HSBC Premier Credit Card has been in existence for a while in India but it was never widely spoken about in the past because it used to be one of the least rewarding in the segment.

But as HSBC India has finally upgraded the card’s features and benefits along with a metal form factor, it’s now worth exploring the card. Here’s everything you ever need to know about the HSBC Premier Credit Card in it’s new form,

Table of Contents

Fees

| Joining Fee | 12,000 INR+GST |

| Welcome Benefit | 12,000 INR Taj Hotels Gift Card |

| Renewal Fee | 20,000 INR+GST |

| Renewal Benefit | Nil |

| Renewal Fee waiver | Qualified HSBC Premier Customers |

The 12,000 INR Taj Experiences gift card is a very good option in my opinion but I wish they also consider exploring reward points as an alternate option, just like how Amex Platinum Charge Card had back in time.

Looking at the joining fee, it seems HSBC is inspired by Axis Magnus which in-turn was inspired by HDFC Infinia.

Eligibility

A qualified HSBC premier customer is the one who falls under one of the below:

- Total Relationship Balance: AQB of 40 Lakhs (account balance, FD, demat holdings, etc)

- Salary Credit of >3L INR

- Mortgage: >1.15 Cr

If the criteria is not met for a particular quarter, a quarterly service charge of 0.2% on the shortfall in the TRB will be levied, up to a maximum of INR 2,000+GST.

If the above eligibility criterion is not maintained consistently, the Bank may reclassify the HSBC Premier account to an alternate offering.

The Card

The HSBC Premier Credit Card now comes in a metal form factor on Mastercard World platform. The card looks definitely premium even without the metal form factor as you can see above.

The design looks simple, elegant and is great to hold in hand. The MasterCard logo definitely adds a nice colourful touch to the card.

That said, you can’t differentiate a metal Premier Card from a non-metal Premier Card except the weight. So I might just continue with the existing plastic card for some more time.

Rewards

- Earn Rate: 3 Reward points / 100 INR spend (3% Reward Rate)

- Validity: Reward Points never Expire

- No restriction on spend category, for now.

- 1% fee applies on rental transactions

As of now HSBC follows simple reward system with no major exclusions except for the rent that carries additional fee. But as they’re gearing towards higher earn rate, expect some restrictions in the coming years.

So for now the mind can be free when it comes to the usage of the card.

Redemption

- Airmiles: British Airways (Avios) & Club Vistara (CV Points) are useful among others.

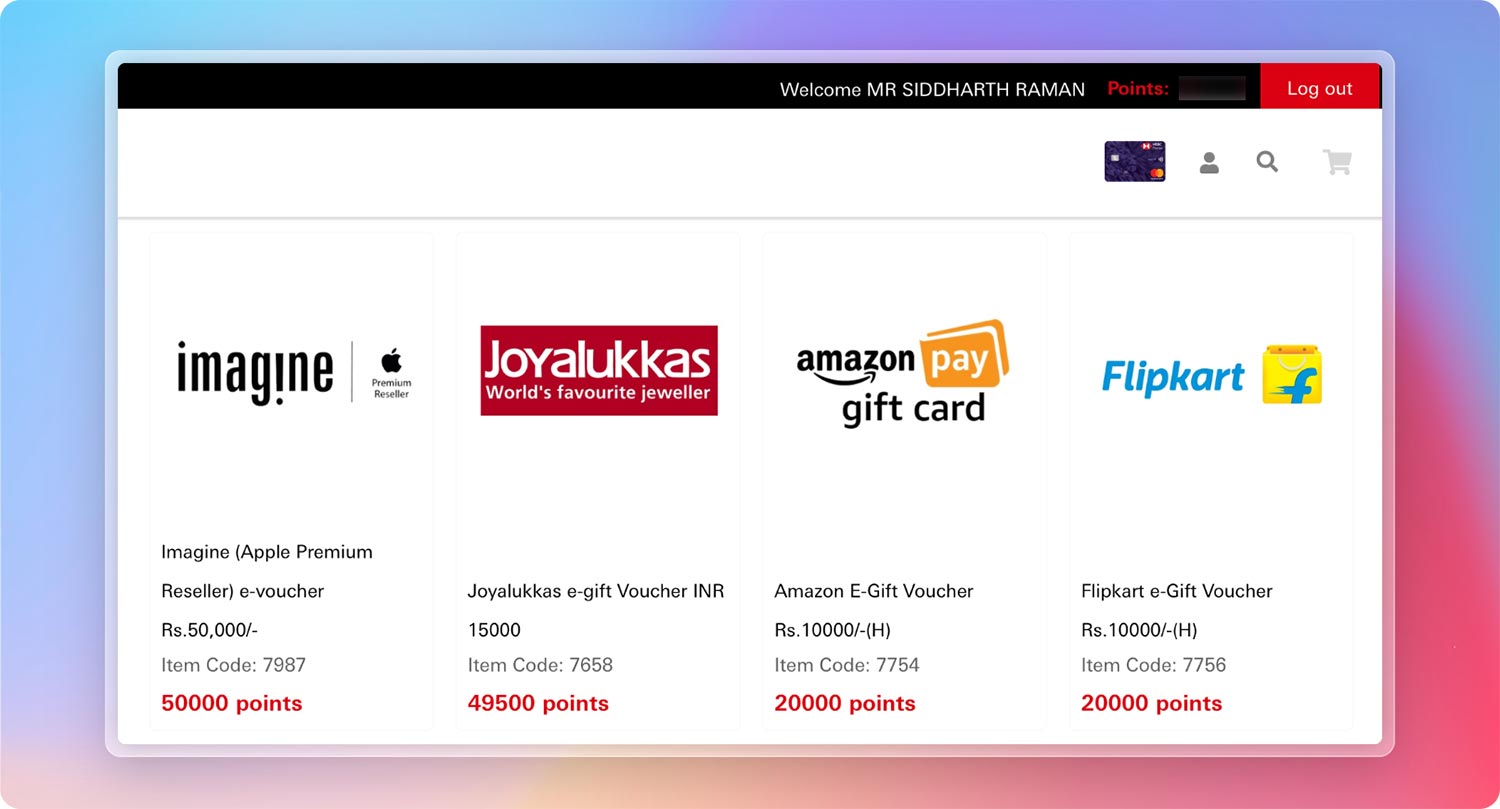

- e-Vouchers: Imagine Vouchers (Apple Reseller) at 1:1 / redeemable both online/offline (3% Reward Rate)

- e-Vouchers: Amazon/Flipkart at 1:0.5 (1.5% Reward Rate)

Apple vouchers are tricky though, more on that shortly. Here are the complete list of Airline Partners, just incase if you’re wondering.

And here’s a quick look at the e-voucher options.

The trick of the trade used by HSBC for Apple vouchers is that the minimum voucher value for the redemption is 50,000 INR, which means, you’ll need to spend ~17 Lakhs to earn 50K points.

Airport Lounge Access

| ACCESS TYPE | VIA | LIMIT | GUEST ACCESS |

|---|---|---|---|

| Domestic Lounge Access | Visa / Mastercard | Unlimited | – |

| International Lounge Access (Primary) | Priority Pass | Unlimited | 8 |

Guest access on Priority Pass (for International lounge access) is a good one to have and it is limited to 8 access per “card anniversary year”. That’s sufficient to cover the access for your family.

Forex Markup Fee

- Foreign Currency Markup Fee: 0.99%+GST = ~1.2%

- Rewards = 3% – 1.2% = 1.8% (net gain)

Being a HSBC Premier Credit Card Customer, chances of you being a world traveller is very high and so the low foreign currency markup fee on the card is certainly useful.

With the improved reward rate, the net gain now is 1.8% which is quite handsome.

Other Benefits

- Golf: Golf benefit is given as a part of HSBC Premier Account and not separately for the Premier Credit Card

- Taj Epicure Membership

- Eazydiner Prime Membership

- Festive Offers: It used to be good, but it’s getting worse over time, for ex: have a look at the 2023 Diwali offer vs 2022 Diwali offer.

These benefits are certainly useful for those who’re not into other bank credit cards.

My Experience

My experience with HSBC Premier banking & the credit card is mixed. Many a times I’m disappointed for ex, there are hardly any features on app/website to control/view the credit card.

And sometimes I’m surprised to see that the bank has given good power to the Relationship Manager like Limit enhancement requests, etc. Checkout my experiences with HSBC Premier in detail.

So if I’ve to average out my experience, I would say that it’s just “above average” for the NRV that the HSBC Premier Account demands and I feel there is lot of room to grow.

Should you get it?

There are multiple scenario’s as to why you should get the HSBC Premier Credit Card. Here are they:

- If you’re already a HSBC Premier Customer, have under 25L annual credit card spends and wish to stay within HSBC ecosystem.

- If you’re already a HSBC Premier Customer, have >25L annual spends but never mind about rewards. (that’s not a joke, as I see many like this)

- If you wish to spread your spends across multiple cards for specific needs, maybe for Apple vouchers in this case and you’re capable of taking HSBC Premier relationship

Having said that, it is also essential to say that if your annual spends are very high, like over 25L INR or so, it’s better to get the Axis Magnus for burgundy Credit Card, as the opportunity cost is very high at that spend level, because the reward rate comparison would be like 3% (HSBC Premier) vs 10% (Magnus for burgundy).

Bottomline

- Cardexpert Rating: 4.2/5

Overall the HSBC Premier Credit Card in it’s current form is decently rewarding and the recent upgrade is certainly a noteworthy one.

However, given the NRV that the HSBC Premier Account demands, I would anyday expect complimentary Airport Transfers & Airport Meet & greet services to make it truly worthy of a king, and of you. 😉

Do you hold a HSBC Premier Credit Card? Feel free to share your thoughts in the comments below.

Sir renewal fees is very high plus no renewal benefits. You haven’t discussed about that point

It’s meant only for HSBC Premier customers, I see no reason for anyone to pay such a high renewal fee.

Is Joining and renewal fees exempted for Premier customers?

Used to be. But no longer.

How do you get the Epicure membership with this? I got the card early this year before the metal form factor kicked in and reward rate changed.

Haven’t checked, as I anyway have one already. I guess support would be well equipped to handle these queries by month end.

What other cards like this one provide rewards on utilities spends?

Still Infinia is much better. Infinia 5x and 10x are the best in the industry still . Coming back to HSBC, reward redemption is not good either (except for apple products).

Do you get point for rent pay(via red giraffe) ? If so, is it capped ?

I had HSBC Premier from 2011 until 2020 and closed it as it was not much use after I did not require the Global Banking feature, so I closed it. I held the complimentary Premier MasterCard as well and swiped maybe only once or twice in the ten years. I had other more rewarding cards to use instead. Now 3% is a gimmick as effectively only 1.5% Amazon or other vouchers is practically the choice. Even Axis Ace Card gives 2% flat on all spends as cash back to the card itself. It is not at all attractive in my opinion to pay Rs.12000 for this card…

HSBC will give rewards on Govt Spends that no other card will give

4.2/5 is very generous. 3.2/5 would be more like it.

3% reward rate with no renewal benefit but renewal fee at 20k. What a disaster.

Adani lounge in Mumbai for domestic travels does not accept HSBC premier card. Asks for priority pass instead. I had to use some other credit card.