There has been a lot of buzz with forex cards for foreign travel and I thought to clear some of the common queries. Beware, after reading this, you might never get a forex card. By looking at forex cards from multiple banks, i decided to review HDFC Multi-currency forex card as it seems better than other bank offerings.

Load Multiple Currencies in Single Card:

With HDFC Multicurrency ForexPlus Chip Card, you can load one or more currencies to your single card. It’s more like multiple wallets that can be loaded and reloaded in one single card. The nice part is that they advertise it as 0% forex charges which means, if you’ve loaded USD and charged USD, there won’t be any additional charges.

HDFC very well explained the practical use case in a nice video, watch below,

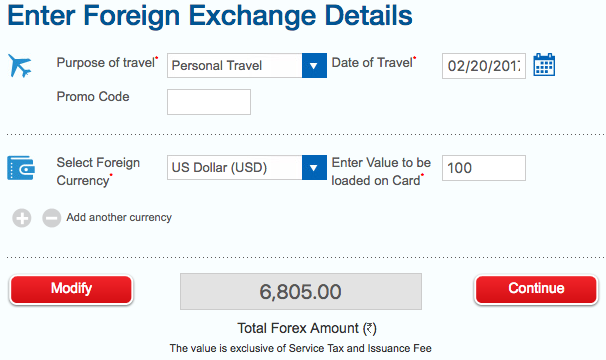

But, you should be aware that the said 0% markup fees is already charged @ ~2%+tax while you load the card. Here’s an example of applying for 100$ HDFC Multi-currency forex card:

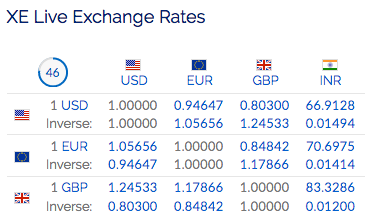

- Actual USD value in INR: 66.91 INR (as on xe.com)

- HDFC rate per USD: 68.05 INR

- Difference: 2%

So that’s about 2%+tax (not mentioned anywhere), which is the lowest by HDFC provided on their premium credit cards. Interestingly, they’ve mentioned the same 2% fee when you shift the balance from one currency to other within the card or, when you swipe for a currency that’s not in the wallet.

HDFC Multicurrency ForexPlus Card Charges:

Apart from the above, there are other charges like issuance charge, re-loadable charge etc. you can find major charges applicable on forex card below:

- Issuance charges: INR 500 + S.T

- Reload charges: INR 75 + S.T

- Move from one Currency to other: 2% + S.T

- Charge on unlisted currency: 2% + S.T

- ATM withdrawal Fee: ~$2 + S.T

- Balance Enquiry Fee: $0.50 +S.T

- Cardexpert Rating: 3.5/5 [yasr_overall_rating]

S.T -> Service Tax which is currently 15%

That being said, there are too many things to keep on mind and the Forex cards are not for the one who already hold Premium Credit Cards. It makes sense to get Forex cards only for those who don’t have a credit card.

Its Very Expensive sometimes: This card is infact an expensive option if you’re traveling to a country with a currency that’s not available on the card as you’ll be charged markup fees TWICE, first while loading, next while spending.

When it comes to me, my recent favorite choice for foreign travels and even online spends is Indusind Exclusive Debit card which has ZERO charges for anything and everything, from markup fees to withdrawal fees. This allows me to go cashless every-time i’m on a foreign trip while my friends wander with notes to costly Money Exchangers. This saves me a lot of time, confusion and most importantly money.

Apart from this debit card, i’m also using Diners Black and Business Regalia (not after devaluation though) for online spends when the expenses are more. Also, i’ve recently applied for some cash & forex card from third party service provider that promises 0% markup fees. I’ll share a separate review on that shortly.

What’s your experience with Forex Cards? Feel free to share your views in comments below.

Thanks.. Pls correct the link for Indusind Exclusive Debit card. Current http link is for Yes First Exclusive Credit Card.

Thanks for noting it, just did it 🙂

Does this Indusind exclusive debit card is lifetime free or has annual charges ??

It has the annual charges. Check out the respective link.

I siddharth

Can you suggest me any application. Which is showing my all save credit card benefits in one app. So that I could considered at a time purchasing. Which card is best for me now. Pls help..I m searching my answer to last two months to google.

Thanks

Vinay

Are forex cards are more secure than a credit card?

Credit cards are more secure always as it has dispute/chargeback benefit with it.

Good to know nothing comes in front of Indusind Exclusive debit card. Loving this card. Saving every bit from withdrawing to conversion charges. Hands down ! There is no need for forex card to be honest when there are debit cards like Indusind Exclusive 🙂

But when something is too good, it doesn’t last long. That’s what am afraid of 🙁

Exactly. Unfortunately all good things come to an end 🙁 Lets hope some other banks come up with offers like this 🙂

Agreed. This feature is there in their arsenal for more than 2 years now. Intially, it was offered on the Platinum Card that was offered with the Exclusive account. Also, the same feature was there in their Indus Select Account too. I had opened a Select Account because of that only in past. Later on they changed their product offering in Indus Select a lot. But they never touched the Exclusive Portfolio. I’m very confident that if IndusInd continues to offer this facility, it’ll stay with this Exclusive account only and nothing else. I’m waiting for the day ‘no mark up fees’ concept is introduced for credit cards!!!

At the same time, try reviewing the IndusInd multicurrency Forex card. They don’t charge a Forex at all. I checked it myself. Kindly you try doing that and please confirm this. You don’t have to book actually, you just have to try ordering. It’ll show you the cost and all.

Yes, i see that it costs less as well, but while swiping in other currency, they’re charging 3.5%+tax instead of 2% as here. Let me do a full review on it shortly 🙂

Exactly. But the point is if you already have an Exclusive Signature Debit Card, there is no need of an extra Forex Card. Till now I haven’t found a better Forex card deal than IndusInd. The Forex Cards by HDFC and ICICI hold more currencies but those come at a cost!!! 🙂

Ofcourse, i dont need forex cards, but i’m kind of addicted to have new plastic in hands 😀

Can I use a forex card for online transaction in USD? Thanks.

Yes, you can use this Forex card online.

I have used bookmyforex many times and and bet they are the cheapest in market which i have also experienced.

Cool, i’ve got one with Doorstepforex recently. Yet to use it, will share a review on it soon. 🙂

Hey Sid,

I have been reading your page for quite some time now but this is the first time I am commenting. First, accept my congratulations for making a top-notch informative website to help the rest of us forage into the credit card jungle. Second, I have a small suggestion. Although this will be a little programming intensive, but I am sure you can pull this up. Why not make a small “Card Finder” based on salary, income, FD, etc.? It will be really helpful for people who stay abroad and finally want to come back and settle to India. Am really looking forward to something like that from you! BankBazaar has one, if you need a ref!

Have a nice day

Thanks much for the kind words.

Sure thing. I’m planning on something similar. Glad to get a feedback on this.

Highly appreciate it.

It should be live in 2-3 months 🙂

I will wait eagerly for it. I am sure we can expect a way better quality from you than BankBazaar’s run-of-the-mill design.

They’ve recently copied our blog’s design to their blog as well 😀

I swiped my regalia card at HPCL petrol station. The swipe was for Rs 1150. In my statement I see a debit of Rs 1182.98 and a credit of Rs 8.62. Anybody face this thing and know the maths?

Should i avoid swiping regalia card at petrol station?

8.62 is the 0.75 cashback which HPCL gives as per government instructions.

You paid 1150 + 2.5% Surcharge + Service Tax and received 0.75% cashback.

Please check your bill, there should be a credit of the 2.5% Surcharge (28.75).

But I assume you would get the surcharge waiver only if you swipe it in the HDFC terminal and not others.

Hello,

So if you already hold a REGALIA card with its 2% mark-up on foreign currency, there is no benefits to go for a MULTICURRENCY FOREX Card?

Great website

Mostly Yes.

is there a fee for actually swiping the HDFC forex card at POS (like at hotels, restaurants etc)?

The Markup charges will be added wherever applicable.

Hi,

Have you published an article on “cash & forex card from third party service provider” as you have mentioned in the last paragraph?

Yet to, will do it sometime soon 🙂

Hi,

going to malaysia.

I have a HDFC jetprivelage master card platinum.

The bank suggested that get a forex as it will save you from conversion rates.

Ringgits are part of the 23 currencies.

Should i get the forex card or forget it.

You may get the forex card as Jet Platinum is not a premium one.

But don’t we get points on HDFC cards when we load HDFC forex card via credit card. Also probably you missed the Prepaid card offer.

It’s like if HDFC is charging 2% it’s like markup charges which they charge on credit cards and you are getting usual reward points + 2500 bonus points via this offer

hello

im going to usa for studies, can you please help me which card is better to go with. I have a HDFC account where i can get HDFC relgia credit card and im confused to go for a HDFC forex card as there are hidden charges of 2%. can u please suggest HDFC student forex card vs Indus forex card (which desnt have any extra fees)

I’ve been using HDFC Multicurrency Platinum ForexPlus Chip Card for over a year now. Load the amount you want once (plus whatever taxes or cross-currency charges deducted or charged) and just use it. You can change currencies online.

No charges whatsoever when I shop online or swipe at POS. Only country specific atm charges are deducted when you use it at atm.

Hi, do big HOtels accept the HDFC Multicurrency Platinium ForexPlus Chip Card? I heard that the Hyatt does not accept it. Can you let me know.

So does that mean that the only purpose of the Forex card is for buying groceries and other items from shops and onine?

Hi avid reader of your site here. I see they’ve launched a Regalia Forex card which looks like its much better. Would love to get your thoughts on that too.

Also do suggest a good alternative to Diners Premium after HDFC did the recent massive devaluation. I see you mention a post is due. Looking forward.

I just reviewed that new Regalia Forex card. Check out the latest article.

Hi

I will be going to europe for an year. I presently have diners premium from HDFC only. What Forex /Debit or credit card will be the best to save on exchange rates/taxes and can be used widely in europe without any security issues. i have heard diners acceptance in europe is not good enough.

Thx

Currently I am working for XXX and recently i moved from India to US and my company has provided me a Multicurrency Forex corporate Card(loaded the amount in USD) . Now i would like to transfer the balance here to one of my account . I did withdraw the amount in ATM once with withdrawn fee.. Will there be any transaction charges or I can go to any bank here and do the transactions without occuring any penalty?

i would like to know whether i can top up my forex visa card without using my debit or credit card as i am not carrying them now

You can use Net banking for topping up.

With so many charges. Isn’t it advisable to just use Credit Card while travelling?

…and withdraw cash using a credit card. Really? 🙂

“Also, i’ve recently applied for some cash & forex card from third party service provider that promises 0% markup fees. I’ll share a separate review on that shortly.”

Is the review available now? 🙂

Thanks for the article and tips. I have a HDFC Forex Card and not using it lately. What do I do to reverse the funds I have in my Forex Card account bck to my savings account? Thank you.

Hi Mittur,

Approach any nearest HDFC bank. They have a form for Forex card refund. Just fill and submit it there. They may ask you the original Forex card and original ID proof for processing refund.

Within 2 business days, You will get the refund. I have HDFC account and I got the refund on the same day.

Thanks,

Sharath

Any way to get it for free? I mean without one time issuance fee.

Till 30th June, Issuance fee is waived for all forex cards from HDFC if you have a HDFC Savings account.

HDFC Forex card is a big flop. I had taken one for my US visit. It was hell of experience. At many places i had to face problems.

Rate of conversion was also higher than what was told.

They entered wrong phone number and e mail id. I can not say whether it was intentional or by chance.

when tried to check my transactions on line after login, i was surprised to find the reply, User is blocked plz contact customer service” Thank god i had my debit card which was working there.

Has anyone availed the 10X benefit for reloading this card using HDFC credit cards?

with an Infinia or DCB 33% cashback via rewards points is a sweet deal – capped at Rs. 5000 per month per credit card

valid till march 19

Do share your thoughts.

Now 10x deal on forex reload is valid till June 30. Good idea to upload 15000 every month and dave for future international trip :))

I am using currently using HDFC Forex Plus multi currency card. Just to beware everyone that HDFC don’t bother at all about their Forex Card customers. You can never reach their customer care even after waiting for continuous 4 hours. HDFC has mentioned 24 hr customer care but nobody bother to picks your call.