I’ve been using my SBI Signature Credit card for couple of months now and as you might know, it gives you 3% value back if you can spend 5 Lakhs on the card. I’ve explained more about it in the above review which i wrote recently. This is one of the very rare credit cards wherein you can convert your reward points into cashback. 1 Reward point = Rs. 0.25 Ps

How I Earned Rs.18,000 Cashback on SBI Signature Card:

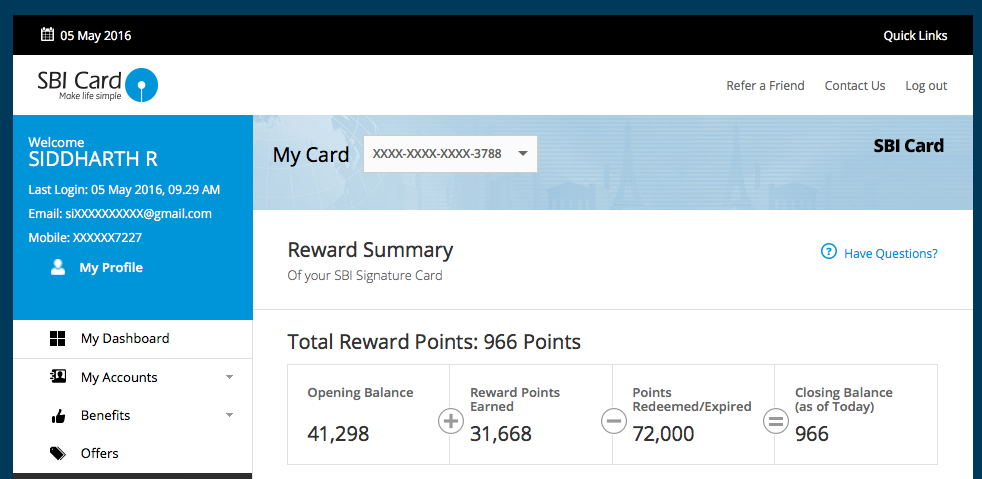

Typically, you can earn 60,000 Reward points in total on spending 5L, considering the regular and annual spend bonus on the card. I was able to achieve the milestones and added to this, i received some bonus points on International spends due to which my reward points went as high as 72,966 points till date.

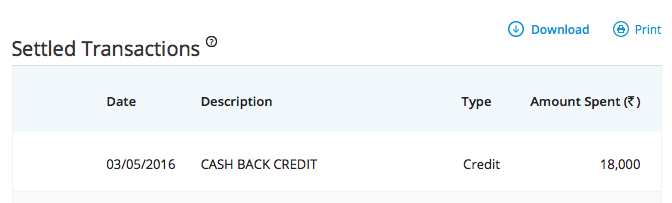

Now the nice part, you can convert reward points to cashback credit on your credit card just by calling SBI customer care. My request to redeem 72,000 points for statement credit was taken and i received Rs.18,000 as cashback credit on my card within 48 hrs. I should appreciate the speed of SBI because HDFC takes 10 working days to process the cashback request on HDFC moneyback credit card.

Few things to Note on Milestone Rewards & redemption:

- Your Milestone bonus reward points gets credited into your a/c after approx 10-15 days of reaching the spend.

- You can only redeem in blocks of 2000 reward points for cashback credit.

Sadly, its time to stop using the card as it gives no more perks after 5L spend. SBI Signature card still remains my favorite due to the Bookmyshow offer on the card which am utilizing every month.

After using the SBI card for couple of months, its unbelievable that their service/support is almost in par with American express. SBI customer care guys are really knowledgeable unlike in other banks like HDFC/ICICI giving crappy robotic responses.

- Update: This card no longer issued by SBI, it has been changed to SBI Card Elite and here are the changes

Have you redeemed your reward points for Cashback on your card? Share your experience below 🙂

Yes… I too received my 17000 cashback within 6 months of card usage. Now I have locket it off since it is not usable when u cross 5L. I make use of the BookMyShow offer every month though. Now a days I never pay for my movie tickets, since I receive 2 free tickets from SBI SIGNATURE CARD, 2 free tickets from Amex Jet Airways Card, n buy 1 get 1 free offer from ICICI rubyx 4 times a month.

Coming to the customer service front, I would like to differ from u in that, no bank comes even close to amex in their customer service. Recently I purchased stuffs from Apple iTunes store, n seeing that, the kids in my home merrily purchased stuffs from the app store, since app store doesn’t require OTP verification on purchase. When I contacted Amex on this matter, immediately they raised a dispute and credited back the amount to my credit card. Such things will never ever happen elsewhere. However, coming to SBI, Sure they have employed knowledgeable staff n they r many times better than HDFC in that part. They would help u in most of the matters. I have got my CITIBANK PREMIERMILES CARD just now. So I have to see how they fare.

which indian card is best for international spends?

which indian cards can give access to dubai airport lounges?

HDFC Regalia is good for Intl Spends & lounge access.

IDFC ONE Card is best for international spending as its forex markup fee is 1%.

For how much time period is the reward point earned in sbi visa signature valid ?

Hi,

I am confused between HDFC Regalia and SBI Signature/Platinum Card. My usage is very simple. I manage my money well. All I want to use Credit Card is for the rewards it provides than normal debit cards. So I want to do all my payments using Credit Cards and pay back at time. This is to earn reward points to get better benefits.

Do you think the scenario works? If yes, what should I choose between the HDFC Regalia and SBI Signature/Platinum Credit Cards. My income is good, and I am a controlled spender.

Vishal,

Get both of them. Both have their own advantages.

– SBI Signature good if you spend 5 Lakhs

– Regalia good for lounge perks and overseas usage

Hi Siddharth,

Thanks for the quick response. Really appreciate it.

This will be my first credit card, and I want to go slow. So at this time I will be going with only 1 card. Recently I don’t plan to spend overseas or go abroad, but can have tours in India. I have already told you how will I use my credit card.

Please suggest any one of them. By your reply, it looks that I should go with SBI Signature Card. A help would be great 🙂

Alrite, then SBI Signature card would do. Good thing is, these reward points can be converted to cashback which can’t be done on Regalia.

Thanks Siddharth. A second opinion always sounds good.

I am really keen to pick up the Amex Platinum card but am worried that Amex has low acceptance when compared to VISA or MasterCard.

Could you please recommend which card from VISA/Mastercard will be equivalent to Amex Platinum in India.

Thanks

Ravi,

It depends on what kind of benefits you’re looking for. There is no one kind fit for all card.

Next year also I would have to give rs 5000 for membership fee, so from all the benefits 5000₹ would be dedcuted. So the rewards is lower than it seems.

I have been using credit cards for a while, and never noticed how much I was spending on them.

After using HDFC Platinum for 4 years, accumulating shitty points, converting them to shitty Dominos vouchers; Rs. 500 for 1660 points, I woke up. I had been wasting money.

I realized that points could be converted to vouchers that could be used @ Re .75 / point. Realized my last year’s card spend was well above 7 lakhs.

After wasting tens of thousands, I got Regalia, and applied for Signature. Now I intend to use both of them in following fashion :

1. For all air tickets, book on hdfcregalia website. – REGALIA 4%

2. For all dining spends on standalone restaurants : REGALIA 4%

3. For everything else till I reach 5 Lakhs : SIGNATURE

Deepak,

Glad you woke up on time 🙂

That’s a pretty good strategy!

Check out Diners cards 10X rewards. Knowing how much you can save with it will blow your mind 😉

Diners club black.

3.33 percent normal, 6.66 percent on their site.

10000 fees that you get back as 10000 reward points. But spending 100000 in 3 months will reverse joining fee of 10k.

So i am getting 10000 free points, and another 3333 for 100000 spend.

By spending 100k, I get back 13k. Doesn’t seem right

Yes, double dip kind of.

Thanks for this post. I did encash my points, I was too worried that I only have to redeem them as coupons and end up on mandatory shopping coupons. 🙂

Most welcome!

Hi,

So here’s the thing. The status of my SBI application showed that my card was rejected.

I went ahead and applied for American Express Platinum Travel card, which was approved. And now, I have realized that my SBI card application has also been approved and the status it indicated on the site was wrong.

I am looking at Rs. 10,000 in annual fees for both these cards now.

What should be my usage pattern? How do I split my spendings between Regalia, SBI Signature, and Amex Platinum Travel Card?

For me, air tickets / indigo vouchers / cash credit are equally valuable, as I am guaranteed to spend about 60,000 a year on domestic tickets

Thanks so much

Deepak,

To utilize the full value of both cards. You have to spend total of 9L. 5L on SBI Sign an 4L on Amex Plat Travel card.

Maybe start with Amex first as it will help you to travel for free,

saving you 60k or so.

Can you confirm if the Redemption fees for reward fees (99+ Taxes) are applicable even if I redeem the points as statement credit (@Rs 0.25 ps) instead of redeeming them for a gift on the reward catalog.

I don’t think there are any charges. I wasn’t charged any!

Hi Siddharth,

Good Day to you!

i could see that you have given review for most cards and that too in same time period. !! how was you able to do that ? are you using the cards all at a same year ( time periods)?

I took AMEX card during SEP 2015 and i achieved 24000 RP ( reward points) by AUG 2016. Where my total Spend on the card is just 140,000. I could earn this reward points by way of 4000( welcome points) + 12000 ( 1000 Bonus points for 12 months) + 8000 RP by my expenditure on selected merchants with 10x points.

1. so my this expenditure says this card Reward rate is 7% , what do you comment on this ?

2. now as this is card renewal period, to avoid renewal fee of Rs 4999+ tax, i spoke to AMEX customer service who said they will give me a special offer which will reduce the annual fee to Rs 2200+tax. same time they will give 5000 reward points. do you think that i can ask for 100% reversal of Renewal fee?

3. now as i have just taken SBI Signature card. Can you guide me will SBI Signature card give more benefit than the above? if so can you explain me how?

4. I was told by SBI team that first year the card is free and i can earn 2000 Reward points if i spend just Rs 2000 within 90 days of card activation. can you please tell me like AMEX, will SBI also give monthly bonus ?

Yes, i applied for most cards this year jiden.

1. Do not add welcome points as you’re paying for it.

2. Put some high value purchase and ask them to waive off fully. They’ll do as long as you spend more with the card.

3. Am unsure which amex card you’re comparing with. SBI Signature card is good, but elite card is not that great.

4. SBI don’t have monthly bonus thing.

I Have AMEX GOLD CARD, now points worth 24000, i am not sure what is the most profitable way of redeeming it. can you guide me? the sales person said to buy BOSE DOCK system, But i could find that the BOSE dock system is just Rs 9000, so it will be better to get cash credit of Rs 10000 on to my account.

i hold below credit cards, can you guide me whether to hold it with me or to close some of them.

1. AMEX Gold card ( renewal by OCT 2016)

2. SBI Signarure ( VISA) ( just received it)

3. CITI Rewards ( since 2010)

4. Citi IOC ( since 2013)

5. HDFC ALL MILES ( Since 2014)

my spending pattern is

AMEX for shopping with BIG BAZAR

CITI IOC for petrol.

CITI rewards only if i get sms with some advice on offer.

HDFC for all other home groceries

can you look at the above information and guide me how to gain the maximum returns.

Do you now if any CREDIT card has got offer on LENS KART ? i want to make purchase on lenscart.

This month i have to

Better get statement credit for the points as you can get those catalog based items for better rates from flipkart or others.

Upgrade your citi cards to premier miles or prestige and HDFC allmiles to Regalia.

Hi Siddarth,

Nice to read your very incisive analysis!

Tell me, did you also pay the joining fee of Rs.5000? (redeemable in store vouchers)

I have a problem with the SBI card, which they never resolved. The joining fee is Rs. 5000, for which you can choose to get a voucher of 5000 from M&S etc. I got the voucher code and I spent around 3800 from the voucher code the M&S store, and the clerk told me that that I could utilize the balance next time, but before expiry of the offer.

However, when I tried to utilize this balance at another M&S store, I was told that the offer was valid for one time use only and could not be used in splits. I called SBI, but their response was cold. I did question them as to why it was not mentioned that split usage was not allowed, and they responded by saying that they’ve also not mentioned that split usage is allowed!!

I have an account with HSBC, and have their Premier card. I am not totally aware of the reward points etc ( I will take more interest after reading your review), but their service is par excellence, and minor transgressions (delay of 4 to 5 days in making payment on due date etc., provided you have a good history) are written off on a single call. In comparison, the SBI card service, in my opinion is abysmal.

Rakesh

Yes, i’ve paid 5k going fee and took the welcome voucher.

Yes, generally these vouchers are of One time use. That’s how they make money as well 😀

HSBC Cards are not yet upto the mark so far.

Hey,

I want a credit which offers maximum cash back my spending would be near 3L

Can you suggest the best card

Thanks

Sandesh

Rakesh ji,

I too had received the 5k shoppers stop voucher and used it partially and taken a credit note for the balance amount.

You should have asked for the credit note. All these code based vouchers are one time usable only.

Himanshu,

That’s interesting. Can u explain a bit more about the “credit note” system?

Hi, is it wise to get a credit card only for the reward points.. Im not a fan of credit system and stopped myself all these years from getting one because of “over spending”.

But if it’s more rewarding and cash backs then I will get one

Hi Siddharth,

Will i be getting reward points if i pay my insurance premiums through this card?