Generally speaking, the anniversary year of a credit card is usually the “date of issuance of a new card”. It applies to both new card issuance and upgrades with almost all banks, except SBICard.

SBICard has a strange system where-in the card anniversary year for “Annual fee waiver” and the card anniversary year for spend linked “milestone benefits” are different, especially when you “upgrade” your card through the portal with the pre-approved offer, just like how I did for Aurum.

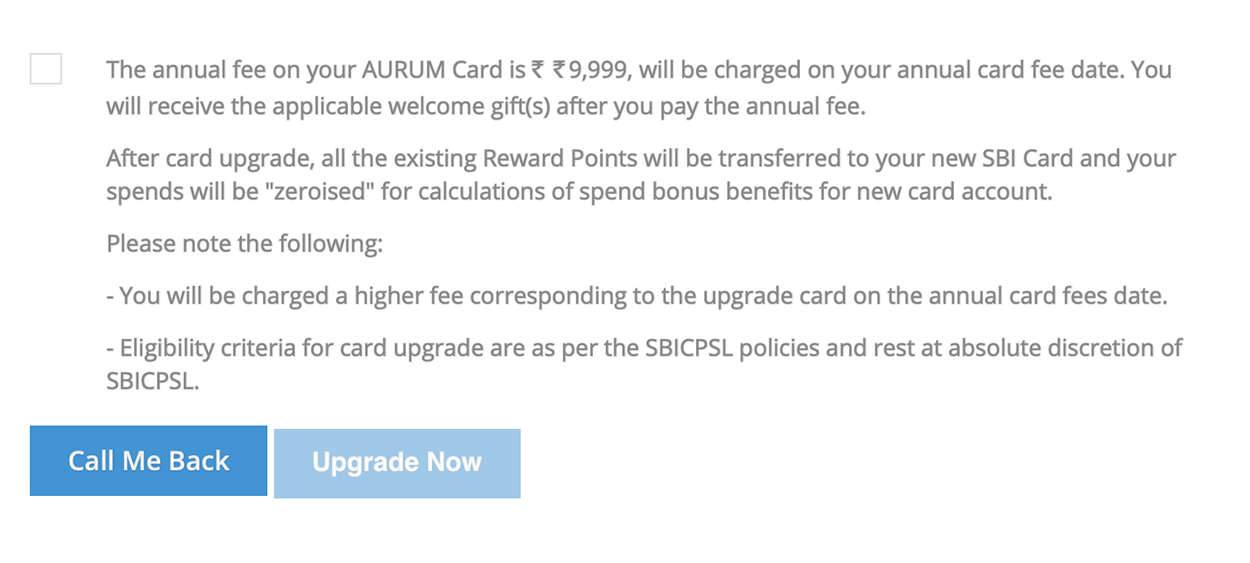

This difference is because the card gets billed during the usual bill cycle of the existing card you intend to upgrade. In my case, when I upgraded to Aurum, I was charged the joining fee only after a few months of upgrade, on the regular annual fee date of my previous SBI Prime.

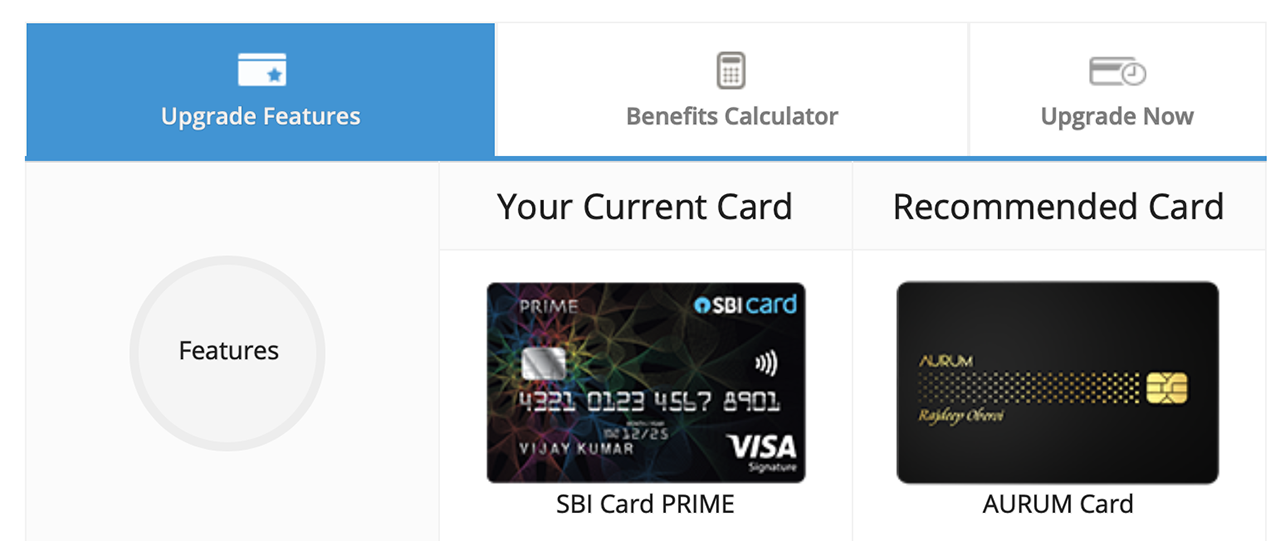

In fact, SBICard clearly mentions this while processing the upgrade (see below), but I didn’t expect this would shuffle the calculation period for milestone benefits.

After someone recently reported the milestone fulfilment issue on SBICard Prime, I went ahead and checked my card anniversary year. I wasn’t surprised to know that the calculation period for milestone benefits and annual fee waiver are indeed different.

To sum up, this is how it is calculated:

- Anniversary year for Milestone Benefits: begins from the day of new card dispatch

- Anniversary year for annual fee waiver: begins from the day of annual fee billed to account

So you’ll need to optimize your spending accordingly to match the above to avoid unpleasant surprises.

Not to mention, SBICard has a lovely feature called Spend Analyzer that let’s you check your total spends on the card with the ability to change the date range.

Final Thoughts

While the current upgrade system is good in a way, as you don’t need to pay a fee in a short while just incase if you had already paid the fee or got waiver for previous year. But I wish SBICard mentions the difference in calculation as above so that cardholders are not disappointed.

I dint know about the different dates and no one in SBI card department informed me of this even after speaking to 8 different execs. I lost 7K milestone voucher due to this. Anyways, I have stopped all spends on SBI cards unless some bank offers come.

I had this issue on my prime card. I had to go till the nodal officer to get the exact dates for milestones and fee waiver. It was a hassle to deal with these differences and ultimately I closed the card after prime devaluation.

I was upgraded to Prime few months back. But so far I have not taken delivery of the card citing address change, and hence I have not been billed the annual fee either. Don’t want to close SBI card since that’s one of my oldest card accounts and closing an old account will hit my credit score bad. At the same time I m not interested in Prime, I was ok with my previous LTF cards. Are there any LTF choices available and do they allow downgrade?

Yes Sid, I experienced, last yr my spend on beneficial yr (may to may) was 550k but annual spend(sep to sep) was 297k and they charged mi 3k as annual fee. Very disappointed

U r absolutely right. And I got to know a year back when annual milestone benefit for sbi prime was checked and found different period for both

The spend analyser gives incorrect information most of the time….even very vague figures so don’t rely on that

Hi Sumit,

Do not rely on Spend Analyzer, better count on the monthly statements generated and calculate manually to avoid any discrepancy.

Sid,

On a topic that may reduce the points earning capability of Prime Card , with the recent RBI crackdown on Standing instructions SBI CC upon my query had informed me that none of the existing standing instruction will be processed and to pay directly.

I used to get 3k points with just 15k spend earlier with other spends just getting about 400 – 1000 points on a monthly basis .

Now with this change the reward earning potential on Prime Card would be significantly down.

The 20points per 100 on standing instruction accelerated rewards also seem to be removed from the Prime card page in SBI , but my emails to CC hasn’t yet received any response even after 6days.

I hope Prime cards may get some other feature to overcome the reduction in earning potential linked with Standing instruction.

If you are aware of any developments this regard, would be great to come up with thread for Automated Standing instructions

I also need clarification on this point. Since I had purchased this card primarily for paying utility bills.

I had exact same issue with my SBI Simplyclick card. They gave me two cleartrip vouchers of 2k each for completing 1L milestones twice. But charged annual fee of Rs 500 and didn’t waive it off by reversing(eligibility is 1L spend in an year) .I decided to close that card.

Hi Sid,

Its true, I faced it when I upgraded my SBI SimplySAVE card to SBI Prime. My first card setup month was May-2016, every yr. annual fee charge & reversal happens in the same month. I upgraded to SBI Prime credit card in July-2019, they did not charge me any joining fee that time, but in May-2020, i was charged for Rs.2999 + GST towards Prime card joining fee in lieu of which they gave me joining fee vouchers for Rs.2999/-.

I was also informed that Anniversary year & Milestone benefit calculation varies for upgraded card.

This year though my spends were more than 5L but I was not given Milestone Benefits voucher of Rs.7000/- as they informed me, the year is calculated from 15 July 2020-14 July 2021. My spends within this timeframe was short of 8k.

So, please check with them the exact date for your Milestone benefit calculation and spend accordingly.

I had an escalation with SBI Nodal officer for this issue but nothing happened as they wont tell any customer upfront the exact upgraded card setup date.

Yes, found it out with my flip to Simplyclick from Simplysave last year. The milestone benefits for Simplyclick is calculated on the basis of the date of issue of the new card, yearly fee would be charged on the basis of original account creation.

The executives I spoke at the outset weren’t clearly about, but I eventually chanced upon one who knew what he was talking about. I was charged the yearly charges though I had crossed the spend threshold for the year, but subsequently they provided me the Amazon Pay voucher a month down the line… Unnecessarily complicating things, but the positive as you pointed out, is that you won’t to have pay charges in a short span if you are flipping/upgrading early into a card year…

I have most of the cards in the industry except SBI. They are the worst card i have ever experienced. They are very rude and adamant. They blackmail you in your CIBIL and other things. It happened to many of my friends as well. All closed SBI cards. They never wanted sbi card even lifetime free and so am I.

Worst card i have ever used.

Thanks! Was wondering why I wasn’t getting milestone benefits on spending 5L on my Air India card. I had to spend around 7.5L to get it. Will now crosscheck spend amount with the date of miles credit – Fee is debited in Jan, and new upgraded card was dispatched in May.

@Manoj Singh: I have had issues like the company not giving me points for Air India bookings – one is still pending, their UX also sucks, giving add-on cards has now become a pain, but the SBI Air India cards has paid handsomely to me.

Thanks again for clarifying on a topic which was nagging me.

They dont bother t answer any queries . I was issued wrongly prime card instead of club vistara prime. Since i already have axis vistara card . It is harrowing experience with SBI Cards.

I use sbi prime and a frequent traveler. So my sms are missed out and they don’t email my milestone voucher codes.

I would like to which credit card bank is absolutely transparent

Hello All,

I have an issue in receiving a gift voucher from SBI Credit Card for fulfilling an offer. SBI states that the voucher has been sent but I never received it. I have raised 18 complaints till now and reached customer service head and still I am getting the same response that the gift voucher has been sent. Is there any other higher authority were I can register the complaint with in SBI? If not what are my options outside SBI Credit Cards. any help is much appreciated. Thanks.

Hi Jeyaganesh,

You can drop an email to Nodal officer for this issue. But they will take time to respond, as due to COVID-19, nodal officer team responds with a good amount of time. You need to do regular follow-ups. Speak to customer care, they can resend the coupon codes again over the SMS to your registered mobile no.

Thanks Rohit, I have sent complaints multiple times to Nodal officer, escalated the same to Customer Head. It’s 18 complaints now to the top layer. This is going on for the past 5 months. Every time I am getting the same response that the coupon code is sent to your registered email id and mobile but I never got it. I am really disappointed with the response even from the top layer Customer Service Head.

Does anybody know how many SBI credit cards, you can have at the same time? Customer care guy told me 3 cards but some websites are mentioning that out of 3, one has to be secured.

At one point I had 3 unsecured.

Hey Sid,

Why don’t you write an article regarding SBI Cashback card which gives 5% cashback on all Online merchants. That too Cashback limited to 10,000 per billing cycle which is quite high.

Hello Sid,

Could you please confirm whether the Anniversary year for Milestone Benefits and Anniversary year for annual fee waiver will differ even if we are with the same card without any upgarde from day 1.

I received SBI ELITE card in the month of August and 1st statement was generated on 2nd of September. I spent more than 10 Lakh from August to August which I considered as Anniversary year.

But recently 4999+GST annual fee was charged saying that Anniversary year for annual fee waiver is from September to September(September 2nd Annual fee was charged and I did not recieve any reversal in october statement). Now they are saying that Annual fee was charged on 2nd September and September month would be considered for Anuual fee waiver.

Could you please help me?

Hi Naresh,

Anniversary year for Milestone Benefits and Annual fee waiver will not differ, if you haven’t changed the card variant from day 1. But it is always safe to check with customer care rep., from which date the card Anniversary begins because if you calculate on your own, then you need to keep into account the card setup date/dispatch/delivered to you date whichever is earlier. Better confirm with CC rep. In your case, Sept.to Sept. would have made a lot of difference in the expenses calculation that is the reason, you have NOT received the reversal.

Better call cc now and ask for card closure, they will transfer your call to Retention team, they will ask the reason/check the card closure option through online portal, you will get plenty options as retention bonus points/reversal of annual fee. Select the Annual fee as the reason for closure.