I recently got the SBICard Aurum – the super premium credit card by SBICard and here’s my detailed hands on experience with the card. Note that this is not the review article. If you’re looking for the features and benefits of the card, you should check out the SBICard AURUM Review article.

Table of Contents

Application Process

One fine day, one of the reader was asking whether he should take an upgrade from Elite to AURUM as he could see the upgrade option on net-banking. That’s when I came to know that they started taking applications for Aurum.

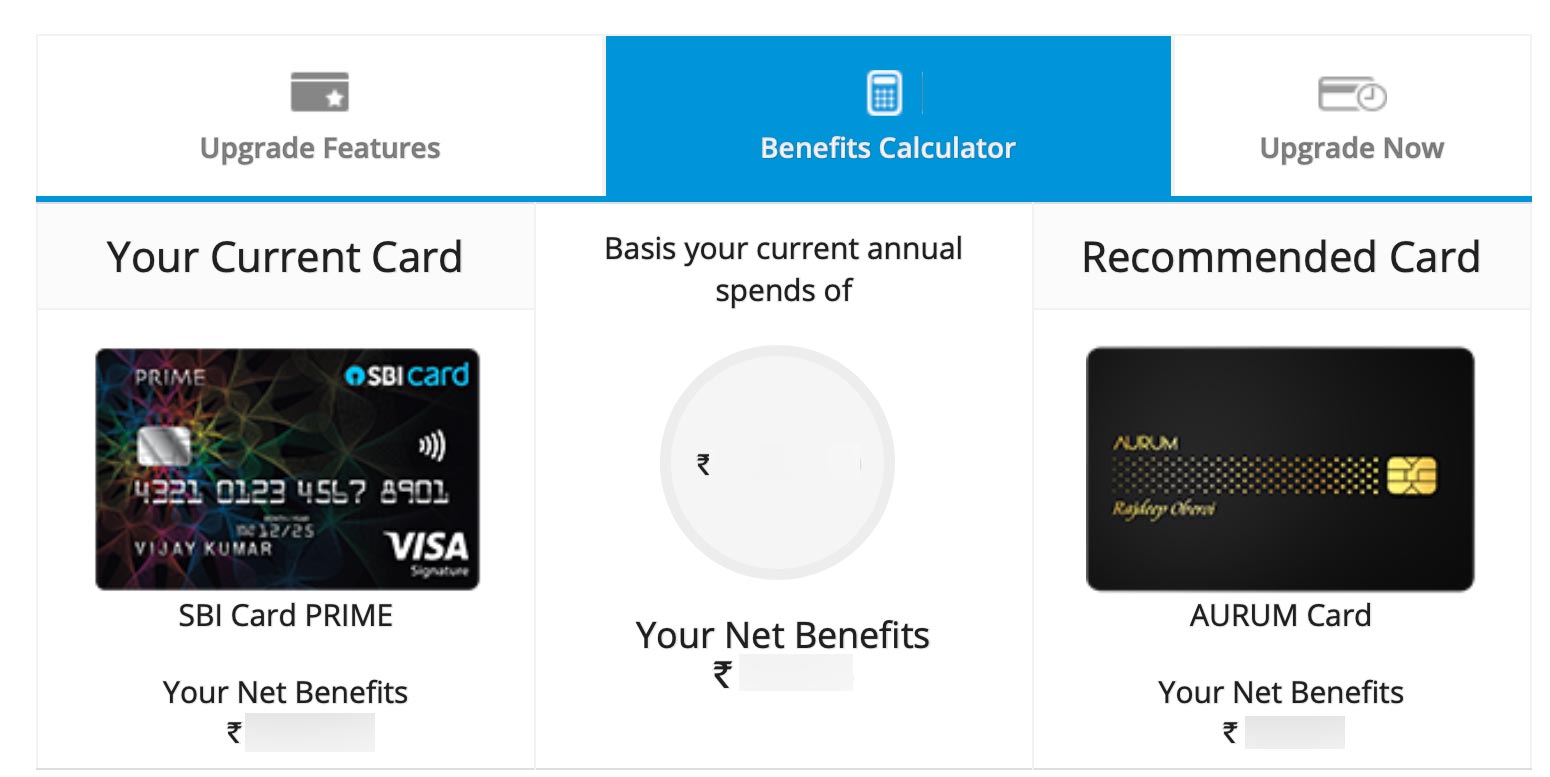

I logged-in to the SBICard net-banking to check if I have the upgrade offer and I saw the AURUM in place of Elite which used to show up earlier.

So I went ahead and upgraded in matter of few clicks without thinking much on benefits as all I wanted was to experience a new credit card – a new plastic with a new design to be precise. 😛

Getting the card

I got the Virtual card details within 3 days of requesting for an upgrade. Physical card took a while though.

I had to call Aurum support multiple times and I finally got the card with a delay of about 3 weeks. It’s likely the initial dispatch issue (which is normal with SBICard new launches) but going forward this shouldn’t be the case.

I was initially said by the AURUM support that I’ll be getting the physical card hand delivered by someone from SBICard team but it came via Blue dart. The parcel was marked critical priority/fragile.

Note that you may still get the card hand delivered if you’re in select metro cities where SBICard has an AURUM RM to take care of the AURUM cards.

It came in a wooden black box that weighs so much that I couldn’t hold it in one hand. The nice looking AURUM metal card was inside with a lot of booklets that probably added to the box weight.

Unboxing AURUM

Take a quick look at the unboxing pics:

The Card

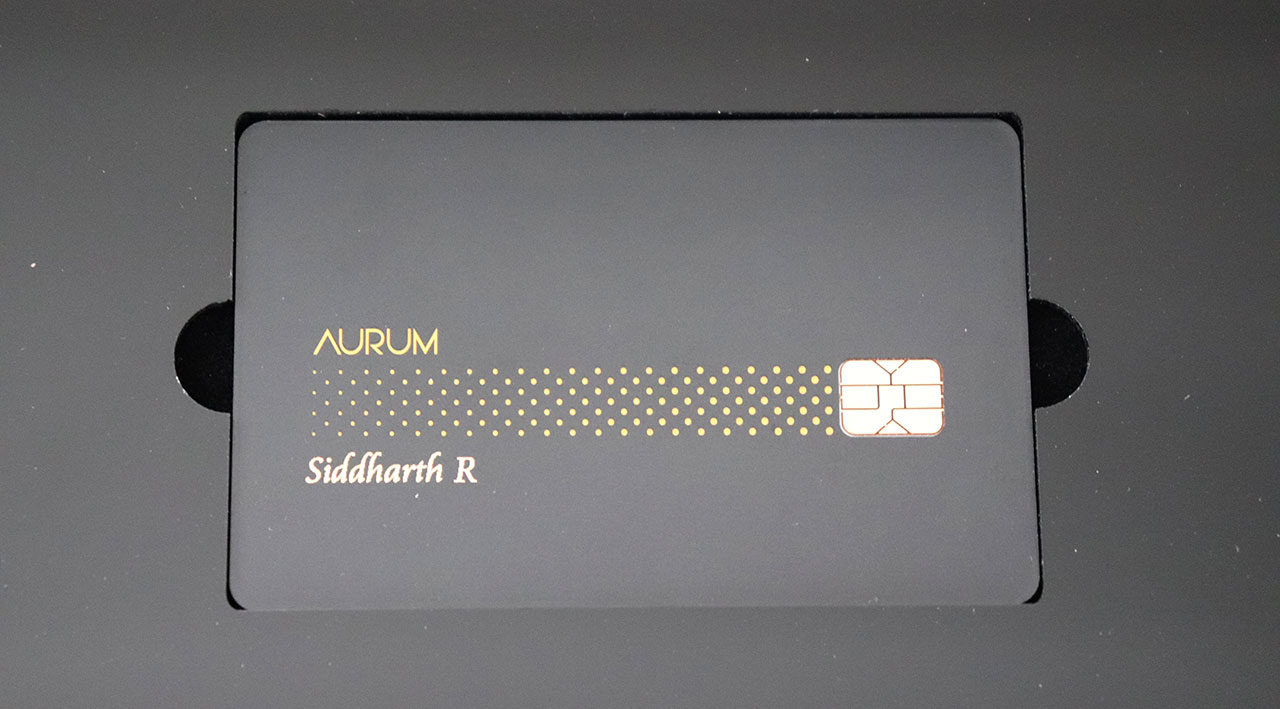

The card is indeed in metal but can’t actually say what kind of metal.

- Weight: It weighs almost same as the Amex Plat metal card but as I don’t have the weighing scale can’t comment much about the difference.

- Design: They sort of combined both vertical & horizontal card designs. For ex, if you had already noticed, the chip is on the right/bottom, not on the left/top as with most cards.

Overall, the front look is good but at the back, I wish they had put the numbers in single line in those empty space at the center.

Availing Card Benefits

As soon as you login to the SBICard portal, you’ll have a link to the AURUM Dashboard which has all info about the AURUM card along with the benefits and how to avail them.

Apart from that they also send an email (for each membership) with guidelines on how to avail each of the benefit listed.

Good news about these memberships is that your validity is topped up, meaning, if your Zomato Pro expires 2 months later, this will extend the validity further so that your 2 months validity is not wasted. This doesn’t work with Amazon though, but the activation link is valid for couple of months, so should be fine.

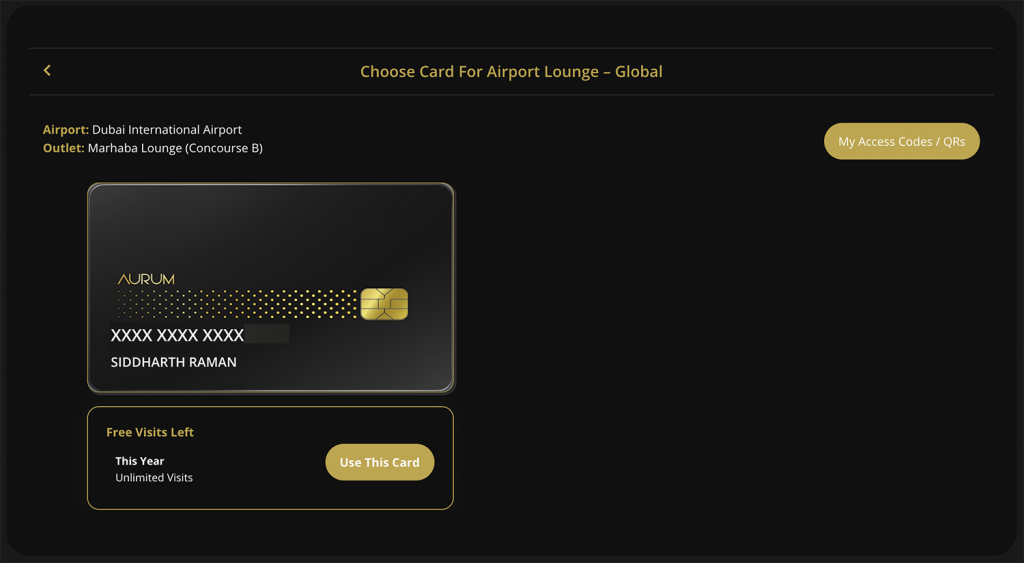

The Airport Experience dashboard inside the AURUM dashboard is cleverly integrated with Dreamfolks system and it allows you to do a lot of things. For ex, you can generate QR code for availing complimentary lounge access (international).

You can even use the dashboard to book Airport Meet & greet, Airport transfer, etc. You’ll be asked to make a payment wherever you don’t have complimentary visits left.

It’s all wonderfully done and ready to use. But I’m just waiting to see the day when we have complimentary access to airport meet & greet/transfer services as new normal on super premium cards.

Rewards Portal

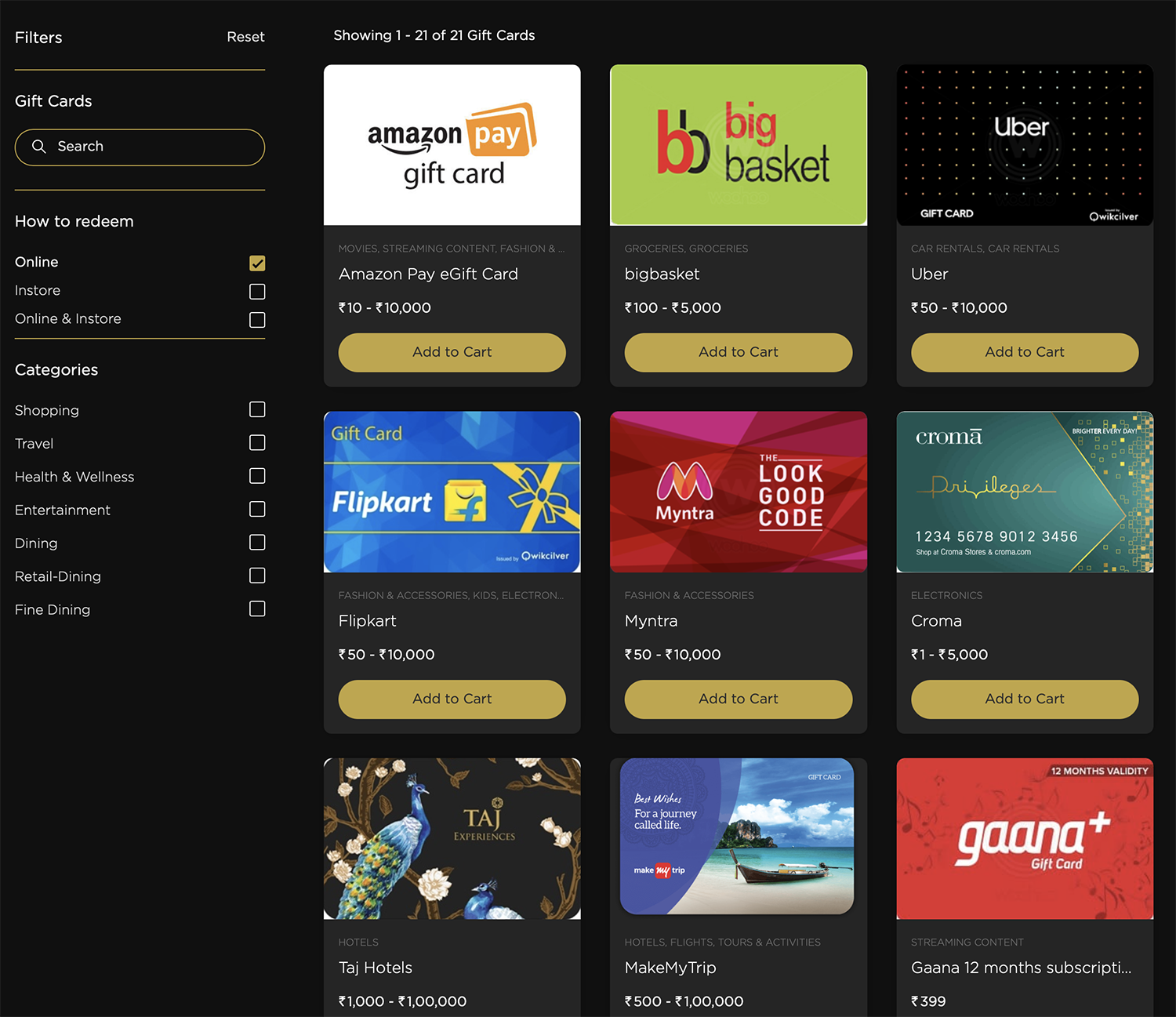

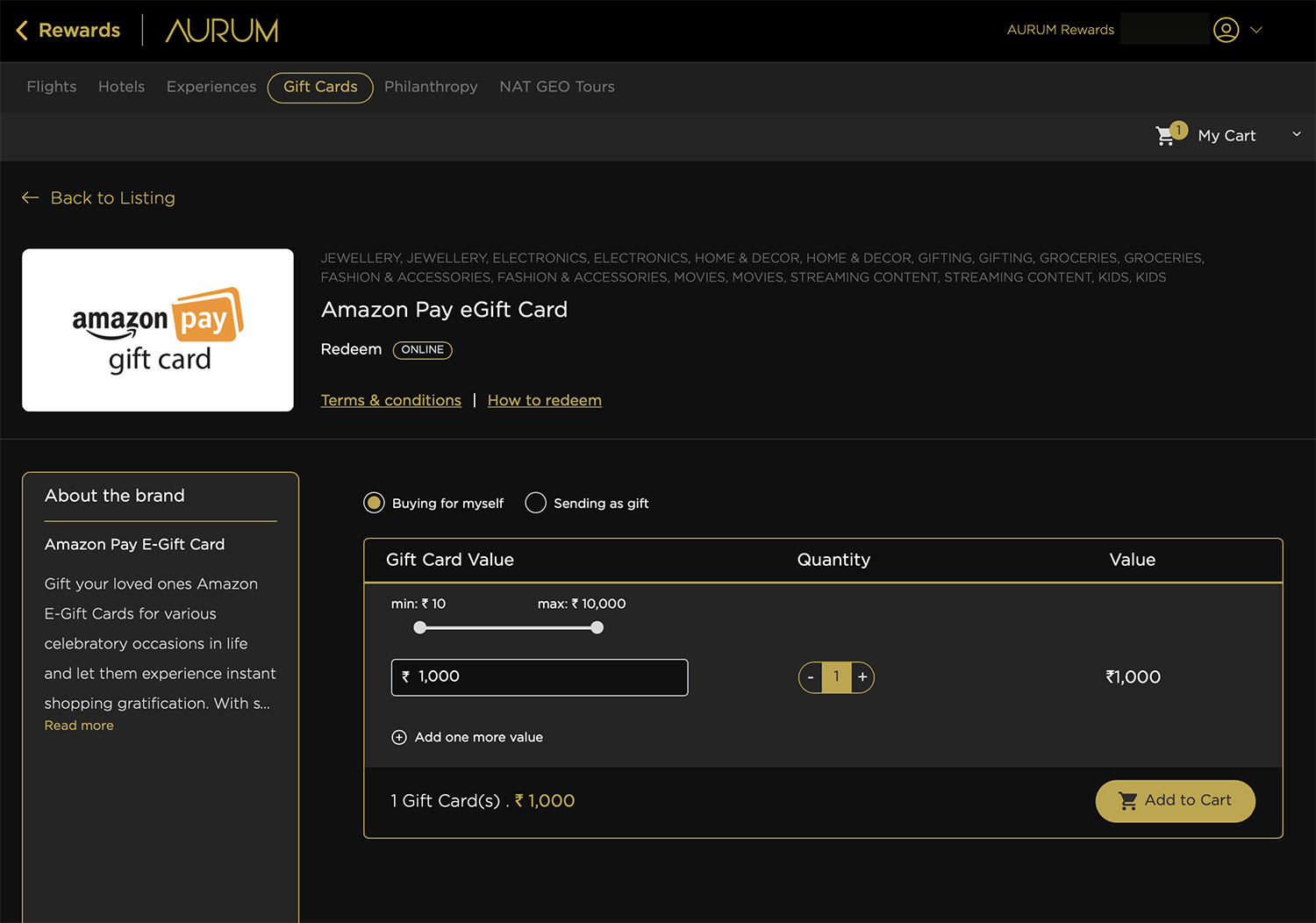

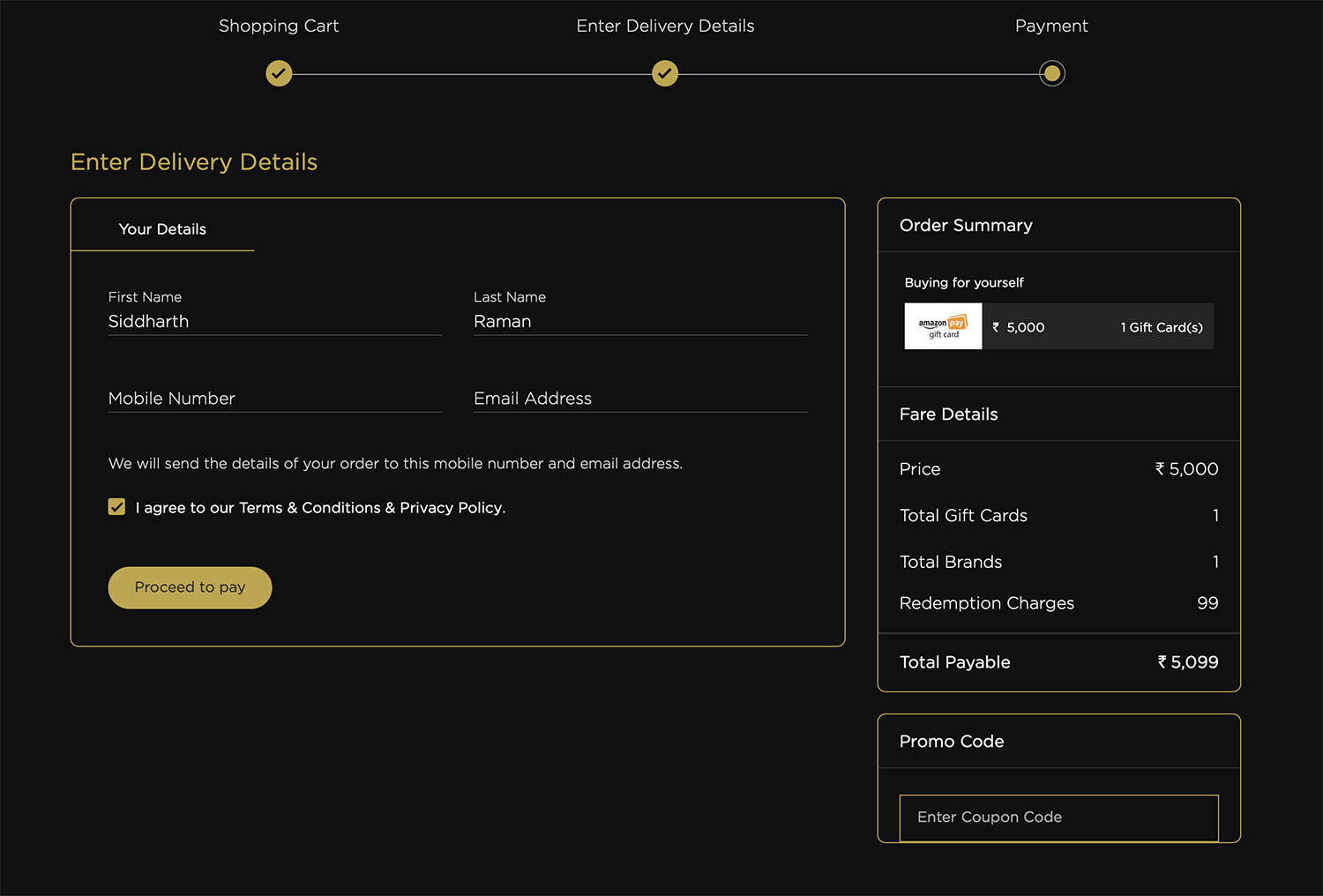

Fortunately rewards portal has the vouchers I was hoping to see. Currently Amazon/Flipkart vouchers are available for redemptions and I hope we continue to see them even after more AURUM cards are onboarded.

Overall the redemption portal looks good and the redemption process is smooth enough. Here’s a quick look at one of my recent redemptions:

AURUM Support

- Phone Support: Aurum cards has a dedicated premium support line and they are pretty good, as good as HDFC Infinia support, even better I would say. And the good news is, they can even call you back if they can’t find a solution to your query right away. That’s great!

- Email Support: They promise a response within 4 hrs either via call or email.

Only downside of AURUM support is that you’ve to call a 1860 premium number which is chargeable at 1Rs/minute. I wish they had 1800 or any other landline/mobile number as that would serve the purpose and also would be easy for international travellers reach the support, as I don’t think 1860 is reachable across the world.

Concierge Experience

Concierge Services are lot better than I expected. The requests are taken care by a third part company that also handles the AURUM loyalty portal.

I would say that AURUM concierge services are as good as Amex Plat Concierge services. Well, in-fact AURUM is lot better when it comes to email response speed & follow-up’s.

Most of the responses are coming within few hours, which is great. I maybe enjoying the speedy services temporarily, as hardly very few are onboarded on AURUM so far.

I was also said that the concierge team is the same team that handles SBI Elite cardholders requests, with minor difference. Maybe just like the Amex Plat/centurion services.

But initially I was surprised to know that even Elite had Concierge benefit. That’s a lot of value for Elite, for those who need!

Bottomline

Overall, AURUM experience is beyond expectations, especially when it comes to small perks, yet it still lacks the wow factor, especially because of the reward rate when compared with other cards in the competition in super premium credit card segment.

What’s your thoughts on SBICard AURUM? Feel free to share your thoughts in the comments below.

Siddharth,

Can you comment on how do you use the concierge. If it’s just flight/hotel booking, then it can be pretty much done ourselves in a few clicks..it might take more time going back and forth with the concierge.

Usually to get things done like calling/following up on some delivery/service and checking availability of sold out items, etc. Detailed article on that is pending. Hope to cover soon.

🙂 AmEx Plat concierge is already pending since long… this is 2nd one 😀 😛

I have never used these services so any article which says anything about them is lost on me. Would be great to cover those benefits and what they are. I keep on getting calls for upgrades on my credit cards which I refuse because I have no idea about what these benefits actually do.

Like what is this “dragon pass”, “concierge” and other things that you keep on talking about

In the mobile and computer age concierge is of not much use..

Dear Sid,

You HDFC DC/Infinia, AMEX Platinum, SBI Arum, ICICI emeralad and other cards. Please suggest, how r u managing all cards and how are you availing maximum benefit form all the cards,

I use Infinia & Amex Plat most of the time. All others are for seasonal usage, as and when offer pops up.

SBI is the Maruti of credit cards. They don’t understand P of premium card. With the kind of reward rates and benefits that they are are offering with this card, it is not even worth it even if it is offered life time free.

Aurum appears to be Nexa of Maruti for that matter. But yes, could have done better on rewards.

Not Nexa. It’s like a Kizashi. It’s the company’s first “premium” product. As an offering, it’s decent. Die-hard fans will go for it. But too expensive, and definitely not value for money. Will hopefully provide enough learnings to the company to launch a better quality premium offering a couple of years down the line.

The no. 1860 is chargeable by airtel , from jio its totally free. Try with jio number.

but why?

why doesn’t sbi provide an actually super premium product?

when it comes to their concierge, ( I am assuming it is the same as elite as the phone number and the website are same). The service is not at as expected, I dont know I used Chase sapphire platinum not even reserve, they way better service than SBI, when elite is second most premium ( I have elite BTW).

is it their reluctance to not take premium customers seriously?

At present I have decent income but only 1 year of credit history and I do not have good relationship with any bank obviously.

what would suggest I do? I have a bare minimum expectation of customer service being responsive or at least listen what I say.

I am okay to take a credit card and wait for the bank to upgrade to one of the “super premium ones”.

Except for american express, does any other issuer accept FICA score instead of CIBIL?

genuinely need your help siddarth, I have seen very good comments in the comment section of other articles kudos to you!!

if possible could make “Amex Guy” to respond as well :p

thanks anyways

Please tell me how many supplementary cards are allowed on Aurum and are these chargeable or not

2 Add-on cards, for free.

I hold an SBI Elite Credit card (Credit Limit of Rs. 4.35 Lakhs) for more than 5 yrs. My average spends using the SBI Elite card is about Rs.3 Lakhs to Rs. 4 Lakhs per year, based on my balanced spending on my other cards (I hold a Citi Premier Miles and Axis Miles & More Credit Cards). I was expecting SBI to provide AURUM invite to me.

To my irony, I see 2 lower graded credit cards – SBI SimplyCLICK and SBI PRIME offered to me, in my Account page under the “Get new Card” option. Both the cards are complete of no use for me.

I wonder how SBI sends AURUM invites. I’m Self-Employed with an ITR of about Rs. 40 Lakhs.

Coming to Citibank Cards, I have Citibank credit card for about 14 yrs continuously, upgraded from Indian Oil card, Rewards card to Premier Miles (now with CL of 8 Lakhs). I was tempted to apply for Prestige. But with recent downgrades and COVID situation, I’m not convinced to spend Rs. 20K annually for Prestige.

Axis Bank Miles & More credit card (with CL of Rs. 10 L) was amazing to accumulate just miles in Miles & More network. I used to travel Lufthansa (a minimum of 12 Lufthansa International flights before COVID).

Hi siddharth, I have an hdfc infinia card. I have an annual income of rs. 50 + lakh. How can I get Sbi Aurum. I don’t have any relationship with sbi or sbi cards

A quick look into the last call with Aurum Support:

Me: My friend is looking for Aurum card.

Is there any reason why you’ve revoked the initial invites and not sending new ones either?

Aurum Support: We’ve issued 1300 cards for now and we are inviting more every week. Kindly allow us some time to send more invites.

That aside, it might be tough to get it as a fresh card.

Sidd, please help with this

Do u really need that . Recently I got autumn credit card and sbi employee told me if anyone want this card then you can share his contact details

Hi guys,

Any tips/tricks to get this card? I currently hold a Elite card and a prime card.

Upgraded my SimplyClick (earlier downgraded from Prime Vistara Signature) to Aurum today as a FYF card.

One of the most premium packaging I have ever seen. The box was as big as a shoe-box😅 and the card was enclosed in a wooden box. Lately I haven’t seen these kinds of efforts put in by any bank here in India when it comes to packaging of their cards. Though the reward rate is kinda low, but nothing beats when it comes for free to you😅

Earlier AMEX used to send their Plat Charge and Centurion (Black Card) cards in a similar wooden box (now discontinued).

Were you invited or offered on the app automatically? Or how did you get to apply?

How did you got it as first year free?

Not invited .applied only based on hdfc infinia

Can you please elaborate on the application process? I also hold hdfc infinia.

Just visit the Aurum website and express interest in multiple names of friends and family you know and wait.They will randomly select the profile screen and call for extending an invite.

I am getting upgraded to Aurum in couple of days. I have a question about Joining fee. My annual fee for simply click card was charged on February 25 and next annual fee levy would be on February 25, 2023. Now my question is that when the annual fee of 10000 is levied on February 25, 2023 will it be considered as Joining fee and provided with equivalent welcome gift or will it be considered as renewal fee?

Reason why I am asking is when I switched to Simply click card from fbb in March 2021 and spent more than 2 Lakhs, I was still charged 500 rupees on February 25, 2022 and mentioned that it was joining fee and I will get 500 rupees voucher in 30 days.

If anyone have experienced this situation, please let me know.

I had same experience with upgrading to Elite, you’ll get welcome benefits after paying fees next year. But there will be difference in annual spending calculation and milestone spending calculation.

This article may help: Card Anniversary Year issue on SBI Credit Cards

Hi Sid,

Can you tell me for how long closed card accounts reflect in the SBI Card Dashboard? I closed an Ola Money card in Aug 2021 and it is still showing up (although the account status is closed both online and in CIBIL).

It will a renewal fee

Positive things happening with SBI Cards I had in Feb cancelled my Aurum and got a SimplySAVE LTF in return after retention team intervened. Well 2 days back my old Aurum RM called me and offered a new Aurum card at a special first year fee for which I was pre-approved for but the card will be a new card and now an upgrade. This worked for me since I did not want to loose the LTF SimplySAVE.

The catch is that the new card will eat from the same 5Lac limit of the SimplySAVE which I asked be divided into 3:2 with Aurum & SimplySAVE respectively.

How much is this special fees? What are the benefits against it?

Hi…. Just got my Aurum yesterday. I’d like to know when and how the 40k welcome points get credited and how can one redeem them?

The points are credited after paying the annual fee.