While Axis bank has amazing entry level card (Axis Flipkart Credit Card), highly rewarding Airline card (Vistara Infinite Credit Card) and a very good travel card (Axis Privilege Credit Card), their premium and super premium lifestyle cards were not competitive enough and so they decided to refresh them to win the respective segments.

Axis Bank has re-launched their premium (Select) & super premium (Reserve) lifestyle credit cards with new design & benefits and here’s everything you need to know about them:

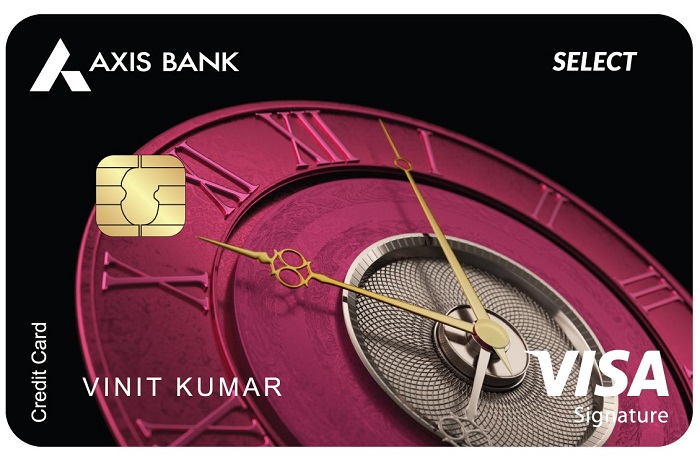

Axis Select Credit Card

What a beautiful design it is! This product is live on Axis website already and below are the newly updated features:

- Annual Fee: Rs.3,000+GST (Renewal fee reversal on 6 Lakhs spends )

- Eligibility: Annual Income of 9 Lakhs (not a strict criteria)

- Welcome Vouchers: Rs.2000 Amazon Vouchers

- Reward Rate (retail shopping): 2% on retail shopping (20 eDGE rewards points per Rs.200 spend on retail shopping spends – online/offline)

- Reward Rate (everywhere else): 1% everywhere (10 eDGE reward points per Rs.200 spend on all other spends)

- Milestone Benefit: 5000 Edge Rewards on 3L spend (Rs.1000 value)

- Swiggy Offer: 40% off up to a maximum of Rs. 200 / valid twice a month.

- Bigbasket Offer: 20% off, up to Rs. 500 p.m., valid once per month.

- BookMyShow Offer: Buy one and get up to Rs 300 off on the second ticket, valid once per month.

- Up to 12 complimentary Priority Pass visits worldwide in a year / 2 domestic lounge visits per quarter

- Golf: 6 complimentary rounds (3 more rounds, on spending 3 Lakhs annually)

- 24×7 dedicated concierge

That’s a very good set of benefits for a fee of this range.

And the design.. how could I not speak about this mind-blowing work of art. The looks are just stunning that adds an instant WOW factor to it. I hope it looks the same in hand. Ideally it must, just like how Magnus is.

Its really good to see a 2% reward rate on Axis bank credit card clubbed with other nice features. Yet, the “Retail shopping” is bit tricky just like the old select but we haven’t seen any complaints on it so far. So it should be good.

Furthermore, its free for Burgundy customers, and for others 6L spend will give the waiver, which is decent.

Only downside I see with the card is that they could have done better on welcome vouchers. Amazon Voucher is almost a cash equivalent, so it definitely makes sense. Yet, I wish maybe they could have given a Rs.1000 Swiggy voucher along with it 🙂

Overall its a wonderful card for a fee of this range!

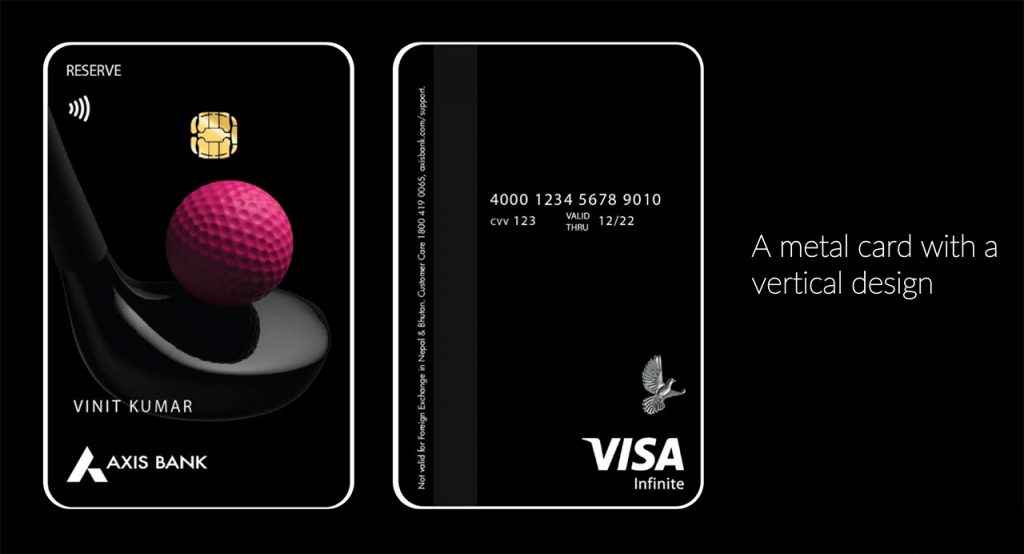

Axis Reserve Credit Card

Note: New Reserve is yet to go live on Axis website, but we of-course have some details on the product.

Its expected to go live in a month and so donot consider below benefits to be 100% accurate, though it has to be. Well, you don’t need to worry about it. You will know why shortly 😀

- Annual Fee: Rs.50,000+GST (Renewal fee waived on 25L spend)

- Welcome Bonus: 50K points (Rs.10k value)

- Form Factor: Metal

- Reward Rate: 1.5% (domestic), 3% (International)

- Airport Concierge Service (Meet & Assist) – 8/year

- Luxury Airport Transfer – 4/year (only at select domestic airports)

- Unlimited Domestic Lounge access for primary & add-on cards. 12 additional complimentary visits for guests

- Unlimited International Lounge access for primary & add-on cards. 12 additional complimentary visits for guests

- Golf: 50 complimentary rounds (domestic)

- Hotel Benefits: Accorplus with 1 Night complimentary stay, rate benefits at Oberoi & postcard hotels, Club Marriott Membership

- Bookmyshow BOGO Offer: Rs.500 Off on 2nd ticket upto 5 times (movie), Rs.1000 off on 2nd ticket upto 5 times (non-movie)

- Dining Benefits: ITC Culinaire Membership, Eazydiner Prime

- Markup fee: 1.5%

- 24×7 dedicated concierge

As you see, this is the first credit card in India to introduce Luxury Airport Transfers. This is Amazing indeed but I wish they had atleast 8 transfers for the fee it comes with.

So for most of us, its not the right card, not because it doesn’t carry a value, but because its targeted for Golfers, just as you see on the card design itself.

Hence, if you don’t play Golf or have other cards like Amex Platinum to serve that need, you will find hard time in getting value out of the card.

While you may still squeeze some value with various benefits, it wont justify the fee unless you make use of the Golf/BMS/Lounge benefits to the max.

How to Apply?

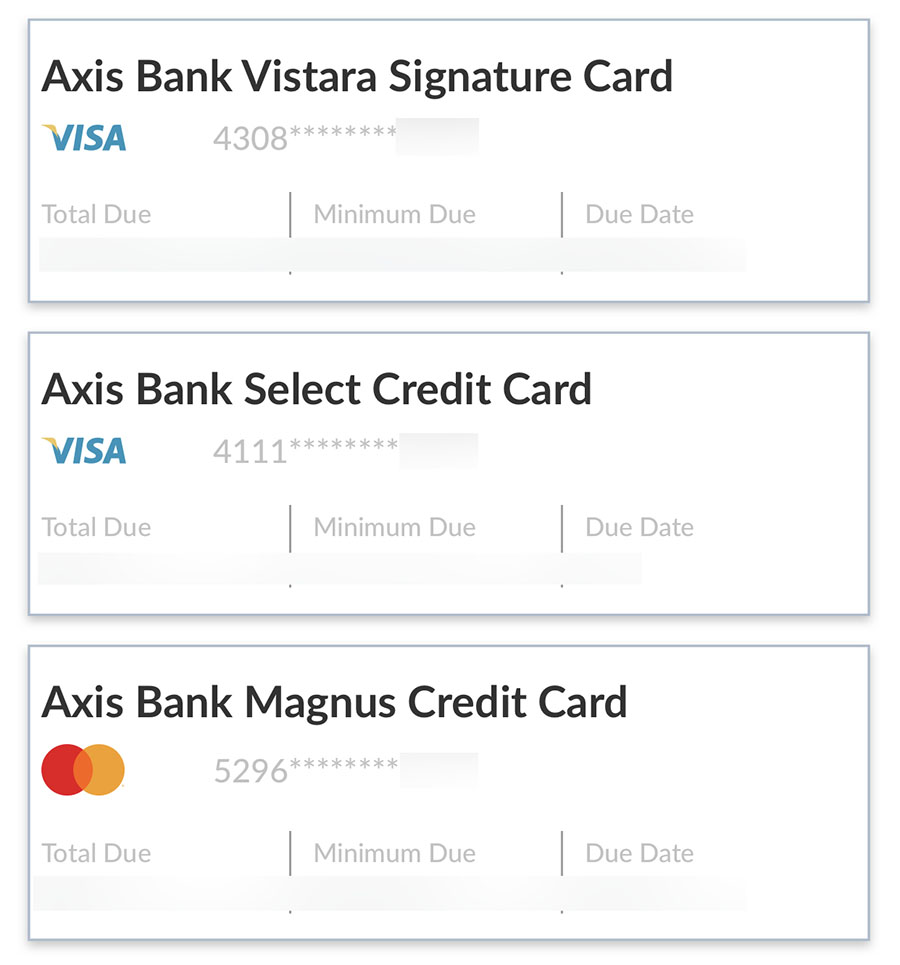

Axis Select: Branch started taking applications already and I’ve submitted the application 2 days ago (executive took the application in tablet) and it got approved and showing up on app already.

Though, its pretty new and so I would suggest you to wait for ~2 weeks (if you can resist, unlike me) to see if there are any launch offers, as I “expect one”.

Axis Reserve: New Reserve maybe live on front-end in a month time. Hence, kindly wait till Aug 2020 to look at the official final list of benefits as these benefits were known pre-covid. So there could be minor changes.

Bottomline

So finally Axis bank has a promising product in “Premium credit card” segment with the new Axis Select Credit Card, as it stands as a very good competition for HDFC Regalia among others.

Yet, when it comes to super premium segment, something more could have been done to Reserve.

Perhaps they (or anyone) could do a 20K fee card with a mix of Axis Select like rewards + Axis Magnus like Meet & assist + Axis Reserve like luxury Transfers (excluding golf, BMS, unlimited lounge, hotel, dining benefits) and I’m pretty sure it will sell like a hot cake.

Anyway, overall a great attempt by Axis Bank and I can’t wait to have hands on this beautiful pink card. 🙂

You may expect as detailed review of both the cards shortly once we have more details.

What’s your thoughts on the newly revamped Axis Select & Reserve cards? Feel free to share your thoughts in the comments below.

The reward structure of New Select is same as the old one…..

Only things changed are

1. The stellar design

2. Welcome voucher from 1000 Rs Jabong to 2000 Rs Amazon voucher

3. Added bonus of Swiggy, Big Basket n BMS (earlier available through Visa Signature – luck basis) now fixed monthly

4. Complimentary Priority Pass lounges fron 6/yr to 12/yr

Am i missing something in this picture? Would love to hear your views on this

Milestone benefit

Golf

Great Article! Do we know whether all card benefits are applicable for existing card holders as well? Like reward rate and milestone benefits? I have the select card since 2 years (under Burgundy program) and can already see 40% discount on swiggy since last month. But not sure about other benefits. Checked on website also, but there is no info on benefits being applicable for existing card holders.

All New card benefits are applicable for existing card holders as well – Yes, I’ve confirmed the same with bank.

You may re-check however to be on safer side.

Called Axis reg same, he said they have information about reserve card release only.!!

Hey sid,

Just curious to know.

How many credit cards do you have?

How do you manage all the credits cards, please give some tips or write an blog on how to manage multiple credit cards. It would be really helpful.

Around 12 I guess. Not counting them these days 🙂

Sure, will do an article on it. Thanks for asking.

Hello Siddharth,

Do the 12 cards include your’s and family’s cards or the cards for family are separate, over and above 12? Just like Mohit Malhotra’s request, I would also like you to write an article on how to manage multiple cards and which card do you use for which purpose to get maximum total value from all the cards.

Apart from the above article, I will suggest you write one article every month on how you used all your cards in the previous month and how much savings or how much value did you get from them in the month. For example, currently we are in July, so in the 1st week of July, you can write an article on how you used your cards in June and how much value did you get from them in June. I suggest you write one such article every month. This will provide us great guidance on how to maximise the usage of credit cards on a monthly basis.

Thanking You!

– Cards for family are separate, over and above 12

– Thanks for the suggestions.

Hi Siddharth,

In addition to all the questions here, I would like to add, what wallet do you use so that it holds at least 8 cards without issue 🙂

@Siddharth

I have been reading your articles and also been contributing and helping other users since more than a year 🙂 Even I had a same question how many cards you have and how much fee you end up paying for all 🙂 Most of the cards I guess is LTF cards you own 🙂

Also Is there a way we can pay ICICI credit card bill using HDFC credit card. Is it even permitted in first place.

Yes. An article on how to manage multiple cards would be very helpful.

Also, in the article, please mention how do you track the payment date for a particular card and if possible, how much time do you wait before applying for a new cad.

Regarding keeping track of payment due dates I use SMS Manager app. It organizes all due dates in a reminder tab and it even reminds you before the due date. I have 10 credit cards. This app is of great help.

Hello Sid, thanks for valuable information I have Axis select, privilege and Flipkart Credit Card, but I have one problem with select that it has 6 priority pass lounge access, and for next year you will get more 6 on renewal if I spend 3L in previous year .

So I think that was not so good as I am paying 3000 + GSt as renewal fees so must get 6 more priority pass access as a renewal benefits,

Need your comments if this is change with new variant or its same

Hello mate, thanks for your article. I am just wondering is that really worth to pay 60k+ gst for the features and return Axis reserve card if providing? How could you get chance to use this card for spending when you have Infinia and SC ULTIMATE card, both Ava at very low fees and returns are much higher that axis bank cards?

Yes as far as Axis select, I think HDFC premium cards are still better off next comes SCB Ultimate.

I am a Burgundy customer and already have a Select Credit card for the past 18 months. The design has changed and some benefits have changed and some are the same.

1. Reward points are the same.

2. Swiggy, Big Basket, BMS are new additions. Though BMS was earlier as well through Visa Signaturebon weekends.

3. Domestic Lounge is same. Priority Pass, earlier 6 free visits now 12.

4. Welcome vouchers I got before and they are the same.

5. Earlier they also gave Club Marriott membership and it was renewed if the total spends were above 3 lac. Now I have no idea about the Club Marriott membership for exiting Select Card Holders.

Overall its almost all the same with slight tweaks. Looks like ill have to hold on to the old design and no idea if we will get old benefits or the new benefits.

The additional 6 visits are only unlocked after you spend 3 lacs. This is also same as before. Nothing much has changed I feel and the clubmariott membership was already removed since the last update.

Thanks for the article but it is very disheartening to know that the Marriott membership is taken away I already Mr holder of Flipkart shoes the burgundy program and have already spent about 9 lakh rupees in the last financial year through the card but neither have I received any update about the same or reissue of a new marriott card which was supposed to come earlier this year.

Sid, are you having shared limit between vistara signature and Magnus or different limits for each card?

Shared across all.

1. Can anyone with multiple Axis Bank Credit Card please confirm if I need to apply for a new card say Flipkart card separately or do they take the application online considering I already hold their card?

2. Will there be a new CIBIL inquiry when I apply for another Axis Card when I already have an Axis Credit Card?

Just call CC, no application is required. And no cibil enquiry

I did call the CC. They said you need to apply for the card separately. I told the CC that I already have an Axis Credit Card but he said the agent will collect the documents and then the application will be processed but the limit will be shared among the cards.

What items comes under retail shopping?

Hi, I see that you have multiple cards with Axis. I have the privilege card for now. Can I still apply for other axis cards Are? Are the limits shared in between all?

You can have multiple cards with Axis, approved case to case basis. All as separate application. Limit is shared.

Dear Sir,

In my case, its different.

I hold 3 cards of axis viz. SELECT, PRIVILEGE AND FLIPKART.

Select has a limit of 2,50,000

Privilege has a limit of 2,25,000

And Flipkart has a limit of 1,50,000

All the credit limits are different, not shared.

Broo.. Could you say more on Axis edge Redemption rates? Are they 1:1 or 0.5:1 for these 2 cards? And for what all could we redeem Axis edge points?

1 RP = 20ps

Pls refer Axis edge rewards website.

Thanks thala! ❤️

Thala Srliankan business class review varum nu sonninge Inu varla? Epo varum

2) Thala You have any plans to go for Axis reserve card?

Ah, Shortly.

No way, I will rather renew Amex plat for one more year with it 😀

Hello Sid, New Axis Reserve Card Fees ₹ 50000.00. The Fees is the same for Axis Burgundy Private Credit Card. Then what is the difference between the New Reserve and Burgundy Private as both would have same fees and metal design.

Difference is in the features & also its clubbed with Burgundy private a/c. Forex markup on it is “Nil” and that’s the Primary USP of the card.

Damn, I cancelled my Axis select card last week. Although to be fair, with no travel, it is increasingly difficult to spend on the cards. And reading your blog over the years I have realised, my HDFC Diners black + Amex travel Plat is the combination which gives me the highest returns.

I have a bunch of other cards and planning to offload them in the near future.

You need at least one MC or Visa card as the acceptance of Amex n DC is an issue at many places. Suggest SC ultimate or Axis Vistara or ICICI Amazon card.

Is anyone receiving any spend based offers from HDFC or SBI? This is the second month i received offers from both the banks.

1. Spend XX using your Credit Card from 3rd July to 31st July and get a voucher worth 5000 of your choice – On my HDFC Regalia

2. Spend XX or more using your SBI Credit Card ,

during 17Jun’20 – 17Jul’20 & get a Pantaloons Voucher worth Rs.1000.- On my SBI Simply Save

I wasnt using the card so maybe they sent these offers to lure me into spending…!

I have received spend based offers on HDFC, SBI and SC.

Mee too received offer on dcb for second straight months. Spend Rs12k last month and now Rs14K for Rs.750 voucher.

for DCB I get no mails on spend based offers. Is your DCB card Idle ? I spend around 10k to 20k per month might be thats the reason I get nothing.

Well with HDFC, receiving these spend based offers is not really dependent on your card being idle unlike other banks, however, I am also not very sure about the algorithm/logic that triggers it.

Last year in April, I got the offers opt-in issue fixed for my HDFC account & in the last 1 year it has paid off significantly giving me spends based bonus points & vouchers worth 45,000/- on my DCB card. Before that, in the first 3.5 years until April 2019, I did not receive any kind of customized offer emails & SMS for Credit Card, Loans, etc.

In the last 1 year starting from August 2019 to July 2020, I have received credit card spend based offer in 10 out of 12 months. (The only exception being Apr & May 2020 due to lockdown). I have constantly achieved spend targets & have even received the fulfillment for Aug 2019 to Mar 2020 spend based offers.

I also got spend based offers on HDFC & SBI this months. On HDFC my spends were heavy in last 3 months, still they gave offer- Spend 46K get 2500 voucher. On SBI Simply click- spend 15K, get 1K bigbasket voucher, SBI card was idle.

Yes, my wife too received spend based offer second month for HDFC Regalia

Spend xx from 3rd to 31st July get 2500/- voucher of your choice

Received similar offer on HDFC regalia for June and July , giving additional value of 3.125% for June offer and 3.95% for July. But I’ve spent 1 Lac+ in June , and still received offer for July.

Spend 39k n get voucher f 2000RS

Last month it was 32k n get 1 k n I had spent 37.5k

What a scam these credit card companies are running. Spending 20k for 500 voucher is hilarious. Just don’t spend that 20k to get 20k instant savings.

@anup why is this scam? Elaborate please. Its an offer, id u dont like then dont spend. Bank is not forcing u to spend.

What about Insurance cover in this new select card, earlier in old select card it was very lucrative. So any information?

I am having a very bad experience with axis bank for card application . I don’t have any relationship with axis, i applied for axis flipkart card in march this year from flipkart app. It was approved instantly but as lock down was going on, no one came to collect my documents. Now they habe rejected my application. Tried reaching out to customer care multiple times. But they are of no help. Sometimes they just hang up on me. I tried applying via website too, but no calls yet. Can some one suggest, what could be next steps. I don’t want to visit branch in current situation and face similar experience like on phone

@Sid

Something off with the website as reported by few users few days ago. Even after repeated refreshs the pages don’t get updated. Like for this page i refreshed around 7-8 times to get to this point otherwise it was showing only 1st 4 comments. Recent comments section gets update after 1st refresh but the threads don’t get updated.

Yeah, aware of this issue caused by Cache system. It refreshes automatically every 24 hrs. So it causes issues if you arrive at the page before that with new comment notification. Will see what could be done.

Hi Siddhartha, can you please review the the Samsung Pay application. I am using it since its launch. Really good for credit card users. May be you can add some pros and cons of it.

Hey. New to Samsung pay ecosystem. Could you explain how to make the most of it?

Might as well take and keep renewing Amex Plat for 50K fees !

Hi Siddharth,

Among SBI Prime and this card, which is the better one? Both have 3k annual fee. I just applied for prime from your website and then today I see this card from Axis.

I have DCB, Yes First Preferred ltf and scb titanium ltf. Will ditch yes and scb once i get Prime. If SCB upgrades to Ultimate, is it worth?

Thank you for the informative and interesting article Siddharth. I was planning on getting an Axis Select Credit card, could you please clarify whether online shopping and delivery apps like gyftr, zomato n swiggy are included in retail shopping? If not then what does this term include?

Hey Siddharth,

I have checked with my Burgundy RM with regards to the newer variant and he came back to me saying this card is applicable only to new customers and not existing customers. He then again called me back saying even existing ones will get, i just need to block the card on my app and the new one will be sent. Could you please clarify which one is correct and if block on the app is the right way to go forward? Should i wait a few days so that i dont get sent the old card again.

Most Axis shipments are affected as of now, so there could be some delay. So you may request for new one late July.

Hi,

I was using SBI elite against FD, which I discontinued as annual fees was due and not renewal benefits were being given. Thought of re-applying for without FD, but the RM, says they are not issuing Elite anymore. They asked to use simply save which I don’t want. I liked SBI Card a lot. My second card is HDFC Diners Privilege. Now can you suggest which premium card I should apply. Yes Exclusive Card I applied online but says not eligible. I can have that card on card basis know? If this is not possible can you please suggest which card should I opt in for. Premium with fees Upto 5000.

Maybe you can apply for Indusind Iconia Amex or legend, which gives upto 2% statement credit. Iconic seems to be issued as LTF need on few users via bank bazaar.

Hi Sid,

It will be quite beneficial if you also mention about “Reward Point Validity Period” in review. Thank You!

Noted with thanks.

Hi Sid

Were you able to view virtual card in the app?

Did Joining fee get charged? Even before card was delivered?

All your Axis bank cards will have 1 statement and and have 1 due date?

Payment needs to be separately done or can be done in any 1 card?

Were you able to view virtual card in the app?

– No

Did Joining fee get charged? Even before card was delivered?

– Yes, Don’t like it!

All your Axis bank cards will have 1 statement and and have 1 due date?

Payment needs to be separately done or can be done in any 1 card?

– All separate, except limit.

Hi Sid, one question. How do cibil show these multiple cards with shared limit. One account in cibil or multiple ?

Multiple

Hi Sid,

I’m having Magnus and Privilege, limit is same, but not shared.

As per customer care, one can have upto 3 cards with Axis in the same reward platform. So, fourth card can be non EDGE rewards like Vistara.

This Reserve card’s benefits are nearly same as Magnus, which has 10K as yearly fees. So comparing that, it’s not that much worth.

Privilege credit card and few other debit card variants provide double value when redeemed for PayTM flight vouchers. That makes the reward rate of EDGE rewards as 40 ps, as against usual 20 ps.

Thanks Sid

Guess I’ll have to wait for the card to be delivered before I can use it.

Brilliant review Sid,

How many credits cards do you have in total?

I have the select card since 2+ years and I always *HATED* the old design and the welcome envelope they send it in considering the high end card its meant to be – their Burgundy Debit card packaging on the other hand is miles better.

This re-design is little better but its a shame they didn’t go for an all black look like the other cards. Still I guess its positive to see they are keeping an eye out to stop their offerings get stale.

I am planning to open Axis Bank Burgundy Account; is Select Credit Card included in the welcome kit of Burgundy Account or I have to apply separately?

Hello Sid, I am holding Amex Platinum, DCB, Axis Magnus and Select (LTF). Would it make sense to cancel the Magnus and go for Axis Reserve Metal with Addon for family members (who hold individually Axis cards)

No, not suggested unless you need a specific benefit on Reserve, like: Golf or Lounge access for additional guests.

Thanks Sid

I already hold an Axis Select credit card since a few years on LTF. If I select “block and replace” on the app, will I get this new card also under LTF?

You should get the new design as replacements are always new design if any.

I got reserve card upgraded from select card with joining fees of 30k + gst

How ?

How did you get the same ? I also have Magnus and Select.

You can hold maximum three axis credit cards ..I had Vistara infinite, select and magnus card .. I asked the customer care guy to upgrade select card on 12 July and received the reserve card on 17 July .. in the welcome kit it stated as joining and annual fees is 30 k

What was your old limit on Select card and new limit on reserve card ???

Limit is same as select card 3 lacs

Hello, how did you get it for 30k. I had called customer care and they informed that the charges are 50k and no waiver. 😩

They too told me it’s 50 k .. I agreed ..but the joining fees charged on my card was 30 k .. maybe I was lucky

😀. Ok.. I guess not worth the risk.

Hello, ok. I understand. Let me try to do the same.

Hi Sid,

Thank you for the reviews, they cover a vast spectrum of topics and provide most of the information in a single capsule.

Please can you also include redemption transfer options in your review as it is an important factor while applying for a card.

You have already included the ”Earn” ratio, how about the ”Burn” ratio? For example, airline or hotel transfers, will that be 1:1, if not what would be the ratio and so on?

For 50000+GST Burgandy Private is a much better card.Specially If you travel multiple times abroad every year.

Eligibility criteria for that is 5 cr. NRV!

Reserve card not looked sexy. In present scenario Accor plus membership available for RS 2000/-. I spent around 40 lakhs per year. Using Regalia/ SBI Etihad / ICICI Emerald

Emerald covered my world over lounge access. Regalia gives me 5 & 10 x reward point & SBI Etihad gives me extra weight allowance & upgrades.

Sidharth do u Have any other recommendation

can you please share the link where we can buy Accor plus membership for Rs 2000 …its Rs 13000 in hdfc smartbuy

Sid,

Is Reserve the only card offering guest lounge access, either domestic/international or both?

I dont think even platinum charge card offers this feature.

Folks need a suggestion,

I hold Vistara Infinite cc with Axis which will not be worth renewing,

Shall I downgrade my card to the Select or any other Axis CC you folks recommend just to keep a credit line open with Axis since I don’t have a bank account with them?

Or are they not worth it and I shall close this card?

I already have Amex Plat Charge, DCB ans LTF yes first exclusive

Axis is giving retention benefits. Ask for that and card will support itself for next one year. Or you can downgrade to privilege that axis is offering first year free.

Got 2K CV points as a retention offer. Not taking it. Any luck with others ?

Hi ,

Does anyone know exact definition of ‘Retail Shopping’ ?

For every transaction (offline and online) on my select credit card , axis bank is giving 10 points per Rs 200.

Curious to know what transactions would fetch 20 Edge points per Rs 200 spent.

I also searching for this but no one knows.

Not sure about all categories that comes under “Retail Shopping” but have checked for Groceries and got 20 points for 200.

Siddharth, did you downgrade your Vistara infinite to Signature ? Why so ?

Got Vistara Gold via Infinia by then which helped me to keep flying biz even with P.E vouchers, via upgrades.

Oh, great… By the infinia, they stopped Vistata

Ive been using the Select card from past 2 months. The 2x points on retail shopping doesn’t get credited at all. The only good thing about this card is 40% off on swiggy. Currently using this as a backup card for my diners club privilege. Not worth paying 3k annual fess. Might aswell use Regaila or Diners Privilege.

I have infinia with spending of more than 8lac by adding all family insurance premium so it comes free, yes exclusive Ltf, SC ultimate with 900/- taxes to be given as fees and points are same(5000 points equilvent to 5000rs),Amex gold charge card getting free (4500/-) by doing more than 6 transactions every month through Paytm for utility bills and getting 18000 points ,sbi bpcl Petrol card ltf , Indusind pinnacle Ltf.moreover made yes business Ltf, regalia business free by spending more than 3 lacs annual on school fees and gold Rd, Indusind nexxt Ltf, add on Amex gold charge, add on infinia and add on yes exclusive for my wife as well.now I am trying diners black for my spouse. Had closed sbi elite as it didnt seemed worth it after carrying for 4 months. Also having LIC axis, rbl, icici coral and platinum which I do not carry in my wallet and are used twice in a year on grocery and restaurants and are all ltf.

I am closing my Burgundy account how will that effect mt LTF Select CC?

RM said its free for life but CC says that its free till I have Burgundy status?

Anyone have any idea.

Free till you have Burgundy status is right.

S&S

Free till you have Burgundy status. Else 3K plus taxes as per site which is waived off on 6L spends per year. Written in post above ^

Your Axis RM sounds like HDFC RM! :p

Once you resign your Burgundy status, your select card will be converted to the paid variant 3000 + taxes per year.

Reserve seems inspired by citi prestige and citigold debit card

Are the 6/12 Priority Pass visits on the Axis Select card complementary for domestic lounge use cases?

Finally I have 5 credit cards in my wallet. Amex mrcc, Hdfc diners club black , Yes first exclusive, Axis my zone and axis select. except last two, the remaining are LTF.. I have priority account in axis. Axis select I have got for 1500 only which is done from my RM side.

Amex cc is for paytm loading with gives 1000R.p for 1500 spent 4 times

Hdfc for flipkart and amazon via smart buy

yes is for 25% discount in BMS and alternate for black and amex

Axis my zone is for swiggy

Axis select is for big basket and retail spends.

all the info I have got in this beautiful web only. Thank you Sidharth sir.

Excellent choice and corresponding usage.

Wondering how you got amex mrcc as ltf. can you please help elaborate?

There was an offer in 2016 for Those who are having salary 12LPA and above. So, I got that card LTF

Hi,

can you please tell if you got the DCB recently or you an old customer? they are providing it LTF to new customers but not to old customers. I am holding it for 4 years but they are not making it LTF.

Sourav,

For DCB LTF, keep pushing your BM and RM. Thats the way it might work. Now that HDFC is able to issue card after ban, they may help you

Regards,

Balpreet

Hello saurav sir,

Keep using dcb card. They will only make it LTF. I have not even requested for LTF. One day I have called their cc for an information. They only told that this card is LTF in between the talk. I have shocked to know that fact.. Which is not expected at all.☺️☺️

And the funny thing is I have not even had account with HDFC. I have axis bank account.

Hi Sid, wanted to understand what this axis grabdeals portal is. I was aware about the 5x/ 10x points through the gyftr portal, but am not aware of the grabdeals portal, maybe because I’m new to axis. Just got a mailer and when saw it, it has voucher like amazon/ flipkart etc. at a discount if 1%, plus is says flat 10% cashback on voucher purchases. Couldn’t find too many T&C there but if it’s truly flat 10%, then it seems to be great value at about 11%. Plus the mailer said 3x points as well. In that case it a cool 14%. This is for select card.

For Select Credit card, could anyone confirm if it fetches 20 Edge reward points per 200 for Utility payments also?

No, it works for grocery, Swiggy spending.

It didn’t work (retail MCC) on Swiggy for me though. Ideally depends on the MCC that PG shares while taking the txn and they’re not consistent with it.

I got 20 reward points for “Swiggy, Bangalore, IN”, but sometimes the Swiggy transaction charged as “Bundled Technologies” which didn’t work and received only 10 reward points.

Have seen both of them as well but not as retail. But this happened 1 yr ago. So I assume it has changed now.

Maybe, I started using the Select card recently and this is my observation in the last month Swiggy transactions,

Swiggy, Bangalore, IN is categorized as Departmental Store and got 2x.

Bundled Technologies is categorized as Others and got only 1x.

Okie cool, thanks for the info.

The priority pass card we receive with credit cards first year, will active next year with new visits or a new priority pass card be delivered every year??

How are milestone benefits credited? Is it credited at the end of the financial year or as soon as the criteria is fulfilled?

Does anyone know how to redeem the Rs2000 Amazon welcome voucher on Axis select card?

The voucher code I received for Axis select is a name..literally an Indian name.for eg Atul Kumar Sharma (name changed of course)

How do I redeem this on Amazon?

Looks like it was a prank by some one at the bank.

Got the actual voucher today. 😁

JioMart and Amazon Grocery give 20 reward points for every Rs 200 spent. I bought an air conditioner from amazon but did receive 10 reward points for every Rs 200.

How can I prove that ac purchasing is a retail transaction?

Hi Siddharth, maybe you should write a review on reserve card? I didnt get why you picked this 50K fees card unless you got a fee waiver for something

Coming soon.

Any update on this? 50k is too much fee unless it is justified in some. Please share details.

Coming up next.

Hi all, any idea which all MCCs are covered under the “Retail” category?

Hi everyone, Whoever is having Privilege account with Axis can get Select card on LTF. I just got one and I heard that the Privilege A/c holder can avail this offer till May 31.

#justashare