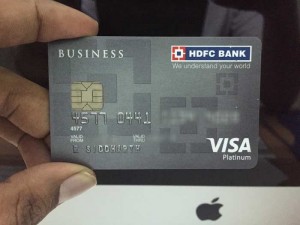

Update: This card has been Discontinued

HDFC Business Platinum Credit Card is one of the best credit card for beginners with great cashback benefit. I was looking for a basic card and this was issued to me as I’m self employed and later after hours of research i came to know that it was one of the must-have cards in the market because it gives you 1% cashback on all retail purchases you make with the card, provided the bill value Rs.50k or more. It fits me perfectly as I cross that limit very easily as I put most of my business expenses on the card.

Fortunately, i was lucky enough to get it without even knowing its features. It’s been 6 months I’m using the card and I’m loving it for its simplicity and ease of use. Surprisingly this card comes with lowest joining fee. It will also be waived off on yearly purchase of Rs.30,000 on the card.

Cashback gets credited to your card account within 48 hrs of bill generation. For ex, if you spend 75,000, you’ll get Rs.750 as cashback within 2 days on your credit card account. This gets adjusted in your next billing. For some reason, from my experience, some Rs.20-30 gets missing on each cashback credit, which customer support were unable to answer. Well, it’s not a big deal, so I dint mind about chasing them.

Features of HDFC Business Platinum Credit Card:

- CardExpert Rating: 4/5 [yasr_overall_rating]

- Reward rate: 1% (as direct Cashback)

- Cashback Conditions: On Bill value less than Rs. 50,000 you get only 0.5% Cashback. 1% cashback on international spends with Rs.10,000 or more international transactions in a billing month.

- Complementary Airport lounge access: Upto 2 free visits in a quarter.

- Fuel Surcharge Waiver: Upto Rs.500 per Billing Cycle

- Foreign Exchange Markup fee: 3.5% + Service Tax

- Joining & renewal Fees: Rs.299 – Will be waived off on meeting their spending threshold.

- Special Features: Its a Business Card, so you can have higher credit limit of upto Rs.20L based on your business financials on your IT File.

Paying HDFC Credit card bills is quite easy, just register for auto debit from your savings account to get peace of mind. One thing i wish HDFC could be better than ICICI is that the statement gets updated only after 2-3 days of the transaction, while ICICI updates them within a day or so. Overall, my experience with HDFC bank is quite good except that their customer care support team always responds with only robotic answers.

If you’re a self employed Business man, the Business Platinum Credit Card by HDFC bank is the best card you can find in the entire Credit card industry with outstanding cashback benefit and a very lowest joining fee. I’ve earned more than Rs.5,000 (1% of my spend) as cashback itself in couple of months with this card. Hope the review helps at-least few of you guys who is getting started with credit cards.

Update: I’ve swapped this card to HDFC Business regalia credit card

Do let me know your views through comments below 🙂

I have Hdfc bank Platinum edge card with credit limit of rs. 97000 as upgraded.

i just want to know about its billing period and finance charges they put on every month in statement.

plese help to know about the actual hidden charges of credit card and rate of interest and penalties.

There are no hidden charges as such, as long as you know how credit card works.