American Express Platinum Reserve Credit Card is positioned as a Premium Credit Card in Amex lineup, standing one step below the Platinum Charge Card (metal). The Amex Reserve Credit Card was never a go-to card in the past for most because of it low rewards and high annual fee.

While these issue still remain even after the current refresh, some changes have been made to the product to make it slightly better for some. Here’s everything you need to know about the AmEx Reserve Credit Card in its latest form in 2024:

Table of Contents

Overview

| Type | Premium Credit Card |

| Reward Rate | 1% – 3% |

| Annual Fee | 10,000 INR + GST |

| Best for | Monthly Spends of 50K INR |

| USP | Accor Plus Membership |

The Accor Plus membership is the USP of the Reserve Credit Card, as there are only two other cards that offers this membership: Amex Platinum & Axis Reserve. Let’s explore more about Accor Plus little later in this article.

Joining Fees

| Joining Fee | 10,000 INR + GST |

| Welcome Benefit | 11,000 Reward Points (~5,500 INR value) |

| Renewal Fee | 10,000 INR + GST |

| Renewal Fee waiver | On spending 10 Lakhs |

| Renewal Benefit | Nil |

Expecting 10L spend for the renewal fee waiver is unreasonable for the benefits it offers. However, you can get it waived to an extent with a retention offer, more on that below.

*** Best Card with Accor Plus Benefit ***

Apply through the link on the page to get extra 8,000 Referral Bonus MR points (~4,000 INR Value) post 5K INR spend in 90 days.

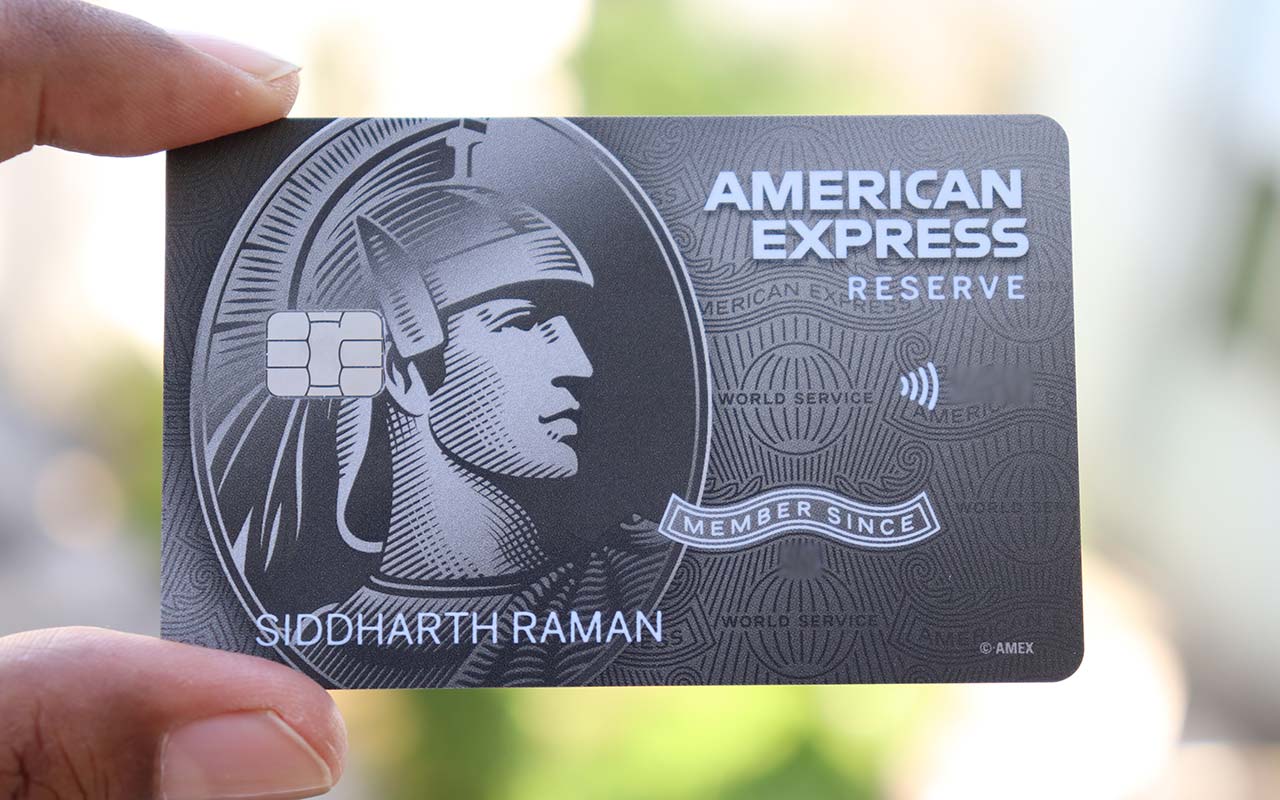

Design

The new design looks great on the screen and quite good in reality too.

However, the name on the card kind of disturbs the beautiful design, especially when your name is not correctly aligned in center, unlike mine.

Rewards

| SPEND TYPE | REWARD POINTS | REWARD RATE |

|---|---|---|

| Regular Spends | 1 MR / 50 INR | 1% – 2% |

| Utility, Insurance, Fuel & EMI | No Rewards | Nil |

The reward rate is based on the assumption that one can get 1MR=0.50 INR easily with Marriott Points transfer but getting 1MR=1 INR isn’t easy in most circumstances.

So, a 1% reward rate just like most other Amex cards, is quite a disappointment, but well, that’s why the milestone benefit exists.

Monthly Milestone

| SPEND REQUIREMENT | MILESTONE BENEFIT | VOUCHER TYPE |

|---|---|---|

| 50,000 INR | 1,000 INR (2% value) | Flipkart, BookMyShow, MakeMyTrip & more |

- Enrolment is mandatory to avail the benefit

While the revamped milestone benefit is better than before, life would have been much better if it was a quarterly/annual benefit.

Nevertheless, it’s a good way to earn 2% on spends that wouldn’t earn rewards otherwise.

Given that there are so many restrictions on other bank credit cards in 2024, this card could help get some value back on those type of spends as well.

Accor Plus

- Up to 50% off on dining across Asia Pacific

- Accor ALL (Accor’s loyalty programme) – Silver Status

- 20 Status Nights in Accor ALL Program to get closer to Gold or beyond

- Upto 50% off on rooms with red hot rooms sale

American Express Reserve Credit Card comes with an “Accor Plus Traveller” Membership as complimentary. Note that it doesn’t offer a complimentary night stay, or other dining/stay discount vouchers.

The primary use case of Accor Plus membership is the dining benefit with which you can get 50% off on dining (if 2 person dine).

This is an amazing benefit that could save few thousands on dining when you’re travelling abroad with family.

While it’s meant for Asia Pacific only, surprisingly it also works in few other countries as well, like in South Africa & Egypt where I availed it few months ago. Perhaps it’s just hotel-specific when you go beyond APAC.

Taj Epicure

- 25% discount on food & beverage and Qmin

- 20% discount on Jivas Spa & Salon

- Complimentary celebration cake (500 gms) in birthday month

- Happy Hours 1:1 at Taj Club Lounge, valid twice

- And few more vouchers

Taj Epicure Plus is the customised membership by Taj Hotels for American Express cardholders and it’s slightly better compared to what we get with ICICI Emeralde Private Metal (or) HSBC Premier.

However, just like Accor Plus, Taj Epicure also doesn’t come with the complimentary night benefit.

That said, the 20% discount on Spa and 25% off on f&b are the benefits that some Taj loyalists that I know can’t live without.

Note that you might need to order the celebration cake 1 day prior, as sometimes the hotel doesn’t have it ready the same day, as it was the case recently with me at Taj Exotica, Goa.

Golf

- 2 Games per month

- Spend Requirement: 50,000 INR (two months prior)

Historically, Amex Reserve was primarily used for Golf and now Amex has decided to put an end to it, literally.

Spending 2 months prior, tracking it, and booking them later is not something that one can easily do.

They could have instead simply enabled the complimentary access based on annual spend and saved cardholders from processing unnecessary calculations.

Airport Lounge Access

| ACCESS TYPE | ACCESS VIA | ACCESS LIMIT |

|---|---|---|

| Domestic (Primary) | Amex | 12/Year (3/qtr) |

| International (Primary) | Priority Pass | 2/Year |

The new addition of International lounge access is good to see on the Reserve card but the limits are way too low for the fee it comes with.

If one needs domestic & international lounge access for self and add-on, HDFC Regalia Gold is the one you need.

That aside, Amex Reserve no longer offers access to Amex lounges in Mumbai and Delhi. Thanks to Plat Charge Cardholders who are travelling left and right, leaving no room for others to step in.

Other Benefits

- Eazydiner Prime membership (25% savings at most restaurants)

- No Fuel surcharge at HP fuel pumps (limits apply)

- 3X on Reward Multiplier

Companion Card Status

Most Amex Reserve Cardholders that I know have got it as a companion card issued as complimentary with Amex Platinum Charge Card.

However, post the refresh of Reserve card benefits, now Amex has dropped this companion card benefit on Amex Plat Charge.

To those who already hold Reserve as a companion card, it would continue as is, as long as the Plat Charge is active.

Retention Offer

Apart from card spends being the primary factor, Amex also keeps changing the retention offer from time to time.

As of early 2025, upto 50% annual fee waiver is available on Amex Reserve through retention route.

How to apply?

Applying online is the quickest way to get American Express Cards in India.

Currently, one of the best offers you could get is 8,000 additional bonus points as a part of Limited Period Offer when you apply using a referral link.

The current 8K bonus is the best signup offer on Amex Reserve and is probably the best time to take the card just incase if you were eying on one.

Apply through the link on the page & you’ll get 11,000 MR Points (INR 5,500 Value) + 8000 Referral Bonus MR points (INR 4,000 Value).

Bottomline

- Cardexpert Rating: 4/5

The re-imagined American Express Platinum Reserve Credit Card is certainly better than what it used to be in the past. It’s great for those who can make use of Accor Plus benefit along with monthly milestones.

But except for the Accor Plus and a few other benefits, American Express Plat Travel Card is a much better choice as it’s not only light on the pocket but also can get you more than 2X the reward rate on Reserve.

So, the Amex Reserve with refreshed features holds good only for a small segment, leaving a lot of room to grow if it needs to attract a larger segment. Perhaps American Express has to re-imagine the product yet one more time.

Until then, Amex could consider doing some small additions like adding Accor ALL as points transfer, which even at 2:1 would make the card sell like hot cake.

I would like to apply using the link. Just a question I am already a gold accor and accor plus member. Can I get additional 20 nights credit?

No, Accor will call you for a new email address to create a new account in that case. That’s what happened with me as I’m already on Accor Plus with Axis Reserve.

For existing Accor Plus members who wish to apply for this card, ideally, they should have allowed continuation of the same Accor Plus membership rather than making a new one for this card.

For most, a combination of MRCC and Platinum Travel credit card is the best and the most rewarding. Now they don’t even give access to Amex lounges on reserve. Reserve is good only if one can make good use of the golf and Accor membership. Other than MRCC and travel, most other Amex cards are just good as status symbols or may be for a very specific clientele.

I got this card just for Accor membership.

Got this free as companion card with my Platinum Charge card (of course, after few calls to customer support to make this LTF)

I had Axis Reserve earlier (till renewal after devaluation) and took benefit of free stay at Accor with Accor Silver membership, but unfortunately Amex Reserve card does not give free stays with Accor membership. And other benefits are not much use since I hold Infinia , ICICI Emerald Private and Amex Platinum Charge card too.. This card is least preferred card for me, almost not used.

Keeping it with me just because it’s free for me !

Amex should seriously think on adding value for money factor to this card (and other cards too)

The card design is classy. May be this is good for Acccor users.

Any reward points for rent payment

Is Accor, Taj and easy-dine will auto renew every year? Or just for first year.

If it is only for just first year, this card is not yet all worth from 2nd year.

Should renew, as is the case with Plat Charge.

> However, the name on the card kind of disturbs the beautiful design, especially when your name is not correctly aligned in center, unlike mine.

On the contrary name is exactly aligned with the roman soldier figure. So looks cool 🙂

Yeah, kind of luck in my case, but not for all unfortunately, as it’s otherwise left aligned.

Hi Siddharth,

Add on Supplementary Card Holder can access domestic lounges and International on American Express Platinum Reserve Credit ? Or Domestic and International Lounge Access is only applicable to Primary Card holder ?