Fuel is one of the day to day expense in everyone’s life and having a credit card that gives us cashback or rewards on Fuel is something nice. For those who spend a lot of Fuel, its a source of mighty savings just by swiping the right credit card. Lets look into some of the popular Fuel credit cards in India that gives either cashback (or) meaningful reward points on fuel spends in India.

Before that, ever wondered what the hell is Fuel surcharge & the waiver? Check out Fuel Surcharge Waiver on Credit Cards in India to learn more in detail.

Best Credit Cards in India for Fuel Spends:

#1 HDFC Bharat CashBack Credit Card

Its a recently launched credit card by HDFC for beginners and its one of very rare cards that gives you upto 5% cashback capped at Rs.150 (per month) on Fuel spends. Good for those who spend less than Rs.3000 a month.

- Fuel CashBack Rate: 5%

- Max CashBack: Rs 150 Per statement Cycle

- Read Full Review: HDFC Bharat CashBack Credit Card Review

#2 Standard Chartered Super Value Titanium Credit Card

Standard Chartered Super Value Titanium Credit Card is comparatively a better choice if you spend on fuel more. Note that here you get only 2.5% cashback.

- Fuel CashBack Rate: 2.5%

- Minimum transaction amount: INR 750

- Maximum cashback per transaction: INR 100

- Maximum cashback per month: INR 500

- Read Full Review: Standard Chartered Super Value Titanium Credit Card

Update: Here’s more info from one of our reader. Kapil Khurana Says,

Though cash back cap is 500 per month but cash back cap on FUEL is only 200 per month. This is how 500 cap is broken:

- 200 – fuel

- 200 – telecom (postpaid mobile / landline bill payments)

- 100 – utility bills

#3 Citibank Indian Oil Credit Card (Platinum)

Fine with swiping only on Citi terminals at Indian Oil pumps? This card is for you. Here, you’re given turbo points (nothing special with turbo though 😛 ) and can be redeemed over the counter, instant redemption.

- Fuel CashBack Rate: 2.6% (as points)

- Max CashBack: 267 Turbo Points = Rs.267 (or Rs.10,000 Spend) per transaction

- Read Full Review: Citibank Indian Oil Credit Card Review

#4 Indusind Iconia Credit Card (American Express Variant)

While Indusind Iconia is not basically a Fuel Credit card, but this is one of the rare cards that gives you reward points even on Fuel spends. The reward rate of the card remains same for the Fuel as well. Good thing about the reward points with indus-ind is that you can redeem them for Cash credit on statement which is as good as cashback concept.

- Fuel CashBack Rate: Upto 2% (as points)

- Full Review: Indusind Iconia Credit Card Review

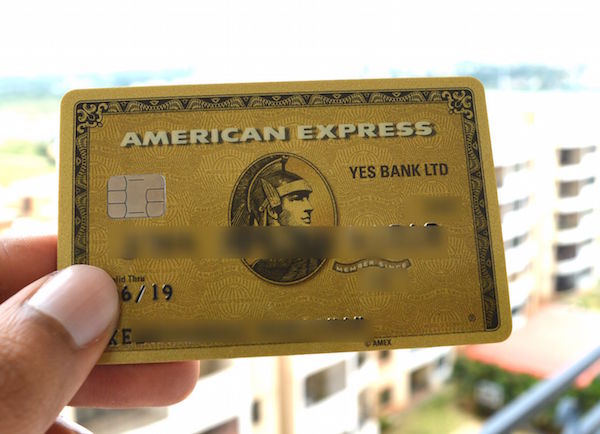

#5 American Express Gold Charge Card

American Express donot give reward points or cashback as an in-built feature on any cards. However, Amex is recently running a short term promotion that gives you 3% cashback on fuel spends upto Rs.1,50,000 (or Rs.4,500 Cashback).

- Fuel CashBack Rate: 3% (temporary)

- Full Review: American Express Gold Charge Card Review

Temporary Promos on Fuel Cashback/Reward points listed here:

Above are some of the cards that has fuel surcharge waiver & cashback benefit on them. Personally, my fuel expenses are quite less and so i prefer cash until recently i started using my Amex Plat Travel card to avail 3% cashback. Then came the whooping 5X reward Points offer on HDFC in tie up with BPCL.

I recently attempted to use my HDFC Diners Black to avail this offer. I noticed that they refunded me the Fuel Surcharge & also tax component but the 5X reward points is yet to kick in. Lets see how HDFC deals with it as they mention in many pages that reward points donot accrue on Fuel spends. HDFC is always mysterious about reward points stuffs 😛

Looking for cashback across all your credit card spends?

Check out my list of Best Cashback Credit Cards in India with full Reviews.

Whats your favorite Fuel credit Card and why? Feel free to share your comments below.

There is a correction sid.

On stanchart titanium, though cash back cap is 500 per month but cash back cap on FUEL is only 200 per month. This is how 500 cap is broken

200 – fuel

200 – telecom (postpaid mobile / landline bill payments)

100 – utility bills

Kapil,

thanks for the valuable information. I’ve updated the article with the same 🙂

Which credit card is best for dining restaurant usage ? In terms of more cashback or more rewards point ?

I am having HDFC Regalia , Kotak royale signature, Citibank rewards, Amex jet airways, SCB Manhattan credit cards, Indus ind platinum.

You should come out with a blog on this subject.

I don’t know which card I have to use for online shopping , which for restaurant , which for mall shopping , which for petrol pumps. How to get maximum discount or cashback I can earn ?

Sure, working on it.

Wow great.

I would love to read it.

So we all will know for which particular purchase or spending , which card is better to use.

As all card has its special features. Some cards are good for mall and departmental stores, few cards are better for movies and restaurants , few for online shopping or for petrol pumps.

Wish , we see it soon on ur blog.

StanC Titanium cashback amounts to 4% now, ever since surcharge was reduced to 1%.

Yes Bank also runs targeted offers of 5% cashback (plus 1% surcharge waiver), usually with a cashback cap of 500 per month.

Hey Sid,

I think you missed ICICI HPCL Coral Credit Card. It gives 2.5% cashback on fuel upto 100 INR per month. It also has 100 INR discount twice a month in BMS. I have the HPCL Coral Credit card Amex variant which also has Lounge access in addition.

Nice one. But Rs.100 a month is too low to consider. Lounge access is a good benefit though.

Yes. Agree with only 100 INR cashback a month. I fill my bike for 500 INR a week which is 4k INR month. I won’t use more fuel than that so I get the 100 cashback from fuel each month. BMS and Lounge access are like bonus. So in a way it is better than the Iconia card mentioned by you. 🙂

You need to review ur maths skills.

Hi Ashok

How did you manage to get the HPCL Coral Credit card Amex variant? It would be great if you could share since I’m unable to find anything regarding it.

Thanks

Hi,

I called Customer care and they informed this is a lower variant than my Coral CC, and i said thats fine and speciafically asked for Amex variant and i was issued an additional card. Limit is shared between all ICICI cards (Just like SCB). I took because Annual fee was lowest (AMEX cards) and i also get Lounge access.

Last time i visited Premium Paza in Bangalore, used my Visa Sig, Master World, and Amex card seperately for Myself+2 guests. All Free with Re 1 access fee for verification.

Sounds good Abhishek. Happy lounging for free 🙂

CITI INDIAN OIL Credit i can use only in Indian Oil pumps or its applicable for all fuel station?

only in indian oil pumps with CITI swipe machines

Only indian oil pumps. If you use at other pumps it is like any other transaction with surcharge and normal points .

Hi Sid, I spend around 80k per month on my card for fuel. Which card according to you would give me the best rewards points / cash BK and fuel surcharge waiver

Dear sir,

Thank you very much for your guidelines.

I am spending 700 to 1000 amt for fuel expenses. i taken citibank Indian oil credit card. i observed as citi bank swipe machines status is not upto the mark in my area. other than citi bank any other suitable. please guide.

My fuel spends are over 25k a month. I have 3 cards- Infinia(i believe does not give any rewards on fuel?), citi premiermiles, SBI elite and soon to get Yes Exclusive. Which of these is the best for fuel taking fuel surcharge waiver and reward points in mind?

? Anyone help out?

None. Go for indianoil citi card. You get 4 rs per rs150 spent. Or if you have a fleet go for fleet car from respective retailers.

Dear

Please guide me which one fuel card is best suitable for a employee

Thanks

I strongly believe ICICI HPCL Amex card is worth mentioning in this list for someone having a fuel spend of not exceeding rs 4000 a month. Apart from 2.5% + 0.75% CashBack it also gives 6 payback points per Rs 100 spent in fuel. That is equal to another 1.5% if converted to rupee equivalent 4 payback points =rs 1.5. It also gives 8 complementary lounge access and all the Amex deals as well as the BMS offer. In my view it is a bargain at the annual fee of rs 199.

Will get it updated in a while with fresh list and more info 🙂

After reading this post i have applied for converting the platinum card to hpcl coral amex card. According to me looks best of them all with 4% saving. But 2.5% will inly be given if swiped on icici machines also payback points cannot be redeemed for cash only products or vouchers from payback site.

Nope you can convert payback points to cash (not supercash) in mobikwik. Go to the redeem section and add your payback card.Happy conversion to cash!!!

Hey! Great article there.

Can you recommend the best card for a heavy fuel spender like me (I spend around 8k – 10k a month)

Hey,

Please suggest best credit card for fuel purpose. I spend (monthly avg) 5-7k on credit card having a part of fuel approx 3000 inr as of now on my Yes bank Reward plus platinum card since past one year.

Looking for one with good cashback & offers.

add-on info:- I hold a salary of 40k a month.

Seek for the best answer at the earliest.

Thanks.

You can go for SBI BP card recently launched with reward rate of 3.75% or ICICI HP amex card with reward rate of 4% or Citi indian oil with reward rate of 2.6%.

SBI seems to be a better offering as it give 1.25% rewards on dining, grocery also. check out the site.

SBI card is not really 3.75% as you loose fuel surcharge and only 1% they refund. Effective savings only ~1.75% at BPCL pumps.

whoa..that’s some “clever” marketing from SBI saying 13X reward points!!

Check standard chartered titanium credit card. Few details are as follows:

“Earn 5% cashback on fuel spends across all fuel stations up to a maximum of INR 200 per month (max of INR 100 per transaction). Minimum transaction of INR 750.”

Vishal,

Start using digital wallets. Mobikwik gives flat 10% cashback up to Rs.50 or 100 very often. Some times 100% cashback upto Rs.100. You can avail these offers once in a week. They keep changing the offers but have something or the other on fuel all the time. So it is much more beneficial than using any fuel card. Paytm also floats fuel offers. No headache of surcharges and you’ll also get 0.75% cashback per government regulation.

I can see only Paytm wallet accepted but no scope for other wallet.

I’m OK with ICICI HPCL card, with this I will get

1.Waiver of Surcharge

2. 0.75 percentage cashback

3. ₹100 cashback

4. Playback points

5. Additional ₹150 to ₹300 Amazon pay balance as cashback on Amazon on every month 1st/2nd

Please elaborate on how you will get additional 150 to 300 Amazon Pay balance by using ICICI HPCL card. And i think it is Payback points and not Playback 🙂

Its the offer amazon rums every 1st week of month for ordering groceries through amazon pantry. Its better to use icici amex hpcl card which gives 6 payback points and 2.5% cashback rather than only icici hpcl card.

That’s Payback points I know after my post but I don’t know how to correct it.

I have noticed that there is no Playback points for Visa version

Amazon Super Value Day Offer :-

—————————————————————————————

₹1500 to ₹3999 10% cashback

₹4000 & above 15% cashback (max ₹1200 cashback)

Not mentioned that Citi reward points can be redeemed to buy products in IOCL pumps at the rate of 1 point = 1 rupee for fuel or lubricants as rewards sale. That’s lucrative.

Hello everyone,

Is there any card or combination for Business use? Our monthly fuel consumption runs into lakhs.

Use Yes First Exclusive via Paytm and get 2.5% reward points + 0.75% paytm cashback.

any card which gives reward points on wallets can be used , eg already mentioned the YFE

i will appreciate if above article is updated suitably to present current cards giving maximum benefits.

The above one is may be outdated. Could you please re-review considering the current options available.

Why not add this category in your yearly best card review

Someone said the list is already exhaustive 😀

Please review the best credit card for fuel for now.

I regularly fill @ BPCL pumps. I use Paytm and Amer MRCC combination for this.

Any suggestion for BPCL?

Kindly review the best fuel credit card as the list is pretty old for now.

Please update this list with new entrant IndianOil HDFC Bank Credit Card

Can you please update about recent Indian oil hdfc credit card?

Thanks in advance.

Currently HPCL runs upto 100% cashback (max -Rs.3000) for March and april for its loyalty program dedicated app HP PAY. you can register by approaching any HPCL pump station. You can add money from any credit card without any charges upto ₹10,000/- per month. Normally you will get 8 payback point per 100. And can redeem them directly in HPCL pump station.

Could you update about the new SBI BPCL Octane Card

I hold an SBI BPCL card for the last 2 years and was waiting for a new card from SBI for an Upgrade only for my fuel expenses which is coming up to be beyond the max eligibility of 1300 per statement cycle for the 13x (3.75% value back on Fuel Spends) and thought the new card is an appropriate one.

Awaiting your thoughts on the new card as the value back proposition is about 6.25% with the new card on BPCL Outlets as well as the inclusion of Airport Lounges Benefits.

Can you update this article OR write new article on which are the best cards for fuel in 2021?

Consider exploring HPCL Gift cards or HP Pay codes. 🙂

Will check…though BPCL SBI Octane card looks appealing for now…although with 1500 annual fee