Its been a while since i’ve been holding HDFC Business Regalia and i wanted to upgrade my card to the topmost version which is Infinia. However, as the requirements are pretty high for Infinia, i never gave a try, rather went for Diners Club Black as it has lucrative 10X reward points and unlimited lounge access across the globe, which appears to be best choice as i’m traveling quite often both for business & leisure these days.

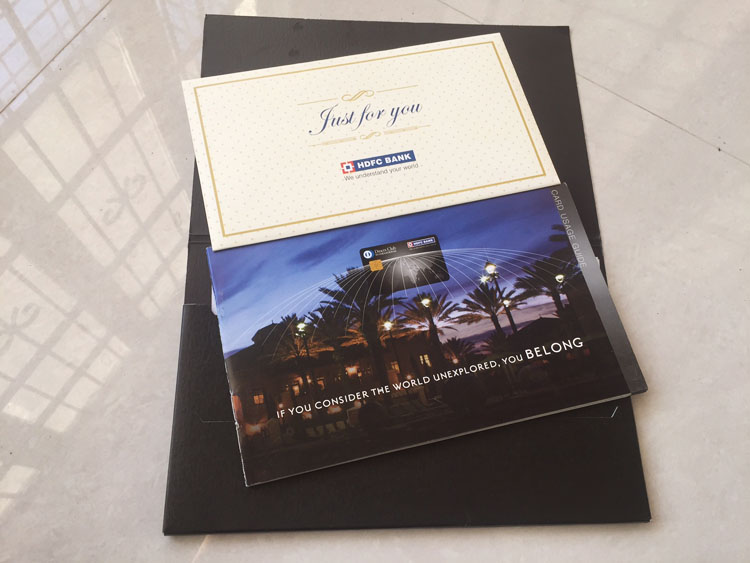

HDFC Diners Club Black Credit Card Approval & the Kit

Applied for Diners Club Black card on one fine day and got the card approved after chasing for a while. It didn’t take long as my usage was pretty decent on my Regalia, added to that my relationship with HDFC is pretty good, hence they don’t have a reason to reject. Once approved, it got delivered in a week. The welcome kit came with,

- Diners Black catalog

- Insurance cover docs

- Shopping vouchers like Kenneth Cole, Brooks & brothers, etc (nothing exciting)

- Terms & Conditions docs and

- The Diners Black CARD with Add-on Cards

The CARD: Map on the card shines a bit while you hold it near bright light else it will appear to be full black. It has Discover and Pulse logo on the backside of the card. Which means the card is accepted in discover/pulse terminals and payment gateways, like Paypal. Here’s how it looks:

I’ve requested for Add-On cards for my family hence it came with the same kit. Add-On Cards gonna be useful with Diners Black as it has unlimited complimentary lounge visits in any part of the world. It might help some day or other when i take my family for a holiday. But remember, you can’t use both primary & Add-on together.

While i received the card, within a week, there came the big news on Diners Club 10X Rewards Programme changes. Doesn’t matter much for Black card though, at-least for my level of usage. Hoping to have a great time with its rewards programme as its gonna give me more points for booking flight tickets, hotels and shopping with their preferred partners.

Update: I thought to update this thread due to overwhelming response/emails about this card. I understand everyone wanna get the top tier card. All you need to do is, hold a high relationship value with the Bank with nice usage on your old card. Once done, get in touch with your branch directly.

You may still contact me for a personal consultation/advice on how to get Diners Black Credit Card. Or, do you hold the Diners Black card already? Share your experience in comments below.

Congrats Sid!!

Share more on your experience with this card after you use it for a while.

Sure thing!

Hi Siddharh,

You have mentioned

Add-On Cards gonna be useful with Diners Black as it has unlimited complimentary lounge visits in any part of the world. It might help some day or other when i take my family for a holiday.

Can you confirm that add-on cards also have unlimited complimentary access to the lounges across world?

as per the official website

add on card doesn’t have unlimited lounge access

it will be charged

Yes! its free access for add-on cards too

That is amazing Siddhart. Lots and lots of congratulations to you. I am very excited. Please answer some of my questions.

1.Could you please tell that how much was your average monthly spends on Regalia ?

2. For how many months you had Regalia before switching to Diners Club Black Card ?

3. Which credit card of HDFC you had before Regalia ?

4. Exactly what relationship you have wih HDFC. I am a Preferred Customer of HDFC. Does it matters during upgradation of credit cards ?

5. What was the documents required for the application of Black Card ?

6. Finally the most important question is that how much credit limit you had in Regalia and how much credit lmit you got in the new Black Card ?

7. Please answer the 6th question precisely.

Ah, lots to answer. 😐

But the point is, nothing gonna happen if your RM is not taking the step. Anything is possible if your relationship value is as high as Imperia customer with high card usage.

If this card u got with upgraded or new.

If I will get new card with preferred account. Is this eligible for this card

Preferred a/c does not makes you eligible for the card. Its about the old card usage, repayment, limit, overall relationship with bank, etc that matters a lot.

Hey sid.! Congrats on receiving one of the Ultimate cards in India. Im holding the HDFC REGALIA CREDIT CARD currently. My limit is not that high. I desperately want to switch to the Diners Club Black Variant. Could you please guide me on this thing? How long have you been holding the Business Regalia Card? How much Credit Limit is needed to Upgrade the Regalia card to Diners Club black credit Card? Do we need to send our income documents also? BTW, Im from Chennai only.

Vinod,

The magic is in your RM hands. If your relationship value with bank is high, it shouldn’t be a challenge at all.

I’ve been banking with HDFC for quite long.

I don’t have an account with HDFC. So I don’t have an RM. I started with the Platinum Edge variant, then AllMiles, then Diners Club Premium, and now Regalia. The bank doesn’t have the Physical form for Diners Club Black now. I think it is gonna be hard to get the Black Variant.

More chances to get if you have good relationship value wit the bank. With Card alone in the case, might be tough. but with higher limits like 5L and higher income can make it easy though.

Hi Siddharth,

I am also a Regalia card user and HDFC imperia customer, and have been thinking to switch to Diners Black for a while.

Can you please let me know the process to shift to Diners Black? Also, did you receive the life time free offer?

What happened to your reward points on Regalia? what was the conversion ratio?

Best Regards,

Meher

Meher,

The card is designed for Imperia customers and you wont have a problem in getting one. Get in touch with your branch 🙂

HDFC has diff rules for each customer.

Hi Siddhartha,

How can I know.. The type of Account I have with hdfc.. Coz I too have a dedicated RM provided as one point contact with the bank..

Classic/Preferred/Imperia all have dedicated RM. You might fit in one of these. Check netbanking logo. It will be mentioned below logo after logging in.

I am a Imperia customer and i have a regalia first credit card, after upgrading my credit card to dinners black I have plans to downgrade my hdfc Imperia account status to a savings account and still hold my hdfc black card , is this possible ?

hello what is the minimum credit limit required to get upgrade to diners club black card

Wonder what does DC and RW embossed on the card stand for.

DC is Diners Club

RW is kind of country code or bank tie up code i think.

Its there on Diners Premium card too, probably on all diners cards.

Yes. It’s present on all the 3 variants.

Hi

I am currently holding citibank premier miles card from the time it was launched. I got it after my Jet Airways Citibank card was discontinued. I also have a diners club rewards with HDFC which I never use. My current spent on premier miles is almost 15L pa. Can I ask HDFC to issue me a Diners Club Black by giving Citi credit card bills and payment info or I need to have considerable spent on HDFC card itself?

It depends more about the credit limit on citi card in this case. Anything above 5L “might” help. Get in touch with your branch, BM/RM might help.

hello what is the minimum limit required for upgrade to regalia to diners black.and you says diners black is better card than regalia and when i contact to customer care they told me that regalia is second top crad and diners black is after regalia.

Amit,

Diners Black is the top end in Diners version. Regalia is powered by Visa/MC.

there is no specific limit, anywhere around 5L is easy though.

I have a 5L limit on my Regalia, high spends, as well as preferred status, with good credit score.I still got declined for the upgrade to Black. Also due to the recent attention this card has been getting they are getting more selective in terms of the people they are getting onboard, I guess.

hi akush i want to know that how much time you have regalia and 5l limit because my father has upgraded to diners black within 8 months after gettig regalia with limit 3l

After escalations and multiple follow ups, and a twitter post I did finally manage to get my card. One important aspect for several people to keep in mind is the lower acceptance of Diner’s across merchants. You need to have a separate Visa or masters card as alternative. Even Amazon doesn’t accept Diners for now. While the redemption options are better, where there is a 1:1 ratio, its not much of an upgrade from the Regalia. Only if you shop and spend regularly in large volumes from the partner brands to get the 10x bonus, or if you can redeem points to partners that the regalia doesn’t, then I would recommend the upgrade.

Thanks for mentioning this very informative advice. Even I was planning to upgrade from Regalia bur have dropped it now. As per my RM it’s a down graded card.

hello i contact to hdfc phone banking for upgrade of my regalia card to diners black they said that regalia is only upgradable to infinia only by invitation and diners black is lower card than regalia

Not true.

Hii sidharth

I have allmiles card with 6 l limit classic customer and good relationship with bank I have applied for upgrade of diners black and they told me that first year will be free and from 2nd year onwards 10000 yearly fees if spent over 8 lakh then free…and 10000 points after fees is this a worth? I m planning to upgrade I have one regalia in family so issues of acceptance…so what should I do?

Thanks in advance.

Yes, go with it if you spend more on Diners Partner Brands.

THANKS a lot BRO

Hi

I know you have been ploughed with so many questions but we are all Diners black enthusiasts here.

Can you indicate what “might” be a good average monthly / annual spend figure on current card (say Diners Premium) to convince the RM

😀 Awaiting the reply.

No such pre-defined numbers, though, if you can spend 10L and if you have good relationship value with bank, it will be easy.

Hi Siddharth

Looking at getting a diners black add on for my wife.

Free lounge access for add ons is something you’ve written about, and possibly taken an add on with that in mind !)

Was wondering where you got that info from?

Validated?

TIA 🙂

I’ve used the add-on cards for lounge access recently. Validated!

Thanks !

Applying right away 🙂

Hi Sid

Is it necessary for the primary card holder to be along with the add on card holder for him/her to avail free lounge access? Or can she avail it even when travelling alone?

He/She can avail if traveling alone as long as the add on card is the name of the person traveling.

Is the lounge access on add on card applicable to dinner’s premium card too?

Yes, it works. But its officially not advertised though. So, they may revoke anytime.

Hi Siddharth,

1. Which are the cards on which accompanying kid(s) can access the lounge?

2. Since I have relationship with HDFC bank only via credit card and ofcourse no RM assigned. Currently holding a Regalia card. What should my approach to upgrade the same to Diners black?

Please provide suggestions

1. Depends on the lounge actually.

2. Email HDFC directly.

Well since you’ve just been upgraded, there is a “add-on” good news for you. Just spend Rs. 1000 on your new black card 5 times or more (any transaction anywhere – offline or online) in a calendar month and get 1000 reward points additionally. With value of Rs. 1 per point, that’s a neat 20% benefit over and above any that you are already enjoying. And this will be valid for 12 months from your card activation month.

Cheers!

Kapil,

May i know where this offer is mentioned?

This offer was available on Diners club new card holders during later half of 2016. I am a verified user of the same

Hi

Looks like this is the best card for airport lounce access and hopefully, bumping up your jetprivilege tier level. Plealse correct me if I am wrong. I used to have Amex Black with 50K annual fees but doesnt make sense to me if,m like me, you dont travel overseas extensively.

would appreciate your advice.

Thanks in advance.

I don’t think they give Jp tier level with this card. By Amex black, do you mean Centurion Card?

The one that Pranav is talking about is the JetPrivilege HDFC Bank Diners Club Credit Card. It is the highest co-branded JetPrivilege Card. But even though that is also a top of the line card and is of the Super Premium League, it doesn’t come anywhere close to Diners Black/HDFC Infinia.

What should be the approach to get this card , if only relationship a person has with HDFC is CC only and no RM

now i have jet world card from hdfc and if i will upgrade to regalia then how miles converted into points

-and if upgrade to diners black if eligible ok or not for this card now limit is 1,00,000

No idea about miles to points conversion.

Tough to get Black card with that limit.

Hi Siddharth,

What’s the annual fees for Diners black card? If someone has lifetime free Regalia card, is an upgrade to DC black card also lifetime free?

Thanks in advance.

Joining fee: 10k, Annual Fee: 5k (spend waiver is there as well)

But sometimes you maybe given for free as well. Depends on your relationship with bank.

How’s this card for retail and online spends? Does the Diner’s club get acceptance everywhere?!

I currently have a HDFC MoneyBack card with 1.9L credit limit, but anticipate high expenditure – specifically travel based in the upcoming months due to a shift in the job.

I’ve asked HDFC for an upgrade of the current one, hoping for a positive comeback.

Any suggestions to convince them or should i look for another card altogether?

Thanks,

Sunny

Sunny,

It cannot be the stand alone card due to acceptance. Its still best in India as long as u need lounge access & 10X rewards.

Moneyback is lowest and Diners black is the top end. such upgrade not possible. Try to upgrade to some mid variant – Diners Premium/Rewardz

Thanks Siddharth. I will try accordingly

Looks like there is a fraud being played out by hdfc & / diners.

Latest points to air miles conversion on hdfcdinersclub website shows 1RP = .70 miles.

It used to be 1RP = 1 Mile.

Very sad.

Every since I’ve taken the card unwanted surprises are graduating to unnecessary shocks 🙁

I was recently open preferred account in hdfc with 5l initial check and rm said jetprivilege world card is applid. And jet world dinners premium card is same segment card diners premium is top compared to jet world

hi what is eligibility critira for upgrade to diners black card

Hi Siddharth,

Only after reading from you website, I applied for Diners Black card and finally it was delivered today.. Awesome card and benefits for me as I do lots of online transaction on flipcart, makemytrip, big basket etc ..

Thanks for the information .. it was really helpful.

Glad it helped you 🙂

How did you apply? Via a print form, net banking or one of those online forms?

hi i want to upgrade my regalia credit card to diners black card pls guide me thankyou

Are the add on card also eligible for free lounge access, With and without primary cardholder?

Yes, Add on cards also has lounge access, independent of primary card holder and i’m regular user of add-on card as well for my family lounge access.

Hi, was this an upgrade from Regalia or you hold both cards? Does HDFC Bank allow you to hold more than one card at the same time? I currently hold a Regalia and am interested in this, but i don’t want to lose my Regalia card. Thanks in advance!

They can issue two cards if your limit is high. They can’t split 1L limit into 50k each on such premium cards, but higher limits like 5L can. That’s the point.

I had Regalia with 6L limit.

After getting Diners Black, my limit is 4L for DB and 2L for Regalia.

A good, persistent RM can do it for you

Hope this helps 🙂

Sri

My RM IS telling me that I casnit have 2 cards. I gave told him it is possible but he is not budging what to do

Hey sid, I’m being rejected to upgrade from regalia to Black, tell me how to get black ? Please tell what to do

Get in touch with your RM.

Like many others, I have only a credit card relationship with HDFC. I currently have the Regalia and would like to get my hands on a Diners Black too. Since I have no assigned RM, can someone on this thread share the contact details of their RM (preferably in Bangalore) so that i can contact the RM directly to process my Diners Black request.

Only the RM assigned to your ac/ has the ability to take request. If your Limit is good & spends are high on Regalia, you can try through customer care, if not, tough. Because they can’t risk giving super premium/high limits to someone that bank doesnt know about except cc usage.

Even he won’t help me to get the card.

they said 30 lakh itr required.

really unhappy with the service.

any way sid ?

You can ask to take an exception. They will be able to do if you’ve good spends & limit on existing card.

Siddharth,

Have you tried not applying ‘HDFC5X’ coupon on MakeMyTrip and got 10x? There are conflicting statements from different people/customer care folks on this, I want to confirm for sure. Besides, HDFC5X coupon can’t even be applied on premium hotels like Taj.

Niranjan,

I still wonder about this. I’ll be testing this in coming week, but to know the result, we will need to wait for a month.

IF you happen to get more info on it, do share 🙂

Hello Sid,

I m planning to take international ticket from Diners Black if I use any other coupon code or cashback offer, go cash will i get 10x reward points?? or i have to pay all for reward points…??

Thanks…

If you’ve more points, yes you can redeem them. Else you can yes go for 10x reward points on goibibo. yes, you’ll get points even if you use coupon codes.

thanks a lot bro for ur quick rply…

I decided to upgrade my Regalia Card to the Diners Club Black card. But its frustrating to know that HDFC still asks for paper forms for everything.

They want me to send a hand written letter to HDFC Chennai for requesting card upgrade.

Also, when I ask for some clarification on certain benefits of the card, their customer care executives give different answers every time.

Happens always with HDFC!

How much should be the Fixed Deposit amount to get a Diners Black Credit card.

5L or above for sure.

what is the best way to redeem the points from this card. I tried to redeem for postpaid bill for which they charged redemption fee of Rs 75 + service tax(15 Rs approx).

is there any way to avoid redemption fee or any trick to minimize the redeption fee

Redeem max points at a time and use at once rather than redeeming every month or so. That’s the only way. You can always prepay your postpaid bills 🙂

I don’t get charged 75 + ST when I redeem points for bill payment. I called up customer care and confirmed that they don’t charge anything for redemption on Black.

Sid, can you confirm this statement? I have in past used Regalia, Diners Rewardz and Diners Premium. I got charged for all of them. What about redemption on Black?

They’re not charging me for both regalia & black. Maybe a Preferred privilege. i’ve no idea.

Have you tried the Golf access with Diners? Waiting for a review on that. 🙂

Not yet Ashok. Have to try sometime soon.

Hi Sid,

Were you given this card for LTF?

I have recently upgraded from Moneyback to Regalia First, now after sometime (say 6 months) can I request for upgrade to black for LTF? how will HDFC decide on LTF or chargeable? I am hoping as I have been using HDFC CC from last 4 yrs with good repayment history and Am a classic customer.

Chaitanya,

Its done from the branch.

Its more about the limit avail on your Regalia which makes it eligible or not for Diners Black.

You got to talk to your RM reg. the same.

Sid,

Limit is 1.65L on my Regalia First, how likely it can be upgraded to black? If not black I expect upgrade to Diners Premium for LTF atleast?

Diners premium maybe possible. LTF i’m not sure, it varies from card to card based on the usage.

Hi sid,

Have u used Complimentary Taj Epicure Plus Membership any time can u elaborate it?

Have read some where in Hdfc site that they have now discontiue Taj Epicure Plus Membership is it?

Thanks and keep rocking bro viewers will increase on your site because of demonetization…

Ketan,

Nothing much special with Taj membership.

Only benefit i get is late check-out & Early Check-in.

Hi Siddharth,

I got Diners Club Premium along with Regalia (2 cards together). Can the Diners Club premium be upgraded to Diners Club Black? Any idea.

It depends on the Limit on Diners Premium and your IT papers.

Hmm. Ok. IT Papers wise no issue but Banker was saying that Diners Premium is part of Regalia. So if I want to upgrade my Regalia will have to be submitted for upgrade.

I don’t want to give up Regalia. Any idea, suggestion? Also is Diners Black also available for free?

If the limit is high, holding both can be easy.

Thanks. So can Diners Black be awarded free of cost basis relationship?

Yes, it can be.

Hi,

I am currently holding Diners rewards card. PLease let me know how can i upgrade to Diners black card?

Upgrade to premium and then to Black.

Hi Sid,

Do you expect the 10x rewards program on Diners Black to get extended beyond Mar 2017?

Probably Parag. But not sure.

They might restructure the 10x program with Different partners & limits maybe.

Hi Siddharth

I am holding a Regalia card with 3L limit since April, prior to that AllMiles>Superia>Signature>Platinum>Gold. Started with the Gold card in mid-2008, same time as my HDFC Savings Account. I easily spend Rs. 8-10 L annually on my credit card. Average monthly bill is 50-60K, and occasionally over 1L.

I have 3 questions:

1. How good are my chances to get a Diners Black Card if I apply for an upgrade now? I don’t have a personal RM, I normally fill up the upgrade request along with my income proofs and drop in an ATM.

2. Is there a way I can keep both my Regalia and get a Diners Black? The reason I ask is that my Regalia (and other variations of it prior to that) has been my daily drivers since the past 8 years. I have Manhattan from StanC and AmEx Gold, but Manhattan rewards not as good and AmEx not accepted at many places. My HDFC Visa really helps me here. I also love the 5X rewards at BP petrol pumps, which I don’t think Diners has.

3. How is the acceptability of Diners at regular stores, restaurants, etc? Dees any place that accept Visa and MC also accept Diners, or is it limited like AmEx? (Another reason why I’d like to keep my Regalia)

Thanks for your time.

Pls check Diners Club Credit Cards in India and its Acceptance.

Reg. upgrade,

Each ac is different. Pls check with BM or directly with bank.

Dual card with this limit is tough.

Hi Siddharth,

Thanks for writing and helping everyone in general. I do enjoy your reviews and response.

I have had a word with my RM and I have been told Diners Club Black is not provided life time free for anyone. He did tell me that I can get it as First year free, but I have to use the waiver option based on spends only. There is no life time free Diners Club.

I just want to know if this is the case with you or anyone else as well. It would be great if you could let me know.

Thanks

I’m unsure as well. It didn’t matter to me as i can spend the required amount for renewal waiver (5L or so). Hence i didn’t bother 🙂

Hi sid,

I have started using my Diners Black. till date i haven’t faced any difficulty in using it.

just an update on the acceptance.

these were the POS machines, i have used my card without any issues,

1. HDFC Bank

2. ICICI Bank

3. SBI

4. Axis Bank

thanks for this wonderful blog.

Thanks for the kind words Bharathy,

I never know ICICI is accepting as well, that’s a good news now.

Add to that, Yesbank machines are also accepting Diners Card and some small shops like medicine shops who use “M-Swipe” can also accept Diners. The logo on the machines shows only VISA, Mastercard and AMEX. However, when I gave him my Diners Card to try it successfully got charged and I knew the reason when I saw the slip. Actually, Diners Club has partnership with RuPay. So, in this case the card got detected as RuPay and it worked. So the acceptability is outstanding now a days!!!

Yesbank too? sounds good!

Hi Sid,

Are you getting 33% cashback for insurance premium also(via HDFC smart pay ) ?

thanks for this amazing blog.

It wasn’t charged on the card somehow, so i didn’t get it.

I hold a credit limit of 6l on my HDFC Regalia, I just have a basic savings account relationship with HDFC. RM doesn’t help. Customer Care says send your IT Returns or latest pay slips along with the upgrade request form to their address.

Any idea about the email address where I can scan and send it? I do not wish to send my IT returns is that okay ?

IT is mandatory, 6L should be fine for upgrade though. Try talking to BM.

Got Diners Black Card today.

I have a query regarding the validity period of this card. My card is valid from 02/17 to 02/20, i.e. 3 years. Do all diners black card come with 3 yrs validity only or some get more than that ?

Yes, usually by the time of expiry they will send you the fresh card. If the card is discontinued, they’ll issue a upgraded one.

Thanks buddy

Great blog…love having this card. The 10X partner benefit has been around for some time now. Have you heard anything about whether it will continue after March 2017?

No one knows, but we do expect it to be continued.

hi ,

i have a diners premium card with 2 lakh limit. i know that for black we need minimum 5lakh credit limit. So can i upgrade my card to black if i put a fixed deposit of 5lakhs with HDFC.

No, they’re not issuing Black on FD basis. Anyways, if you have good relationship value, give it a try.

I asked the RM in branch to upgrade my card to Black as my credit limit is Rs.5.88L, he said only criteria is ITR of Rs.21L. Will try again in 2 months as my regalia is only 6 months old, i have done average Rs.1 L spending in past 4 months.

The spend is pretty low for them to consider.

Hi Siddhartha,

I have been reading your blogs for sometime now. Thanks for sharing such wonderful articles. It really helped me and I recommended your blogs to my colleagues at office as well. Keep rocking!!

I have upgraded my regalia card with 4.9Lakhs limit to diners black and got my card yesterday. I usually spend around 4L in month and today, when I browse thru netbanking, I have an eligibility to upgrade my limit to 5L which is just 10000/- more, should I go ahead and apply for limit enhancement or should I wait for a better increase in the coming months?

Sounds good, congrats.

No, its better to apply for limit enhancement from branch.

We have a small bunch of hard core credit card freaks out in our company, I am a recent entrant to it.

Our fear is that wef Apr 1, 2017:

10X/5X will be discontinued.

Value of the Black Card RP will be reduced from Rs 1 to 75p.

Regards

75ps?

How do you say that?

@Majumdar

Where did you get this info mate. I have over 60K points on my diners club. If it becomes 75 Paise I am losing nearly 15K

Sorry, seem to have communicated poorly. Didnt mean to say that we know that- we are only fearing such a devaluation may happen. This is based on past track record of devaluation on other HDFC Cards and even Citi and AMEX cards in the past.

Regards

i had 30k Regalia points which got transferred to Black without any deductions.

Also the call center guy confirmed tht no redemption fee of Rs 75 for Black customers.

sounds great

Dear Sid,

Got my DC black recently courtesy you.

I came across your site a few months ago. I have a Citibank card for more than 15 years with negligible benefits. Citibank never offered to upgrade. I too never bothered as I was not very savvy about these things.

Your articles made me realise the potential benefits of a good credit card.

I read almost all your posts and zeroed in on DC Black .

Followed your advise and spoke to my RM and voila. ?

Thanks a lot

Keep up the good work.

Congrats Kumar.

Glad that i was able to help 🙂

Finally got my Regalia card upgraded to Diners Black. Process was so simple which I never thought this easy. Just took a chance and sent a signed card upgrade form request which I downloaded from the bank website and didn’t even provide any income proof documents. They upgraded within a day of receiving my request letter.

In the process I lost nearly 26k points as when they upgraded the card they decreased my existing points to just 40%. Bad I didn’t spend the points before.

Thanks Sid. Now I am worried if the 10X/5X is discontinued.

Congrats Jay!!

Hopefully they’ll extend with some changes in partners. Lets see.

@jay Congrats…can you tell me the link of the form you filled?

Thank you all. Applied Addon Card for my wife too only for lounge access.

I didn’t send any income proof documents or any ID Proofs. Just the form filled and sent to Chennai address.

I had around 8l limit on my Regalia Card and was using it for more than 3 years.

Statement for the first month was generated 2 days back, Hurray they haven’t charged the joining fee of 10k for me.

Yes, I didn’t understand their points conversion table before, just now saw and understood. They have clearly mentioned on the 2nd page of the form that 60% of the points will carry forward when we upgrade from Regalia to Diners Black.

Congrats. I think the conversion is 60%. You should check with them. HDFC is known to goof up while upgrading cards. Infact the upgrde forms mentions 60% conversion.

It means only 40% points are transferred. 60% points you lose on upgrading.

Jay congratulations. How much limit you had in Regalia and how much limit you have now in Black ?

Bad luck. I knew about this rule and thus had used all the points before upgrading. We only lost 154 points while upgrading. 🙂

if i start an FD of 10 Lakh at HDFC will they be inclined to issue me a black card, or they dont offer the black card on FD basis at all.

I heard from one that they don’t. But you can give a try.

Are they offering it free? I was told that on this card only first year fee can be waived. After that fee is 10000 per year.

Reaching all these post, I applied for Citi Prestige getting it next week. Applied online and got approved for HDFC dinner black. My branch manager says he is arranging for Infinia invite. I am going to very confuse which to carry forward. I guess DC Black is free if I spend 5L on DC black. Rest I can spend on Citi Prestige. Probably drop the Infinia. Never given thoughts to cards and benefits in last 10 years and lost so much h benefit.

Thanks Sid for these great posts. Thoughts welcome on card rationalization.

hiii sid,

in smart pay they are giving 10x reward point?

No idea, my billers got denied.

thanks bro for the reply, will let u know once I get the update…

hello sid,

plz tell me if we pay insurance directly throug auto registered will get 10x reward points if not then i can buy gcs of FK plz rply fast.

thanks in advance…

I think-No

T&C says: “SmartBuy offer is applicable only on Flight and Hotel bookings. Also cardholder has to continue as a guest to avail the offer”

10X points extended to 30th April. Website is updated. However no clarity on 10X for SmartPay.

Hi Siddharth,

I’ve been using Regalia for the last year or so. I enquired for an upgrade and they have offered me 2 options. Either upgrade to Diners Black (only) or a combination of Diners Premium + existing Regalia.

Which among these would be the better option considering limited acceptance of Diners cards and that the 10x reward points is available only till end of April 2017.

I have a few other credit cards like Citi IOC, etc. but the reward rate is not very great.

Thanks in advance for your help.

It depends on your usage. IF you spend more on 10X partners, Diners Black might help, else dual card would do.

Diners black has now changed the max RP to 25000 and removed all travel websites ( except smart buy) . They have included amazon and dropped Flipkart.

I got to know that Diners Black criteria being Take Home salary of 6-7 Lacs per month… I was surprised. Does it mean its only for people a Salary ( before Tax) in range of 1 crore…. Doesn’t that sound absurd..

Anyone else having heard something like this?

Hi Dude,

Nice article. I actually hold a regalia card with a limit of 3L. I have been using it for more than an year now. I have an average spending of close to 60k per month. I now applied for an upgrade and they rejected saying that the salary requirement is 1.75L per month. I actually have 1.12L per month now. What do you suggest? Any chance to get it if I talk to the bank guys again?

Thanks

Babu

Higher spend on existing card and even more credit limit may help.

Any update on 10x?

Yes, the new changes are published. Check the latest article.

10X points extended to 30th October 2017.

10X Rewards points will be posted only on eligible retail transactions on SmartBuy Amazon, Lifestyle, BigBasket, Uber, BookMyshow, Swiggy, Redbus, Luxhues on both website and mobile app spends.

Maximum total reward points that can be earned per statement cycle across all the above merchants is 25000.

So Flipkart , Myntra are out and Amazon is in. No flight booking portal like MakeMyTrip and Goibibo are in new 10X partners list. Swiggy is new entrant. Monthly cap reduced from 50000 points to 25000 points.

Sid,

I’ve asked for CC upgrade from Regalia to Diners Black (ltf)through email. I’ve been asked to send the “Credit limit increase/Card upgrade” form to Thiruvanmiyur.

My current limit is 3L and holding Regalia for ~6 months. So far my total spend is ~2l. Recently my CTC increased to ~17l and it may go upto 19l this year(part of my CTC is stock based. Due to this my salary will fluctuate a lot, mostly it will increase). Other than CC, I don’t have any relationship with HDFC. My Cibil is 810.

Will i get Diners Black CC as ltf? or If i denied upgrade, will it going to affect my Cibil or relationship with HDFC?..

Is it worth the shot asking for upgrade(ltf) now. Need your thoughts.

Thanks,

Gokul

Hi Manish

I am about to apply for Diners Black. HDFC site mentions that in Diners black only primary card holder is eligible for lounge access, where as you mention it’s applicable for add on card members too. Can you check & verify ?

Personally I have 2 other cards (Not HDFC) which take care of lounge access. The reason for selecting Diners is that it allows me to to take my add on members too

An early reply will help as I intend to complete the formalities over the week end.

Got my Diners Black yesterday (upgrade from Diners Premium). Pretty smooth experience, all thanks to this blog. Thanks a lot Siddharth.

@Nitin

Can you please tell me the process for upgrade to Diners Black.

I tried to upgrade my Regalia first to Diners black,they said it can’t be due to salary ineligibility .

But when checked with RM,FD of 6 lakh might get me Diners Black..

Hi Suri,

upgrade form regalia first to diners black is very difficult. you can try to upgrade to diners premium and try black later.

Hi Suri, as suggested in the blog earlier, I went ahead with tried and tested method of sending the upgrade form to their Chennai branch. I put in the form and 3 months salary slips in one of the drop box at HDFC branch, and got the card mailed to my home address within 12 days.

Not sure of the FD option, and I dont have an account with HDFC. Only the credit card.

Is your annual income more than the eligibility of 20L.

Can I use the diners card for lounge access twice on same day? I have a hopping flight and hence this need.

Regards

Suraj

I am new to Diners Black. Checked with their call center on supplementary card lounge access. They said its only for PRIMARY CARD HOLDER.

However, the card no for suppl. card is same ( just that name is different)

Then wont this help to access lounge for Suppl. card holders?

I have tried this card in Sri Lanka. Primary and add on cards did not work together. Only one of us could use the lounge at a time.

Thanks Harsh. Helps me..

That’s bad . Even you cannot use two master or two Visa cards with the same name together , when going with your partner. Usually they ask for a master and Visa or amex or diners

Hi,

Can I use the card for lounge access twice in the same day in different airports ?

Thanks,

Mouli

Ofcourse you can!

I just got an email confirming approval of my upgrade from Regalia to Diners Club Black! I’m excited. Can’t wait to have it in my hands! 😀

wow ! congrats ! how did you manage it?? pl share with us

Sid,

Check out Diners black page for 10x changes. I am no more pursuing this card. I will change to JP DC

Ram,

There is no changes in Diners Black for 10x

Whats the problem Ram? Nothing has changed.

PSA: HDFC has started distributing new design Diners cards in India. I saw it with my Korean buddy in July, and I thought the new design is edgy but looks less premium. Now we have it too. The globe is shifted slightly to the left, it is more matte finished, and there is a sparkle on the right side of the globe which appears to be a glimpse of rising sun behind the globe. Also, the part above the globe is very very dark navy when held against the light. The continents on the right are lit, and towards the west are dark. The map does not glow anymore. The part of the card above the globe is kinda sparkly and appears to change from pitch black to dark navy.

How do I know? I got a replacement card (used it in high risk country) and an add-on card today. 🙂

Cool. Yes, they’re using this new design on their web banners lately.

Hi Siddharth,

Just received Diners Black yesterday ! After I read the benefits of this card from you blog, I applied for upgrade from the LTF HDFC moneyback card I had. Thanks for all the information.

I had a regalia since last 3-4 years (or more), current limit 8L. I asked my RM for Diners black last week. He checked and said I’m not in “auto eligible” list, but if I can give an ITR proof of over 20L, it “might” be done from back end. After giving the docs, I kept checking status of my application, it always returned- can’t find my application. Surprise-Surprise!! Recd. the Diners Black, without any intimation sms/email within a week! Cool…

FYI: I have never ever defaulted/Delayed in any of my card payments ever since I had a Credit Card- THAT surely helps. My spends are also not very high, less than 2L/Yr./Card, though I now plan to cancel all my other cards. This 1 seems good enough. N rewarding enough – i’m licking my lips!!!

Congrats. Dont cancel your card as long they are free. Uou never onow when they might become usedul. It will also help in maintaining ur Cibil.

Hi All,

I received my DCB card 2 months ago which was an upgrade from my HDFC Regalia LTF. I was using Regalia for nearly 3 years with pretty good spends (avg 8L per annum) and also never defaulted on my payments. My credit limit was 8L on the card.

I told the RM that Diners offline acceptance isn’t great so I would like to retain the Regalia mastercard too. He spoke to his supervisor and made it happen :). They split my credit limit as 5L for DCB and 3L for Regalia and I got to keep both. Flight travels for last 2 years have been almost free of cost for my family and with DCB, I am dreaming of Business class travels already 🙂

I am credit card minting freak and have cards from 13 different banks! I guess that if you are a “Siddharth”, you love credit cards ! Love your website as it is very well maintained and contains the information on cards I am always looking for.

Cheers,

Siddharth

I forgot to add, they waived off the joining fee for DCB for the first year and mentioned that there is a spend based reversal of annual fee if I hit 5L spends per year.

Thanks for sharing your experience 🙂

Btw, 13 Banks is Mind Blowing!

Sorry Sid. One correct. It is 13 different cards from 9 different Banks. Only major bank which is missing from my kitty is Axis bank. Not sure if I will ever take one from them considering the crappy reward rate on all their cards.

@Sid .. I can share the list of cards I am using personally with you and would be happy to share my experiences with all of them. I have been a credit card user for last 11 years.

Sure, feel free to comment back on the same.

Is there a way to track the Rewards points? Their statement shows bulk points including all transactions for the month but no per transactions breakup.

We lose track of points in this situation (especially applies to smartbuy)!

Hi Sid,

What is the best way to track the reward points of DCB ?

Best is to Call and check so you can know right away!

Thanks Sid, Will the call centre be able to tell the status of reward points per each transaction level, whether the points are credited?

The problem is usually with bonus points and for that they wont be able to give a breakup txn wise.

Siddarth,

I am planning to go for a DCB. Currently, I have a Regalia and Diners Premium with a combined limit of 7 Lakhs odd. I will not fulfill their salary criteria of 1.75 lakhs/month. Having relationship with HDFC since 2011 and have never missed a payment till date. what are the chances of getting it approved ?

99%

You can ask the card with 4L+ limit to switch to DCB.

Thank you. I will give it a try.

Hello card experts,

I am holding Hdfc Regalia with 4 lacs limit for past 1.5 yrs. I also have Diners rewards which is also LTF with 2 lac limit which is around 2.5 yrs old. Can I request to upgrade this Diners rewards directly to Diners black. I rarely use this Diners rewards card. I am in salary bracket of around 25 lac. Is it possible that they will upgrade it. I don’t spent much on hdfc cards roughly just 10-20 k per month, rather use Yes preferred or SC card as it has better rewards rate. I have other CC with upto 8 lacs limit.

Is diners black is LTF or do i have to pay fees from second year. My yearly spend on credit card will range around 15 lacs. Should I give it a try to upgrade directly to diners black or first ask for diners premium.

What are the chances.

Waiting for any response.

You have chances to upgrade Regalia to DCB but not rewards as the limit is low. Fees varies from profile to profile. Check with RM for the upgrade.

Hello Sid,

I have received my Diners Black card today and I thank you for making this platform available. It has been ~1.5 years since I have started following your blog.

I am a preferred customer with HDFC bank and I started to use the credit card from HDFC since 2012, starting with Platinum plus to Moneyback to Regalia to Diners premium to Diners Black. I was pushing my RM to get Diners black approved since last one year but it could not go through due to lower credit limit/not meeting bank’s salary criteria. However, recently the credit limit was increased to more than 5 lacs and Diners premium with use history of ~4 months got updated to Diners black.

Thanks to others as well who participate in discussions for sharing their thoughts/experiences.

Regards

Ganesh

Congrats! Glad to hear that.

Wow congratulations Ganesh. How much limit you had in Diners premium ?

Thanks. It was ~3.2 lacs which got increased to 5.2 lacs.

Congrats Ganesh.

Is this LTF or some charges? Pls elaborate. Thanks.

The 1st-year fee is waived-off with the registration of bill under smartpay. The renewal fee is 5000+18%GST.

Hi, right now I am holding Diners Clubmiles card, I did upgrade by sending docs to Chennai office directly. I didn’t thought of selecting Diners Club Black in the list. Made a mistake I think so. But I thinking looking at my usage which is around 90k per month bank approved Clubmiles without hesitation. Do u think I would have upgraded to Black if I have had selected Black.

Hi,

My HDFC RM is offering me Diners Black card with First Year Free and renewal waiver on 5L spend.

Though, my usage is around 7L per annum, but still was wondering, if anyone received this card as Life Time Free card?

P.S. – I am currently holding below cards:

1. Diners Premium Card (Life Time Free)

2. Axis Bank Select (Life Time Free)

3. Yes Bank Prosperity Edge (Life Time Free) – hoping it to convert to First Preferred soon.

4. CitiBank Indian Oil Card (Life Time Free) – Rarely used

5. Indusind Platinum (Life Time Free) – Only for BookMyShow buy 1 get 1

6. Indusind Platinum Aura (Life Time Free) – Rarely used, Planning to surrender this one.

Ganesha what is your salary

Credit limit on my card was increased by Rs.1.5 L today after 6 months. got a call for confirmation. I did lot of spends in last 6 month more than 1.5 times the credit limit.

MY experience on Lounge Access. DCB didnt work in Mumbai T1 & T2 on different days. However it worked in Delhi T2 /T3. I in fact complained about DCB not working from Mumbai T1 ( as I had to use a Priority Pass instead) They say its a network issue. Has anyone else faced a similar issue with DCB in Mumbai?

Just to update you guys mine Diners Rewards got upgraded to Diners Black. Initially they were reluctant but after a month of mails and escalations they finally approved. I received the card yesterday only. Also the limit was increased from 5 lacs to 8 lacs. Lucky to hold both Regalia and Diners Black variants from HDFC. I have to check whether its LTF or not as my last Diners Rewards was LTF. I do hold Yes Exclusive which I am using these days for most of transaction but I was missing 10x reward on diners for international transaction.

The next step is to apply for add on cards. Its good next month I am going to US for long term. This card will be very handy.

Hi, I m using HDFC bank credit card since 2012 and card upgraded regularly.I have latest regilia credit with 3L limit .I signed a application for upgradation of regila into DB card and it upgraded into two days with limit 4.2L .if you want this card ,contact with your RM

Now they are giving complimentary MMT(makemytrip) Black membership as well to Diners black card holders (just got invite)

Hello Siddharth,

Though it ain’t new anymore but still congratulations for Diner Club Black Credit Card.

I already hold a signature edition card i.e. SBI Elite Card.

I do not hold any relation with HDFC right now.

Am I eligible for HDFC Diners Black?

Thanks

Dr. Gaurav

@Dr Gaurav

If your net salary is more than 21 lacs then you have a chance. Otherwise you can only get it via upgrading from lower cc. If your credit limit is more than 5 lacs on sbi cc then you can try via card on card.

I’m self employed, do not have a bank account with HDFC Bank, but I’ve had their Moneyback card for 6 months which I upgraded to Regalia based on ITR. Now I’ve had the Regalia for 6 months with 2.5 lakh credit limit. Card is lifetime free.

Can I upgrade to lifetime free Diners Black if I send in the application? I don’t have an RM as I don’t have a bank account with them.

Hi Sid,

I am holding Regalia First Credit card with CL 2,60,000. I am using HDFC Credit card from last 6 years and after few upgrades currently holding Regalia First. My salary slip shows 1.2 L and holding one Saving account with HDFC with Avg Balance of 50K. Last Upgrade from All Miles to Regalia First was almost 10 months back. What are the chances of getting Dinners Black. Considering no upgrade option in net banking.

Very less. It can be upgraded in only 3 cases 1. ITR>Rs.21L, 2. existing limit>Rs.5L, 3.Very good NRV with the bank. I think ur case does not fall in any of the above.

From my experience of upgrading from Regalia to Diners black, chances are good if your ITR is >24lakhs and spending is around 5 lakhs in last six months.

I also got complimentary MMT Black membership last month via YES First savings account.

As a MMT Black member I can gift 2 more invitations to friends. Please go through the benefits on MMT app. Its valid for 1 year.

If anybody requires it, just provide me ur name and email. I will be happy to invite upto 2 persons (I suppose its complimentary invite).

Finally Diners Black it is…hurrayyyy..

hello guys,

First of all let me thank sidharth for such a wonderful blog. as its pointed out everywhere, getting a Diners Club Black is an impossible task but dont loose hope guys, Finally i got my diners premium upgraded to Diners black. It took almost 1.5 yrs for it. I am govt Employee with a salary bracket of just 50-60k per month so dont think tht its impossible. If i can do it, i am sure you all could get it. My CC journey is HDFC Superia 1 lakh> 6month > HDFC Jet World 2 lakh > 6 months > Diners Premium 2.65lakh > 1.5 yrs > Diners Black 2.65lakh. for the past 1.5 years i have contacted multiple RM, SM,BM and every guys for the upgrade req and multiple times manual req to chennai add and all was denied bcos of income criteria. at one point of time i stopped chasing it and was satisfied with Diners Premium. It became an habit for me to check CC upgrade option in net banking every week and i feel sad everytime when i see this option is not availble at the moment. I was planning to send the req to chennai for upgrading to Diners Club miles and prepared all papers and before posting it, i checked net banking one final time and to my surprise, the option for Diners Black was there with same credit limit Voila!! i just clicked Yes and took a screen shot in my phone, was jumping in my bed with joy..ha ha..finally DCB arrived after 5 days. So guys dont loose hope, just wait you will get the upgrade eventually. What i understood is that i always pay my bills on time, and never took the Help of RM or BM for upgrade , always Useless, they always try to push something to get thier incentives. all the upgrades and credit enhances i got by sending manual req to chennai by myself. I was a silent fan of this blog and this blog helped me a lot . thank you guys.

Hi Ali…..is it LTF or chargeable ?

Wow ! That gives us a great ray pf Hope for all of us Mr. Ali… Thanks for the positive Vibes…

1.Could you please share us ur Usage patterns? What was ur Credit Utilization Ratio?

2.What were ur spends mostly on?

3.Do u have any EMIs or Insta loans going on?

4. Are u a Classic or Preferred or Imperia or Regular Savings account holder with HDFC.

Ur Reply would be of Great Help to us.

did u mean ur diners black has 2.65lakhs credit limit?

Today only I got limit enhance to above 4.5. Can I ask for an upgrade to DCb

Hello Mr. Siddarth & Mr. Abhishek. I am a big fan of your blog and enjoy reading each and every topic as well as each and every comment on the site. I have a Diners Clubmiles Card with limit of around 2.35 lacs with monthly spends of avg Rs. 1.2 lacs in past 6 months. My last 3 years ITR is 11 lacs, 12 lacs & 14 lacs respectively. I am a self employed professional. I have recently in the last month foreclosed an HDFC Auto loan worth 13.5 lacs after paying 14 installments. Also I have another bank credit card with 4.1 Lacs limit. What are the chances of an upgrade to Diners Black Credit Card.

Ali we are eagerly waiting for your reply.

Dear all,

I currently have a Yes Bank Preferred card MasterCard(since 7 months), SBI Elite VISA (Since 1 yr) and HDFC Regalia MAsterCard (Since 4 Yrs). My stock card usage is Yes Bank. I use HDFC only for the flight bookings for the 10X Points. SBI is hardly used except for bookmyshow tickets. Can the house advise me whether i should opt for Diner’s Black instead of Regalia. I was thinking in terms of a more favorable reward points system there and that i already have a Mastercard and Visa card. Applying for Black may require me to surrender the Regalia. Current take home for me is above 25L/annum. thank in advance!

Hi Siddharth , i got my diners black today, it’s upgraded from my regalia card…my question is if i have to paid joining fee of 10000 then i will get equivalent value points vouchers etc against joining fee of 10000? Most probably first year will be free for me but not sure about this so please let me know asana…thanks…Dr.Hardik Patel

@ Hardik

Please check with your relationship manager. Diners Black joining fee is subjective, but yes, if you pay 10,000, you will get 10,000 worth reward points ; but you have to pay gst on that

Hi Guys,

I was Diners premium card holder for past 3 years, with starting credit limit of 1.3 lac and last year september they increased it to 4.4 lac. In jun 1st week I filled DCB upgrade form alog with last 3 months salary slips and put in near atm. To my surprise it got approved and received card today. 50% points got transferred as well, so I do not loose any interms of value. Also as I checked with customer care, they are saying it is lifetime free card (my earlier one was also lifetime free.) Very much excited to use this card. with reward points accumulated In past 3 years i could get 4 dubai return tickets for my family. Looking forward to utilize the best features of this card 🙂

I hope this experience will help others as well. 🙂

Hi Siddharth,

Are concierge services not popular in India or is it just that Indians haven’t learnt of its convenience/advantage?

Can someone please review concierge of Diners Black? What have you requested and were they able to fulfill your requests. Can I ask them to run errands for instance. Is it handled by Intl SOS or Aspire Lifestyle?

Hi Siddharth,

I have been holding Regalia from Jul’14 tilll date. Current credit limit on my Regalia card is 9,64,000. My yearly net is around 17L(less than 21L). Will I get an upgrade to Diners Black.

My RM doesn’t seem very well versed with credit cards & is not very helpful regarding this (My savings a/c is in my hometown in Jharkhand).

Should I proceed directly with sending upgrade form to Chennai? What are my chances as my ITR amount is less but my Regalia credit limit is pretty high!!!!

Please advise.

Vinny

Your chance of getting DCB upgrade is almost 100% if all other parameters that banks check like CIBIL etc are ok. Send the upgrade form directly to Chennai cards division.

Guys anyone here having LTF Diners Black ? How to get one if its possible to get DCB ? I currently have 5L limit LTF Diners Premium.

Hi Siddharth,

I am a Diners Club Premium Customer for a few years and have been looking to upgrade to Diners Club Black Card.

I just had one question you could help me with, when you upgraded from Regalia Card to Diners Black card,

what happened to your reward points? Were they erased? Or were they converted? If yes, what was the conversion ratio? Or none of this happened and both your cards were functional under the same account?

PS: I only have a credit card with HDFC and not a savings account and don’t think or know about a RM with HDFC per se. The one number I have of a CC manager didn’t know the answer to my query 🙁

Thanks in advance! 🙂

you will lose 50% of the points.

and rest 50% will be forwarded….

when i converted from premium to club miles, fortunately i had only 40…. 20 points lapsed

You will not loose anything. Final value would be same. Regalia 1 point =0.50, where else black 1=1. So if you have 50k points in regalia when migrated to black you would get 25k points. I have migrated from multiple cards. I never lost any points.

How is your experience for dcb? There is minimum availablity of pos for diners club black? How good is it. What does pre approved means and 20dinner black (10000)? Do I have to submit proofs or I would get the card updated automatically after giving details.

I have applied for diners black and online status is shown as ‘Approve’ but I don’t have hdfc account. But yesterday I had a call with the lady who took my application and she is saying that hdfc bank account is mandatory for it. Should I open bank account or will they stop card issuance even after approval if I don’t open bank account?

Amit, what was your limit initiatlly ? and did you apply for DCB via netbanking ?

please share more details. I hold a premium currently ….and my limit is 2.27 lakhs

This was perhaps the most emotionally connected card I had but now I have to give it up because off my better half 🙁

There is no international lounge acess on this for add-on cards so she would be left out in the cold on our trip to Japan early next year and we both think paying $32-50 for lounge acess is not worth it.

Since she does not hold like to hold her own card it means I will have to grow up and get her included somehow which means addon card PP ‘Diners you have dropped the ball on this’. Talked with prefferd RM about alternatives he suggested only upgrade to Infinia can help but since my branch does not have imperia first my account will need to be altered and yes RM will be changed. After that all Diners did not want me to leave and it was causing delays in upgrade. So my new RM told me to close the DCB so that a fresh application for Infinia can be requested/processed.

So today I broke my card in two pieces and gave them the closer form with the pieces, feeling outright sad of loosing my friend.

An update:

Seems cancelling the diners black to get a new credit card really works out. I got partially approved for the infinia “After telling my whole problem to the RH credit card” but since my branch does not have imperia facility they have approved an Regalia for me with a limit of 12.5lac “Highest I have ever gotten”.

I have written a mail trying to get back the DCB in a split limit with the regalia I hope they do consider it since DBC rewards are much much better.

Hi Sid,

I have been daily following your blog for recent updates in credit card world. Good news, today I have been upgraded to DCB from Regalia since I was fulfilling their ITR requirement. Reward points reduced by 50%. The card is expected to reach in a week time.

One advice to all those who are aspiring for DCB is try to first enhance your card limit to 5-6 lacs, maintain good relation with bank, your RM will also help u in getting approval from his end. (Mine RM was too helpful).

Did your RM help you with any exception approval? Since, you already fulfilled their ITR requirement for DCB, you should have received this straightforward right

What my RM did was useful in getting fast approval. First increase in credit limit, second helping me getting contact details of officials from HDFC premium card division so that can I directly send the document to him instead of Chennai office. They took internal approval and then send the documents to Chennai. So I know within two days that DCB is approved and card will be issued once document reaches Chennai.

Hey Ankit, is your DCB lifetime free? Do they give lifetime free DCB or the charges remain as they are

Can we negotiate ? Reply

Hi

I have been using DCB for almost 2 years now. The card is great but sometimes I feel that all 10X points are not getting credited. I checked with Bank and they told it’s not possible to track the points for all transactions. Anybody else facing similar issue?

Divyanshu

Hi Divyanshu

Even I had the same doubt and I backtracked for 6 months. Even though it is not accurate but the points are less which I ignored until recently . I escalated since I didnt get bonus 1500 points and finally after 4 to 5 months I got it credited. So it is better you keep a track if your spends are more.

Also I want one information. I got a mail stating that I am eligible for pre approved diners club black card. When I mailed to customer care they said nothing as such is shown in my existing card. But in netbanking it says to get my pre approved card. And when I click on that it is asking for personal information and card to choose. What does 20 dinners black (10000) mean? Also there is *tc. Whether it means I have to pay 10k per year and grace period is 20 days for bill payment?

Also if I fill and submit will my previous card get upgraded or there would be another round of documentation and verification?

I guess diners club card has very limited usage and availablity. What is your experience with the card. I currently have regalia Thanks in advance.

I had got my card upgraded to DCB around an year back. After waiting for 6-7 months for LE, I applied for credit limit enhancement by sending the form to Chennai office and received a Limit increase only by 10% in September. Now as I have completed more than an year with the current card, I have again received an auto triggered Limit increase by another 13-14% and thus compounding to a Limit increase of around 25% from an year back. My credit limit utilization was on average 30% throughout the year.

Now my query is:

Is this a decent auto LE that I have received? Should I go ahead and accept the currently shown auto triggered limit increase in net banking?? Or is there a chance of better limit enhancement offer after 2-3 months in case I do not take any action right now? Also if I do not take any action now, will that current LE offer stay for at least a month or so or is that available only for a very limited time?

Same thing happened with me.

Take action right now. If you won’t bank will not further increase your credit limit as they think that you don’t need it. One you increase it, then from that date they have a cooling period of 6 months. After that only any further increment will take place.

Hi GTMAX, my opinion take the Auto LE. i Got Auto LE back to back 2 months, once i completed 6 -7 months on DCB. thought i am a heavy user (maxed out twice) mostly international. I got this in Last year June, very low limit in range of ~3 L. in Dec i got approx 10% LE and again in Jan this year approx 50%. On my wife’s regalia, i get LE without any significant usage but EMI triggered that LE (i assume).

Hi Amit,

Thanks for the reply. Getting LE in back to back months is incredible. Will go ahead with LE acceptance for now and then see if it gets trigerred again 🙂

I am having a hard time getting approval for Dinners Black. Recently I have received a limit enhancement on my regalia (holding it from 3-4 years) 4.2L from 1.8L.

I will be filing an ITR of around 16L this month. Also maintaining a holding of > 12L with HDFC, my account is also being upgraded to Imperia.

Any pointers on how to get hands-on Diners Black ASAP?

You should get an upgrade option in netbanking within few months from now.

Got a limit enhancement offer, now my limit is 5,61,000 from 4.2L and account is also Imperia now.

Can I do get my RM to apply for dinners upgrade without income documents now?

I just don’t want to wait till my AY19-20 ITR for DCB.

You can give it a try, send a mail to customercare.cards

go for a couple of escalations.

As I was not getting any upgrade offers since a long time, I decided cancel my Clubmiles card and requested to upgrade my Regalia to DCB through my RM. Received my DCB Yesterday.

I got my DCB upgraded with limit of 4 lacs. The card has not yet been delivered. Sadly but the rewards been reduced to 5x for smartbuy.

Next on my list Standard Chartered Ultimate Card – fingers crossed.

From the past comments, It looks DCB offered unlimited lounge access to Supplementary card holders also.

I have received the DCB Card few days back along with supplementary card, but the lounge access was not available for the Supplementary card holder when we tried to use it. Can anyone confirm on that?

I can confirm that the Lounge Access is still available on the supplementary cards of HDFC DCB. However, I have always swiped the primary card /supplementary cards separately. They work just fine. I have NEVER swiped them simultaneously. It might not work simultaneously. That you have to be careful about.

I applied for an upgrade though my RM from my existing card of Regalia First with 5L limit. My Gross salary is 1.3L per month. During taking the request RM was pretty sure that it would be approved as i am a preferred customer and also have FDs in the bank but after a couple of months of no update when i enquired my RM he just said i did not meet the criteria of upgrade as they need 1.65 Nett salary so it’s rejected. I am not sure if he processed the application or just rejected it himself by not sending it to processing.

Have anyone faced any issue like this with card rejected via RM or should i try once with sending an upgrade request form to the CC division

Dear Gopal

I faced similar issue in past. From my experience I can say that Regalia First to DCB upgrade is possible only if you meet salary/ ITR criteria i. e. 1.75 lacs/ 21 lacs. Even my BM was 200‰ sure of upgrade but didn’t happen though I escalated 2-3 times.

Better way will be 1st upgrade to Regalia and then try for upgrade after 6 months of holding Regalia. That will be much easier. Regalia First to DCB upgrade is possible only in exceptional circumstances is what I have learnt in this process.

Hi Satish,

Thanks for your valuable input. I was also thinking of the same but also planning to try my luck by sending the update form directly to Chennai if it fails i will opt for a Regalia upgrade and trying out as you suggested after 6 months.

Dear Gopal

I tried that also (sent upgrade form along with documents and a nice covering letter to Chennai) but only resulted in waste of another month or so. As they didn’t even reply that upgrade request has been rejected, so I had to follow up for the status.

There is no harm in trying this route, but chances are very slim. Still as your credit limit is sufficient for the upgrade, it may well be worth taking your chances.

Got a Regalia First(6 month usage around 8L)(3L credit limit since approval) , to DCB yesterday. Sent the upgrade form with 20.5L form 16 of last financial year. Got a message new card approved and a separate one mentioning that limit has been increased. I would really like to know how much it’s been increased to, is there any way?

Is holding a bank account mandatory to get DCB as LTF for a fresh application?

Guys, is it true that New HDFC bank credit cards are not LTF but only FYF. I downloaded upgrade form from their website and now there is no option for LTF

Yes now they are offering only FYF

Hi, is a priority pass card issued with the dcb card of Hdfc? I know that it’s the case with regalia and hence asking. If they do not issue a separate card, can we just swipe the dcb card for lounge access across the globe?

Hi Vikas,

There is no separate card for DCB to access lounges across the globe. You can swipe your card itself to gain access to the lounges.

You can access the Diners Club lounges using DCB directly. These are not always the same as Priority Pass lounges. In fact they are far less.

Just redeemed 1.5l points for 4 nights stay in maldives 😀. Will further redeem some points next month if i get on time for flight.

Where are you staying in Maldives, just curious. I guess you booked through the Diner site.

You redeemed only for flights or for the hotel also?

Because I haven’t seen much value in booking hotels through DCB portal

Have a good trip !

Does anyone know of a way to upgrade from Clubmiles to Black without having to submit ITR? Presently avg. monthly spend on the Clubmiles card is between 2.5-4.5 lakhs per month. This has been consistent for over a year. The system doesn’t seem to trigger an auto-upgrade option and working with the customer care team is a pain. Any insights will be deeply appreciated.

What kind of relationship you hold with the bank i.e. Standard, Classic, Preferred etc.

Try upgrading your relationship and wait for sometime.

2.5-4.5 Lacs per month spends would put you in their top 1% high spenders possibly.

I would suggest to download the Credit Card upgrade form from the internet and courier it to HDFC’s Chennai address. However, you will still need to attach your financial documents alongwith the card. This worked for me, despite not being eligible on the Net Monthly Salary basis, nor I have any good relationship with HDFC.

Hi Siddharh,

You have mentioned

Add-On Cards gonna be useful with Diners Black as it has unlimited complimentary lounge visits in any part of the world. It might help some day or other when i take my family for a holiday.

Can you confirm that add-on cards also have unlimited complimentary access to the lounges across world?

Lounge access is complimentary for the primary cardholder only.

Hi Siddharth / Team, Can you advise on how to find the EXACT/ACTUAL list of international lounges that I can access using the DINERS BLACK card? I tried the dnata lounge in Singapore that’s listed on the diners site, but they said they can’t accept the card.

There is diner club website and also an mobile app that has list of lounges and other diners facilities.

Just got my card .

A change in the max limit of points those can be aquired through smart buy.

This is a bummer. It was 25000 till the end of May. And now it is 15000.

However, for Infinia they continue with 25000.

Also, it is clearly mentioned that this is valid till the end of June only…

A lot of people are getting confused about Domestic or International Lounge Access on DCB Supplementary Cards.

In case of DCB, Add-On cards are exact replica of Primary Card with only name change. Hence, the features of Primary card will be same for Add-On card.

Why some people failed in lounge access using add-on card:

They must have used the Primary card first, and then the add-on card. As I said earlier, these cards are replica and hence on one POS terminal, only one card be used at a time. So, may be try sending the add-on card member to another lounge with DCB acceptance in the Airport, and it may work. But on one lounge, you can use only one card at a time.

Thanks to this blog finally got upgraded to DCB after 2 years use of regalia. It seems HDFC has upgraded the design.. moreover contactless now available in diners cards… @Siddharth-would love to share a pic if you need

Is it different than the one here?

It’s same but with contactless sign on the right

It’s the same one just with a contactless sign

Wow a contactless diners club card, that is awesome.

Aditya just asking, why did you opt upgrade to DCB and not Infinia?

@Mickey, partner 10X offers, lower fee waiver, separate card not needed for lounge access, etc.

I SUCCESSFULLY, GOT DCB ON 26-08-2109, AFTER GAINED KNOWLEDGE THROUGH THIS BLOG, HOW TO GET DCB. IT MAY BE USEFUL TO OTHERS.

1. HDFC SAVINGS BANK CUSTOMER FOR THE PAST 15 YEARS WITH AQB 15000/-

2.HOLDING PREMIUM/CLUBMILES CARD SINCE 2107.

AFTER READING THIS BLOG, AND ESPECIALLY SRI SIDDARTH COMMENTS, I APPLIED THE FOLLOWING STRATEGY.

I AM PENSIONER, AGED 61. MY ITR 2018-19 SHOWS 24 LAKH DUE RECEIPT OF RETIREMENT BENEFITS. NEVER IN THE PAST, MY ITR s NOT EXCEEDED 18L.

IN JULY, 2019–I MADE THE FOLLOWING:

1. CONVERTED MY SB ACCOUNTS INTO CLASSIC, AND MAINTAINED BALANCE OF RS.60000/-

2. MADE A FIXED DEPOSIT FOR RS.160K

3.TOOK A MEDIUM LOCKER

4.TOOK A REGALIA FOREXPLUS CARD WITH A BALANCE OF USD500.

5.MY CIBIL SCORE AND SPENDING ON CLUBMILES IS OK.

IN AUGUST 2019, APPROACHED THE BM OF THE BRANCH WITH MY LATEST ITR AND ALL MY RELATIONSHIP WITH THE BRANCH.

AT THE END OF AUGUST I RECEIVED DCB.

THANKS TO HDFC BANK AND THIS BLOG.

How can I get my hdfc diners rewards get updated to ltf HDFC diners black. I got LTF rewards card 5 years back but I hardly used it. I also hold HDFC infinia and yes first exclusive card. Annual card spend is about 20 Lacs.

I just got my emoluments revised and received a sum of 185000 net this month in salary. Can I send current month payslip to upgrade to Diners Black or I have to wait for atleast 3 month’s pay. I am currently holding Regalia first with 220000 CL.

Atleast 2 months… As this is what I did as well.

Thanks for your reply, i sent form with one month slip,

my request didn’t go through, now will try sending 3 months.

My HOD received diners club Black, she applied for a car loan through HDFC, during the application she was asked if she wish to apply for a credit card, she said she want diners black. The executive told him that she has to pay first year fee as well as the renewal fees every year. As she agreed she got it delivered within 5 days.

P.S. she is eligible her CTC per month is around 2.8 lakh net, but she never hold any HDFC Bank credit card before and she has basic relationship with HDFC bank, not even classic.

I hold both Infinia and Diners Black cards from HDFC. Does HDFC has any better cards to offer apart from these..

Hi sid,

Thanks for the blog….truly informative one.

I’ve recently applied for DCB and got it delivered today…

Background: I have a relationship with HDFC only since Sep’2019 and opened my savings account with 500000 as initial amount. The account got upgraded to preferred in a couple of days. Then applied for DCB through ITR route ,I have an ITR of 19.34 lakhs(which is below the required ITR limit for DCB-Self employed category) and got it delivered.

I currently hold 7 CC with different banks and my CIBIL score is 846 and no history of late payment. I think this drove me to get DCB even though I’m not eligible through ITR route.

Does this card offer rewards point on Insurance?

Yes, it does. But points you earn are capped at 2,000 per payment.

Got DCB with 3 months payslip and bank statement to branch,it got approved from an earlier moneyback card with limit 130000.Thought of sharing.

Hi Fortune Speculator, how did you go about getting the upgrade? Did you mail requesting for upgrade, or posted the form directly to Chennai office? And where were you with the income level? And did you apply for upgrade now during lockdown? I too am in similar situation and would like an upgrade soon as possible.

Thanks in advance.

Salary was met as per diners black requirement.I had just been to an hdfc branch in november and asked for their upgrade form -provided salary slips to the lady by email, signed the forms and gave them.It took a week to get delivered

Hi Sidharth

You mentioned in the blog that both primary and add-on cant be used together. What does that mean? Also should be have to pay additional charges for the add on card.

Thanks in advance

Hello all,

I got my DCB last year and 1st statement was on 16th June 2019. First transaction was done on 25th May 2019.

Technically, which one is my card anniversary year?

I have some big payments to be done. I would like to plan accordingly so that they are counted against next year’s spend based fee reversal.

To be on a safer side do any transaction before 25th May. Why take chance.

Hello Card Experts,

Is there a way to pay NPS payment through Diners Black card and also earn 3.3 rewards rate. I checked on NPS site only Visa and mastercard are accepted.

I pay NPS using my Amex. There are 2 payment processors for NPS, one is Billdesk and the other is SBI. Select either and try. I don’t remember which one takes Amex or Diners.

I always use SBI gateway. That accept the Credit Cards for AMEX also. But you wont get any points as same comes under insurance category.

Actually, you can just call them and send them a screenshot of the transaction of proof and they give you the points. I have done this so many times over the past 2 years now for myself as well as my family members.

Diner card accepted for NPS contribution. Even though diners not in mentioned explicitly, you can go ahead and enter diners card during payments page. Like visa, mc- 1% will be charged by payment gateway.

Diners cards work. I’ve made a payment in March through Diners Privilege Card. Just enter the card details and make the payment. It would work.

Can anybody inform if we can directly pay our credit card bills via transferwise or from foreign banks for DCB.Let know if anyone can guide me.

Why will you want to do that? This will make your tax filing complicated and might get you in trouble later on.

I got DCB today and the welcome kit does not feel like anything shown here. In these years, they have made it look nothing like a premium product.

I Don’t know if this is the right post to add this comment!

This is on HDFC DINNERS BLACK CARD & LOUNGE ACCESS!

Many had many queries on using Addon & primary DCB cards at the same time in the same lounge!

I did try it recently on 12 APRIL 2021!

3 of us (1 primary cardholder & 2 add-on cardholders) accessed the New TFS lounge at Chennai Airport Domestic terminal (near gate 1) at the same timing and went inside!

Yes! First Primary cardholder swiped, Got approved