If you’re looking for the fees, features and benefits of the ICICI Bank Emeralde Credit Card, do check out the actual review here: ICICI Emeralde Credit Card Review. This article covers my experiences since past 1 year of holding the card.

Table of Contents

Upgrade Process

I showed interest for the Emeralde card as soon as it was launched. They called up in a week or so, took the request over call for Emeralde (Amex variant) and got the card delivered in another ~2 weeks.

This was initially given as a paid card but then I figured out that I was eligible for FYF (First year Free) and so I followed up with them again and got it converted to FYF.

For FYF offer, they did have a list of eligible users by then (likely based on previous year spends). You may request for one through ICICI Wealth Management RM.

Unboxing

Da Milano Voucher

- Voucher Value: Rs. 5,000

I was sent the Da Milano voucher as a welcome benefit in about ~45 days post reaching the spend.

I redeemed the voucher at Da Milano outlet in Mumbai T2 terminal for a wallet and some accessories.

As expected they were new to this voucher and took nice ~30 mins of the precious time, which I initially panned to spend at Amex Lounge.

Trident Dining Voucher

- Voucher Value: Rs. 7,500

As its a birthday benefit on only Amex Variant, I got the voucher ~1 month prior to my birthday (comes with ~6 month validity).

I redeemed the voucher at Trident Chennai to offset the dining bill accrued during my stay. It was a smooth process but its always safe to check with the property once before the intended usage.

Airport Lounge Usage

I recently visited Chennai airport (early 2020) and tried to access both the lounges at domestic terminal the same day with the same card. Interestingly the 2nd swipe was denied.

It usually goes through with other cards but I think they were using copy of same registered terminals, making the system to treat as one. Though not exactly sure of the reason.

Spa Benefit

Complimentary Spa Access is one of the most important benefit of this card and I was dreaming of using the benefit with friends during trips and extract massive value out of it.

But well, the reality is I did not use the benefit, not even once after getting Emeralde!

Part of the reason is I travelled less last year and also I’m done with the quality of service at Indian airports after exploring the spas like this one: Royal Orchid Spa at Bangkok Airport.

Boingo Wifi

I’ve tried to use this benefit at various airports including Chennai & Mumbai T2 but it never worked on my iPhone.

Sometimes I do get the coverage, but when I try to use it, it disappears. I have tried all methods but nothing worked. Got to find why!

Other Benefits

- Bookmyshow benefit: I saved over Rs.3000 within first 2 months with Buy 1 Get 1 offer, but then never used after that.

- Wellness Benefits: The website that deals with the other benefits like wellness/medical benefits are very poor and full of bugs when I explored. So gave up! They might have got improved by now, but generally nothing eye-catchy for me yet.

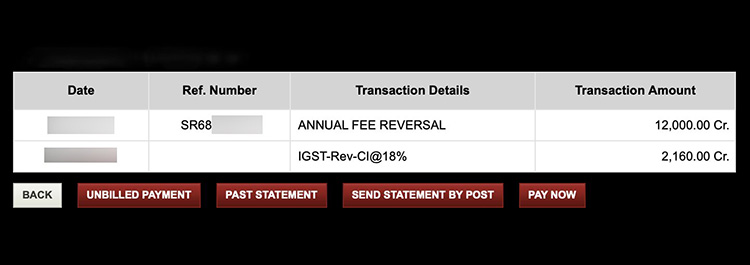

Renewal

My renewal happened during the Covid situation and I haven’t met the 15L spend required for the auto renewal fee waiver.

So I checked with the bank to see if they can waive off the fee. After the fee was charged to card, the a/c was reviewed and the charges were fortunately reversed.

If you’re wondering the criteria, this is what they said: “Valuing your relationship with ICICI Bank, we are coordinating with our team concerned with regard to the reversal of the annual fees along with Goods and Services Tax”. I think spends+account relationship helped.

If you find it tough to reach the regular support over call, you may reach out to them on social media.

Bottom line

So as you see, overall I saved well over ~Rs.15,000 in a year which excludes spa/lounge benefits & regular reward points.

That’s a good enough reason to have the card either as paid or free.

As this credit card makes sense only if you make use of Spa & Lounge benefit, post Covid-19 I don’t know what will be the fate of these benefits, especially the Spa benefit. I wish they replace it with something else to add value to the table.

So if its issued to you for free, you may indeed save some with Da Milano voucher (only 1st year) & Trident Dining Voucher. If not, its hard to extract the value out of it as it comes with a very low reward rate of 1% on regular spends.

Do you hold ICICI Emeralde Credit Card? Feel free to share your experiences in the comments below.

Hi Sid, you mentioned to use this card at Amex Lounge T2 Mumbai. Does These co-branded Amex cards allow you to access Amex lounge at Delhi / Mumbai ??

Ah no. I intend to use Amex Platinum there.

Sorry ! My Bad.

This card reward rate is very poor. How can anyone able to use this card for shopping? I have Infinia and Ultimate card, both provide 3.3% return. This card is only useful if you travel alot and use Spa.

Do you know that you can get 3x points on various online merchants using this card ?

I took this card with monthly fee payment option as I could pay the same amount over 12 months. I used Spa benefits to the tune of almost ₹20K. I couldn’t use my birthday voucher benefit owing to COVID.

I called these guys for cancelling my credit card as it isn’t used from past couple of months while simply paying the monthly fee. They agreed to cancel it (I can reapply whenever I want, in future) & on their own, reversed past 2 months’ monthly fee – that is, 2K (GST wasn’t reversed). Pretty impressed with their decision to reverse the amount, that too when I wasn’t asking.

Have to see how things pan out in next one year (do not see COVID situation vanishing anytime before that) & then decide on reapplication of this card.

20K Usage on Spa benefit – That’s Awesome!

Reversal – That’s good to know and is indeed surprising to see this happen with ICICI. Thanks for sharing, Rampy.

Thanks for all the amazing articles Siddharth and now this one.☺️

Finally connected with icici customer care through email( been trying to connect with them since May 18,couldn’t reach any) they say my voucher was kept on hold and they will dispatch soon.

I would like to know of your experience when traveling in india(airports) and international using this card for lounge access.unlimited lounge access through Dragon pass abroad and in india ? like you said they denied you your second visit ,we can use the Dragon pass there can’t we ?And where all can we use this ? Abroad and india.Any issues ? I’ve heard dragon pass issues where they deny sometimes abroad and in india.

And Boingo usage abroad,in flight and in airports etc.

Thank you once again for your amazing articles !

Dreamfolks DragonPass card can be used only in foreign land and it should work well just like priority pass.

My issue with domestic lounge is bit different and it wont happen at most other airports.

Have been a reader of your website. This is really very informative to know about the experience as we may not use many benefits that come with a card once we lay our hands on. A new type of article. Impressive

Very much glad to know. Will try to add more such content in future 🙂

Hi everyone,

I have an HDFC Infinia and SCB Ultimate card. Owing to the recent changes in rewards scheme of HDFC, I’m looking to get a new card.

Any recommendations?

I have already shifted non 10x spends on sc ultimate. Its the next best card after infinia.

It’s funny how ICICI works.

Despite spending 17 Lacs+, I have been charged annual fees and customer care has no clue why?

Request for reversal is pending for almost 10 days now.

I had opted for monthly fee option. It never gets reversed automatically when you exceed the spend threshold. Each time you have to raise complaint and escalate it till managing director desk to get fee reversed. Finally after 6 months of usage I cancelled the card and took a lower variant so as to keep my credit history intact. Surprisingly, there was no retention call.

Hi Siddharth,

Thanks for writing this article, this helped me to convert this card into another LTF Card for me…

Once again thanks…

But how LTF?

I have Business Banking Relationship in ICICI Primarily, but this card is issued on my personal wealth account. So after reading this article I called upon the B.M, and said despite giving so much business banking value to your bank (Last Financial Year The Banking done was I guess in 9 digits,approx), not giving any fees waiver or something, and then he said he will call back me once this issue is resolved, then after two days, he said your card has been converted to L.T.F Emeralde.

But on the other side they always refused for LTF for my ICICI Diamant Card…

Cool. Thanks for sharing.

Never Mind…

Just wanted a quick advise, should I surrender my ICICI Diamant Card or just wait, Last year when I asked about this card to their Regional Head, he said this card has gone for restructuring and said we will let you soon, and said you can expect a fresh version by last quarter of 2019, but that had not happened till now…

What are your thoughts on this…

Its an outdated product, better to cancel IMO as you anyway have the Emeralde.

Thanks for you views, I will consider it to cancel once I confirm from them, whether they are reviewing it or not…

Thanks…

Thanks for sharing your experience Siddharth, informative as always

Can i ask why this card makes sense for you, the only tangible benefit over other premium cards is the airport spa benefit which is only 30mins and valued around 750-1000 INR.

Isnt the opportunity cost more compared to spends diverted on your Infinia for example.

At times I value the new type of experiences more than the actual value of money. (Like Trident/Da Milano in this case)

Its more of a personal choice I think.

This card comes with its own set of benefits. I took this even though I already had LTF ICICI Sapphiro CC.

Without spending a dime (for reward points through shopping, bill payments, etc.), one would get Trident benefit, BMS, unlimited lounge & Spa at airports. I haven’t used this card for any other spends – Diners Black & SCB take all my load. Plus, since I made monthly fee payment, I had an option to discontinue this card now without paying the complete annual fee.

Sid,

How do the rewards compare on this card to the rest of the premium segment,

what is best use of Payback points

Use merchant sites from payback app(app gives 2x reward instead of 1x on the desktop) like amazon and flipkart.

Plus regular card rewards so essentially its 3x rewards ie 4points/100 or 1rs/100(1p=25paise). Redeem them in HPCL which I’m doing as of now or convert them in statement credit(25rs charge applicable). Also you can cancel hotel(4 and 5star only) and flights(all classes) & movie tickets upto 12k twice a year.

No FYF, although sb a/c since 2006 and demat since 2008 and held Sapphiro Jet earlier

Not worth i feel to take with this fees and less rewards 🙁

Hey Siddharth,

Would you mind telling if you have used “No cash withdrawal fee” and “No late payment charges” features on this card.

Not yet.

Hi Sid,

I have a quick question, I have a cibil score of 791. I already have two cards. Can I apply for two or three more credit cards simultaneously?

Are there chances that my credit card gets rejected and impact on cibil score?

A quick info for those unaware, ICICI Emeralde has two offerings, Emeralde and Emeralde Private. Some offers that depend on card bin number are not available on Emeralde private, but are available on Emeralde. Similar, for golftripz, the Emeralde Private card number bin is not recognised, and you need to call ICICI to have that added from backend.

Hi Sid,

Can you please explain the other features of this card as well.Which come in the instruction/help book with the card.Like no cash withdrawal fees from atm,no late payment fees,no late payment charges and other features.

Siddharth, ICICI emeralde is no longer visible in the usual cards section in ICICI bank, but if you google, the main emeralde which is outdated, is still live. Can you tell if this card has been discontinued or not ???

Interesting find. Will get it checked.

i am issued emeralde today FYF

As per the latest info that I got, AMEX variant of emeralde has been discontinued till further notice.

Got the amex variant today itself!!!

Sid..are you aware if Kaya clinic offer is still active on this card?

Any update Sid ? There is a lot of information coming from everywhere and is confusing.Some say amex variant has been discontinued,some say many Privelege’s which come with emerald have been reduced.Can you please shed some light

They have restarted shelling out amex variant again.

Hey any update on how to activate boingo wifi through emerald amex??

I had a Sapphiro LTF. Called customer care to ask if i can upgrade to Emeralde. They informed me that as i have to get my limit enhanced to get upgrade. So I shared my ITR and got the limit of 6 lakhs, earlier it was 3.45. And now when I called them they are saying that they have some issue at the back end so they are not issuing Amex variant. I am not very confident about Master card. Should i wait till the Amex resurfaces or go with the master for now?

Plz wait for the AMEX variant as it gets lot of offers from AMEX.

The SPA benefit did not work at the O2 spa in T3 Domestic. Called up ICICI ppl they had no clue and told me to mail and my emeralde CC has issues of its own.

I recently converted my payback to payback plus. They have a dedicated priority toll free line starting with 18005720740 for payback plus members. Also u get lots of vouchers like 2k off on amazon lifestyle products. But the main attraction is that u earn 10x rewards on payback voucherworld and 5x points when u shop online like amazon etc…max bonus points under 5x is 500 points.

Does anyone have any information about the Emaralde Private and how it’s different from the normal Emaralde?

Mine is ICICI Emeralde Private but I don’t have much info as I got to know that my Emeralde is private version on BMS as my Emeralde Private generated only 2 Free Tickets instead of 4 on Buy 1 Get 1, maybe Sid would be the right person in this case, even I am eager to know the difference.

Very poor experience with the Trident Voucher which was issued to me. When I tried to redeem at the hotel within 3 weeks of issuance I was told that the voucher has expired. When I complained to ICICI bank after facing the embarrassment at the hotel, instead of apologising and offering a statement credit they simply said we have revalidated your voucher and you can now use it again.

The voucher is supposed to have a 6 month validity and the wealth management customer service simply redirects to the ICICI Customer service and you get generic responses on email.

The only benefit to this card is the Golf experience program and the Spa when one can use it (post pandemic)

Very soon ICICI is going to launch the metal variant of Emeralde on mastercard platform, not sure about the amex variant though. Big question, How do I know. On the website teetimes.golftripz where golf booking is done, under register new cards, its mentioned there. Even a visa variant of emeralde is also mentioned there.

Nice find, Arnab.

I called and checked with customer service and domestic lounge access is available to add-on cardholders. Regarding international lounge access, the ICICI website says that you can take guests and the number of visits will be deducted from primary cardholder quota, but this card has unlimited access. Does anyone has anything to add here?

hi, can you please tell is the trident voucher redeemable on buffets.Please ans this as i have one lying and need to know

Yes. You may verify with the property as well.

This card will soon be launched in visa infinite variant as per the screenshot that i grabbed from the mobile version of emeralde page.

Yes, already live. Got an update from the RM. But unfortunately no FYF, as of now.

I will stick the amex variant as couple of months back when i visited delhi t3 lounge, after i came back from shimla at 7am thru bus, i reached airport via airport express transit metro at around 9.30am. From then I was swiping the card every two hours on the plaza premium pounge pos machine and i spend until 7pm on the business class lounge located on the right side. I had unlimited domestic access for the entire day..before that I thought i can swipe only once per 24hrs. Also I spent 1hr in O2 spa with a nice head massage. I used the DreamFolks app and from that a QR code was generated which the scanned twice after every half hour. So Im pretty happy with this feature. Even if you have visa infinite, you will still be directed to the common lounge in plaza premium on the left side.

10 hrs in lounge & spa. Wonderful!

But did they actually ask you to swipe for longer access? Assume its voluntary action to swipe every 2 hrs.

Anyway that’s an interesting find. So maybe only Priority Pass is having the 24hr limit.

They didn’t ask me in the lounge….I voluntary did. But on spa it was a requirement.

Hi Siddharth,

Is this card not issued anymore ? ICICI agents called me and is offering Saphiro free. they are telling this card will not be issued anymore.

Why are my comments always get censored.

The censor board is bit lazy. 😀

Btw, saw 2 pending. One cleared, other one was a duplicate one. Hence not approved.

Not this… Regarding new ICICI rewards system. Apparently they are ditching payback.

I mean approved same comment twice already from others elsewhere, hence.

Hey! Long time lurker here.

I have a regalia right now, and I am possibly looking at getting the Infinia or the Emeralde. What do you recommend? I’ve delayed the infinia thus far since I believe that this year I won’t be able to use the first year marriot membership benefits, but alas I don’t want to keep waiting.

Hi Sid, Can you review ICICI Emirates Emeralde Card…? Thanks.!

I just came to know that such a card exists. Thanks 😐

Though, with 2.5/100 earn rate, it’s not attractive. But again, not sure if there are any sweet spots for redemptions.

Is the new card being issued is metal variant or plastic one?

Birthday benefit has been changed to 5000 tatacliq voucher since Feb. This is for non-Amex variant holders only. Amex variant holders will continue to get 7500 Trident voucher only.

Thanks for the update on this.

Wrong. It applies for amex variant.

Hi do we get complimentary card for family and can we use International lounges for complimentary card holders.

Despite the ban on Amex being lifted a month or so back, ICICI still mentions about the ban on Amex in this card’s site and only offers Visa Infinite variant.

Refresh browser cache. That notice was removed 5 days back.

They still don’t offer emaralde on amex platform.

Siddharth,

Do add on card posssible in emarlde with domestic and international loungr access alomg with spa?

Hi,

Please review the latest metal variant. Thank you.