After seeing a massive success on the HDFC Regalia credit card by devaluing the points, looks like HDFC Bank now decided to use its past name and fame of “Regalia” to brand its new Forex card. HDFC has launched a new Forex card this month that revolves around the concept of – No Cross Currency Conversion Charges, which is indeed in high demand lately. HDFC that has a forex card for a while – HDFC Multicurrency ForexPlus Chip Card that also has similar features, but this new one does have significant advantage. Lets have a look,

HDFC Bank Regalia ForexPlus Card Benefits

HDFC Says: “HDFC Bank Regalia ForexPlus Card is exclusively designed for globe trotters. No hassle of carrying multiple currencies or managing currency wallets, currency conversion charges are thing of the past.”

Its clear that their previous multi-currency wallet concept seems to be too complicated for a normal person to understand and use, hence comes this new product. Lets dive into its features:

- Regalia ForexPlus Card Issuance Fee: Rs 1000/-

- Reload Fee: Rs 75/- per reload

- Balance Enquiry – 0.50 USD

- ATM Cash Withdrawal – 4 USD

#1 Zero Cross Currency Charges

It is the most important benefit that a Forex card needs. Now you get 0% Markup fee even if the transaction currency is different from the currency available on Regalia ForexPlus Card (USD). Problem solved?! No, there is a catch.

- GST on Currency conversion towards the purchase of Forex currency is applicable

They charge around ~2%+GST or so (which they usually charge on HDFC multicurrency forexplus card) on purchase, which is nothing but the markup fee. Hence, you’re actually paying the markup fee upfront.

Its not fair for the so called “India’s #1 bank” (as they brand so) to hide this fee and promote it as 0% markup fee card.

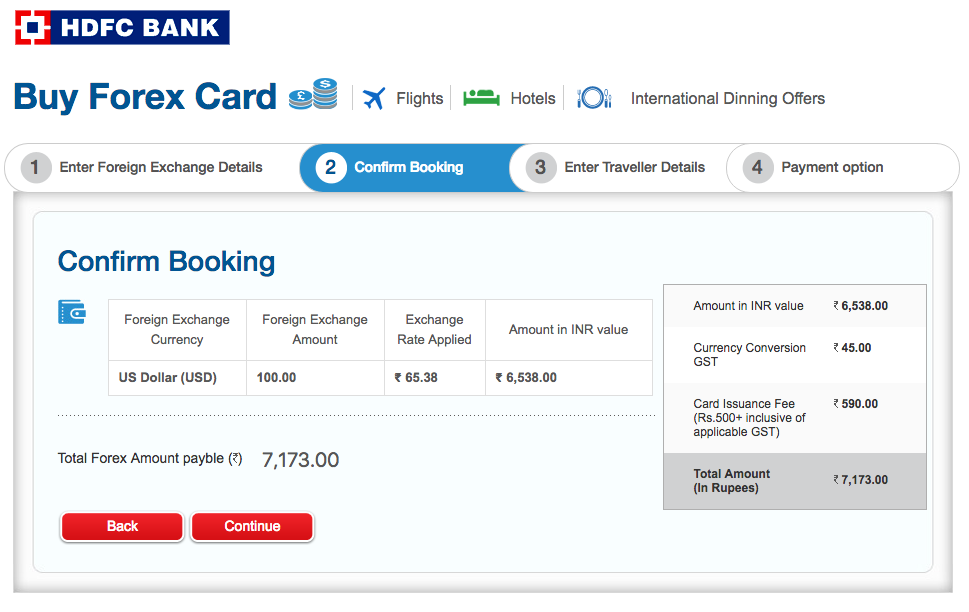

Here are the numbers exposed for $100 forex card when XE Rate: 1$ = 64.4

- Actual Rate: Rs.64.4

- Bank conversion Rate = Rs.65.38 (~1.5%)

The good part is this card runs on Mastercard network which gives you the best exchange rate (when you use on other currencies) as per the recent research. More on it here: Visa vs MasterCard vs Amex vs Diners Club – Which has the Best Foreign Exchange Rate?

#2 Complimentary Lounge Access

- Complimentary International Airport Lounge Access in India (Limits Not disclosed)

This means, you’ll get complimentary access to mastercard airports lounges in terminals with international departures only. They haven’t disclosed the max. limits yet. This maybe be like 2/qtr as usual.

#3 Online Usage Enabled

Bank allows E-commerce facility on Regalia ForexPlus Cards to make payments towards shopping done on online website / shopping portals. In case of Ecom transactions, the system may prompt for second factor authentication where you need to validate the transaction using the NetBanking PIN for your Regalia ForexPlus Card.

So any left-off currency after your trip, you may consider splurging on sites like AliExpress. Though, not sure how practical it is.

#4 Cashback of 5% or 5X Reward Points Offer (limited period)

- Debit cards: 5% Cashback limited to Rs. 2500

- Credit cards: 5X Reward Points Limited to 2500 Reward points for

This is indeed the major benefit if you’re considering to get this card. Loading your Regalia Forex Plus card with Rs.50,000 using a HDFC debit card will get you Rs.2500 cashback which will set off the issuance fee & the markup fee. Same with credit cards, makes sense if you hold Infinia or Diners Black to avail 5X reward points.

Other Benefits: There are other benefits like ‘Thanks Again’ Reward Program by MasterCard and ‘Waiver on ATM Access Fee or ATM ownership charges’, however both are limited to a small network, hence not a major feature to rely on.

Final words:

If at all you’re going for this Regalia Forex Plus card, its worth it if and only if you do so by availing the 5%/5X offer mentioned above. Else, you loose a net ~2%+GST and additional withdrawal charges. Consider Indusind Exclusive Platinum DEBIT card or Indusind Exclusive Signature DEBIT card for any withdrawals.

Be aware that using debit cards abroad is not suggested as its not that secure as Credit card, which is one of the major reasons to hold a credit card. Hence you might rather go for any of the cards that we’ve listed for international transactions (but never withdraw from credit cards). Here you go -> 7 Best Indian Credit Cards for International Travel.

What’s your take on HDFC’s new Regalia ForexPlus Card? Worth the hype or yet another fail? Feel free to share your views in comments below.

Request to update the issuance fees at the beginning which is Rs.500+GST as shown in screenshot

Their Terms & conditions says below:

==

50% discount on issuance fee INR 500 – for loading card with less than USD 2000

The offer is valid till 31st August’17, post which Issuance fee of INR1000 will be levied to the customer

==

Edit! Cashback offer is only until July 31, 2017

I’ll like to correct something here.

“The good part is this card runs on Mastercard network which gives you the best exchange rate (when you use on other currencies) as per the recent research”.

As per my knowledge, the rates of Mastercard/VISA are applied only when you do a transaction and want VISA or MasterCard to carry out the transaction for you. When you buy FOREX from a bank, it is the “bank’s wholesale rates that get applied.”. What does this mean?

This means, a similar card on a similar card on the master card platform from say for eg IndusInd Bank will have different conversion rate. This is because the whole sale rates at which IndusInd sells the FOREX is different from that of HDFC Bank. Ideally, if the argument in question had been true then both the bank’s would have charged equal money for loaodnv $100 to the card if you leave the mark up and other loading fees aside. I hope I’m able to convey what I am trying to.

That’s applicable anyway when you load and what you said is correct when you ‘spend’ on USD.

But when you spend on “other currencies” say, GBP, same like indusind, Mastercard decides the conversion rate of USD->GBP as bank don’t interfere in this part. (0% benefit of the card actually is used only here)

Abhishek,

You are right in your understanding. I realized it myself when i went abroad and used HDFC’s forex card. They charged me a mark up which was different from the Inter bank rate(Lowest possible rate), they also charged me for ATM transactions.

I came across IndusInd Bank’s forex card which is available on indusforex.com. The charges are very close to the Inter bank rates and the markup is negligible. This is very different from what the banks usually charge us. Also 2 ATM withdrawals are free! You should try it. I dont really expect bank’s to be transparent about pricing, but if you book through indusforex then you get total transparency. I am impressed.

yes offcourse

Hi. How is the Forex Card issued and What will be the validity of such card?

Plz elaborate the point that debit cards are not as safe as credit cards during foreign trips…

If the item you’ve ordered was not received from the seller, you can very well ask the credit card company to raise a dispute against the transaction. In credit card terms, its called “chargeback”. This is NOT available on debit card transactions.

Hi

I will be going to europe for an year. I presently have diners premium from HDFC only. What Forex /Debit or credit card will be the best to save on exchange rates/taxes and can be used widely in europe without any security issues. i have heard diners acceptance in europe is not good enough.

Thx

Hi,

I recently used the IndusInd Bank’s forex card. The card has 0 card issuance fees, 0 markup and is available on their website. In fact i was able to do a completely online process and get the card delivered to my home! They are also giving 2 ATM withdrawal free of cost! I think this is the best forex card that is available online.

It also has all the Visa offers bundled in the card.

Hope you find this useful.

Hi Siddharth,

I am traveling to Europe for about 20 days next month on a vacation. While searching for best forex solutions, I came across your articles and really liked them!

However, when I spoke to my RM in HDFC he told me a slightly different story:

– If you load USD 2k+ in this card- there is no card issuance fee and hence no GST either. So, essentially what we pay is only the rate you see (published on website/ branches) which of course includes a markup of around 1.5-2.0% (which according to him is the lowest among all banks). He also said that he would try and give me some discount on this rate also (around 15-20p per dollar). Plus I can use any credit card to load currency in this card and get cashback/ bonus RP in addition to normal rewards points there. So, in all a saving of about 0.5-1% over even the XE rate!! Plus, since this is single currency card with zero cross currency charges- I can continue using the same card for all my future official/ personal trips abroad. This all sounded quite convincing!

Do you think it would be good, compared to Axis bank multi currency forex card?

Hi Siddharth

Have been usinng bookmyforex for over 2 years now and can say that their rates for forex sale or purchase + delivery of forex card (on axis bank visa platform) semms best in rates and service + 3 free withdrawals pm. Similiar rates as seen on

xe.com

Let me know your thoughts

Yes, its good. Bookmyforex & doorstepforex – both are good.

Hi Sid and all,

I am planning for my first euro trip in October😊 is this card the best, or should i go some other card. Can you please suggest? I would be loading around 1000 euros.

Aman try bookmyforex also for forex offers they work on zero commission.

I have Yes First Preferred card which has 1.75% mark up fee, as well as Regalia, which is at 2%. I was planning to use these on my upcoming trip to US/Canada. Would you recommend this forex card over those 2 credit cards?

For w/d cash – yes. For swipe – no.

What if we use our regular SBI/HDFC/ICICI/other bank debit cards for withdrawing cash abroad instead of using the Forex card as the forex card locks the money?

Can you please also post an article about HDFC ISIC Forex card and also HDFC kids advantage account easyshop platinum debit card

I am a student going abroad for studies please help me with cards to take and other financial things

Thanks

Parth

Hi. I am planning for Dubai trip.

Would you recommend HDFC Bank Regalia ForexPlus Card for this as I will be using it for shopping,dining and sometimes ATM withdrawal.

Dear sir

offcouse you can use Hdfc bank regalia forex card as it especially made for foreign transactions you can say it is a currency card and acceptable anywhere because it is linked with master card ,if you are planning to go dubai you can do shopping ,hotel booking by swipping it.

last but not least when you teke cab/taxi there only forex card is used for swipping if you use debit or credit card it will charge3% extra per transaction.

talking about ATM transaction if you will withdraw cash from atm it will charge 2 usd per transaction . however if there is an emergency for cash withdrawal you can withdraw.

he best part of the card if you purchase is that you can lock the currency rate even best rate forget about day to day currency fluctuations .

again the best part of this card is forget about currency lost as you can carry it easily if you lost this card you can block immidiately through net banking of this card or call on a toll free number.

the 5X points offer is there till March 31 2018 and has a cap of 2500 points. I was initially thinking to go for it, but with points cap it will be of lees value. reason being $4 charge for each withdrawal and also it is charging Rs.1 more for each $.

Bookmy forex seems good with free atm withdrwal and less conversion charge.

So I think that it is best to take a forex card even if we have a Regalia First credit card from HDFC as we should not withdraw from CCs.

I’m thinking about using Uber kind of services which charge your card directly in other countries, if this is a forex card, it will have 0 charges but if it is a DC or CC of India, there will be huge charges.

This will be a disaster, I’m still not sold on this Regalia Forex card or the Multi- currency card by HDFC, if I have to transfer SGD – MYR – THB , I think they charge either markup or some other fee.

Regalia forex card option works when you load with 5X points. Else, you may checkout Indusind Forex card.

Reg. Uber, i noticed a strange thing recently. My friend’s Diners card gets charged in INR (kind of 0% markup, as good as XE value) when we took a Uber in singapore. But mine always gets charged in the country’s local currency. Looks like i’m missing something on this.

Hi Siddharth,

Please can you tell me where they say online on site, they have cap on 5X rewards points upto 2500 points only.

Because the executive who came to me said 5X reward points without cap.

I am looking for INR to Euro to Icelandic Krona can any one suggest the travel card with zero or lowest possible cross currency charges

Hello Sir,

I am about to leave to Indonesia(Jakarta) IDR ; next week. I am thinking to buy HDFC Regalia forex plus card. Since I am a preferred customer of HDFC so RS 1000 as a issuance fee will be reversed for me. Along with it It has Zero Cross currency charges. Only $4/WD. I am getting 5% cash back of up to RS 2500 in my account within 2 months. Is there any catch ?

Is it worth to buy? Along with this could you please suggest a better place to get IDR in New delhi. Book my forex is asking for 1INR= RS 0.0067 (exchange rate) somewhere i heard RS 0.0063. Is it a best rate ? I need your suggestion Bcoz I want to save my money in whatever the best possible way are. Although I will be getting the forex card from my company either from AXIS or ICICI still buying HDFC regalia forex ? Is it worth buying?

How can I use Regalia Hdfc Forex card for online transaction such as on US amazon in US? I could not find any option asking for forex card details. Please help.

Use Credit card option while paying through Forex card.

Zero conversion charge propaganda is fully false when it comes to ATM withdrawal. I would’ve been better off with a euro forex card but I took regalia. I got charged a conversion fee for withdrawal of almost 10%!! The worst part is customer service where noone from HDFC is responding. I would not recommend this card to anyone

Hello Ramya,

For Regalia forex card, they have mentioned ATM charges as 4$ per transaction. That is might be a reason. But could you please share your experience for doing online transaction in Euro or any other currency that dollar? Are they charging any hidden conversion charges?

Hi Siddharth,

Since Regalia ForexPlus Card is loaded with single currency USD and I transact in any other currency(say SGD), in this case the conversion rate that would apply, will it be of Mastercard or HDFC Bank? Also if it is Mastercard, I believe it is very minimal and the best in the market and then it makes sense to take it and load it with HDFC Cards with good reward rate.

Also, as HDFC bank advertises it as 0% cross currency conversion charges, as per my understanding no GST should be applicable while transacting in SGD? Are there any GST charges apart from when we are loading/reloading it?

You can transact in any currency. There is no foreign currency markup. Also, no GST charged on transaction apart from initial and subsequent loading/ reloading/ transfer out on the card.

The current offer on this card is 10x reward points on loading or reloading, and so it sounds amazing using DCB.

Two questions though:

1. Does using this card for INR transactions in India (after return from trip) permitted? If yes, then without cross currency charge?

2. Has anyone used the ongoing Boingo Wifi offer which comes bundled with this? Any reviews?

Thanks!

You can’t use it in India as it is. You can only transfer out your balance from the card to your account. No idea about the Boingo offer.

Anyone please tell me if I can use this card on paypal ?

You can use it on PayPal site which is based out of India and has base currency other than INR.

So i have some question:

1. Is the 10x offer applicable to all or those who receive mailers.

2. Can i load card with 2 hdfc cards and get 10x twice?

3.leaving aside offers which is better mmt forex or regalia forex as i do not want any offers. I want cash/points returns net of fees.

Hi Siddharth

Nice article. I’m travelling to Poland for some months, they use their local currency Polish Zloty (PLN). Carrying too much cash is not safe. And every month getting money from India seems troublesome.

I was considering this card, so that every month I can reload and spend. Is their any other forex card with much lower fees/ conversion charges/etc ? I am open to debit and credits as well.

Worst card. Doesn’t even open its account page. The all point atm network app says the card doesn’t support its atms when scanned. Fake promises. Don’t go for it. Travelling malaysia and find it a bit odd.

Boingo Wifi works, used it on Etihad flight from Delhi to New York.

This is interesting. How about the speed & caps?

Hi Siddarth, very nice article … I am planning to take this card … could you please clarify what will be the selling price they offer when the purchasing price was Rate = Rs.65.38 (~1.5%) while the Actual Rate was: Rs.64.4?

Does that remain the same while selling or does it changes like selling the USD in cash?

Also, is there any other forex card with zero issuance and zero markup fees?

Hi Siddarth,

I have canceled a product that I have purchased at Amazon in the USA. I used the HDFC forex card for this purchase. Will I get back the amount refund on the same card?

Thank you!

Does HDFC Regaliya forex card work in China? Can it be used there?

Yes, Regalia is having Single Currency I.e USD. It will Work in China.

MMT forex card – ATM withdraw charge is USD2 (or equivalent). Whereas this card it is USD4, which is double.

And Cashback of 5% or 5X Reward Points Offer, available on both.

Hi Sid and other readers,

Do you have any idea if we can combine both the offers on forex reload:

1. 5000 point on reload of forex card ($1000 or more)

2. Rs.5000 cashback on EMI loading of forex card (Rs.75000 minimum transaction size)

Additionally we will get Rs.1000 (500×2) Amazon voucher. So a total savings of Rs. 11,000

Where is the second offer?

Also 500×2 amazon vouchers? I can’t find it?

I am having Regalia ForexPlus Card its valid upto 10/2023. I have used this card in last feb 2019 in Qatar. Now again I am going Qatar shall I use this card for shopping. Whom I have to approach.

Thanking you

Yes You Can Use It.

Hi,

Is it possible to transfer back any amount loaded onto this card back to my HDFC bank a/c.

If yes, is there a cap to this transfer back and are there any charges for this?

Thanks!

Yeah you can transfer back the amount. The limit and charges are as mentioned in the TnC booklet.

With the new budget, should forex card reload be charged 5% TCS? And can it be claimed in IT returns if the value is less than 7lakh?

This is the most useless card/bank for the Forex Card. I had a problem in loading the card despite the fact that money was debited from my account. Still I am struggling to load the card and the online HDFC helpdesk is of no use. You can imagine the plight of the person who is in USA without any money because of HDFC. Secondly, I was surprised to see that my card is not linked with the bank account. However, I have a very high value for axis bank Forex card which I have used earlier.

Can regalia Forex plus card can be used in Singapore airport lounges

Do we still get points for loading this HDFC regalia forex card with DCB or Infinia?

I didn’t get when I loaded once last year. So it was likely stopped sometime back.

Any other ways to load this card using Axis Atlas then? Would be helpful in completing the platinum tier then… Any inputs would be great as only 3 days left for Atlas devaluation