Cashback is always catchy and indeed nice to have whenever possible compared to reward points. That’s because it provides money back directly as cash instead of reward points, which we need to monitor and redeem with caution. Basically It reduces the net expense right away which makes things simple and easier.

Let’s dive into the list of best cashback credit cards in India which gives Money-back directly on spend (or) by converting the points to cash credit on statement without too much of terms and conditions.

List of 7 Best Credit Cards in India with Cashback Feature:

#1 SBI Elite Card

Sbi’s one of the premium credit card is SBI Elite Card which gives spend based milestone reward points which can then be converted into cash credit against statement.

- CashBack Rate: Upto 2%

- Tip: How I Earned Rs.18,000 Cashback with SBI Card

- Full Review: SBI Elite Credit Card Review

#2 HDFC Business Moneyback Card

HDFC Moneyback card was one of the excellent cashback card for few yrs after which they recently Devalued, however, the Business variant of the card still holds 3X reward points on online spends which can then be converted into cash credit on statement in matter of clicks.

- CashBack Rate: Upto 1.2%

- Note: Its issued for Self Employed/Business individual

- Full Review: HDFC Business Moneyback Card Review

#3 Indusind Pinnacle Credit Card

Indusind credit cards are well rewarding compared to other cards but it comes at a cost. Joining fees with Indusind is always high for some reason. This card is for you if you spend a lot online. If you’re able to get this card at affordable joining fee, it gives great rewards as below.

- CashBack Rate: Upto 2.5%

- Online spends: 2.5% Cashback

- All other spends: 1% Cashback

#4 Indusind Iconia Credit Card

Yet another card from Indusind which is worth holding as it gives reward points even on fuel spends. Once of the rare cards of this type. Joining fee is lower than Pinnacle card. Choose Amex version of it as it has better reward structure.

- CashBack Rate: Upto 2%

- Full Review: Indusind Iconia Credit Card Review

#5 Standard Chartered Manhattan Credit Card Review

I would call it as a family man card 😛 You can get better rewards on departmental stores and also better reward points on Dining and Hotel reservations.

- CashBack Rate: 5%

- Full Review: Standard Chartered Manhattan Credit Card Review

#6 Citibank Cashback Credit Card:

You get 5% cashback on movie & telephone Bill payments and 0.5% cashback on all other spends. Simple as that.

- CashBack Rate: Upto 5%

- Full Review: Citibank Cashback Credit Card Review

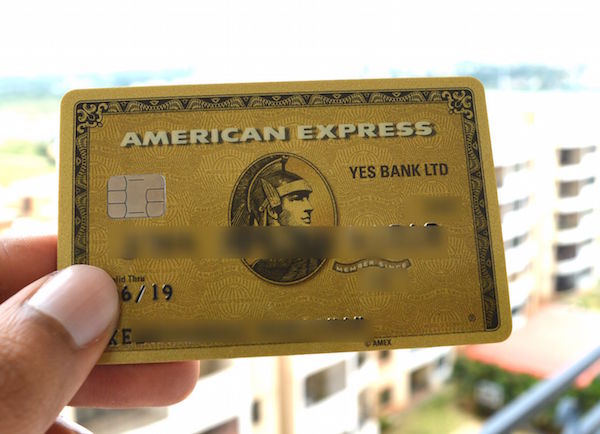

#7 American Express Gold Charge Card:

One of the prestigious cards that comes at an affordable joining fee is not actually a cashback card, but if you’re able to stack upto 18k or 24k points, you can convert them into cash credit against your card bill. You need to be calculative and keep track of few terms and conditions to reap the maximum value. Do you know? Its not a CREDIT card, its a CHARGE card.

- CashBack Rate: 2.2%

- Must Read: 5 Things You Must Know about Amex Gold Charge Card

- Full Review: American Express Gold Charge Card Review

So that should give a broad idea about the cashback credit cards presently available in India. While there maybe few more cards with cashback feature, i prefer the above list as they’re most popular, best rewarding and easy to use.

What’s your favorite Cashback card? Let me know in comments below 🙂

great write up siddharth!

can u plz let me know,how much should be the salary per annum to get a credit limit of 7 lakh.

3-4L Monthly Salary would get you such limits faster. Else you’ve to start with low limit and keep on increasing every 6 months. Check out my other article on how to increase credit limit for more info.

Hello,

Am currently residing in Kolkata and have been upgraded over time from Platinum to World Mastercard to Allmiles to Diners Premium with HDFC. Am enjoying Diners premium very much and love the structure of Diners Black. But on contacting stupid customer care, i was told BLACK is not offered in KOLKATA which is hard to believe. I hold limit of 3.09 Lacs on Diners Premium. Highest limit SBI ELITE 3.60 Lacs. (Am a freak like you, hold about 10 Card! :P). Help me get Diner’s BLACK.

10 Cards, That’s so much man 😀

3L is quite decent limit. You should be able to get Black.

Just talk to your RM/BM.

Most times they favour if you have savings/current a/c with them or anything that makes them money.

Also, Citibank Rewards. Each point is Re. 0.35 statement credit after 3500 Min. Effectively, at LittlePixi app we cold value it at Rs. 2.80 for Clothing & Departmental Store, Flipkart, MakeMyTrip (partners) & 0.28/Rs. 100 otherwise. Plus Citibank has one of the best customer care & partner tie-ups for offers!

Which is the best card siddarth for movie vouchers like book my show except sbi elite

Only that. Many others just have Buy 1 / Get 1 offers and not fully redeemable.

RBL Fun Card provides BookmyShow gift Rs.500/Monthly…

there is no limit for Ticket Quantity, that is a cool feature… I am using My SBI Elite Card they are also providing Rs.500/- BookmyShow offer but there is a limit for Ticket Quantity, I can book only 2 tickets within Rs.500

Hello

I have standard chartered cc with good credits limit , can you suggest some credit card with life time free or low annual fee, also I am going to apply on card on card based

I prefer credit card which provides EMI options,

Sir,

Yes Bank offers a Life Time Free Credit Card with gud features.

Regards,

Arun

Hello

I wish to hold 2 credit cards with maximum cash back and rewards points on online and other retail spends such as groceries, apparels and bills. I don’t want fuel, travel and airport lounge benefits as I hardly spend on these categories. My yearly salary is approx 7.2 lacs. Also my monthly spends would be Rs 10,000 approx.

Pls suggest best cards for my needs. PS: I have AMEX Gold charge card.

Thanks.

Hi Siddharth,

I have HDFC Allmiles Card (Limt ~3L) and Jet Airways :ICICI Jet Airways Rubyx (~120K), IndusInd Voyage Amex(110K), HDFC world debit card.

I don’t like HDFC Allmiles Card. Is there any good card to upgrade in HDFC. Is it ok to upgrade Allmiles to Jet aiwarys card

Upgrade to HDFC Regalia from Allmiles 🙂

I m a first time applicant for credit cards , which card siuts me best as I m a frequent flier and on both national and international circuit. I have selected SBI elite and air India SBI . which should I go for.

Depends on how much you spend as well.

I have moneytap rbl credit card which is best for money transfer in bank payback only @15% reducing interest on bank transfer so I use my card limit as cash.

Dear Siddharth,

I am a middle class Government employee with net monthly income of @ 60,000 + and want to have my first credit card with no or minimum annual fees to save on day to day expenses like purchase of grocessary from departmental stores like D-mart, paying utility bills, School fees, booking of train tickets etc. I am also having good credit score still I want to further improve it. I am having salary account in SBI. Can you please suggest me a good Credit Card in current scenario.

Sbi prime seems to be a good card for your criteria.

Hi Siddharth,

Thanks for this great and insightful article.

I want your suggestion for a credit card as I would be applying for the first time.

My main spends include 6K+ spends on air travel (half-yearly); monthly 5k on groceries (D-Mart and other local departmental/provisional stores); rarely online spends (Amazon, Flipkart); 1.5K+ monthly spends in Ola, Uber; monthly 0.5k+ spends each in mobile recharges and utility bills; and monthly 0.5k+ in e-wallet deposits. Also, once in a quarter spend of 2k+ from Shopper’s Stop/Central/Pantaloons etc.

I am interested in cashback rather than rewards. I guess the cashback gets added in the credit statement thereby reducing my credit balance.

Kindly suggest a credit card that would best suit my lifestyle with meagre or no joining and annual fees.

Regards,

GDB

Get an Amex Charge Card or amex membership rewards card.You can get almost 10% statement credit by spending 4000 on groceries for 18 months by accumulating 18 k points ,if you first put the money in Paytm through 4 transactions every month.For Uber also you can pay through paytm. By spending 72000 spread out over 18 months,1000 points for doing 4 transactions of 1000 each month

Hi Sidharth,

I am using HDFC Regalia card. How to upgrade it to Diner’s black card.

Regalia – im not paying any annual fee. But Balck card it seems 1 rp is 1 rs. so suggest shall we go ahead to d-black card?

Thanks,

Ramesh

Hi Siddharth,

Which credit card is giving maximum cash back in a month.i will spend around 1 lakh monthly I want as cash back as cash not as vouchers so which card is good for me.please suggest.

Regards

Giridharan

i want to max cashback on amazon,freecharge,paytm on online use credit card.

without any limit or caping of cashback rewards or points.

like : sbi simply click or axis flipkart or amazon pay icici

which card is best????

@Vikram – AmazonPay for shopping on Amazon+Paytm or Axis Flipkart for shopping on Flipkart+Paytm.