New list is up: Check out the latest list: Best Credit Cards in India 2021

Looking for the best credit cards in India? You’re at the right place. Whether you want cashback, rewards, airmiles, premium or super premium cards, you can find everything here. I’ve analysed 70+ credit cards across various banks and complied a list of 20+ best credit cards in India based on various user segments.

Remember, there is no one card that fits all, because where we spend, how much we spend and how much joining fee we’re willing to pay varies from person to person. With close to 10 active cards in my wallet, the below list covers most of my cards and even more. Lets begin!

Table of Contents

Best Lifestyle Credit Cards

Lifestyle cards are nothing but the cards that suits almost everyone for any kinds of spends, be it dining, online shopping, etc. Hence, these are all-rounder cards used by vast majority of users and it is easy to get approved as well. Suggested income range: 6 Lakhs+

1. SBI Prime

SBICard Prime was launched in 2017 and its one of the best credit card in India for many cardholders since then. From milestone benefits to lounge access, SBI Prime has everything you need under single roof and that too with a renewal fee waiver on 3 Lakh spend. USP of this card is that you can use it to pay your house rent and get a great reward rate on it. So 3L spend shouldn’t be tough to achieve.

- Reward Rate: 3%-5%

- Joining Fee: Rs.2,999 (You get equivalent Welcome Gift)

- Full Review: SBI Prime Credit Card Review

- Apply Now

2. HDFC Regalia First

Unlike SBI Prime which is a paid card, HDFC Regalia First comes at free of cost, which fits well for those who are not comfortable with paying high joining fees. The best part of HDFC cards are its merchant offers, as very often you get 5X/10X promos which will increase the reward rate of this card to the roof. I suggest you have atleast one HDFC credit card in your wallet and this one is good to start with.

- Reward Rate: 1%-10%

- Joining Fee: Usually Free

- Full Review: HDFC Regalia First Credit Card Review

3. SBI SimplyClick

If your spends are mostly into online and is less than 3 Lakhs a year, you could prefer Simplyclick. With SimplyClick card you get accelerated rewards on few merchants as well. It also comes with sweet milestone benefit (Cleartrip vouchers) that makes this low annual fee card Click!

- Reward Rate: 1.25%

- Joining Fee: Rs.499

- Full Review: SBI Simply Click Credit Card Review

- Apply Now

4. Citibank Cashback Credit Card

While i don’t personally use Citibank credit cards, a lot of my friends working in metro cities hold it and that’s how it made to the list. You can get this card easily if your salary account is with Citibank. This is a pure cashback card that gives flat 0.5% value back. Also like HDFC, Citibank is also famous for its Travel & shopping offers all through the year.

- Reward Rate: 0.5%

- Joining Fee: Rs.500

- Full Review: Citibank Cashback Credit Card

5. Standard Chartered Manhattan

Standard Chartered has very good cashback offers with Uber and so holding this card is one of the best ways to save on your cab expenses. They also keep adding new merchant offers every now and then that are really useful. So if you’re going for SC for any reason, Manhattan is good to start with.

- Reward Rate: Upto 5% (some limits applicable)

- Joining Fee: Rs.999

- Full Review: Standard Chartered Manhattan Card Review

- Apply Now

Best Premium Credit Cards

Premium credit cards comes into picture when your lifestyle falls bit beyond ordinary. Premium credit cards are kind of upgraded versions of the lifestyle cards that we’ve seen above. It comes with more travel benefits like domestic and international lounge access, better reward rate on high spends, etc. Suggested income range: 12 Lakhs+

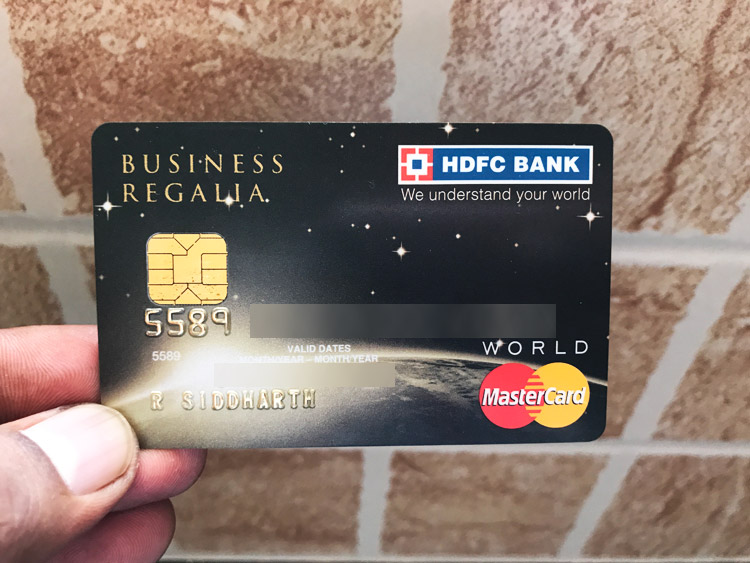

1. HDFC Regalia

It’s HDFC’s flagship credit card and has its name and fame for many years in the industry. Consider it as an upgraded version of Regalia First which we saw above. Low foreign currency markup fees on international transactions, 5X/10X rewards with selected merchants are some of its benefits. Newly added milestone benefits increases the overall reward rate.

- Reward Rate: 1.2%-12%

- Joining Fee: Usually Free

- Full Review: HDFC Regalia Credit Card Review

2. Yes First Preferred

Yesbank is a new player in credit card industry but they’re rapidly growing to capture the market share. Yesbank’s Preferred card is one of the best with its default 2% reward rate. The advantage of Yesbank cards is that they run spend based campaign very often that gets you 10X/2X rewards than usual.

- Reward Rate: 2%-6%

- Joining Fee: Usually Free

- Full Review: Yes Bank Preferred Credit Card Review

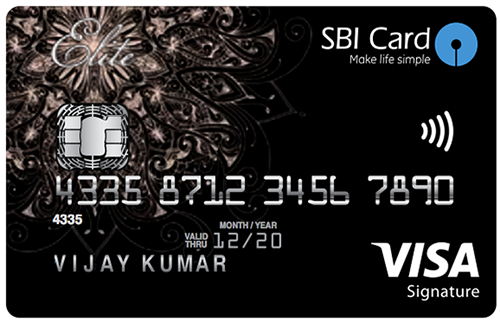

3. SBI Elite

SBI Elite is one of the best premium credit card with the ability to get 2 bookmyshow tickets (not buy1 get 1) worth Rs.500 every month and is one of the best Bookmyshow offer around. It suits well for movie buffs and high spenders, as the renewal fee gets waived off on 10L spend.

- Reward Rate: 2%

- Joining Fee: Rs.4,999

- Full Review: SBI Elite Credit Card Review

- Apply Now

4. Amex Gold Charge Card

If you’re into premium lifestyle, you MUST have atleast one of the Amex cards in your pocket and Amex Gold Charge Card can be a best fit for that reason. This is because Amex is very aggressive and active in running offers with various merchants, especially related to travel and during festive season. Check out 5 Reasons Why You Should Have an American Express Credit Card.

Remember, its a “Charge” Card and not a “Credit” card and hence no EMI options. if you’re interested in having the credit card variant of it, you might need to check out Amex MRCC instead of this.

- Reward Rate: ~2%

- Joining/Renewal Fee: Rs.1000+ST/Rs.4,500+ST

- Full Review: Amex Gold Charge Card Review

- Apply Now

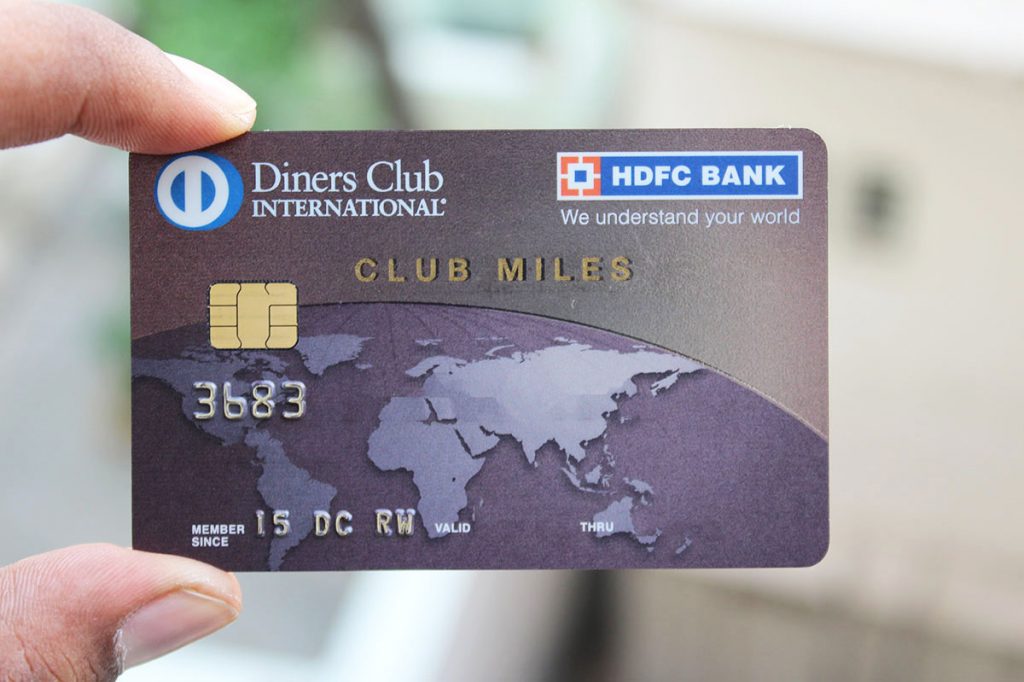

5. HDFC Diners ClubMiles

If you’re more of a traveler and online shopper, HDFC Diners ClubMiles Credit card will help you save quite a lot with its 10X Reward Points and complimentary lounge access. The only downside of this credit card is that its not a Visa or Mastercard but Diners Club itself and the Diners Club acceptance is not 100%. Hence you always need one backup card to be on safer side.

- Reward Rate: 1.3% – 13%

- Joining Fee: Usually Free

- Full Review: HDFC Diners ClubMiles Credit Card Review

6. Indusind Iconia

Do you spend a lot on weekends? Consider getting Iconia Amex Credit card. I’m personally using it for fuel spends as it doesn’t have fuel surcharge at HPCL pumps. Earlier they used to give Reward Points on fuel, but now it has been revoked. USP of this card is unlimited domestic lounge access, which maybe revoked anytime soon.

This is for credit card enthusiasts and i would not really suggest for beginners as Indusind credit card systems are not so great at the moment.

- Reward Rate: 2%

- Joining Fee: Rs.3,500 no voucher (or) Rs.10,000 with equivalent gift voucher

- Full Review: Indusind Iconia Credit Card Review

Best Travel Credit Cards

When your life has good amount of travel, that’s when you need to have these Travel credit cards. Travel credit cards are designed in such a way that you get travel vouchers instead of cashback and reward points.

1. Amex Plat Travel Card

American Express Platinum Travel card is the best travel credit card in the country, hands down! Its designed for high spenders as you get ~Rs.30,000 worth of travel vouchers that includes domestic travel vouchers + Taj Stay vouchers. You get all these on spending 4 Lakhs on the card, however, your spends need to be bit higher if you’re looking for the renewal fee waiver.

- Reward Rate: 7%

- Joining/Renewal Fee: Rs.3,500 / Rs.5,000

- Full Review: Amex Platinum Travel Credit Card Review

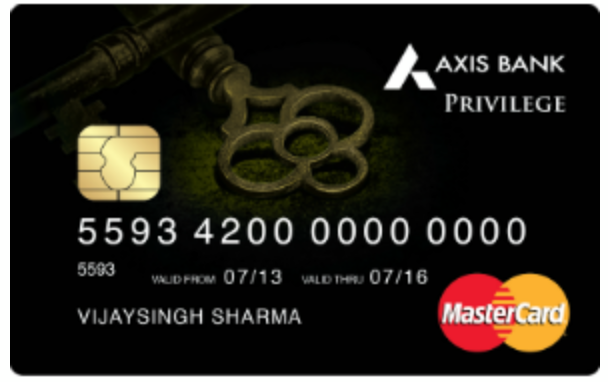

2. Axis Privilege Card

If you’re an Axis Bank Priority customer, you can get this card for free. That being said, this card comes with decent benefit for travellers in terms of Yatra voucher redemption options. I would suggest to go for it only when its free as the merchant offers are less, which makes it comparatively less attractive.

- Reward Rate: 1%-2%

- Joining Fee: Rs.1,500 (Free for Axis Priority Customers)

- Full Review: Axis Bank Privilege Credit Card Review

3. SBI IRCTC Card

With SBI IRCTC credit card, you have a chance to save upto 10% on your train tickets and redeem them back for train journeys. If you travel by Indian railways very often (40+ trips annually), consider going for this card.

- Reward Rate: 1%-10%

- Joining Fee: Rs.500

4. CITI PremierMiles

First of all, its NOT an Airmiles card, which even most of the card holders think it is so. Citibank Premiermiles is a rewards card more like HDFC Regalia and fits well only for the Citi Priority/Gold account holders. You can also convert your points to major airlines & hotel loyalty programs. This card in itself is not a great card, but it helps to get Citi Prestige, which i’ll cover shortly.

- Reward Rate: 1.8%

- Joining Fee: Rs.3,000 (Free for Citi Priority/Gold account holders)

- Full Review: Citibank Premier Miles Credit Card Review

If you’re a frequent traveller, you might also need to check out the list of best Airmiles Credit cards in India. More on it at the end of article.

Best Super Premium Credit Cards

With over 2 Lakh+ High Networth Individuals (HNI) living in the country, they certainly need special attention, don’t they?! So banks have super premium cards that comes with higher credit limits, unlimited lounge access, highest reward rate & more perks.

- Suggested income range: 25 Lakhs+

- Suggested spend range: 10 Lakhs+

Getting approved: Before we get started, its worth mentioning that these are some of the toughest cards to get approved in the country. Though, if you hold high relationship with the respective banks, nothing can stop you from getting one.

1. HDFC Infinia

India’s most Prestigious Infinia Credit Card comes with a minimum credit limit of Rs 7 Lakhs+ and the unique NPSL* (No Pre-set Spending Limit) feature makes it stand out. HDFC’s most popular 5X/10X rewards promos with select merchants makes it one of the highest rewarding credit cards in the country.

- Reward Rate: 3.3% – 33%

- Joining Fee: Rs.10,000 (Free for select accounts)

- Full Review: HDFC Infinia Review

2. Yes First Exclusive

If you’re unable to get hands on HDFC Infinia, the next best card you can get is YesFirst Exclusive. While it has almost all benefits as that of Infinia, the reward rate is slightly lower, though you can make up that by availing Yesbank’s 10X/2X/3X promos which they run from time to time, which i’ve mentioned earlier in this article as well.

- Reward Rate: 2.5%

- Joining Fee: Rs.10,000 (Free for select accounts)

- Full Review: Yes First Exclusive Card Review

3. HDFC Diners Black

With its lucrative 10X reward points program, its undoubtedly the best Credit card in India, especially for travellers. Even without the 10X points, it comes with a great reward rate by default, as good as HDFC Infinia.

Only downside though is lower acceptance of Diners cards in India compared to Visa/MasterCard, which means, you have to keep a backup card handy.

- Reward Rate: 3.3% – 33%

- Joining Fee: Rs.10,000 (Free for select accounts)

- Full Review: HDFC Diners Black Review

4. Citi Prestige

Citi Prestige is a whole different card compared to the rest in the list. Despite being an expensive card, you get maximum benefit only if your lifestyle itself is very much a premium one. Holding Citi Gold/private account will further help you get accelerated rewards. If you are doing trips in APAC, this card can help you save well (Hotel+ lounge+ Limo).

- Reward Rate: 2% – 10%

- Annual fee: Rs 20,000 (Free for Citigold & Private Clients)

- Full Review: Citi Prestige Review

5. Standard Chartered Ultimate

Standard chartered Ultimate credit card has been recently launched and is certainly one of the best rewarding credit card. Not only the default reward rate is great, the redemption options like Amazon voucher (temporary) also makes it one of the best card to hold for high spenders. However, it doesn’t have other major benefits like unlimited lounge access etc.

- Reward Rate: 3.3%

- Joining/Renewal Fee: Rs.5,000

- Welcome Bonus: Rs.10,000 Cashback

Other Categories

Above mentioned lists and the respective cards are some of the most commonly used credit cards in India. Though, as your requirement may even be more precise, i’ve also compiled few more lists for you to explore. Click on each of below link to check out the list of best cards in the each category.

Bottomline

As always, choosing a credit card must be totally based on the Individual’s lifestyle and spend pattern. Thumb rule is to get maximum reward rate on your spends. You shall have as many cards as you wish and all you need to do is find a strategy to get maximum value out of them.

And not to forget, credit card industry in India is rapidly changing and hence you need to be aware of the changes happening in the space to make the most out of your cards.

Hence, consider updating your strategy atleast every 3 months to stay in the trend. You may also like and follow Cardexpert Facebook Page to get latest updates instantly.

Hi,

Nice list. I think 3 more cards can be added.

1.Amex MRCC: better than gold charge card, only 4tx for 1000 points +emi facility.

2.amex plat reserve as a lifestyle card: for memberships in taj, eazydiner, oberoi etc

3.citi rewards card: 10x points equal to Rs.3 on spenda in apperal etc.

Got it. But adding more similar cards to list will distract the new comers, hence made it as compact as possible.

But Axis Flipkart should have been there.

I don’t see any Merchant under 10x Partners for Citi rewards card.

Once it was a bit list but in the recent years , there will be hardly 1 or 2 merchants and as of now I think its nil

U get 10x points for spends on apparel’s etc. its the default feature of the card. I have been using this card since it was launched some 7 years back i guess.

I’m using Citi Rewards Card since 2002. At that time I didn’t understand rewards & all. Also rewards used to expire every year in those days.

Great list Sid…One can totally make out the cards you own, and the ones you don’t..:-)

Glad the pictures helped 🙂

Sadly SCB has revised joining and renewal fee of Manhattan card to 999/- + GST.

Also spend based reversal is now higher at 1,20,000 per year.

Info Updated. Thanks for noticing it!

SC made Manhattan card LTF for me when I tried to close this after 3yrs of relation (only CC), as I moved to SC Ultimate.

I have Citibank Cashback card since last 10 years and no renewal fee is charged if annual spend is above 30,000.

Also any wallet topup earns reward points at usual rate of 0.5% cashback.

Cool!

I think you should get an MRCC card , load wallet @1000 *4 transactions and then get either Rs 250 cashback every month or go for their 18k redemption of 7500 cashback after you have spent Rs 72000 i.e 18*4*1000((4 transactons every month)-This would be equal to more than 10% savings , better than any other card

I have HDFC Regalia First since last 8 months and almost every month ( I guess 5-6 times) they have send sms that as a part of HDFC activation campaign I have earned 200/- mobile topup.

Recharging any mobile no. I wish since last 5-6 months( Jio recharge is excluded as per sms received) with above offer.

Yes, HDFC does have good welcome offers now and then.

Sadly I never received any such SMS offers.

I got my HDFC Regalia first card around a year back since I was travelling and wanted lowest foreign markup fee etc. After that have been using it regularly with around 30k spends per month. Not sure why they do it selectively. I am wondering should I upgrade to Infinia ( am eligible now ). But I don’t want to pay any annual fees/charges etc. Is there a way to make it lifetime free?

One thing am disliking with this HDFC Regalia card is mastercard is reducing the number of lounges drastically.

Many thanks to you Siddharth for this site. I am a very conservative person and used to dislike credit cards and so never used them ever. Was using HDFC Platinum debit card which gives 1% as cashback back to the savings account. So was happy using it. But credit cards if used with discipline is good. My billing date is 15th and payment last day is end of month. Am thinking of getting another card with end of month billing and last day as 15th. This way can get a month of “free” credit. What do you think? Will HDFC allow two credit cards to the same customer.

I wonder why Axis Vistara Signature card doesn’t make through your list. With 4 Premium Economy tickets on 4.5L yearly spends and 3k joining fees, I hardly find any other credit card giving such benefits. But one needs to play well in the airmiles redeemption (last minute premium eco ticket prices go beyond 10k, so be wise to redeem at the right moment). One major disadvantage is unavailability of Vistara network which mainly connects major Indian cities with Delhi only.

There is a separate list for Airline cards. Hope you went through the links in article.

Dear Sid

For my spouse (a private school teacher) having ITR of approx 3 lacs, which HDFC cc will be best that can be approved by branch. She holds a HDFC savings ac alongwith 2 kids ac attached to her account.

Though overtly optimistic, I have shortlisted HDFC Jet World, Regalia n Regalia First. RM said will try for Regalia First. And what about HDFC Rupay bharat card which can be easily approved.

I will be mostly getting the DCB within a month, thanks to guidance provided by your PAID CONSULTATION SERVICE availed few months back. So I would be using spouse cc as a backup for DCB incase Diners isn’t accepted anywhere.

Though your suggestion may be the final deciding factor.

Satish,

Get HDFC Classic/Preferred ac will certainly help to get Regalia First for her. Other cards mentioned are bit tough unless you give lots of profits to bank in one way or other.

Advance wishes for DCB 🙂

hi siddarth,

thanks a lot for all infos your are sharing. great work. does having hdfc a/c in rural areas and city areas get treated differently? because MAB differs for rural and city

Great article as always. Thank you for providing such great info. And yeah you have so good collection of Super premium cards. I find it more exciting and somewhat jealous. My obsession for CC started since i followed cardexpert.

Currently holding HDFC RF and Simplyclick.

Cheers.

Thanks a lot for your wish n prompt response.

Dear Sid

I could spot your new experiment of HIDE or SHOW Contents instantly. Its indeed very nice.

Ah yes, it helps in navigating large article 🙂

Personally I think the HSBC card can also make the cut in the list. It is LTF and have great reward/cashback offer for new customers. I like the fact that there is no quota applicable on BMS redemption unlike other cards and each add on is eligible for all the offers in addition to primary. Recently they have been coming out with great merchant offers with MMT/Cleartrip, PC Jewellers as well.

Yes, i see HSBC getting better. Will certainly add it in coming months.

@Indian

Infinia though charges 10000/- joining fee but also gives 10000 points worth 1 Re each. You only endup paying GST of approx 1800/- per year. Renewal fee of 10000/- waived if u spend 8 lacs in a year.

You can’t get Infinia LTF. Best way to avoid fee is spend 8 lacs + per year or else be content by paying virtually 1800 GST if ur spend is less than 8 lacs per year.

Hello Sid, I make a lot of payments using wallets, upwords of 50k per month. Can you suggest me which credit card will give me best rewards for such usage? Right now I am using simplyclick which gives me 1.25% back flat.

Yes First exclusive @ 2.5% flat

since you are spending more than 6L , you would be getting 2000+2000+499+7500 (milestone+milestone+annual fee waiver+RP on 6l spend) = 11999rs

so the effective reward rate for you is 2%

SC Ultimate Visa Infinite gives 3.33 % reward rate for wallets, so you would get 20000rs back on 6 Lakhs spends

there is annual fee of 5000+gst, how ever u get 5k points also, which is 5000rs, so you end up paying GST of rs 900

so effective reward rate for sc ultimate would be 3.18%, which is better than sbi simply click

good luck

SC Ultimate would give you 3.3%

Get an Amex MRCC card for the first 4000(4*1000) trasaction , then use Yes First exclusive for the remainder.

Can anyone confirm if SBI prime is still giving 5% return on rent payment through Red Girraffe. I confirmed with them today and they told me that rent pay doesn’t come under utility but under separate category of Rent Payment.

I will be applying this card only for 5% return on rent payment.

Yes it does. I get 5% cashback as reward points every month.

Yes it is. You get 5% return through Red Giraffe.

How to get HDFC Regalia First as life time free??

You can get Regalia First (or for that matter, many other HDFC cards) LTF by attaching a insurance policy for auto pay with you card. It’s not actually LTF, you won’t be charged fees as long as you keep the biller in their autopay system (called SmartPay).

I think this is also true for other utility billers, but not totally sure about that. You have to ask customer care about that. Mine is free because of the insurance policy.

Depending upon when you apply for the card, there will be promo offers from the bank ( mostly some or other product cross sell).

Better open a saving ac with hdfc bank if you don’t have. Now talk to your RM, who will tell you how to get it LTF. Most HDFC cc are issued LTF if you are little smart.

Hi there,

This question might is a bit out of topic. I have 6 credit cards currently and was having 2 till last year. I have a hdfc diners premium, citi super miles, icici rubyx, amex rewards, yes first preffered and indusind signature card. All these cards were issued LTF from the banks itself.

My question is –

1. Will so many credit cards affect my credit score?

2. Is it good to keep so many cards for a long period?

Also , I wanted to upgrade my diners miles to diners black and they are asking me to keep an FD of 10L for this card and surrender my current diners miles as we can have only 1 card per bank. Is this recommended? Please help me out with this

Your credit score will nit be affected , in fact clean use can enhance it. It depends on you how bad you want the diners black. Existing limit of 5 l on a hdfc card can give u upgrade to black.

Hi Eshwar,

It would be great if you could share how you got the following cards LTF :

1.) IndusInd Signature (IndusInd doesn’t gives this card on one time joining fee basis in exchange of vouchers.)

2.) ICICI Rubyx (ICICI doesnt even give free premium debit cards, lee alone credit cards)

3.) Citi Super Miles (I think you meant Citi Premier Miles. This is LTF only for HNI CitiGold customers)

@Eshwar

1. No as long as you pay your bills fully before due date.

2. No problem if they are LTF.

You have to surrender your current diners cc to get Diners Black. If you are ok with blocking an FD of 10 lacs then no problem in taking it. But remember as you are taking Diners Black via FD route, your fd will be blocked until you have this card. And limit enhancement or further upgrade option also won’t apply in your case.

You have Great collection of premium cards ? What is 15 DC RW and 16DC RW written on cards? And how come you able to get cards with different names like Siddharth Raman, Siddharth R and R siddharth?

Just Curious.

Hope you reply.

Thanks

Not sure about RW.

Reg. name differences,

My old docs were with initials, which is how most id’s are in TN.

I am using sbi simplyclick for 8-9 months now. I was given credit limit of Rs 50K. I just want to increase CL. No pre-approved offer till now. Guys are saying given latest IT return papers. May i know will it affect cibil score by manually giving itr details for limit upgradation.

Thanks

Rajesh

Nope.

Hello Guys,

I want to ask something. It might be out of the context question. How you guys manage credit card bills? Do you think setting NEFT instructions are the best option. I prefer to setup standing instructions but problem is that, banks expects physical form to be sent and we guys keep on upgrading cards and have multiple cards. Do we have any easy way to automate credit card bill payment?

If you are on Android, use an expense manager app like Walnut. It gives you reminders for card bill payments 2 days before the due date. I personally pay everything on 1st of every month and check again once between 10th-15th dates if there are any more bills due.

I use NEFT + auto debit option.

I have set a reminder of 4 days before the due to credit cards ( I use 3 cards). Once the reminder comes, I pay the bill immediately.

Hi I need a suggestion

I have a hdfc allmiles card (upgraded by hdfc from basic card 4 years back) from 10 years. Limit 975000/-

I want to opt for infinia or dcb. Suggest how to do it

When called hdfc cc cc I was told to fill one form and submit docs and will consider but need to pay joining and annual fees . However my present card is free for life.

I am not frequent traveller and want to change the card pls suggest

Hi, I’ve recently applied for regalia first business variant and all the verification is over. Any idea from your experience how many days more it’ll take for the card to arrive? Thanks

Shouldn’t AMEX platinum charge card be one of the super premium card category.

Its not good enough to make it to the list. It’s expected to get a refresh by late 2018. So, it may make it to the list in 2019 🙂

Hi Siddharth,

Thanks for great information. I need a suggestion from on choosing the right card. I am holding diners black and SBI elite. Looking add one more card to have higher credit limit. I use the cards mostly for purchases from offline shops and online.

Pl suggest a card which can give good reward points with value.

My last ITR value is around 19 lakhs.

Thanks in advance

Amex Plat Travel has a wonderful reward rate with excellent credit limits.

Hi Sid

Do we have any good cards from Axis that we can hold, i am daily getting calls to get a credit card from axis

Axis co-branded cards with Vistara are very good value.

I have a regalia first credit card. I want to get another credit card. So which would be the best credit card to hold along with the regalia first as a combo?

Hi Siddharth:

Excellent website with tons of information. After going through the contents of this site, I applied for Infinia, and got it in a weeks time. I can comfortably discard my AMEX Platinum Reserve now. I need a Mastercard as a backup. Which would you recommend. Thanks again.

Ravi

I would suggest Yes First Exclusive if you want Mastercard

Hi Sid

I am now going to draw 18 LPA from my new company.Do you suggest any new cards that can be added or upgraded from my current deck.I have HDFC moneyback, Indusind platinum select ,Amex MRCC and Yes First Preferred.

Hello Siddharth, can you shed some light on “Best Credit Cards for Fuel”. Considering the recent removal of Reward points on many Credit cards and considering various cashbacks in the form of Fuel surcharge reversal and Government cashback, this topic is a dire need for daily fuel fillers in the group. Thanks in advance.

Hi Ashish,

Best card for fuel would b Citibank Indian oil Card there is no surcharge for transaction upto 10K and u can redeem the points at Indian oil pumps at 1re per point which is of a great value.

But should be used only in Indian oil petrol pumps.

If you have any IOCL pumps near your place this would b a great value card.

Cheers,

Kiran

Dear Sir,

Please advise can i use this card at any Indian oil petrol pumps or specific Indian oil petrol pumps?

Thanks in advance.

Regards

Karthi

Indian Oil pumps with Citibank EDC

In Specific Indian Oil Petrol Pumps only and that list is mentioned in Citi website .

In that specific Indian Oil Petrol Pumps also, you should swipe the card in Citi machine

Standard Chartered Super Value Titanium Card is the best card for fuel… you get 4% cash back (up to 200 per month)..

I can go for icici amex hpcl coral card or indian oil citibank card or both. I have both.

Arjun

1. Upgrade HDFC Moneyback to Regalia

2. Apply for Citibank cc. They run some cool offers in online shopping & travel category.

Recently i redeemed points for travel on 4 credit cards and here is my feedback:

1. American Express Travel card:

As spicejet has very few flight i opted for ATO vouchers. I had 2 milestone points welcome benefit and 4L milestone points from last year. I got vouchers worth Rs.11.5K instead of Rs.14K (spicejet) a loss of Rs.2.5K. On top of that for 3 tickets i was charged Rs.810 as convenience charges. I booked indigo, had they not shifted to spicejet we all would have saved a lot as indigo has more flights. Total per ticket extra i paid around Rs.1100. Anyways i am closing this card and have already replaced this with Amex Platinum reserve. Great offers on it if you stay at Taj, Hilton etc.

2. SBI Simply Click:

Had a Rs.2K milestone voucher to be redeemed on cleartrip. Book a ticket and extra i had to pay was Rs.290 or so as convenience charges.

3. Yes Prefered:

Redeemed points on yesrewardz website. Extra i had to pay was only Rs.100+taxes for redemption, no convenience charges. A tip book all your tickets in one go as u have to pay redemption charges everytime.

4. HDFC Diners Black- The go to card 🙂

As usual no convenience charges. No redemption charges.

Also one tip if you are looking to book flight tickets and earning points go to smartbuy and book u get flat Rs.200 off and no convenience charges irrespective of the ticket price. So for ex. i booked a delhi to jaipur ticket for Just Rs.1050 and earned 33% points. Had i booked on other portals i would have paid Rs.1050+200(discount)+Rs.300(convenience charges)=Rs.1550 and almost negligible points.

In my experience Hdfc Diners and Yes First are the best cards. Amex travel is good if you travel in India and can spend Rs.4 L. Other cards that issue vouchers are not good as you have to pay redemption + convenience charges.

Here is one more experience of booking Hotel on smartbuy:

I book Taj exotica goa half board package for 2 days on smartbuy which in turn books on cleartrip which in turn uses expedia network. I paid Rs.45K for half board although i was getting full board for Rs.44K on Taj website.

After booking i called Taj reservation to confirm my booking. When i told them that i paid Rs.45K they said “Sir you have been overcharged as we have only received Rs.38K for booking, Kindly check with expedia and ask for refund”. I immediately called cleartrip and i was told” Sir you must have compared prices on other sites also and then only you must have booked, if you think you have been overcharged kindly cancel the booking as there are no cancellation charges from Taj and you have to pay Rs.300 to cleartrip.”

In short hotel booking against points is not a good idea to some extent, only book if the difference is very less. Like i booked Hongkong Disneyland hotel for 32K points and i was getting it on website for Rs.28K. not much difference.

Anyways i am getting 15K points so net cost to me is only Rs.30.5k for Taj. But still cleartrip, smartbuy are making a killing on hotel bookings.

The best value from points can only be got by booking flight tickets.

All in all you save money by using any card it just how wisely you redeem.

I hope it helps.

Is it mandatory to provide Aadhar card details for a new credit card application when you don’t have any existing relationship with the provider bank/issuer?

I recently tried to apply for an Axis Bank card and they wouldn’t issue one without sharing Aadhar card details. The actual KYC list issued by RBI says one of the following for ID proof:

1. PAN Card

2. Passport

3. Voter ID card

4. Aadhar Card

5. Driving License

Hi Siddharth, I am new to the world of credit cards. I have started an ecommerce store and I need to make payments to international suppliers. I recently got the HDFC Freedom Visa CC and SBI SimplyClick Visa CC. But I am not sure if these are the best cards for my intended use, that is, paying my suppliers who are mostly based in China/Abroad.

So I am going to be making payments to my suppliers outside India. Can you tell me which will be the best card for this purpose. I believe I need something with low Foreign currency conversion charges but I am not sure about this. Also, since I will be paying my suppliers online through portals like Alibaba.com, will it be considered an online transaction similar to online shopping from Amazon? If so, which card will offer me good rewards for such online payments. I am expecting my monthly payments to these suppliers to be in the range of around 2 Lac rupees or say 3000 US dollars for now.

My business is just started so I am not sure if that will be a problem.

Also, Are there credit cards which are specifically for business use?

I hope I have not confused you and you will be able to answer me. Just to clarify, I am not interested in rewards for grocery shopping / departmental store / movies / dining / fuel / air travel. I am only interested in card that will offer rewards for online ecommerce transactions plus low foreign currency conversion charges.

Thanks, Ankita

Caution: You might hit the safe limit set by FEMA and your ac might fall under scrutiny.

But if your accounts are perfect, you shall start with Regalia First and upgrade it all the way to Infinia. Or, if the site supports Diners, that can save you a lot through 10X rewards as well.

Hi Sid, could you plz elaborate on your comment about FEMA limit ?

Hi Sidd

Is not the FCY rate is lesser for Yes First than the Regalia First or Regalia? If we can get hold of Yes First, Should we prefer it over Regalia*

Hi, Siddharth.

Nice article for credit card freak!!

Would you please like to help me to choose between ‘YES Prosperity Edge Credit Card’ and ‘HDFC Regalia First Card’. I am not sure, which card is better. I want to use it for day to day use, e.g. bill payment, online shopping, flight & train ticket booking, mobile recharges etc.

I thing I would like to know, whether these cards give reward point, when we do bill payment / ticket booking / mobile recharge via any e-wallet site.

Thanking You.

Both are equally good. U can have either of the two or both….

Thanks Prashant for your prompt reply.

Actually I have already two credit cards. One is from SBI (secured card against FD with lower limit) and Standard Chartered Landmark Platinum Reward Card (LTF with higher limit). I run almost all my day to day and monthly expenses on SBI card including online / offline shopping, bill payment, flight / hotel booking, e-wallet loading etc. I have never used Standard Chartered card since it was issued (before one year), because I think the reward point is very limited to few of the selective Landmark group store.

And I dont want to have more than three or four cards.

My priorities are NOT lounge access, dining discounts or foreign currency exchange.

My priorities are cashback or rewards in routine use as i mentioned above. My monthly average expenses are about 40k and flight / hotel booking twice or thrice in a year without having a need for lounge access. I have never done international trip, but will definitely do after 1 to 2 years.

So looking at current scenario and future prospects of credit card, which one would be suitable for me?

‘YES Prosperity Edge Credit Card’ or ‘HDFC Regalia First Card’?

Thanks in advance.

If your SC landmark card limit is more than 3 Lakh, go for SC ultimate card…

i believe regalia first is better card

value of 1 RP

INR 0.30 in regalia 1st and INR0.25 in yes

priority pass visits

3 free visits in regalia 1st and 0 in yes

if above two factor doesnt matter to you, then you can go yes card… yes prosperity is also good card.

Thank you all for your information. It will be helpful for decision making.

One more thing I would like to know is, If I apply for two different credit cards at the same time, does it affect the credit score?

2 different cards will surely affect your credit score if applied at same time because of the enquiriea they will make on your report

Suggest upgrading to SBI prime (from the one against your FD ) and going for hdfc regalia first , yes bank sometimes gives real low limit and their reach aint as wide as hdfc

Hi Sid,

I am thinking of applying for my first credit card. Almost all my spends are on food/dining, online wallet recharges and shopping, more of online than offline. Don’t require lounge access as such. Main priority is lifetime free or waiver of annual fees on some spend. What are my options?

Accelerated rewards points on grocery shopping, bill payments etc will be useless for me.

Thank you in advance.

I would suggest Indus Iconia Amex. Only one time charge of 3500 INR + tax. Gives you 2% cashback on weekend spends and 1.5% cashback on weekday spends. You can redeem in cash .

Hi Sid,

I have HDFC Diners Black + HSBC Visa Platinum+ SC Super Value Titanium.

I am looking for one more premium card (preferably LTF). Please can you suggest a good option.

I had applied for Yes First Preferred, however, looks like I’m not getting that as of now. They have kept my application on hold for more than 45 days.

Regards

Kiran

Amex is giving first year free MRCC card. From second year onward, there is no renewal fee, if spending is more than 1.5 lac in previous year. Otherwise annual fee of Rs. 4500 + taxes would be levied. Is it a good bet, looking at hefty fee? The offer is valid till 31/08/2018, as per Amex website.

Good list. Wanted to figure out which cards offer complimentary priority pass and free international lounge visits for add-on card members (apart from HDFC Regalia and Yes Exclusive (I beieve this is for both domestic and internatioanl while Regalia is only for international)).

I applied for HDFC Regalia First credit card, but I have received HDFC Business Regalia First credit card. So is it the same card with same benefit? or Is is better? Please give your valuable opinion, otherwise I might have of return it.

Thanking you in advance.

Hi all

Interesting article and very good info – thanks for this.

What card would you suggest for a person spending on an average 70k to 100k per month. Access to travel ounges in airport is a must for me. I currently have the following:

1. SBI Prime visa – this is my primary card. Was using SBI Elite, but downgraded to SBI Prime (visa) last year as the additional benefit of retaining Elite was insignificant.

2. HDFC Regalia visa – was using it as the primary card, but not been using it for a little more than a year now. I’m a “preferred” category account holder in HDFC. Should this be my primary card? Any possibility of getting an upgrade to Infinia? and is it worth?

3. Citibank rewards – was using it, but it’s now a spare / backup

sir my salary is almost 50k. i have recently become a member of sbi simply click credit card. i am a fisrt time user of credit card. they assigned a credit limit of 35k for me…. they are not telling me the possile reasons….. can u tell me the possible reason for such a low credit limit…. previously i was a student…. i recently joined government job( almost 8 months running) …. i dnt have any kind of loan or history of loan or something like that….

continue to use the card…..check online for limit increase from time to time…..it will increase….. Most probably as u dont have any history they have assigned a low credit limit…. we all started with low limits……

That’s probably because you don’t have credit history/score.

Hi Siddharth, I really like reading your articles regarding primium credit cards, I had 2 queries:

1. After using Regalia, Limit 3L, for about 3 years, I got an upgrade to Diner’s Club Black (Limit 4.5L) last month, now my aim is to get Infinia…..can you advice me how should I proceed to achieve it,

2. I have NRE Yes first savings account and want to apply Yes First Exclusive credit card, as per the income criteria, I am elegible but as per my RM it may not be possible, kindly suggest how should I proceed with getting YFE credit card,

Thanks very much

Hey,

I am using HDFC Regalia first for a year now. Can anyone suggest me a good credit card for spends and reward which will compliment Regalia first?

Hi Sid

Really informative & nice article…

Can you please suggest any good card in which rewards points can be redeemed/ adjusted in Cash.

I have already holding IndusInd ICONIA Card, pls suggest can i further go for AMEX (MMRC) ?

Check out SBI Cards – Elite/Prime/Simplyclick.

Citi Rewards/ ICICI coral/ HDFC moneyback – I have redeemed points for cash for all these 3 cards.

I wish to apply for a credit card for the first time. I will be using it for online purchase, utility payments & travel bookings. Which card would be ideal for me. My gross annual income is 8 lakhs. I do not have any idea about credit cards and confused as to which card I should apply. Please suggest the best credit card.

SBI Prime

Free Insurance offer on HDFC Credit Cards without paying any Premium. 1. Accidental Death – Cover of 5X the Credit Limit max Rs. 50 Lacs. 2. Purchase protection – Fire & Burglary cover for items purchased above Rs. 5000/- using insured HDFC Credit Card upto 180 days max Rs. 2 Lacs. Eligibility – Minimum 4 transactions of Rs. 100 & above in a calendar month.

Any NRIs on here? Just checked with HDFC, apparently Diners Black card isn’t available as an NR card. Does anyone have any experience with this? My DB card got temporarily blocked because of my NR status (boo hoo). I hold a Regalia which thankfully hasn’t been blocked yet. I also hold a Yes First & SBI ELITE card with no problems.

NB: Excellent blog Sid & I hope we see more pictures. If you’d like, you can provide a link where other card members can provide pictures of their cards so that you can use actual pictures. Some people get cards based on what they look like 😋

Hi ankit,

How did your card got blocked? Did you inform them you are moving out OR did they do any check?

Mr. Verma, they checked that I hold an NR account with hdfc & thus they decided that they should block the card.

Hi Sidharth, I have a ICICI Bank Sapphro Visa+Amex duo cards and I am going to get the renewal notice in November. The Visa is free for lifetime and Amex is Rs 5000 for renewal with 5000 bonus JP miles and a one way ticket. Now I am tempted to cancel the Amex card and get a new HDFC Diners Club Jetprivilege Card which gives 30000 miles and one way ticket for first year Rs 10000 and renewal of Rs 5000 with 10000 JP miles and one way ticket> My aim is to maximise my JP miles collection while retaining the lounge access benefits. Do you think it is a sound idea?( I can ramp up spends of Rs 1,50,000 in 90 days to earn the bonus miles offered by DC card.)

Hello friends,

I have the following cards in my wallet:

1) HDFC Infinia

2) HDFC Diners Black

3) AMEX MRCC

4) ICICI HPCL AMEX

5) HSBC Advance platinum

6) Yes First Exclusive

7) Axis Neo

I spend mostly on travel (domestic and international) and online shopping which I put on DCB and Infinia in that order. Besides this all wallet spends are put on YFE and MRCC. Could you please suggest an optimal strategy as I am looking to close some of the accounts to get SBI/Citi card which I am loosing on now.

Look forward to your guidance.

Thanks

I am holding Citibank Cash back card for the last 6 years, and I still enjoy its benefits. I think it has not degraded much in this period and happy to see in the list of Best Credit Card in every year. 🙂

Please make a correction, in your line “This is a pure cashback card that gives flat 0.5% value back.” You will actually get up to 5% of cashback, of course with certain conditions, and 0.5% is the minimum percentage. You don’t have to worry about your points redemption since it will be automatically credited to your account. I actually love this.

But 0.5% is too low if you spend much. It can be a good backup card especially for offers from citibank.

If you spend much, you should choose a premium credit card. You cannot expect premium features from a basic card.

If you are spending much, you should choose a premium credit card.

Now a days basic card also give more points. Bro between me and my wife i have 15 cards. I have 4 different cards from citibank.

“i have 4 different cards from citibank”

you mean u r primary holder of 2 cards and other 2 ur wife holds from citibank?

or u mean u have 4 diff citibank cards as u being primary card holder.

im curious to know your cards collection, if u can please share 😛

I have 3 citi on my name and 1 in my wifes name. Haha the collection is too much 😉.

Hi sid, I’m a frequent flyer in India which credit card do you suggest me which has access to lounges

Planning to move from Manhattan to SC Ultimate. I have DCB and Amex Plat travel already. My annual spend on this card will be around 3 lacs or so as all major expenses like travel, hotel, Amazon and Flipkart etc has moved to DCB due to 10X offer. I have applied today and now waiting for the processing.

I’m looking for a card with low FX conversion fee and available to small town residents. Currently have an HDFC Regalia which is 2%. Any others? I’m not eligible to apply for most cards since I live in a small town and not a big metro. Already tried Yes Bank for First/Exclusive to no avail due to location.

Which one is the better out of SBI Elite vs HDFC Regalia? Please let me know as I am looking to get one soon

Will there be any bad effect on my credit score if I close my credit card in 9 months?

Its subjective. If you already hold other cards & constantly using them then it may not impact.

Have anyone invested in National Pension Scheme (NPS) by paying using credit card? I want to know whether we will receive rewards pints for the investment done using credit card. The transaction charges for paying using credit card on NPS is 0.09% of transaction amount + GST(18%).

The charges for credit card payment is 0.9% + GST = 1.062%. I guess only Visa, MasterCard and RuPay would be accepted.

Might still make sense if we can earn more than 1.1% and/or have to meet minimum spend requirement either for fee waiver and/or bonus points.

Does NPS accept AMEX cards ?

No when I paid 2 months back.

Yes, it does. Use SBI payment gateway (not billdesk)

But do no pay using AMEX cards as you will not receive any reward points for that transaction. NPS comes under SBI life insurance AMC and hence any payment made is considered as insurance and AMEX do not provide reward points for insurance transactions.

True.

I made the payment of Rs 50,000 to NPS (normal amount for IT exemption) through Axis Privilege. Although the normal reward rate on Axis Privilege is just 1% (2% if you take yatra vouchers, with lots of conditions) which approximately covers the extra charges of 1.062% (Rs 531). I used this card as im chasing 4L spend for fee waiver next year. Else i have Yes FP with 2% reward rate, which i plan to use next time or to any spend based offers around diwali.

Anyone.. Any better idea ??

I have done it twice for 50k nps contribution and have recd points each time. Though charges levied for paying via cc almost nullifies the reward points benefit, if you don’t have super premium cards.

Thanks for the quick reply.

Just another thing if I pay using HDFC credit card, will I receive the rewards points?

I paid using Regalia cc and got points. So I confirm.

I had received reward points for NPS contribution amount and i am having Standard Chartered Ultimate card

Is there a way to get any of the Super Premium credit card LTF? I already have DCB but because of its acceptability issue, i am looking for another card.

Sid,

Could you publish a post on what are the Credit Cards in India that can be availed on C2C basis? Especially the mid to higher tier ones ?

TIA!

The only I know and availed is Yes First Preffered and Yes First Exclusive

Scb Ultimate also.

Prashant,

How much limit is required for ultimate? I don’t have scb card

For card on card basis Rs5l on other bank credit card.

Sid, expecting a post about ICICI paylater and other similar products. Is it credit card alternatives?

Prashant,

How much limit is required for ultimate? I don’t have scb card

Hi Himanshu,

Credit limit should be above 5 Lakhs. They ideally expect available credit limit should be 5 lakhs.

If your credit limit is exact 5 lakhs, available credit limit should be 4.5 Lakhs. They expect utilisation to be around 10% of your credit limit. You can even do some prepayment for statement to show the expected credit limit or reduce your purchase on that month in that card.

Thanks Sharath for valuable info. I have hdfc regalia with 4.90 lakhs limit. I’ll use my other cards for a month to keep utilization low.

Btw one of the sales agent has asked 8 lacs CL on other card.

You don’t need to bother about what the sales agent says.

I recently got the card. Just try to apply for Ultimate card with some higher value income in the first page.

Once you verify the OTP in Second step, Leave it as it is. Don’t submit the application. One of the SC representative will call you on the same day or within 2 days to enquire regarding the application.

That time you could tell regarding your limit and you would like to apply on Card to Card basis. They will help you out.

5 lakhs

Please update the list for 2019 waiting for your updates…

Hello guys, I currently have HDFC diners club card, with annual usage of around 5L. Reward rate is around 1.3%, that too only on flight/hotel bookings. Can someone suggest a better card which will increase my reward/cashback rate. I am not preferring regalia first as conversion rate is .3 vs .5 (diners).

Thanks.

Go for IndusInd Iconia Amex

https://www.cardexpert.in/my-experience-with-indusind-iconia-american-express-credit-card/

What is your annual usage on this card?

You can request HDFC Bank to upgrade your card to Diners Club Black – this card has reward rate of 3.33% and in some cases upto 33.3% under 10X reward programme.

Please update the list for 2019. Would like to see what is the current situation.

I have a Titanium Times Card (Co-Brand) HDFC Credit Card and am planning to upgrade it to Regalia First (Super Premium). My question is, can a Co-Branded card be upgraded to a Super Premium Variant?

Regalia first is not a Super Premium card. It’s not even a Premium card. Your “plan to upgrade” would depend on the credit card department analysis of your worthiness.

Which Credit Card is easy to get and maintain ?

My credit score is 810. My current credit card is HDFC with low credit limit.

My most spending on online, bill and other daily need.

I am self employed.

Which credit card is easy to get on docs base ?

Also easy to maintain in India and Foreign Trip ?

Which premium AMEX card is free without any joining / renewal fees ? Is it available as card on card offer ??

Which credit card provides maximum reward rates and no need of FD for NRI ?