One of the most demanded feature on HDFC super premium credit card products like HDFC Infinia & Diners Black is the transaction-wise reward points accrual details. This is primarily because the cardholders are having tough time to understand the fulfilment of offers like 10X rewards program and the cardholder had to call support every-time to check this information.

But now you no longer need to waste your time on call. The wait is now over (sort of) !!

New Features

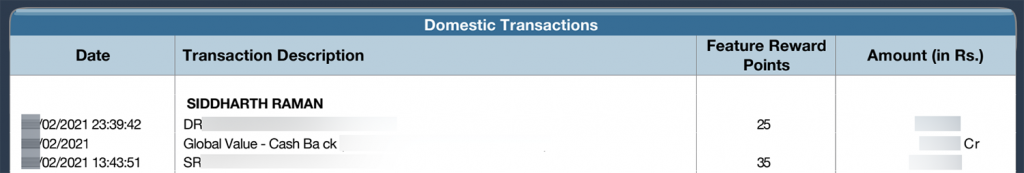

I got my March 2021 Infinia CC statement and here’s what I see in addition to what we used to see earlier:

- Feature Reward Points: You can now view how many reward points you’re earning against each and every transaction. This is for both Domestic & international transactions.

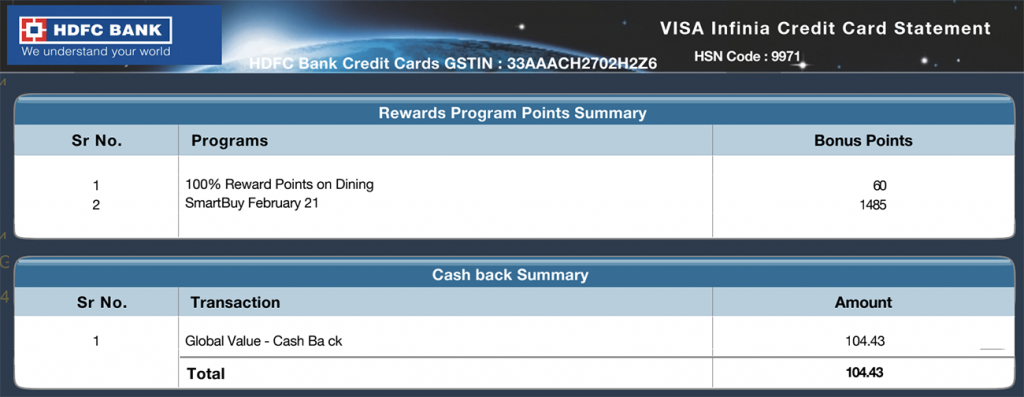

- Rewards Program Points Summary: This must have been named as “Bonus Reward Points summary” for easy understanding. Basically this section shows the summary of accelerated/bonus reward points added to your reward points a/c in that particular statement period.

- Cash back Summary: This section shows all the cashback you’ve received on your card a/c in that particular statement period. I see the global value cashback on my stmt, and maybe it may also show the fuel surcharge waiver as well.

Final Thoughts

This is definitely a wonderful feature to have – no doubt.

But if you ask whether this solves the problem – well, not exactly. It would have been LOT BETTER if the bonus points are reported against every txn just like the feature reward points.

But unfortunately it doesn’t work like that because the the fulfilment is not instant when it comes to most of the bonus reward points offers. So summary makes sense for monthly statements.

Maybe if HDFC wants to Woo their super premium cardholders, they could simply “update” the monthly statements after 90 days or so with the bonus rewards column (per txn) and make it available for download through net-banking.

Doing so it will fix the fulfilment queries once for all. This is very much doable speaking about the tech feasibility of such updated stmt’s, but the God decides whether it has to be done or not. 😛

- Update: This feature is enabled for Diners Black & Regalia also from May 2021.

It looks like a special privilege reserved only for Infinia/Diners Black, for now. But of-course the bank may enable this feature for others as well, if they ever feel the need for it.

Note: This feature appears to be rolled out in phases, so not all Infinia/Diners Black Cardholders are seeing this. However all should see very soon.

What’s your thoughts on this new feature given for Infinia Cardholders? Feel free to share your thoughts in the comments below.

Haha had tweeted about this just a day back and also gave it as a feedback glad to know they finally implemented it

I was waiting for this feature for a.long long time. What I was doing till now was to write high value or 10X transactions in notes and call customer care some months later to confirm each transaction, one at a time. This though still not perfect, will bring much needed transparency to 10X system.

This is progress for sure from HDFC that has an otherwise appalling trackrecord when it comes to crediting reward/cash points. I hold one of the most affected cards in this regard, the HDFC Millennia and introducing something like this for this card may not be in the making any time soon. But at least, they are making a move in the right direction in general and that in itself is good to note. Hopefully, even if the statements are not saying it out clearly, at least they will credit the points from now on for all their cards without the customer having to fight it out, every step, every month…

For some strange reasons, my last statement (2nd Mar) is still the same old (no bifurcation of points)! Believe some other members also did get the old one. Is it in a phased manner?

*Last month I changed my statement date, so the billing period was actually 47 days. Need to wait for next statement (2nd April).

Seems it was enabled on 3rd/4th March 2021.

In my statement, it still shows 3 columns – Date, Transaction and Amount. Infinia card statement generated on 10/03. I need to check for the next statement release.

I also have the same issue for my 15th March statement. No Bifurcations.

Hi Siddharth,

I checked my statement and realised that HDFC is not giving credit for rent payments (through RedGiraffe). Is that the case for you as well, if you are also using it.

Regards,

Sachin

Sorry, not using RedGiraffe. But I can see the rewards added for CRED rent pay.

Yes, I also just realised that they have not been crediting reward points for rent payments made through Payzapp. This is ridiculous. Going to raise an escalation now.

They do give points for RedGirraffe transactions. But for some reason, they treat it as Insurance transaction, the points for which are shown separately at the bottom of the statement, just like the bonus points.

Yes even I noticed that no points for rent payment. I did payment via Payzap.

I get points on regalia on no broker via payzapp.

@Sachin Kumar Banthia

@Varun

I called & checked with HDFC CC with regards to my particular transactions in January & February, they say points are credited.

I hold a Infinia MasterCard. I received my latest statement on 14-Mar-21 and I don’t see the split of reward points per transaction in my statement. Is it specific to Visa card holders? Am I missing something?

Looks like this either only for Infinia card holders or being rolled out in phases. Received my statement for DCB this morning, I still see the old format!

Thank you Sid for sharing such an useful information with fellow members. I have a Infinia MasterCard from HDFC and I didn’t see the featured rewards points break up by transaction in this month’s statement and it is a complete no-brainer from HDFC. Based on my relationship with them over the last 13+ years, I found their practices to be very inconsistent. One can get a different response for a same question from their phone banking, virtual RM, email Helpdesk, and not to forget grievance cell

Got my Infinia Credit Card statement today, but it does not have any additional details of reward points. It is in the same old format. Am I the only one who got the statement in old format or do I have a company? I am not the imperia customer, is that the reason?

Me too…:)

My statement is generated on 10th March but there is no bifurcation of points. Not sure how are they implementing.

My bill generated today (received over e-mail) and I see the same old format.

Received the infinia statement generated on 13th March without this feature.

I didn’t get breakup of rewards in my infinia Visa

ok this will sound wierd

my statemensts generated on 15th march

my visa infinia has latest updated statement with feature rewards points column [paid variant]

my mastercard infinia has old statement without feature reward points [ LTF]

so looks like new statement is visa or paid variant specific

Hi Ashish – could you tell me any major difference between the two variants of the card? Thinking of upgrading DCB to Infinia. Thanks.

How did you managed to get both variant. For me they upgraded from master to visa on request.

I too received my Visa Infinia stt yesterday without this feature

Hi Sachin & Varun,

I’m paying rent in Payzapp bill pay (Redgiraffe) for the last 1 year. Initially there was no issues on RPs. But somewhere in Oct-Nov last year, I didn’t get it. I followed up with Infinia CC for an extended period and finally got it after approx a month. Same story repeated next month. But then I was getting the points normally w/o follow up but on T+3 days whereas for other transactions I get RP on T+2.

its a great feature. My statement generated on 8th March has this.

First HDFCBANK should learn service. Service is very bad.

Their service, like every other private bank, is only good if you have NRV for their top most account variant. Depends branch to branch, RM to RM

HDFC had started sending bonus points sms per transaction but it has again stopped it.. This may be due to the TRAI thing.. Not sure.

Hi Siddharth,

Have been offered upgrade to MC Infinia with annual fee. Currently have Regalia LTF with limit of 8.75 lakhs.

Should I wait for FYF or LTF offer or take the upgrade with annual charges.

Thanks

Dhiraj

Hey Sid

Just noticed international lounge access has been removed for all ICICI debit cards plus the domestic lounges have also been limited to a handful with t&c such as limited quarterly spends to get access to the lounge.

A welcome feature. A point about updating past statements, it is a banking industry standard, or rather, industry sin to update past statements. Any past updates or modifications are always reflected and adjusted in subsequent statements. Although, this is a relic pf the time when statements used to be paper and sent by mail. But banking industry doesn’t change that fast just because tech allows it.

Recvd statement generated on 16th Mar without breakup of points per trxn.

Hold a preferred banking with hdfc.

The wait doesn’t seem to be over for all.

Recvd statement generated on 16th May with the breakup of points per trxn.

Feels great, ‘Rewards Program Points Summary’ which summarises category-wise points is a true delight.

Thank you HDFC.

Hi. I am holding regalia first credit card for 1.5 years. Have a credit limit of 3.12L.

Recently received upgrade offers to Regalia/Indigo 6E Rewards XL. Both are lifetime free.

Which one is better to go for?

FYI, the other credit cards apart regalia first, in my portfolio are:

1. ICICI Amazon pay

2. ICICI Sapphiro

3. Flipkart axis bank

4. SBI Ola money

5. Yes Premia

6. HSBC Platinum

7. Citi Rewards credit card.

Upgrade to Regalia.

Once you select co brand hdfc card. Updates don’t come. Have read instances of jet cards users facing same issue.

From my own experience, I realized good thing about Regalia is – it gives you realistic prospects of reaching Infinia/DCB in future(took 2 years for me). If you are not a very frequent flyer(that too with Indigo), Regalia is better to have.

My visa infinite variant shows points, and my wife’s Matercard variant doesn’t show points in the statement, both generated on 13.03.21.

Any mastercard variant holder got the new format in statement or received only old?

I belong to the mastercard variant in the recently upgraded LTF category, did not receive the new format of the statement, mine was old format only.

Recvd new format statement that is generated on 16th May.

Jan 2021 upgraded, FYF card.

The best I can say is that it will come to you, I was also anxious to get it since they started rolling out. They are slow, that’s all.

received statement on 15th but without these feature ..mine is mastercard variant.

Infinia Visa here.

Statement generated on March 16th without points breakup.

Best bank keeps getting bested by others.

Too big to implement genuine feedback regarding appalling customer services.

S&S

Good one actually, Infinia got it, DCB yet to get!

No point distribution on my FYF Visa Infinia. The CC had no idea of it but my RM said it is being rolled out in phases.

Statement generated today with old format. MC Infinia user. Looks like rollout is in phases.

Been to bank yesterday and met cc incharge. I asked him whether I can swap DCB to infinia and asked about people who got LTF infinia from regalia. He said that offer came for only 3 days and people who saw it got it including branch manager. I asked whether he could make a request and he denied as usual and said it is not in their hands. One or two years before I could agree the difficulty of getting Infinia but i am not sure what is the problem now for the bank to swap card to LTF atleast to preferred/imperia customers.

Can anyone confirm whether able to swap from DCB to infinia ?

Download the card upgrade form from the HDFC website and post it to their Chennai address, bypassing the middlemen. I found the branch, RM and the cc team useless.

Got my DCB LTF upgraded to Infinia LTF in 3 days. Not sure in the credit limit matters, as I had > 8L limit on DCB.

Hi,

I also have a DCB LTF but are we sure that infinia will also be given as LTF?

How did you go around this. Can you please let me know. While I have 8L+ spends yearly but just don’t want to be under pressure.

Thanks

Hi, I also have a DCB LTF have a 10L+ limit.

I want to send for an upgrade to infinia but the only question I have is, how can we be sure if the upgraded infinia will come as LTF. Any suggestions for this?

thanks

As per my RM, if your credit limit is more than 8L than you are qualified for upgrade from DCB to infinia. The only catch which is restricting me to upgrade is you tend to lose LTF benefit if you have it on DCB

was your RM able to tell how the LTF status can be carried over?

No breakup for me in mastercard infinia statement generated 18th march

I have a DCB and I’m getting the points for each transaction since last cycle. Maybe they are implementing it in phased wise approach

No breakup for me in the statement for DCB

Happy days indeed! Indivdual transaction breakup is a step up. May still need to maintain an excel to calculate the xtra reward points.

Recieved my statement today! Makes tracking 50% easier.

Received statement with transaction level points details on 14 March for my paid Visa Infinia card.

Dear Siddharth, can you please explain how to get offers (without applying) for credit card(s) from banks that we dont have any relationships with? Thanks in advance.

Simplest way is to have more friends like me (having more than dozen cards) and visiting cardexpert.in regularly.

Hope that helps. 🙂

Try going through third party websites

Hi Siddharth,

Could you please explain reward point accrual for the 10X/15X schemes for DCB/Infinia, in case we go for an EMI transaction?

The customer executive said that RP are accrued based on every EMI payment and that payment would in turn reduce the respective month’s general 7500 cap as well.

Does this mean we shouldn’t go for EMIs in this particular scheme?

Will I get points for payment made to NPS using my Infinia ?

Will I get points for payment made to NPS using my Infinia ?

Read the write up on NPS on this blog site

Thanks Shivi

The statement generated on 26th March with no detailed reward points accrual info, but for the first time under Important Information, they mentioned this:

“Please do not use your personal card for working capital funding or any other business requirements.”

Did anyone receive such a message ever? Pls share any thoughts on this.

Added to all stmts I guess. They started doing this since past 2 months or so, so that when they debit the points they can show you the proof that they’ve already warned you. 😀

Ohk.. good to know that it’s a generic message! Thanks Sid

I received it starting January. Just your friendly neighborhood HDFC Bank advice i guess

Did anybody with Infinia Mastercard get points breakup?

Statement generated Last Week, but no breakup-points yet.. perhaps our MC variant will reflect the points in a phased manner!

Nope. I didn’t get breakup of rewards point for the transaction I did with my Infinia Master Card. Not sure how they are implementing this.

Received Visa Infinia Statement on 26th March , yet no points break-up.

Is it just me or did anyone else find the reward points credit on HDFC Infinia lesser than usual in the March bill? I think they didn’t credit the additional (10X or 3X – X(base)) reward points in March but do let me know if Im the only one getting this feeling. This feature of transparently showing the reward points earned, with a retrospective update for past statements post considering cancellation periods etc , will really close loop this for anyone who is a points junkie.

I received sms of crediting March smartbuy bonus reward points on 30th March. But points are less.

Same here. If I am supposed to get 5000 accelerated reward points then I got only 4500

Received 11k points only instead of 30k points for march which were credited on 29th march itself

Any idea on re start of HDFC credit cards

They had another issue last 2 days. I don’t think RBI would clear it anytime soon.

There was this smartbuy extra offer in December about 15x on amazon. Has anyone got points for that?

Are we getting reward points for adding money to bbdaily wallet? Though it it is technically a wallet it acts more like grocery purchase only I feel.

Today received the second statement after the points bifurcation implementation, yet I’m not getting the point details.

Mine is MasterCard FYF variant, subsequent annual fees were waived off based on spends.

SAme here. Bill generated today and I didn’t got to see the points birufication.

I’m Ltf infnia master card holder.

God knows when it would be hppening

Guys, I spent decent amount during extra saving days sale using DCB. When i checked the statement there are 9000+ reward points in adjusted/lapsed column of the statement. Any idea what that means ? I got the card couple of months ago so no chance that they can get lapsed. Please help !

The reward points from old card is transferred to DCB as per conversion ratio.

The rest of the points (New – Old) shows as lapsed/adjusted.

Even regalia cards have started to show Points breakup in the statement from this month. Received the statement on 25/4/21

My Regalia statement doesn’t have the points breakup. Generated 18th Apr 2021

I can confirm its for regalia card as well. There’s an extra column “Feature reward points” in the statement, which basically shows the respective reward points for each transaction.

My infnia card still don’t show rewards points. Still same old.

I have received the statement with rewards points against each transaction. I am paying rent through my infinia but I am not getting any points for the same. Similarly the bill pay towards electricity is also not fetching any points to me. Anyone else is facing the same issue?

Utilities dont fetch points

From when is this change? I used to get reward points for Bill Payments of Utilities.

Yes, I also don’t see reward points for rent payment through payzapp with redgiraffe. Probably, HDFC started cutting down rewards for few biller categories

Payzapp is considered wallet recharge by HDFC and hence they wont give you points

@mt

If you do transaction through payzapp then you would get points. But if we add money in payzapp wallet then we won’t. I lost more than 1000 points until someone told me I get points for using dcb card in payzapp coz in t and c only visa and master card was mentiend.

Its there since a long time. In March 2019 I did pay the rent through PayZapp for Redgirrafe and did not get any points. Since then I am using my ultimate card for rent payment. Used DCB for a while in nobroker when the offer was there.

Ultimate card?

Standard Chartered Ultimate card.

He means SCB ultimate i think.

it takes time i myself used redgiraffe for a month points get ceedited but a cap of 2k is there and it takes time

Now they added for diners black creditcard also in may month statement

Hi Siddharth,

Thanks for all your posts on Credit Cards, I do visit and read your site frequently.

Just FYI, I received the Diners Black statement today and happy to see the Rewards point column as you had shown for Infinia.

Recent job change my gross salary has increased to 1.5 lac per month. I have a 1 year old regalia credit card with 3.5 lac limit. Should i apply and will i get an infinia now ?

You can try. 1.5 lac may be less for approval. The exiting card limit should be over 8 lacs.

@Sid

Since it is there for DCB also now, hou might want to update the below section in article 🙂

And Diners Black & other cardholders.. sorry guys, it looks like a special privilege reserved only for Infinia, for now. But of-course the bank may enable this feature for others as well, if they ever feel the need for it.

That aside, this feature adds up a bit towards Infinia for those asking: Should I take Diners Black or Infinia?

“And Diners Black & other cardholders.. sorry guys, it looks like a special privilege reserved only for Infinia“

Sid brother, just now received my credit card statement , the same now shows also on Dinners black!

Reward point for every transaction just like Infinia!

So now Special privilege are also for Dinners Club Black too!

I hope you would spell it as Diners & not dinners.

Surely not that difficult

Should we pay rent through NoBroker app to get the reward points ?

This question is open to all here.

I have been buying smartbuy vouchers from my diners black every month from 3-4 different accounts to reach the 7500 RP maximum cap each month.

But since April’21, after having bought the voucher from one account, it always shows an error while buying from other accounts, looks like we’re allowed to only buy from one account now?

Anybody else facing this? Do we have a hack?

I too thought that you are allowed only 1 voucher each across all accounts.

I think there are chances that they may block the card or forfeit RP accured against those transactions.

The limit was never from HDFC. It was gyftr Website that was blocking the HDFC card if one card was being used on different phone numbers for buying more than 5000 Rs. worth Amazon Vouchers.

There are people whose cards were blocked. They called for a replacement card and then they were able to transaction again.

Initially it was allowed but now they have plugged that loophole. You can only use one card on max 2 accounts and that too after the 5k limit is breached, you can’t use it for that particular brand. Also, I would advise you to use it on one account only as I have heard of them blocking gyftr accounts for using the same card on multiple accounts.

Use your points fast. A ban is coming soon for you

I thought we were allowed to buy Amazon voucher only once per card irrespective of the account. Correct me if I am wrong.

@Prateek, we were allowed to make one purchase per GYFTR account, which essentially means one purchase per phone number. We could use the same credit card across 5 different accounts and buy 5 vouchers a month.

You are speaking in technical terms here. Starting from September 2020, HDFC has started blocking cards which are used to buy voucher across different accounts. I am surprised that your card is still now blocked. Maybe they stopped blocking again.

Hi Siddharth,

Reward Points accrual details Feature is now available for Diners black members as well.

HDFC also included the bonus details separately as well.

For Example. Diners Ecomm 2x, Smartbuy April21, Annual Benefit(if eligible), Monthly Benefit(if eligible)

Definitely its from HDFC side also, I received a written warning mail from HDFC (Back in Oct 2020) to refrain from using multiple accounts otherwise points may be forfeited.

Update with diners cards :

Hdfc is no longer extending the Validity of book my show vouchers for DCB. I spoke to bms and they said for other vouchers they have been extending till September 2021 but hdfc is rejecting for diners cards.

I have around 2k worth of bms accumulated from last year and inspite of theaters are shut hdfc doesn’t want to extend. I told to bank to remove bms from dcb. Why is it even been offered. Bank asked to use it in comedy show 😂😂.

Is there anything I can do. 2k is a lot to let it go 😒 already one 500 got expired.

I stopped redeeming for BMS long back. Instead you can select for ola select voucher. It is useful sometime where you get low fares during peak time.

I think DCB only give validity of BMS voucher only 2 months for spending target of 80000 per month. I think we should escalate the same to nodal officer either to extend the voucher validity or give flipkart or Amazon as voucher option as well.

@Rohit

Bank is doing real comedy with you. 😉

Received my MC Infinia statement dt 18/05/2021 along with points break up transaction wise. Bonus details also included seperately at the end.

It’s really a nice feature and now there will not be any doubts regarding RP.

I got the itemized reward points finally

Received DCB statement a few days back and the transaction wise as well as bonus points summary at the end.

One question I have is what’s Adjusted / Lapsed, I haven’t had any cancellation or refund relating to any orders

Also there is a section that states Smartbuy Reversal , similar to above there was no cancellation of any Smartbuy orders

Hey,

Did you figure out what is Smartbuy Reversal row is?

The transaction wise reward points have also showed up on diners clubmiles

Ya.. for me too on the statement generated on 16th May.

Update :- Dinners Clubmiles card statements also started getting reward points option for each transaction as well as bonus points option.

One of the features I liked was that at the end it also shows the ongoing promotional offer going on the card which for dineout.

Diners Black 10x rewards points partners for June 2021

Swiggy (food)

CRED store and travel

Cure.fit

Seiko

Birkenstock

Finally on my 2nd June Infinia MC statement, I got the point details.

Got the updated format for April & May Statements for my Diners Privilege Card. Had requested for last 6 months statement on an ad-hoc basis and they were shared with the new format too.

I can see the Rewards Points Summary section for Millennia for this month’s statement.

Hi,

Looking for some advice on whether I should upgrade to infinia with annual fees from dcb lifetime free? Is it worth it?

Thanks

HDFC credit cards (all variants) now reporting credit limit to CIBIL \o/