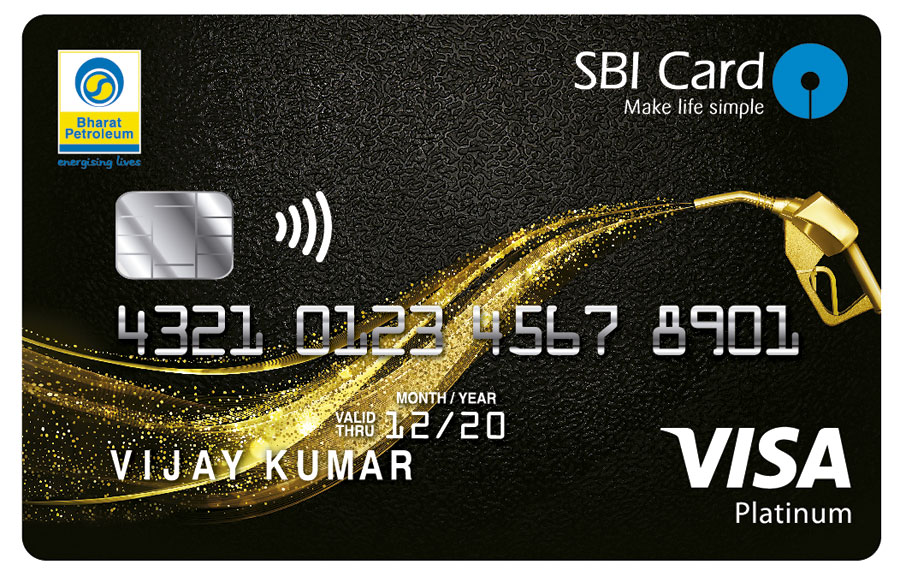

SBICard recently launched a dedicated fuel credit card in association with Bharat Petroleum Corporation Limited and this article is all about it. The features mentioned on the card is kinda bit confusing because of lots of terms and conditions but here we’re to breakdown the numbers.

Table of Contents

Overview

| Type | Fuel Credit Card |

| Reward Rate | Upto 3% |

| Annual Fee | 1,000 INR+GST |

| Best for | BPCL Spends |

| USP | Good redemption options |

I would never suggest fuel credit cards to anyone and SBICard support is very poor in that matter. So, stay away!

Joining Fees

| Joining Fee | 500 INR+GST |

| Welcome Benefit | 2000 Points (Rs.500 worth of fuel) |

| Renewal Fee | 500 INR+GST |

| Renewal Fee Waiver | Nil |

Your joining fee is only partly offset by the welcome benefit (except GST). That aside, you don’t get renewal fee waiver with this Card, which is otherwise present in Axis Indian Oil & Citi Indian Oil fuel credit Cards.

Features and benefits

The “13X Reward Points on fuel purchases at BPCL” simply means 13 Points and as the value of each point is Rs. 0.25, effective value out of 13X points = 3.25%. Now lets say you fuel for Rs.1000 and see how much you save.

- Fuel Charge at BPCL: 1000 INR

- -10 INR (1% Surcharge)

- +10 (1% Surcharge Waiver)

- -1.8 (18% GST on surcharge)

- +32.5 (13X Points)

- Total Savings = 30.7 INR Equivalent (3% value)

So, in simple words, you can save max. Rs.325 per month (1300 points max per billing cycle) if you spend ~10,000 INR (may differ if you cross this limit) exactly ON FUEL but the effective savings maybe lot more if you’re currently using a credit/debit card that charges you surcharge.

Apart from the above, you can also get 5X points by spending on certain categories, which will save you 1.25% (5X points) which is OKAY if you don’t have cards like SBI Prime (review here) which has wonderful reward rate on many categories.

Conditions:

- SBI Surcharge on Fuel: 1% or Rs.10 whichever is higher (txn value Rs.500-Rs.4000)

- Max Surcharge Waiver: Rs.100/m (Spend: Rs.10,000/m)

- Max txn value per swipe: Rs.4000

Important Note: If you note the first point, the above savings wont work if you fuel BIKES, which is usually in Rs.500 range. Hence, holds good for car fuel spends between Rs.1000 to Rs.4000.

The limits above are in place to avoid charges by commercial vehicle users. Ideally, this is an acceptable limit for the card as its primarily positioned for beginners with BPCL spends.

Bottom line

- CardExpert Rating: 3.5/5

Its good to see banks come up with dedicated Fuel cards but i wish it could be made even more simple. For example, I always prefer to use Amex cards at HPCL pumps so i get NO surcharge at all – peace of mind.

That aside, overall its a decent card for those who’s getting started with credit cards or for those who like a good value back on fuel charges. If you’re looking for even better fuel card, do check out the list of Best Fuel Credit Cards in India.

What’s your take on the new SBI BPCL partnership? Feel free to share your thoughts in comments below.

Still icici amex hpcl gives 4% value and citi indianoil gives more than 2.5% values apart from the surcharge saving. I think these are the best out there.

Yes it is. Its quite a basic card and we should take it as “something is better than nothing”.

hi sir

I can’t redeem my SBI BPCL credit card point at petrol pumps.can you provide the list of petrol pump in Delhi where one redeem that points.

It is worst please don’t keep dreams to redeem ur points in petrol bunks

Friend,

There is no BPCL or very few BPCL pumps that allows redemption of accumulated points as fuel. I had tried to redeem the points but it is a wastage of our time. I even tried tk raise this issue with BPCL twitter handle and they simply beating around the bush. I haven’t seen any pump that allows me to use this facility. I am based out in Kerala, and there is plenty of BPCL pumps here. Even BPCL owned fuel outlets don’t allow this feature, you can imagine the condition of other pumps.

Yes, even I am facing this issue in Hyderabad, Telangana. I have inquired with customer care and as per their update this card will work any BPCL outlet in hyderabad or metro cities but I have tired around 10+ petrol pumps but they are not allowing these rewardpoints and yes, this is waste of time and I am planning to cancel this card.

Completely useless card.

I can’t redeem my SBI BPCL credit card point at petrol pumps.can you provide the list of petrol pump in pune where one redeem that points.

Hi,

BPCL pump near RTO pune

BPCL pump FC road

Hello sir,i have some complain abt bpcl credit card.actually as per my credit score the company offer me credit card.they collect all my document,and visit my place also.and also they told me u are eligible ,within 11 working days you ll get your card.but i dont know why they people suddendly cancle my card.its like harrasment to client.if i m not illgible then tell me on the time ,but they done all formality but cancle. I am so harresment of this company.plz let me know how i give complain abt this fraud company.and also i want all my document back.pls let me know abt this procedure.i dont know where to give the complain.m glad if you solve my problem.thanks

Sir these people entering your details at the time of verification make a mismatch of your address so either you are not eligible or they mismatched your given info like name, address or contact info. Please fill a complaint and ask the customer support why did they cancel the card.

Thanks

Fuel surcharge in sbi is 1% not 2.5%

Standard charted card is also good for fuel , as it provide 5% cash back ( effectively 2.5% after surcharge ) for min transaction of 750/-

Icici gives 4% after surcharge. Ans citi 2.6% after surcharge.

StanChart’s Super Value Titanium is the best fuel card. You can use it at any fuel station. Spend Rs. 75,000 every year and the fee will be reversed. I am saving Rs. 200 every month which accounts for Rs. 2400 in a year. 4% sc cash back, 1% surcharge reversal and 0.75% cashback from government. A total of 5.75% cashback. Plus there is no charge for transferring the cashback in your cc account.

Cool!

Maximum surcharge waiver is 100 rupees per month.. waste.

Dear siddharth ,

can you share the list of station,where i can use my BPCL voucher (delhi NCR)

Yes it is. I am also using Stan C Super Value Titanium. It has max limit of 200 a month. However I still find it useful. When I fill petrol for 1000 rs in any petrol bunk. I get 40 rs back and Fuel surcharge will be waived. There is no expiry to this Cashback and you can add the Cash earned to your Credit card anytime.

Fuel transaction – Min – 300 rs & Max – 2000 rs.

I am not sure, however I will say I find this Card as a Good Fuel card. **with few conditions.

BTW. Fan of your blogs. Pls continue your work.

But from this onwards they are not reversing Annual fees against my spends more than a lac rupees per annum. There customer care people are also very pathetic having no authority or eagerness to retain old and loyal customers.

My fuel spends are approx 30k a month…I have Infinia, SBI Elite and Citi Premier miles. Which card is the best to use for fuel? I believe all of 3 cards hv surcharge waiver and no reward points on fuel?

Wallets might help you 🙂

I switched to wallets for my fuel spends where I get 5% or 10% returns depending on the offer.

Citi-IOCL, Amex-HPCL partnerships already in place, BPCL was left out and SBI roped them in now. A good competition in place but I feel wallets are more rewarding than any of the fuel cards.

True that! It works as long as banks keep rewarding Wallet txn’s.

Sid,

I have a different strategy for fuels. Pay using Mobikwik (or Paytm if Mobikwik not available) and load them with that credit card which gives you the highest yield (in my case Amex Plat Travel Card).

On Mobikwik effective savings for fuelling upto Rs 10K per month could easily be around 4-5%, no surcharge and around 7% yield on Amex PT.

Regards

That’s a nice idea which i think you’ve shared before too. But in my case, no wallets are being accepted in my location.

P.S. I’ll add this point as an option in best fuel cards list shortly. Thanks.

The SBI website mentions 4.25% value back. which would be 3.25% + 1%.

So i think that would mean 325 saved on ever 10k spent on fuel.

Its false marketing. Pls go through the article, Its in-fact 3.82% value back!Amrit is right, the fuel surcharge is 1%. I have this card (offered when my 10 Year old Gold & More was up for renewal), for a fuel transaction of Rs.2400, the card was charged Rs.2428.32 (surcharge of Rs.24 @ 1% and GST of Rs.4.32 @18% on Rs.24). Surcharge of Rs.24 was credited back and so was the 0.75% GOI cash back of Rs.18. The reward points credited were 312 and that’s equivalent to Rs.78. So, for a Rs.2400 transaction the value back is indeed 4.25%, i.e Rs.102 (Rs.78 worth reward points and Rs.24 as surcharge reversal). If we factor the GOI cashback of 0.75% the value back is 5% for now.So, their marketing isn’t false.

Thanks for sharing your experience on this Rajesh. I just figured out the surcharge has gone down to 1% from 2.5% earlier. Not sure if its same case with all banks.

That being said, i’ve redone the calculation and updated the article accordingly. I’ve assumed GST is not refunded.

Yup, GST isnt refunded. Cheers!

Hello Siddharth, first I’d like to thank you for keeping such an excellent blog. This is where I got my basics of credit cards and started building my creditworthiness. I got this SBI BPCL card last month and have been using this since. It is my second card, with the other one being a 9 months old HDFC Times Titanium card. I got the SBI card seeing the 13X rewards on fuel spends (I am a motorcyclist and spend a lot on fuel), but after reading your article I have decided to upgrade the card to Prime or SimplyCLICK variant as soon as I can.

I’d like some suggestions on the HDFC side of things as the 25% off on movie tickets isn’t much use to me and the Times Cards are of the lowers value group in the redemption catalog. I would like to change that card to something else in the HDFC range (wanna keep something from HDFC as it is my second oldest line of credit). I mostly spend on fuel, shopping, dining, and hotels (not star hotels as I travel to remote regions more often), but not so much on air tickets and stuff. Does it make sense to look at a Diners Club card? My current limit on the Times Titanium is only 65K and my take home salary is around 40k a month. I expect HDFC to improve the limit as there is a good amount of usage on that account (always paid in full), with around 4 EMIs that were all paid without a single default. DO you think the Diners Club Premium is a good fit? I also have an ICICI Coral Debit card with 2 domestic lounge access every quarter. I’m open to suggestions as to how I should progress with the cards.

You mentioned “I always prefer to use Amex cards at HPCL pumps so i get NO surcharge at all”

Is there any minimum transaction value requirement for this?

No, there is no min. limit. But there is a max limit, which is good enough though.

We spend around 7000/ month for petroleum ,is this card worth for me or should I choose other card. Which one would you suggest?

Thanks Siddharth for such a nice review. Could you please explain in case of spending Rs.1000 on Non BPCL Pump how much waiver/ cashback we get.

I think this is better than other fuel cards. I maybe wrong. Other cards have precondition that the swipe machine should be of same bank.

Citi Indian oil card has this precondition, but it has been waived off recently

Got another targeted offer. This time from SBI. Says “Use your card no. ending xxxx 6 times for min trxn 1000 from 12 July to 31 Jul 18 and get free Flipkart voucher worth Rs. 1000/-, not valid on cash & fuel.

Hi,

The SBI card provides rewards points worth Rs. 0.25 each.

Can we redeem them as cash into the credit card account?

Like say we have 5000 points which is Rs. 1250, can this be adjusted into the account?

I see somewhere that we have to call customer care to do it(no online option and don’t want to use the catalogue items, but actual cashback into account). Does it have any redemption charges in this case? (If I remember correctly, HDFC charges Rs. 99 for each redemption)

Hi,

Just wanted to update members of this blog –

I have this card and have been using it for fuel purchases, though the rewards rate for fuel is one of the best in the industry however the rewards cannot be used for fuel redemption.

I have been to over 10+ BPCL outlets in Mumbai ( all of them mentioned in the dealer list on SBI site) none of them accept this card for redemption of points against fuel. The site also mentions one can redeem points for BPCL fuel voucher however in the points redemption section on site no such voucher is available. Other voucher are available however they give a lower over all return % when compared against fuel. Have raised the same concern with nodal officer, awaiting response

Hi Karan

Even I am facing issue with this card the 3 benefits are namely:_

1. Surcharge waiver 1% exculding GST

2. 0.75% Cashback for digital transaction

3. Reward points

Out of the 3 things I sometimes do not get credited with all 3 of them or sometimes for two of them.

Credit of rewards points is also not guaranteed and they only get credited when I mail the customer care.

It is very difficult to keep track of all the transactions and whether or not there benefits have been credited.

Very poor experience and greatly disappointed.

Same problem with me.*

Same issues being faced with me.

Even an e-mail to customer care wont help, one have to call (multiple times) for every single transaction – which is practically infeasible.

To make matters worse, the Nodal officer is no less than a “Sarkari Babu”

Worst experience and deeply disappointed is an understatement.

Definitely a mistake on my end to apply this card

Will switch to wallets for fuel and will put this card on a freezer mode.

Update after 8-9 months.

SBI seems to have upgraded its system. No issues 90% most of the times with regard to rewards redemption, 13x points, surcharge reversal and 0.75% GOI valueback

Now its the best option for 4% return for my yearly fuel requirement

Do you still get 0.75% GOI cashback? Read somewhere that it was changed to 0.25%. But I don’t even get 0.25%. Kindly confirm.

0.75% GOI valueback stopped from 1 October onwards. This was in public news

So have to contend with with 3.20% now

Sid, could you please share your review on newly introduced “SBI BPCL Octane credit card” which rewards more than 5%

Soon.

Hi Karan,

Did you get a reply from nodal officer on this? Even I am also experiencing the same issue.

Hi Amitava,

Finally figured out how to redeem for fuel, we need to call customer care and request for BPCL evoucher which cost 1000 points for a INR 250 voucher, you will receive voucher in SMS, which can be used at any BPCL pump, however i usually sell them online for some discount

Hi my monthly fuel spending around 25k…. Can any one suggest me best fuel card…. Right now IAM having Citi Indian oil card , HDFC dinner card and some other cards…

If your filling the fuel in IOCL petrol pumps then citi bank Card is good u will get .75% has cash back and reward rate is also good. Also you can redeem the points for filling ur fuel 1point = ₹1.

Which goes a good value and spending 30K ur annual fees is waived off. So by just using this card for free u get good reward rate.

the cashback from the Govt has been reduced to 0.25% w.e.f 1st Aug 2018

Hi Siddharth,

Please review ICICI HPCL coral AMEX credit card if possible. Other than cashback on fuel they are offering 2 lounge visits per year. Considering such a low annual fee the card is total value for money. Plus what is the way for a reader to get a review published? I wish to review few of my credit cards which are not reviewed here.

I had the same card for low fee and lounge access.

BPCL SBI CARD is useless.Cardholder has to call customer care service to get 13x rewards for every transaction or send mail for each transaction.Same for the cash back also. I give 0 star in 1-5 star RATINGS.I struggle for rewards and cash back.

SBI Bharat petroleum credit card is useless and pathetic.

Please don’t use.

On the sbi page, it says maximum limit of 10000 per month? Is it on the savings using value back?

Hi Team,

I am using this card for last 4 to 5 months. I use it to fill petrol in my bike at BPCL petrol (Godrej BPCL petrol pump, LBS Marg, Vikhroli, Mumbai 400079). I fill petrol worth Rs 200 every week or twice a week. The amount that I pay at the petrol pump by card is Rs 200. Even I get message of that much amount being cut, but as per credit card statement the its always Rs 212.58 that gets deducted from the card.

Is this fraud?

Hi Vishwesh;

That’s not a fraud it’s your surcharge which is been charged.

Use your card for more than ₹400 and less than ₹4000. The surcharge should get reversed back to your account, say for ₹12.58 extra charged you might get back around ₹11,

Hope this helps.

Cheers,

Kiran

Dear brother me too had faced the same issue but the sbi person’s are least bothered about our issues

Hello,

I am a fleet owner ( Transporter ) i have consumption of diesel of 25 Lakh per month.

Can i use this card for above consumption.

Regards

Hi Mahendra,

Using your card more than ₹4000 per swipe wil have surcharges added to it, you wil end up paying an higher surcharge by using it for 25 lac and having a higher credit limit on this card would also not be possible.

Highest surcharge waiver card is Citibank IOCL Card wherein you can swipe upto ₹10,000 without any charges subjected to condition you swipe only at IOCPL pumps.

Cheers,

Kiran

The Surcharge waiver is now changed to Rs 100 pm. Pl change that.

REWARDS POINTS ARE NOT CREDITED AS PROMISED . ALMOST 50% OF PUMPS ARE NOT COVERED IN THE LIST OF PUMPS WHERE REWARDS POINTS ARE CREDITED AFTER FUEL PURCHASE.

OVERALL NOT GOOD CARD AS COMPANY GENUINELY DO NOT GIVE BENEFITS AS PER COMMITMENT IN CARD DOCUMENT.

Yes u r true me too facing the same problem

Hi Siddharth,

Can you please explain how this SBI card compares vs HDFC Bharat Card . The HDFC card claims 5% cashback on fuel. Does it end up giving more back vs the SBI card ?

Thanks.

HDFC doesn’t give this 5% cashback unless you ask (most of the time). Not worth exploring.

I am using this card.

I have just 3 points for you:

1) Don’t get this card. They shortchange the points you earned. You have to contact customer service to give them to you.

2) Redeeming the points for fuel at BPCL outlets is a pain. I live in Pune and still haven’t found a pump where it has been easy to redeem, without the manager’s help.

3) StanC SVT is the best card for fuel cashback but it has weird conditions, like only if you fill above 750, you would get 5% cashback. And that is actually 4% + 1% surcharge. I fill fuel worth 2k twice in a calendar month and am able to get the 200 Rs back (80 as cashback and 20 as surcharge waiver, twice).

Please provide me the BPCL petrol pump list for cash of reward point .

Because this facility is not available at every pump .

Please provide me the BPCL petrol pump list in Bangalore for cash of reward point .

While taking the the card executives will say lot of things but while redeeming the points they are telling that they don’t know how to redeem the points and they asking to call customer care. if we call cc they are telling that they don’t have BPCL vouchers call after 15 days.

Please advice how to redeem the SBI BPCL points.

Thanks,

BPCL Card is 100% fake and Fraud

In Kerala none of the BPCL pumb have the facility to redeem rewards points. I have called customer care and they told me about some pump there we can redem when I approach that pump they are saying previously they have currently that machine is not working. I am suing this card for the last four month and till date I didnt find any way to redeem the points. SBI cards mobile app always saying unable to connect SBi server when we try to redeem.

Please stay away from this frad card. Its my humble request.

To all my CardExpert friends, I am also using this card and have not been able to redeem even a single point on BPCL fuel.

But there seems some hope. I inquired again at my local BPCL pump and they told me they will accept the BPCl Fuel vouchers instead of directly redeeming the points (which they have tried several times and failed.)

So you can call the customer care to place the request for redemption of points in the form of BPCL Fuel vouchers.

I am going to try it out myself tomorrow so atleast I can redeem the joining fees.

Please tell admin why its not good for refuelling bike ?

Dear Team,

Kindly share the station location where i can use my BPCL voucher.

airport lounge access is available this card ?

For reward redemption in website it says that “can be redeemed in selected BPCL outlets” where will the list of outlet list available to redeem the reward points with fuel.?

I am using SBI BPCL Credit Card from last 2 months as per conditions by SBI Credit Card Associate that

BPCL CREDIT CARD OFFER 13 Rewards points for every Rs.100/- spent on BPCL OUTLET FOR FUEL CONSUMPTION BUT IN MY BPCL CC but as per conditions rewards NOT CREDITED AS PER TERM & CONDITIONS. YOU CAN CROSS CHECK ALL TRANSACTIONS ALL REWARDS POINTS AS PER CONDITIONS NOT CREDITED. And as per Joining Fee First Year Rs.500/- Joining fee Refund as 2000 Reward Points value As Rs.500/- we can redeem on BPCL outlet. if I m trying to redeem reward points for Fuel no one on BPCL PRTROL PUMP EMPLOYEE in Ambala Cantt KNOW HOW TO REDEEM REWARD POINT FOR FUEL EVEN I dont know.

Today I am called to Customer Care Executive they said they dont know the BPCL outlet where I can redeem and after this I talked with SBI Credit Card Executive for the Same he said u have to go for Chandigarh for redeem Reward Point and no service in Ambala area. But this scheme for Sbi BPCL Credit Card display on all BPCL outlet from last 2 months but no after sale service for customers. Due to this Rs.500/- Plus Service Charges of Rs.88/- and from last 2 months approx Rs.5000/- fuel used by this credit card on BPCL Outlet but no reward points.

Please refund my Annual Charges and Loss of Reward points used on BPCL outlet and Cancel my Credit Card Service after refund.

Sir after faced these problem I had registered the complaint to National Consumer Helpline with complaint ID : 1532483.

Hey all,

If u facing redemption pump location issues, I have a solution.

Try befriending a BPCL sales guy and ask him about current redemption enabled pumps nearby. In my case the guy was friendly enough that he shared his number with me for a new lead and has most of the time helped me to find a working redemption location in my city during last six months. Be friendly with the guy and don’t be pushy.

Hi sir

I can’t redeem my SBI BPCL credit card point at petrol pumps.can you provide the list of petrol pump in Allahabad Uttar Pradesh where one redeem that points.

The list of petrol pumps to redeem the points is given in the sbi card website please check it once

BPCL SBI card is a scam. SBI card website has list of BPCL outlets that provide POS redemption of reward points but none of the outlets actually do that. I live in Nagpur. There are 15 BPCL outlets listed on the website in Nagpur that should allow instant point redemption in exchange for petrol and I have visited 4 of them. There excuses range from:

A) No damn idea about the scheme

B) Reward redemption machine not available

C) Reward redemption machine out of order

Sometimes I believe that BPCL outlets themselves might be involved. May be reimbursing the points for actual money is a pain for them so they avoid doing that. May be they do have the machine but the pump owners have instructed the employees not to entertain reward point redemption requests.

The BPCL e-voucher is also not available on SBI card website. It shows up on google search results but disappears soon as I log in to SBI card website.

I could use the points for other e-vouchers or services but the value back is not the same (4 points=₹1) as promised on petrol. I will have to cough up more points for same amount of benefit.

Also, many times the reward points and petrol surcharge waiver don’t get credited. I have to keep track of my statement and contact the customer care whenever it happens.

I wish I had never got this card.

The peace of mind lost in all the communications is just not worth it.

Thinking about surrendering the card once I complete one year. After all I’ve already paid the joining fees of ₹500. Just before I’m charged renewal fees, I’ll use up all my accumulated reward points and surrender the card.

Mr. Saurabh,

You are 100% correct, same experience everywhere, in short they fool us, and I also will cancel at 11th month, otherwise they will charge next Rs.500+88 gst again for the next year.

I think SBI BPCL credit cards are fraud agency, which gives customers full of promises, later which they are not fulfilling.

I had tried also to representatives they are not answering the calls.

We have faith on SBI as it is a one of the big important bank, and that is why we are taking this card., but if such type of situation is arising then we have to cancelled these cards.

Do not apt. for these fake cards.

Hello, friends,

I take back above my words.I can reimburse my points by purchasing fuel. Only just you have go at right petrol pump and right men. and not to give up.

Best Luck.

can i swipe my BPCL card in JEWELLERY SHOPS, I need a clarification of charges rates and i want to know, if there is any separate charges for those purchases

Siddarth,

SBI has launched BPCL Octane credit card. Reward rate seems to be good for those spending high on fuel. May be you should review this card.

HI Sid,

There is a new card on offer from SBI – SBI BPCL OCTANE card and any thoughts on this one. It seems to be rewarding well.

This card really cheating us, initial point of time after getting this card Surcharge waiver was returned back automatically. But later after a year, I’m not getting the refund on surcharge, when I call to customer care they replying like that I’m not used in BPCL fuel station. Really it frustrated me, where from the beginning I’m using my card near by my house one of the fuel station only, then I have asked to check the earlier statement and see the particulars what Agency Name I have got refunded, then again request to check the latest statement which I’m not get the refund, then they accepted that it was BPCL. But refund has not reflected in next month statement, and further same issue continues for next three to four months and keep on following with customer care, and finally they made few of the transactions and not for the balance. When I check with Customer care again, they were replying like you have exceeds the maximum limit of refund. Actually the maximum limit has reached due to they not provided the refund in to that particular month statement, and given only after four months. But they are not accepting my concerns and not listening to my concerns. Like this they cheating, so I would request you all to check the each month transactions mainly on Fuel purchase whether you have received the Refund on surcharge or not.

Really cheater and I have cancelled my card due to this. And also its not my duty to follow up and notice the customer care that I have not received the surcharge waiver to my card. Please all take a view on your statement each and every month.

I was able to redeem my points for 1800 RS worth of fuel at BP Chauhan Petrol Pump Amritsar. The pump attendant accepted points as payment method without any questions 🙂

Today same card launch in RuPay Platform.

“BPCL joins hand with SBI Card to launch contactless RuPay credit card.”

Offers and benefits same.

Is this still best credit card for petrol or any other cards give best rewards.

SBI reversed annual fees for this year, had not more than 2000rs spend in last 1 year.

Even during last year renewal they added rewards equivalent to Annual fees rather than reversal.

So SBI do consider reversal or bonus rewards against renewal fees in-spite of not much spends on the card in whole year.

This is surely a fraud card. I started using it from 2 months. My first transaction at authorized BPCL petrol pump at Solapur attracted Surcharge and GST! When enquired to SBI, they informed that this BPCL petrol pump is not listed so I paid Surcharge as well GST on surcharge!

Next time onwards, I change petrol pump but this time, SBI is only reversing Surcharge but they are not reversing GST on surcharge! When enquired, SBI informed that GST would not be reversed! This is really frustrating which means if you are filling petrol of 10,000 INR per month, you need to pay 15-20 INR extra every month!

Further, it is really painful to find petrol pump where you can redeem your rewards. Since SBI has already taken 1 year fee (non-refundable), I will use it for 1 year and throw away this crap card.

SBI Spend based offer. Seeing it for the first time in my whole 4plus years of use.

“Get Lifestyle e-Gift Voucher worth ₹1000 by spending ₹42000 or more between 22May23 – 20Jun23 with your SBI Credit Card”

SBI website claim 6.25 percent + 1 percent value as rewards while reality is way too off.