IndusInd Bank and Tiger Fintech (Bajaj Capital Group company) recently launched the IndusInd Bank Tiger Credit Card, a Lifetime FREE co-branded credit card that runs on Visa (Signature) platform.

With accelerated rewards, low forex markup fee and much more, it’s certainly a card that you might want to explore if wish to enjoy premium credit card benefits at no cost, as it’s a new and noteworthy lifetime FREE credit card in the country.

Here’s everything you need to know about the IndusInd Bank’s Tiger Credit Card in detail:

Table of Contents

Overview

| Type | Premium Credit Card |

| Reward Rate | Upto ~5% |

| Annual Fee | Lifetime Free |

| Best for | Accelerated Rewards |

| USP | Transfer to Airmiles at 1:1.2 |

On a quick look, one might assume that it’s a entry-level card because of it being Lifetime free but when you look closer, it acts both as an entry-level card and also a premium travel credit card on high spends.

With benefits like accelerated rewards that gives a higher reward rate with airmiles transfer, access to domestic & international lounges among others, it’s a hidden gem for some.

*** The Hidden Gem of 2024 ***

Fees

| Joining Fee | Nil (Lifetime Free) |

| Renewal Fee | Nil (Lifetime Free) |

It’s quite a surprise to see that IndusInd Bank and Tiger Fintech are generous to offer a Lifetime Free Credit Card with benefits that can match a premium credit card.

Design

Looks like the designer is impressed with Federal Bank credit cards, as they have similar design but fortunately it’s not a copy paste like with HDFC Infinia’s new design.

Nevertheless, it looks neat and simple and the dotted elements certainly looks good.

It’s interesting to see that even the name has been moved to the backside of the card on this IndusInd Tiger Card and I see this happening with other credit card issuers as well these days.

Rewards

| SPEND SLAB | Rewards / 100 INR |

|---|---|

| <= 1L INR | 1 |

| 1L INR – 2.5L INR | 2 |

| 2.5L INR – 5L INR | 4 |

| >5L INR | 6 |

- Exclusions: fuel, utility bill payments , insurance premium , government services, Educational Institutes, Real Estate and rental payments

- 1 Reward Point = 1.2 (Airmiles)

- 1 Reward Point = ₹ 0.40 (Cash credit/Indus Moments)

- Redemption Fee: 100 INR+GST

- Max Cap on redemption: 25,000 Points per month

If you’re into Airmiles and have the habit of redeeming Vistara CV points for Vistara Business Class (or) even tickets on premium economy/economy, then you would quickly fall in love with this card as you get wonderful return on spend for Airmiles transfer by transferring the points to Vistara at 1:1.2

As of now only Intermiles (forget it) & Vistara (good) are part of the airmiles transfer program and chances of British Airways making it to the list is quite a possibility as IndusInd Bank recently tied up with BA/Qatar for Avios Credit Card in India.

Airport Lounge Access

| ACCESS TYPE | VIA | LIMIT | GUEST ACCESS |

|---|---|---|---|

| Domestic Lounge Access | Visa | 2/Qtr | – |

| International Lounge Access | Priority Pass | 2/Year | – |

Note that IndusInd Bank’s Lounge Access program is comparatively better as it covers almost all lounges in India, so 2/qtr is a good limit.

And it’s a world wonder to see complimentary access via Priority Pass on a Lifetime Free credit card especially when it’s issued by IndusInd Bank that generally gives low access limits even on paid super premium cards.

Forex Markup Fee

- Forex Markup Fee: 1.5%+GST = 1.77%

- Reward rate on Intl. Spends: Same as domestic (differs with spend)

- Net gain: ~3% (gain, assuming spends are over 5L p.a.)

While the reward rate might be too low when spends are low, it can be quite attractive when spends are over 5L, as you get accelerated rewards beyond 5L spend.

Movie Benefit

- Complimentary movie ticket upto 500 INR on bookmyshow (not Buy1 Get1)

- One ticket every 6 months in a calendar year.

This movie benefit is similar to the one of Eazydiner Credit Card except that it’s not that lucrative. Yet that’s 1000 INR value every year, which I think is decent for a lifetime free card.

Hands-on Experience

While I don’t have the Tiger Card, it was applied for one of the family member and it took a bit to arrive, as it was new back then.

But after little over 2 months of usage on it, I can safely say that the points are getting credited smoothly as per the slab.

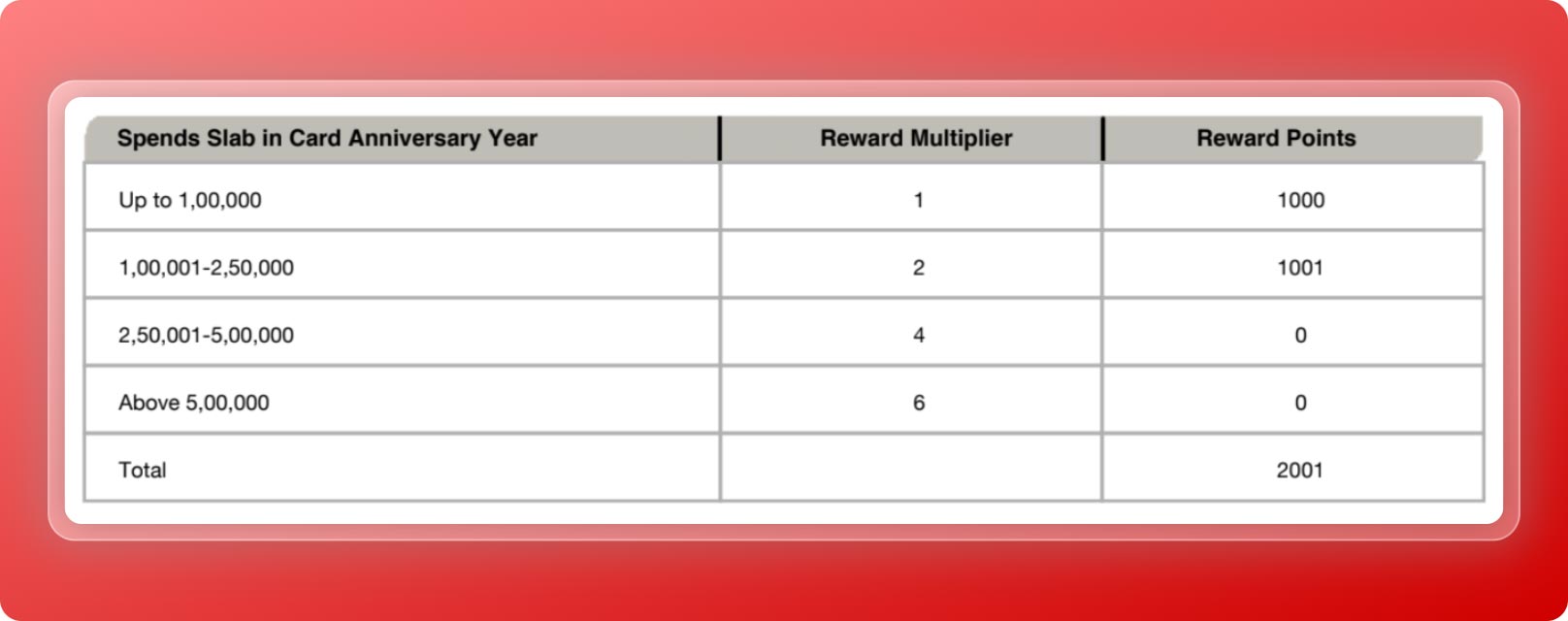

In-fact the Tiger credit card statement shows the bifurcation of the reward points earned as per the slab. Here’s a quick look at points statement, on total spends of ~1.5L INR.

This is such a wonderful feature to have, as it avoids all the confusion on how the points were earned. Brilliant work by IndusInd Bank in making it transparent.

That aside, I’ve initiated a points transfer to Vistara through IndusMoments portal and it took about ~2 weeks for the fulfilment.

How to Apply?

IndusInd Bank Tiger Credit Card can be applied online (or) can as well be applied offline through branch.

I would ideally suggest applying online, as you might be aware that offline applications takes quite a long time with IndusInd bank, as long as 1 month in most cases.

Note that if you’re in a tier-3 city, you may still need to go the branch, as only metro cities and the nearby tier-2 cities are part of the online application system.

Bottom line

- Cardexpert Rating: 4.5/5

Overall IndusInd Bank Tiger Credit Card is a wonderful card that can be very useful for those who don’t prefer to pay high annual fees to enjoy higher rewards and lifestyle benefits. It’s as good as a premium credit card even though it’s issued as a Lifetime Free card at the moment.

So looking at the way things are, the card may-not remain the same for a long time, so as you may know by now,

Make hay while the sun shines!

Do you have IndusInd Tiger Credit Card? Feel free to share your thoughts & experiences in the comments below.

Nice review. I was looking at indusind website few days back and I somehow completely missed this.

Its perfect for people with T names and Tiger as nickname. Looks good too.

What I like most is, as a ltf card, the international spend reward is the same at 6 rp / 100 once you cross the 5L mark. Its actually good for people with high international spend.

The reward system seems good, but lack of good redemption options other than vistara.

I already have emeralde and magnus, so not much need for this card. But the free 2 movie tickets per yr is something new. I think its the 1st card which offers this service. Specially useful when you want to watch a marvel movie and your partner / friend is a dc fan lol.

As far as movie tickets are concerned, I would say Eazydiner card is lot better.

This card is actually too good a card to be true with zero annual fee. I had Ltf legend, took this card back in August on split limit basis. The CIBIL enquiry they did was under ‘others/loan’ category. But apart from that no trace of Bajaj capital in application or during usage. No spam calls yet from Bajaj.

I’ve already used 500rs BMS offer and utilised this year’s two complimentary international lounge access. All went smoothly. Pretty happy so far… recently applied and received another in family member’s name.

Mainly to have a separate priority pass. Now the question is when they’ll devalue it. But one thing I really didn’t understand, what was Bajaj capital’s interest/gain in this card.

Hi, how did you get the PP? I didn’t get it as part of my card? Do you need to apply separately for it.

Not didn’t come with the card. I applied over call to customer care, delivered within 5days of calling.

Is it better than the Indusind Legend? I have LTF legend, should I opt for this one? I don’t spend much on Indusind card as I have Amex Plat travel, HDFC Regalia and Citi IO credit cards as my main goto cards for daily use.

It’s ideally for those who’re into Vistara, as there are no other cards that gives earn rate as good as this.

Great card, it seems. so for someone spending >5lacs it is a cool 6% return if i assume Vistara cv point value as 1/-

I value CV points at ~75Ps these days as they’ve increased points requirement a bit for business class + added convenience fee, but yes it’s still good.

Is there any discrimination on rewards for wallet loads? Also, how many indusind cards can one hold at a time?

Haven’t tried wallet spends lately.

There is no limit per se technically, but not easily given. Dual cards are very much possible when there is good limit on existing card and preferably have a premium banking A/c with them.

I already have pinnacle card. Can I apply this Tiger card as a secondary card?

Yes, can have a 2nd card with a split limit but bank decides the same based on credit limit, profile etc.

Limit is just 2.2L earlier when easydiner was launched. I had applied. But was rejected.

This time as you said, I will go to branch

Hi Sid and all

how I should apply for the Tiger credit card. I already have legend credit card so I called CC and ask for this they told this card is not being issued from Indusind bank, you have to contact Bajaj fintech

Is this a way to apply for this card?

At branch, with a split limit.

While I took it, I just emailed customer care, they replied with option for split limit basis, i have consent, card received in 10days. That was in August. Not sure if their policy changed.

Yes I was given the same reply .

On their website there is no option to choose to apply tiger cc

Are co-branded cards like this eligible for Indus bank offers on e-com sites?

Sid,

One clarification … Exclusions mentioned won’t earn any rewards. But will try count towards reaching the milestone of 5 lacs ? If yes then it’s a great card to have

What are the best cards to pay taxes now?

Hi all, just wanted to know if there is any premium credit card which I can get on card on card basis. I have HDFC Diners Black (Limit 15L) and Standard Chartered Ultimate (Limit 15L) amongst few others. The issue is I don’t live in India anymore, so don’t have payslips to show, but still have few expenses as my family lives here. Apart from that, have Citi Prestige (30k AUD limit monthly) and few other Australian credit cards. Please let me know if there’s any worthwhile premium credit card worth having, though I understand credit card rewards market is not what it was 5 years back.

Thanks,

Nitin

Hi Sid, Brain Trust,

Any feedback on my query above please?

Regards,

Nitin

I have tried to transfer points from this card to Vistara. Apparently there is a cap of 25,000 points per month. You can’t transfer more than 25,000 points in a month to Vistara.

Thanks for spotting it.

This wasn’t there few weeks ago but I now see as well.

Looks like it’s the new site-wide limit for redemptions on all cards via IndusMoments.

Fair enough for Tiger card though, as it equates to about 4L spend (24K points).

Hi, thanks for the details. Could you help me with below query?

I have to travel (domestic) every month 4 times due to work. It costs me 11k for round trip so about 50k per month including cab etc.

I’ll spend about 8lac+ per year on the credit card, which one would be the best for me? Axis Atlas/Magnus/Indus Tiger/IDFC Vistara…. I’m very confused. Could you suggest me a good one for my use case. Thanks!

It’s really hard to tell in 1 line due to frequent exclusions of rewarding categories. Take an excel sheet and workout for those 4 cards with your probable spending on categories. Once you come to some conclusion post that here to be verified.