Citi Bank is in the news for a while for all bad reasons. This October 2019, they removed reward points benefit on insurance spends and few other categories. This was a major blow to some, but well it makes sense from bank’s point of view.

A week back they stopped Home Loan & Demat Holding being part of NRV for CitiGold. I wonder which soul removed Demat and for what reason. This in-turn reduces the ability to earn bonus points for credit card holders.

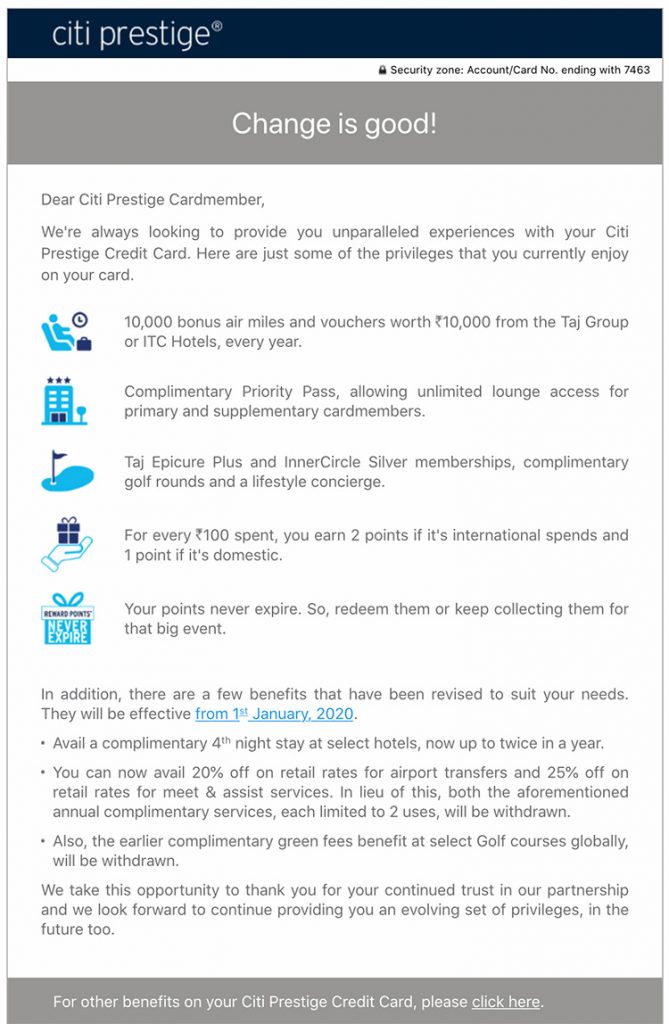

After all these changes across products, they’re now removing one of their major USP – meet and greet / airport transfer benefit among others. Here’s the email that Citi sent out last evening to its Citi Prestige Cardmembers (thanks to Amex Guy for the sharing it)

Let’s see the upcoming changes in detail one by one:

Table of Contents

# 4th night Complimentary Stay

This change is expected and many were aware of it even before. I think it makes sense as it still gives you the ability to use the benefit twice, would typically work well for 2 short vacations.

While this one is not a big devaluation as such, frequent travellers may not like this going away.

Going forward, if you need more such complimentary night benefits, you may need to check Amex Plat charge, which currently runs 3rd night complimentary benefit with Oberoi Hotels & lucrative 25% off at Taj.

# Meet & Greet / Airport Transfer

This is the major change out of all, esp. because it’s one of their USP. I personally see citi prestige as a card that enables “miles game” and “luxury airport transfer experience”. Now that the latter is removed, it definitely looses its aspirational value.

From what I know, meet & greet / airport transfers costs the bank heavily (at times as grand as 17K INR as mentioned by the customer) and so it seems Citi decided to cut down the costs.

This is a big devaluation which most of its customers gonna hate. I wish they could have rather enabled it on some spend criteria rather than just removing it altogether so that high spenders are not affected. Bad move indeed.

So going forward, if you need meet & greet, there is only one card that’s reachable for wider audience, that’s Axis Magnus, but again the problem is it can be used only in Domestic Airports!

# Golf Benefit

Green fees waiver is going away! I’m super surprised to see how they even removed it completely as this is one of the major and regular benefit on a super premium credit card.

While it looks like Citi prestige cardholders played golf a lot, it doesn’t make sense at all to remove the benefit on a 20k fee card.

Bottomline

Overall these changes are bad for its customers leaving them disappointed and yet expecting them to pay 20K fee isn’t fair. Now that they’ve reduced the benefits, it would make sense if they reduce the fee a bit as well.

If not, it makes no sense to hold the card, unless the spends are very high (>20L) which could get you a couple of biz class tickets. If the spends are lower than that, HDFC Infinia is lot better product as you also get a renewal fee waiver.

Anyway, it’s good to see that at-least they didn’t touch the reward rate. So those playing the miles game, you may continue to do so.

Devaluations are regular in the industry esp. when too many get into the basket. While I don’t know what’s the reason behind this, part of it could be that they started upgrading premier miles to prestige “easily” in the last ~2yrs. Or maybe they’re working on a new product to position above prestige? God knows!

Whatsoever it maybe, Citi Prestige is not a cup of tea for most credit card holders. It not only demands high fee, but also high spends to play the miles game.

What’s your take on this move by Citi? Feel free to share your thoughts in the comments below.

You missed 2 times a year airport transfer on Merceded E class type sedan. That is also gone

I kind of considered both as one. Thanks for mentioning, updated accordingly.

I recently used the airport transfer in Hongkong and last year in Singapore. The HK trip, after I looked up the service that was sent to pick me up, apparently costs upwards of Rs.17,000/- . Sad to see this going away. Fourth night free, I’ve used it a couple times, but both times, I wasn’t convinced I was getting a lot of value. Some value, yes, but not a ton, as I wasn’t convinced pricing was the best on booking.com. I do hope they reduce the annual fees. I’ve only used Citi Prestige + HDFC DCB thus far, but taking away insurance/utilities spends + this is forcing me to consider reaching out to the HDFC RM (OMG!) on Infinia!

Citi is working on brand new card. but they are gonna launch in few months.

I’ve heard this a few months ago as well. Something between Prestige & Ultima? The 20k for Prestige now definitely sounds off after the October cuts and now…

How do you know that? Has a Citi employee given you hints on this happening and perhaps what kind of a card that would be.

I feel Infinia is also in line for devaluation, lately they have distributed a lot of DCB and infinia cards thus paving way for devaluation

First DCB, Infinia might be spared. But anyway the fee change should extend that devaluation temporarily.

A friend of mine went to a HDFC branch & he was pitched Infinia quite aggressively instead of DCB. My friend doesnt have a relationship with the bank & I was really surprised HDFC pitching Infinia.

Maybe they have sourced too many DCBs, so yeah maybe a devaluation is on the cards.

Still Prestige has very good rewards programme. Miles never expire you keep it as long as you want. Unlike dcb infinia

The whole NRV methoodolgy change makes no sense if the current limits ( 75 l for CitiGold & > 5Cr for CitiPvt) exclude demat positions. What do they expect us to do , FDs? I would happily do FDs for 1/5th the amount at HDFC & get my hands on the Infinia.

The devaluations of the Prestige do suck esp since the default reward rate isnt too fancy for a “premium” card.

I will not be surprised if they start upgrading premier miles card to prestige the way yes bank did.

Existing good ones getting devalued, and at same time lots of new ones coming. But would there be an all in one card which serves all purposes and we can carry just that one…currently it seems everyone catering to some specific needs only

It will never happen, if it does, the fee wont be attractive. Multiple cards serving specific needs is the only way.

Maybe its time to look at Magnus, only if it is for the domestic airport transfers. They have set up at a Kiosk at T3 Domestic, Delhi. Will have a chat with these guys next time around.

A dedicated Kiosk for Magnus or Axis in general?

Axis. They seem to pitching the Vistara Infinite & Magnus quite aggressively.

Hi Neo,

In the Axis Kiosk, will they accept application based on business class boarding pass like Amex or having ITR is the only way to apply for a card?

@ T2 Mumbai too by Axis

Yes. It is Dedicated for Magnus…

@ Sharathkumar Anbu,

Full set of docs needed ( including pay slips, ITR, etc). I rechecked with the rep there.. Magnus only provides Meet & Assist no airport transfers. I somehow thought they did that too

Fuel, utilities, rent etc were removed in Oct.

One can almost still recover the fees with 10K miles + 10k Taj/ITC vouchers + Intl travel insurance

The inviting add ons are gone.

CP not inviting anymore!

S&S

Which bank is giving points on Insurance spends these days ? I have 2 upcoming payments.

HDFC

@Amit

Axis does.

Yes must be.. have not tried.

pay insurance via paytm. Go through the payment gateway & pay using CC. Amex works for me this way.

Doing it thru paytm ; wallet load from citibank app.

Loading wallet and then doing insurance payment works.. but with HDFC it does not as HDFC does not gives RPs on wallet load.

@Amit

If u tell ur card collection, it would be easier for us to guide as to which card is best in ur portfolio for insurance payment.

@Praveen : I hve CITI,AMEX & YFE

@Amit

I’am assuming it’s a LIC payment and U don’t have Citi card giving more than 1.5% return (YFE gives 1.5% as RP)

U can directly use YFE as insurance payment is not excluded for RPs by YFE, or use YFE + Amex to load one of the wallets accepted by LIC.

Wallets that LIC website accepts are: Airtel Money, DCB bank Cippy, Icash card, Jio Money, Oxigen, Payworld, Phonepe & Yes Bank wallet.

Another latest news is, LIC from 1Dec onwards stopped charging extra amount for payment made through credit card.

I have an insurance payment coming up as well. Can you advice which card should I use from my collection.

Axis vistara infinite

Amex Plat travel

Hdfc regalia

Thanks

Pay thru paytm or wallets from citibank prestige

U can use Paytm / jiomoney / MobiKwik for insurances

As vistara is not there, is there a way to redeem prestige points for Singapore airlines/Etihad, and then use miles for domestic booking?

I guess you can transfer points to Air India and use domestic flights

Super Sad to see this news – I got upgraded from PM to Prestige just last week and was looking forward to use Intl meet and greet next quarter

Thanks Sid as always for the blogs and making me plan my strategy as an avid traveler- Now i guess with following in my kitty ( Infinia yet to get as no HDFC account)

DCB, Vistara Infinite, Magnum, Prestige, Yes First Exclusive and Amex Plat Travel, SBI Elite ( thinking to downgrade to SImply Click) I guess i have almost all the ones needed to serve my purpose.

I would like to review any of above if needed in future.

Scb ultimate is very good when it comes to reward points with no exceptions. They give reward points for insurance, wallet loads, fuel etc with no tnc. And from past 1-2 months there has been good reward redemption options.

Are you sure about the redemption options of SCB? I can’t find anything worthwhile except for may be MMT or Shoppers Stop/ Lifestyle/ Westside vouchers. They have stopped Amazon vouchers long back. Not sure whether the card is still worth. These days I normally try to use in the following order

1. DCB for all 10X spends and other spends where you get more than 5% return (incl cashback etc)

2. Axiss Vistara Visa Infinite (new card hence trying to reach 1 lac milestone benefit in 3 months)

3. Amex travel upto 4 lacs (to reach 4 lacs milestone benefits which means around 7.5% return)

4. SCB ultimate – only if there is any special offers on master card or SCB

It’s worth it to be honest.

The redemption best suited for me is Big bazaar vouchers which get frequently replaced if they are sold out.

Here is what I do:

Use DCB for smartbuy 10x rewards and partner 10x rewards. Plus I also load my forex card with it which gives 10x reward points separately apart from smartbuy limit. Also i use the dcb for shopping where hdfc card discount is there.

Earning almost 25k reward points per month this way. 😀

Now for my scb ultimate, i use it for general shopping(where no other offer is available), fuel transactions, wallet loads etc. I just sell the big bazaar vouchers to my colleagues as i don’t use them but they do.

Right now, DCB and SCB ultimate are the best when it comes to discounts and reward rates.

Prestige isnt a discount / cashback card. It is a ( now a mid level luxury , i think) with airmiles at its heart. Complimentary travel insurance, 2x points on forex & now the watered down free nights benefit target it towards people who are flying. I believe it is still the fastest mile accruing card in the country & when coupled with DCB can unlock great value for flying premium cabins at a fraction of a cost

Same here! DCB + SCB combo is the best for regular use. Not into miles game yet.

Last year , I didn’t use the meet and greet. or airport transfers . Infact I forgot to use. Hotel was sometimes not beneficial when you have DCB miles to book them. But this year I have a travel on Dec 30 to US and I had booked the Local airport drop here from my origin. I think it is just in time 🙂 . Other than that I had managed to get a one way business class ticket to US for this trip . and still have points to book another one in future. The Taj Gift Card is the other main feature I have used till now.

Main cards I use are Diners Black, Citi Prestige, Yes First Exclusive( stopped using since redemption options are limited now) , Amex Gold Rewards, Amex Plat Business ( Cancelled just recently as I felt since many perks like Priority Pass are already there with Prestige and Yes bank ).

If Infinia is a better option than Citi prestige, I should apply for 1.

I am planning to close citi prestige,

Is there any other card which gives decent reward rate on star alliance network? From what I have gathered so far :

1) Air India sbi signature on AI – Holding this card

2) AXIS miles and more on Lufthansa. Not sure if its worth?

3) Diners gives on krisflyer. Holding DCB

4) Amex has airline transfer partners, but reward rate is too LOW. Have Amex plat reserve and MRCC. Mrcc is good for 4 monthly swipes of 1000 + which gives you 1000 points every month. Above that not much value.

5) Have axis vistara infinite which takes care of domestic travel pretty much.

Need a replacement for CITI Prestige now.

Any other card I am missing?

Unfortunately, Prestige still remains the fastest miles earning card in the country, IMO. I also have a similar card portfolio ( Amex Plat Charge, MRCC, Axis VI, DCB, Prestige). What you could possibly add would be a Gold Charge (6×1000 txns pm ) would give u 1000 MR more.

DCB/Infinia still remain the best bet to accumulate points for SQ/BA if thats your plan

Can we transfer infinia points also on krisflyer /BA?

I don’t have infinia as of now but might get one if can do miles transfer.

Since DCB does, i believe Infinia does too. I am also on the fence for Prestige renewal but wont close it most likely since it has more transfer partners. The taxes on BA avios redemptions can be real mental , not sure about SQ though . Btw if you are keen on collecting *A points by flying Singapore, why not look at Alaska Airlines. The miles collected on premium cabins on SQ can be superb.

Vistara for example lists only DCB as transfer partner, not any other HDFC card. So I am not sure about infinia.

Amex /citi also have other airlines like Etihad /Qatar.. They have there own airline partners where you can use miles. Which airline is best to transfer miles to for cheapest redemption and lowest fuel charges /taxes?

Depends on where you plan on going. But generally the taxes on BA can be quite high. Mileage needed for the ME airlines can be high too, esp for the premium cabins which is where you should aim to redeem

I gave them a feedback that this Change is NOT good, of removing airport transfer. Today they called me to acknowledge it, and that they will pass the feedback to the team.

I am writing this to just check if people with Citibank cards have experienced anything similar.

Like many people, I have 2 Citibank card (PremierMiles and Cashback) which has been upgraded several times over the last many years. My earliest was a Jet Airways Citi Card. Anyway, while check my CIBIL records, I found that Citi has not marked one of my cards as closed, but has added the replaced card as a new card. I wrote to them mentioning my old card number being shown as ACTIVE and informed them that it was replaced by a different card.

I was expecting a response that they shall look into it. Instead, without verification, they actually CLOSED the present card. I am flabbergasted!!! Citi has always had the best customer service. I wonder if that is changing.

FYI, it was over the Citi portal that this communication was carried out. I re-read my mail to check if there was a chance of miscommunication, but I think it would have been a far stretch.

I have raised a “REQUEST”. I have been asked to call back on Wednesday.

I recently got my and spouse CitiRewards converted to IndianOil. Will take a couple of months for CIBIL report to update and reflect through. Will update here on the same.

So Citi CIBIL servicing is very poor if things go wrong. I have only had one upgrade (from PM to Prestige) and it went smoothly for me. The PM number changed on CIBIL to Prestige number, same card account continued. However, I bought an insurance product through my RM a year or so back and for some reason some Citi software made an “auto loan” CIBIL hit. RM is clueless. The entire Citi team is clueless. Multiple back and forth and after a year nobody at Citi actually knows how this happened. Nobody knows how to fix it or even track it. And this is after two Citigold RMs and a higher up official from Prestige handling involved.

My point is — don’t hold your breath.

Just to update, after sending a detailed email, my card has been reinstated to the original position. Having another card with citi avoided the KYC process.

Silver lining on black cloud! My yearly renewal was due this month. I called them and got myself downgraded to LTF Indian Oil card.

It doesn’t matter. If it was due 11 months from now you could still do this and Citi would give you a pro-rated refund on annual fee.

I’m a little surprised that people are downgrading because of these changes. But these things are subjective.

Does this mean, if you swap your Prestige to say Premier Miles after 2 months of renewal, then you get pro-rated annual fees refund and still be able to keep 2500 points + Rs 10k Taj voucher?

Amex Guy,

What is your thinking? Are you continuing with Prestige? There are two recent changes: one in Oct (with regards to TXs that will get you points), and one now. Do you still see value in Prestige? Personally speaking I had a sizeable expense in education – so a tad sad to see that in the excluded category as far as Prestige is concerned (and the school does not accept either Amex or transactions via PayTM). Of course losing the other benefits did add insult to the wound.

Infinia airline transfer partners are Jet (Inter Miles) & SQ only.

SQ taxes are very very reasonable.

Using their spontaneous escapes discounted miles offers monthly can be quite handy (within Asia, Asia to Australia, etc)

SQ miles can be used for Vistara. Though not very economical.

BA has low taxes for intra asia (intra Japan can be made zero!), intra EU and intra aus with OW partners if Im not wrong.

For long haul one can transfer ba avios to Iberia avios for affordable taxes.

QA is again best used during monthly easy deals (50%,40%,30% miles discount to select destinations from Doha).

Taxes are not bad at all 3k-5k, but a part of it is non refundable.

Asia Miles is a great bet. Almost Alaska-esque after Alaska took a hit for intra asia usage and sparsely available premium long haul on JAL etc.

If one figures out Asia Miles chart then it can be quite quite handy for intra asia, even usa… given the stopover rules for one way, return, multi city etc.

Virgin Atlantic miles on ANA are one of the best sweet spots in the miles game. Tad high on taxes though.

Cheers

S&S

Still nothing beats 25K on way India – NRT/HND on JAL using Alaska. Rest of Alaska intra-Asia charts are no use IMO.

BA has enormous taxes. BOM-DOH QSuites was 22k Avios + 35K in taxes!!!

@Neo

Alaska is not a points transfer partner for Citi Prestige India.. so how can one book on JAL using Alaska?Am I missing something?

@Krishna, Alaska can only be done via Marriott Bonvoy which transfers from Amex 1:1

Isn’t mariott to miles ratio 3:1?

Does it make sense converting those points..you lose 67% value no?

are u sure about the infinia airlines partners ?

also if only krisflier and intermiles are the only partners how to convert it to ba?

Thanks. Any more tips on maximizing Prestige points. Would be great if you can write a guest post here!

There was multiple bouts of mild to major devaluation in the near past:

– MMT flight Rs 1200 cashback to Rs 1000 instant discount

– No points for Insurance, Education spends

– Less offers than previously offered (for eg, there was no Diwali offers)

– Interest Rate hiked

– Demat holdings not counted towards NRV (HDFC also doesn’t but SBI and Axis does)

– Now this Prestige devaluation

I’ve applied for HDFC DCB (holding ClubMiles now) and if approved will close the Citi Prestige at renewal time. Even if DCB is not approved, mostly I will close the Prestige card.

Can anyone confirm the outrageous FX rates for Citibank Prestige?

I am getting 73.xx nearing 74 this month for $ spends.

I love the airmiles since i use that to move points and get redemptions, but the FX rates of late are killing.

Just want to get others view on this.

Another shocker.

effective Jan 2020 statement and will be applicable on opening balance and further transactions including

cash withdrawals.

Current Interest rates Revised Interest rates

37.2% 42.0%

39.0% 42.0%

40.8% 42.0%

42.0% 43.2%

@MK,

Interest rates shouldn’t come as a shocker to any financially disciplined person. I mean its always good to know the interest rates levied but in reality if someone ends up paying interest regularly on the credit card then they should probably rethink about their decision to hold a credit card.

Citi Prestige – 4th night offer is fraud.

I have been with Citi Prestige for last 2 years, have been in a paying member. I have tried their 4th night off on 3-4 ocassions but have always found their pricing too high. Even the process to search & book is cumbersome. Last time escalated the issue with screen shots from their hotel booking partner – Hotels.com and few other travel portal and from the hotel website. but after several email exchanges (pathetic SLAs), the issue just died. It was like their 3 nights pricing was covering for the 4th free night plus leaving some money for them as service charges.

I eventually booked much cheaper.

Since I am not into Golf, the only benefit that I & my family members use is the Priority Pass.

Last year they didn’t issue me the 2500 miles on renewal – I had to fight for it.

Just now, they declined issuing me the 10k Taj voucher for my 2nd year renewal as I was late by a few days and my 3rd anniversary just started.

Their customer service is nothing compared to that of AMEX.

I use Prestige to consolidate my spending but their service sucks, that too after paying full fees 20k plus taxes.

An update-paid insurance using paytm app thru Prestige. No points accrued. Similar flow with Amex & Axis always works.

Citibank seems to have switched from Visa to Mastercard . Any idea if the Citi Prestige is a Master Card World or World Elite?

Hi Akash, it is MasterCard world elite. My dad lost his card recently, and he got an master card world elite instead of visa infinite. This makes it one of the few cards in India to be under this platform (after yes private). If you wish to get replacement just place a request of your card being damaged and you will be given this one

Does 4th night free work with MasterCard elite platform ? Which platform is preferred for prestige?

I got my Prestige card swapped with LTF rewards card. As 1 year was not complete, they also refunded fees for few months which were pending. I still got the 10K voucher and 2.5K points. Have infinia for daily use. Just cutting down on annual fees where I feel is not worth much 🙂

Did not know the “Airport Transfer” was history had called CIti for the same on behalf of my brother and they gave a 20% discount of the transfer from Japan Airport to City which was around 13k “INR” whereas I searched and got a deal for 11.4k for the same from another OTA provider.

Very disappointing and not expected can anyone recommend a card with complimentary Airport Transfer or at least much higher discount?

Siddarth, Citi Bank is exiting from retail banking in India.

Thanks for sharing the news Hari. So now some of us don’t need to worry about getting Citi cards 😉

P.S. Assuming they also mean exiting from credit cards, as it comes under retail banking.

Citi is exiting retail business in India and 12 other countries.

Believe credit card business would be certainly affected. It was my first ever card issuer though I had closed it also very soon. Less than a decade back they had the 2nd highest market share in India and kept slipping ever since.

Do you think credit card business is part of retail business or it can run stand alone?

They are looking for a buyer for their credit card business.

Yes

The 13 nations Citibank will pull out from are Australia, Bahrain, China, India, Indonesia, Korea, Malaysia, Philippines, Poland, Russia, Taiwan, Thailand, and Vietnam.

Buh-bye Citi Credit Cards!

In such a sale of their credit card business, what will happen to my sky-high (₹46 Lakhs) credit limit built over 16 years. Gone? Don’t know if some other bank they sell their credit card business to can continue me with the same credit limit.

Depends on the buyer.

For ex, if HDFC takes it, it may not go down much. But if SBIcards takes it, expect it to become 4.6L!

Citi was among the pioneers of credit card industry in India. Sort of once an industry leader, 2nd biggest as of 2012. Once SBI’s partner also. But many pioneers die out and only subsequently founded competitors flourish. Like whatever happened to taxi4sure, oxigen, orkut, in their respective spaces.

Citi sales people aggressively sold cards but also sold hidden charges. This created the same sort of resistance among people as “population control” measures of the 70s has. Even today there’s a huge reluctance among urban class who are approached for credit cards, they are still suspicious and someone close to them has burnt their fingers atleast once. It’s taken years of effort by whole lot of card brands to overcome that fear, plus increasing cashlessness, to restore some confidence back.

Beautifully articulated.

“Your Diner’s Club Black Credit Card xxxx comes with a gift voucher worth ₹7000. To avail, use it for ₹172000 from 12th April- 30th April, 2021”

Long back I had Deutsche bank credit card, which I liked. Once they sold to IndusInd, I used it rarely after that, as conversion to there card was not good. This card was already devalued, cant say what new owner will do. Prestige is global card of Citi, will they allow the name to be used by new owner?

Seems that CitiBank has started issuing Visa Infinite variants again due to the MasterCard ban.

Is it a good idea to get prestige? My credit limit with citi rewards card is good, so citi will swap it with prestige. Only thing is 20k fees and I have infinia also. Does citi give enough offers to justify fees apart from 10K voucher and 2500 points. Can someone pls share there experience of present