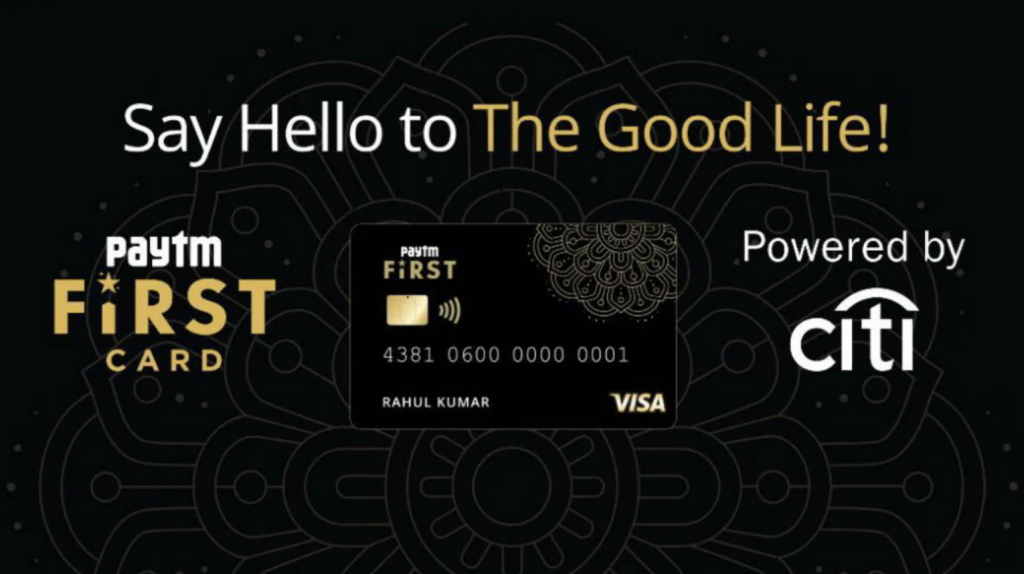

Just as every big brands like Amazon, Flipkart, Ola, Paytm too is getting into the credit card lending business. Paytm today (May 14th) has officially launched its Paytm First Credit Card in partnership with Visa & Citi bank, India. This is more like a co-branded credit card that we see with airlines & other brands.

Before we get into the details of the Paytm credit card, you may need to know few details,

- Paytm parent company One97 Communications started as a Citi commercial banking client back in 2009. Citi was also selected as an advisor on the initial investment by Ant Financial in 2016.

- Paytm wallet got integrated within Citibank online and mobile app in 2016.

- Visa recently tied up with Paytm to issue debit cards for its account holders. Currently they’re issuing only rupay cards which is not so easy to use in many places.

- Paytm First is the loyalty program which Paytm launched during March 2019 and has good set of benefits.

So now Paytm tied up with Citibank to issue the Paytm first card which is the credit card for mass. This deal is probably the only way Citi can increase the Credit Card userbase exponentially, which may help them to sell their premium cards later.

To make sure Paytm meets the target group demands, this has been launched as a beginner card with a low annual fee. Here are all the details,

Paytm First Credit Card Details

- Joining fee: Rs.500+GST (charged at the end of the year, waived on Rs.50k spend)

- Card Type: Works on Visa Platform, contactless enabled. International acceptance, unlike Paytm Rupay debit card

- Rewards: 1% Cashback on all spends, no upper cap.

- Type of Reward system: as direct cashback to statement (not to wallet), auto-credited every month.

- Other Benefits: Paytm promocodes worth Rs. 10,000 on spending a minimum of Rs. 10,000 in first 4 months. Link to T&C

As you see, Paytm claims that it will offer unlimited 1% cashback, “without restrictions, auto-credited every month,” through the new credit card. 1% as cashback is absolutely great for beginners.

You can view the txn details on the Paytm passbook. (similar to Paytm Postpaid). The Passbook of the credit card will also highlight exclusive offers from both Paytm and Citi on a real-time basis.

Paytm, which has about 150 million active monthly users, expects its AMU base to increase substantially with this credit offering. Paytm, the largest wallet player in the country, has a user base of about 300 million at present and expects at least 25 million users to opt for the Paytm First Card, (may happen by 2025).

How to Apply

Citi and Paytm have jointly built a selection tool to identify the potential base and access creditworthiness. This will help enable customers to own a credit card without requiring a prior credit history.

It appears that Paytm First Credit Card would be initially on invite only basis, something similar to what we see with the Amazon Pay card. If everything goes well, everyone should be able to apply in few months down the line.

Applications are open to select Paytm Accounts for now. Check your App!

Crushing the Competition

The basic credit card variants issued by banks are its direct competitors. With this launch, a lot of credit cards currently in the market made for beginners becomes useless, as their reward rate is less than 1% and that too as reward points and not direct cashback.

Along with it, as Paytm can also provide relevant travel/entertainment offers better within their platform, the need for basic cards by other banks goes down. So its time for banks to up their game.

But, if you compare Amazon Pay card with Paytm First Card, I would say Amazon Pay Card has an edge over Paytm card for Amazon users. Yet, if you’re someone who love cashback’s, Paytm’s unlimited 1% cashback might sound appealing.

Bottomline

While Paytm First credit card is not a target for premium cardholders like most of us at Cardexpert, its still an AMAZING card for those who’re new to the credit system.

If promoted well, it’ll help in increasing the credit card penetration in the country to a whole new level. Its definitely a great move by Paytm for a cashless future.

Updates:

- Applications are open to tier 2/3 cities as well.

- Support will be taken care by Citi, just like another co-branded card

What’s your take on Paytm First Credit Card? Feel free to share your thoughts in the comments below.

So does PAYTM first card and Amazon ICICI card give Lounge acess ?

No.

Paytm Rupay debit card gives lounge access (2 per qtr)

Thats a RuPay – Platinum Card offer not all Rupay Cards.

This is like Micro finance, bringing credit access to first time Credit card owners

In all probability Paytm First card will be offered to tier 2 & 3 cities also, as there target of 25 million customers is ambitious.

Pros:

1. Self employed persons will be able to get a Citicard (They used to get denied earlier)

2. Persons with no credit history will also have a fair shot at it

3. Other bank cards hardly give 1‰ cashback directly without any tnc

4. Paytm custom made offers maybe good at times to keep it at par with amazon/ flipkart

Cons:

1. Citibank will soon have a customer base multiple times of what it has currently. This may result in bad customer service or they may launch separate customer care for this card

2. Merchant offers may get diluted or may not be applicable on this card

3. Credit limit for most customers will likely be 10K or 20K kind of

The only plus point I see for this card is CITI CC discounts on flipkart/amazon.

I Don’t remember last time I saw any cashback offers from Citi on Flipkart/Amazon. Only HDFC Bank and SBI are major leaders in providing cashback on Flipkart and Amazon.

I think that also might not be applicable, because this might come under a co branded card!

@Santosh

Other co-branded cards like IOC Citibank card also provides Citi merchant offers.

I think the risk factor would be of paytm.

Customer support again with paytm.

Paytm took citi as partner just to satisfy banking regulation as they cant offer cc themselves being a payment bank. Ofcourse initial expertise of citi comes handy to overcome initial hiccups.

For citi its just another partnership to get idea of rural areas n small towns and select the cream out of it.

How I wish they charge 0% on forex charges! Would be the first card in India to do so.

You shouldn’t even wish that, on a Rs.500 rupees card. 🙂

But yes, if the demand is there, they may even launch a premium variant with such benefits. Who knows!

looks like a walmart version of SBI Elite credit card >_<

@Sid

Citi has practice of giving only 2 cards per customer so will they extend this one as additional or one has to replace existing card to get this one?

I am having Citi Cashback Card which is 0.50% on regular spends & 5% on Movie/Mobile etc. which is useless so I would prefer swapping it as anyhow paying fee for that card also

@A2Z

I also have Citi Cashback card. Thankfully its LTF for me, so I may not go for this card unless so called paytm exclusive offers are too good.

@Satish

I anyhow want to get rid of that cashback card

I use that only for Citi bank specific offers

And already hold premium cards from other banks so would prefer swapping it instead of getting it fresh and separate

They are giving annual fee waiver for spending more than 50K per year

I got the offer for PayTM first. I can see that but with joining fees of Rs 750- 100(cashback) = 650 there is no USP for this card even for first timers. For first time the Cash back should have be great higher than MRCC or HSBC Plat. or MMT Card from ICICI. All these do offer some sort return to customer which is completely missing as I can see.

@Ankush

The Paytm First offer you are telling about is its membership sold at 750/- per year. The paytm first credit card is different from it.

This is pretty complicated card. It uses Paytm’s Visa network partnership, but Citi’s banking license. Liability (legally at least) resides with Citi that way, while Paytm get 100% of the cut in MDR. I’m thinking there must be an understanding somehow. The card BINs, therefore, should not be that of Citi’s, so I’m unsure about claims that Citi network offers will work.

Customer service is 100% Paytm, the reps have no indication of training about this card. Card replacement, as well as issuance, is 100% Paytm. This card will not count towards quota of 2 with Citi, since not issued by Citibank (their definition). So this is also not a legit and easy way to get on Citi system. They weren’t sure if it will show as Citi card on CIBIL. my take — The issuer needs to do that. Paytm Payments Bank can issue cards, but not limit. So they can actually report to credit bureaus.

I’m thinking based on how deep I’m into product line up of both Paytm and Citi, I should be getting an option to apply soon.

I don’t think Paytm would get 100% of MDR. But if they ever get it, Citi would get something in return, which is nothing but the users. They’re typically spending for the aquisition. So CIBIL should reflect Citi and not Paytm. If it shows Paytm, then it means we’re far away to think about their business plan. 😀

Btw, Even if 5% of Paytm’s over 300 million customers gets the Paytm First Credit Card, Citibank India will become the market leader in credit cards. Maybe this is the reason why Citi agreed to the deal.

What is the minimum salary requirements for paytm first card?

25000/- per month.

Hope they give first preference to customers who had opted Paytm First at launch 😛

Dear A2Z

Its available for all in new paytm app. Anybody can apply.

I had read up somewhere that Paytm has or is preparing a Credit Rating System, some time in January, outside the MNCs like Experian. Is that what you mean by Selection Tool?

I think that both Citi and Amex are playing at both ends of the market. Amex with MRCC and Everyday Spend card, and now Citi with this. Anyone who knows how to play this game will not be enticed by this card. But it does get the serve the purpose of getting the would be premium card holders early and then showering them with good service and an occasional offer to upgrade to the next level every now and then.

Amex can’t win lower end of the industry unless they invest in increasing the POS acceptance rapidly.

They can never have a higher acceptance due to huge MDR. Regardless, with the latest offers on MRCC and Platinum Travel for FYF and LTF options (MRCC Only) if we meet the spend targets, this is as good as it can get.

Lot of people know to me who applied ot today for this card got Rejection…. (option is now available in updated Paytm app).

Strangely citi seems to be very strict with guidelines with this card too…. even with an Experian score of 800+, i did not qualify.

That’s sad to know.

If Citibank goes old Citi way of approving even this card, then they can hardly get the numbers that are talked about.

After applying I too got display saying “Rejected” but next day I got sms from citi saying application is in process.

It’ s 5 days today but still no update, I called customer care they told in 7 Working daysI will get call for document collection.

Does this card fall under VISA platinum or VISA signature?

Platinum

This announcement may have something to do with their newly launched “My Credit Score” section on the Paytm App with partnership with Experian.

The author of the blog seems to be completely ignoring Cashback Cards!!

Cashback is better than flight tickets/recharges/vouchers, as you get better offer for these on many websites/apps/banks and everybody doesn’t keep traveling/recharging so often.

Cash(back) is king!!

Now, the masterstroke:

unlimited 1% cashback, “without restrictions, auto-credited every month,”

1. Unlimited word itself makes it more attractive than StanChart Titanium or HDFC Moneyback as they restrict max cashback amount every month.

2. Without restriction means no cap for any particular spending category as other cashback cards mentioned above have for Fuel, Utility bill payments or others

3. Auto-credited. “Jiska sukh, vahi jaane”. This saves you from having to call customer care/ visit website each month/quarter/half to redeem cashback.

I even do not agree with “Amazon Pay Card wins” statement as cash(back) is better than amazon pay credits as amazon pay has limited, restricted use.

I’ve updated few lines to make it more appealing to Cashback loving readers 🙂

Well, cash is king, all things being equal. At 1%, all things are not equal.

With due respect to cashback cards, I feel ICICI Amazon is a better card. LTF versus Rs 500 fee. 1% everywhere plus 5% on Amazon, 2% on partner sites versus 1% everywhere.

Regarding the cashback it will mostly be cashback to your PayTM wallet and not as statement credit. While I agree Amazon Pay balance has more restrictions than PayTM wallet balance, I would as of now value them at par since I see offers with Amazon Pay is much more than PayTM.

Regarding Cashback, most probably it would be credit in Paytm Wallet and not in the card account just like Amazon Pay card.

It is direct cashback to Card, not to wallet. This is the main USP of Paytm Card.

U must be loving cashback……but who will not love free yearly vacations for family for same amount spent……so majority of us points are better…..last year went to HK and Taj exotica goa….this year going to Maldives overwater bungalows 🙂

Just out of curiosity…how much does one have to spend yearly to come anywhere near that possibility? Thank you.

Link

Here’s how the 10k cashback works, not very appealing

They didn’t gave only the max cashbacks per category per month but didn’t mention the percentage of cashback. or my understanding is wrong and they are giving 50 cashback for 100 rupees?

Hi Siddharth,

I was planning on upgrading my SBI Simply Click Card to SBI Prime Card but after reading your post where you highlighted on CIBIL impact I think against it. Now I plan to open new premium credit card, while keeping my oldest a/c of SBI Simply click as it is. Can you suggest some good cards other than SBI & CITIBANK

@Author, clearly ignoring the comment ☹️

There isn’t enough data to suggest one.

I have consulted with SBI customer support team with the article you published about upgrading SBI simply click to SBI prime. They clearly mentioned that no account closure takes place, and they simply change the card on same credit account thereby creating no impact on Credit History

I was asking for some suggestions over mid range premium credit card list classified based on bank. Would be helpful if you could create an article over that or suggest few good options here.

Look forward to hearing and it’s always learning read you articles. Thanks

sid, ola with sbi card launched.

And the article is also live 🙂

UPDATE : Apply Now button activated for me. After pressing it, asking for Full Name, PAN No., DOB and Address. But I am not applying now, because I am from Indore and Citi Bank does not service here Credit Cards. Will apply only after confirmation for that. Does not want CIBIL enquiry for no reason.

Where do you see the apply now button?

It’s in the new updated paytm app. Visit top left corner area and under that option on scrolling you will see.

Not showing up for me yet, maybe because of IOS?

Not Showing for me on Android too.

Update for iOS came for me this evening. The version history mentions the card. Still no option to apply in hamburger menu.

Same here.

It’s not showing for my friend on updated android app either. Means it’s not available for everybody atleast for now. I might have got the option to apply because of my Paytm First relationship.

Anyway I am not interested in this card right now.

They are taking application from all cities including tier 2/3 cities. Confirmed with Paytm! You may proceed with the application, if you’re planning to get one.

P.S. That still doesn’t guarantee approval as there are lot many factors.

Hi Sid it’s not true..I am residing in Agra U.P but after entering address it’s not not allowing me to apply .In address field it’s showing not serviceable..I randomly tried to enter the address of Delhi and in this case giving me option to apply…Seems presently they are allowing tier 1 cities customers to apply for this card..I have raise the issue on twitter but have not got reply till now..

I have 790 cibil, they rejected my application saying your application cannot be processed at this time.

Any idea if this card and ola sbi card provides 1% cashback on all spends or their is minimum spend criteria like hdfc’s above 150 per transaction or like amex has 1 point for 50 spend ? Not able to find anything regarding that.

First update the app to get option for paytm first card..

It’s open for everyone..Click on top left profile tab option then scroll down (its just above the 24×7 help section).You will get Paytm first card option..

Now the main point is they are not issuing this card to tier 2 and 3 cities now…because I am residing in Agra and at the time of applying for this card it showing NOT SERVICEABLE..

Hope it’s helpful.

One more update…I have observed ,in this card paytm is just working as intermediary.They are just collecting basic info like pan,dob,address,gender and forwarding it to Citi for processing..That means Citi is fully responsible for issuing this card…Here the procedure is indirectly same as we are applying for Citi credit card directly through Citi website..

On Paytm app, you can click on the Paytm first card icon present or Paytm First card option in the hamburger menu. On clicking this, a form will appear. Please fill the details correctly, once the details are filled and verified, a Citibank representative will reach out to you for KYC process. If the credit card is approved, it will be mailed to your communication address with the welcome letter.

NOTE:-Last month I have applied for Citi cashback card through Citi website..But they have not approved the card due to location(Agra) issue..despite having all the things are in order(Experian score 896 and salary in hand 49k,never done late payment on my HDFC,ICICI,SBI CARD)..

APPLICATION PROCESS UPDATE : First of all, update the PayTM app from playstore or apple store as there is an update released yesterday. After that, on PayTM app, you can click on PayTM First Card option in the hamburger menu. On clicking this, a form will appear. You have to fill all the details required there. Once the details are filled and verified, a Citibank representative will reach out to you for KYC process. If the credit card is approved, it will be mailed your communication address with the welcome letter.

I have an experian score of 836 and my mom has 878, still on applying the Paytm First Credit Card on Paytm App is rejected.

Citi Bank should really stop its traditional way of approving cards.

On applying, the DOB is taken as one day before of the corrected DOB, strange error, I applied with DOB 15 April, but an email from Citi stated my DOB as 14th April. This same error happened with me, my mom and my uncle even.

Confused

same thing for me too. DOB- 1.

I think, till now there is not a single person who got approved for this Card.

Patym card update: applied this card from paytm application,upon filling all the details as usual Citi Bank denied my application as already happened before 2 times, because i am self employed 🙂 So they are aiming at 25 million users initially by denying application of worthy people,this was my last application to citi bank cards ,if they think self employed aren’t worthy,i also don’t find any worth in holding such cards as there are better cards available in market!🙂

> because i am self employed

Did they say that? I got my Citi card when my company was less than a year old. I still know a bunch of people who are self employed who got approved for Citi (some directly to Prestige) this year. So things have not changed in this regard.

I’m fairly convinced it is either the industry you operate in, your PIN code, or some dumb reason like that causing the rejection.

Was your last Citi application under 6 months ago?

Amex guy , i am not a normal dumb type user who comments anything without confirmation, From September 2018 citi bank stopped taking self employed applications as that was my second application to citi cards,they told as you are self employed it was denied when i contacted nodal head on call as this was very hurting as my cibil was 823 With only 2 cards in kitty, at that time i got to knew that and as per my knowledge your company had applied it before sept 2018 frame, Today again i sended same mail ,hoping to get reply soon Secondly I haven’t applied citi or any cards from last 8 month’s!!

Amex guy,i am really frastursrated with citi bank currently and I don’t think to apply it in near future as 3 rejection are enough they don’t need my application again, i am a sole proprietor,pincode is Mumbai pincode and my neighbour has Citi card so pincode isn’t a issue ( he is sole proprietor too ,got Citi card in 2016) Or can you possibly help with more reasons? I even heard citi doesn’t like when you have more cards too??

I have sbi,hdfc,amex, IndusInd and axis currently! Thanks in advance!🙂

@amexguy, its true cities not issuing for self employed. Applying through cities website, when you choose self employed, you get message, card cannot be issued due to internal reasons. Tried with swiggy & zomato app for cities card, as you choose self employed you get message, card cannot be issued due to internal reasons. Anyway there is no query in civil by cities at this stage. May be they are issuing to a/c holders of citi or HNI’s

Any self employed existing citi bank credit card holder tried applying for this card ? What are the chances of getting approved since citi is issuing the cards..

Got the link on the app. The offers look tempting including free paytm first membership. But already have too many cards sont wanna apply for more.

Hi Sid

Does Citi Bank issue cards on card to card basis?

Can you please review Citi Ultima Card? & Citi Debit Card as well?

Does being a PayTM Payment Bank user help ?

I use it for my monthly expenditure, maintaining an avg monthly balance of 10k in the account.

I also have the debit card as well.

I am not seeing any application option even after update

I have tried to apply today. My city Indore is also serviceable. But after entering all the required details, the error message says “CUSTOMER IS NOT WHITELISTED”. Now, what is this? Looks like some new criteria invented by Citibank.

That means imo you live in an area or pin code blacklisted by citi completely. Happens when they get too many payment default at particular place, their system blocks it for new business from that place.

Hi Sid,

I have been following your blog since quite a time now. I have read almost all of your reviews and I genuinely appreciate your work to enlighten people with the world of Credit Cards. Keep up the good job!

Looking forward for more informative posts from you.

A quick question, currently I own HDFC Diners Clubmiles card with 88k limit, SBI SimplyCLICK with 65k, SBI Unnati with 65k, ICICI Platinum with 45k and ICICI Amazon Pay with 45k(Shared with Platinum). I am a salaried person with 4.5LPA Net.

Which other cards you may suggest I should have in order to get the maximum out of them? I am willing to close basic cards like Unnati and Platinum from my collection.

Kindly advice!

Regards,

@dev rather than income i think it depends on how much you spend and what kind of benfits you are looking to reap from.

Even if you 3lac per annum i think

Clubmiles + simplyclick + amazon pay are best combination.

Clubmiles gives you worldwide lounge access plus 1:1 miles transfer to vistara or avios.

Simplyclick is good for wallet load where clubmiles wont give you benefit. Amazon pay is good for amazon spending.

Use then wisely instead of blindly going after other cards.

Hi, I am already Paytm first member. If I get Paytm first card, will my paytm first membership be extended for 1 more year? Also, is Paytm providing 10,000/- worth vouchers use it in Paytm for the next 12 months as mentioned in some websites? I don’t see this benefit in Paytm app. Also when I spoke with Citi bank support team, they were not aware of these vouchers.

For this card, salary of the employee below 20k was showing not eligible.

Appreciate anyone’s response on my above query as Citi is going to collect my KYC forms tomorrow. If I don’t get those benefits (extension of Paytm first membership and getting 10,000/- Paytm coupons), I am not interested to apply the card.

Got the card today after 4 days of application. The doc’s were physically picked from me, and I was made to sign their physical application form.

Sir plz tall me whitch documents will be required for Paytm first card ???

existing paytm first membership dont get extended with the card

Thanks… do you know if we get 10,000/- worth Paytm promo codes?

@ sudheer you will get those vocher if you do a purchase of 10,000 using Citi card in 4 months of issuance,after spending 10,000 of card in 4 months the offer would be given to you in Paytm account as per the statement, secondly congrats you got applies for card,can you reply few questions like are you salaried?, What’s your income you put in while application ? Just needed as i was denied by citi again and again!

Thanks Hardik.

I am salaried and I have mentioned my annual salary around 20lks. I have an existing relation with Citi (have both debit and rewards credit card)

Welcome,sudheer So as per your older relationship it was easy for you to get the card, don’t know why Citi bank isn’t issuing cards to worthy users, I haven’t seen in our site someone got approved yet for this card who has super premium cards in kitty, don’t know what citi is expecting!

This is the answer from Paytm support team on existing Paytm first membership.

Sudheer, as per company policy, the terms of your original Paytm First subscription will continue – the free 1-year subscription with the card is only for those who currently don’t have Paytm First. However, as an existing Paytm First subscriber you’re now eligible to get Rs.650 cashback in your Paytm wallet on the successful issuance of the Paytm First card.

By mistake i had enter wrong date of birth in Paytm First credit card application hence my application is rejected can i apply again

My application got rejected! I don’t know on what basis they are doing it!

Amazon Pay Card is better than this. Apart from minimum 1% on everything, Amazon card gives 2% on spend through Amazon Pay Wallet and 5% on every spend on Amazon dot com.

All this without any joining or annual charge.

Yes. But Amazon and ICICI are not giving it to everyone. I have tried to get it or at least tried to enquire regarding the eligibility criteria, and nobody seems to have a clue. Paytm First credit card is available for application.

@Alex

You can easily get it, if you have any existing ICICI credit card. Else best idea is get any LTF ICICI card n wait for 3-6 months. Amazon card invite will be easily available. I did this way and got the invite in 3 months.

It seems like Paytm First cards are not eligible for the Citi Offers. Here is one of the point on the offer eligibility I saw while going through the T&C of the offer:

“Offer is valid for domestic flight booking done between 16:00 hrs to 21:59 hrs on every Tuesdays during the offer period on Citi cards except Citi Corporate Credit cards and Paytm First Credit cards.”

If there is no access to Citi promos then what’s the benefit for Non-Citi cardholders to apply for this card? Does anyone think that based on spends and repayment history, one can upgrade to a regular Citi card say 6-12 months down the line? Or is this a ‘PayTM’ card that is utilising the Citi credit card infrastructure to establish their presence in the market? Also, does anyone foresee aggressive promotional marketing campaigns from PayTM side in order to please their customers and entice them to spend more on this particular card over the other cards that they may be holding. A Citibank executive is expected to come over on Monday to pick up the documents but my primarily intention on getting this card was to utilise the various Citi promos from time to time. If, this card is being excluded then it makes me wonder if it makes sense to get this card in the first place.

Citibank is very old school in their processes. I have applied for the Paytm Credit Card and they refuse to collect the KYC documents because there is no cross or main mentioned in the provided address. I requested them to collect it from my office address and they refuse that also. They want me to reapply. I am thinking of giving this card a pass. Too much of a hassle.

Thinking of trying for the Amazon ICICI credit card using the tips given by @Satish Kumar Agarwal. Thanks Bro! 🙂

Applied on 16th May. Docs collected on 22nd May and card received today on 29th May. This is second card from Citi bank (have rewards card since 2016 end). Paytm is yet not reflecting actual status of card (says application submitted).

Can u please elaborate the procedure , what docs did they collect from you & any verification call or visit ?

Hi Srikkanth!

Citi executive collected PAN card, aadhar and Voter id in my case. Verification person only confirmed over call if their executive verified originals. Thats it. No document collected or question asked about income.

Paytm accoubt is now uodated with my card details. I can see card transaction as passbook within paytm app. Good thing is that today itself my paytm first account is activated. So I can say integration of citi and paytm is very fast. Now the only concern is about 10000 offers on apend of 10000. This offer is not mentioned in welcome kit. We will have to get this clarified with paytm now, it seems.

Do we get 1% cashback for wallet loads paytm and non paytm ?

1% Cashback on all transactions. Cashback will be adjusted in your monthly statement. Cashback is 1% of the whole amount of the statement. It is not on every transaction. It will be calculated 1% of the total purchase transactions of the statement.

@Siddharth, Can u provide info on how to reapply for this card once rejected or in how many days we can reapply. No option on city site to apply. And in Payton once rejected, it always shows rejection. No info on after how many days they will enable option to reapply. Mine got rejected because of two city card. I have merged all cities card into one, but how i can reapply.

@Siddharth, Please update the article. Out of PayTM user base of about 300 million at present, Now PayTM expects at least 300 users only to opt for the Paytm First Card, (may happen by 2025). Thanks. 🙂

300 lol 😀

For those who hold PayTm First subscription prior to applying the credit card will get the first year subscription money (₹650) reimbursed to the wallet after activating the card. This is a good thing.

Is existing paytm first member will have further extension in membership?

No. The tenure of existing Paytm First member will not get extended on applying the credit card

No

This card is really old fashioned.

1. It is Visa platinum.

2. The design is just basic print which will get rubbed with regular use.

3. Even the card number is not embossed.

Got this card delivered today although with a meagre limit. Although still confused how to activate the Paytm first subscription, still asks to pay 750

This is just a scam in the name of credit card. I guess only few mayblee less than 300 in 300 million got approved for this card . I have citibank credit card i call them and asked abt my application they said , we didnt gt your application . So basically paytm is just making fool . better apply for amazon pay icici card

Anyone received 10,000 worth of Paytm coupons after spending 10,000? Paytm support team is Saying this offer is not there.

I spent 10,000 and yet haven’t received any promo codes. I believe the offer is withdrawn, and to add fuel to the fire, paytm is now offering a 1000 cashback for new applications!

Hi Sid and other card expert members ,

I finally pulled the plug for the Paytm first Citi credit card and I would like to give a detailed review of the reason for applying for the same alongwith the product review

Why Apply ?

Did not have any credit card or relationship with Citibank . I have an Indusind Iconia Amex (LTF currently refer respective review page comments for add info ) and the weekends rates of 2% on all spends is just way too good than category wise spends Citi cashback/ Citi rewards offer . Did not make sense due to existing cards and my spend pattern on those categories . Citibank IOC was not an option for me due to no fuel expenses . Hdfc diners clubmiles covers my travel requirements so I dint even think of Citi premier miles as an option with a steep annual fees . Coming to Paytm Citi bank first credit card the first year fees is offset by the Paytm first Membership which gives a lot of services especially the Paytm load cashback , 10% on uber rides and stuff, Zomato 3 month subscription etc . Another thing was total 10k cashback coupons spending 10k in the first four months. Out of the 10k coupons I found coupons worth Rs.7000-8000 of my worth . So overall , this was the card I could pull the plug for just for the joining benefits.

Process

Applied through the Paytm app and after sharing the basic details and it was showing as submitted successfully and pending for kyc from Citi end . Paytm provide some reference number which is different than Citi application tracking number . The Citi application tracking number was messaged to me in a few mins post applying on the Paytm app . The next day got a call from Citi personnel for document pickup . This card doesn’t take into account the salary criteria as I wasn’t asked for any income proof document inspite of asking them multiple times do I need to submit any . Seems they have developed some algo based on the spend patterns on Paytm and cibil scores for screening applicants . The document collection was smooth and the mandatory details were collected and within Six working days the card was delivered to me . The card passbook was available on Paytm app after delivery so I guess there is some good level of integration between Citi and Paytm . However , the Paytm first Membership wasn’t activated automatically and I dropped them a message on twitter pertaining to the Paytm first Membership for which I was replied that my Paytm account will be whitelisted within a weeks time . For the 10k cashback coupons I got a reply that the offer is active through their twitter handle though nothing has been mentioned in welcome kit of the card . The processing was pretty fast

The review

The package was delivered with the basic information kit . Nothing special though the black welcome letter looks cool . The card itself is pretty only the gold visa logo stands out . The print itself is pretty poor with no embossing and the printed ink being of low quality (the worst among all my credit card ) and is cheaper than my 2 year old icici coral credit card . The only card I have which can be equivalent or cheaper to this is the Niyo global card ( this is a prepaid card in partnership with DCS with zero forex markup . Trustworthy as I used it in a foreign trip and they actually charge the visa rate from the visa website . Nothing more nothing less . Sid I guess a review about it could also work. Better option than forex cards unless you want to lock the forex rates ) . Coming back to the topic the card provided me a limit in between my top card ICICI and the least one amex .The card design is not that great comparing it with the revamped Citi bank card designs . A little more like SBI like new cards design could win this card some looke.The customer care number is not seperate like Amazon pay card that’s a good point . The offers catalogue as I do understand may change a little however most of the citi offers are also applicable on this card . The tracking can be done directly through Paytm so no need of downloading the Citi bank app . Pin has to be generated at Citibank website itself . 1% unlimited cashback for all categories is their selling point . Though I feel this is a starter card in my honest opinion and only the joining benefits make sense apart from Citi offere . Again the cashback is to the card and not to the Paytm wallet like Amazon icici co branded card . Fuel surcharge is waved on IOC petrol pumps with Citi swipe machine . Also currently there is no option to apply for add on cards as stated by the customer care executive.I would love to see Citi and Paytm develop some special offers for shopping on Paytm specifically for this card only. For the fee waiver spends of 50k in previous year is required which is more than Citi rewards card. In my final opinion this card can only be helpful for you to gain access to Citi network and provided you find more value in this card than Citi Rewards / Citi Cashback . For the joining benefits , I guess this card currently offers the best value among all Citi cards because of the Paytm 10k coupons and the Paytm first Membership .

Hi Nabendu

What is the description and TnCs of the 10k coupons you received? You mentioned that 7-8k of them are worth. Can you pls elaborate?

how to get paytm.first membership i have recived the card

Hello everyone. I get my paytm first credit card today.i am astonished after getting this card because i got a credit limit of 60k.let me introduce myself.i am a self employed . I have a cibil score of around 790.i use two credit cards 1)sbi unnati (2 years age)=credit limit 32k

2) rbl supercard ( 2 month age)= credit limit 97k

3)sbi simply click credit card(cancelled 3 years ago)

I have never defaulted in my life

I had a home load from mhfc of around 6 lakhs (10 years tenure) which i paid back early (in just 5 years )

I purchased two major appliances in emi from bajaj finance and paid back all the loans.

I submit my itr for last 4 years with net income of around 350000.

I have only one savings account in sbi.

Now from paytm citibank representative came in just 3 days ,collected my documents without any proof of income. Then i little delay of 2 weeks.suddenly i got a message from city bank that my card is approved and will reach within 3 days.Today i get it. I have also applied for icici amazon pay credit card and the documents are also collected. I hope i will get that card also. thanks.

Hi there,

A comparison between Amazon Pay ICICI, Ola SBI and Paytm CITI bank card will be good to choose between these and for spending it wisely. This will also help everyone where these cards are limiting us and benefiting us.

Where do you see the apply now button

Anyone received 10,000/- worth of Paytm coupons after spending 15,000 in first 4 months?

I am as curious as Sudheer. Been 2 months that I got this card but haven’t spent a single rupee. If someone can elaborate the nature of 10k vouchers they give on 10k spending, possibly I would find motivation.

@KK, don’t bother. The paytm customer care confirmed that the offer is not there. No promo codes for any spends. Only benefits are unlimited cashback of 1% alongwith paytm first membership. I am thinking of cancelling this card now as I have the Flipkart axis card which gives 1.5%.

I want this card but i m not spent any annual fee

I am facing a problem while submitting my request for

Paytm First Credit card in the Employment

Details section Ito rasing a popup that

Monthly Income is either incorrect or does it

meet the eligibility criteria. Can you please

sort it out.

I have now paytm first card.. but I am facing one issue that.. how to activate subscription for paytm first that is one year free membership.. it could not activate automatically.. so how to activate give me suggestions.

same here didnu manage to get that activated

Just raise a support query through the paytm app stating the same.

0 review. Very bad process. I have to request before 20 days. And message displaying “your application done within 7 working days.” Today 20 days completed. Very bad process. I have daily contact to city bank.. but no any response. Very very bad.

So, I have applied for the paytm first credit card and I would be getting it soon. Here are my experience while applying for the card.

1. After applying on the paytm app, reps visited within 7 days to my house for the documentation.

2. Recieved few calls from paytm and citi for the document confirmation and its Approved.

I already have HDFC money back credit card with LTF which i use rarely.

Although I have applied and getting paytm first credit card but I still feel that ICICI Amazon Pay card is better than paytm because it offers more benefits which is viable for most of the user, along with LTF.

Now this is really irritating. First they spam me with mails and messages to apply for the card. When I finally make up my mind and apply for the card, they tell me my address is not serviceable. Apparently, Card is not available in Nagpur. Then why spam me with the messages and mails. Paytm obviously already had my address in their database.

I finally took the plunge to add this card to my portfolio . The 1000 CB seemed attractive.

However , i have noticed that there was no place to apply CITI1000 coupon. I applied via the app when i received the notification that application has 1000 CB.

Will i receive the same after completing all T&C or it was just tricky placement of the Coupon Card Column to deceive people.

Really thanks for the great post. really very thanks but i want to know about how can i get the benefit on my Paytm app its option is not available i have latest version i think its have on Beta Version but how can i download Beta Version.

I applied for the paytm first credit card, the representative who called me for documents collection told me that once you spend 50000 in the first year, the card becomes lifetime free. Anyone else got a similar reply?

What’s the credit limit you got on the card ?

What is the procedure to close the paytm credit card.?

Hey, can we know the reason for going for cancellation of this card. Sharing your experience will help others make up their mind whether to add this card or not.

Have they closed permanently

Is this card permanently discontinued ?

Now there is no option in the app for Paytm First Citi Bank Credit Card.

I do not find this card useful as I have ICICI Amazon Pay and Flipkart Axis credit cards as I am using cards for shopping offers and discounts. I found that CITI credit card offers on Amazon, Flipkart etc. excludes this card from extra offers. Also there is no option for upgrade or replacement. Overall not good for me. Decided to get a new card on citi and return this card. But citi customer support is awesome

Paytm stopped issueing Paytm First Credit Card. Option to apply removed from Paytm App

PayTm launched its own credit cards today. Targetting 20lakh cards to issue in next two years.

Can see PayTm Credit cards option under PayTm app with Coming Soon page.

Hi,

Paytm Citi credit card has new terms and conditions now with better offers.

5% cashback on Paytm mall.

2% cashback on Paytm flights.

3% cashback on all other spends on paytm (including Rent payments on paytm).

1% cashback on everything else except wallet loads and fuel spends.

Update this on this post..

Link to this updated info please?

Hi Sid,

Why are you not updating the details that I have given. I have already provided requested Terms and conditions on previous comments.

Thanks for the link, will go through and cover it in sometime.

Hi, do you get 3%cashback on Insurance spends from paytm app?

I did not get them for LIC. The entry in the statement showed LIC of India and not PayTM. Not sure about other insurance providers.

After the change of rewards scheme, first month bill got generated with right points structure. Second month bill I had to approach the customer care for corrections, which they obliged and credit in the third month statement. Have to see how it goes.

Have you tried by paying from Paytm wallet app? or from LIC website. if you did from lic website you wont get

I paid from the PayTM App itself.

Can I use payment first card and shop at flipkart/amazon and still avail 1% cashback?

After Citi and SBI, now paytm comes with a range of HDFC cards, both personal and business. Benefits are pretty entry level. But doesn’t look like it’s getting anywhere like the previous ones.