Yes, but now they excluded almost all categories of online spends from 5% cashback right. Can you let us know where we can still get cashback of 5%?

What about gift cards will it get 5% cashback or not.

I used this card only once for insurance payment later mostly for Amazon gift card purchases from gyftr and intermiles and once for paying school fess. So, this card wont useful to me much, i only tried to earn cashbacks from these till now.

@Siddharth how can I buy amazon gift card through credit card?

can you please help me?

Buy from Amazon and add the card to Amazon pay.

Does amazon gift card purchased through intermiles classified as travel transaction?

Yes. I have purchased it through Intermiles.

When they will issue 500 voucher.

Will it be forwarded to email I’d or should we follow up with SBI cc team

I have paid bill for April statement and trying to make school/tution fee payment but it’s not allowing in cred saying ‘monthly limit reached’. Is there any other option to make payment to grab 5% cashback.

From MAY 1st, 2023, edu fee will not be rewarded. Also the monthly cap is 5000 INR. So, as of now for me it seems the best we can get is thru axis ace which is 2%.

I am buying some stuff online like server space (hosting), google workspace account online. Is this purchase are eligible to get 5% cashback. As i am buying online from providers which are using CCAVANUE or Razorpay payment gateway.

No reason why you shouldn’t. This card’s cashback t&c doesn’t exclude them.

Hey Guys!

Since it’s been some time since the new changes, i was hoping to get some clarity around the following:

1. Do you still get 5% CB on Amazon pay gift vouchers bought directly from Amazon?

2. Is there any alternative to paying insurance payments and availing the 5%? I’ve tried cred and Amazon pay ( directly not GC) and they give only 1%

3. I notice the CB after every cycle gets posted as a credit on my account. Does that mean that we can pay the total amount due minus the cashback for that cycle? Or do we have to pay the whole amount mentioned in the bill and have the CB deducted from the next month’s spends?

4. Do online forex transactions get 5% CB?

1. Till now I got. But the last transaction done on Apr 26, the app showed I got but in the final statement it is not reflected. I mailed them and waiting for explanation.

2. No. If the SBI CB card ceases rewarding cashbacks for amazon gift cards, I don’t see any trick to get 5% cbs.

3. Pay the whole amount mentioned in the bill. Yes, CB will be deducted from the next month’s spends.

4. Should be. I haven’t tried though.

No longer the sbi card team allows you to transfer the limit from one card to your sbi cashback card

I have a simplyclick credit card

Wanted to transfer some of the limits to the other cashback card.

The customer care executive informed me it is no longer possible

Hi,

Can anyone please share where in online spends we can still get cashback of 5%?

Thanks

This card is applicable for 10% offer in SBI credit card offer in (flipkart, Amazon, exc..) .

Example. I have purchase in Amazon products (SBI credit card discount 10%) so i am getting 10+ 5 = 15% or only 5% any one pls help on this?

For people whose most high value online purchases are on Amazon and Flipkart, this card doesn’t really make much difference if they hold the Amazon icici and Flipkart axis cards as the reward rate is same, but these are LTF cards unlike SBI. Only upside to holding this card is for online travel expenses and other use cases.

has cashback been stopped on flight booking as well? i recently did transaction on yatra app and did not get any cashback.

Don’t take this card now, because I am using this card from last 6 months and it was very good for cashback but now they revoked the cashback on almost all categories and revoked lounge access. We are not getting cashback now. So, now it is not worth to pay anual fee. There is no other reward points or cashback on most of the spends so don’t take this card now.

What categories they’re revoking if I may ask?

SBI Cashback Card Terms and conditions

Cashback shall not be earned for following spends/transactions on the card,

– Any purchases at petrol pumps/service stations (MCC: 5541, 5983)

– Balance transfers, Balance Transfer on EMIs

– Cash advances

– Financial charges (e.g., late payment fee, dishonored cheque charges, service fee, transaction charges etc.)

– Disputed transactions

– Encash

– ATM Withdrawals

– E wallet loading transactions identified under MCCs 6540

– Payments towards Rent/property management under MCCs 6513 and 7349

– Jewelry transactions identified under MCCs 5094 and 5944

– School and Educational Services transactions identified under MCCs 5111, 5942, 8211, 8220, 8241, 8249, 8299, 8351

– Utility transactions identified under MCCs 4900, 4814, 4816, 4899, 9399

– Insurance transactions identified under MCC 6300

– Card, Gift, Novelty & Souvenir Shops transactions identified under MCC 5947

– Railways transactions identified under MCC 4112

– Member Financial Institution transactions identified under MCC 6012

– Payments made using Standing Instructions / Fetch and Pay on SBI Card platforms (Website / Mobile App / Chatbot ILA)

– Flexipay Transactions

– Merchant EMI

Below categories will not be eligible for Cashback benefit:-

Category – Merchant Category Code (MCC)

Fuel- 5541, 5983

Wallet- 6540

Rental- 6513, 7349

Jewelry- 5094, 5944

School & Educational Services- 5111, 5942, 8211, 8220, 8241, 8249, 8299, 8351

Utility- 4900, 4814, 4816, 4899, 9399

Insurance- 6300

Card, Gift, Novelty & Souvenir Shops- 5947

Railways- 4112

Member Financial Institution- 6012

Hi Siddharth, any idea if we can get 5% cashback on purchases like an ipad or apple macbook.

Ofcourse, as long as it’s bought online.

Is unblocking worth the pain?

I tried to purchase Amazon GV on intermiles portal on 26th June, and the transaction got declined and card got blocked. Reaching the customer care executive on phone is nearly impossible, but somehow I did that couple of times. First time my unblocking request was taken and a request nuber was provided on SMS.

Second time when I tried to enquire the status of my request, I was told that it would be unblocked on 3rd July.

Even today, 4th July the card is still blocked and when I enquired, I was told that I’ll need to send some documents (self signed scanned copies of Aadhaar etc. etc).

All this is too painful and troublesome for something which is not my mistake. That too for a card with dimishing returns (too many conditions on cashback).

For now, I’ve raised a card closure request. Hope the rentention team either makes things simple, or else I’m happy with my Infinia :-).

Hi everyone,

Has anyone faced the issue, credit limit across SBI cards reduced significantly?

My credit limit across SBI Cashback & SBI BPCL card reduced from 3,71,000 to 70K, without any intimation/notification. I just logged in to the site, was shocked to see such a huge reduction. I never ever missed any payment/did shopping beyond the assigned limit. Could it be due to very less usage of card?

Has anyone else also faced similar issue?

Hi Rohit,

It happened to me also. Cashback limit decreased to 1.23lacs from 3lacs. Prime limit decreased to 1.03 from 2 lacs. When i enquired CC, they said as per new RBI policy and new cibil score, they revised credit limit.

My usage is heavy on both cards. So usage is not an issue here

Does payment of rent still count towards hitting the 2 lakh spend milestone?

I am agreed about sbi cash back credit card is a very good card, but until unless they won’t give you credit limit what is the use. They are giving very low credit limit.

Would I get cashback if purchased from other websites like Herbalife for nutrition products?

Until unless we know the website, we cannot tell whether we get backback or not. For Herbalife we will get the cashback.

Unbelievable BS from SBI:

Currently Add-on applications are only accepted from following cities: Delhi NCR, Mumbai, Pune, Bangalore, Pune, Chennai (Limited PIN Codes covered)

Is this true?

Is 5% cashback provided on direct tax payment and flight booking through MMT etc?

Earlier these travel apps had an MCC of railways leading to ZERO cashback. Heard that they fixed it few months ago. The best is buy amazon gvs which give 5% , add them to amazon wallet and use them to pay in mmt.

Hi Balaji,

You are wrong. Purchasing of Gift cards will not give 5% cashback on SBI Cashback cards, initially due to glitch few people used to get but later they made changes now gift cards purchase doesn’t give any cashback. Its a waste card as there is no clarity on reward points earned on every purchase.

On Amazon site Amazon pay gift vouchers are still rewarding 5%. Even last month I got.

Does anyone know if cashback is given on flight and hotel booking thru MMT yatra etc? Last time I booked I got no cashback which was many months ago…

On Yatra its ZERO. Booked about 14K worth of bus bookings and got 0 .

Yes, I got on Cleartrip.