RBL Bank offers one of the best travel credit cards in India: the RBL World Safari Credit Card, which features a 0% forex markup fee. It’s arguably the only RBL credit card worth considering, as the others offer very low rewards.

With the RBL World Safari, the bank has transformed the perception of its credit cards. Here’s a detailed review.

Table of Contents

Overview

| Type | Travel Credit Card |

| Reward Rate | 0.5% – 2.5% |

| Annual Fee | 3,000 INR+GST |

| Best for | International & travel spends |

| USP | 0% forex markup & International travel insurance |

RBL claims that their World Safari Credit Card is the India’s first travel card with 0% markup fees. Well, that’s only partially true because Axis Burgundy Private credit card is the first one with that benefit, but its an invite only card.

So as a retail card offering, it is indeed the 1st credit card in India with 0% markup fee.

Fees

| Joining Fee | 3,000 INR + GST |

| Welcome Benefit | 3000 INR worth MMT Voucher |

| Renewal Fee | 3,000 INR + GST |

| Renewal Benefit | Nil |

| Renewal Fee waiver | Nil |

- MMT Voucher that can be used on Flights/Hotels (online) & Holidays (Offline)

The joining fee is Offset by the MMT voucher but we get nothing for the renewal unless we go for the cancellation which might trigger some retention benefit, depending on when you ask for.

0% Markup Fee

- 0% Forex Markup Charges (but no rewards on International txns)

The USP of this card is its 0% markup fee on international transactions and that is great esp. because they’re using Mastercard platform which usually has better conversion rates.

But note that you will not get reward points on international spends, though you may continue to get the milestone benefits just like most other credit cards.

Rewards

- Travel Spends: 5 RP’s for every Rs. 100 spent (~1.25% return)

- Non-Travel Spends: 2 RP’s for every Rs. 100 spent (~0.50% return)

- 1 RP = ~0.25Ps

- Validity: 2 years

The reward rate on regular spends is quite low without a doubt but the milestone benefit makes up for that pretty well.

Milestone Benefits

| SPEND REQUIREMENT | MILESTONE BENEFIT | Cumulative Reward rate |

|---|---|---|

| 2.5 Lakhs | 10,000 Points | 1% |

| 5 Lakhs | 15,000 Points | 1.2% |

| 7.5 Lakhs | 10,000 eVocuher | 2% |

- Gift Voucher Options: Taj experiences, Amazon, Croma, Myntra & Makemytrip

So on 7.5L spend, you get a nice 2% reward rate via milestone spends alone, which is decent for a card with 0% markup fee and affordable joining fee.

Overall reward rate could be as good as 3.25% if you use the card only for Travel but of-course that’s rare so you can get little over 2% even on non-travel spends, which is pretty decent especially on Forex spends.

Airport Lounge Access

| ACCESS TYPE | ACCESS VIA | ACCESS LIMIT |

|---|---|---|

| Domestic (Primary) | Visa / Mastercard | 2/Qtr |

| International (Primary) | Priority Pass | 2/Yr |

- Get 1 additional complimentary lounge visit via Priority Pass on spends of Rs. 50,000/- or more in a calendar quarter.

But that’s too low to make any difference, yet we can’t ask too much on a 3K fee card anyway.

Golf benefit

- Complimentary Golf Games: 4/Year

- Complimentary Golf Lessons: 12/Year (1/month)

This is a Mastercard World privilege and not the feature of the product per se. Still good enough.

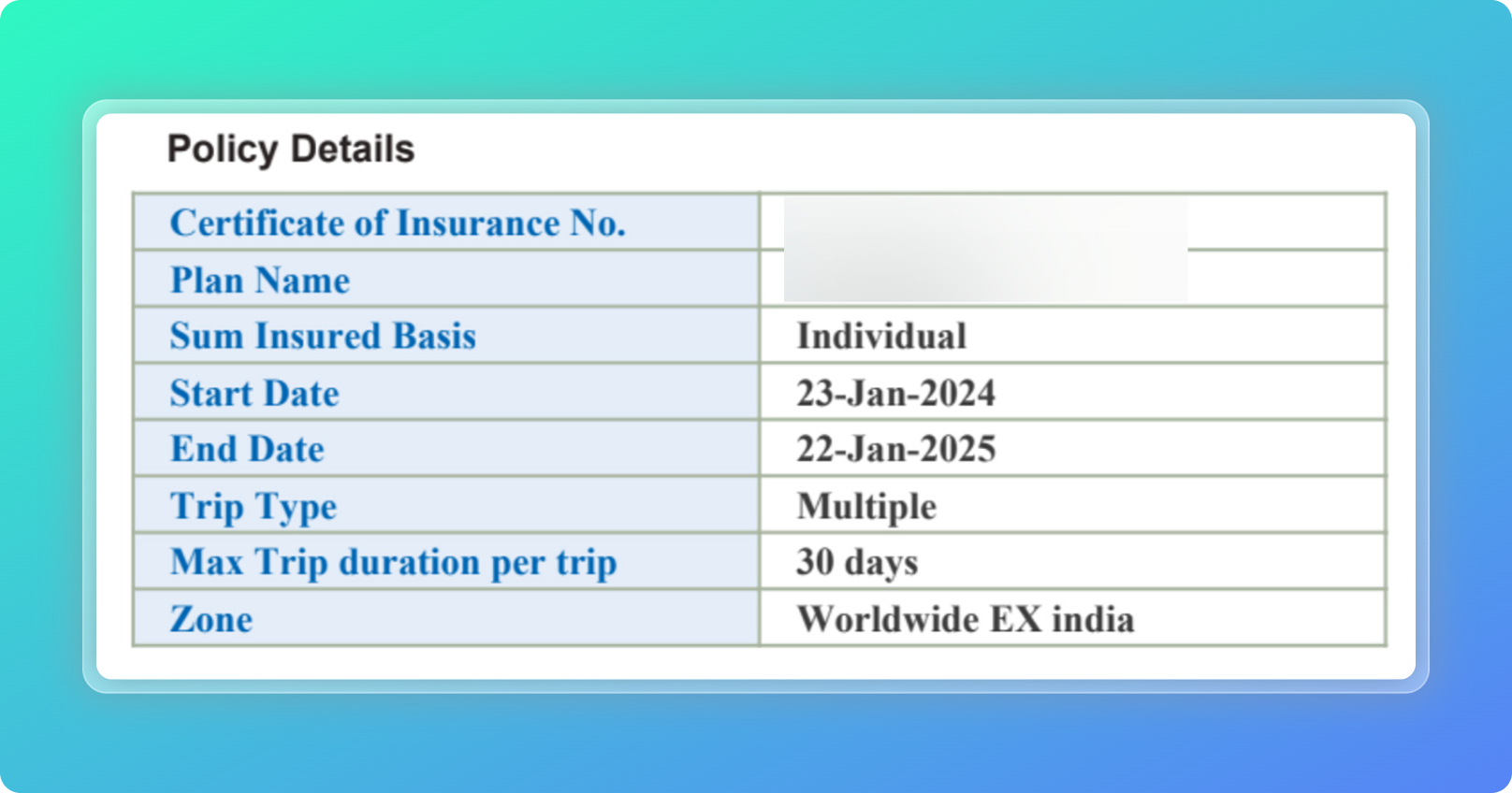

International Travel insurance

The complimentary International/Overseas Travel Insurance is one of the most useful benefit of the card as it’s accepted by almost all embassy’s across the world to procure the Visa.

| Policy Period | 1 Year |

| No. Of trips | Multi-trip |

| Coverage | Worldwide (except country of residence) |

| Emergency Medical Insurance | 50,000 USD |

| Max trip duration | 30 days (per trip) |

| Recognition | Accepted by almost all embassies |

Typical Coverage that you can expect:

- Personal Liability coverage

- Trip Delay

- Baggage Loss

- Loss of Passport

- Dental Treatment & more

Policy is issued by Care Insurance, formerly Religare Health Insurance Company Limited. It’s a group policy with Individual coverage and they issue the individual insurance copy, which can be used for Visa procurement purposes as mentioned earlier.

The policy is issued within a week of card issuance post a quick verification on the insurance portal. Here’s a quick look at the details of my policy which I got recently:

Just incase if you’re wondering, ideally it’s valued at 7,000 INR or more.

Do note that this policy is better than the one issued by American Express Platinum Charge Card as it comes with meagre limits.

So if you’re an international traveller doing multiple trips in a year, you can get the RBL World Safari Credit Card with eyes closed just for this benefit .

Should you get this card?

If you’re an international traveller who does at-least 2-3 trips a year and does about 7.5L spend a year, I see no reason to not get this card. That’s because you get:

- Decent Rewards

- 0% Forex markup Fee

- Lounge Access

- International Travel Insurance (Worldwide for 1 Year)

That’s more than sufficient list of benefits for a credit card with 3K annual fee. So I would say it’s totally worth it.

Tip: If you’ve got other RBL Bank Credit Cards with good spends, initiate card closure request and on retention call you can get the RBL World Safari Card as a First Year Free Card. You can thank me later. 🙂

Bottomline

- CardExpert Rating: 4.5/5

Introducing a credit card with a 0% markup fee is a bold move, as markup fee is one of the major revenue streams for credit card issuers. So, RBL Bank has done a great job with the RBL World Safari Credit Card for international travelers.

Moreover, the international travel insurance offered on the RBL World Safari Credit Card holds real value for those taking multiple foreign trips a year.

It’s an amazing card for those who don’t have super premium credit cards like HDFC Infinia to get better return on forex spends.

It’s also good to see the Taj voucher as a part of the offering. I hope they come up with more new cards with good USP’s like this.

What’s your take on the RBL Bank World Safari Credit Card? Feel free to share your thoughts in the comments below.

For spending existing money from my account, I would choose NiYO Global Card for international transactions (instead of forex cards) as it offers no markup fees & conversion rates are that of Visa international exchange rate. Lowest.

It is free for first 5 years & works in over 150 countries. Basically, in any country where Visa is accepted. Doesn’t charge for ATM withdrawals (any charges maybe of the ATM’s bank, which they say doesn’t exist for global banks). Beats forex cards hands-down. They are even giving 500₹ on referral.

For credit card transactions, as you rightly said, HDFC super premium cards (with GVP) would work best.

Can’t find it on RBL website. Do you have the link?

Its there on the website

does this make sense for someone that has infinia? Although Infinia has 1.99% forex mark up it also has 3.3% rewards on all spends so essentially you yet get 1.3% after deducting the forex fee.

Nope, as you get 3.3% + 1% with global value program.

RBL Safari Credit card , though they said no forex charges on international transactions but they are making hidden charges like 1% on over all swiped amount. Since the forex conversion rate is extra 20piase they charged on my recent transactions. Customer don’t have answers to it and they are disconnected the call during the conversation more than twice. I am not sure why RBL banking system is like that

Hi Abdul,

I am apply for World Safari Card.. But you are confirming that u have been charged extra 1% .. Plz confirm if u got refund of 1% charged from the RBl bank.

Hi,

Did you get clarity if we get charged some fee as opposed to what is being claimed by RBL on world safari?

Hi Abdul,

Are you sure they charge some fee on international transaction contrary to 0% that they claim?

Nah. You get more than 2 percent after Global Value Program and reward points adjustment on Infinia (if you add Yatra voucher and welcome RPs) and exactly 1.97 percent without these two (with GVP though).

There is GST on fx markup which u forgot to consider.

I think, Niyo – in collaboration with DCB Bank was FIRST to offer FREE travel card with 0% markup. It’s already in production and takes 1 day to get the card.

I have SBI Elite which has 1.99% markup. Is it still worth taking this one with zero markup?

Depends entirely on your international transaction volume.

Same here. On my second year and will cancel as all benefits expire (Priority Pass as well) and they never waive annual fee unless you hit exactly 10L.

This card looks helluva lot better

Siddharth, you need to consider the spread on the rupee that these guys charge. It varies from payment network to network. So 0% markup doesn’t mean it is same as swiping a card in local currency

Its pretty close though. Check Visa vs MasterCard vs Amex vs Diners Club – Which has the Best Foreign Exchange Rate?

Siddharth I really appreciate the work you do. I got hooked onto credit cards thanks to you. Started with regalia first and progressed to Diners Black in less than 26 months. I would really love if you could kindly explain forex card and compare them.

Get additional complimentary lounge visit via Priority Pass on spends of Rs. 50,000/- or more in a calendar quarter – please add this to the main review, this increases the quota for most users

Updated, but wish they had given something like 2 more visits on every 2L spend a year or so.

I spoke to the RBL Customer Care today and the executive who I spoke to confirmed that the card offered up to 12 lounge visits in a year. 8 Domestic Lounge Visits (2 per quarter) and 4 International Lounge Visits (1 per quarter. There will be no renewal bonus or renewal fee waivers. The best way to derive max value on this card is to utilise is for the full 7.5 lakh milestone spend. For those who shop from international websites and travel a lot, this card could make sense. I see the potential of utilising this card to buy flights and hotels in foreign currency especially on merchant websites that don’t offer support for Diners Club payments. Also, if you are an existing RBL Credit Card holder then you can apply for this card and your existing credit limit will be split between both cards.

With ~1.2% reward rate isn’t DCB/infinia still same if not better better choice having 3.3%reward-2%forex charge with 1.3% effective return?

I mean where does the comparison even come in? Infinia is a premium card. How many people r eligible for Infinia?

Hi…

I had icici, sbi, hdfc cards and good credit score, Can i get this card on card to card basis.?

Just the card have been looking for something similar to 28 Degrees in AU. Even that is on the Mastercard network

Hi Sid

Started my credit card journey with the HDFC Moneyback card with a credit limit of 75 k in 2017 upgraded it Diners club miles after 9 months with the same limit in 2018 . Recently before 2 months my credit limit was increased to 1.5 lcs . Quick question I received my first credit card without any income proof till date since i hold a savings account from the past 6 years. What are my options to upgrade to higher variant card if possible ? I do not have a source income in India because I’m based abroad would that prevent me to upgrade to a higher variant card like DCB ?

PS : I hardly use my credit card & even when i do it’s usually 5 – 10 % of credit limit & have a CIBIL score of 830 + consistently since 2 years .

Thanks

They have the worst customer service, I got the card and had taken specifically for the purpose of travel insurance and have been running behind them since 6 months, escalated till their principal nodal officer but still nothing, they tend to not care about the customers complaint or experience, its shocking to see such kind of behaviour from an organization, you can never see this type of things with AMEX or even SBI.

Did you ever hear back from them?

It seems like they don’t even know about the travel insurance feature! I am going to escalate it, but I have no hope.

I wasn’t able to figure out if the priority pass is just valid for 1 year or not, I know for SBI it’s just 2 years with prime and elite however not sure about this one, I got the card and the expiry of the priority pass is almost after an year, what would happen after that would they renew or just like sbi nothing?

has anyone got this card issued as LTF?

I have Insignia relationship, they are offering it to me LTF. I am trying to decide between this card and the Insignia Preferred card.

If you have insignia relationship, simply go for the LTF insignia credit card.

Indeed, I am leaving towards the Insignia, primarily because of the 6 international lounge access and ₹500 BMS discount. I have lots of travel plans though, so the 0% forex markup and the travel insurance benefits seem enticing over the Insignia. (but only 2 priority pass visits vs 6 on the Insignia).

I have been using this card for past 1 year and paid annual fee of 3000 + gst to receive 3000 MMT voucher. Once I am back to India, I kept on receiving sms and calls related to pre approved upgrade to Icon credit card. Just now I called the customer care, both World Safari and Icon credit cards get joining bonus or voucher only on first year upon payment of annual fee and no chances of fee waiver from the second year onwards. I am still thinking on what to do as I have 2 options i front of me.

1) Cancel World Safari before this month bill generation.

2) Pay 5000 + gst and get 20000 rps (1 rp 20 paise) (1900 rs I will need to pay after reducing rp value)

I think, I will choose the first option.

You’re thinking right 😀

I got world safari fee waived off. I requested cancellation and they waived off.

Hi Siddhartha,

You got which fee waived off? Also can you confirm exactly how much are you being charged on international transaction (including forex conversion rate etc)

What is the limit that you got on the Safari card?

This card has got one of the most inefficient customer service. I would highly recommend that you let go of this card unless you are in dire need and they are the only one offering you a credit card

Hi Siddharth,

Do we have international ATM withdrawal charges in World Safari Card?

ATM charges are levied by the ATM and the bank has no control over it.

But this card isn’t suggested for withdrawal anyway, as it would incur finance charges just like any other credit card. You might need the IndusInd Premium Debit cards if you intend to withdraw funds at 0% markup fee.

Are the points earned through this card converted to Airmiles?

Hi,

Can anyone confirm the validity of priority pass and travel insurance which comes along RBL Safari credit card? Is it valid only for 1 year or upto the card expiry date?

Also,

For people who desires priority pass and 0 forex cards, what are the other alternatives?

Is AU zenith card good if received LTF? (I assume there are forex charges though hence looking towards RBL Safari card)

Thanks.

Sir, an important point. Tried in multiple POSs in Dubai, everywhere transaction got declined. This is the same response from this card users in credit card forums.

Did bank or the merchant provide any reason for the decline?

No, merchanta said to activate international transactions but all were active with maximum limit. Checked with RBL social media, they said to send a mail but didn’t have patience to send.

Someone used earlier this month in Dubai, got accepted

Hope you are well Sid. I was holding a Shoprite card which I had received as a replacement for my Zomato Edition card. It was LTF and just lying there unused. After reading your review I just mailed them saying I would like to close the card as I do not have any use for such a low rewarding card. As a retention offer they offered me World Safari or Icon – both LTF. I didn’t know much about Icon so I just went ahead with World safari as I had read your this review few days back . Hopefully I have made the right decision. It’s just a back up card for me anyway as my primary spends are on HDFC Infinia.

Other ex-Zomato card holders can give this a try and raise 9 card closure request. I guess for most of us there’s nothing to lose as Shoprite is useless anyway 🙂

So it seems they’re giving LTF for email request and FYF over call. LTF is a great value as long as they don’t revoke the travel insurance benefit.

Hi Siddharth,

For milestone stone benefits – what does it mean by Year? Is it a calendar year or one year from the card issuance date?

A very basic question. Travel Spends: 5 RP’s for every Rs. 100.

What all consists in travel spends? A normal hotel stay in india and flight booking is travel spend or normal spend.

Yes, domestic spends count as well, as long as the merchant reports MCC properly.

The insurance seems to be greatly devalued as per rbl website. Also, does the insurance renew?

A recent update u mean?

Supposed to auto renew but sometimes they don’t and we’ve to escalate.

I have been using RBL world Safari for almost 3 years now and travel abroad alot. The 3k fee doesn’t offset the markup fee. I mostly used cash for transactions. Couple of times it came to rescue when cash was not available. But I could have used any credit card for less transactions, it wouldn’t cost much. Another negative is priority pass validity, which is one year only, from 2nd year, one has to pay $99 for card !! Not worth it.

Hi,

Good Review

you have mentioned Max trip duration 30 days (per trip)

But As per the terms and conditions, the Maximum Travel Days is 10 Days quiet confused

Correct me if i am wrong. I am planning to apply for this card

Best regards keep up the good work

Info on RBL website might be outdated. The policy says 30 days, so that can be taken as actual.