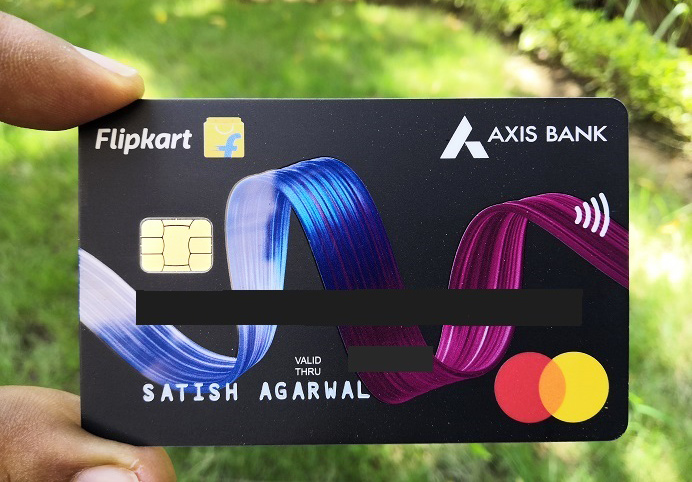

This is a review by our reader Satish Kumar Agarwal who recently got hands on Axis Bank’s newly launched Flipkart credit card.

Flipkart Credit card could possibly be a game changing addition to Axis bank family of credit cards, so much so that it can take Axis bank credit card user base to a high level if managed well by the bank.

Comprehensive features of this Axis bank Flipkart card has already been covered in the card launch article. So this article will cover more about the card application experience as well as some of the useful facts about the card which may benefit prospective card seekers.

My Application Experience

Applied for this card via Axis bank website on 23rd July 2019, the day it went open for all to apply. Prior to this date the card was mostly open to previous Axis Buzz credit card users for swapping. Flow of card processing is as below–

- 23.07.2019- Applied for the card via Apply Now tab on website

- 25.07.2019- Bank executive visited my house for KYC as I had no prior relationship

- 21.08.2019- Received email/ sms that card is approved (Cibil enquiry also done today)

- 27.08.2019- Received Application ref no. for the first time via sms which was not provided even by the executive who came for KYC

- 30.08.2019- Received sms containing Bluedart AWB for tracking

- 01.09.2019- Card delivered (Generated Pin via Axis Mobile app)

- 07.09.2019- Pin delivered by EMS Speed Post

As can be seen card processing time can be quite long, like 35 days in my case when you don’t have any prior relationship with the bank.

Name on the card is printed and not embossed. Card design is as usual but looks vivid and colourful. Credit Limit is almost 1X my salary and among the lowest of the 6 cards I hold.

Things to Know

- Welcome bonus of 500 Flipkart GV on any spend within 30 days ( I received it via sms link within 2 days of 1st transaction )

- 1st transaction on Myntra using this card will give you 15% cashback upto 500

- Most importantly EMI transactions will not earn any cashback

- Wallet topup/ Gold purchases will not earn any cashback

- Every Wednesday/ Saturday Axis bank runs good offers on Grofers/ Amazon Pantry/ Big Bazaar

- Sms received after each transaction confirming the eligible % cashback

- Cashback to be credited in card account for use in next billing cycle

- Every billed transaction shows earned cashback against them (completely transparent) in the monthly statement

- Bank executive told me salary requirement of 60K+ for the card (this may vary from city to city)

- He also told me 2-3 times that the card is pre-approved for me. As I don’t have any prior Axis relationship so far, only possible reason may be salary north of 60K plus

- Generated the pin via Axis mobile app as soon as I got the card. Few days later sadly I am unable to use the Axis mobile app as an error is shown everytime saying Customer ID login mismatch. Axis bank support is unable to help and suggests to visit Axis bank branch.

Looking at the past 3 months statement it’s clear that there won’t be any cashback below spends of Rs 100 for general merchants or even uber which falls in 4% cashback category. Can’t say about flipkart though.

I hold Citibank, HDFC, Yes, RBL, ICICI, Kotak apart from this card and this cards statement is much superior and transparent than any of the card I hold.

Bottomline

Over the past year I have found that Axis bank is not generous in issuing credit cards to non account holders. As Axis is targeting to issue 1 million of this card in first year itself hence even if you don’t have an account, chances are that card may still be issued easily if monthly salary/ ITR/ CIBIL is good enough. Though card processing time could be as long as above.

If opening Axis account relationship is not something you want, better apply this card via website and not through branch, as branch executive may insist that opening an account is mandatory to apply for the card which is not true.

Also if you don’t have any of the Super Premium credit cards and are an avid online shopper, this card along with the ICICI Amazon Pay card will reward handsomely being comparatively easy to get approved.

Have you applied for the Axis Flipkart Credit card? Feel free to share your thoughts in the comments below.

I already have ltf axis neo with 40k limit (less limit coz i have 10 other cards also :D) and salary is well above 60k. Will they give me this card or do I need to close my existing card? Any chance of getting this as ltf

Just call Axis CS and they will easily approve this card in most cases. Though I doubt if they will give it LTF to anybody. May issue LTF to their real HNI customers selectively.

Yes, just call customer care and ask for an upgrade… They will not give u additional credit limit though.

Just call customer care and tell them u need an upgrade if u already have an axis bank credit card like I did. If you need the old card to keep working, tell them not to close the old card and if you need an add-on, tell them at that time itself. DO NOT FORGET THESE TWO THINGS.

Getting an ADD-ON with axis bank is the most difficult thing to do unless u do it when u apply. Mutiple follow ups and rejection for some super secret reason.

I had myzone. This method will not give you LTF. I dont know if they even have LTF for this card.

I got this card this month. only. I applied for it within the Flipkart App last month. And now I see they running 1000 Rs Flipkart voucher bonus on joining. Should’ve waited a big longer. They sending a detailed SMS after every transaction of how much %cashback I’ll get on the transaction and which billing cycle will show it. Pretty decent card.

I think the Rs 1000 Flipkart Gift card is for applying for a new Citibank Rewards credit card. The Axis Bank Credit card does NOT come free as there is a joining fee always which they do reimburse with a Rs 500 GV for Flipkart.

Pls check your Flipkart app and let me know if you are indeed getting this Axis Bank card with GV as I might then be tempted to get this card.

I have Axis select card already.I was interested in this card also,so wanted to apply this card through the website initially.But,someone mentioned that,you can get this card by calling customer care,If you hold a Axis credit card presently.So,I tried that route and to my surprise,they sanctioned the card within 5 minutes,and the cedit limit is same as my existing select card,2.4 Lakhs.I am very much satisfied,with the customer care of Axis credit cards.

Yes, they are issuing Flipkart card to existing card users quite easily basis a call to cs.

I’ve applied for this card about 3 times now. They even took my ITR, Bank Statements, etc but since then haven’t heard back. This was way back in August 2019.

On a slightly similar note, I used to have a MYZONE card with them. Until I started seeing random charges from the UK on it and I immediately called the bank to cancel. They said they would cancel my card and I would be getting a new one in the mail within 10 days. Been over a year now and still nothing.

Gave up on Axis credit cards with that!

How will you compare this card against HDFC millennia card?

Can’t exactly compare Millenia with this card. Both have their own advantages n disadvantages. This card is among best offering from Axis bank.

Whereas in HDFC there are way better cards than Millenia if you are eligible.

For paying rent via payzapp (redgiraffe) won’t Millenia gives me around 5 percent of the rent and along with the usual promo code of billpay it would be 5 percent plus 200 ?

Hdfc is far better than others and about Axis card, it is third class card. Customers satisfaction is zero. Useless card, arrogant banking system of axis. Don’t take any product from axis. Third class bank

I got this card within 10 days of application over phone. I already hold neo and privilege credit card from axis (started closing them). Already earned more than 10k in cashback. It was super helpful in diwali sale when I maxed out 10X of DCB. From my experience I can say this has the most transparent reward experience ever. Few points I want to add.

1. 5% cashback on flipkart has a cap of 10 transaction in a month

2. Cashback is rounded off. Transaction of 70 rupees earns 1 Rs cashback for 1.5%. Very useful for small value transaction

3. As always Axis offers reward point/cashback for wallet loading.

4. One hack I found is for NPS topup 1% is charged on the amount of investment as surcharge. This card gives back 1.5%. 0.5% profit.

Pragyan – There is a Payment Gateway Charge for NPS while making payment with Credit Card -(0.90% of the transaction amount + Goods & Services Tax (GST) @ 18%). Is this 1% surcharge includes above 0.9% payment gateway charge?

Point 3. I did try loading paytm wallet and sms came that this transaction is eligible to earn 1.5% cashback. But when I checked the statement on generation, no cashback provided as its supposed to be wallet loading.

@Pragyan, what’s the hack in it (Point 4)??? The 1% (actually 0.944%) surcharge (actually Payment Gateway Charges) in NPS is levied to all credit cards. The cashback (or Reward points) are totally different things. I can use my Infinia card and get 3.33% value back (as reward points).

The point is, you’ll get 1.5% cashback in all you transactions, not only in NPS.

If the charges were waived for any particular card, then it could be termed as hack/trick.

Actually the cashback is not rounded off, they are truncating all decimal digits. Eg.

purchase for 120 rs,

1.5% is 1.8 rs

but axis will give only 1 rs cashback and pocket the 0.8 rs.

nice trick.

I’m having this card since 4 months. I had Axis Buzz card (with one add-on) and when applied through Flipkart site, card was instantly generated (similar to ICICI amazon pay).

The limit was similar to existing Buzz card. My primary Buzz card was deactivated soon after I used this new card, but surprisingly the Add-on card is still active.

I think you are promoting axis cc service.

Not reviewing the service, I have bad experience from axis bank cc center. Last 3 years I am using my zone cc on last September, I just upgraded to Flipkart card and added an add on card for my wife at the time of upgrading. No bank executive came to my home for addon card. Poor service by axis bank cc center.

To be frank I planned for surprise gift to my wife.

Finally I cancelled the service blocked the card and ended the 7 years bank relations.

Such a bad experience…

Please read the review carefully before jumping to any conclusion.

It contains multiple negatives which I faced actually with Axis bank cc.

No visit is required if you take another credit card if u already have one card. Just call customer care and give a request within 7 days card will be attached to account which you can see in axis mobile / net banking and card will reach to you within next 7 days. No document verification, no paper work, nothing, just a call, if u upgrade and you get what u need easily. Axis is best for this service.

I am also facing same issue with axis bank online app, customer details mismatch, how did you sorted out this problem

Still not sorted. Will try next week by visiting a branch.

Im interest credit card

My application is pending

I applied for this card on 29th of October and got the card delivered on 7th November i.e. within 9 days of applying this card.

You said “Every billed transaction shows earned cashback against them (completely transparent) in the monthly statement” but they also employ a trick to cheat customers in cashback.

I have this CC and although Axis says that it gives 1.5% cashback on each transaction, I have noticed that they reduce the cashback in every transaction by removing the decimal points completely. They don’t even round off, they simply remove all decimals. For ex. if u purchase worth 1790, although 1.5% is 26.85 rs but they will give u cashback only of 26. So Axis will pocket the remaining 0.85 rs and they do this in all transactions.

This is not being transparent, this is just fraud.

You said Axis is targeting 1 mil customers for this CC, imagine if Axis can cheat 10 rs per customer per monthly bill, they can fraudulently make 1 mil x 12 months x 10 = 12 crore every year just by this trick.

So trickery in our Indian banks 🙂

Axis should not have done this. But imagine if they didn’t give points details it would have been much difficult to even calculate.

So you are right. Forgot to add this point in review.

@Mungurappa The point is many credit card companies credit the point on the basis of per ₹100(SBI)/₹150 (HDFC)/₹50(AMEX) etc. This is used to calculate point in the multiples of the number mentioned above. So this is not fraud, it’s just the way the bank calculates the points. for eg, whatever may be the spend value. If it is less than ₹150, you’ll not get a single point from HDFC.

Rightly said Abhishek. However, I would like to counter that.

SBI, HDFC & Amex gives 1 point for every Rs.100/Rs.150/Rs.50 spent by you and not a fixed percentage.

Axis bank Flipkart card has 1.5% cashback. So they should give the complete cashback including the decimal portion.

Also ICICI bank Amazon pay credit card gives complete cashback including decimal portion.

plz let me know one thing, are you paying any extra amount while paying to merchant? or you thiink that when you pay with your debit card then you get more than 1.5% cashback? or any other card in this range giving 1.5% cashback on all transavtion? If these are not true then why are you blaming that they are doing fraud? These cashbacks are not given by merchant these are given by Axis bank only, so its their offer to give you what you said its 26 RS or 10 RS . Its given you for free. So be happy and in my openion its one of the best card, as i am already using this card from last 6 month.

@Mungurappa,

What about HDFC then? Then don’t give us any points if transaction value is even 149.99!!! Every bank has their own terms & conditions. Terming Axis ‘Fraud’ for denying decimal values is an overstatement. 1.5% value back for a non-premium card is way too much. Even some premium & super premium cards don’t give that much. Only DCB & Infinia (which comes at 10 & 20 times annual fee respectively) have a higher (only 0.166% more cash) value back.

@Pranab How did you come to 0.166% figure? NPS charges 0.9% + GST that amounts to 0.9% + 18% of 0.9% = 1.062% of the total value that you spent for NPS. Considering the fact that HDFC Diners/Infinia/SC Ultimate gives 3.33% as return in the form of RPs, therefore net gain is 3.33%-1.062% = 2.268%. I hope this is clear. Let me know if I am doing any mistake in this or not.

As per my understanding Pranab was referring to cash credit comparison. As in DCB and INFINIA cash credit will be 1.65 per point as compared to 3.3% if redeemed for Flight tickets or Hotel booking.

The only reason I got this card was for other spends.

i have been using this card for 2 months.

No other card gives blanket 1.5% cashback for all spends. except for dcb &infinia, but they are not giving me either of the cards.

I saw hsbc cashback 1% on weekdays and 1.5% on weekends. this card is better compared to that.

Pros:

– I use ubereats more than Flipkart, so 4% is a good default cashback option.

– 1.5% default cashback is a good cashback to get behind this card for credit card beginners.

– All cashback are credited 3 days before the next billing cycle, so overall you need to pay less. which is equivalent to cash in hand at the next billing.

– Statement is very clear about cashback for each transaction.

Only downside I am facing is that cashback is rounded down to the lowest value. even if u r eligible for 2.95rs. They will credit you only 2 rs. You won’t lose much in high-value transactions. eg. spending 1495 you will be eligible for Rs. 22.4 but you will be credit only 22 so the effective cashback is 1.47%. but the smaller ones u lose more. eg. if you spend 130 u are eligible for 1.95 but you will be credited only 1 rs which makes effective cashback to 0.76%

@Abhishek,

You merged my two replies in one.

Anyway, your first concern is right. It was a calculation mistake by me. It’s indeed 1.062% for NPS. But the context by Pragyan is totally wrong. It’s never a hack. I mean, how it could be??? We’re getting 1.5% cashback for every transactions, not only NPS. The statement of his a total waste and bogus.

Coming to your second concern, I’ve already mentioned ‘Cash’ (DCB & Infinia) and further elaborated by Satish. In Axis Flipkart, we’re getting 1.5% (Annual Fee 500); whereas in DCB/Infinia, it’s 1.666%* (Annual Fee 5000/10000). So only 0.166% more CASH benefit but a huge 10/20 times annual fee difference.

*Considering points conversion to cash, not Flight/Hotel bookings.

No sane person will use DCB/Infinia to get statement credit or “cash” as you call it. The real benefit of the card is only when redeemed as RPs and not as cash. Plus, the amount of priviledge you get for that amount is unparalleled. Besides, the fees is waived off if you spend more than 5L for DCB and 8L for Infinia. Most owners can meet this criteria. So i think they are great card and in no way can be compared to Flipkart Axis card.

How can anyone compare dcb/infinia with axis flipkart card. Thats insane. The benefits cant be compared.

@Pranab,

One thing that you have rightly said is 1.5% cashback for a non-premium credit card is quite good. However, comparing DCB/Infinia with this card just on the basis of fees is quite inappropriate. There are many more additional things that these super premium cards offer, the most lucrative being its Smartbuy 10X offer which translates to 16.5% (Cash benefit)

Axis Bank is a cheat. They have PVR Cinemas as a preferred partner, I always get a message for 4% cashback but the statement only give me 1.5%. I have escalated the matter but to no avail. They don’t respond and there is no respite.

I am going to close the card before I complete one year. Pathetic service with Axis Bank.

I use Goibibo site to book tickets for which it is supposed to be 4% but I am receiving only 1.5%. Raised query, complaint against but nothing happened.

If you don’t apply any coupon code then only 4% is applicable, otherwise 1.5%.

@Abhishek and GTMAX, I’m not comparing. My sole intention was to discard the ‘Fraud’ statement by Mungurappa.

In less than 3 months of having Infinia, today (26th Nov) my RP balance is 87718 (after approx 10K points redemption in flights for a colleague). It’ll be at least 300000 in a year. I’m not a frequent traveler (2-3 times a year), yet to have a mark in my passport. So, there’ll definitely be a time when I’ve to redeem my points as statement credit. That’s the reason I consider Infinia rewards rate as 1.666% (16.66 for smartbuy).

Dont redeem above 100,000 points for statement credit , it attracts Gift tax , our dear friend income tax department will send you a sweet love letter to cough up tax , reward rate will be even lower thereafter , rather splurge on a business class ticket if you end up having 300,000 points at end of year … its just a suggestion

All those who are complaining of floor function / decimal truncation, we should tweet about this and tag @AxisBank, @Flipkart and @AxisBankSupport with hashtags #AxisBankFraud #FlipkartFraud and #Fraud.

Till axis bank fixes decimal truncation of cashback, use Axis bank flipkart credit card only for transactions above 133.

Till 133, use one will gives cashback for even 1 Rs. 😛

@MT,

Thanks for your suggestion, it’s a very good info which I wasn’t aware of. Just tell me, if I redeem multiples of 99998 points (Maximum Rs.49999 statement credit in each redemption), will it still be taxable?

If one is looking for a LTF card or very cheap annual fees card for just domestic lounge benefits and movie ticket benefits (BOGOF) for 4th card to add to the wallet (other 3 takes care of online spends, intl travel lounge, rewards thru cashbacks), what would you recommend?

ICICI Coral cc will fit nicely to your requirement. If you have an account in ICICI bank, you may get it as LTF from time to time or else fee is 500 per year+GST.

Yes First Preferred is also good LTF card if you are able to get. But movie offer is 25% on BMS and comparatively higher airport lounge access per year plus PP for International lounge access.

I’m having vistara platinum ..If I apply for this card..my limit will be merged or I will get separate limit for this card..?

Hi Kishore,

The limit will be shared between the cards.

Finally Today I received this card..Can’t understand their procedure..First I have applied for this card ..they rejected and same day I called customer support and asked them to convert my vistara platinum card to Flipkart card..after 10days today i got this card..

CS executive told me limit will be same and shared between both cards.it seems they given the same limit but not shared between the cards..I have done some transactions on new card and available limit is showing different than the old card..and both have different bill dates and due dates..

Axis customer support is plain horrible. I already have axis signature credit card and I also have salary account with Axis. I called customer care once in September and once in October to apply to this credit card. They said their sales team will get back to me. Nothing happened. Third time I applied online by providing all the details and then finally their sales person called me to arrange document pickup. So, even though I have salary account + credit card, I had to submit the documents once again. Then for next 1 month, no updates.. The customer care person said that I have to apply for card again. This when they had already made a CIBIL enquiry. Then I had to escalate the issue. After two days, card was approved and dispatched couple of days later. I didn’t liked the packaging much, one of the simplest card packaging I have received. The card has a separate limit than my existing credit card. It’s almost 4X time my monthly take home, so no complaints there.

The fact that 4% won’t be applicable on MMT/Goibibo with coupons is a very big disappointment.

Now comes the most horrendous part. A week after receiving the credit card, I get a scam/phishing call. The caller knew I had applied for axis bank credit card. They were asking for last 6 digits of my card, what variant it was (flipkart/neo), were confirming expiry date (since they knew it was issued last month, so they were able to take correct guess) and whether it was mastercard/visa. And I realized that only that information was enough for phishing guys to do an international transaction. Wow. I had a very interesting conversation with the girl trying to scam me. First I fed up all wrong information to her just to see where this was going. Later when I called out on scam, she got angry and started cursing me, saying “we work so hard, it’s not easy to scam people” and then threatened that she is anyways going to transact on my card.

So somewhere during the process my name, my number and the fact that I was applying for an axis credit card was leaked. And it worries me that a phishing group has my mobile number and name.

I recently upgraded my Yes and HDFC credit card, and the process was so smooth.

Hi sonali k same here. I applied axis vistara card on card basis and after my card was approved by citi card was fraudulently used in nyc laundry. Thank god cvv no was incorrect.

Actually after getting all new card i cut highlight the cvv no by permanent marker so to read it one needs to put it under direct light to watch for engraving.

Mine was also the sales guy who came with tablet.

Dear Jambui,

Did you apply axis vistara cc on card to card basis? Can you share the details please

@Bala I applied the card via sms code from vistara website. Their executive called from delhi and rejected on-call as i flied 2 times with vistara in last 10 months not 6months they want.

After 2-3 months in march first week i received call from mumbai sales office asking for what all reasons i didn’t applied the card. Told him to give me card on card basis and he asked if i got diners black he is happy to accept my application. Told him i have citi permier miles instead with good limit and he agreed …. rest all i wrote above how the guy with tablet came for application and was surprised that my application was getting accepted C2C basis. I think it was year end sales target which made it happen.

Yes, there is indeed some problem in axis bank security system. After a fraudulent transaction with my axis card (which was solve in my favour) I keep block and change card in every six months. And once or twice a year I got msg that some one try to do transaction with my old card numbers and failed as it was already blocked from my end. So always I block my axis card transaction for international from your mobile app and open it on way when ever required.

After applying for axis Bank fk cc my application got rejected but after rejection I received same type of call that u got

This is very common with Axis cards. I also receive such fake calls once a week on average. The scammers already know that I have a Axis Vistara Signature card and try to confirm other details on some pretext.

@sonali k

I’m also having axis credit card… I have contacted customer care to convert my existing card to Flipkart.. they told we can’t downgrade a credit card, you can apply for a fresh credit card application…I applied and same day they made a CIBIL enquiry..next day I received a message that application delined.. having their premium credit card with good salary and CIBIL.. can’t understand what would be the possible reason for rejection..?

If your earlier Axis card issued within last 6 months? Otherwise, escalate via social media.

Bcoz quite a few old Axis card users got their card converted to this Flipkart card via just a call to Axis cc. May try 2-3 times as Axis cc is quite unpredictable.

@satish Kumar

My card is more than 7 months old.. recently got limit enhancement also..CC support told me “you will get the rejection letter in 14 days through post.. reason will be mentioned in the letter” …

Mis-management, I’m dealing with them for last 10 yrs and when I raise any request ,I anticipate every possible mistake from them. For instance, they have my 5 address, and when I upgrade to vistara from priveledge, they sent the card to my old house despite confirming address twice. So tough to deal .

I received 4% cashback for all 3 Uber spends even though 25% Uber discount coupon was already applied. Hope they won’t revert back.

can anybody confirm if we can open internet banking id, if we dont have bank account with axis

Yes. I have only cc and netbanking is working.

How you manage to register? It asks for Customer Id.

Please share the link where we can register for Card Netbanking.

Use Axis mobile app to see Customer ID

Even to check on app, you will need some login. How you will register for the first time on app?

Register on Axis mobile app using credit card no. alongwith name/ mobile/ email based verification.

Is there any limit of using this card for groceries at flipkart…I see a message during payment of groceries at flipkart that max 10 orders.

I don’t get it..plzz somebody help me

Got my card recently, managed to activate Axis Mobile. However, when trying to register for Internet Banking, it is not accepting my customer ID, saying invalid credentials. Called up the customercare, they say only SB account users can register for Net Banking, not available for credit card only users, will have to use Axis Mobile.

Dear Mahesh

Same thing happened with me for sometime after getting the card and their CS was unable to solve the problem.

One fine day (almost a month thereafter) , I tried again and was successful. I think you might have got faulty customer id, because my customer id was likely changed by them due to the same error (without any request from my side).

Don’t listen to CS. I have only CC with them and netbanking is working for me.

Though netbanking options are nothing great and on par, in comparison to Axis mobile.

Dear Satish

I tried registering again. When I checked on the AxisMobile application, the customer ID was the same, and when I tried registering, unfortunately I got the same result. If you input the Customer ID they say invalid credential, if you input the registered phone number they say your phone number is not linked with us. Its another matter that I do have a customer ID, and my phone number is pretty much registered and working for all credit card services. May be I’ll give it a try after a month or so.

Would have liked to have the netbanking access. As I happen to be a visually impaired user, and as the Axis Mobile has serious problems in terms of implementing Google’s accessibility norms. The Windows interface on the web is likely to be far more accessible.

This card doesn’t work with repayment of LazyPay due’s. Has anyone else also faced the same issue?

One query sir

Suppose there is already 10% discount on Axis bank credit card sale ongoing on Flipkart platform. If I use Flipkart Axis bank card which have 5% extra discount. Whether effectively I will get 15% discount or 10% discount only

15%. That’s beauty of this card.

@sunil kumar,

You’ll get 10% upfront discount and 5% cashback on final price after 2 billing cycles.

If the initial price of the product is 10000, you have to pay 9000 and will get 450 cashback after 2 months (depending on your billing cycle).

While going through the TnCs of this card, I found that to get the 4% cashback on MMT/Goibibo, we need to apply a coupon code. However, often there are better offers than this 4%, available on MMT/Goibibo. So, has anybody tried doing a transaction without applying the 4% offer promo code, and instead applied the best offer code at that time? If yes, then how much % cashback will you get?

I applied for Axis Flipkart Card and the card was pre approved. I submitted my aadhaar card/pan card and my HDFC Credit Card statement in income proof having limit of Rs.3.45 Lacs. But they have rejected my application and have not provided any reason for rejection also. Is there any way to re-apply for this card or to know the reason for rejection.

“Another credit card statement” is not counted as an Income proof.

It’s either last 3 months salary slips/form 16/ saving or salary account bank statement showing salary deposit/last 3 year ITR for salaried people OR last 3 year ITR/P&L statement/balance sheet/current account statement/GST number for self employed.

That’s incorrect Dear Shivi, I applied for the same card with Amex Smart Earn Statement and was smoothly approved 20k more limit than Amex.

However, only CC with more than 75k Limit is considered.

I applied in the month of September 2020, card delivered in 10 days after applying.

Does wallet load fetches 1.5%?

nope. Axis bank doesn’t give points for wallet loading.

I got this card few days back and the limit was said to be shared with my LTF Neo card I already have. But in the app, it shows me same limits for both cards with separate Available Credit. My primary card is above 60% use now (temporary due to an unexpected medical expense). Will I be charged over limit charges if I make a purchase that will make the total credit utilisation of both cards combined above the credit limit of the Neo.

I had opted this Card with very much excitement and enthusiasm by seeing the offers what you were offering. I was even wondering no other card can beat you in terms of rewards.

But unfortunately within a short period of time I’m realising there is nothing major rewarding part in your card rather that it was just a gimmick to attract customers and cheat them subsequently.

I have used this Flipkart Axis Bank Credit Card since last 1 year and spent more than 2.5 Lakhs till date using this card.

Each month I was seeing some weiered method of computing Cashback.

This month surprisingly it breached all the public offering it was showing on papers.

1) Transaction on Flipkart worth Rs.16999/- was credited with Rs.254/- (not even 1.5% , 1.5% will be Rs.254.985) against actual reward of Rs.849.95

2) Transaction on Phonepe Bill Payment site worth Rs.563/- was credited with Rs.0/- (Not sure whether you are considering Bill Payment as Gold / Fuel purchase). The same site another purchase of similar amount was awarded with 1.5% earlier.

3) Downward Rounding of Rewards. Doesn’t matter even if it’s 99.9999999 , The Cashback will be just Rs.99.00000000. Not sure what algorithm you are using for not giving exact 1.5% or 5% rewards.

4) No Rewards for Purchases upto Rs.99.9999 even when it still can reward you Rs.1.5/-

I feel pitty on you guys for giving such attractive Offers on papers and cheating customers in reality.

I may be just 1 customer out of 1000 who noticed this. There will be 999 customers who are still using this card without noticing such a huge loot.

Flipkart, you have some brand value. Please refrain from such partners who doesn’t value of honor what they offer

All the best !!

I received the statement today and same thing happened with me, they didn’t provide cashback for most of the transactions (even for Flipkart transactions also showing zero cashback earned, in statement).

Do anyone knows how to report the same? Or the card is devalued or cashback is capped to some limit?

I have also received 0 cashback for many transactions despite receiving messages of 5% and 1.5% from axis. This has happened for the first time. In thinking of raising a complaint with axis cc.

The downward rounding and no cashback below Rs 100/- is already mentioned in Terms & conditions. But you can raise the complaint for point 1&2. I have also received 0 cashback for many transactions despite receiving messages of 5% and 1.5% from axis.

I have received the first statement of my card, but to my suprise it has not mention the cashback even for a mobile purchased from Flipkart, although I got a message that I will receive 5% cashback on it.

Same is the case for other few other usage where they have mentioned zero cashback, while the sms received after purchase mentioned that you will get 1.5% cashback.

Since this is my first bill which I received, kindly suggest your opinion.

I am using this card since almost last 1 year, but out of more than 40 transactions done at flipkart, this has happened only once last month that they didn’t provide 5% cashback on a single low value transaction. So the journey for me has been satisfying, but if it’s happening repeatedly, then Axis should clear this technical issue asap so as not to loose customers faith and hence business.

I have Axis credit card with 3L credit limits , I applied to change(upgrade) variant to Axis Flipkart Credit card 8 months Back as suggested by Axis customer care but its got rejected no reason provided. after 8 months i applied on card on card basis provided axis card and hdfc card (limit 5L) still got rejected . Not understanding why axis rejecting my application though I have axis cc with 3L limit , good credit score never default on payment need some input How to get axis flipkart CC Thanks

I called the axis customer care and they informed that this 0 cashback is technical issue and it has happened to mant customers. They will rectify it within 5-7 days. No need to register any complaint. They will rectify it.

Axis don’t seem to rectify the issue.

In my last statement, in the cashback calculations section, 1.5% and 5% are properly calculated but in the cashback earned this month (cumulative) section, Flipkart transactions aren’t included (approx ₹2000 cashback). This is simply ridiculous 😠!

Even for me Cashback wasn’t posted. I reached out to CS via chat and here is the transcript,

Me

cashback isnt properly credited in last cycle statement

Ravikiran

I understand your concern regarding the cash back amount.

Ravikiran

I am sorry for the inconvenience caused to you.

Ravikiran

I would like to inform you that, there was technical issue with the cash back amount posting. All of our Flipkart credit card customers are facing the same issue.

Ravikiran

Please do not worry! Our team is working on the issue to get this sorted at the earliest.

Ravikiran

The cash back amount for all the eligible transactions will be posted in your next statement.

Has anyone got the 0 cashback issue sorted ? I am also given 0 cashback while eligible cashback should be in 3-4k. Please share of anyone got the issue sorted

Yes recieved sms stating revised cashback

what is the revised cashback say?

“Dear customer, due to technical error, cashback for your credit card ×××× in july CC statement was displayed as rs 208 instead of rs. 291. Please be assured that the correct amount of rs 291 will be credited in the next statement. Regret the inconvenience. ”

This difference tallies with the cashback of the transaction given as zero in the last statement.

Did anyone get 4% cashback for uber? I noticed that they are giving only 1.5% cashback.

If we pay utility bills (Elec, Water, Mobile recharge etc.) using this card via PayTM, PhonePe, Amazon, PayZapp etc. will we get the 1.5% cashback? or will this be considered as Wallet money loading and hence no cashback?

No cashback on Utility Bill payments, this is a hidden terms & condition, just confirmed this with Axis Bank customer support. This is cheating to keep such terms hidden from customers. This was not expected from reputed brands like Flipkart & Axis. Really disappointed. I have raised a formal complaint for official clarity on this, will keep you all posted 🙁

Has the problem been sorted?

I pay utility bills using this card through Payzapp, Mobikwik and Phonepe. Till now I have got cashback for all transactions on these platforms.

Will I get 5% cashback if I did Flipkart transaction on my friend’s Flipkart account??

Or is it necessary to order from Flipkart account from which this card is issued??

You’ll get 5% cashback.

I applied for Axis Flipkart Card on 06/08/2020 and the card was pre approved. I submitted my aadhaar card, pan card and my HDFC Credit Card statement as income proof to the axis bank executive on 13/08/2020.

Got message from axis bank on 16/08/2020 that card is approved and limit is 1.25Lacs.

Virtual Credit card generated on 18/08/2020 in Flipkart app.

Physical Card received on 22/08/2020 and pin generated on the same date.

Done shopping of 2,200/- in offline store on 24/08/2020 and got flipkart voucher of 500/- automatically on 25/08/2020.

Card joining charges is rs. 590/- including GST.

I am a non Axis Bank Customer and having no prior relationship with axis bank and it really doesn’t matter in my case. Overall, my experience is good with axis bank.

if you’re not axisbank customer, then what do you mean by “the card was pre approved” ?!!

regards

It’s pre-approved on his Flipkart account.

it’s pre-approved in my flipkart account. Pranab is right.

What was the limit of your hdfc credit card based on which you got flipkart card.

It’s 4 lacs

Piyush, what do you mean by pre-approved?

You mean it took 5 minutes to get the approval from bank and then the document pickup was scheduled?

Where did you find on the app, that the card is pre-approved for you?

Flipkart Axis Bank Card is my first credit card with no any previous relation with axis bank previously. They have some criteria to check online that you are eligible for CC or not. Its depend on your salary. on the basis of this they will preapproved the card for you but they can reject it during your document verification or address verification. preapproved isn’t mean that your card is approved. it means that there agent will come to you for document pickup.

Got below message from Axis:

With effect from 22nd Sep 20, there will be a change in the EDGE REWARDS accrual towards Insurance Premium txns on your Axis Bank Credit card and will be capped to Rs. 5000 per txn.

Did any once else receive this kind of message?

We get cashback and not Edge Rewards in case of Axis Flipkart. Will this rule be applicable for Axis Flipkart as well? Like max cashback for Insurance payment for any amount more than 5000 will be capped at Rs 75 (1.5% of 5000)?

Thanks in Advance.

For the past couple of months, I am unable to pay rent via payzapp using flipkart axis card. It worked fine until July. When I called the customer care, they are saying that axis bank is declining all the transactions from payzapp wallet since they found many fraudulent transactions on it. Is it true?

Even I could not pay rent via payzapp using Axis flipcard card

Same is the case with me.. They have been declining all payzapp transactions without any notice

It is 9 days since i filled the form on flipkart website. And despite repeated requests they have not visited for my documents and application. Everyday they change the person assigned for completing the formalities. Dont know how they manage the bank. In my mind i have already opted out of this card.

Devinder, any update on the process?

I’m in a similar scenario as you. Applied on 18/09/20 and document pick up was scheduled on 21/09/20 but the executive didn’t turn up

any update bro , did you get any conditionally approved message or anything ?

I cannot apply for the card on flipkart’s website or app. It shows “coming soon”. Is this by any chance an invite only card or is there any caveat I am missing ?

It probably means that based upon your relationship/ transaction history with flipkart, they are not willing to offer you the card pre approved as of now.

Better try on Axis Bank website.

Flipkart website always shows only that message. Try in Axis bank website – i applied 15 days back through this and got instant approval (no existing relationship with Axis reqd)

What is minimum eligibility criteria for card on card basis for axis flipkart card?

I ham seeing option of apply card in flipkart app ,

is applying on flipkart good or should apply on axis site , want to apply on basis of icici credit card (85K credit limit 5 years old)

75K limit on existing card which should be atleast one year old. They ask for one month statement to verify that.

Day 1: Applied for this card from FK App after getting a notification,

Day 2: Documents were picked up, however only KYC documents were asked, no income proofs etc. was asked

Day 3: Got notification from Flipkart App saying application was rejected

I did a quick survey, and a couple of my friends from other metro cities were asked a credit card statement from an existing bank, however the agent picking up documents said nothing of that sort was required, now I feel I really should have handed it over to him.

Did you get conditionally approved msg or not ?

I didn’t get any text from Axis bank, but I faintly recall looking at a notification. Just checked my CIBIL, and the hard enquiry is of Day 1 when I had applied the card through app. So, the timeline is pretty much, I applied from the app, they did a hard enquiry, took 5 mins to decide whether to proceed or not, and then I got a soft approval notification and I was asked to schedule an agent visit for documents collection

What is soft approval ? , In app it clearly says what all doc are required , did you not go through it?

Isn’t that obvious I’d check that, there was only mention of KYC documents

If you give option as Salaried while applying for card on flipkart app. Then no income proof otherwise you have to give income proof.

It’s day 2 of mine… They picked up my KYC documents ..lets see if the card gets approved or not.

I have just started working with an MNC as my first job and hence, I only have a single payslip as income proof. I have CIBIL of 750+. So, should I wait for another month so as to acquire payslips of 2 months or can I apply for this card now?

They need 2 months payslip + 3 months bank statement showing your 3 salary credits. I guess you’ll have to wait for two more months

Are these required documents, the same, for Amazon ICICI Credit card also?

Received flipkart axis bank credit card on basis of card statement

also i got embossed version of card feels premium better than printed version.

Hi Ankit,

How did you apply card on card basis.

I received card today. They issued just by taking my other bank credit card statement (ICICI AMAZON PAY). I applied through online, previously I applied from Flipkart app but they denied because I don’t had pay slips with me.

what was the limit on your ICICI Apay card and what limit did they give you in FK Axis card ?

same here, On my icici amazon pay credit card I applied for axis flipkart credit card but my application was rejected. Total limit 90000/- available limit 66000/-.

In statement available limit is 80000/-

Very bad experience on Axis bank support.

Flipkart Axis credit card now being issued free of cost for one year from Flipkart app

WIll i get cashback on purchasing gold jewellery from Tanishq or any Local jeweller?

Worst quality of axis bank customer care support.

I am very very disappointed on Axis bank customer service. I experienced worst quality of customer support from axis bank. According to eligibility criteria I applied for flipkart axis bank credit card and provide all necessary documents properly. But my application was declined by bank even my net salary is 45000/-. I three time try for same but declined by bank. Bo any valid reason given by bank. When ask on phone bank say due to internal parameters your application was rejected, Stay away from this axis bank.

I am used ICICI bank amazon pay credit card very good experience from icici bank.

It’s not only Axis bank, this “internal parameters” nonsense can happen with any bank.

I just wanted to about flipkart axis bank credit card…as while made purchase, how to pay that bill and with in hw many days should i clear that amount!! And wat if i hav paid late !! Please cleae doubt before i apply!!👍

I got flipkart axis bank credit card first time I used it at Myntra but got msg of 5% instead of 15% as welcome gift…plzz somebody help

Does Axisbank mobile app provide facility for utility bill payments or auto pay instruction for bill payments. If yes, how do we do it ? I don’t have savings account with axis bank, so I don’t have facility for internet banking for my Axis Bank CC

Dear Pankaj

Surf through Axis mobile carefully and you will be able to see the Customer ID by clicking Credit card details.

This customer id will help you activate Axis netbanking.

After a big struggle, I have finally got the Flipkart Axis card. I happen to be a visually impaired person. So though the card was preapproved on Flipkart, they initially rejected it on the basis of my disability. I don’t mind application rejection, it happens, but not on this ground. So fought it out, made multiple calls to the customercare, and eventually chanced on an RM who used to work for ICICI earlier and had worked on my application issue when I had a similar fight with ICICI. I provided all the relevant RBI and GOI regulation on non-discrimination for disabled people, and after multiple back and forth, including declining the application once more, they have eventually given me the card.

On the actual card use itself, there are a couple of initial difficulties. You have the option to set the pin on AxisMobile, but effectively don’t work if you are a CC only user, as the app needs to be authenticated and you need a pin or NetBanking for the same. So I had to go to IVR to set pin, and they need you to enter card number really quickly to set it. Was difficult but managed. The other issue is that if you are a CC only user, you can’t activate NetBanking.

Hope Axis would improve on these fronts as well.

Dear Mahesh

I am able to use Axis netbanking despite being only CC customer. Please try activating netbanking as per my reply to your earlier comment and tell if successful.

Hi Sid

I have noticed something odd in Axis Bank Credit limit when you have 2 cards. I recently got Axis Flipkart card (September 2020) in addition to another Axis card (using since 2018).

I got a 50% limit enhancement offer last week and took it. It was only applied to the old card and not the Flipkart card.

Customer service says the old limit is shared and enhanced limit is only available to the old card. He also said atleast 6 months must pass before limit enhancement offer is available on new cards.

So I guess I’ll have to check in March/ April 2021 for new limit to apply to Flipkart card.

Anyone experienced this?

Think it usually happen with multiple cards with shared limit. I have something similar with ICICI. My Visa Platinum and Amazon Pay ICICI cards have shared limits, and then in October 2019, I got a limit increase that applied only to the Platinum card. I was told that a limit increase for a card would be possible usually after at least a year of use and so the Amazon Pay card will have to wait. Its another matter that even after a year, they haven’t provided a limit increase for that card.

Are you guys getting monthly e-stmts emails from axis banks for Flipkart Axis credit card? I own this card from last 1 year, all i get is sms notification that bill is generated, i need to open the app and see which is a hassle. App says my e-stmts are active and axis customer says the same, Trying for 6 months. Very frustrating. I see no options related to this card on flipkart account as well? Any ideas, please share

1. Update your email id.

2. Login to NetBanking using Mpin. You can view statements there as well.

Today I placed request for Closure of Both Flipkart and ACE cards..

Why?

Hey Sid,

Any update on decline of transactions thru payzapp on FK Axis card?? Bank refuses to even acknowledge the existence of such issue. Payzapp side, they are clear as the transactions are thru with all other cards..

Was the txn >10K INR ?

Yes. it was for rent payment

Axis has some new unwanted restriction which blocks this txn. I experienced this last month and they can’t do anything about it, for now.

Rule: Axis cards wont allow you to do more than 10K INR in a txn on any wallet or wallet run payment gateways.

Even transaction for less than 10000 don’t go through @ Payzapp

I have applied for card through Flipkart app and it was issued instantly. Virtual card details are immediately available on Flipkart app and Axis mobile app. I guess physical card will be delivered in few days. Since I am already Axis bank customer (credit card and saving account), card was issued instantly. Normally I only prefer LTF cards but due to benefits offered, I am going for this card.

I had raised this issue with Axis bank, the reason for txn decline on Payzapp is that the CVV is not present while processing the txn. Payzapp never asks for cvv, and hence Axis declines it due to security reason. The issue is across all Axis cards. Makes sense though, Payzapp should start taking in cvv as all other payment gateways do.

The main reason for decline the transaction is

Hdfc Payzapp did not Ask CVV they do transaction without entering CVV , Thats’s why transaction failed

I got this email

Your transaction attempt for INR ××× on your Axis Bank Credit Card xx×× has been declined for security reasons.

Right sidd, even I encountered same issue when using it with payzapp esp.

Try to pay rent of 7500 Using Flipkart axis bank credit card on No broker using Payzapp but Transaction decline

Applied on: 16Dec, same day cibil enquiry happened and message received as provisionally approved upon doc submission, scheduled document pickup from Flipkart app on: 18Dec 7-9AM no one turned up, Called Axis CC on 19Dec, CC cluesless said will come in 7-10 days.

Doc Pickup: 22Dec, Just Aadhar fingerprint taken, no docs taken, 23Dec: Msg received about sucessful approval, 24Dec: Virtual card in Flipkart App, was able to login Axis app too (I have no prior Axis relationship) 25Dec (today) Physical card delivered through Bluedart. I made a purchase for 7999 and it showed 400 cash back (rounded up!!) I hope they have worked on the feedbacks, but fingers crossed, let’s see how it goes.

It shows as Max 10 orders for 5 percent cashback, I don’t know if it is daily or monthly limit. So it is not truly unlimited 5 percent unlimited cashback like Amazon Pay. There is not even a star or condions apply on their Ads.

I am however okay as I am planning to use Amex for small purchases (as there is a cap of 2500 rp) and Flipkart Axis for big purchases). Flipkart Super coins is still an advantage. I got a years Zomato pro free last year and already ready for next renewal.

Have not checked other partners yet, I hope I get the welcome offers as promised without any hassle.

Is the 10 order limit per billing cycle ? I came across it while making an order today.

I forgot to mention, CC limit was the least 1.6 L. My average limit of other cards are above 6L with Max 12 L on one card. I have 3 previous cards.

Got the Flipkart Card without any Income Documents. Just the Fingerprint Biometric authentication of Aadhar card and Photograph of Pancard & Self was required. Limit was decent enough for an Entry level Card. I dont have any Relationship with Axis bank.

Does anyone know what’s the flipkart supercoin conversion value when redeeming them at offline stores or restaurants? They have a pretty poorly explained SCAN QR feature in supercoin tab, which doesn’t say that it’s only valid for specific flipkart QRs. And Flipkart doesn’t think it’s important to provide these details, it simply says that the coins balance can be used 100%. So rest is a surprise when you actually pay at the outlet and then discover how many supercoins get debited. It seems 500 supercoins have just Rs100 value for mobile recharges through mobikwik.

Hi Satish,

Have tried again to register on Netbanking, again the same issue, it is not taking in the customer ID, saying its invalid. Tried to check if there is a new customer ID by sending in the message in the given format, but didn’t get a response from Axis.

The concern has now become more important than earlier. The Axis Mobile app already had accessibility issues with Google TalkBack, the screen-reader built-in on Android devices. But it was functional for an experienced user. However, the app accessibility has been completely broken. TalkBack is unable to read a single thing on the app. Absolutely unusable. All the more important to register on netbanking, but that’s not happening either. Bit of a bind…

Have you been able to register for Axis netbanking? As I wrote earlier, I have been struggling to register for netbanking on the site as it is not taking in my Customer ID. I can technically register for the App, but it has accessibility issues specific to users like me. So I need to register for netbanking until they get the app fixed, but unable to register. Some say you can’t use netbanking if you are a credit card only user. But as made clear over here, some people are able to access the service. Since you don’t have prior relations with the bank, and presumably a CC only user, would like to know your experience. If you haven’t tried Axis netbanking, please try registering and share the experience.

Having continuously engaged with Axis Customercare, I have eventually managed to get my netbanking issue resolved. They were initially sending out those robotic responses, but as I pirsisted on the Facebook page messaging as well as on the PNO email ID, they got round to fixing the issue.

Not a very neet interface, but as I did expect, the Windows interface is at least usable for a screen reader user. Hope they’ll fixthe mobile app soon.

@Mahesh: How to fix Axis netbanking issue? I am not able to register for netbanking. The mobile app has also gone down in usability after the last few updates and we are not able to see any data on credit card just “total credit utilised” is shown and nothing else in the app.

Called Axis customer care to register dissatisfaction over the ivrs calls received with wrong total payment due. Also expressed displeasure over changes in privilege card redemption options. Result, got this card issued instantly by the CC staff. Saw the card details in app/netbanking in few hours. Card got dispatched the next day.

Did they offer it to you LTF?

Card is not free. Paid Rs.500+tax, but will receive Rs.500 Flipkart voucher (yet to get the voucher, as first transaction is done only a week back).

Next year I will try to make it LTF.

For the first time in almost 2 years, received LE on this card to the tune of 50%. Although limit is lowest among all cards, still sufficient for Flipkart purchases.

I got this card 9 months back and since then wasn’t able to see details on Flipkart app until today, out of nowhere. Can’t login to NetBanking as I have no other relationship except credit card. Applied for Ace credit card and received in 10 days. No Limit enhancement offer so far, got just 25k limit which is now shared between two cards, making both quite useless. I was getting rewards appropriately under 5% and 1.5% category for last 8 months until June statement came and all the Flipkart purchases were marked as “other debits” and given 1.5% cashback instead of 5%. Complaint on CC, no help. Tweeted on Axis Bank support and got a reply “Hi, we wish to inform you that the differential amount of cashback will be credited in the next month’s statement for the eligible credit card accounts”. Let’s see how this plays out. So far I can see Axis Bank had over promised and over sold this card and barely able to fulfill the promise.

I got Flipkart Axis Credit Card last year.

Its annual fee waved off after spending 2 lakh.

But even after spending 2.1 lakhs they have charged annual fee in unbilled transaction.

Anybody knows what is the process will they credit 590 ₹ in final statement ?

Automatically reversed if spending criteria is met.

seems some offer going on. in flipkart app its showing a banner of life time free offer.

https://www.flipkart.com/flipkart-axis-bank-credit-card-store?affid=hello19th&affExtParam1=TSB/134/021&affExtParam2=20210902clcgi9e2grjq

Looks like flipkart has relaunched Axis Flipkart card in Visa variant. Shows LTF in flipkart app today.

Reached out to Axis for conversion of my Axis Flipkart to LTF .was told that this is for new customers only..wilo be closing my card.

Any chance I get the LTF version offered in the future?

Close your card and give the annual charges as reason for closing. They might relent though axis bank working is more government like than even hdfc. And they might not agree.

Maintain your rating above 800 and you will get scores of credit card offers.

Closed today..went to the branch for closure and looks like Axis is giving tough competition to Sarkari banks in being more sarkari than them..branch person first told me card was not being given LTF to anyone and then that the card is a mastercard version and hence its impossible its being given out to new customers…they then made me call customer care for card closure and refused to do it themselves…I called their customer care from the branch itself . The customer care was equally reluctant to close the card but had to after i connected him to the branch people…absolutely pain if one has to close the card

Called customer care to close Flipkart card. They gave me 2500 points on my zone card to cover the annual charges and I took that and didn’t close it. It will take time before existing cards can be converted to LTF.

Had converted my zone to LTF 2 years back. I also have Ace card.

Was getting a ltf sms message from flipkart from the last few days and since i shop online quite a bit decided to click the link.

Absolutely the fastest approval for any card ever.

Maybe 5 seconds and i had got the digital credit card showing up on my phone , ready to use.

With a message that the limit of my present axis credit card would be shared – 3 lakhs.

I never ever touched the axis card as its pretty useless but seeing all the unlimited 5 % cashback with this card , axis makes a strong comeback.

I do have Ace card. Tried applying through the Flipkart LTF SMS link. “your application can not be processed due to axis bank internal policies” message is displayed . Tried two/three times, always same message.

Same with me. Axis support says one can have 3 credit cards but why Flipkart app is showing this message?

Just checked my axis account and my old card limit is 3.95 . And now the flipkart card is also showing as a seperate 3.95 limit. Since old one limit is showing as 3.90 due to minor usage , it seems the limits are seperate and not shared between the two cards as i thought previously.

When I try to apply for Flipkart Axis Bank Credit Card on the Flipkart app, I get a message “Sorry! Unable to process your request at the moment”. This message has been coming for months now. I also hold Axis Vistara Infinite card.

My Flipkart axis card got approved yesterday and i received the sms as well. Today i was able to see the virtual card in my flipkart account but when i try to view card details it says OTP sent to my mobile number but i actually do not receive the OTP at all. Resend OTP is also not working and throws an error Unable to proceed with ur request.

What could the reason be? Shall i wait for the physical card and that needs to be activated or something before i start getting otp?

Wait for few days and it will work automatically.

Hi

From Axis Bank, how many credit cards one can have? 3 or 4? please confirm anyone.

I have 3 Axis credit cards.. so 3 is a definite possibility. Dont intend to take another

Atelast 3, yes I can confirm.. not sure about 4.

I applied for the LTF version on 3rdSep. Documentation done on 7thSep. After that no update. With the temporary reference number available on Flipkart, Axis website saying invalid AppId. Customer care saying pending for weeks.

Do not know what is happening

I’m the same boat.. And my date of application and the collection date are exactly the same

After multiple follow up over email with customer care , they created a service request number and assured to provide update in 15 days. Really surprising and worse than PSBs. Fortunately I do not have any prior relationship or account with Axis. Only applied because of LTF.

Bala,

Do let us know if there is any update in your application process. Flipkart still showing resume application.

Yesterday, Axis Email support mailed that service ticket they have closed and now my Application is in rework.

Really strange things happening. Let’s wait and see.

It was a smooth process in my case. Applied on 15th. KYC inspection finished on 16th. There were couple of verification calls. Card approved on 23rd. Details showing up in Flipkart App today (25th).

Hope to receive the card shortly and hope there will be no issues during Axis Mobile registration as I do not have any prior relationship with Axis Bank.

I hold Flipkart (with fee), Neo (LTF) and MyZone (LTF) cards.

Called Axis CC to convert Flipkart to LTF. They expressed inability to convert to LTF, but, I am not so serious in the request either, as I have paid the joining fee few months back only. Will wait for first year end and then will make another try for LTF conversion. Else will look for other option of “free reward points”.

Regarding maximum number of cards with Axis, it is 3 for sure. However, I am trying for the 4th card.

Mugunthan,

Do Axis issue Neo / MyZone as LTF?

Many people were offered My zone as LTF. Maybe only for savings account holders. But that was a small period. Not offering now.

Application process is a big hassle unlike other private banks. Icici has the best process and hdfc the best benefits.

Yeah but ICICI has the worst service , I have visited multiple time at branch for changing mobile number in card for past 8 months and still it’s not done. They have charged me wrongly and never escalates the issue on my request. I have cards from multiple banks, but I had worst experience with ICICI Bank. And I had interactions with SBI cards, Kotak, HDFC and many other banks but ICICI is the worst here.

I already had another card with Axis. So, it got immediately approved for me and started showing up in Flipkart app. Next day got a formal sms regrading application approval.

Weird thing was I got 2 application numbers and after login to axis site, I was able to see 2 cards under my account. Called customer care and they told both are LTF and one will be blocked. 7 days later got 2 blue dart AWBs and 8th day got both cards delivered.

After delivery, 2 pins also got shipped on same day and delivered on next day. Both cards are working so far. There isn’t any additional benefit though apart from the additional lounge thing and maybe those sales where number of transactions are fixed. But I anyway don’t exhaust the lounge and other limits.

The worst part is that the credit card application tracker doesn’t work. Even though mine was approved on 1st day only, I was trying hard to get some information on shipping for a week, but nothing. Customer care just says it’s approved and is pending for dispatch. So, I can understand frustration of people who were trying to get their first axis card.

Also, there is some issue with their documentation. Before applying card, Flipkart T&C says no joining/annual fee. After applying, it says 500 joining and annual fee. When I received the card, the letter alongside said 0 joining and 500 annual fee. I had to call customer care to confirm that it is indeed LTF.

I just stumbled upon this offer of LTF. Tried on flipkart website( could not see that on app) However I got an SMS that I am not elibile for the offer.

Anyon else too got a similar “not eligible” message. Wondering what is their criteria

Regards,

Balpreet Singh

I applied for it and my documents got collected on 13th September. However from the same day itself the status shows “Card generation in one day” till date.

Even the Axis bank call centre is unable to provide any information regarding application process.

Same for me. Now it’s showing card generation in 1 day for last few days. I completely lost hope of getting it by seeing this kind of response and lack of tracking process.

Finally after almost 1 month i got message today “You application for Axis bank credit card is approved. Card details will follow shortly”.

Don’t know why they are taking so much time for approval. Lets see now they take how much time for card delivery.

I have received two SMS one on 22nd Oct and another on 26th Oct similar to above for Application approval. Waiting for card to be delivered.

Maybe u r getting 2 cards. Is the application number same or different? For me, also, same thing happened, actually just a gap of 2-3 minutes. Somehow the application gets duplicated, even with a single OTP.

I got 2 cards and both are LTF, so not asking customer care to block them just in case I need to use them for festive offers where there is cap per card.

Today I have received the card after almost 2 months of application.

can we triple dip using Flipkart axis credit card during BBD ?

1. Like 10% instant axis card discount

2. Unlimited 5%cashback using Flipkart axis credit card

3. 5% Grab deals cashback

Or is it like 5% grab deals not applicable for Flipkart axis card

So if its triple dip then we can save 17.6 % on purchase of 80000 (6750 Instant discount + 3662.5 (card cashback) + 3662.5 (grab deal)

I think it works. I did one transaction few days back using grab deals and was shown 5% cashback using Flipkart card and also got an sms saying 5% cashback after transaction. Not yet got the statement, but it should be fine ideally.

I have a query regarding grab deals offer. It says 10/7.5 % cashback for burgundy/priority accounts. So, does this apply even for other credit cards (like Flipkart card), if someone has burgundy/priority accounts? Or one needs to transact with burgandy/priority debit cards only to be eligible for 10/7.5% cashback?

You will get 10% discount up to the limit (I think it is 1750) provided you meet the minimum purchase amount.. You will also get 5% cash back. So effectively, 14.5 % savings. This is confirmed. Also, given in the T&Cs.

I am not sure about the grab deals part.

I received my first Axis CC and dont have any other relationship with Axis.

Trying to register my card online but neither the 9 digit customer id nor the registered mobile number is being accepted. Both the customer care numbers simply dont connect.

Any tips on how to register the CC on Axis website?

TIA

Just send a message in facebook asking to activate your Customer ID, by default it’s in deactivated state not sure why they do that, you can get it activated through Customer Care as well

Please advise the best way to do shopping in flipkart with flipkart axis card does grabdeal triple dip (10+5+5)work or is there any other option which is better. I currently did via payback app, I have seen zingoy with similar offers. Does price change of items when we go through zingoy or grabdeal, I hesitated this time to do via grabdeal.

i used to have the mastercard version of the card which i closed recently after the launch of the LTF version of the Axis Flipkart Card.

Now, i am seeing the offer to apply for the LTF version i my flipkart but on proceeding I am unable to apply due to Axis Bank’s internal policy. Any idea when would i be able to apply..and does Axis permit re application for the same card after card closure?

Did you managed to get new one? I want to do the exact same thing..as difficult managing multiple paid cards. Tried to talk with CC and they said they can’t convert it to LTF

No..planning to wait a few months and reapply if it is still being offered

Hi I have Axis savings Account and I hv My zone (LTF) and Flipkart CC. I am going to close my savings account will be able to log in to Axis app? As right now I can’t log in because of Debit Card hotlisting not even with log in ID. So, I just want to use Credit Cards and not the Account will I be able to use Axis bank app? How can you log in to the app if you have only Credit Cards…

Yes, Bcaz I have done t same. Axis bank have worst services n their RM r worst than so called gvt employees. Even SBI is 1000 times better than them.

For axis bank customers r money minting machine n RM is leech.

So I got saving account highest version closed. Now have SBI HDFC , happy with it.

Same here, I also feel that even SBI is better than Axis.

Yes, I have only Flipkart CC and can login in Axis Mobile App.

Why are you approving such spam / fraud comments sid?

Dear Sharatkumar

Actually it’s not Sid, it’s me as a post author. Already 2 same comments trashed. Will take care.

if the card is used to make a transaction on a flipkart account other a flipkart account registered with the email address or mobile number of the credit card holder, will such transaction will still be eligible for 5% cashback?

yes it will be considered.

Axis Bank Cc (Select / Privilege / Signature) provides 5x rewards (5 % Cashback) on GV purchase including Flipkart, Amazon.

Does this mean One of these axis bank cards are enough instead of individuals cards

1. Flipkart Axis

2. Amazon Pay

There is monthly limits on vouchers. Plus in case of axis Flipkart card, u can use axis grab deals portal to get 5%+5% cashback on Flipkart and 5%+1.5% cashback on Amazon. And sometimes there are extra offers like currently 10% (total 10+5 for Flipkart or 10+1.5 for Amazon) offers also on grab deals.

So, in my opinion, Axis Flipkart is better than HDFC Millenia as well as Amazon Pay Icici, when used correctly.

Amazon Vouchers are still good for Amazon pay merchants and utility/insurance payments and the grab deals gift voucher section removed amazon vouchers some time back. So, for that those axis select/privilege cards are still better. But they come at higher annual fee.

5% value back on GV purchase on other cards is not a core feature and might go away any time. Moreover there might be some upper capping, I am not sure. On the other hand, this is not the case with Flipkart Axis and Amazon Pay cards.

Lifetime free offer through Flipkart is over it seems. Now in flipkart also it’s being shown as a paid card with usual Rs 500/- + taxes annual fee.

They didn’t credit cashback this month , anyone else facing the same problem ?

Yes, I got below response

“We would like to inform you that cashback is not posted because of technical issue & would be posted in next months statement. The issues regarding cashback is only for the December month will be resolved and earned cashback will be posted & visible in February month statements”

Yep.

UPDATE : cashback was posted two days late after complain.

I am not able to make any rent payments using my Axis Bank Flipkart Card. I tried on various platforms like Cred, MagicBricks, and Housing.com but the transaction gets declined due to security reasons. (mentioned in the mail that I received from the bank). Anyone else facing the same issue for rent payment transactions? I called the bank and their executive said that they have banned all the rent pay-related transactions for all the Axis bank credit cards.

Try Paytm Rent Payment

I tried from Paytm as well but the transaction got declined.

I have paid via Cred at the beginning of the current month using my Axis card (not Axis Flipkart card but other card)…when was this update give to you by customer care?

I got the update 2 days back i.e. on 18 Jan 2022. Even on Twitter axis bank support team replied to me saying – we wish to inform you that said transaction is declined as per bank internal norms.

you may have used rent pay excessively or did rent transactions already in jan month , it happened to me also in november but the i was able to do rent pay transaction in december and jan.

you should wait for feb .

Which Axis Bank Card are you using? Flipkart one or some other? I am using this card to pay rent only once a month.

i am talking about flipkart axis only.

i would suggest you to wait for feb . I used it for rent payment in the first week of jan will update in feb regarding the same if it works or not.

Ok. Thanks for the update!

I am using Axis Vistara Infinite for rent payment

Ok.

Got a mail from Axis Bank, no more cashbacks for rent payments after 15th March.

Hope this doesn’t become a trend with other banks…

Idfc also stopped for rent payment.

Indusind also stopped

Yes no more cashbacks for rent payment effective march 2022

Cashback shall not be eligible for following spends/transactions on the card,

Fuel Spends

Purchase of gift cards on Flipkart & Myntra

EMI transactions

Purchases converted to EMI post facto

Wallet loading transactions

Purchase of Jewelry items

Cash advances

Payment of outstanding balances

Payment of card fees and other card charges

Rent Payments

W.E.F. March 15th, 2022, cashback shall not be eligible for payments made towards rent (MCC – 6513)

The following MCCs have been excluded from cashback eligibility (for fuel, wallet load and jewellery transactions): 6012, 6051, 5541, 5983, 5542, 5944, 6011, 6540.

Cashback of 5% and 4% categories (Accelerated Cashback) will be calculated basis the Merchant IDs (MIDs) shared by the respective merchants. Axis Bank shall not be held liable if a transaction on any of these merchants does not earn accelerated cashback.

The terms and conditions mentioned in the document can be revised or terminated at any time with 30 days prior notice.

The cashback shall not be applicable if the Card has been withdrawn or cancelled or is liable to be cancelled or the account of the Card member is a delinquent Account.

Axis Bank’s computation of the Cashback shall be final, conclusive and binding on a Card member and will not be liable to be disputed or questioned.

This cash back/reward based on MCC code without any recourse/dispute system is very nasty. While doing transaction there is no way to know mcc code, or there is any? In big transaction this can be very disappointing. Many times I have seen many times Amazon products purchase getting classified as Amazon Pay and LIC premium payments getting classified as wallet loading.

Flipkart Axis card is now LTF again, till Feb end. The website still shows a fees but once you proceed with application, the fees are 0.

Maine axis fk paid cc ko my zone ltf me convert karwa liya

Then applied for free axis fk cc

Now it is showing rejected.

Any hope now ?

Does axis bank allow 2 versions of flipkart card i.e mastercard and visa simulataneously.

yes

I have called customer care and asked to provide me visa variant flipkart since it is LTF. I am told I can’t get it as I already have paid version of mastercard. So I asked to cancel the card and I have applied it from their app. Now my visa LTF card is approved and visa variant generated in axis app. Now waiting for the physical card.

i also cancelled my mastercard Flipkart card. now it isnot showing axis bank app. but not able to apply from axis bank app. Is there any other way to apply