New list is up: Check out the latest list: 25+ Best Credit Cards in India 2019

Everyone wants the best credit card ever available in India, but what’s best for me may not be best for you. This is because where we spend, how much we spend and how much joining fee we’re willing to pay varies between you and me. However, this article covers anything and everything that you would ever need to make the most out of your credit cards. Be it a beginner to the credit card or the celebrity who spends few lakhs to crores every year, i’ve covered them all 🙂

If you’re very new to credit cards or if you’re wondering what are the basic benefits of holding a credit card, you must first check out 7 Reasons Why You Should have a Credit Card in India. Others, lets begin with the list.

India’s Best Credit Cards in 2017 – The Most Famous All Rounders

If you’ve a very high income or looking for a super premium credit card, you can find them at the end of the article. Now lets first look at the ones that are more popular, easy to get and common among the credit card holders in India.

- SBI Card Prime

- Yes Bank Preferred Credit Card

- SBI Elite Credit Card

- HDFC Regalia

- HDFC Diners Premium

- SBI Simply Click Credit Card

- Amex Gold Charge Card

- Indusind Iconia Credit Card

- Standard Chartered Manhattan

- ICICI Bank Coral Credit Card

- Citibank Cashback Credit Card

and now lets see why each of them are in the list.

#1 SBI Card Prime

SBICard recently launched a new credit card in 2017 which is my favorite pick of the year. If you’re looking for a single card that serves all purpose, its SBI Prime Credit card. Its a power packed credit card with a lot of features stuffed inside. From milestone benefit to lounge access, SBI Card prime has everything you need under single roof and that too with a renewal fee waiver of 3L spend.

- Reward Rate: 3%-5%

- Joining Fee: Rs.2,999+Tax (You get equivalent Welcome Gift)

- Full Review: SBI Prime Credit Card Review

- Apply Now

Best for: Dining, Groceries & Departmental stores Spends, International/Domestic Lounge Access,

#2 Yes Bank Preferred Credit Card

This is more of a replacement for HDFC Regalia (as its devalued now) and is relatively easy to get approved. If you prefer to redeem your points primarily for Flight tickets/recharges, or even amazon vouchers this card is best fit. Yesbank entered Credit cards space in 2016 and they’re growing super fast. Their recent promotional offers are good enough to consider holding one of their credit cards.

- Reward Rate: 2%

- Joining Fee: Usually Free

- Full Review: Yes Bank Preferred Credit Card Review

Best for: All type of spends, International/Domestic Lounge Access

#3 SBI Elite Credit Card

If you’re looking for a best credit card with the ability to redeem reward points for cashback, this card will fit in perfectly. Also you get 2 bookmyshow tickets every month (not buy1 get 1) which is one of best kind of Bookmyshow offer you could get. It suits best for high spenders and your annual fee gets waived off on 10L spend.

- Reward Rate: 2%

- Joining Fee: Rs.4,999+ST

- Full Review: SBI Elite Credit Card Review

- Apply Now

Best for: Dining, Groceries & Departmental stores Spends, Free Movie tickets every month, International/Domestic Lounge Access

Yes, it comes with a high joining fee, though you can get a waiver on a 10L spend per year. Even if you don’t spend that much, you get the value back through bookmyshow vouchers.

#4 HDFC Regalia Credit Card:

It’s HDFC’s flagship credit card and had its name and fame for many years, but now after a huge devaluation, it has lost its position big time. Its a lifestyle card, you get decent reward rate, free domestic and international lounge access, low foreign currency markup fees on international transactions, 5X rewards with selected merchants and access to host of other offers with HDFC.

I’ve been using it for more than 2 years, accumulated a lot of reward points and used them to book FREE flight tickets for my recent trip to Vietnam. If you find it tough to get approved, apply for Regalia First and then upgrade it to the Original Regalia after 6 months.

- Reward Rate: 1.3%

- Joining Fee: Usually Free

- Alert: HDFC devalues all their cards very often

- Full Review: HDFC Regalia Credit Card Review

Best for: All spends, International/Domestic Lounge Access (Priority Pass can be shared with Add-on Cards)

#5 HDFC Diners Premium Credit Card

If you’re more of a traveler and online shopper, HDFC Diners Premium Credit card will help you save quite a lot with its 10X Reward Points and complimentary lounge access in India. The only downside of this credit card is that its not a Visa or Mastercard but Diners Club itself and the Diners Club acceptance is not 100%. Hence you always need one backup card to be on safer side.

- Reward Rate: 1.3% – 13%

- Joining Fee: Usually Free

- Full Review: HDFC Diners Premium Credit Card Review

Best for: 10X Rewards Categories, International/Domestic Lounge Access

#6 SBI Simply Click Credit Card

If you spend more online and happy to redeem your reward points for Amazon Vouchers, this is the card for you. Also you get 2X returns when you spend with partner websites.

- Reward Rate: 1.25%

- Joining Fee: Rs.499+ST

- Full Review: SBI Simply Click Credit Card Review

- Apply Now

Best for: Online spends & with selected partner merchants

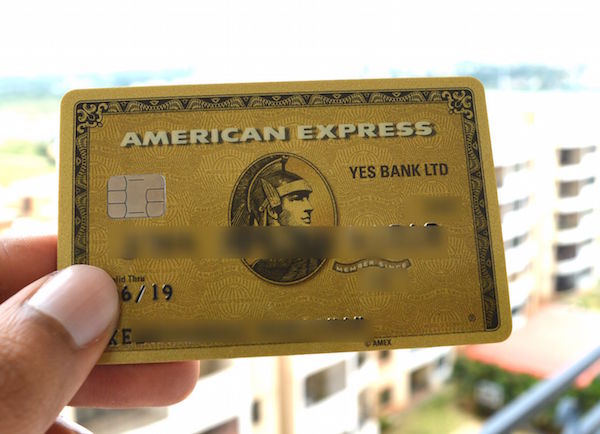

#7 Amex Gold Charge Card

You MUST have atleast one of the Amex cards in your pocket and Amex Gold charge card can be a best fit for that reason. This is because Amex is very aggressive and active in running offers with various merchants, especially related to travel and during festive season.

- Reward Rate: ~2%

- Joining/Renewal Fee: Rs.1000+ST/Rs.4,500+ST

- Full Review: Amex Gold Charge Card Review

- Apply Now

Best for: All spends, Travel & lifestyle offers, world-class customer support

Note that its a charge card and hence you can’t buy things on EMI, for which you might consider the MRCC card. Do you know, with Amex Gold charge card, you can start with 1 Lakh internal credit limit and go as high as 8 Lakhs in just 6 months. Before you apply for one, you must check out 5 Things You Must Know about Amex Gold Charge Card.

#8 Indusind Iconia Credit Card (Amex)

The ability to earn reward points on fuel & utility spends and redeem them for cashback makes this card a unique one among the most popular Credit cards in India. Best when spends are made on weekends. Go for it if you’ve a lot of Utility spends, if not skip it as it does have a joining fee that you can’t escape from.

- Reward Rate: 2%

- Joining Fee: Rs.3,500+ST

- Full Review: Indusind Iconia Credit Card Review

#9 Standard Chartered Manhattan

Are you a Family man Looking for cashback on groceries and departmental store spends? This card is for you. Standard Chartered also has good cashback offers with Uber which makes this card stand apart. Having this card is one of the best ways to save on your Uber expenses.

- Reward Rate: Upto 5% (though lots of limits applicable)

- Joining Fee: Rs.499+tax (Waived if you Spend Rs. 30,000 in a year )

- Full Review: Standard Chartered Manhattan Card Review

- Apply Now

#10 ICICI Coral Credit Card

In earlier days its famous for the Bookmyshow Buy 1 Get 1 offer, however these days its very tough to get it due to the limited availability. Availing Buy1Get1 with this card is like booking a Tatkal ticket 😀 Apart from that, its very useful for Lounge access. Make sure to grab the Mastercard variant for lounge access.

- Reward Rate: 0.5%

- Joining Fee: Rs.1,000+tax (sometimes free)

- Full Review: ICICI Coral Credit Card Review

#11 Citibank Cashback Credit Card

Get flat 0.5% cashback irrespective of where you spend, infact it gives you 5% on some categories. So you don’t need to deal with reward points and all that stuff. Good for beginners and as like Amex cards, Citi also runs travel offers quite often for which this card will be very useful.

- Reward Rate: 0.5%

- Joining Fee: Free

- Full Review: Citibank Cashback Credit Card

Alright, these are the cards most of the Indians are having in their wallet. Its upto you to choose which one you need based on what benefits you’re looking for. Ideally, you can have 2-3 credit cards for someone who has yearly spend of ~3L and for anything more than that, i invite you to the super premium credit card segment.

Super Premium Credit Cards:

Got a high income or have credit card spends more than 3 Lakhs in a year? You’re supposed to have one or more of these super premium credit cards in your wallet. All these super premium cards are lifestyle cards and has better rewarding experience on Travel, shopping & Dining.

-> For Full Reviews of each, check out: 5 Best Super Premium Credit Cards in India

Domestic Travel Credit Cards:

While most of the super premium credit cards in itself has cool travel benefits, there are some of dedicated travel credit cards in India that gives you Air Miles (or) travel vouchers that can be redeemed for complimentary flights and hotel stays.

While most of the super premium credit cards in itself has cool travel benefits, there are some of dedicated travel credit cards in India that gives you Air Miles (or) travel vouchers that can be redeemed for complimentary flights and hotel stays.

-> For Full Reviews of each, check out: 7 Best Travel Credit Cards in India

International Travel Credit Cards (also for Foreign currency spends):

Once in a while you might want to travel far and beyond the limits of the country. If you do, here are some of the best credit cards for international travel and it is also applicable for those who spend in foreign currencies, both online and offline. These cards typically has low foreign currency markup fees.

Once in a while you might want to travel far and beyond the limits of the country. If you do, here are some of the best credit cards for international travel and it is also applicable for those who spend in foreign currencies, both online and offline. These cards typically has low foreign currency markup fees.

-> For Full Reviews of each, check out: 7 Best Credit Cards for Foreign Currency Transactions

I hope that helps you find the best credit cards you would ever want. Was the list helpful? Do share your views in comments below.

Hi Sid,

For Regalia card, I suppose domestic lounge access facility removed and for diners club there is an unlimited one plus one movie ticket to PVR movies.

You can still access domestic lounges directly with the credit card at Visa/Mastercard affiliated lounges. Ofcourse, one on one movie offer with Diners is good, but it doesn’t cover all cities, especially mine 😐

Excellent compilation. All information in one article.

For fuel one can have citibank indian oil card, seeing most of the banks now only reversing 1% surcharge.

Yes, it seems Fuel surcharge waiver is getting tricky these days. I’ll get this thing updated for other cards shortly.

Great compilation!

I think the ICICI card review is incorrectly linked to the Standard Chartered card review.

Thanks for spotting that Raj. Fixed 🙂

Hello Sid, If I do value for my time vs money for reading your post and spending time on your blog makes perfect value and returns. Keep updating your customers with your passion. Thanks.

In 6 months time I may spend nearly 5-6 lacs for marriage, currently I hold dinners premium card for past 2 months, what is your CC suggestion to get maximum benefit interms of rewards like flight, forex, international spent, hotel booking to minimize honeymoon spent 🙂

Thanks much for the kind words.

Typically, for this spend, you need to check out the Super Premium Credit cards in the list 🙂

Just upgrade Diners premium to Black, which could save you a lot on your honeymoon travel.

U can apply for amex platinum travel card. On 4l spends u get vouchers worth 28k for indigo and taj.

Congrats on a great blog that is going places..

I have 2 questions:-

What is the difference in getting the regular Amex and the Yes Bank affiliated Amex cards?

Which card do you think is best for utilities and/or fuel?

Also, not sure what I should do with my normal Amex cards – I switched my Jet card to the Plat Travel and they reduced my limit from 5Lakhs to 70k! I tried speaking to them but oddly for Amex someone was very rude and told me to cancel my card. Which card do you think I should move to? I already have the Diners Black.

Thanks you,

1.Any Amex card has nice 3% cashback on fuel, limited promo though

2.You actually closed one and opened a new a/c as AMex doesn’t support “upgrade”. So its normal.

Sure, but Amex has lower acceptance in fuel – is there any way I can get points in fuel?

Or maybe it counts towards a milestone upon which I get benefits?

Ideally larger than the small Citi IOC card, where I can make meaningful transactions every month..

Indusind Iconia might serve your purpose.

I spent like 6-7 lac rupees on hdfc diner premium and applied for upgrade to black card and was still denied the same. How to go about getting this card. I don’t understand that!!

Well,

They also look for relationship value & income.

Please check the respective review article for loads of experiences shared by other readers.

I liked the first pic with all your cards stacked in a nice way. Gives a good feel to have your hands on cards from various providers.

Happy that you liked the pic 🙂

Standard Chartered Manhattan card features changed

Downgraded

Even features for Standard Chartered Super Value changed

But still good

Why sbi elite card is not in the super premium segment?

Because its not 🙂

Hi Sid

I have HDFC platinum money back card, HDFC has offered me an upgrade to Regalia or Diners Premium. Which one should I go? Personally, I think Diners premium as it gives unlimited lounge access and a movie ticket. I am not much bothered about its limited acceptance. Please suggest.

Regards

Ved

Yes, Diners Premium esp for Lounge access and 10X rewards.

What does 10x rewards means?

Can you provide some example for my understanding

Firstly i want to thank you a lot Sid because,

I used to own HDFC Regalia Credit Card and i thought i had the best credit card in india with all the benifits that any single credit card could offer and didn’t bother to get any other credit card but then i came to know about your website,

I thoroughly studied your articles for couple of weeks and then concluded as below,

If you want to hold multiple credit cards then hold each one from different credit card technology providers like visa, master card amex etc,

I used to have regalia with 8 lack credit limit so first thing i did was, Get YES FIRST EXCLUSIVE Credit Card on card on card besis so i can MasterCard credit card which i can use for free domestic airport lounge visits because my visa regalia didn’t help much with lounges in cities other than delhi and mumbai,

Second thing i did was to get American Express Platimum Travel Credit Card so i could use their amazing domestic and international hotel deals,

Third is Diners Black from HDFC Bank to get 33% discount on partner websites and buy one get one unlimited movie tickets offer (i am Add On card owner),

Fourth was my Visa varient HDFC Regalia which i got upgraded to Visa varient HDFC Infinia after chasing HDFC Bank staff for some time, Visa has some nice offers like 75rs OLA cashback etc.

So,

American Express Platinum Travel

MasterCard Yes First Exclusive

Diners Black From HDFC

Visa HDFC Infinia.

Awesome & Congrats on all!

That’s a perfect strategy.

Am glad that i was able to help through the blog 🙂

Sir,

You four powerful cards with you…great to know and congratulations

Hey Siddharth,

Which credit cards allow free lounge visits to companion ? If not included in primary card then with addon card .

Which one is best & easy to achieve ?

Priority Pass also allows only primary holder.

ICICI’s high end Sapphiro is not providing this perk either.

Thanks

Hi Siddharth,

A little help here will be very much appreciated !

Thanks

For Domestic?

Consider Diners cards.

Easiest though is some Mastercard debit/credit cards.

Can you please suggest cards ?

I wish to have access to lounge ( domestic + international ) for wife with addon card.

Will HDFC Regalia work for this purpose ?

I have Diners Premium but not sure if lounge access to companion is allowed with this card.

Thanks a lot for quick response.

Diners premium itself has this.

Icici’s high end card is the carbon card

Now HDFC is very clear about the Eligibility Criteria for all their Credit Cards. HDFC has updated the minimum eligibility criteria for all their cards in their website. For Dinersclub Black it is >21 Lakhs, Regalia >12 Lakhs, Dinersclub Premium >7.2 Lakhs, Regalia First >7.2 lakhs…

They have also updated the Rewards Catalogue and the heart break is, Regalia Credit card has been placed at a Lower Level than Dinersclub Premium.. Regalia is in Category E, whereas Dinersclub Premium has been placed above it in Category F.

What it means that, Inorder to redeem your points for a 32Gb Iphone 7, you need 2,00,000 points in case of Regalia, and only 1,75,000 points incase of Dinersclub Premium.

Hello Siddharth,

I am salaried person 40k/month is my take home .. Currently I am using ICIC Bank Platinum Chip Credit Card. Could Please let me know some good cashback/any other Credit cards for my regular use(Grocery, Online/offline shopping, Flight ticket booking & Dining). For a kind information I am looking CC from HDFC Credit card or you can suggest the same from other bank also

You can start with HDFC cards.

Siddharth,

It would be helpful if we receive Notifications for the replies to our comments. Is it possible?

Sure, will look into it.

Siddharth

Informative article and thank you for being generous in sharing your knowledge

Had some queries/suggestions

Great if you can include processing time if you aware

What does one do if there is a card rejection – eg. applied for SBI platinum and got no reason for rejection

Costwise Is it economical to use a forex travel card for expenses instead of credit card when traveling overseas making – which one is most cost effective?

thank you

6 Months wait time should be fine. reason for rejection is very imp though.

Check out the best credit cards for international use in the article. Those are better than forex cards, as long as you don’t need cash.

Hi,

I am a Diners Rewardz Card holder and recently being upgraded to Diners Premium. Just want to know what would happen to my RPs. I have accumulated around 25k. HDFC is saying just one line, RPs would transfer as per the applicable ratio. Whats the applicable ratio. Also, i am to get some cashback for my purchases, luke 1200 from Goibibo, 6k for buying iphone7. Will that cashback get deposited in new Card? Thanks

I dont remember correctly but its like half of one third. So HDFC customer representative told me to redeem the points first before upgrading your card. So I redeemed the points and then applied for the upgrade.

Hi Siddharth,

What is card-on-card basis? How to apply using card-to-card and which all cards are applicable for this?

Its basically applying for a new card based on the proof of existing card with other bank. Offers vary from time to time.

GREAT work!

I have become a fan of your contents. Just wanted to put a word through – Hats Off !

Sid , Do you have any updates for HDFC 10x ?? Has the bonus point scheme actually expired ?? Might consider changing my Donera premium in that event . Any suggestions ?

Thanks for the kind words. 10X will run for quite sometime 😉

How i am looking to apply for a Credit card, after reading your article i am planning to apply for Amex Gold but annual fees are very high ? i have few questions for amex gold charge card

1. Is there any monthly/ annually spend required so that customer care support can waive off annual fees ?

2. i currently hold league kotak card ? is that worth having ?

3, what is your strategy to use this Gold charge card ? how to make most use of it…

4. I hold addon card of Regalia and i have my own Citi rewards card ? is it worth keeping citi rewards card ?

1. Spends like 10L can help

2. Maybe, if free

3. Redeem for 18k or 24k

4. As long as its free.

Basically as long as you have enough spend to do on each, you can have as many cards as you want.

Havoc on HDFC Diners Club website. Complete chaos and confusion on list of vendors. The top list of partners and list below have lots of diff names. Maybe MMT etc no there- no OTAs. Huge loss. Points capped at 25K

Regards

Dear Siddharth

great article i studied keep writing get a credit card great happiness.

thanks

Which is better of hdfc infinia and hdfc diners black?

Please help me to get my first credit card.

from which cc i should start.

I’ve selected few below please suggest as you know better than me.

SBI SimplySave

CITY Rewards

or anyother you suggesting.

Mostly i want to use card for grocery shopping, dineout , movies and some shopping.

1L limit is enough for me. Please suggest.

Excellent stuff. Great website with a lot of useful information.

Sid, What Amex card would you recommend a person with a salary >1L per month, but with a credit card history of just one month [Regalia First] (paid off the first month bill in full).

It also depends on your yearly spends. Gold card or Plat travel is good to start with.

Dear Sid

I am holding HDFC Regalia and I want to upgrade to Dinner premium please suggest

I am also a little puzzled on this, I am provided 2 options to upgrade from Diners rewards:

1. Diners Premium

2. HDFC Regalia

(both LTF)

I am planning on going with Diners Premium, because:

1. Lounge access = 6 (domestic, international combined and shared with the add on cards), which can be availed on add on cards as well and not limited to 2 per quarter for domestic.

2. Movie Buy 1 get 1, still there on few theaters, I hope, they will bring back PVR to their list.

3. 10X category, which results to around 13.3% rewards. (e.g. spend of Rs 600, give rewards equivalent to Rs. 80)

4. Same reward rate, after devaluation of both Diners and Regalia = 1.3% (except for 10X on diners)

PS: for other benefits I also hold Axis Select Credit Card (LifeTimeFree) like:

1. Priority Pass – 4 complimentary international lounge access

2. Domestic Lounge Access – 2 per quarter

3. Visa offer Buy 1 Get 1 on Bookmyshow

4. Reward rate on all Retail = 2.5%

5. Reward Rate on all other spends = 1.3%

For diners premium card 6 complimentary lounge access is applicable only to primary card holder and not applicable to add on card right ?

hi siddharth,

I am self-employed having an ITR of 10 lacs, but HDFC gave me a credit limit of Rs 75000 only with moneyback card which I feel is way too less.

1. In your experience which bank will provide me with maximum credit limit for the given income??

2. Also, which bank’s credit card enhances credit limit most rapidly if used properly??

1. It also depends on many other factors.

2. Amex

Hi Sid,

Recently, HDFC bank released two cards in their pool. Bharat Cashback card and Freedom Card. Both are in cashback catergory. What is your view on this one

I’ve reviewed them. Pls have a look.

Hi Siddarth,

For about 5 years+ I was using the ICICI Signature card. About a year ago ICICI have offered me a Sapphiro with the same limit of 3.9 lakhs.

My yearly spending is more than 5.0 lakhs & i travel atleast twice abroad.

To use the international lounge access I have been given a Priority Pass Card but on which I get charged !

Could you suggest me:

a) any other ICICI or a SBI Credit Card with similar perks

b) How to best utilize the 26000+ reward points accumulated on my card .

Thanks

a) Check SBI Prime (newly launched)

b) Payback points? consider redeeming it in partner sites.

Siddharth , thats a fantastic job done by you. seriously no body would have thought you much earn so much by using credit card. infact i started using pirority lounges after using your blog. i wasn’t aware about it . Unless i started using HDFC Regalia credit card. Just one question to you according to you which is the best credit card for use.. which would have all the or most of the benefits which an average spender needs.

I have a HDFC Jet Privilege World Card with limit of 3 lacs. I want to get a Regalia or Regalia first. HDFC wants me to cancel this card and then apply for a new one. I don’t know what kind of system is that.

That’s for sales count they maybe trying. You don’t need to.

After GST I can see now service charges are showing up, this were not present in any of my statement earlier for so many years, no matter what purchases I did. Credit Cards are attracting more charges now. Can you shed some light on credit cards charges and how to use them after GST. My CA has said double charges will be attracted on Credit Cards and avoid using credit cards here after to do away with unnecessary charges.

What charges are showing up exactly? Can you please list few of them?

I’ve around 10 credit cards and none has any ‘extra’ service charges showing up.

Also, if your CA said that double charges will be attracted on credit cards, its time to change your CA. Its merely a hoax, nothing else. Only only change post GST is the amount of tax that you pay on services/fees/interest.

For example, if you do not pay card dues on time, you’re charged interest + GST on that interest. Also, if your card has any annual fees, you have to pay GST on that annual fees. This GST is 18% for all financial services. Earlier, we used to pay 15% VAT+service tax. So 3% increase only on the interest or fees component. Nothing else.

Hi Sid,

I am surprised that you have not considered the AMEX Platinum Travel Card. That card beats every other card hands down.

Over a year on around 5 lakhs of spends I got more than 33K worth of vouchers (if it is used for Indigo, you get at the rate of 0.8p per 1 reward point).

You also get money back on fuel spends (3% back) which is unbelievable. Add to that the Taj voucher for 10K.

Note: This are my thoughts and I do not work with Amex nor have any benefits from anyone using/not using this card.

Its indeed one of the best travel credit card. Above list is mostly all rounders.

Go through the whole article to explore more cards for travel/foreign txn etc 🙂

Is AMEX Platinum Travel Card obtainable on card-on-card basis?

Among the best cards does Yes First Exclusive only have that option?

1.No

2.There are few more. Card on Card offers vary from time to time.

Hi Siddharth

I am a basic credit card user with financial spend of nearly 2-3 lakhs. I have below cards

1. Regalia First

2. SBI Simply Click – online spends on amazon

3. Standard Chartered super value Titanium – for petrol , utility and telecom bills

4. Citibank Rewards card – for general or flipkart

Please tell me which Card i should add or remove from the above. I want to move to semi premium cards from the basic cards.

I suggest that you apply for American Expression Membership rewards credit card. You can claim 1000 point per month by doing 4 transactions of RSVP. 1000 each and get a lot of travel benefits.

I have an Amex Platinum Travel card for 2 years now, last year I got the Annual Fee waived off, however this year they are saying they no longer waive the fee due to some update in the policy. My spends on the card has been good (4 lac +). Any clue if this is right?

What is you recommendation on any Kotak Credit cards?

They’re all low rewarding. Reviews on it coming soon.

Just an update. I applied for Amex platinum travel and they told me after reaching the Rs. 4 lakh spending limit I get 10k reward points which I can use to buy Taj vouchers. Also Indigo is not one of their partners I think now. Is it still worth it or is there a better travel card in the market?

Yes its still worth it.

Hey, is it still worth taking HDFC Premium Diners card after they have devalued it from .75 to .5.

What is your view on standard chartered platinum rewards credit card with no annual fee

Very basic card. There are much better cards in the market.

I recently called ICICI customer care and asked for another credit card HPCL Coral Amex Card (Because my Ferrari Platinum Visa card does not any lounge access in Kolkata Airport). They Issued HPCL coral amex card as requested but it is linked to my current Ferrari card account. (Same limit, every thing same except card number and variant). Is it possible to get standalone limit on my Amex Card? How can they link two different card to same account with same limit and everything.

They did the right thing, you asked for a card variant, not another loan account. If you want a whole different card account, you need to have a new application, it will make a hard enquiry son your CIBIL and then subject to approvals you might get it. Most banks don’t do multiple loan accounts from same customer in same category, especially when category is Home Loans and Credit Cards.

Hi Siddharth,

I think Amex gold charge card is losing it’s popularity given that membership rewards credit card is now on LifeTime free offer, with same benefits and option of EMI plus the 1000 bonus points are for 4 transactions compared to the 6 transactions on Gold Charge card increased recently.

Also today received a mail on corporate offers from AMEX for new customers which are pretty attractive. Since I already have Amex gold charge card cannot avail these. Let me know which one is Best in your view.

Below is details on free lifetime offer from Amex for corporate employees on select cards:

The American Express Membership Rewards® Credit Card

1st Year : NIL

2nd year Fee: NIL if annual spend is greater than Rs. 1.5 Lacs.

Else Rs. 2,250 + Applicable Taxes

The American Express® Platinum Travel Credit Card

1st Year : NIL

2nd year Fee: Rs. 5,000 + Applicable Taxes.

Fee waiver: (in form of Statement Credit)

50% @ Rs. 1.9 Lacs spend in lieu of Travel Vouchers

100% @ Rs. 4 Lacs spend in lieu of Travel Vouchers

The American Express® MakeMyTrip Credit Card

1st Year : NIL

2nd year Fee: NIL if annual spend is greater than Rs. 90,000.

Else Rs. 1500 + Applicable Taxes

The American Express® Platinum ReserveSM Credit Card

1st Year : NIL

2nd year Fee: NIL if annual spend is greater than Rs. 5 Lacs.

Else Rs.10,000 + Applicable Taxes

The Jet Airways American Express® Platinum Credit Card

1st Year : Rs 5000 + Applicable Taxes.

2nd year Fee : Rs 5000 + Applicable Taxes

More details here:

americanexpressindia.co.in/cognizant

americanexpressindia.co.in/credit-card-single-form-lp/corp-gen/offer-terms-all-card.pdf

Hey Sid,

After reading your blog changed my whole card portfolio. So currently I am holding following cards :

1. HDFC JP Titanium (mastercard)

2. SBI Prime (Visa)

3. IndusInd Iconia Amex

4. Citibank PrimierMiles Visa

5. StandChart Supervalue Titanium

Out of which StandChart is only used for fuel and utility bill payments because of cashback and it is LTF.

So these will be enough na? 😉 😛

or will you suggest something else?

That should be good enough for a typical user. Consider upgrading HDFC and if you’re a high spender, you may add even more 🙂

HDFC again changed benefits wef 1st oct 2017. 🙁

now unlimited mastercard lounge access has been capped. I have more than 30k jpmiles in my account.

Now confused which card to opt for upgrade.

Please guide.

Earn rate is still not touched. Hence shouldn’t matter to most. “Unlimited” lounge access thing on any card other than super premium cards is just a luck, and is no more 🙂

so should try for HDFC JP World? 😛

Yes, As long as Lounge access change doesn’t bother you.

Hi Siddharth,

Thank you for sharing so much of information on your blog. It is helpful. I have two queries. Can you help me with them?

1) I am looking for a credit card with free lounge access for the addon card. It will be fine if there is limited lounge access as I am looking to use them on our upcoming family trip to Hyderabad from Mumbai. I am having ICICI Instant Platinum Credit Card and recently got a AMEX MMRC under the LTF offer.

2) YesBank is offering me both Yes First Preferred Credit Card and Yes First Business Card. Which do you think is better? Let me know. Thanks!

1. Yesbank cards should help

2. Depends on how much you can spend.

Thank you for your reply.

1. Which card to be precise? Lounge Access is only there for Primary Card Holder in Yes First Preferred.

2. I am taking Yes First Preferred as it seems to offer better reward rate for retail spends and free lounge access for domestic.

Hii Sidharth,

First time i have gone through your blog, it’s really informative. My annual spend is around 3L-4L. I am using cards for online spends, departmental stores mostly. I am using 4 cards right now without any review, they are

1. Diners club rewards

2. Yes bank rewards plus

3. Sbi Simply save

4. Citibank visa platinum rewards

Please suggest which are to be removed and which suits for me.

Hi Sid,

Paytm charge some % for loading wallet through credit card. What about other wallets like FreeCharge, mobikwik, Jio money, Citrus. Do they also charge on loading wallet through credit card.??

Paytm doesnt charge anything for loading wallet through credit card and neither does any other wallet. The fee is when you want to transfer money in your wallet to your bank account.

Hi Siddharth,

I recently went through your blog and love it. Your articles are detailed and helpful.

My annual spend is around 4L and through your blog advice I have got Yes First preferred and Amex rewards card both life time free in the last 2 months.

Yes is now used for most spends and Amex only for availing monthly rewards.

I have also two old cards –

Standard Chartered super value titanium card – continued to be used for petrol offer – Paid card but I get waiver every year

HDFC moneyback card – Life time free but post devaluation stopped using it.

Please advise regarding my last two cards. I would prefer carrying 2-3 cards at the max.

Hello Siddharth,

Any suggestions?

hello siddharth,

i am an avid follower of ur blogs for quite some time. i have a doubt. both me and my wife possess cards which offer domestic lounge access. But i am still doubtful how we can get free access for our kids. they are 5 and 8yrs old. plz reveal the secret for this…

Good Question….

Even I had this query in mind sometime back… Missed asking on the forum.

Will await some experts comment on this.

Dear Sir,

I want to apply for a credit card to have international Airport Lounge Access for me and my wife and I am a salaried person kindly suggest which credit card I should apply in order to get the Lounge Access in abroad.

Dear Sir,

i have sbi prime card. can i get priority pass lounges access complementary?

Use Priority Pass only for International Lounges. Its charged for domestic lounges.

You can use you SBI Prime card for domestic lounge.2/Quarter

thanks. international lounges means in india but only international departure side.

Hey Guys,

Can any of you suggest me which would be better as an over all card SBI Prime or HDFC Regalia First?

Want to make one of these my primary

SBI Prime is way better than HDFC Regalia but SBI Prime is not LTF card nut it worth paring the joining fee

Hi guys! Need a few inputs from big time online shoppers in the bank card strategy. I want to cover almost all the leading banks either through a card or through a savings bank relationship so that I am able to reap in the offers which are often restricted to specific banks.

What I would like to know is:

1) would you know which banks mostly put out credit card only offers. For example I often see HDFC Bank restricting the promotional schemes to their CC customers. Any other bank following this practice?

2) I would like to avoid having credit cards with all the major ( the top 5 private banks, citi, HSBC, SCB and SBI) banks as this would kill my CIBIL. Hence a judicious mix of savings relationship and card seem plausible. Hence what do you think will be that judicious mix which banks to hold a savings account with and which banks are good for only a credit card. I have a Citi and Hdfc savings relationship and hold HSBC, Amex, Icici cards.

Looks forward to your inputs

I’m looking for a rewards + cash-back credit card. I don’t dine out much (usually order in). I shop online often (Amazon, other sites). I use e-vouchers (Amazon, Raymonds etc.)

Which card would fit my needs?

In the lower segment, SBI SimplyClick is best for online shopping. If willing to pay a higher fee or if you have a high ITR, go for HDFC Regalia.

SBI Prime credit card allows lounge visit for only Primary cardholder and not for add on card holders like spouse or any other family member.Is there a good credit card which provide free airport lounge access for both primary and add on cardholders.

Diners Black, Indusind Iconia Amex, Yes First Exclusive. AFAIK Prime allows lounge access across all add on cards provided that the combined use doesn’t exceed 2 free visits per month.

Hi sid

I think list need to include Infinia, YFE and/ or Yes Private. Please see what all can be done.

Aman,

Got it, Will update this page shortly.

Hi. Currently I am using regalia first. My itr is 22 lakh this year. Hdfc saying i will get diners black on itr above 30 lakh.

I basically use it for business purposes. Any better option i can get to save more points? Monthly spends 3.5-4 lakh .

M using this card from 5 months. Need to upgrade to a higher version cc. Pls suggest. Thank you

You should be able to get it if other factors are good. Else just upgrade to Regalia and then try from there.

Which one is good regalia or diners black?

Hello Siddharth,

Can you please provide your feedback on the ICICI jetairways Sapphiro Credit Card.

I am looking for a Credit card that does not have really high Joining/Renewal fees and can be used for offer like for Movie Tickets, Flight Tickets, Lounge access and other similar offers.

Please suggest if you have any other alternative.

Check out the discussion here: ICICI Jet Sapphiro Credit card

Nice card indeed!

Thank you for that.

Which one would you suggest as per my need mentioned in the previous comment,

ICICI Jetairways Sapphiro Credit Card or SBI Card ELITE Credit Card?

Both are completely different cards with different set of features. Please go through both reviews to decide.

Hi Sid,

I am using HDFC cards from 2007, currently holding Regalia card. Also have SC titanium card (best fuel card) and Amex Membership Rewards card (got it recently). Since Regalia is devalued, i planning to get a new card. Should i try to upgrade to Diners black ? Yes Bank First cards are not yet available in my city. What are the other better cards? SBI Prime?

Hi Sakthi,

You should consider SC Ultimate card if you are looking at rewards points. It offers 5 reward points for every Rs 150/- spent. Each reward points is worth Re 1/-

I have on SBI Elite/Signature card .. I would also like to have an Air India SBI Signature card for the travel benefits … Can I have 2 variants on SBI card at the same time or I need to surrender Elite card for SBI Signature card. Your thoughts?

1 IT based + 1 FD based you can have with SBI

YES YOU CAN HAVE. I HAVE IRCTC AND ELITE. SBI SAYS YOU CAN HAVE ONE CO BRANDED CARD AND ONE SBI CARD. AIRINDIA FALLS UNDER CO BRANDED

Someone recently even got two non co-branded cards too. Btw, in your case how was the 2nd card applied?

2017 is almost over…are you going publish a new list?

Yes ofcourse.

Hi Sid,

I will be a first-time user of credit card. After going through your blog, I used like to go for either SBI Simply Click or SC Platinum Rewards Card. However, I have a few queries:

1. How to save on annual fees? Unless I am not using my card very frequently, how logically is it go for a card with annual fees?

2. If I pay the credit within dates, then do i need to pay any additional interest or only the net transaction?

3. Any precautions for first-time users? What can be done if the bank falsely charges for something? I saw many such instances in television.

1. If you get more value, then you can pay.

2. no

3. Go through this article: 7 Reasons Why You Should have a Credit Card

I have 2 sbi cards both IT based. Although i had to compromise with the limit to get my prime card as simply click was too good to close. I had to go up to ceo desk for getting 2nd card approved in multiaccount facility. As soon as i got the 2nd card i applied for limit increase on my simply click card as it completed 6 months and got it increased easily. And for prime card ill apply for limit increase once i complete 6 months. You need to push but they issue 2 cards for sure.

Its very rare to see ppl with 2 Cards with IT based. Looks like i got to try for one now after seeing this 🙂

Hi Siddarth,

I have read all your articles it’s really helpful.

I am using a SBI simply save credit card since september’17 with 10K credit limit only. Is it possible to get another bank credit card based on my SBI card. Now I am working abroad. I need a card with 1 lakh credit limit with international lounge access. kindly suggest me suitable cards.

Thanks

Hdfc regalia first is easy to get as long as you have Saving account with them. Sbi is least valued for card to card approval.

Hi Siddharth,

Thanks for all the information.

I would spend most of the next year abroad. Most of my expenses (personal travel,food) are corporate reimbursed leaving expenses like Spouse/family travel, shopping, retail purchases in US. Is there any article of yours which talks about best credit cards for 100% international spend.

I prefer low forex conversion and the only card i have for now is SBI Elite. I wonder if there are better cards than JP Diners club, which i am inclined to own.

About time to replace Diners Premium with HDFC Clubmiles in this list, don’t you think Sid?

Yes – Soon!

I never imagined that there is so much play with CC’s and thanks to Siddharth for publishing this brilliant info.

I am one of those with a Regalia card and satiated with it, till I came across your website.

I have a yearly spend of 13~15 lakhs mostly on Policy premiums,Electricity & Telephone bills, International and Domestic Online shopping and Fuel. What should I consider? I would prefer staying with 1-2 cards rather than 5-6.

And where does one get to see the number of cards issued in one’s name. I would like to cancel my unused cards.

You may consider sbi prime card

Your CIBIL report will have all owned credit card details. This is available free upon registration in CIBIL website.

For insurance and utility payments, go for SBI PRIME. IndusInd Iconia Amex is best for fuel and also will give you access to Amex offers.

My take home salary is about 45k and I am currently holding ICICI Platinum, Citibank Rewards and HDFC Diners Rewards. I do not like the payback system associated with ICICI and Diners devalued its Rewards card to a great extent. So all my cards are pretty basic. I am looking for a card which provides good reward system and lounge access too(international lounge would be a plus). Please advice.

Hello ,

Is there new update coming on the article….

Probably a fresh one.

Hi Siddharth,

It’s a very helpful article and great work on your part. I would like to ask if you could please update the article. Eagerly waiting. Thanks.

Hi Siddharth, please add at least one post once in a week. We are eagerly waiting and visiting your blog 4/5 times a day. Sometimes feeling disappointed.

I Agree and i’m sorry that i might need a week or more to come up with new articles. Got some tough times!

Hi Sid

I am holding a Citibank CASHBACK MC credit card with 1L limit. This card does not give any complimentary lounge access in domestic airports. Does Citibank offer free lounge access on any of their credit cards without annual fee or renewal fee? Couldn’t find such details on their site.

Regards

Rishi

which is the best credit card to pay insurance premium?

Hi,

I’ve several credit cards. HDFC Money Back,SBI Simply click,Kotak Urbane Corporate Card. Kotak has recently offered me upgrade from Urbane Credit Card to Kotak League Platinum Card. I’ve to pay Rs.1500/- joining fee & no annual charges. I want to know is this Kotak League Platinum Credit Card a premium card? Is it worth paying Rs.1500/- just for upgrading from Urbane to league platinum card?

Thanks

Hey I work for an IT company and am just a freah graduate. This is my first job, but i plan on leaving it for my masters in Germany.. As you might have guessed, a lot of travelling, international spends, emi probably, and I’m also into trading.. Which card should i apply for? Whivh would be the best But not burn a hole in my pocket?

Please suggest.. This would be my first cc application and i do not know the approval rate or ease..

Suggest a good credit card.

Hi,

Currently ,I am using HDFC VISA Platinum credit card .Let me know if it’s worth using this card or i need to switch to some other credit card.Please suggest.

Dear Sir, how can we find out which card it will be best to use different places?

I’ve several credit cards. HDFC Regalia first ,SBI Simply save,Kotak Vis Business gold, Standard Chartered Super Value Titanium, ICICI DMRC Platinum .

Pl suggest which is better card- HDFC Diners Black or Jet Privilege HDFC Diners

Many thanks sir, my utmost appreciation for the effort of your team, i am a regular visitor to your website

indeed, i thought to, (out of courtsey) provide some suggestion and feedback

of my own , would be thankful if you could reply or recognize

my suggestions to make this website more content oriented .

Regards.

Rana Duggal.

Hey Sid,

Time for 2018 winners ….

Hi Siddharth and Abhishek Roy,

We are eagerly waiting for the new content to be added. Please add more and more content to this domain. Add reviews of new cards like Amex..

At least change the year in the title.

Thanks in advance

Understood!

New list is almost ready. Few articles should be live in a week along with this.

Hi Siddharth,

I am getting both Coral and Rubyx cards from ICICI with no annual/renewal fees.

What would you suggest? Which would be the best?

@Sunny

None are good for reward benefits. Though they provide lounge access and LTF.

Better apply for any HDFC card depending upon salary/ itr. You may give more details of your profile to suggest a suitable cc and also spend category/ area.

Hello All,

I hold Axis bank Neo Card & Canara Bank Card. Both the cards are more than 6 months & have 50K limit in each.

Now I am looking for a Credit card from any other bank except from ICICI & HDFC Bank.

Request you to kindly advise which banks can offer me a Card against my existing Card (having 50K limit) . I would highly appreciate for the advises. I am open to take a new card with initial low limit.

Thanks,

SKG