Important Update: YesBank is unstable as a bank and hence their credit cards are no longer suggested for primary/secondary usage. Kindly update your credit card strategy accordingly. Here are some of the other best credit cards in India for 2020 to choose from.

I’ve recently got upgraded to YES Bank’s Exclusive credit card and here is a quick look into it. If you’re looking for features and benefits of YES First Exclusive credit card, please check out my full review here: Yes First Exclusive Credit Card Review. This article will be more about how i upgraded from Preferred to Exclusive card.

YES First Exclusive Credit Card Upgrade Process:

I’ve been waiting for the upgrade to Exclusive Credit Card for quite sometime and I’ve prepared the stage to make sure the upgrade goes through if I request for and so it did. This includes high spends, increased NRV with bank, accepting temporary limit enhancement, etc.

Once I got into 6th month of My Yes First Preferred card, I dropped an email to YES First card team to look into the upgrade along with limit enhancement. Within a week, I was said that they’re looking into it and is subject to approval. Within another few days, my card has been upgraded and got hands on the card the next week.

Later the limit also got enhanced to match my HDFC Jet world credit card, though I expected even better limit as my NRV with YES bank is more than what I have with HDFC lately. Anyways, it’s still a good limit for a super premium card.

Side note: I’ve once exceeded the credit limit on my YES First Preferred card by mistake and the charge still got approved. Good thing is, Over-limit charge was not applied to my account, maybe because I’ve paid the the difference to card Ac the same day.

The Card: YES First Exclusive Credit Card

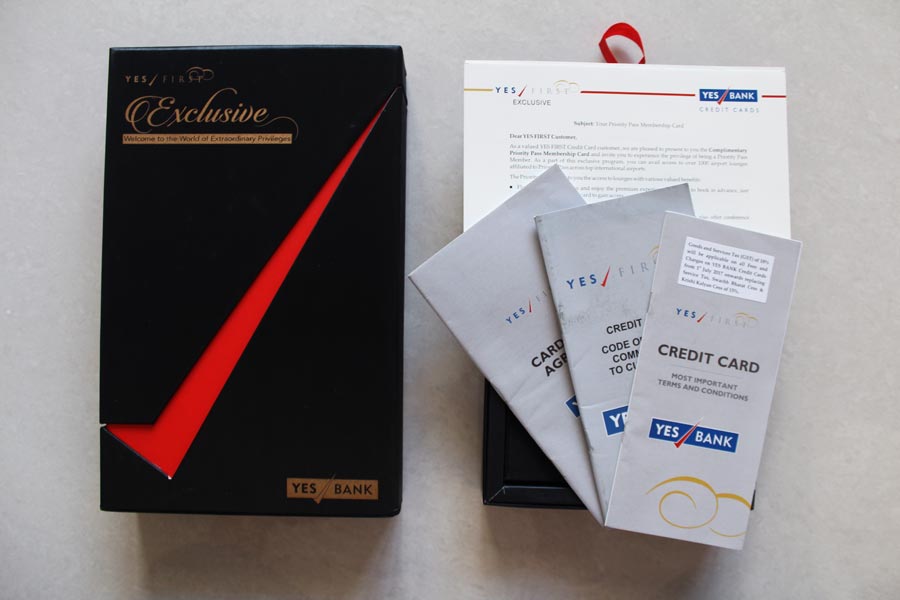

The box in which the card was delivered was much more superior in quality compared to Preferred Card Box and I’ve even kept it like a showcase piece in my workplace as the silky kind of box material shines a bit in daylight 🙂 I’m still not a fan of the actual card design but the new MasterCard logo looks quite good.

The package coms with 2 neat letters which talks about the most important feature of the card: Lounge Access. You get unlimited lounge access both via Mastercard & Priority Pass (Primary + All add-on cards) and you can also use your Priority Pass in Domestic lounges without any charges, though it maybe changed in coming months.

Having Unlimited Access to Priority Pass lounges is really a HUGE benefit even if you have Diners Black because Priority Pass covers all kind of lounges, including secondary lounges like those in Arrivals or in Landside. Hence, your PP visits always needs to be treated as precious ones.

In meantime, I was checking to see if my upgraded card is also LTF, but wasn’t mentioned anywhere in the package. No charges were applied yet, so it seems it remains as LTF, though, i have heard from one of the reader who was upgraded on payment of joining fee. So, it seems to be dynamic based on the profile, again like HDFC.

Here’s how unboxing of the package, the card and the contents looks like:

Reward Points Transfer:

This is by far the most important concern for me as I had good amount of points on Ac and want to make sure it gets transferred properly. I made the request for upgrade after receiving all bonus points so I don’t get stuck there with missing points. Infact I didn’t participate in recent spend based promos just not to make it complicated.

It takes approx. few weeks for the points to be transferred to new card and you need to wait until the first statement gets generated to use those points.

Note: Your Old card will be marked as “TRANSFER” and will still be visible on account, like in HDFC. So technically any bonus points should keep accruing on old card, but not sure how it works practically if you’re waiting on bonus points.

Increasing Chances of Upgrade:

- Increase NRV: At-least Yes First account (not zero balance ac) with high balance or other relationships with bank should help. This also helps them to give you a better limit.

- Spend more: The more you spend, the higher your chances of upgrade.

- Other Super Premium Cards: If you have other bank super premium cards, it’s an added advantage.

- Age of Card: At-least wait for 6 months as this is quite important for banks to analyse your account for upgrade.

I believe there is equal weightage of all the above to increase your changes of upgrade to YFE with NRV being the most important, without which its tough to make a strong case.

Apart from above, you can also get the card first hand if you’ve other bank card with 8L limit. Along with it, you may also need high ITR and good relationship with bank as it’s not easy as before to get YFE.

Bottomline:

Overall, the upgrade process works quite well even-though they haven’t come up with any upgrade process publicly AFAIK. That all said, i’m happy to have YFE for its decent base reward rate of 2.5% along with PP lounge access.

I got this card at right time that i was able to use it during my trip to Singapore & Malaysia as many online ticketing portals (to sight seeing places) accept only Visa/MC “Credit” cards and so YFE came to rescue with its low markup fee & 1% Cashback on International spends.

Hence, i’m having a very good time with YES Bank’s Yes First Exclusive credit card so far 🙂

Have you got Yes First Exclusive credit card either by Upgrade or on first try? Feel free to share your experiences in comments below.

Congrats Sid!

Thanks Ganesh.

Just to add my experience, I hold dinners black and it has all the benefits .except that it didnt have unlimited lounge access for family members , so I was only left with INFINIA but it had huge joining and renewal fee so I was avoiding it and managing my family entry into lounge by my other cards like Yes first preferred and hdfc preferred platinum debit card but still I was looking for INFINIA but then I read your article on Yes first exclusive card and I got excited about especially its LTF feature and kept enquiring the cc regarding it and my Yes first preferred card was only 1and a half months old but just on 17th August means 2 days ago i got a message that i have an upgrade offer to Yes first exclusive cardI couldn’t believe that within such a short span of time my dream is coming true, and without thinking much I immediately called cc and gave request for upgrade and now within a week I will get my Yes first preferred card and now have the best combination DINNERSBLACK and YES FIRST EXCLUSIVE CARD.

Sid I thank you for the information which lead me to get Yes first exclusive card .

Rockstar

Guys, don’t make a credit card your dream!

SID,

Today I got my YFE card that also LTF I am so happy all credit goes to you cos my dream cropped in only after reading your post and I thank Yes bank for upgrading my card in just 2 months. Guys all the best to you all .

With lol

Rockstar

Can you explain how did you get it? Did you have previous association with Yes Bank? Bank account, Range of deposits etc.

DD,

You call it sheer luck or they must have seem my credit score, cos I had applied for Yes first preferred card which I got with too much of hassles, and I got a call from YES bank that we are offering you 1000 reward points for opening saving account so I opened it.

But to my surprise with 2months i got this SMS to upgrade your card to YFE cos i never thought I will get upgrade so fast and also I had used card not for any big amount

But I got the card on 21st.in a b’ful box as nicely described by Sid.

All the best to you.

Rockstar

Sid

Today the 22nd August 2019 within 2months of Yes first preferred card I got my YFE card, bro I liked the package b’ful box same as u have shown? Cos evry other card comes in simple envelop, It really made me special,

Keep posting good things about card.

Rockstar

Congrats Rockstar! That beautiful box is probably the only good thing left of the Yes Bank offered credit card. It has been devalued even further recently. But ya, that box really made me special as well. It was delivered to my office, and right from office guard to colleagues thought I have got jewellery delivered or won a lottery.

Good for nothing to be frank!

Haaa , true bro but the good thing unlimited lounge access for self and add on card and definitely I agree the RP conversation is less 0.25 paise but for that Dinners black is the best card with 10X reward points in Smartbuy and partner merchant and I use it.

But for me specially, I feel its better than INFINIA cos its Rs 10000 plus GST Joining fee and the same amount as annual fee.

And YFE is life time free card.

But every one has their own choice of cards and uses

All.the best guys

Rockstar

Dear Sid

Congrat on getting YFE for Exclusive person like you.

Thanks Man!

There is one catch on spend base reward points, if we spend 7.5 L on YFP will get 20K bonus reward points, for YFE we need to spend 25L to get 25K reward points, which is quiet difficult to get that spend base reward points.

Apart, Unlimited Lounge access and their promos are good to watch…

Yes, that’s there. Would be great if it was 15L or so.

But its too much to ask for, as Priority Pass itself would help save hell a lot 🙂

Its 20 L Siddharth… You have to spend 20L to get 25K additional reward point. BTW the only difference between yes first preferred n exclusive cards is d Unlimited Lounge access and additional 2 RP on every 100 spent… Does this justify the difference in annual fee between the two cards?

That’s still a huge difference isn’t it? 🙂

1. Air Accident death insurance cover is Rs. 1 Cr on YFP vs Rs. 3 Cr. on YFE

2. Medical cover abroad is Rs. 25 lakhs on YFP vs Rs. 50 lakhs on YFE

3. Credit shield cover is Rs. 5 lakhs on YFP vs Rs. 10 lakhs on YFE

Hope you take into account above differences in YFP and YFE too.

Above all are applicable only when you book the flight tickets through YFE card

The benefit from the additional 2 RP by spending 7.5L using YFE over YFP is Rs.3750 ( or 15K RP). If you participate in their spend based promotions, the additional RPs earned using YFE would comfortable over take the 20K RP milestone benefit received from YFP. So if you are getting a free upgrade, then I feel one should go ahead with it.

Congrats Sid

Now that you have YFE, any other card to target for (other than 10x on Dinners)? YFE is my default card as I’m not finding spends on 10x categories of Dinners attractive to me. I even use YFE to pay for fuel via paytm. Gets me 3.25% return.

Got a lot of (3x/2x) bonus points credited to my YFE Amazon vouchers and International spends cashback too all for spends in YFP from earlier.

Only missed out marginally on 1 of the upgraded cards for the 7.5 lac spend 20k bonus points in one of my family member’s card. In case of upgrade, 7.5 lacs must be spent prior to upgade and not Anniversary Year wise.

Thank you Aman.

My Diners is getting dust for couple of months as i kind of reached a saturation point on spending. I’m thinking about Diners Jet and others related to more of travel.

Sad that you missed on 20k points. Did you request for the same? as i’m expecting it to kick in automatically post anniversary year.

Hi Sid

These are the facts: on 1 of my family members card the spend was 7 LACS at the time of upgrade to YFE. Before Anniversary Year was completed in December 2017 it exceeded 10 lacs. Asked in Jan 2018 for the bonus points. Reply was: not possible as Spend on YFP must be 7.5 lacs.

So now I’m happy geting upgraded and using unlimited PP and higher reward rate. Plus lots of bonus points on promotions from time to time. I actually also got Rs.10k (cashback) into 4 persons (spends around 50k each) using samsung pay schemes with Yes bank cards. Sadly that has now ended other than 1 scheme on ICICI CARDS which I dont use nor is it attractive enough for me to aplly for ICICI.

Congratulations Sid !!

I am sure you have your reasons but I cant fathom why you or Aman discard/ignore Diners even for 10 X. Any particular reason that I am missing ?

Thanks man!

Its just that i can’t keep spending on 10X partners all through the year. With less travel in past 1 yr + Good amt of points stacked up already since 2016, i’m just refraining myself from buying things that i don’t need. And most importantly, i’m not buying anything for others to keep records clean.

So its more of a personal choice 🙂

Hi Rahul

My major spend is on electricity bills approx Rs. 4.5 lacs monthly which does not accept dinners. This I collect from my tenants in cheque.

Plus as per my knowledge Hfdc does not give amazon vouchers, which is what my redemptions are.

Amazon pay allows me to use these gift cards to pay for household bils (dth, elec, water, mobile etc. Using NIKi.AI app ) and grocery directly from amazon.

Hence I’m actually saving crazy amounts just by charging the big electricity bill onto my CCs and having to pay after 50 days interest free period at no extra charges. 😉

Lets enjoy till the party lasts.

Which card are u using to pay Elec bills and which portal has no conv fee?

Hi Sharad

I’m paying directly at the electricity company website of UP. No charges. Plus there is the option of paying via Paytm too. Again no charges.

The card of course is YFE.

Congratulations.

1. Did you provided Income documents and HDFC credit cards statements for upgrade ?

2. What was your percentage of limit increase during upgrade ?

1. no / yes

2. above 50%

All communications happened over email including sending documents or did they come to pick up the physical documents?

Yes, all on email. No physical pick ups. They’ve enough info on the ac anyways 🙂

Hi Sid,

Congrats on the YFE. Are they still giving YFP through Card on Card process?

Should be, at-least for next ~2 years for them to be in the game 🙂

Congrats man! I got this approved on the basis of my Infinia card but got just 20% of the existing credit limit. Will try to apply for a limit upgrade after 6 mths. But a great card to hold and yes bank has a very transparent system of crediting rewards on spends! Something HDFC should learn from.

Thanks man! Cool.

HDFC has systems to do it in a transparent way but they don’t do that on purpose. (Disclaimer: personal experience)

Yep. I got 20% of my Infinia’s limit as well. Such a shame.

Dear Sid

Whether you were YES First ac holder with them and what was the minimum AQB or NRV they asked to maintain for. Coz in my case they just asked for 5 lacs AQB and not NRV based. Maybe bcoz my YES First ac is relatively new.

My RM tells they probably will start CC operations in UP in April. Hoping to get one in about 6 months time.

I wasn’t on YF. Had good NRV but just that i didn’t want to upgrade for time being.

Congratulations Sidh.

Just wanted to highlight one more benefit of YFE- no rewards redemption fees. For YFE, redemption is completely free.

Ah yes. Thanks for highlighting it.

Hi Sid

Just saw in my YFE card statement ( March 2018 schedule of charges page) today :

“Reward Redemption Fee Rs 100 per redemption request”

while in Feb 2018 statement it said :

“Reward Redemption Fee Rs 100 per redemption request (waived for Exclusive)”

Has anyone holding YFE been charged for redemption???

I redeemed some points a week back and no charges on ac so far. Will keep you posted if i see it on statement.

Can you share your credit limit on the old YFP card and your average monthly spending on it so that we can assess out chances of upgrade? Thanks!

Congrats Sid!! Just sent an email for upgrade request after reading your article. Hope they consider mine for a upgrade. I have already spent nearly 10 Lakh this FY on my Preferred Card.

Cool. Good luck!

I have been waiting for YES to start offering cards in my city and they are offering now. My income is not eligible for the YES preferred but I have two cards with more than 3 lakh credit limit and i would like to apply for YES preferred through card on card offer. But in online only income criteria is checked, is there any other mode for applying for card on card offer?

Branch ofcourse!

HI SID,

IS THE EXCLUSIVE ALSO LTF? LIKE PREFERRED IF WE UPGRADE

It depends on the profile, as i mentioned in the article.

Congrats Siddharth,

I am regular reader of this blog. A lot of useful informative one.

Thanks man! Keep coming back 🙂

Did they ask for any additional documents?

What’s the best way to reach HDFC for upgrade? Any email or phone only?

No.

RM always as they can t easily reject requests coming from imperia/preferred RM’s. If not by email.

My experience was exactly opposite. My RM was good for nothing. Whenever, I would ask for a possibility of upgrade, he would ask me about my salary meeting criteria and would say later that he tried but nothing happened. In the end what I understood was that he was conveniently ignoring. We later just filled up the forms and sent to Chennai. I got upgraded to Diners Premium from Diners Rewardz and my wife got upgraded from Regalia to Diners Black.

Yes i hear that often. Maybe as i’ve access to BM, it seems to work the right away.

Still, it doesn’t work all time. For ex, one of my family card is still stuck with Diners premium for ~2 yrs. The major difference is NRV of that a/c.

For me it was the upgrade form. Send it to chennai with relevant documents and if every thing is right u will get upgraded.

Hi Sid,

Congrats. You got upgrade in 6 months, great.

Was there any ask on Monthly Income from you? Coz my BM has been saying no to me for upgrade only basis Monthly Income criteria. As per him, no other criteria, they check. I have tried reasoning out about NRV ( like you wrote) having a Yes First account and also told him about HDFC Diners Black.

Again asked my RM to pursue my case.

A mail to Card team directly will help?

Will upgrade criteria differ from region to region( city to city) ?

Regards,

Balpreet

Yes, you should email to YF team as BM doesn’t know much about CC operations as its all new for them. No Qn on income. NRV is primary – the higher the easier it gets.

Thanks Sid.

You wrote email to YF Team? Is there a separate mail id that you are aware for YF.. What I know are generic mail id yestouch or yestouchcc( for credit card)

Regards,

Yes, to the generic mail id

Hi,

Sent a mail. Got a reply with stating there is no Policy to upgrade cards in Yes Bank. Hence they cannot consider my request…

Don’t understand how they operate selectively..

Balpreet

Congrats Sid.

What was the limit you had in Yes First Preferred Card ?

I am holding Preferred card for 9 months and had spent around 10 Lakhs and my card limit is 1.5 L only, though I applied card on card basis with my HDFC Diners Black

I am having Yes First Savings account also

I have placed request for upgrade to Exclusive card last week & I am asked to wait for few more months

I don’t understand the logic they are following for upgrade. I planned to escalate this to nodal officer

All Yes First World Debit card holders are eligible for Exclusive card , that’s what mentioned in the Welcome Kit of Yes First Bank Account

My limits were in line with the Premium/super premium cards. High NRV is the key apart from Spends. Consider adding FD/RD/MF/savings/current a/c balances to the mix.

He’ll,

My hdfc money back card hasn’t get any limit enhancement or card upgrade offers,

It is almost 8 months complicated,

My spend till now is 4lac in 8 months,

Should i drop a mail to them for limit enhancement and card upgrade,i have a itr of 6lac.

Replies appreciated.

Yes you should. But as we spoke on this earlier, reduce your outstanding to ~30% range for better success.

Friends Good News : We can convert Yes Bank Debit/Credit card points to cash via max under redemption option of Mobikwik(Catch:You cannot takeout the cash but can use it for recharge anyways). Actually a lot of PSU Bank card points also can be converted to cash via max.However the catch is it has a very measly limit of converting points per month to cash.We can also convert payback points to cash via both mobikwik and oxigen wallet.Hopefully this info will be helpful to all.Not sure if it has been shared before by anyone in any other thread.

Hi Arjun

Please explain in some more detail regarding Mobikwik & Max. How much can you convert? Also converted amount is Supercash (only 10% to 20% can be used in a transaction ) or as good as money added (100% allowed)?

No You can convert any amount of points for cash(It is Not super-cash but loyalty cash).Loyalty cash can be used fully during payments.

Login to mobikwik go to redeem option.There will be two options 1) Payback and 2)Max.

Under Max option you can add your yes card and try.I have already converted for my debit card.Think it will work for credit card also.Check and let us know.

*Just to add it seems only for Debit cards since the credit card partner page doesn’t mention it but guys give it a try and check because i dont think they can differentiate.Also Checked that any number of points of these cards can be redeemed as cash in mobikwik wallet

Hi Arjun

They can differentiate.

While there are several debit cards that are supported, Only kotak & idbi credit cards points can be converted via Max Get More..

Amazon gift vouchers is the best option. Amazon pay also can be used for recharge and bill pay.

Hi Sid

I am going to apply for the YFE using ITR/salary slip. However my credit score is only 780. I have no debts and just one other high usage credit card. In addition, my employer name isn’t listed on the Yes dropdown, nor do I have a relationship with them. Do you think it’s worth applying for it, even though I qualify via ITR?

Thanks

Hard to answer with less info!

But its a super premium card and is totally worth it for many. Maybe a branch visit would help.

Siddharth,

What all banks are giving credit card, Card on Card basis like YesBank?

Hey Sid,

Can I use my Yes First Preferred and PP cards together to get comp lounge access in domestic airports for me and my spouse? Will the lounge accept two cards from one person?

Totally depends on the person at desk. Hit or Miss!

Congrats, Sid!

I got my upgrade processed a month back after holding the YFP for 10 months. I made ~8.5L spend, over shot the CL once, made single swipes of 1L+ twice, had 3 monthly statements billed with nearly 80 to 90% of CL, always made payments on time, participated in almost all their spend based promotions, have a yes bank zero balance savings account ( I literally keep it at zero balance) with YF world debit card.

I didn’t ask for an upgrade, but they themselves offered an upgrade along with a CL increase. So what I concluded is to spend more and pay regularly and the upgrade will happen automatically.

Wonderful.

I think you’re the only one who got the upgrade invite 🙂

Its still surprising to have received the upgrade despite zero balance!

I have similar experience, I was using YFP for ~ 10 months and have been using the card for the first 6 months bit extensively (40%-50% of the credit LIMIT, used on my international trip). I approached them for upgrade after 6 months twice, tried escalation but they said No for upgrade. Then I let the card go in to cold storage for 2 months and as bolt out of the sky, the bank approached me with the upgrade offer (YFE LTF), took it without 2nd thoughts. Now I hold plat charge, DCB, Prestige and YFE 😁

How much limit you had in in YFP and now how much you have in YFE ?

Did you have any investments with Yes Bank ?

Limit on YFP was 2 lakhs and same in YFE, No investments with yes bank

Just an update. The same trick (using the card extensively for few months and then not using it for another few months) worked with Axis and Amex. Axis increased my CL on my Vistara signature by little over 50% and CL on my Amex plat travel was increased by 500%(yeah you read it right, 500%)

Congrats Ram. Have you provided any income documents to YES bank, AXIS and AMEX M

As always !! Great Insights from you Sid. Thanks there.

But somehow my YES Prosperity Edge they have not been upgrading to YFP. Spoke to customer support like 4 months age of YProsperity edge card to which they replied UPGRADE program has not been rolled out yet. Got the same reply that they are tesing the upgrade program and will rollout in short while ,even when I was already 6 months into their system with YES PRospertiy EDGE card.

Metrices : Had 20-30% Utilisation rate on my Pros. Edge card for last 4 months.

Have a Savings Account on AutoPay to card. High balances not been maintained in Savings account though. Almost finished my 7 months with edge card without payment delay/default. Still wonder why whats wrong with my upgrade request from Prosperity Edge to First Preffered. 🙁

“High balances not been maintained in Savings account” – I think you have the answer already 🙂

Try to request if you’ve other bank cards with 3L+ limit.

Is the unlimited lounge access only domestic?

I recently used priority pass that came with me YFE card at Bangalore International terminal lounge. Will I be charged?

Hi Sid,

Thanks for sharing your experience. I also got upgraded to Exclusive this week but my limit is still the same. How much time it took for your limit to change? Or did you send another mail to remind them to enhance your limit?

Thanks

It didn’t happen until i reminded them. Seems they do one thing at a time.

One more question about priority pass and mastercard.

Can I use my PP for access for my partner, and my mastercard for my access on such cards? Aren’t these linked to the boarding passes?

Thanks

Hey Sid,

congratulations on your upgrade to YFE…welcome to the YFE league

it been almost 6 months using the YFE , a gr8 card , especially using the reward points for redemption on amazon , now that BMS accpts amazon pay , most of my movie tickets are taken for free.

i got upgraded to HDFC infinia , and they gave me a real good limit , which makes my YFE limit look like peanuts.. do you suggest i pressure Yes bank to increase my limit to match Infinia limit ?

You should probably get a good LE if the NRV with Yesbank is also good. Else i doubt, as giving very high limits like Infinia on YFE with less NRV is a high risk to the bank.

Hi Mrinal. Can you tell us credit card enthusiasts how much limit you have in YFE ?

Also how much limit yoi have in your HDFC Infinia ?

From how many years you have HDFC credit cards and what other relationships you have with HDFC ?

I have savings account with HDFC bank for 5 years now , had business regalia with 3 lakhs limit for 1 year , then upgraded to infinia with limit of 8 lakhs

Yes bank , only YFE card with 2.5 lacs limit (not joking , its pennies compared to infinia now) … yes bank actively calls me to open a yes first savings account , i am not interested in it despite of their high SB interest rate because all my business transactions are through HDFC

For credit limit enhancement they asked me to wait 6 months from card setup date which falls next month , lets see what i can get

Thank you so much Sid!! Just got upgraded to YFE within 2 days of email to Yes First CC Team. They have automatically enhanced the limit with 20% of the current limit. My another concern now is the bonus points and also the annual spend bonus as I have crossed 7.5l limit already in YFP Card. They credit the 20k Bonus points only at the end of one year of the card setup date.

Yes, that’s right. I’m waiting on that as well. Hope it kicks in on time.

I am waiting for the same and my anniversary date is in Feb. I can confirm towards the end of the month.

I got the milestone RP (20k) credited to my YFP card over the weekend. I guess they’ll get transferred to YFE in the next billing cycle.

Cool, keep us posted 🙂

Hey Sid,

Did you get the 20K Bonus reward points credited?

I crossed the 7.5l limit on my YFP last month and this month they upgraded me to YFE. But I am concerned whether they credit the bonus reward points at the end or do we have to meet the 20L criteria for the YFE card.

Thanks.

Congrats Jay.

Want to understand your relation with Yes Bank. Just CC or Yes First( with a high NRV) Haven’t been able to decipher their criteria of awarding upgrade.

My Spends were very high and NRV on SB Account too was high from last six months.

Good review! Can you exchange the bonus points for miles or only as discounts on purchases?

The upgrade process can be done over the phone by calling the customer care. They do their back-end profile check and let you know if you’re eligible or not.

I tried it for 2 cards in my family and my opinion is that it is based more on the NRV one maintains with the bank.

Card with less spends relatively out of the two last year (around 8L) but much higher NRV with the bank got an instant upgrade.

Card with much higher spends last year out of the two (around 20L) but lesser NRV relatively with the bank didn’t get an upgrade even after escalating the request.

My experience is that NRV they didn’t look at. Spending probably they consider more ( at least for me)

Seems they aren’t consistent with their criteria

My yes exclusive request has been denied by Yes bank. I mailed them for the upgrade from yes preferred to exclusive variant. I was holding preferred card over 8 months and the total spend during this period was over 14 lacs. I also maintain a Yes First account with balance of around 2.5 lacs in it. The response I got is do not meet their criteria for upgrade.

Should I further reach their grievance cell or should I try upgrade after 6 months.

2.5L is too low. They expect in ~10X range of that for YFE.

10X range of 2.5 L ~= 25 Lakhs or 10 Lakhs ?

Should I deposit 10 lacs in my YF saving account,and again ask them to consider for upgrade request. They didnt told me about this criteria in their response mail. I wont be keeping the money for long though and will remove later.

At least with an NRV ( saving account + shares+ MF investment via Yes Bank) of 25 Lacs plus they are not offering upgrade from YFP to YFE. Tried to escalate, however that also didnt work.

Diners Black with 3.3% is anyways more than 2% return that YFE gives. So that way, diners as of now seems to me as my Primary choice. YFP can be a good 2nd pref where Diners doesnt work

Hi,

have you confirmed it is LTF?

They give LTF for card-on-card basis at least.

What is the starting series of Exclusive card , is it the same 5363 as of Yes First Preferred or different one ?

Its different

Hi,

I stumbled on this site while browsing and liked it a lot. Not sure, if this is the right forum, but have a question and any advise is appreciated. I plan to travel with my family. My wife and I have lounge access with our coral credit card (domestic access) and I have priority pass (regalia). How can I get access for my children, should I pay for them or can they be allowed on our cards (if we still have the allowed quota). Is there any chance without paying for them in lounge. Finally, very good work in sharing valuable information with everyone. Thanks again.

Shankar

Shankar,

For domestic lounges normally they won’t ask to swipe for your child. My kid is 6 years and I have never used card for her lounge access. If its International then you need to pay

My daughter was allowed for free in ITC green lounge delhi. But in lounges outside india i was asked to swipe a card for her separately. It also depends in the person swiping the card, its his discretion i believe.

@sharathkumar anbu

By 10x siddharth means 25 lakhs not 10 lakhs.

@manav by which mode(phone,email,branch) u went for upgrade??

Dhruvil,

I tried my email as well as branch. In fact on another escalation I had via social media, tried from them( this was a couple of days after the mail team rejected) However rejected via all options )

Now I am thinking to move the relationship out of Yes First if they cannot give me a card, let me find another bank / PMS service.

Regards

I got my Yes First Preferred card on June 2017 , though I applied for Exclusive I got this through card on card basis

I applied for upgrade on this February after spending around 9 Lakhs. In the meantime I opened Yes First Savings account also during last Nivember

I used to maintain around 50k in that account. When I called to CC for upgrade they said no offers avaiable now and they asked me to wait for another 6 months

Then I emailed to yesfirstcc and yestouch , after that I got a call stating my card upgradation is approved on Feb 3rd and I will receive the card within 9 working days

I called after a week to check the status and came to know that approval was rejected in the next stage as the executive didn’t mention to which card the upgrade should happen then another request was taken

On Feb 13th afternoon I did multiple transactions because of some issue in the Yes banking system they sent sms and called me in the early morning of 14th stating those transactions happened at that time and I immediately blocked the card

When I called they took new request for upgradation again and I got the courier details also , when I check in the portal it was not exclusive and they sent preferred card again

When I called they said as the card is now blocked they can’t process the upgrade so they are reissuing the preferred card

I escalated the issue then again new request for upgradation was taken and finally today I got the Exclusive card with the same limit 1.5 Lakhs

This is the only super premium card with low credit limit, though I have given CL increase request that was also rejected

Plz email for upgradation and talking to CC is of no use and in my case its only based on the spend I got the upgradation

Mouli,

As I haven’t used the card much ( DCB has got most of my usage with 10X and in general 3.3% point against 2% on Yesbank Prefferred) So as you say, spend based upgrade, I tend to agree with you

Hi Sid

Have been following your website keenly for a few months and you can unabashedly count me as a fanboy ! Real world reviews and great content all around. Coming to my query regarding premium cards, I hold the ‘Yes First Exclusive’ and ‘Diners Black’ for quite some time now. However, wanted to expand my repertoire with a top tier Visa/Amex card. What would be your recommendation for a Visa Card (preferably LTF). With regards to Amex I’m inclined towards the Platinum reserve / charge card. Any pointers on how to get the joining fee / annual fee waived off on a top tier Amex Card.

Thanks a lot and keep up the good work.

Very tough to answer as it totally depends on your lifestyle & needs. All reviews are here for you to go through and choose one 🙂

Waivers varies from card to card & from time to time. Ideally 10L spend should help, but you can put that spend on DCB or YFE to get better rewards.

Sid,

Comments with large content are not getting approved, I have 3 such instances in my case

Do you have any limitation in terms of content size ?

Hi, not really. Was away for a while, just cleared a lot of comments now.

Hi Sid,

We need an article from you with your current credit cards and how you spread your usage among them to maximise rewards. Consider it please 🙂

Hopefully soon.

Hi Sid

Any luck giving a thought to my query of 28 Feb 18. Would be grateful if you could spare some time and share your thoughts please.

Just did.

Hi, i am planning to apply for YFE directly. I hold yes first savings account with around 10 lakhs of average monthly balance. I am planning to apply card on card basis via my jet airways american express platinum credit card with limit of 3,18,000/-

I have 2 questions here:-

A) by which mode i should apply….branch, RM, email, or by calling yes Credit Card Helpline??

B) what are my chances of getting YFE directly??

Please provide your valuable suggestions below in reply comments.

@siddharth your reply/suggestion would be much much appreciated.

1. Branch is better

2. 30%

AMB and the existing limit are both less for YFE. But you can still try as they keep changing requirements now and then.

Hi Sid,

Spoke with my RM regarding this and he said i am pre approved for YFP so he went forward and sent guy at my office to sign forms and collect documents. When i asked about YFE he said he will get the upgrade done in 6 to 8 months.

So i have went further for YFP at the moment though i am not much excited about this as i wanted grab hands on YFE!!

what do you think how much credit limit they will provide me on YFP??

Totally depends on lots of factors. Many are getting low limits recently but if your relationship with bank is good enough, you can expect a decent limit.

Hi Sid,

You won’t believe, i got only 10% of credit limit of my amex card of which statement i had provided.

This is the lowest limit i have seen ever in any of credit card.

I hold premium cards of amex, sbi, hdfc, and kotak. I don’t have any banking relationship with any of these.

With yes bank i have yes first savings account with average monthly 10 lakhs balance, plus did a few fd’s recently. Still look what they did. How can they issue such premium cards with such a low limit.

My cibil score also 806, and zero payment defaults.

Can you tell me what could be the reason behind it??

Also please suggest me what should i do now because i just can’t use this card with this limit, even a single transaction will exhaust the entire credit limit of this card.

Awaiting your earliest reply.

Other fellow readers can also help me with their suggestions.

Thank you in advance.

The reasons are endless as each bank has their own way to look at CIBIL reports and the open credit lines. Yesbank stopped giving high credit lines to most lately but they’re good at increasing every 6 months. Consider escalating the case, you may mostly be considered, as you’ve YF ac in good standing.

I didn’t know there were so many credit card geeks like me out there. Nice to know.

Hi Sid

First of all I must congratulate you for great content on your site regarding credit cards. Now coming to my query. I hold Yes bank Preferred Life tIme free card which I had got on Card to card basis with my SBI card having limit of 4.5 lacs. Now after using for almost an year and spending more than 7 lacs still they are neither ready to increase the limit nor upgrade. I tried CC and mail. same result . not approved yet .

I dont hold any savings account with Yesbank . Any tips .

Hi Siddharth, can i get yes first exclusive lifetime free against fixed deposit with yes first saving account? What do you think or they give yes first preffered? I want yes first exclusive so…Dr.Hardik Patel

On March 12, 2018 I called customer care and enquired if my existing Yes prosperity edge credit card, which I was holding since one year could be upgraded. Customer care executive checked something on her system and stated that there is an offer on my credit card for limit enhancement as well as credit card upgrade. I asked her to take my request for the same and I was expecting I would get yes first preferred card. Just to confirm, I enquired about which card I am upgraded to and to my surprise she said it is YFE. After placing the request , I got my credit card delivered on March 16.

My colleague, holding Yes first preferred also called CC on the same day and he was told that there was an offer on his card and it got expired two days ago. But he still asked her to take general request for upgrade without any offer. Even he got his card upgraded to YFE and it got delivered to him on March 15.

Yes Bank hasn’t upgraded my limits in almost 1 year. They are stringent in Limits on cards for sure. I started with 50% of Regalia that i had then and its still there. Dont mind it, however not geting an upgrade to Yes Exclusive as promised verbally by RM then is a sore point.

@sid,

Firstly thanks for your prompt reply.

How do i escalate the matter to the bank??

Most of my issues were solved by sending mail to YF cards email. If it doesn’t work, you can write to nodal officers/GRIEVANCE REDRESSAL.

Hi Sid,

Thanks again for your prompt response. Appreciate that.

I will do just that and keep u posted on this.

Sid,

I received reply from yesfirstcc team & they have denied my limit upgradation request.

I even made a few new term deposits with them and my nrv with bank would be now around 20 to 25 lakhs.

I seriously can’t believe yes bank doing this to premium customers like me.

With the other bank cards i hold, i do not have any banking relationship with them still limits provided by those banks are in 3 lakhs range.

Yfp limit of only 44k is no use of me as my average cc monthly spends is around 3 lakhs from the 4 cc’s i have.

Please suggest what should i do??

Pls drop me an email. Might need more detailed info (card age, spends, type of spends, etc) on your a/c for me to help on this.

Write on Twitter. You will get a response from the nodal officer.

Thanks for taking out time to help me, appreciate your help!!

Hey,

Mind sharing the email that you wrote to them for upgrade 🙂

Its few lines about NRV, spends, spend types, age of card. Then an upgrade request. It doesn’t matter much, as they’ve all details.

Hi Siddharth, can i get yes first exclusive lifetime free against fixed deposit with yes first saving account? What do you think or they give yes first preffered? I want yes first exclusive so…Dr.Hardik Patel

No one replied my exact question so I reposted it again…

I haven’t seen anyone with LTF on FD linked card so far. Please check with your nearest branch.

Hi Siddharth , to apply for exclusive cc on card to card ,do we have to submit salary slip or just card with 8 lakhs limit is fine ..my card is 4 years old

just card with 8 lakhs limit is fine

Thank u Sid 😊

On credit card upgrade request thru email , I got the following reply.

We understand that you wish to upgrade your existing card to YES First Exclusive Credit Card and desire a higher spend limit than currently offered on your YES BANK Credit Card. Please note you need a Minimum Gross Salary (Annual) or Annual Income of INR 50 lakhs and above.

If you fulfill the above criteria for upgrade, we request you to share any of the following documents.

1. Self-attested salary slip of last 2 months.

2. Income Tax Returns with computation sheet.

I think the 50 lacs income criteria is not true for all.

A quick question – Does Amazon gift card redemption results email GC or by mail GC ? It is not very clear on website

Its a Physical GC

Ok – Can you chose which address to ship the same or does it ship to default address…Thanks for clarification and appreciate quick response

Default address.

Hi Siddharth,

I just happened to check the redemption offers for Yes Bank Preferred/Exclusive credit cards, and was shocked to see it very limited to max 7-8. I believe Amazon gift card was an option earlier, which I dont find there now. This seriously limits the redemption to only air miles now, the rest of the options are just not worthy. Am i missing something here?

Hey Sid,

I can’t find the Amazon gift voucher any longer on the Redemption catalogue for Yes First Exclusive. Has it been removed (would be sad if they have).

Interestingly, by changing the number at the end of any other product’s URL, you can find some more vouchers that aren’t visible in the catalogue. But I can’t find the Amazon vouchers (which are of most value). Do you know any way to redeem points in form of Amazon vouchers here?

Sad to see Amazon vouchers removed from the catalogue. Now what could be the best value redemption?

I have accumulated lots of reward points, because there is option to redeem as amazon vouchers. It’s not available from last few weeks, I have sent email to their rewards team asking when it’ll be available. They said currently, it’s not available so use other redemption options. When I called customer care, they said it’s discontinued use other redemption options. But I compliant like need amazon vouchers, they said they’ll raise to concern team. Maybe all users can request for amazon vouchers, so that they might consider adding in near future.

Disappointed with Yes Bank cards team now. Both Amazon & Flipkart are not there as a redemption option. Unacceptable. Will have to stop using Yes First Exclusive card altogether. 😕

Sid

Please suggest a good alternate card with Amazon as redemption option.

Lets hope they add it back soon.

SC Ultimate can help in meantime.

Sc removed flipkart and Amazon vouchers

SC still has amazon & flipkart vouchers, I checked it today… I think there is a delay in restocking of amazon coupons. That is why it becomes unavailable for few days.

Thanks redeemed just now

Trying to get SC Ultimate without the joining fee as I dont have any use of MMT. In the meantime, Yes Bank has added Hidesign, Louis Philippe, Arrow, Van Heusen and Helious to their redemption options. Still not interested. No Amazon or Flipkart as yet.

Further removed iPhones from the redemption options. Though I don’t believe anyone wanted them as they cost very high. Still hoping for Amazon vouchers to be back.

Do you get ultimate for free?

Hi All

Yes rewardz have added some redemption options : Jbl, Chrome cast, fire stick, Swiss Military, Tupperware items, PVR, Nike, Home Stop, reliance digital, mothercare vouchers.

Enjoy

Hi

Just saw a whole new set of redemption options for YFE. Genesis Gift Cards and Samsung galaxy phones etc. Check it out.

Thanks for Sharing the information about YFE. Applied for it after knowing that they will process card to card. Got the card today. Credit goes to cardexpert 🙂

hey guys,

just wanted bit if help , i am holding YFE with 2.5 lac limit and HDFC Infinia with 8 Lac limit.

want to try to get my YFE limit increased

will they do it for card on card basis ? without giving income proof ?

Hi,

No, I have Personally tried this, but somehow I feel YFE are not that keen in giving limit enchantments. I had even escacled the issue with Nodal officer but they refused to increase the limit.

Have to seen if they get liberal in coming days.

Cheers,

Kiran

thanks for the help

i wont pressure them to increase limit , am happy using the Infinia

and now since they stopped amazon vouchers , no point getting into arguments with them over CL increase

Mrinal,

Income proof is the only criteria for limit enhancement.

I got two LEs so far and for the second one, I have proactively sent my other card CC statement that has 5L+ limit. However, when the concerned team called me after the LE process, they said they would only consider income proofs along with other criteria but not the CL on other cards.

After using this card as the primary card for the last 6 months, I am thinking of switching to some other premium cards like Standard Chartered Ultimate.

Main reason being the redemption options do not make much sense to me as they have removed the Amazon Gift vouchers. So, all the points I am accumulating is not really helping much. Earlier, I had encashed Rs 8000/- worth of Amazon vouchers but now so such option. Also, I never liked the idea o f physical vouchers in this day and age. last time, I had to run around to catch hold of the Bluedart courier guy.

This time, I used the points to do a hotel reservation on the yes rewards website which was overpriced and is not the best use of the points. I will still be keeping this card as I got this lifetime free and it has awesome offers on lounge access and foreign currency markup.

I think SBI has the best redemption option as you can directly convert it to cash to pay off the credit card bills but they really do not have any premium card. I am already having the SBI prime card which offers the best value I feel. They have offered me to upgrade to Elite card but I think Elite is useless card with high joining and annual fees (unless one makes full use of the bookmyshow vouchers).

Please suggest any other option. I am planning to go for the SCB Ultimate card as HDFC Infinia is hard to get and Diners Black does not have good acceptance. I am hoping Yes bank will improve their redemption options soon.

Hi Sid,

Thanks for all the information and effort you put in for the Blog. it helps to a newbie like me.

Question:

I am 29 year male who had never used a credit card yet. I know how it sounds but yeah till now i didn’t used it.

Now i am getting an offer of ICICI rubyx card without any charges (my organisation is listed in ICICI bank).

– Should I opt for it ?

– Can you recommend me a creadit card suited for travel, cashbacks(online shoping), dining offers ??

Hi Sid,

Thanks for the wonderful blog. I want to apply for Yesbank preferred card on card to card basis, how can I do that. On their website they do not have this option, and I do not know whom to contact, I do not have a bank account with Yesbank. Could you please advise me?

Thanks and awaiting your reply.

I did call up the customer care and they took only my number (no more details) but I have not got a revert in last 2 days.

Eligibility requirements are changed by Yes bank which makes very tough to get. Minimum Net Salary of INR 400,000 per month or Income Tax Return of INR 50.00 Lacs and above

Got the YFE on card to card basis. Got this card with existing card limit of 8L+ . Ofcourse applied after reading this page :). Can someone suggest best way to redeem the points pls.

Is it LTF or paid?

Hi Siddharth how are you ?

It has been almost 6 months since you got YFE. So have you got any limit enhancement ?

Not using it lately, so haven’t tried.

Siddharth,

I am not earning 4 lakhs per months however I holding Yes First Preferred since February 2018 and SBI Elite since May 2017 also Citi has recently upgraded my card to citi Prestige.

What are the chances that Yes Bank will upgrade my existing Yes First Preferred to Yes First Exclusive. Also it would be very helpful if can guide me on how to proceed for the upgrade. My expenses on Yes First Preferred was not very high in last six months as I was using SBI Elite and Citi Rewards. My CIBIL score is 800+

Got My Card upgraded to Yes First Exclusive – Lifetime Free … The Upgrade was done in Just a Half Working day… The Interesting part is that my Yes First Preferred card was just 6 months old… I placed a request Last night through the Customer Care after my 6th month Bill was generated. He Checked my card details and took a request. Today Afternoon i could see d Yes First Exclusive Card in my NetBanking. The limit will also be enhanced. But i have to wait 2-3 more days for that.

Congrats Vinod!

How much was your spend in first 6 months…..

Hi Vinod,

Thanks a lot for useful information. Can you share what was approximate total uses in the 6 months after which Yes bank has upgraded your existing Yes First Preferred to Yes first Exclusive?

Thank you Siddharth 😊

@ Prashant , Nearly Utilized d credit limit one Month, Over paid the Card by 7000 rupees and spent 3000 rupees more than my credit limit once, 50% of the credit limit twice, 4000 rupees Twice…. Usually i use it to pay off my Business current bills. I usually pay d Credit card bill 20 days before due date.

Congratulations Vinod! I hold prosperity edge credit card. I completed six months recently and called customer care for upgrade. They said upgrades trigger itself and they can not take request

@Narinder, The Customer care guy checked n informed me dat der is an offer running in my credit card for upgrade. I received a mail regarding d offer just now. So, may be it is true that they can upgrade only when der is an offer. But u can always raise a request through mail to [email protected]

I received mail today offering upgrade from first preferred to first exclusive…Very happy to see they initiated request on their own..Good thing is it is also coming as life time free.i just accepted upgrade..Need to see in how many months i will receive the same… Anybody any idea how many days it will take.

I received in 4 days from date of confirmation by customer care.

I got upgraded to exclusive with LTF, after 6 months of preferred usage. I made transactions worth ~7.8L(just to make sure also getting 20K reward points for milestone benefit on preferred card) in that 6 months usage and maintained decent amount on saving bank account ~2-3L on average per quarter. But CC customer care team mentioned that saving account is nothing to do with CC upgrade, but they didn’t increase the credit limit and asked to request after completing 6 months of new card usage.

Will you be getting the 20K reward point for 7.5 Lakh spent on Preferred Credit Card? I’m also in the same situation, I too got the upgrade email – the card is 6 months old meanwhile the card is getting upgraded to Exclusive from Preferred – I spoke to customer care and they are saying we will not get 20000 RP i have to spend 12.5Lakh more to get 25000 RP as per Exclusive CC terms. Did someone receive RP in similar situation. I just spoke to Customer Care team.

Yes, 20k gets added to preferred card after 1yr gets over and then gets transferred to the upgraded card the subsequent month.

When I talked to customer care before placing upgrade request, they confirmed that I’ll receive 20K reward points, after one year completion and it’ll be credited to upgraded card.

I have completed first year and 20K reward points(RP) not posted for preferred milestone. I talked to customer care executive, they’re now saying exactly opposite of what they told during upgrade, similar to what Ajmal posted(if preferred is upgraded to exclusive need to spend 20L from preferred card setup to get 20K RP). Did anyone got 20K for crossing milestone benefit of spending 7.5L on preferred and upgraded to exclusive plus not spend > 20L and still got 20K RP?

Hi, today my yes first preferred card was upgraded to yes first exclusive…my card was just 5 months old and i got email that my card was upgraded…i was surprised…Dr.Hardik Patel

Congratulations Dr. Patel. Can you tell us about your initial CL and the expenses you made on your card ?

Hi, Got an email from YES Bank yesterday to upgrade to Yes First Exclusive, after 10 months of Preferred usage. Applied and waiting for the new card.

My YFP was just 5 months old. Total spend in this period is 1.5L. Do not hold any Savings account with them. No relationship with Yes, except CC. Today got mail with LTF YFE card. Opted for the same

Hi Sid,

Today I have received my exclusive card. I have received a mail to upgrade my preferred card and after going through your blog I got it upgraded. Thank you

Congrats. So far 20+ blog readers have reported the upgrade to exclusive 🙂

I didnt get the upgrade but my limit was increased by 25%.

Same here. Looks like YES Bank upgraded a lot of existing YFP to YFE last week. Hope they don’t start start trimming rewards like HDFC did with Regalia.

Highly disappointed with Yes Bank. They refused me any such offer and had declined an upgrade 2-3 months back. With this lousy limits i will just shift. Will shift to Amex/Hdfc. I already have significant holdings with Yesbank. They simply do not understand the meaning of service. Will have to shift my accounts away from YesBank. My experience with Hdfc has been really good at least for our current accounts.

For the all the folks who have been upgraded to YFE, what was the spending like? Was it used like a primary card and high spends or just average.

Hi,

I spent around 8 lakhs in 9 months and went for upgrade, after lot of escalations and calls finally got the upgrade to YFE

I was also upgrade to YFE after around 1.6 years of holding YFP.

I did around 12+ lacs transaction in the first year since they had lot of 2x/3x/5x offers going on but reduced the spend drastically in past 6 months as there were no good offers.

Do you think with so many customers being offered a free upgrade, they will devalue this card?

I was looking forward to the unlimited Priority Pass usage, hope they dont spoil the party

Its indeed not so good to upgrade a lot of people even with low spends. But they wont devalue so early.

Got YF Preferred (Life Time Free) on card-2-card basis, that time they asked 3L limit on the card. Now my friends applied, they asked 4L limit on existing card for YFP.

After 6 months i sent income docs for limit enhancement. Handsome salary + 800 cibil, still requested was rejected. Good thing I got 2 calls after that, shows humbleness of Yes bank.

8 months over, used the card in Marriott hotel to settle charges. Next day itself get an email to Upgrade to YF Exclusive. Life time free was clearly written in the invite email. This can’t be a coincidence, hence wanted to share this with all. Pay attention folks.

I think other banks might also be following this info that who is spending where. Now I have following cards:

Yes First Exclusive LTF

SC Ultimate

SBI Elite

Axis Signature

Diners Miles LTF

Amex MRCC LTF

Will now use Diners where ever hotel/luxury spent is expected, hope to upgrade to HDFC Infinia, if possible. Mind you, my HDFC limit was 2L and after opening Salary acct in HDFC, limited increased to 5L in just 3 months. So yes NRV matters.

I was offered an upgrade to YFE after using YFP for 8-9 months. Received it today with an unlimited PP card today in a very fancy package 🙂

With extremely good benefits, here are a few things that can improve,

– Card doesn’t look like super premium, top of the line.

– Add-on card application process is completely manual.

– App and web UI sucks.

– Rewards catalog can be better.

Just received the upgraded card after clicking a card upgrade link sent on mail 5 days back. Good thing is that The add on card was also included in the package.

It may be noted that i was holding YFP for about 14 months..other than that no relationship with the bank. Further , for the past 6 months no major transactions was made on the card as I shifted my expenses to Diners Black. Monthly statement would have around 50K in this period. No information sent or request made for up gradation ! However , i did cross 7.5 lac spends in the year.

Anyhow , happy that it was done 🙂

Hi All,

Had put my YFE on cold from last month, received this offer sms today

Get 8000 Bonus Reward Points on spending a total of Rs. 110000 or more with YES FIRST Credit Card ending ****. Valdity: 5 – 30 Sep’18.

Cheers,

Kiran

Looks like Yesbank is getting clever in sending the spend based offers.

Seems like a 4% to 4.5% rewards instead of the usual 2.5% on achieving target spends based on average spends done recently plus a target to push you to spend. Got similar offer on YFE with 4.3% return.

What happens if you put your card into cold storage suddenly and don’t use it for a few months?

How long is it before the Bank take notice and then does it contact you with some offers or LE or upgrade etc??

Since, I have taken this card they have not enhanced my limit despite raising the concern to nodal officer several times. Since my usage was almost to credit limit every month and my limit was very low.

In the past 6 months I have not received an promotional offers on the card was confused.

Then I did read about putting the card to cold storage helped few people to upgrade and get better offers, after reading that decided to close total outstanding from August 10th I put the card on cold and on 7th Sept I get the promotional spend based offer.

Will not use until they give me a limit enhancement offer.

So thanks to #Cardexpert, Admins and members of the blog.

Its quite confusing I have been a die hard Amex card user and use up maximum of the limit your always rewarded, but YFE works the otherway.

Cheers,

Kiran

Kiran – very interesting!

Will this work with HDFC cards??

I had crosses 7.5lakhs spend within 10 months on my YFP. How long Bank takes to credit 20000 Reward points on 7.5lakhs spends? (12th Month?)

I had requested them to upgrade to YFE and sent them my Sc Ultimate card statement (Credit Limit: 8.1lakhs). They rejected my request to upgrade. So i decided to keep YFP in cold storage till upgrade (as Ultimate card having better rewards compared with YFP).

Yes exactly what I was asking – does the Bank contact you with some offers or they are generally not bothered?

Bonus points are credited on completion of one year of card issue and same time for every renewal, If you spend 7.5L in six month then you will not get bonus points imminently, You will still have to wait one year to complete.

Murali,

After completing your first year,then 20000 RP will be credited

Thanks,

Mouli

I think benefits/rewards on YFE are very limited (leaving PP and foreign currency markup). It feels good getting so many rewards, but then each one is worth 25p only. For bookmyshow also, many cards offer upto 500 ticket free in 1+1, but for YFE it’s capped at 250 per month.

Hi All,

Finally got my YFP upgraded to YFE. Its quite a bit of story.

Monday Night, while reading thru this article here, I could see greater number of “YFE New Request / Upgrade” are getting accepted. While I have had the YFP since April 2017 all my prior request for upgrade have been rejected. I tried all possible channels.

This time a 2 liner mail sent on Monday 3rd Sept night, got me a response. Next Morning, I received a sms asking me to send my Landline Number to a mail id of Yes Bank Employee. Then a call and mail for confirmation of Upgrade on 5th Sep. Finally Card got delivered on 8th Sept Saturday.

So finally had my “tathastu” moment – ( wish fulfillment) for Yes First Credit Card.

When I started my Yes Bank relationship, I was told I will get an upgrade of CC after 6 months. Later the RM resigned and everyone put the blame on him and washed his hands off. Now that the upgrade came finally.. Feels happy.

Regards,

Balpreet

You are lucky to get YFE. My YFP card was issued in June 17 with cr limit of 4.99 lac. My request to upgrade made on Aug 31, followed up with mails on Sep 03 & call to RM, yet to fructify.

You need to wait for atleast 6 months for Upgrade or CL enhancement AFAIK

I don’t think it works like this. I must have spent over 3 lakh on my YFE over last 3 months and I still got this offer of 8000 extras points on 100000 spend. and I have a quite high credit limit of 3.8L on YFE.

offers and all other things must be managed using AI by banks and hence these offers. and I certainly doubt if one stops using the card, they will get the upgrade. upgrades are usually made on basis of spends and not on who has stopped spending.

I hold YFP Card, Just received a spend based SMS and the email:

Get 5000 Bonus Reward Points on spending a total of Rs. 60000 or more with YES FIRST Credit Card ending **** . Valdity: 5 – 30 Sep’18.T&C:

Cheers,

Satish

Hi Siddharth

I applied YFP on card on card based , I have given my Citibank card with 7.89L CREDIT Limit, they issue YFP with credit limit of 31000, I am in shock how thay givin this much low Limit, to make sure I checked my CIBIL , CIBIL score is 829

Now what I have to do ? Where can I complain ?

They have given less than 5℅ of my current credit card limit.

I have only Citibank cc with me I always paid my bill before time never used Citibank cc more than 60℅ of credit limit.

What should I have to do ? Should I return this yes preferred CREDIT card, or there is any way to short this out

If any one can help me with this

Thanks

Ask your RM or email them at yestouch@yesbank(.)in

They do realise their mistake and increase the limit.

No. They don’t realise their mistake. They give paltry limits. I recently applied for limit enhancement, they even rejected that. I guess I’ll have to wait for atleast 6 months to apply for limit upgrade. Pathetic service.

Hi Abhishek

I went through the same initially too. They only increased the limit marginally. Later substantial auto limit enhancements were offered to my entire family YFE cards. Once in October 2018 and then again in December 2018. So I don’t believe 6 months waiting applies.

Just use the card dor sometime and then ask for limit upgrade. Yes bank is useless and unpredictable in terms of credit limit and card upgrades.

I completed my 1 year with my YFP Card, received 20k bonus reward points :), I contact CC to just verify if i’m upgrade auto eligible, by grace it is. They took the upgrade request. Hopefully I’ll receive the card soon.

I’m holding SC Ultimate Card with limit of 8.15L and Regalia 3.6 L. With this now I’m holding 2 cards of Super Premium Cards. Will chase HDFC DCB soon.

Received my YFE Upgraded Card, all reward Points are transferred perfectly, as I participated in spend based reward Points program I check with customer care and I confirm there will be no issue in posting them too since all accounts are Setup at account Base level rather card level, so we should be good to go.

Thanks Guys, I came to know about Yes First Exclusive card through this blog when I was looking for premium cards in India. I applied for it 2 weeks back. Today I received it along with the PP.

The worst part is that limit is just 5 lacs, which is lowest of all my cards. I applied on card to card basis using my hdfc infinia which has limit of 20 lacs. Good thing is it is life time free unlike infinia which I believe has some annual fees. Will come handy during my international travel expenses as the forex charges are less. Thanks a lot once again.

Hi

I was going to apply for a yes bank add on card for my wife. Is Aadhar number still mandatory after the supreme court verdict, because I checked in Yes bank form it is marked as mandatory. If I don’t provide it ,will the card be processed.

Guys, JUst signed up for YBP card and should receive it next week. Was curious to know one thing. The card states 8 RP for every INR of 100 spent on Retail. There is no other mention for accumaltion of RP.

What could Retail be limited to. Only physical POS or will it also be applicable for online ticket bookings?

Retail transaction includes PoS, online, international etc.

Hello Sid,

I have credit limit of Rs 775000 on my current card

will I get YFE card , Card on card basis?

Regards

Sanjay

Check with the bank. Recently they have made some changes to the YFE card eligibility making it harder to own (compared to last year)

What are the changes?

Hi Sid,

I have received mail from Yes Bank to upgrade my preferred card to Exclusive. I have opted and received exclusive card in a week. It’s great experience having the card.

Hi Sonar

Do let all know if you get a plain card or an embossed one.

I am using this card (Yes First Exclusive Credit Card) for over 2 years now and will say that it is going down the drain when it comes to Rewards Redemption and options. Maybe they are following in steps of HDFC in the way they had downgraded features of Regalia and rewards value.

Couple of months back Yes Bank rewards website took out the option of Amazon vouchers and today upon logging saw that even likes of voucher for Shopper’s Stop, Croma, Lifestyle etc is missing. Pathetic reward system.

I am stopping YFE completely (it’s LTF with limit of 7 lacs) and exploring alternates. Pls suggest.

If you like shopping vouchers, look into SBI Prime/Elite or SCB Ultimate. For travel vouchers, since you qualified for YFE, you may qualify for DCB/Infinia.

You may also look into Amex trifecta of Gold/Payback/Travel cards which will give you terrific value in form of vouchers for spends up to 8 lacs a year.

Hey Amex Guy,

Thanks for your feedback. Missed it reading.

Travel Vouchers are not very helpful for me as don’t plan/travel much. SCB Ultimate – will check as you are the second one suggesting.

Amex guy has summarized perfectly. In my opinion go for DCB with SCB ultimate as a backup. And amex MRCC is a must uave too. For the last 2 months scb is running extra 1-1.5% cashback which has increased the reward rate for me.

When does the Reward points expire on this?

I didnt get any info on this reward expiration in Yes Bank website ,but somewhere I saw that they never expire.

Can someone please confirm as I am having almost 1L rewards and planning to accumulate more.

Points never expire

Sid,

which is good credit card now in indusind and kotak as most of credit card benefits are down graded ?

recently applied for Yes first preferred , got credit card but they have provided only 32K credit limit , yes thats right 32K credit limit with this premium credit card which also provide priority pass ,

I try to escalate issue with yes touch , twitter but no positive replay finally surrender yes first credit card

Now want to apply for credit card please suggest which one is good ,My cibil score is 830 having sbi credit card with 7L credit limit, want to apply on card on card basis

I dont see LTF YFP & YFE on yes website. Not even normal ones as LTF.

Seems like yes has got good numbers.

Anyone recently took YFP/YFE lifetime free ?? Thinking of refering a fren for LTF.

Sid can u enlighten ?

Dear Praveen

Its still on their website for almost all their cards except YFE n Prosperity Cashback cards. Just checked now. LTF for Yes account holders mostly.

Is Priority Pass usage in India lounges charged on YFE cards? My wife recently swiped hers by mistake.

I think its changed sometime back,usage of PP in domestic airport is getting charged

@Tarun

No

Hi sid,

So tell me one more thing the priority pass also gets exclusive tag on it like your credit card?

No Aditya. The Priority Pass is the standard across all banks irrespective of free limits.

Struggling to get an upgrade to exclusive… Please help

I have YFP from June 18.. applied for the in Jan 19 after 3.6 lac spends till date.. request denied however limit raised from 50k to 1.13 lacs.. spent additional 1.2 lacs in a single month and asked for upgrade in last week.. again request denied.. however limit increased from 1.13 lacs to 2.25 lacs.. already spent additional1.6 lacs after that.. planning to spend more 3 lacs in coming 2 months for official trip so that total spends will be more than 7.5 lacs… Very low chances of increasing NRV by AQB in savings for high amount FDs due to limitations.. anything not that I can try other than increased NRV?? Net monthly income is 1lac approx..

Hi Aditya : Was the Limit increased over Call or u received the LE offer through email? What were your Spends Mostly on? Because i had the opposite of your experience… I asked for LE but Received mail for Upgrade to Exclusive.

Hi Vinod.. lucky you :-).. i got a call both times saying that upgrade rejected but instead LE, after I sent the mails for an upgrade.. I was using it as my regular card so no spend category in particular .. however in the last month, I did spend 1000 euros.. that’s probably what made them double my limit for the second time in two months.. what were your spends like? Was wondering if I could use your tips for the upgrade?

Received offer today on yes first prefered card. Get 5% cashback on fuel spends max Rs100 per month, valid till 31may 2019.

Called YES FIRST care for Temp Limit enhancement , I got an executive who has very good knowledge of both YFP and YFE cards, he took my request and understood my concern for more limit ! But he can’t increase my Permanent limit though as he said no offer on my existing YFP card !

At the end, He said that based my card usage and repayment pattern, bank can offer YFE LTF as current YFP also LTF 🙂 I grabbled the offer with both hands 😉

Few things I understood are..

1. Being nice to the YF CC and explaining our concern with patience would help.

2. Min 6 months age on YFP and Few forex transactions and reaching the full limit usage once or twice would help.

3. I’m also YF savings customer but I hardly doubt if that relationship really helped for upgrade.

Most imp thing is I got a service request number on phone so ..I would say the CC guy raised a manual request so..its not really some upgrade from system ? Not sure though !

Hope this info helps some more guys for upgrade

Bad New Guys,

Reward Points reduced to 6 in place of 10 For Every 100 Rs on Retail Transaction.

Got Email for the same YFE

@ devandera

6 points? But their site says 10 points for every 100 spent. For how long are you using yfe? Then what about yes first preferred reduced to 2 or 3 points?

Do we get reward points for EMI transactions too?

I have opened acc with yes and asked for ltf yfe on card on card basis.

Got an auto upgrade offer by SMS today. Called CC and was told it is LTF. So went ahead with the upgrade. Should receive the card in couple of days.

I too got SMS for the upgrade from YFP to YFE this week. Same as you called CC who confirmed its LTF, so went ahead of the upgrade. My current YFP is a backup card for SC Ulitmate.

So looks are they are very generous in upgrading from YFP to YFE.

Yes. I hardly used the YFP card. Still got the upgrade.

Hi Siddharth,

I have been using HDFC Regalia with 3L limit for last couple of years. I am holding a YES Prosperity Account for a couple of years with Avg. monthly balance of 2L and a FD of same value. I upgraded my account to YF around 8-9 months back and applied for YFP in January 2019. I got the card with LTF but a pathetic CL of 80K. This makes the card almost useless and hence has resulted in a total usage of 2L-3L only. Last month I got my Regalia upgraded to Infinia with 8L CL mainly due to NRV. I will be completing 6 months on my YFP in July 2019 and wanted to apply for a YFE Upgrade. What’s your suggestion on how to approach this to increase the chances of first time upgrade?

can you give aproh NRV range here, as a pointer?

Guys, I missed out on the upgrade since never got any email or SMS in the month of March. When I called and spoke to the customer care, they insisted they sent a mail on 4th March. Anyways no point in crying over spilled milk.

Wanted advise from members if there is any info about the upgrade being offered again to people like me who missed it or any other way to get it?

Guys i have got YFP with very low limits. Now its one year old. So have escalted the issue. They have come up with a shocking offer.

They said relevent team said no LE but we can upgrade to YFE (LTF) as an exceptional case. Limit is 40K. Spent approx 4L on the card. I have been spending as much as possible. Taking part in every spend based prog. and been maintaining high relationship with the bank.

What should i do now for LE?

Wait and don’t ask for limit increase

Let them come to you. Telling you from experience.

40K limit after having 1 year of rekationship?

May be they are being cautious after all the NPAs and recent stock crash. 😛

Points Addict,

Some of the guys at customer care even shocked when i tell them about my limit. Still my case is opened. Let’s see what happens.

Amann,

I was contacted by same guy yesterday. He asked me income documents, i provided let’s see what they can do about it. Some of guys here got LE/Card upgarde/offers when they put the card to cold storage.

Lets see what happens. Hoping for the best.

1st of all grab the YFE offer with both hands. Think about LE later. I am not getting any upgrade offer. Since the limit was too low in my case and the card didn’t have much benefit, I was not even bothered to spend on the YFP. Don’t know if I’ll ever use it if they don’t give me an upgrade.

Himanshu, I agree with Abhishek. First take the upgrade to YFE. LE can happen over time. In fact, wanted to know which city and branch of YES bank are you dealing with. I’d love to approach your customer care executive and try and convince him for an upgrade for self. If you dont mind, kindly share details via mail to me. my mail id is my-name without spaces at gmail.

Hey Paresh,

I just droped the mail to greivence team and they took the request. Just drop a mail to head.grienvanceredressal [@] yesbank.in stating that you are looking for upgarde + LE. All the best.

Himanshu,

How did the upgrade go? Did you manage to get YFE?

I have YFP with limit of 3.5L for around 18 months. I tried for upgrade 3 months ago via customer care email and they said they can do if I meet their income slab (50L!!!) but I don’t.

Do you think I should drop a mail to the grievances and see?

Seems to be true. I also received LTF upgrade offer from Preferred to Exclusive though its hardly 3 months i have been using the Preferred card.

Have received LE offers since april this year on my Yes first preferred card.

from 3L to 5L.

from 5L to 6.5L

from 6.5L to 8L

Last week, have asked for upgrade to Yes first exclusive and this time they have accepted my request.

Fellow holders,