EazyDiner in partnership with IndusInd Bank has recently launched a dining credit card on Visa platform to tap the segment that enjoys dining at restaurants.

The EazyDiner IndusInd Credit Card gives deep discounts on dining bills to cardholders and this is done through EazyDiner Prime membership & discounts when paid through the co-brand card on the PayEazy platform inside the Eazydiner app.

If you’re a frequent diner, you’ve just found the best dining credit card in India or in the world for that matter. Let’s see how and why!

Table of Contents

Overview

| Type | Dining Credit Card |

| Reward Rate | Upto 50% Off on Dining + upto 2% rewards on spends |

| Annual Fee | 1,999 INR+GST |

| Best for | EazyDiner discounts & movie benefit |

| USP | Redeeming RP’s on EazyDiner App directly |

I’ve been waiting for a dining credit card for quite some time because this is one of the major out-of-pocket expense for me when I travel. While my stays are taken care by reward points, food expenses are always payable.

So it’s lovely to see a card that has the ability to walk-in to a fine-dining restaurant, enjoy a healthy meal and walk out with zero out-of-pocket spends.

Sounds like a magic isn’t it? Well, it’s not. If you’re wondering how, here’s the complete review of EazyDiner IndusInd Bank Credit Card.

Fees

| Joining Fee | 1,999 INR+GST |

| Welcome Benefit | EazyDiner Prime & 2 more benefits (as below) |

| Renewal Fee | 1,999 INR+GST |

| Renewal Benefit | EazyDiner Prime & 2 more benefits (as below) |

| Renewal Fee waiver | Nil |

We get 3 welcome benefits with the card and here are they:

- EazyDiner Prime Membership: Gives ~25% discount at most restaurants in metro cities. (worth ~2500 INR, offsets the fee)

- EazyPoints (2000 Points): It’s the EazyDiner currency and the value is dynamic, ideally worth ~400 INR in low use case, but might be valued much more if you dine a lot.

- Postcard Hotel Voucher (5000 INR): Postcard hotels are bit expensive, so you may assume that the voucher sort of covers your food component during the day.

As you can see, the EazyDiner Prime membership is the primary welcome benefit and is totally worth it. While 2000 EazyPoints is fine, it would be nice if it was 2000 regular points.

Postcard Hotel voucher of 5K INR is good but not sufficient enough to encourage redemptions, as these hotels usually cost north of 30K INR a night.

Rewards

The EazyDiner IndusInd Credit Card comes with two types of rewards:

- EazyDiner Rewards: They’re called EazyPoints, earned on dining & few other activities. Tough to earn, as we need to spend that much with EazyDiner.

- IndusInd Rewards: They’re the regular IndusInd Reward Points but can’t be redeemed on IndusMoments. These points can be redeemed in realtime against the restaurant bill on EazyDiner through PayEazy platform.

Below are the IndusInd Rewards earn rates on different types of spends done through EazyDiner credit card.

| SPEND TYPE | Description | REWARDs | REWARD RATE |

|---|---|---|---|

| Accelerated Spends | Shopping, dining and entertainment | 10 RP’s on every 100 INR | 2% |

| Regular Spends | Except fuel | 4 RP’s on every 100 INR | 0.8% |

- 1 Reward Point = 0.20 INR (redeemable on app, to pay restaurant bill)

- 1 EazyPoint = 0.20 – 1 INR (Dynamic, redeemable on app for select vouchers)

- 3X EazyPoints on dining spends.

“Shopping” refers to both online/offline shopping, though the challenge is that some merchants in India don’t categorise their store properly.

But I hope it works as expected.

If you’re in a doubt, you may always do a test transaction before going for a high value txn. Fortunately, IndusInd Bank reports the merchant category type for every txn in the credit card statement.

PayEazy Benefit

- Additional 25% Off on the Dining bill

- Max Cap: Rs.1000 per bill (Bill value equivalent: Rs.4000)

- Cooling period between transactions: 2 hrs

- No min. spend requirement

Apart from the EazyDiner Prime benefit, you get additional 25% discount on paying through PayEazy. This is the most important benefit to maximize your savings on the card.

EazyDiner has been quite aggressive on PayEazy linked offers already and the 25% off (without monthly limits) on top of 25% off via EazyDiner Prime is definitely a wonderful deal that can give you a nice ~45% savings on the bill.

If you think that’s great, well, it doesn’t end there!

You can as well redeem your reward points accumulated on this card for paying the remaining bill. For a bill amount of 3000 INR, the numbers look something like this:

| Bill Amount | 3,000 INR |

| Discount: 25% off on EazyDiner Prime | – 750 INR (Net savings: 25%) |

| Discount: 25% off on PayEazy | – 550 INR (Net savings: 45%) |

| Redemption: Reward Points | – 1700 INR (Net savings: 100%) |

| Payable | 0 INR |

So in above example, 100% of the bill value is taken care by “rewards” and “discounts” if used right.

Note that to earn reward points worth 1700 INR, spends of about 85,000 INR is required under “Shopping/Dining/Entertainment” category, as the card gives 2% return as seen before.

If you think spending that much on card is not easy for you, never mind, you still save ~45% on the bill, which in itself is huge if you’re dining frequently.

Airport Lounge Access

| ACCESS TYPE | ACCESS VIA | ACCESS LIMIT |

|---|---|---|

| Domestic | Visa | 2 / Qtr |

This is the typical complimentary airport lounge benefit you get on any Visa Signature Credit Card. So the same applies here as well. Supplementary cards gets the lounge access benefit as well, separately.

BookMyShow Offer

- Offer: 2 free movie tickets a month [400 INR Value]

- Max. Cap: Rs.200/ticket

- T&C: Can book single (or) double tickets at a time.

Surprisingly, this is not a Buy1 Get1 Offer – we get the ticket completely free (convenience fee applicable). This is a very good benefit which works similar to the one on Pioneer Heritage Metal Credit Card and SBI Aurum Credit Card.

This movie benefit alone gives us a sweet 4800 INR savings a year.

Other Benefits

- Complimentary Beverage: Complimentary premium alcoholic beverage at over 200 restaurants.

- EazyDiner Concierge line: +91-7861004445

- Forex Markup Fee: 3.5%+GST

- Add-on Cards: Upto 5 add-on cards as complimentary with the card

Is it for you?

The Eazydiner IndusInd Credit Card is a MUST have for the first 2 reasons listed below and GOOD to have for the last 2 reasons:

- If you’re dining out more than twice a month

- If you stay at luxury hotels

- If you watch movies

- Just to have an IndusInd Credit Card (to avail offers or hold the credit line)

In my case, I generally don’t dine-out every month but when I travel I have to dine-out often. During my recent trips this year, I had to pay for at-least 10 meals at luxury hotels as I stay there. (thanks to credit card points for free stays).

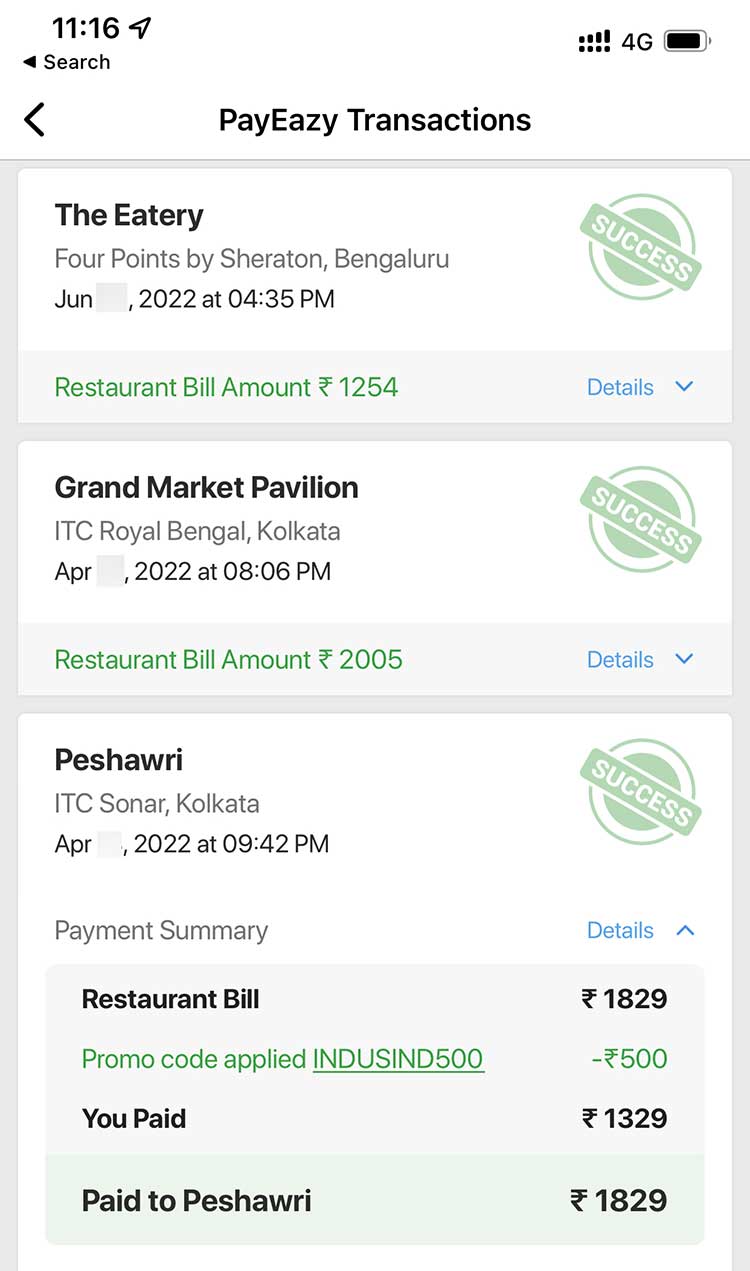

So I’ve been using EazyDiner offers on IndusInd Cards even before as you can see below:

But the problem used to be the recent limitation on coupon usage (1 per 15 days) which doesn’t allow me to enjoy the discounts for the entire trip.

Now with the EazyDiner Credit Card, there are no such limitations and so I can dine with ~45% discount on every bill.

On other side, if you dine out only once or twice a month, the Eazydiner Prime membership along with other PayEazy discounts are sufficient.

Getting the Card

- Fresh Card: You may apply online on IndusInd website (or) via branch.

- Upgrade: If you already hold an IndusInd Credit Card, call customer support and request for an upgrade.

- Minimum Credit Limit: 75,000 INR

IndusInd Bank ideally takes ~3 weeks to process the offline applications, online applications could be bit faster.

My Experience

I recently applied for EazyDiner Credit Card and the card was delivered in approx. ~2 weeks from the date of application.

I got access to the virtual card (some new system for this) few days before delivery but for the card to reflect on app & net-banking I had to link it again via net-banking and that gives complete access to the card controls.

The card comes in a nice package that houses the welcome letter, card benefits guide, Postcard hotels voucher, coasters (2 black, 2 white), etc. Here are some pics.

The front face of the card looks good with simple and modern design elements. I’ve just started using the card and will cover the detailed hands-on experience in some time.

Bottom line

- Cardexpert Rating: 4.5/5

Overall the EazyDiner IndusInd Bank Credit Card is an amazing card to save huge on dining spends and I hope it will certainly “revolutionize” the segment, as they say so.

While the discounts are great, it would have been lot better if we had a higher earn rate on card spends. But well, with so many benefits loaded on a card that doesn’t have a direct competitor at the moment, I think it’s fine.

The Prime benefit + PayEazy discount is worth a lot and even if you don’t avail them, the movie benefit alone can help you cover the fee “twice”. So it makes sense for most to hold one.

What’s your thoughts on EazyDiner IndusInd Credit Card? Feel free to share in the comments below.

1. Other than metro Cities, Eazydiner don’t have many restaurants on it’s platform.

2. BookMyshow Movie benefits can be availed using other Credit Cards also.

3. Postcard hotels are very expensive. We need to use 10K + 5000 Voucher to book 1 night.

4. looks like RBL Zomato credit card is better for food lovers.

1. Yes

2. No

3. Yes

4. No more.

Yeah. Zomato Edition no longer rewards restaurant spends :(. That was the major draw for me as otherwise Zomato spends were fetching a healthy cashback of 4% on my Axis ACE.

You can use axis my zone for 40 percent discount on swiggy or axis select for 40 percent with higher capping

Eazydiner probably has the worst collection of restaurants on its list. Atleast for my city Chennai. I am having the app on my phone since it launched several years ago. But for the last 2+ years I have been unable to use it EVEN ONCE since every restaurant I dine, isnt on its list. Thankfully they are all there on Dineout (though they have capped promos there too off late, but something is better than nothing)

Btw, for those who dont want to get this card can make use of Axis Magnus on Eazydiner to get decent discount.

It’s opposite from my experience!

From what I know, Dineout has many small restaurants/cafe/bars on their platform while EazyDiner has better coverage with 5 star properties.

I agree. Easydiner has more of top rated restaurants and is more suited if one dines in 5 star properties. The second best restaurants are majorly available on Dineout.

I have been using HDFC Infinia + Dineout Passport which also gives close to 45% on most of these restaurants (though recently they have come up with a max capping)

But then, Dineout Passport is a complimentary membership for Infinia card holders and can also be renewed for free.

I already have a Axis Vistara Infinite card that gives a 40% discount (upto INR 1,000) on Eazydiner. Hence, for maximum discount, a bill of INR 2,500 is enough rather than INR 4,000. Would it make sense to take this extra card?

The question is about how often you dine. If its low, then Axis and other offers on PayEazy are sufficient.

Sid,

Hope add on cards of Magnus and Infinite cards can be used to avail this offer if I have already used the primary card

On same account? I doubt. I used to use Indusind, RBL & ICICI back then, helps to an extent.

Hi Sid, free movie tickets upto 2×200 is a great benefit. Until now I have relied on Yesfirst debit and RBL Insignia credit for free tickets every month, my other cards only give 1+1 or 2+2, so this one is worthwhile when going with family.

But are there any distinct dining discounts with this card, such as no caps on number of dining visits? Since Prime membership already gives 25-50% off on select restaurants and various cards give further 15-40% off using EazyPay and you earn eazypoints on those transactions as well.

On a separate note, 1st year free eazydiner prime comes with Indusind Legend LTF. Legend gives 30% upto 500 off on payeazy once in 15 days.

No major caps as of now. Part of the problem with other PayEazy Offers is that its temporary and may disappear anytime. Eazydiner will eventually stop them as they need more takers for their own card. 🙂

Hey Siddharth.. Did you get this one as a second credit card or you had to close your indulge?

Nick, it’s a 2nd card with a split limit.

Hi Siddharth,

I am confused and I don’t know whether I took good decision to applying for this card or not.

I am holding Axis Vistara infinite+Addon and Axis Bank Reserve Credit Card+Addon which comes with it EasyDiner Prime membership. So, we take advantage of 40% 4times (Vistara+Reserve) in a month and also using Kotak credit card 30% twice in a month (no minimum) so total of 6times discount in a month and my point is what is the use of having EasyDiner Indusind credit card which gives 25% maybe it is useful if using more than 6times in a month for me

*I have activated one year Prime membership on October 1st, 2022 from Axis Reserve. Today October 3rd, 2022 another Prime membership activated on the same account/Same number by EasyDiner Indusind Bank credit card. Now, I don’t see Prime membership from Axis logo But only can see by Indusind Bank. It’s like wasted one year/renewal membership from Axis Reserve.

*I am have Indusind Indulge credit card and I have applied for 2nd card with split limit. Which is not LTF

So, my question to you, did I do mistake by applying for EasyDiner Indusind credit card? I need your advice

Please also let me know your card is LTF or paid. If LTF, please guide how to convert it. Thank you

Hi Sid, i have indus Ind Legend which is a LTF and EazyDiner comes free with this. EazyPay has multiple payment offers which can be used in the cooling off period. For movies , i use IDFC Wealth which is alo LTF and has BOGO on Paytm upto 500 which is very decent.

Can u suggest some good paid card for monthly spend of ~ 50k . Considering BOB Eterna or SC Ultimate.

Was planning significant usage on Zomato RBL on my birthday on 4th October but that is not possible now 🙁

Do advise

You’re already considering the right ones. 🙂

Legend gives complimentary eazydiner prime only as welcome benefit (1st year only).

Is there any restriction on BMS discount like first come first serve(used to have on other indus ind cards)?

No!

Hey Sid…

I am Considering to apply for this card.

So can we club prime membership 25% off + Axis Vistara 40% off…right?

Yes, you can use Prime benefit with any other bank offers on PayEazy as well.

Hey Sid…I got the membership…meanwhile my card is dispatched… I tried to use at Restaurent. I prebooked the deal.. but got only card offfer…didnt got the 25% off which was Payeasy restaurent

you have to tell the restaurant before ordering that you have booked through EazyDiner and they will give a bill with 25% discount.

The rest you can pay using EazyDiner App

Recently i use Easydiner App to pay in Barbecue Nation, I do not hold Indusland bank Card because their reward is not up to the mark, I use my CITI Bank Indianoil card which is LTF and i got flat 1000 Rs off and it can be use 2 times a month and I dont see any point to hold this card if you pay a handsome amount fee to get 1000 off.

Thank you

This seems like a great card now that Zomato Edition Classic card got heavily devalued. But since they’re offering so much of deep discounts I can expect a daily/weekly limit getting applied on PayEazy discounts. EazyDiner’s restaurant catalogue is still small in Bangalore but seems like a better one in Delhi and Dubai where I visit quite often. In Bangalore, Dineout still rules because of tie-ups with many Breweries and 5 Stars. I hope EazyDiner also goes bullish on onboarding popular breweries here in Bangalore.

Also hoping this card doesn’t get heavily devalued in near future like it’s competition as I’m tired of closing these card account which is a pain in itself.

any possibility of getting it LTF as well ?

Quick question: How do you manage on-time payment for all of these cards? As cards increase I find it a hassle to track bills of all of them

Use Cred or put them all on Auto-debit and enjoy life!

is this better than legend car which i have LTF?

Hi Sid

Thank you for the detailed articles and the great work as always. In HT front page, I noticed EazyDiner ad with cards from many banks including this one as well as even HDFC Times card where the discount seems to be even higher (Rs 1500). Wondering if you have compared the offering of other partnering credit cards vs this cards and how does this compare to those cards.

Thank you in advance.

Keep up the great work

Applied for the card on 26 August, video kyc done on 27th . Received the physical card on 2 nd Sep at Pune. Seamless experience. I had Aura edge earlier which got discontinued due to non usage. Call centre told me that I can’t apply for new card for next six months but somehow IndusInd card executive manage at back end.

Thanks Sid for well explained article. I am holding HDFC infinia, Axis Magnus, BOB Eterna, SBI Vistara just going by articles. Closing Kotak Kaching soon as it’s useless.

Lets say we go to a restuarant with 4 members and just order 1 sabji and few rotis/nans and bill si around 500. Will the hotel really give complimentary drink to all 4 members? Or will it be just 1 drink per visit in total?

does this card have good tie ups in kasmir ?

Hi,

I’m holding Indusind Legend LTF, with minimal usage that too for any Indusind specific discounts. Today received an offer to upgrade the legend to eazy diner LTF.

Wanted to know if it’s a worthwhile upgrade considering minimal usage on legend as most of usage and requirements are fulfilled by DCB, YES Exclusive, ICICI Amazon at present.

Thanks.

Hi,

I am holding IndusInd Legend LTF card among others for about 2 years. Today I received offer for upgrade to IndusInd Easydiner LTF Card. This upgrade offer is valid till 30th September. Not sure whether I should keep the Legend LTF or Easydiner LTF.

Please help.

P.s. I barely use Legend for its very low reward rates… mostly in weekends. But it definitely has other facilities viz roadside assistance, golf etc (which I never got the chance to use). Moreover I already have paid membership of Easydiner as there are many good restaurants in my location in Mumbai which accept Easydiner reservations and payeasy.

I opted for LTF upgrade offer against LTF legend. Card generated within 3 days in IndusApp, awaiting physical delivery. Apart from EasyDiner benefits, other USP of the card is 2% reward rate (10 RPs/100 Rs. Spend) at non-network standalone restaurants which is good as previously I was using Zomato Edition for same but now it is discontinued on account of devaluation.

Hi,

Just wanted to ask you something. I owned a legend ltf as well and took the option from upgrade to Eazydiner one. I received the card today and while checking the indusind app I can see that my Legend card is still active but it has no credit limit or reward points and everything seems to have transferred to the new card.

Does that mean that the Legend card will stop working altogether ?

Hi,

I have done a transaction to check the status of Legend, I used legend card for it but the transaction was recorded under Easydiner card in the app so that means that Legend will be discontinued post upgrade.

Does the LTF card have prime membership, any vouchers.

No we don’t get prime membership with LTF free version, only postcard voucher.

We do get prime membership with LTF card, but it is for only one year. The card came in nice box. The box has 4 pieces of coasters and a voucher of post card hotel.

However there is a catch here. Although it is a free upgrade but they transfer all of your existing outstanding and point balance to new card. In my previous legend card the value of each point was 75 paise, whereas value of easy points EP is 20 paise. Apparently I lost around Rs. 4100/- in value for my some 7500 points which are being valued at around 1500/- as compared to 5600/- earlier.

My advise is to be alert of above devaluation while upgrading your credit card.

When we get the Movie voucher? Mine card issued in last month and yet not received movie voucher for same.

Select the offer in Bookmyshow promos during billing.

When you pay via Eazydiner, do you still get the full amount restaurant bill? This is true for Zomato pay for sure.

How long will these offers last? ZOmato has already degraded the Zomato Pro offers.

Does Indusind allow one to have multiple cards? I have an IndusInd legend card. I applied for an Indusind card via the Eazydiner app, and there was no movement.

I am close to accumulating 5000 eazy points, which leads to the indusind card becoming first year free. I guess that I won’t get the welcome benefits mentioned in that case.

PS: on another note, what are the best uses of Eazypoints on eazydiner?