Ever since I got into the world of credit cards, i have always been looking to get HDFC Bank’s Infinia Credit Card, which used to be the only best super premium credit card in India by then.

While we now have good alternatives like Standard Chartered Ultimate, Citi Prestige and even more based on one’s needs, Infinia still holds the exclusivity and is one of the best credit cards out there for few reasons: 2X on dining, flexible limit & other merchant offers from time to time.

Note: If you’re new here & looking for features & benefits of Infinia, please check the previous thread with updated content here: HDFC Infinia Credit Card Review

My Journey to Infinia

- Business Platinum > Business Regalia > Jet World/Signature > Infinia

Starting with the Business Platinum card, it took quite a time to reach Infinia. My initial idea was to upgrade from Regalia to Infinia but I got a crush on Jet cards in midway and so I went with Jet World/Signature with a plan to get HDFC Diners Jet to speed up my way to Jet Plat.

But then I realised that I’ve too much of JPMiles to handle already, so I felt there isn’t a need for Diners Jet at that point of time (anyway its not even a topic now). So was the idea of having Infinia.

Getting Approved for Infinia

Infinia applications are usually processed via RM/BM from Branch level. My first request was denied few years back even after approvals from various higher levels. They did have valid reasons though.

Since then, i’ve increased the spends & relationship with bank multi-folds over the years, which certainly helped my way through Infinia.

I got it as FYF (First Year Free) & annual fee will be waived on 8L Spend, else 10k fee applicable with 10k points benefit.

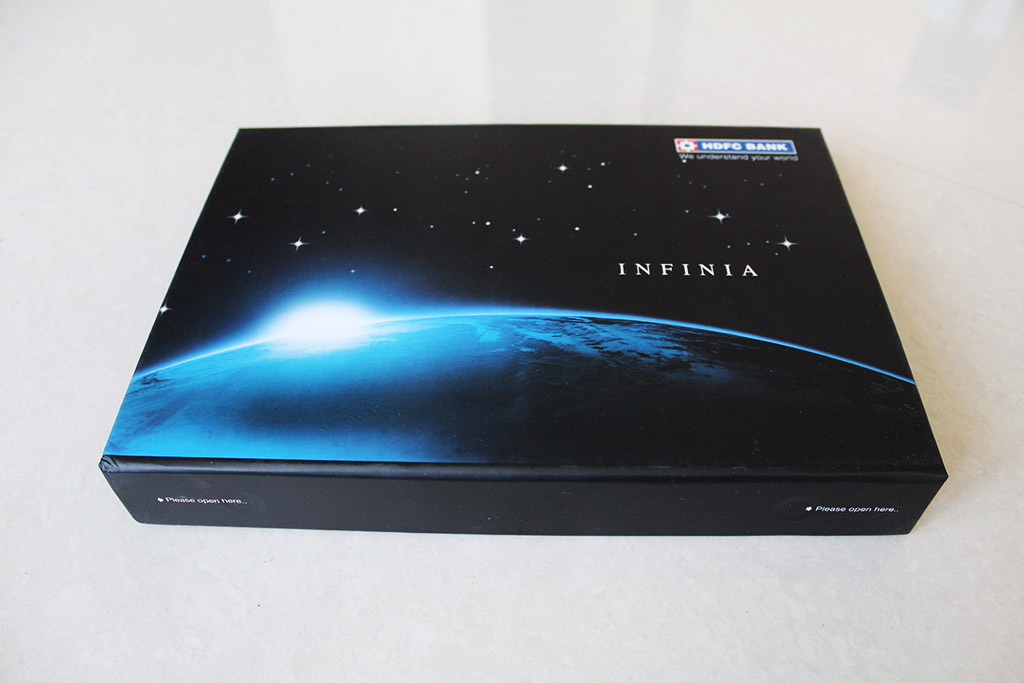

HDFC Infinia Unboxing

The Box: Infinia came in a gorgeous box! Its more like Yes First Exclusive Credit Card box but in the landscape mode.

Contents: Primary Credit Card, Add-on Credit Card & a Priority Pass for Primary Card

PP for Add-on was delivered separately (without raising any request) after a week. Interesting part is, both PP cards of Primary & Add-On’s have same number.

The Design: The card looks neat & cool with numbers in gold colour, like in the Diners Clubmiles card. I’ve tried to snap it in different background to give you an idea of how it looks. Here you go,

Credit Limit

I didn’t ask for a limit enhancement with it so it was the same limit, but good part is there won’t be any “over limit fee” even if I by any chance exceed my limit, upto a “buffer limit”.

A Buffer Limit is a limit beyond your assigned Credit limit that exists on all credit cards and is usually in the range of 10% of your Credit Limit. Sometimes you may-not have buffer limit too, its totally dynamic.

With Infinia, if you cross the buffer limit too, then they do provide temporary limit enhancement usually upto ~2x of the limit (on request, subject to approval) for 10 days by looking into the linked accounts & card history. Ideally, you don’t need to chase limits when it comes to Infinia.

What could make Infinia better?

Maybe they could send some gifts/gift vouchers with the card, for example, SBI sent me a personalised cardholder with SBI Signature (old) & a personalised boarding pass/credit card holder + upgrade voucher with SBI Air India Signature.

This wouldn’t cost bank much, but it definitely throws some smile on customer’s face. American express does this in USA for its Amex Platinum cardholders from time to time. Anyway, Amex is not doing it in India even after charging a high annual fee.

These are some of the memories that cardholders wouldn’t definitely forget, thereby increasing the Brand recall & free word of mouth marketing, just as i did now.

My Experience

2X Dining Benefit: I was dining out often for a month or so just because of this card but now I’ve reduced it as I shifted my dining spends to: Zomato & Swiggy. Thanks to sweet ~40% Off!

Remember, you get 2X Points even on international dining. I used it during my last trip to Vietnam and it works pretty well. On top of all these, the big 10X benefit is of-course quite useful too.

Vistara Gold: I got the Vistara Gold with Upgrade Vouchers with this card before it went away, so I’ve few Vistara Business Class trips to do this year. Anyway, You now get Club Marriott.

Customer Care: The support line is pretty good and no issue there. I don’t usually get a reason to call them anyway, except about the fulfilment of the Diwali 10X benefit sometime back.

Note: It was NOT a contactless card by then. I’ve put a request now for contactless card and its on the way.

Final Thoughts

That all being said, it was quite a ride towards Infinia. Its been couple of months since I got the card and I’ve been using it for Dining & International spends very well, apart from other regular spends.

What’s your take on HDFC Bank’s Infinia credit card at its current position? Feel free to share your views in the comments below.

Sid,

Could you throw tips around how to get hold of Infinia? What should be the spend like, limit on the existing HDFC card to help get there etc.

I hold a DCB with 7L limit. Got it in Feb. Since Feb I have already made spends of about 5L on it.

If you go by the limit, >8L helps

Do check out comments from other Infinia holders on main review thread. There is no single way, as HDFC looks at each profile differently.

i got mine by arm twisting the RM , i used to hold Business regalia before Infinia , an ITR >18L helps in pushing the application , but mostly its the determination/motivation of the RM to get things done for you…a few tips about their concierge/customer care , they are more knowledgeable than the average customer care executive , but they couldnt get a simple refund of 2400 rs deposit they charged me over and above the 2400 for a car i booked via the concierge (avis is their partner) , 10x points are usually posted on 2nd day after the billng cycle though now in the past 2 months i have been facing problems (non of the bonus points credited, but the 2x points on insurance were immediately credited)

lounge access , be free and keep swiping the PP even for domestic lounges , i havent been charged yet , guest charges are $32+GST now .

if you cross 8 Lakhs spend , they dont even charge you the fee ( usually fee is charged and then reversed , not here , 1 year plus of holding the card , not charged even once)

Siddharth ,

Hi.

Thanks for the detailed list of benefits.

Just wanted to make sure that the lounge access is unlimited for international use.

Have a regalia card for almost 3 years+ which is free for life with a very good credit limit and now have been offered a infinia card (not clear if it will be charged or will be free for life).

Very happy with the regalia card and the only issue is just 6 international lounge visits per year. My current travel requires at least 20-24 visits to lounges in a year.

My current Regalia card has 12 domestic and 6 international per calendar year . For domestic lounge access i have other cards which are good.

Thanks in advance. Warm regards,

Amar

Hi! Please let me know how you got Regalia “free for life”? Do you spend 5 lacs every year on your credit card?

U have to register smart pay bill for 6 months.

To get Regalia free for life, you need to spend 1 lac in 1st 90 days – same confirmed with HDFC Bank today (Aug 15, 2022). This is for cards activated after Aug 1, 2022 only.

WoW Sid, congrat ! First AmEx Plat Charge and few days later Infinia. You are on a roll 🙂

Congrats Sid. Will love to know more about how you are using the card.

Updated the content a bit on that now 🙂

Hi. Isnt inifnia on smartbuy 10x rewards now? Dont see any mention on any of your reviews

Congratulations, Sid. Yet another super premium card.

Citi Prestige is probably one left now to get hands-on and I hope you get it too.

Hopefully in 2020. Let’s see.

Siddharth,

In my view, Citi Prestige is not as good as Infinia, any particular reason why you would go for Citi Prestige? Prestige’s reward rate can’t match Infinia even if someone has a Citigold relationship if we consider 10X on Infinia.

Citi Prestige and Amex Plat is a slightly different ballgame , there you need to maximize value per point , anything at or above Rs 1 / point you get is more rewarding than infinia ( yes the 10x smartbuy offer is unbeatable upto Rs. 83,333/- per month) , then they have extra perks for the extra price they charge…siddharth in his 25 best cards blog also mentions that you should only get into citi prestige/amex plat if you know how to maximize on the points game rather than a flat reward rate

Hi MT,

Thanks a lot for sharing this, I know Citi Prestige and Amex Platinum is a slightly different ballgame. Amex Platinum is a charge card so it is definitely a different product and if someone has a lot of hotels stays that to in super premium hotel (5 and 7 star) only then benefits from Amex Platinum can be maximized. Amex Platinum was never on my radar.

I had Citi Prestige and preferred to cancel it after having Standard Chartered’s Ultimate and HDFC’s Diners Club Black. No prize for making a guess that now I am eyeing Infina. I had done my maths and arrived that in no way I can match the 10X of DCB and Infinia even if I have a Citigold relationship. As per my understanding, the Citi Prestige can’t match even Standard Chartered’s Ultimate if you do not have Citigold relationship. One reward point per INR 100 spent cannot match a reward rate of 3.3% no condition attached unless someone finds a way where each prestige reward point is worth more than INR 3.33.

MT, request you to explain how to maximize the value from Citi Prestige which is better than 3.33% of Ultimate, Diners Club Black and Infinia without a Citigold relationship.

Hey Rajeev,

Sorry bro , i am not much help to you this time , i myself am Infinia+SCB ultimate subscriber…citi has rejected my application 3 times ( last being the paytm card) citing bank internal reasons not willing to divulge the actual reason

Your recent article on Infinia has made me curious to get one. I have two questions

1) If you are part of ‘HDFC Preferred’ Program , do you automatically qualify for LTF Infinia card. (My Current Regalia and platinum debit card is LTF till I am part of this program).

2) Regarding reward points , its mentioned on the website ” Earn 5 Reward Points* for every Rs. 150 spent on your HDFC Bank Infinia Credit Card, with no conditions attached”. We will accumulate points on paying utilities bills like electricity bills etc. ?

Thanks

1. Depends on multiple factors. Pls check main review

2. Depends on where you pay bills. You need to verify by testing, maybe on any HDFC card.

Note: If you do high volume utiity/eb bills, you may still get points, but HDFC may revoke anytime if they wish.

Someone I know lost few lakhs points that way 😐

I just called the dedicated Infinia Helpline and they confirmed that except for Fuel charges and online wallet reloads , all charges accrue points. I specifically asked for electricity charges and he mentioned that as long as it’s done on the merchant website directly and not via wallet like PayTm then it should be good for points.

no points on utility , fuel , insurance (limited points) , no points on wallet recharges ( its across the board for HDFC cards)

Is there a card you recommend for utility bills ?

.@ Yash -SBI Prime. 5% Cashback

@shivi.if my elerricity bill is abt 2lakh per month,sbi prime will give me 5% cash back?

Congratulations Sid.

So, you must have surrendered DCB or dual card!!!

Sorry. I didn’t read the article correctly. You already have dual cards. Now I got it.

Amazing. Both DCB & Infinia. Very rare phenomena.

With time, limit & patience, its possible 🙂

Welcome to the club! I would love to hear about how it is living with this card and Amex Plat Charge Card is. I did that for two years and realised what a waste the Amex. While you think there are many “lifestyle” benefits, I have always found using my Infinia for business class tickets and high end hotels a much better/cheaper option thanks to the 10x offers. Upgrades on hotels with Amex are “subject to availability” hence you cannot calculate such intangible ambiguous benefits.

Majority of cardholders can’t find value in Amex Plat Charge for various reasons. Yet, it’s still worth it. I’ll do comparison sometime soon.

Hi Sid,

I do see your point here. But really the Amex Plat concierge leaves so much to be desired. the card will pay for itself if you use it smartly but having an excellent concierge will take it right up there! I have the DCB,Prestige and Plat charge

Still waiting for this Sid!!!

Cool!

Are you in possession of DCB + Infinia now? If yes, has HDFC opened up on issuing two super premiums?

They neither opened, nor closed. They always issue dual cards case to case. Maybe as many are asking for dual cards, its made bit strict.

Whoa… Wasn’t aware of this as they had shoved the door when I had Regalia and had applied for DCB in 2016. They had upgraded me instead quoting the one card policy.

Since I’m an Imperia customer now I should ask for Infinia separately!

i got a polite “No” after asking for DCB while having Infinia in hand , they said they have stopped the practice…however Sid , if you still are holding both , you are a lucky guy

The trick is to upgrade from Regalia or Regalia First to DCB with 5L+ limit , use it handsomely, wait for 6 months to 1 yr rollover; share high ITR atleast 14-18 L , improve the deposits in your HDFC . Make some international spends on DCB , and convince the RM to upgrade to Infinia due to low acceptance of DCB abroad .

It can work out, not to mention the prerequisites of high Cibil, before due date repayments on Cards and multiple product relationships with HDFC with Good vintage.

Just had to open a Fixed deposit…that did the trick.

Have got the awesome pair of DCB + Infinia!

Big Billion day ..here I come!!

@lordsom

Congrats..!!

Hi Lordsom

What was fixed deposit amount? For how long you have been holding DCB and what are card limit when you got second card(Infinia)?

Congrats for getting the card.

I am still chasing it. I have 2 DCB in the family now. As i dont have any account with HDFC so dont know any RM. Customer care always says go to the branch and check out. I have almost spent double my limit in last 1 year. Though i have SCB ultimate so a bit confused also. Only extra benefit to me will be 2X spends on dining and PP for add on card holders.

Having A/c is most important, especially when ITR is not very high. Why not shift some relationship to HDFC? That’s one way of saying thanks for them to give us 10X benefit 🙂

Actually, annual fee will be waived off if you put a bill autopay as well, right? When I got DCB, the fee waiver form had 3 cards — DCB, Infinia, and Jet Diners.

I’m not into HDFC system much (except for DCB and an account that for some reason keeps deducting SMS fee every quarter) — but when I got DCB, I also tried getting it for my cousin. He did not qualify the ITR route, so they gave us an option to get DCB against 6L FD. We were also offered Infinia at 8L FD. Did not go through with it as HDFC does not have an option to move it to non-FD option when you can actually qualify for the card. You have to cancel and reapply. But if one really wants these cards and has some savings, this might be a way for them.

BTW, if your ITR is high enough to HDFC’s liking, and you have DCB, they will try to shove Infinia down your throat every chance they get.

Doesn’t resonate with my card strategy, but I know how much Sid loves this card. So congrats, bro! 😀

Thanks 🙂

# Autobill pay is not there now for renewal waiver i guess.

# My HDFC stmt is One of the cleanest. No sms charges, not even prog. management charges these days. Maybe perks of Classic/Pref./Imp.

# FD route makes less sense, unless one can max. out 10X every month.

Amex – question unrelated to this post, but pertinent to your comment above. What is your card strategy? Are your spends primarily on Citi Prestige and Amex Plat? It would be interesting to know about your card portfolio strategy, and what spends are you channelizing to which cards. Waiting eagerly..:-)

Yup….I already hold a DCB….and they are after my life for an account with them with LTF infinia….I will most probably go for it since yes exclusive has been devalued and i need a decent backup to DCB

Can anyone explain me what are the extra advantages of having Infinia over DCB?

Higher acceptance being on visa/mastercard platform… other things are same as DCB , disadvantage is not having the 10x partners

Infinia is a visa card.thus,acceptance is a brownie.There is no second reason to switch from dcb to infinia.Value per say you can earn 55k points on dcb p.m whereas only 30k on infinia.

Max. is 25k for DCB too, isn’t? How are you reaching to value of 55k points?

25K on Smartbuy + 25K on 10X partners. The limit for the extra 9X is 25+25. Taking the total to c. 55K

@ Heena – Infinia is also issued on MC World platform

Let me share my experience about getting Infinia upgrade from regalia. I was using regalia from last 5 years. Last year in November I got upgrade offer with 1st year fee, then 10k fee or you spend 8 lac.

The quickest route is that you use all your transitions by smart buy and load you PayZap for 50k every month.

I am heavy CC user and use smartly to get the maximum juice.

Today CRED app shared surprise cake for me.

Hopefully sharing many more experiences going forward

Thanks

How does loading PayZapp help here? Can you shed some light on this?

Hey Sid, congrats on the card !

I had asked for fee waiver on autopayments when I applied the card – I was given to understand that this was not discontinued w.e.f Jan 1 2019 but the card would be offered LTF if I open another savings account for a family member/friend

“Doesn’t resonate with my card strategy”.

@Amex Guy: Would you mind sharing your strategy?

Hey Sid,

I’ve had a regalia for many years now and at present have about 75k points on it. I’m eligible for Infinia, but only 50% of points will be converted as per bank rules. Is it still worth upgrading?

Also, as per customer care, infinia cant be provided as LTF. Is this true in your knowledge?

Thanks a ton! Keep up the excellent and fair reviews 😉

.@ Sunny – RP value for Regalia is 1.3%. For Infinia it is 3.3% – You do the math which is better!

Thanks for the reply. I realised this myself and now hold an Infinia 😉

If you spend 8lakhs + on a single card in a year, consider infinia to be free for you… the unlimited PP usage(even on domestic) for your + 3 addon cards is an additional bonus , even if you pay 10k + gst , you get value back at 3.58L spend

Definitely worth upgrading , and as shivi said , default reward rate is higher

Thanks for the reply MT. How did you arrive at the 3.58 lac figure?

10k+ gst = 11,800/- for the card , 11800/0.03333 (3.33% reward rate) = 3.58L approx

Thanks again, MT

Even after 50% devalue points will same worth when you upgrade to Infinia or DCB

Reason 100 points on Regalia have worth of 50 (1 RP = 0.50)

And after moving to Infinia these 50 points still will have same value (1 RP = 1)

Thanks for replying A2Z. Yes I did realize this afterwards and now have an Infinia 🙂

Wow a million congratulations to you. Does investing in ELSS through HDFC savings ac. also counts as good relationships ?

Anything that gives profit to the bank is good. Your internal band level (customer scoring) increases when you do this.

It does. But that strategy is very costly. If you are going to the mutual fund AMCs through an advisor (typically a bank), then the advisor will get a trailing commission. But if you go direct there is no such commission. And that difference shows up in the returns – typically a direct plan fetches 1 % to 1.3% more return than a regular plan. Now if you are doing some serious investment then that translates into a lot of money over the life time of your investment years (just a mere 1% more earning on a 50 lac portfolio is 50K a year, if you do that over 20 years imagine how much you can gain, also your portfolio will grow, so 50K in excess earning will be 60k next years and so on).

A sound strategy is to keep investing and the credit card game separate – and not mix them. I have been seduced by Citi Gold so many times – but I kept myself away from it. I go directly to the AMCs for higher returns. This is not a blog for investments – but though I would put this out there in case it helps some of us.

Its all good till you are alive. After your death, all those investments would go into UNCLAIMED assets coz your spouse or parents wont be knowing about those investments, login id & passwords of each AMC’s. Better to invest through regular plans through your Savings account bank coz atleast there will be a track of investments, insurances, loans, wills, etc. Your Nominee in the bank gets everything and not a single penny goes unclaimed !

You can invest in direct MF plans through Paytm Money, no need to go to each AMC website. And you can track/redeem all your investments through Paytm Money/CAMS/Karvy apps. Very simple, for you as well as your family.

Ashish,

No need to remember all these details. You can manage all mutual funds using MFU(mfuonline.com) or CAMS/KARVY. You can modify/add any bank account or nominee anytime through them.

It really makes a lot of sense to invest in direct funds through any above platforms or through new age options like paytm money, orowealth etc.

Also, do register for NSDL CAS statement which gives all your mutual funds, stocks in 1 statement every month.

All the portfolio can be gotten by the nominee by going to Karvy/CAMS/Franklin depositories and NSDL/CDSL with the death certificate.

Never show your last 4 digits.

That’s not the actual numbers 🙂

Congrats on your card. I have a DCB with a limit of 8L and Regalia with 5L limit. When I requested for an Infinia, I was asked if I got an offer. Since I was not offered one, they said they could provide me an Infinia against an FD of 13 lakhs since I had low ITR. I declined and said I would probably wait for the spend based order. Should I spend more on Regalia as most of my spends are through Diners Club Black?

What kind of FD it is?

I have regalia with >8L CL. Jst started it using heavily after devaluation of yes first. It’s gonna expire next year March. What are my chances my invitation to ltf infinia? Nowhere my spend ll be 8L

What amount of spends on existing card and total investments HDFC requires if someone wants to upgrade to Black or Infinia ?

I’m holding regalia with 9.70 l CC limit, waiting for auto card upgrade, as of now managing SC ultimate (3.3 % return) and YES first exclusive ( priority pass). Hopefully I’ll get upgrade soon.

I had Regalia with Rs 10 L limit before I applied for DCB but did not get invite with that. So having a having a high limit and high spends in itself do not ensure an invite.

Hi,

I also have 8 cards, I was using yes preferred for daily transactions since it had 8 points per 100. But i need to use some other card for better returns, is infinia worth it for 10k? I have upgrade offer to infinia from regalia but didn’t take it yet to high annual fees.

Your comments sid?

Hi Abhishek, I am in same boat like you. I hold approx 8 cards (like Yes Exclusive, Amex Play Travel, ICICI Rubyx etc) and have regalia Ltf and got an offer to upgrade to Infinia. Due to annual fees I am also holding myself back though I am very much tempted to get this super premium card. So did u accept the offer or not. If yes then what points were in favor of it?

Infinia is the only remaining HDFC card I believe that still allows to redeem points for recharge (DTH), so that’s one additional benefit as well.

I am averaging approx 8% rewards most months over a long period on my Infinia. Do keep us posted on how much reward yield you manage.

Best part with HDFC Infinia & DCB is their dedicated customer support which is way better then their usual support team. It’s a direct connect line and no waiting or IVR stupidity.

They are knowledgeable, subtle, to the point & solution oriented.

They understand things well & try to take queries to logical end.

It really feels premium holding this card due to their support.

But their concierge line is pathetic, sometimes you need to wait for 15-20 minutes to get their line.

Did anyone got upgraded from DCB to Infinia ?

And if yes, loosing DCB mandated to get Infinia ? Do not wanted to loose 50k points for 25k ! (though temp benefit, still !)

I got my infinia card last month as lifetime free card. The eligibility out forward was to open and HDFC savings bank account and ITR greater than 40 lakhs for 3 consecutive years. Process was very smooth.

The only complaint which I have is that, most often transaction alerts doesn’t come as SMS while I’m out of India. Strange is that I get all OTP messages on time and HDFC says they don’t have a provision for email alerts. I find this tricky when there is no 2nd level authentication and relatively high credit limit and you don’t even get to know if the card is used until and unless you keep monitoring the available credit limit. I get SMS and email alerts on all other cards I hold. I got no response from so called privileged customer care for this issue.

Are you imperia or private banking customer of HDFC bank ?

Totally agree. Not sure why they don’t have an email for every transaction. SMS get erased / sometimes don’t come which is a vulnerable situation to be in given the high limits.

Use Visa verified by visa, and the OTP comes to your email id for certain websites. Also u can use 2nd default password.

What exactly is ITR of XXX? Where do I find it in ITV acknowledgment form? Can some please help me understand it.

I got DCB card 6 months back and have limit of 7.75 lakhs. Has anyone upgraded from DCB to Infinia? What was their credit limit for DCB before they got upgraded?

ITR of XXX means the final net income amount you offer for tax , ITR V is the acknowledgement of the return filed and can be found when you login to your IT portal on the efiling site of Income Tax… in my opinion , they should offer you infinia since you have a 7.75 lakh limit already on your DCB , get in touch with customer care and request

Hi, can anybody plz tell how someone know that their existing card like diners club black wil upgrade to infinia? Like in net banking it shows in card upgrade section or they send e-mail or sms for upgrade to infinia? Please reply asap…thank you so much…

call the customer care and request

You mentioned 10x for some partners in Infinia, what kind of partners are they? Are they same like Diners?

Infinia doesnt have 10x partners , you can get 10x points via smartbuy and its partners , infinia has 2x on dining and travel bookings via hdfcinfiniarewards website… the place where infinia outshines is unlimited lounge access to both primary and supplementary card holders ( diners black is limited to primary card holder) , and ofcourse wider acceptance being on visa/mc network… if you are looking to maximize on 10x partners , opt for DCB

Diners Black is not limited to primary card holder. I have made it work for my family 3 times in a year (for 3 members each on separate supplementary cards) internationally. Works like a charm everytime!

nw 2x(6.6%) is nt there on travel.when u try to book frm infinia’s web page its redirect to a new page which hdfc has launch on 10 june.

for Infinia – which one is better, if at all, between VISA and MASTERCARD?

How does it compare to Citi Prestige in terms of reaping points & the concierge?

I have a lot of traveling across the country & a few times overseas – which of them gives better returns on booking flights? Any 10x or 2x partners on Citi prestige? it looks like they’re only for citi rewards as per the website

Hi , thanks for the review , please provide me with the correct information

1. If i make bill payment through PayZapp (added credit card in it) will i get 10x reward points or 1x regards point.

2 how much time it takes to get reward points in my account specially for Amazon , flipkart etc.

3. I even called infinia customer care they said wallet money loading,fuel Transaction is excluded ,easyemi is excluded only.

4. Last if make a payment through smartbuy with promo code will i get any reward points.

1) For payments through payzapp , you will accure regular 1x points unless an offer is going on.

2) Depends on the terms and conditions. For Flipkart transactions of this month , points are getting credited within a week. Amazon transactions usually take longer , around 60 days.

4) For flight and hotel bookings on smartbuy with a promo code applied , you will accure 10x reward points as well.

I asked customer care guy, he said on reward redemption site of hdfc no reward redemption fees is changed for infinia members (rs99 fee) is it true. Tell on your experience

I purchased a product from Amazon through hdfc smartbuy

How much time it takes for the points to come in my account,

Tell from Your experience.

How to buy things on Amazon

I first visited smartbuy website.

Then i clicked on Amazon

Entered card no and Mobile no

A Amazon page appears

I then searched the product i want to buy.

Then i clicked on buy now

Login in into my account

Then made payment through that card which i entered the details.

Are these steps correct, i think so it’s Correct as i also seen Amazon t/c of smartbuy

Yes it’s correct,wait for atleast 3 months for points🙂

Did you got your 10x reward points from Amazon

Yes, and send mail after 3 months that the points are not yet credited, they will consider it and then points should get credited in next 7 days. 🙂

What’s the typical timeline? How long does it take from speaking to your RM about it to knowing whether you’ll get one or not? It’s been over 2 weeks since I spoke to my RM about this and he said he’s put a word to the concerned department regarding this and is waiting for their response. I haven’t heard anything back yet. It’s almost 3 weeks now.

Just wanted to share my experience of getting the Infinia card a couple of months back. I almost completely relied on the auto-card upgrade route through limit enhancements. I quickly reached 6L limit on my Regalia LTF card but from there it took me almost 2 years to get upgraded to Infinia. I tried reaching out the Super-premium cards sales manager etc but all that didn’t work.

After getting to 8L credit limit, I happened to be travelling abroad on work and spent close to 11L INR over 2 trips in October’18 and January’19. That resulted in an automated offer for credit limit enhancement to 10L (from 8L) which I availed. The moment the credit limit was enhanced, I saw the Credit card upgrade option on Netbanking offering me Infinia!

So it took 10 years of patience and focused spends on my HDFC to get to Infinia. Ironically it’s only after getting the Infinia card that I’m truly realizing the power of Smartbuy 10x points @ 1Re/point redemption. And of course unlimited lounge visits through Priority pass card for Self+3 Add-on cards is amazing.

Is your Infinia LTF?

Change in HDFC Rewards portal is reflecting now

They have a tab called Privileges on Smartbuy website

Under that it is categorised as Infinia, Diners, Regalia & Other cards

Good they brought all options under one tab & no need to go to different websites but still they haven’t explored to merge rewards in case someone holding multiple cards

Amex allows to group all rewards under single card which helps a lot

I am having regalia for past 2 and half years with limit 5L at present. I hold a Salary account and reimbursement account with hdfc bank. Also I have this years ITR as 20L+. What are the chances of approval if I ask my RM to get me Infinia Card.

Hi all! Received a Mind Boggling Limit Enhancement offer yesterday on my HDFC Club miles Credit Card. I was going through the routine of Checking the LE and Card Upgrade sections in NetBanking, which I do on a daily basis. I was Shell Shocked to See a Limit Enhancement offer from 3 Lakhs to 11.38 Lakhs. Now waiting for the Infinia Upgrade offer to Kick in.

Wow congrats Vinod Kannan. If you don’t mind can you explain in details what kind of relationship you have with HDFC. It will be a tremendous help for lots of people like me.

@Captain : I hold only a Regular Savings Account and Credit Card with HDFC. Nothing else.

Thanks a lot Vinod. I really appreciate it. Can you please answer some more questions :-

1. How old is your card ?

2. What limit you started with ?

3. How much balance you maintain in your savings account ?

4. How much and where is your annual spends ?

5. Have you ever provided your income documents to HDFC for limit enhancement ?

PLEASE CONFIRM THE SAME

PLEASE REPLY

Hi

I had applied for infinia. HDFC has sent me MasterCard version of Infinia. Will the RM provide a Visa infinite instead of MC as that is more useful it seems.

Since I had Prestige as Visa Infinite I asked for my Infinia Visa Infinite to be changed to Mastercard World. RM checked with card team. They wanted reasons. Told them Mastercard has better offers and that I already have Visa Infinite variant via another bank.

They didn’t accede to my request.

Your situation appears to be just the opposite.

You can try your luck but without a reason they consider valid, chances are low.

All the best!

S&S

Btw: I hold an Imperia account.

Yes……Just talk to your RM or the bank directy…….Happened with me for Regalia long time back and i was issued visa as requested by me.

I’m still struggling to upgrade from RF to Regalia 🙄🙄

No RM or savings with the bank, but excellent spends and all timely payment. No auto LE or upgrade received. Even using smartbuy/ PayZapp etc.

Wonder what triggers the system??

Sir I do hold LTF regalia credit card with limit of Rs. 10.00 lacs. I am a salaried official drawing a gross annual income of Rs. 14.60 lacs excluding additional income of Rs. 2.50 lacs. I draw a net monthly salary of Rs.0.50 lacs. I am holding HDFC credit card since 2011. I do not hold any account with HDFC. I do hold digital products of HDFC. My card is due for renewal in the month of Sept 2019. When enquire with customer care, they advised me to send to Chennai citing their reference no. Accordingly, I had applied for LTF DINERS BLACK / INFINIA CARD. I had submitted the upgrade request to Chennai with latest salary slip and last year form 26 statement, previous year form 16 statement and also salary account statement. My CIBIL score is at 845. Will the bank consider my request and if do which card will be issued to me.

Higher chances of DCB

Good Question – if someone has experience for both above queries

Hi All…Very Excited to say that I Got Approved for Infinia Credit Card Yesterday. Still Couldn’t Believe my self. The process was unbelievably fast. I mailed them to Upgrade my Club miles Card to Infinia on Thursday night ( 27/06/19). Got mail that they are looking into it. On 28th I received a Reference number which the Regular Customer Care could not track. They said that this Reference number is from the Main Team. I don’t know what that meant. Saturday and Sunday were Holidays. On Monday, 01/07/19, I received d reply that they Got me the Approval for Infinia Card. They wanted me to Send the Upgrade form Signed and accept the Terms and Conditions for 1st Year Free Infinia. Also they just wanted me to Send the form as a reply mail to the Approval email I received.

The thing to note is that it worked like I had an RM who got me an approval from some higher Team. I hold just a Regular Savings account and nothing else with HDFC.

Wow amazing. Congrats and thanks for your valuable reply.

@ Vinod Kannan

Can you let me know did you send ITR doocuments and if so do you mind to share for how much was it ? I have an approval for Diners club Black but unfortunately my RM and branch manager are showing no interest to push it for Infinia. I have approached cc team directly and they said ITR is must for infinia and they cannot give card based on relationship and no matter how much FD you have. Thats a stupid reason for a bank to give since i have seen many getting it just with FD. I have actually requested for dual card and even that bank is not ready to give stating they have stopped issuing.

@Rohit Roy – No… I did not send any IT Documents. The upgrade was purely based on my Credit limit. Whats ur Credit Limit? If u have >10 lakhs credit limit, u can get Infinia. Try their Twitter handle or Grievance Redressal. They are good at handling requests.

@ Captain :

1. How old is your card ? 4 Years and 8 months

2. What limit you started with ? Just 30,000. Yes.

3. How much balance you maintain in your savings account ? Usually 10,000 Rupees only

4. How much and where is your annual spends ? Heavy Spends last year on electricity bills. Converted many spends to EMI last year and Have been paying regularly. Used to Prepay the Insta loans very often. This year I spent very less on HDFC since i had to make sure I clear all the loans on Credit Cards. Still have loans worth 2 lakhs on HDFC credit card.

5. Have you ever provided your income documents to HDFC for limit enhancement ? I Provided it on d 1st year of Credit Card usage. They Increased d Limit from 30K to 1.5 Lakhs. After that Auto enhancement to 1.80 lakhs. Then again Sent Amex Statement next year and they gave 3L. Last Week I got an Auto Enhancement tfrom 3L to 11.38 Lakhs.

Hi Vinod,

For the 5th point, on what email address should the income documents/other cc statements be sent to be eligible for Limit Enhancement as on my other cards it is almost the triple that of HDFC cc?, because my current HDFC RM is adamant in NOT giving any enhancement or upgrade despite sharing a good relationship with HDFC cc since the last 8 years and having over 10l in savings/FD’s and a TRV of much higher(cibil > 800). Any points to get the work done because even if I move the savings to other banks, I believe I could fetch many premium services – Axis Burgundy or Yes First.

Thanks!

Grateful if someone could help me out here. I’m in a dilemma. HDFC cancelled my DCB & Regalia first due to not being NR cards and now they’re offering either DCB or infinia with FD lien (DCB 7L & infinia 12L FD) with a limit of 5L/10L respectively. Any suggestions would be helpful. Thanks!

Why did they cancel? Are you still a NRI or not?

I am still an NRI but the DCB I held wasn’t. That’s why they canceled after it popped up in their system. Anyway, got me the NR Infinia basis FD.

Hi ankit,

i am an NRI . they blocked my allmiles card after i changed my status to NR. i had an option for applying to NRI regalia or NRI infinia. i received infinia with a FD of 13L.

What’s an NR card?

Non Resident card

Basically credit cards can’t be issued to NRIs without FDs and thus I can’t get a card from Amex (that’s a whole different situation though).

I logged onto my hdfc account to transfer Infinia points to BA avios last week. Surprisingly I only found Jet and Kris flyer options.

Thought must be a glitch.

Logged in again today and again saw only Jet and Kris options.

Wonder if anyone has an update.

Hope to revert after speaking to CC in the interim.

Cheers

S&S

Infinia CC tells me, only Jet and Kris Flyer have been transfer partners for Infinia since inception.

Came as a surprise.

Wonder if I was under a misnomer that BA, Club Vistara and Trident too were partners for Infinia like they are for Diners?

Anyone in the know?

Thanks

S&S

So from reading some posts above it seems that you cannot get a card upgrade, if you have outstanding EMI’S running on the card? Is that correct?

Better to clear off all loans and EMI’S and only then to send the upgrade form to Chennai?

Hi, two questions about the infinia

1) Does the priority pass come with free domestic lounge visit? The letter only mentions international but my RM says domestic included.

2) I read that the add on card gives free lounge visits also (based on the priority card which is given). But is this only for the first add on or also for the 2nd and 3rd add on?

Thanks,

Ak

Hi Siddarth, Can you please also include the differences between VISA variant & master variant? Which is preferred over other?

Today, I received my Infinia card, finally !!!!

My card limit was 9.7l, it took 8 months after my card limit upgrade from 3.6 to 9.7 for auto card limit enhancement.

I have got an offer to upgrade my HDFC Regalia to Infinia. I hold Regalia LTF but looks like there is a fees of 10K on infinia from second year. Is it worth taking the upgrade. Also which variant is more useful Visa Infinite or Master world. I already hold YFE which is Master card one and also have Diners Black and Amex Plat. Are there any benefit in Visa infinite variant over the master world. Every other month I do international trips, so is there any benefit globally which is not in India.

They say that for Infinia LTF I will have to wait for a offer thru HDFC Netbanking but will surely get it soon since my overall spend via the Regalia is 19lac.

My question’s are:

1. Is this really true?

2. I thought the RM is suppose to initiate a mail or something for LTF Infinia was I wrong

3. Is there really a Infinia LTF card?

Siddharth you or anyone in the know kindly answer my questions and also tell me what is the real process of getting a Infinia LTF.

Priority Pass Update:

For premium card as like Infinia we can use priority pass in domestic airport lounge as well. I confirm the same with customer care executive.

Hello

I have got an upgrade offer for Infinia. Can any one tell the difference between the Visa infinite variant and master world. Which was should I prefer. I already have YFE and DCB cards. I do international travel every 1-2 months.

If you have YFE, then you don’t need Infinia for Priority pass (international Usage). These days, Diners Black is more rewarding than Infinia. If you don’t have any specific requirements that the Infinia offers then give a second thought whether you want to upgrade DCB to Infinia or not.

Thanks Abhishek ..sorry I didn’t mentioned.. I have 2 HDFC card one DCB and other Regalia. I got upgrade option on my regalia. Both my DCB and Regalia is LTF but for Infinia there looks to be a fees of 10k from 2 nd yr. My yearly usage on cc is around 30 Lacs. I will push them to give me Infinia LTF. Is it wise to upgrade to Inifina in case I don’t get it LTF. Any additional benefit which I will get. Also my original question if in case I take the upgrade to infinia should I take visa or master card variant.

Ankit – just out of curiosity man, but where do you spend 30L annually on your card?

Some ideas that could help all of us to increase usage!

Why does HDFC cards have same card number for both primary and add-on card. Is it possible that the add-on user can get different card number. If not is it possible that they can get the OTP for online transaction on their mobile number rather than primary card number.

@Praveen

Must be a matter of policy/implementation.

I have Add-on card of Yes First Exclusive, wherein card numbers are different and the Add-on gets OTP on his number.

What I can guess is that providing different number actually end up it being considered different cards in case of offers on portals, HDFC is smart to issue same card numbers.

Hi, I am holding Regalia (LTF) for more than a decade and I also hold Yes First Exclusive (LTF), Amex Plat Travel Card, SBI Prime, ICICI RubyX VISA and couple of other banks LTF cards.

I recently got an offer to upgrade my card to Infinia, though I am excited to get it but its annual fee is holding me back. Does it make sense to upgrade to Infinia keeping in mind I do have unlimited lounge access on YFE and for Infinia fee reversal I need to spend more than 8 lacs per year and 15 lacs in total to get most out of these 3 cards (Infinia, Amex Plat and Prime)?

Any thoughts will be appreciated.

Thanks.

Ask them to upgrade to DCB which is more rewarding these days. No need to take infinia unless u do lot of international travel and your hotel preference is Marriot.

@Amresh thanks buddy. Will try to talk thru.

In some cases I read that HDFC awards 10k reward points in case annual fee is paid but when I called customer care they had no clue about this. Any clarity on this?

Yes , if you are not able to spend 8 lacs , they will charge you 10K +GST as fees and you will get 10,000 RP . So basically you will just end paying 18% GST .

P.S. – Please note that 1RP=1 Re is only applicable for redemption on flight booking and hotel booking . For All other rewards redemption (gift voucer, phones, etc.) , 1RP = 50p

Dear Member,

1:1 ratio of RP is only for hotels and flight bookings.

If you wish to purchase anything from the catalouge, the ratio is 1:0.50 and that is why double the points required.

Hope this answers your query.

Regards,

Priyanka S

Thanks for clearing the confusion I was also facing.

My Journey to Infinia:

I started with basic credit card with HDFC later migrated to Regalia 6 years back, Now current credit limit is 9.7 L. My friends CC was migrated to Infinia last Diwali though they have less (8l +) credit limit than mine. I was trying to figure out why I’m ouster, Then I started with a Recurring Deposit with HDFC and also enabled Bill pay service for my postpaid connection, also start using the card for offline and online shopping. After 6 months, my card upgrade to Infinia…. Finally …. All reward points were reduced to 50% ratio.

After , 10 days … Now my preferred Status of HDFC is now upgrade to Imperia …. this is really exciting.

Hi Sid,

Need your suggestion. I am using SBI Elite card with AMC of 5000/- and my annual spends are 8L. I usually get reward points worth 50,000 (worth 12,500 INR ). My international travel is very limited; does it make sense to go for HDFC Infinia card. Can you provide a ball park figure of how much monitory benefit if i convert points earned through Infinia card. Just compare these 2 cards for a person without much international travel.

It’s not only an International trip, even your domestic travels covered with Infinia, DTH recharge, With Infinia you will receive 3.3% cashback in terms of reward ( Flights, FTH, and Hotels). If you purchase from smart buy U will receive 10X rewards that be 33%….. So Infinia is always the best card to hold.

Hi,have been a regular at this blog.

I have a Question which most is frequently asked.

Visa Infinite VS MasterCard World for infinia which is more preferred and Why?

VISA Infinite definitely has a edge over Mastercard World due to its acceptance through out the world and the merchant partners outnumber Mastercard . Also, as far as I know, to get Visa card it is tougher than Mastercard World.

The conversion at 50% of Regalia points is harsh I think. It’s better to redeem points first and then upgrade. Any divergent view?

value remains same , 1 regalia point = Rs. 0.5 , 1 Infinia point = Rs 1. so 2 Regalia points = 1 Infinia point

Hi, I am currently using Diners Club Miles with 2 lac limit, have many other credit cards too like Amex Plat Travel, Amex MRCC, SBI simply Click all with good limits. I also have a good credit score.

I have monthly USD expenses of about 800 USD and 20k other INR expenses. Expenses are going to increase over time as I am diverting from direct payments to credit cards.

I was planning to get HDFC Infinia or Diners Black. As I don’t have any other relationship with HDFC except Diners Club Miles which I got a few months ago. They are providing me DCB against 7 lacs FD and Infinia against 11 Lacs FD.

My question is it wise and worth to get it against FD or should I increase the relationship with HDFC and wait for an offer from their side which I think will take a long time.

Please advise and thanks in advance.

I finally managed to get hold/upgrade to HDFC Infinia Card from the much cursed and useless HDFC Jet Platinum card. It was quite a jump though keeping the card variant in view. Joining is free, though 10k will be charged next year for renewal , with which frankly I am ok with as the points offered on renewal solves the purpose.

HDFC Jet Platinum card had become useless and redundant for me way before Jets ouster as Jet had stopped flying to my home (Bhubaneswar) few years back.

HDFC were highly adamant in not letting me go off Jet card, regardless I wanted an upgrade or downgrade.

Finally my friend who works at HDFC helped my glide through to Infinia from Jet Platinum.

Just started using it & have made an excel to keep track of points (specially the 10x points).

Lets see how it goes. 🙂

I got a msg on 15th august that I have an option to upgrade from my LTF regalia to Infinia FYF. I applied the same day, card arrived on 17th august morning.

Points movements from regalia to infinia was smooth, PP came with the card. club mariott came in a week. Already raked up 35000 points on the new card in less than a month.. hope to get some more as diwali flying season is coming.

Only sad bit is they have given the mastercard version.. Regalia was also mastercard world, Infinia is also mastercard world.

Hi Rahul, Congrats for your new acquisition. Can you advise me as to what possibly should have triggered your upgradation? Was it spends or bank relationship or your itr.

Thanking you

Spends. Both domestic and international. I got regalia in 2017, then on an international trip i used it for bookings and duty free shopping etc and almost reached the 4lakh limit. They immediately increased it to 6.4 lakhs, which they didnt change till Feb this year where i hit 50% kind of limits on US trip. They increased limit to 9 lakhs in march/april. In june this year I got the 15k bonus for spending 8 lakhs etc and when i was reaching my anniversary year in August. They sent a card upgrade msg and sent the card in 2 days

How long you been using regalia and usage?

Thanks

Mastercard has better fx exchange rates if you are into lot of international purchases online and offline. Marginally less than Visa though. Visa, on the other hand, has more global acceptance. I have been in places where they would accept only Visa and not Mastercard (so far happened in Malaysia, Thailand, Japan, Egypt, North America). Some shopping malls also run occasional offers on Visa “Infinite” version. Visa also has few loyalty programmes under its belt – Hilton Honours being the most popular one.

On a side note – South East Asia shopping malls accept and give freebies and offers on CitiBank issued Visa Infinite cards regardless of the country of origin of the card.

Rahul how much were your spends in Regalia in last 12 months approx when you received uograde?

After my Moneyback card was upgraded to Regalia in Jan this year, spent approx 17.5 L in 8 months. Then got free upgrade to Infinia.

Did u hold HDFC savings account pranab

I think it will be more than 9 lakhs. I got the 15k bonus point for 8 lakhs spend on regalia by may itself. Anniversary year was in august

Hi Sid,

Can you please elaborate a little on Concierge Services on Infinia Card? How to get most of it? Thanks

I just received my Infinia, which I had upgrade from Regalia. I see that I received MasterCard World variant even after stressing multiple times to my RM that I want Visa Infinite variant. Clearly, Visa Infinite variant is more premium and has better offers (BookMyShow just to give an example). The lady who was responsible for processing the card says it is randomly decided by the bank. I find hard to believe and there obviously will be some criteria to decide the variant.

Any idea how do I get the Visa Infinite variant?

Hi Sid

I got upgraded to Diners Black last October. Current limit of 12.7 lakhs. Spends of about 28 lakhs over past year.ITR of 26 lakhs PA. I’m also a guarantor on an automobile loan for one of my company’s auto loan from HDFC. No other relationship with HDFC. Cibil score 836. Any idea when I could get an invite for Infinia? Or should I just send the form to Chennai.

Any existing Infinia customers’ advice will also be appreciated.

Thanks in advance.

A form to chennai should get you the upgrade.

Call your RM. I asked my colleague to do so, his RM guided him how to apply for infinia online and within 3 days he got infinia with 12 lakh limits.

Very fast.

Siddharth,

Earlier we could access domestic lounges with Infinia prority pass but looks like hdfc stopped it. Diners Club Black offers unlimited visit via again its own lounge platform. Hdfc infinia offers 4 visit per quarter via visa/mastercard lounge partnership through main credit card. The separate priority-pass may be chargeable for domestic use by HDFC.

Is this correct? If yes, DCB wins hands down with unlimited domestic lounge access feature and perhaps the only card in India which provides unlimited domestic lounge access.

Nope you can avail unlimited domestic lounge access through yes bank YFE for self and up to 3 add on card members also.

Yes that is correct. HDFC doesn’t allow unlimited domestic lounge access via its Infinia Priority Pass. PP is only good for lounges outside India. Diners Black allows unlimited lounge access domestic as well as international lounges.

However there are other cards that allow unlimited lounge access domestically- Yes First Exclusive, Axis Magnus, ICICI Emerald and Citi Prestige etc

Infinia priority pass allows unlimited domestic lounge access, have confirmed it multiple times with infinia desk. It is also applicable for add on as it is just a replica

Domestic Lounge Access through ‘Infinia’ Priority Pass is absolutely free and unlimited. I availed that on 20th Sep at Kolkata and on 24th at New Delhi lounges (including add-on PP).

Domestic Lounges in Kolkata & New Delhi I have accessed through Infinia only, no need for Priority pass…

can anyone tell if 10x infinia rewards beats the 10% discount offers on amazon(sbi) and flipkart(icici n axis)?

depends on what you value more ? A straight instant cash discount or 33% back in terms of points which are best utilized for travel?

If your choice is former, then SBI/ICICI/Axis offers may make sense.

Is that a question to be asked…the answer is no brainer….hands down 10X offer is better.

Even if you convert the HDFC reward points to cash, its still 16% which is better than the instant discount of 10%. Its just not instant, is all.

Hi everybody,

I am regular visitor of this site. Good to know many of us are getting invite to upgrade to Infinia. I am holding a regalia card since 2016. Current limit is 6.9 lakhs.

My expenditure in last card anniversary year is more than 8lakh. My in hand salary is >10 lakh PA. I have tried to upgrade it to infinia. But not able to get an invitation.

I have reached to my RM, HDFC grievance team. But…

I am a salary account holder of hdfc bank since last 11 years as well as into preferred banking.

Can anybody suggest me the way forward to upgrade to Infinia….

AKN – Send the Upgrade request form with a covering letter to the Principal NO Mumbai

90% it should be done if your track record is good

Quite curiously, the primary and add-on Infinia cards have the exact same credit card number, same cvv and priority pass numbers match too. The names printed differ though. That was not the case with my ICICI add-on card.

Is this how hdfc issues add on cards? Would there be a problem with primary and add-on to use the lounge at the same time?

Thanks

No problem face in lounges till date , only on the statement you will know which addon card holder swiped how much.. another disadvantage, in an online transaction, OTP only comes to primary card holder

So you confirm that the primary and add-on credit card numbers and CVV are exact same?

I have an offer to upgrade to infinia from existing money back card which if LTF and Limit of 12L

is it worth to upgrade from LTF to 10k annual fees ?

i mostly do online shopping and very rare travel ? pls suggest

Have u got invite to infinia MasterCard or visa variant…anyways if your annual spends is more than 8 lakhs, it is an excellent card

Read & Decide for yourself! https://www.cardexpert.in/hdfc-bank-infinia-credit-card-review/

Finally got LTF Infinia. Very happy thanks Siddharth for your wonderful blogs, the fastest push engine is your ITR, to get Infinia.

Hi Shiv,

Congratulations on getting Infinia. Would be great if you can share your detailed experience in getting a LTF Infinia. As from October month onwards, they have put a hard stop on processing Diners & Infinia as LTF.

For Infinia, its mentioned in the T&Cs that there is no late payment fees – can anyone elaborate on this pls?

My whole family recently had hdfc imperia relationship from classic to preferred and then imperia…so how this imperia relationship will help me for my diners club black credit card? I mean it will help to get upgrade to infinia or just limit enhancement? In how many days i will see limit enhancement or any offer for upgrade? My spend on diners black card is quite good…say 10L per annum…

Hi Sid,

I have the MasterCard version of this card. Any benefit in getting the Visa Infinite?

Thanks!

Hey guys i have got an upgrade to this card, I have some points in my old regalia card. Should I carry them to my new card ( at a conversion rate of 50% ) or should i use them for cash back points etc then upgrade? Please let me know.

Carry them to your new Infinia card at a conversion rate of 50% or use them for cash back points etc. then upgrade ~ it is one and the same thing value wise.

Convert. Value of regalia point 50 ps.

Value of infinia point 1 rs

Fkr infinia card they claim reward point value as 1 rp = 1 inr, but when redemption in voucher or cash it shows half.

Aby help?

Reading the T&C booklet which comes with the card and updated reward point redemption T&C usually helps offset such shocks 🙂

1rp=1INR only for redemptions against flights and hotels on smartbuy portal , rest all 1rp=0.5inr or less

You get a value of 1 rs per point when you redeem the points for flight or hotel booking on smartbuy website

I need some information regarding how to use lounge in domestic airport?

I have a priority pass and card for the primary and add on member, if the add on member only uses the the mastercard variant at the domestic lounge will it be changed

Swipe priority pass without any worries

I got an automatic credit enhancement from Rs 4 lacs to Rs 20 lacs yesterday on my regalia card. Probably I used a lot on the POS machines in USA over the last 6 months that’s why I got the enhancement I believe. A quick question, should I wait for automatic upgrade or should I push my RM for an upgrade after a few months? If so, should I request for DCB or infinia directly??

I have recently been offered infinia card but I refused because i am not interested in paying 10k+GST for it. should I regret my decision?

If your spending is north of 8 lakhs a year + you travel airlines to make use of unlimited lounge access +

not interested in 1 year free Club mariott membership + double reward rate compared to Regalia (same as DCB) , regret , if not , Don’t regret

That’s a HUGE CL jump!

Never heard anyone having 20 lakhs CL on a Regalia. Very surprising. Do push with RM for automatic upgrade for Infinia. You should be able to easily get it, given the spend history and current CL.

@Anuj,

1. Did you stay 6 months straight in USA?

2. Received Any calls from bank?

Cheers

Pradeep

I have Dinners black and I have few questions on Infania:

1) Could we transfer Reward points accured on Infiania to Air miles of SQ,Vista,Avios like Dinners

2) Comparing Dinners Black and Infania which has

* The best collection of Lounges

* The best network of Lounges

3) For getting SQ’s Kris Flyer Silver status there should be 25,000 Kris points, so if I transfer 26,000 Dinners reward points to Kris points will I get Silver status?

@Anand,

1. Infinia points transferrable to Krisflyer 1point=1 krisflyer mile , do only if you are getting a value of >1rs per point , otherwise its a waste to transfer , just use them to buy revenue tickets

2. both have almost equal network of lounges , maybe more diffrentiable in USA , in India , my observation is all lounges accept both diners and Priority pass..though diners has less acceptability than visa/mastercard

3. you need to earn those miles , you simply cannot enjoy a status by transferring miles

Hi sid I have buisness regalia holder limit with 9.5 L i need to upgrade to infini please help me

Thank you Siddarth for detailed Review.

Finally got my Infinia card today.

Was holding Diners rewards card since 4~5 years with credit limit 3.6 L. Didn’t had any bank account in hdfc.

In Jan 2017 got in touch with hdfc area head.Who helped me to get Regalia first without closing Diners. With credit limit split 2.5L and 1.1 L.

In Nov 2019 I got option to increase credit limit for Regalia First in hdfc credit-netbanking. It got increased to 7.5L.

In Dec 2019 again approached same hdfc area head for Infinia card. He asked to cancel diners card so that he can merge credit limit and initiate upgrade application for infinia, after which Regalia First credit limit became 8.6 L.

He forwarded my case to Super Premium card sales manager, and here I was asked to open 1 saving account with hdfc, saying that for super premium card Saving account is mandatory (but I doubt on this)

They sent 2 persons, 1 for account opening formalities other for card upgrade application form.

After around 1 week when I called hdfc customer care to check status of Infinia application. Customer care executive told, Application rejected with reason in remark saying, “Infinia card is only invitation based and customer is not eligible”

Immediately I informed Super Premium card manager, who promised me that he will take care of application.

Next day customer care executive told that card application is under process. After 1 week got my Infinia card along with priority pass.

Received message that “As soon as I make first transaction on Infinia card, Regalia First will be deactivated”

Rules told by him –

1. Minimum 8L credit limit is required to apply for card upgrade.

2. Card is not free, if I spend 1.5L in 90 days then it will be free for 1st year.

3. For new infinia card application (not for card upgrade) if customer applies for FastTag along with card application then they can offer 1st year free infinia card.

4. Second year onwards fee is usual 10K +GST, if we spend 8L then it will be waved off.

Though I am personally expecting that, based on usage they may make it life time free in future.

Dear Sir,

I came to know that infinia card reward points value is 1 rp / point.

I have 15000 rewards accumulated but I couldn’t locate any place where i can redeem with full value. Any advice?

Cash redemption is resulting in .5 rp/point

Hi Sidharth

Great blog. I am a regular follower.

One small question. Is there a limit to the regular reward points i can accumulate? Eg if i make a single payment of 10 lakh, do i get 33,333 points?

Thanks for your help.

No limits, but I would suggest to make it in multiple txns as this might cause unnecessary flagging & complications based on the type of txn.

33,330pts you will get to be precise

.@ Dhaval – Quoting a reply to your same previous query on November 19, 2019:

“MT

November 26, 2019

1rp=1INR only for redemptions against flights and hotels on smartbuy portal , rest all 1rp=0.5inr or less”

Hello Sir

I am an imperia customer in hdfc bank holding Regalia First card with 5L limit. I travel out of country more-than 5 time in a year. could you please suggest me better card

Thank You

@Siddharth : I have MoneyBack Credit Card with a credit limit of 15L and I have an offer to upgrade to Infinia.

Should I go for it?

How many points can we get with an average spend of 6 – 8 lakhs per year.?

I travel less. Mostly online spending and paying utility bills and dining often in a month.

@Seyed,

With a default earning rate of 3.3%, 33% on smartbuy (amazon , flipkart) & 6.6% on dining, you could easily estimate your average points accrual basis your spends

@Neo: Thanks for the swift reply. Finally, upgraded the card 🙂

@Siddharth: Thanks for this highly informative blog.

Hi Seyed,

When you get the card, can you tell us if it’s visa infinite or mastercard variant, i heard somewhere they are now sending Mastercard variant even though the name itself is infinia.

The name has always been Infinia. It won’t change; the only thing that changes is the platform and level of membership on which it is based – Visa “Infinite” or MasterCard “World”

@naresh: i got visa card

@Sayed, Can you Please share how did your get such a huge limit on HDFC card. Types of transactions for which HDFC offered limit enhancements . TIA

@dev: my only relationship with HDFC BANK is credit card and i use only for buying gadgets and air tickets (personal use only and not for others)

Last year I got an offer to take Jumbo loan on the card and took it and since then my credit limit enhancement offer alerts comes very often and i recently upgraded the limit to 8lakhs (3months before) and last week they increased the limit to 15 lakhs.

Last two years

Limit enhancement(started with 60k)->1.4->2->4->8->15 (lakhs)

My gadget EMIs are use usually 3-6 months tender and i pay it before due date.

Thank you Seyed for sharing this info.

Hi, am using regalia (lift time free), am credit limit is 9.5L , am Primer customer of hdfc, good relationship with Hdfc.

Am very interested infinia card , how to get this card, average spend of 6-7Lac , online payments and bills, flight tickets

Hi Siddharth and others,

I’ve Regalia with the credit limit of Rs.6,84,000/- since jan 2019. Can I upgrade it to Infinia or DCB? Can I send the upgradation form to their Chennai office without the income documents attached as I don’t meet their eligibility criteria?

I’m a classic account holder and Credit card holder since 2014. I’m a regular high spender of the credit card in the range of Rs.40,00,00/- annually. I’ve a jumbo loan of Rs.15,00,000/-( I paid Rs.8,00,000/-already )

Hi,

Thanks, Siddharth for the amazing info on the blog.

Applied for DCB on 24th jan and got it approved last night.

Quick question, when can i upgrade the card to infinia also are there a lot of differences.

between the two.

I have below cards with me

1.Axis Magnus

2.Amex Plat Charge

3.SBI PRIME

4.Amex reserve.

If I have to describe HDFC in one word, I would chose to use CLUELESS. They don’t know what they do. Each person you talk to in their customer care gives you a different answer for the same question. Less than 2 years before I was told that a credit limit of at least 6L is needed for upgrading to Infinia. When I had that much in my DCB already, it became 8L. Now for over a year I have had a limit of 8.5L and all I got was upgrade to the new DCB from the old. Now I have a limit of 10.5L and I still don’t see the option. I have been a HDFC credit card customer for 10 years, savings account holder for 8 years and home loan holder for 7 years. I know people who draw less than me holding this card. This kind of disparity from HDFC is nothing new though. I have not known any other bank that does this. They tell you upfront what’s the eligibility criteria. These guys don’t because there doesn’t seem to be any criteria at all. Whatever you hear from any of their representatives is probably just freshly made up stuff, a fig of their own imagination.

I agree completely, After having gone through this comment section, its clear that there is no clear methodology at work here. My limit on my Regalia ia 13L and still no upgrade option, However I logged into redeem points website and it shows that at Rs 5L spend this year, it shows CC upgrade 1 as an option, at Rs 8L spend – it shows CC upgrade 2 as an option, my total spend so far is 4.1L so I would have to wait and see what happens at those milestones, I am also an Imperia cust with major Net Relationship Value Like FD’s and current accounts with HDFC but not sure if they make a difference or you just need a good RM, mine doesnt even reply to simple queries. Lol

Always accept the credit limit enhancement offer on your existing credit card. Invite for Infinia will happen automatically once the credit limit crosses 8L.

I have accepted every credit limit enhancement offer thrown at me. Like I mentioned earlier I had a limit of 8.5L for over a year. Now it’s 10.5L. And there’s another person who has mentioned that with 13L limit he still doesn’t see the option to upgrade.

A lot of times the upgrade option doesn’t show up, you have to physically send the upgrade application and they approve it. Do it if you need it.

Nah it isn’t auto invite. 8L is just a criteria for being considered for Infinia.

Does holding other relationships like salary account, demat account, fd’s, ppf, etc. help in getting infinia card? Can someone list what are the services that really help in getting this card? I have read whole comments from top to bottom but it is too confusing.

@Mayank – Additional relationships like the ones you mentioned help you with the Infinia cause. So does high NRV and existing hdfc card with 8 lakh plus limit. They need to be there with a clean credit bureau records however me and a few others got Infinia with rather low spends n low ITRs so the exact calculation are unknown

Do we get regular points for loading payzapp wallet?

No reward points wallet loading on all HDFC cards.

Thanks for the update

Is it worth shifting from DCB to Infinia, incase you have option to get only one card?

Yes, Infinia is better option as you can get all benefits of DCB anyway.

For partner offer, use instant voucher through smartbuy for myntra etc.

In addition, you will be get higher smartbuy limit and higher acceptance internationally in Infinia

Dear guys..

I am holding a DCB with CL 9lakh. Recently I tried for a seperate Infinia card as my DCB acceptance in Europe was very poor and the Chennai CC team denied saying one cannot hold two super premium cards. When I escalate the issue, they have agreed to issue me a seperate regalia by splitting my CL. So please advise me which is the best option for me…

1. Upgrade my existing DCB to Infinia ( already availed the membership benefits of DCB for this year and my DCB is FYF)

2. Accept the offer and issue a seperate regalia card and eventually upgrade it to Infina, may be by 1-2 years.

3. Upgrade to Infinia from DCB and request for Diners Preferred by splitting my CL later and eventually upgrade my DC Preferred to DCB again..

Pls advise guys..which is the best ?

Dear Siddharth,

Awaiting your reply on this…

2 followed by 1.

S&S

@ Dr. Ali

I would have gone for option 3. Take Infinia when you can.

Thank you Praveen, i did exactly the same. Got upgraded my DCB to Infinia with a CLE to 12 lakhs. I will chase for a DCB later if it requires as i have availed all the membership benefits for this year.

Hi,

I had applied for Infinia upgrade from my existing Regalia (9L+ limit) through my branch RM. Today my netbanking shows available limit on my current card as 0.00 which generally happens when HDFC issues a new card. Does this mean they have accepted my upgrade request?

Thanks

Raman

Yes.

So will I just receive my card in post? I have not received any communication by email or sms regarding the upgrade.

Yes. The take a while to communicate.

Hi Siddharth, I have a new DCB card (3610) with 10L limit and its LTF. If I send an infinia upgrade form to chennai, will the upgraded card continue to be LTF?

As i have checked on Hdfc website the infinia card has only 2 benifits 1)unlimited lounge access vis PP 2)Club Marriot.I have the same lounge access via Yes First Exclusive Card(I hope its not dead) and Club Marriot via my Axis Bank Select card.I also have regalia first which i use in diwali or festival period for offers on HDFC cards.Do I still need infinia.Does it offer any other benefits which I dont know.Can anyone explain.

I just received my Infinia, add on too… Mine was a little harder. I do have 40 lakhs ITR and my family accounts and so on… due to some past history (12 years ago I didn’t close the card properly, agent said he will settle and get the NOC but didn’t do it.) Because of that they refused to issue any card. I had to pressurise RM for an year. He issued DCB to my wife a few months back. Finally I got Infinia.

A few things to mention / ask here.

1. I use Amex Plat Travel. I feel Amex is giving more returns than what DCB has given when I compare both. For 4 lakhs I get 10k Taj voucher then 23k worth of Airline vouchers. DCB will only give you 13333. Considering not all expenditure will be SmartBUY>Amazon 10x thing. Let’s assume on the whole it will be 2x then its 26k. But we need to spend 10 for renewal fee. Only if I spend 8 lakhs I’ll get minimum of 26k points + plus whatever 2x/10x.

*Not a great fan of lounges anymore… these days they are over crowded. No premium category or anything. Plus, I have enough Yes Exlusive LTF as well… with unlimited lounges and other debit cards that are enough.

2. Why do you guys use Credit Card for international travel instead of Forex card. For CC, they charge foreign conversion fee 3.5% + transaction (markup) fee 1.75-3.5%. Together the min amount will be 5.5%. How does it make sense to spend so much more money just for some lounge access?

Please feel free to share your opinions.

So Axis bank started reducing credit limits by 90 % approx. Many card holders got the sms yesterday from Axis in this regard. Some had limit of 7 lacs now reduced to 70k .

Hi,

My cibil score report showing the wrong credit limit. It is showing only 33% of the actual credit limit of my Infinia Credit Card.

Is it normal or should I report and ask them to update it.? Please advise because it is affecting my credit limit utilization.

Thanks

Hi I have buisness regalia limit with 11.5 L n also imperia account with hdfc but infinia card is not offered to me yet please help

Hey Siddharth,

I’ve been following your blog a while. I’ve had Regalia First card, which got upgraded to Regalia (Limit 4.3L) in around 6-8 months. It’s now been 7 months since the upgrade. I spent around 1L per month (Gave add-on card to my friend who is doing all the heavy purchases) on my Regalia card . My ITR is around 14L. I have an 8 year old Salary account with HDFC and no other investments or loans. As far as the relationship goes, all I can say is, there’s good amount of billing happening on the card. Do I stand any chance to get a DCB or maybe an Infinia, if I set my hopes to sky.

I have yearly spends of above 25 lakhs of which about 5 to 8 lakhs are domestic spends like insurance and above 18 lakhs in international sites charging in Euros for various fees.Right now I have SBI Elite and HDFC Regalia both with Foreign currency FCY mark up of 2%.I am looking for cards with maximum cash back towards outstanding card payment (1st preference) then followed by those with air miles or good reward points redemption like HDFC Infinia. The card must be with Zero or upto 2% FCY. I would like to upgrade Regalia plus global value program as above 8L spends there are no bonus reward points .SBI Elite has bonus till 8 Lakhs and annual fee waiver after 10 L spends.After that its only 2 RP per 100 Rs ie, 50 Ps /100 Rs.

Please advise a better option or combination for me including Forex cards & credit cards. I have short listed HDFC Insignia / DCB (2% FCY) , Axis reserve (1.5% FCY) , RBL World Safari (0% FCY) I checked with banks for Axis Burgundy Privilege CC & SC Ultimate but said its difficult to get.(I have SC Manhatten too but not using it much and Axis Burgundy debit card)

Please advise a better option or combination for me including Forex cards & credit cards.

Sandy

The spent of infinia was 7.98 lacs for this year. I didnt realize I was just short of 2k to achieve 8k threshold but HDFC bank deducted the annual fees of 10k+gst for same. Can I ask them to reverse them. Will they honor it.

I doubt they won’t !

You can easily keep track of your Milestone spends & milestones reached. Its a very useful feature. Login to netbanking. In cards section, click Enquire, then click Redeem reward points, select your card and click Continue — Opens a new Pop-up window of “HDFC Bank My Rewards”. Click My rewards tab – then click “SPEND PROMO DETAILS”. Here you get to see all the milestones of

–Welcome benefit,

–Monthly benefit &

–Annual membership benefit.

Easily track your milestones from here.

Drop them an email explaining the same, I believe they will be more than willing to help you out.

Regards.