Axis Reserve is the Ultra Premium Credit card that stands above Axis Magnus and are issued to affluent customers of Axis Bank.

The Bank revamped the benefits on Reserve sometime during July 2020 by adding unique features like complimentary luxury airport transfers and few other benefits, after which the card does makes sense for some.

If you’re wondering whether this expensive metal credit card has any value for the fee it comes with, you’ll get to know that in next few minutes.

Table of Contents

Overview

| Type | Ultra Premium Credit Card |

| Reward Rate | 1.5% – 3% |

| Annual Fee | 50,000 INR+GST = 59,000 INR |

| Best for | Golf & Airport concierge/transfer benefits |

| USP | Luxury airport transfers |

Axis Bank Reserve Credit Card is one of the few cards in India like Amex Platinum, the value of which has to be decided based on the lifestyle benefits it offers and not just by looking at the reward rate.

If you’re looking for luxury airport experiences at metro airports, then you can’t miss the Axis Reserve credit card.

Fees

| Joining Fee | 50,000 INR + GST |

| Welcome Benefit | 50,000 points |

| Renewal Fee | 50,000 INR + GST |

| Renewal Benefit | 50,000 points |

| Renewal Fee waiver | On spending >25 lakhs |

Those 50,000 reward points is valued at 10,000 INR (at 20ps) and so its obvious that the welcome benefit is nowhere close to the joining fee. Renewal fee waiver condition too is quite steep in my opinion.

Axis Bank does run sign-up offers with additional 50K bonus points once in a while. It used to be a decent offer back then but now it would be a lucrative deal.

Anyway, we will analyse the total “value” of the card with all its benefits shortly.

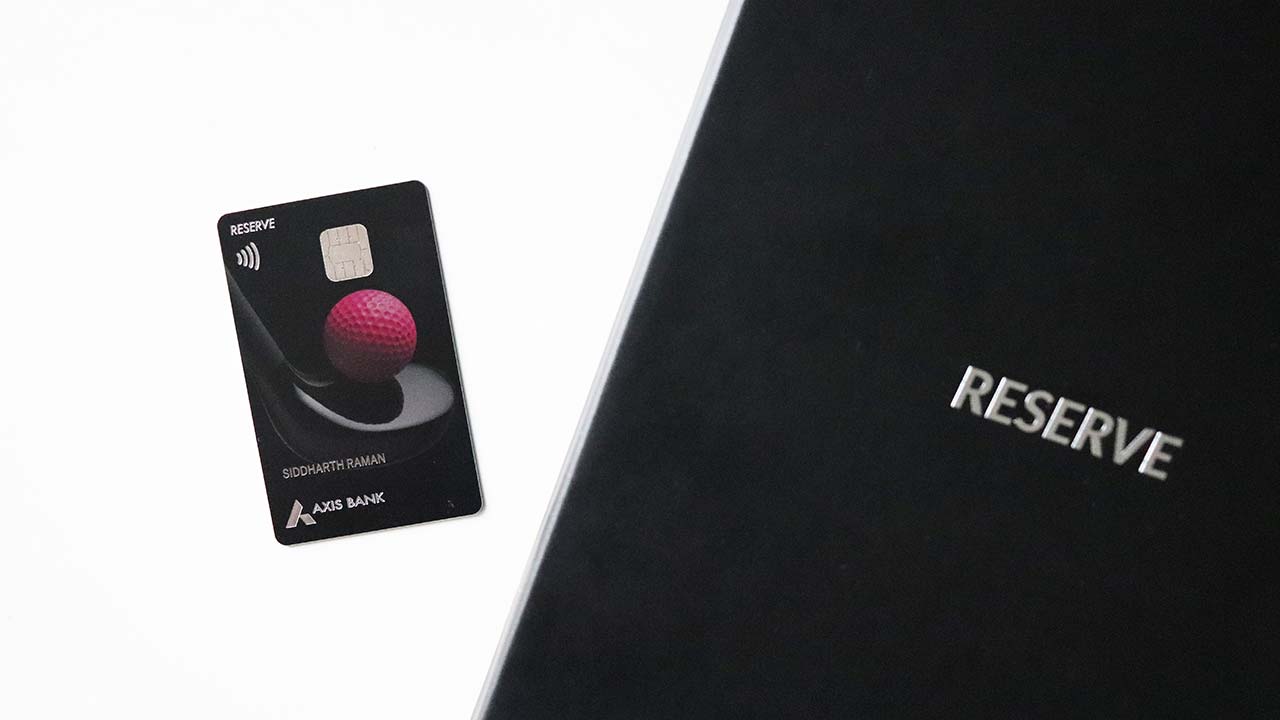

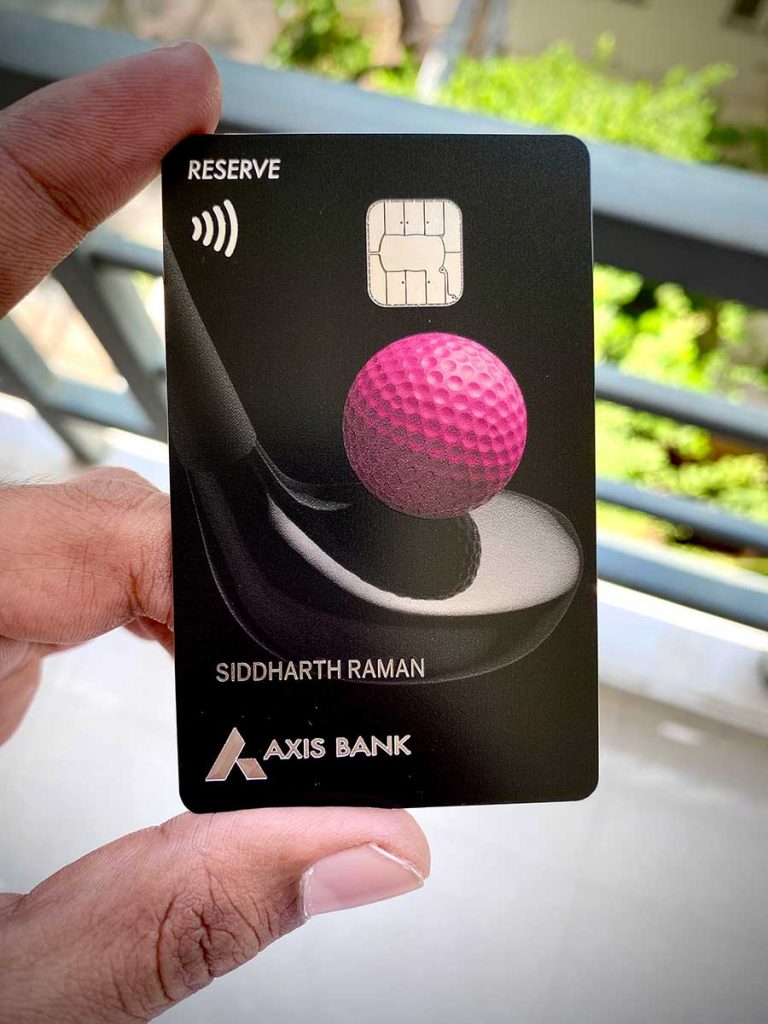

Card Design

The metal card definitely looks premium but it is slightly dull because of the darker tint on that pink ball. If that’s brightened, it would look so beautiful.

You can see that bright image in one of the pics below, as it looks like that in bright sunlight. That aside, it feels just like the metal Magnus to hold in hand.

Rewards

| Spend Type | Reward Points | Reward Rate (Edge Rewards) | Reward Rate (Points Transfer) |

|---|---|---|---|

| Domestic Spends | 15 RP’s on every 200 INR | 1.5% | 3% – 6% |

| International Spends | 30 RP’s on every 200 INR (2X) | 3% | 6% – 12% |

The reward rate on regular domestic spends is indeed bit low if you look at the edge rewards redemptions, for points transfers, it’s decent.

I wish Reserve too comes up with some sort of monthly/quarterly milestone benefit like Magnus to boost the overall reward rate of the card.

That said, it is to be noted that the ultra premium cards are usually meant for giving more experiences over rewards.

Markup Fee

- Forex Markup Fee: 1.5%+GST = 1.77%

- Net gain: 1.23% – 4.23%

Its a very good credit card for international transactions as you gain over 1% of the spend even if you redeem for vouchers on Edge rewards portal.

If you’re into points transfer partners, then there is no doubt that Axis Reserve “must be” reserved for all your international spends. Because no other card can get closer, even the 3X rewards on Amex Platinum metal card stands lower to Axis Reserve.

Redemptions

While you can redeem for anything under Edge Rewards, the new points transfer ability is just mind blowing. So on 1L spend, we get:

- Domestic Spends: 6,000 partner points & miles

- International Spends: 12,000 partner points & miles

The international spends are amazingly rewarded due to 2X rewards, but then it comes with a small 1.77% markup fee as well, as seen before.

Airport Lounge Access

| Access Type | Via | Limit | Guest Access |

|---|---|---|---|

| Domestic (Primary) | Visa / Mastercard | Unlimited | 12 |

| International (Primary) | Priority Pass | Unlimited | 12 |

Given that Axis is having complications in issuing Add-on cards (unless applied along with primary card), the complimentary guest visits are good to have for family travellers.

Luxury Airport Transfer

- Limit: 4 complimentary rides / year

- Car Type: Luxury Sedan (or ) Sedan

Luxury Airport transfer service is the Unique benefit of this credit card which is not present in any of the premium credit cards available in India.

It gives you complimentary airport rides in a luxury sedan (or) regular sedan as per the availability. Here’s the detailed article on Luxury airport transfer service in India.

Airport Meet & Greet

- Limit: 8 complimentary access / yr

The airport meet & greet service – which Axis Bank calls as “airport concierge” service is available with Reserve. It gives VIP Assistance Services for a smooth and hassle-free airport transfers.

The services include assistance across airport processes, such as: express check-in, fast-track security check, immigration assistance, porter & buggy services.

I’ve availed this service at Chennai (MAA), Mumbai (BOM) & Hyderabad (HYD) and its quite useful. Here’s a detailed article on the airport meet & greet services in India.

Golf Benefit

- Complimentary Limit: 50 rounds (games/lessons) / Calendar year

Golf is one of the most important benefit on this card. If you play Golf quite often, like 50 times a year then this is a great card for you.

Also, Axis Golf booking system is superior compared to other banks like HDFC.

No wonder that Axis Bank knows their target customers for this card and so they’ve put the golf image on the card’s front face.

But if you’re playing only once in a month or so, never mind, most premium cards does that work for you.

Accor Plus

- 2 Nights Complimentary Stay (from June 2022)

- 2 Complimentary dining vouchers (lunch for two)

- 1 Complimentary Cake (1kg)

- Lot more dining discount vouchers

- Silver Tier with Accor ALL

“Stay Plus” is the name of the complimentary night benefit given at select Accor properties. At a quick glance, you might think that this is a wonderful benefit. But if you dig deeper, you would find that the offer is limited to only few countries.

Eligible for redemption at: Australia, Cambodia, China, Fiji, French Polynesia, Hong Kong, India, Indonesia, Japan, Laos, Macau, Malaysia, Maldives, Mongolia, Myanmar, New Zealand, Philippines, Singapore, South Korea, Taiwan, Thailand and Vietnam.

There are definitely some sweet spots in SE Asia that could give you 30,000 INR value (~15,000*2) but most other properties in India give you only 15,000 INR value (~7,500 INR*2).

And if you’re planning to redeem it at Fairmont Jaipur, well, I’ve a sad news for you. Because I’m unable to find availability in that property for next 2 months.

But given that most Accor properties are typical business hotels, this doesn’t really excite me as much as a typical Marriott (or) Taj.

Bookmyshow Offer

- Offer: Buy one Get one

- Valid on: movie/non-movie bookings

- Max. Cap: Rs.500 off on movie ticket; Rs.1000 off on non-movie ticket

- Monthly limit: 5 bookings per month

Boomyshow offer is a pretty good one indeed and if you’re in metro cities where the ticket cost is about 500 INR, this makes sense. Else, Visa Infinite offer is sufficient for most.

That said, Visa offers may get maxed out pretty fast compared to the direct BMS offers. So the separate Reserve offer still makes sense.

Is it worth 59,000 INR?

So now we’re coming to the tricky question.

To find an answer to this, let’s analyse the total value of the card by placing an “average” price on each of the benefit we saw above. Here we go,

| Benefit | Description | Value (INR) |

|---|---|---|

| Welcome benefit | 50K points @ 0.20 INR | 10,000 |

| Luxury Airport Transfers | 5000 INR * 4 rides | 20,000 |

| Airport Meet & Greet | 3500 INR * 8 | 28,000 |

| Accor Plus Benefit | 2 nights in India + other benefits | 20,000 |

| Total | 78,000 |

- Total Value: 78,000 INR + Golf

So you get about 18,000 INR or more above the fee you’ve paid. But if you play golf, 50 rounds is easily valued at 1L-2L INR, which is a massive value.

Now after the addition of points transfer partners, I would easily value 50K points at 20K INR instead of 10K INR, so that changes the math again, on a positive side.

Note that I’ve calculated only the most tangible benefits with its approx. average cost price. I’ve not calculated the ITC / Marriott benefits, which also carries a decent value, about 5,000 INR – 10,000 INR each if you’re not already into Marriott/ITC Gold.

But in most cases these additional benefits doesn’t matter much, for ex, those 50% dining certificates can only save little in India as we can anyway save 40~50% on dining via EazyDiner/Dineout.

So coming back to the question, is it worth 59,000 INR? Well, it depends. Below points should help depending on your profile.

- No – If you don’t: play golf (or) travel to metro cities (or) value airport services

- Yes – If you play Golf a lot (or) value airport & hotel benefits

- Yes – If you can redeem points for a better value with points transfer partners

But then if it’s available with attractive bonus / signup offer, then it makes sense even to those who don’t play Golf. You’ll basically need to decide based on how you value the benefits, considering all of the above.

My Experience

I was interested in exploring Luxury Airport Transfer Service and so applied for one. It has been a wonderful experience so far and I’ve just renewed it for 2nd year.

The complimentary airport rides in BMW & Merc along with the meet & greet benefits are just absolutely amazing.

Here’s my detailed hands-on experience with Axis Reserve Credit Card.

Maximizing Axis

The Year 2022 is an amazing year to explore Axis Bank Credit Cards. However, there are various issues with the bank: from application, credit limit to service and support.

If you prefer to have a smooth ride with the lucrative Axis Bank credit cards, do check out this beginners guide: Maximizing Axis Bank Credit Cards.

How to Apply?

You may apply online on Axis website in a matter of few steps. Axis Bank is recently known for processing fresh credit card applications pretty fast.

You may get the card approved usually within a week from the date of application. If you’re new to bank, not to worry, you don’t need to create Axis Savings A/c to have an Axis Bank Credit Card.

Bottomline

- Cardexpert Rating: 4.7/5

The Axis Bank Reserve credit card has the first mover advantage when it comes to introducing the concept of luxury airport transfer services to Indian Credit Card industry.

However, looking at the fee and the welcome benefits, it doesn’t excite most, unless one can really make use of the points, the right way.

I would personally recommend Axis Reserve only when your spends are well over 1L a month, as otherwise Axis Magnus can give what you need: rewards, lots of rewards!

Having said that all, Axis Bank Reserve Credit Card is definitely “reserved for few”.

If you think you need further professional advice for your profile, you may consider going for the one-on-one credit card consultation service.

What’s your take on the Axis Bank Reserve Credit Card? Feel free to share your thoughts in the comments below.

Good Sid,

Now I know its not for me!.

Also a typo :

Card Type: Luxury Sedan (or ) Sedan

I would definitely rate the Accorplus benefit at more than Rs7000.

The membership itself (paid one) costs Rs 15000.

I was able to redeem Stay plus for one night at Fairmont Singapore, where the room rate was Rs 24000 per night.

So that alone is Rs 39000 benefit

Plus Accorplus membership gives round the year dining benefits in participating hotels.

50% off food bill when 2 people dine

33% off when 3 people dine etc.

( in addition to other dining/stay vouchers)

And it also has luxury hotels in its portfolio like Sofitel, Pullman, Novotel etc and not only business hotels like Ibis. But definitely not as many as Marriott.

So it does offer incredible value if you know where to look for it.

Citi prestige used to have the luxury airport transfer service, that too within APAC.. Alas they withdraw it.

One could get incredible value from accor plus if only they would include Dubai in it.

Why Dubai, let them give it in India, like 10K Taj voucher will be great.

Let’s give some revenue to our Indian hotels. 🙂

Totally agree Sid.

I have been using this card since last year 2021. As a traveler it is very useful and using a lot in International Airport Lounge in India and abroad.

Wanted to check if Airport luxury Transfer & Meet & greet service is available for use outside india ?

Not at the moment!

Hi Sid,

Can you please review IDFC First bank’s WOW credit card which is secured credit card and on Visa network with infinite variant. This can be issued with as low as 2k FD for more than 365 days with auto renewal option. Limit will be 100% of FD value.

You should have written about the worst customer care services of axis bank. I have the card from 3 months now and still waiting for the hotel memberships. Escalated infinite times, they just raise fresh tickets.

What is the capping for EDGE reqards on insurance spends on Axis Reserve Credit Card? The capping for Magnus is 6000 afaik.

Hi Sid. A general query on Axis cards, how many cards can a person have. Also, would you suggest someone Axis reserve card in addition to having a Magnus?

Sid, ITC Culinaire (Select) membership taken separately costs 12K+gst. So this is another benefit to partly justify the hefty fees for Reserve.

But I have one doubt if anyone could clarify, the T&C in Axis Reserve site says : The membership benefits of Card-members enrolling into the Program would be the same as the standard Program benefits as detailed on the Program website, clubitc.in/culinaire .

Now Axis Reserve website says get 3rd night stay complimentary, whereas Culinaire site says you get 1 free room night at participating hotels (no precondition to book 2 paid nights). So which option do cardholders get?

Either ways looks great overall if you are anyway staying 3 nights as you end up paying for 2 nights, plus get a free room upgrade, plus if your stay is on Fri/Sat you get suite at 50% off, and dining certificates reduce some of the meal expenses, and you also earn some Green Points. Itc usually values them over Re1.

Now if one pays directly to renew Culinaire Select membership they also get 1500 green points as renewal benefit, not sure if this is awarded if they are enrolled through Reserve though.

Axis linked culinare doesn’t come with complimentary night, but replaced with 3rd night free. Problem with this is you get only basic room and it can’t be upgraded using upgrade vouchers, as it’s already a discounted stay. Still, a good value, like ~30% off on 3 night stay!

How does Axis Reserve treat insurance payments? Any capping?

I think post 1 lakh of Magnus, Reserve could be a very good option.

Hi Siddharth. Thanks for the comprehensive review. A query on the Travel Edge bookings itself using this card. Are the bookings on the portal for the Reserve eligible for the 5X rewards they are offering for their other super premium cards like Magnus? And if it is there, is there any upper cap of such rewards one can earn in a calendar month o. Statement month. That part is not very clear. Would appreciate your clarification. Thanks.

– No 5X with Reserve

– No capping on 5X with Magnus on Travel Edge.

Thank you Siddharth for the clarification

Do you mean Axis reserve doesn’t get 5x on traveledge?

Hi Sid, what about 5x/10x on Gyftr with reserve

Got clubmariott and accorplus in two days. But no news from ITC culinaire

Hi Sid,

I have 3 axis cards already. But I now want to get the Reserve. I want to get rid of the Myzone LTF card and get this. How do I go about it? No upgrade offer shown in the app and customer support also says the same. Will I need to close myzone and then apply again? Any cooling period in this case?

Or can I mention during the application process that I want to get this upgraded?

You can cancel the card you don’t want to continue and post that apply for the one you want. I did the same in Dec itself. I didn’t face any problems.

If you already have 3 cards, phone banking upgrade won’t go through easily. Close one of the card and if your limit is good enough, drop an email to PNO, then once they enable in backend, you can upgrade via Phone banking or chat support. I got rid of My Zone and upgraded Magnus to Reserve the same way.

Can this card be used for grabdeals as part of their 5x, 10x or partner deals

Thank you for the very detailed review. My reserve card is on its way… but the 50K +GST cost vs actual value of the card was something I still had doubts on.

Can’t wait to explore all the new perks with this card. 🙂

For the Accor Plus membership with Reserve, can I choose the city for the Accor Plus membership which is different than my card address city? Accor plus discount/offer certificates are city specific. Hence can one choose say membership for Bangalore, while the card address is Delhi?

Yes the membership is global valid in all countries. i have used it in india, usa, and europe.

What is the eligibility criteria. I already have ace with 4+ credit limit. I called customer card but I am eligible for Magnus only.

Hi on renewal fee waiver on rs25L annual spend.. do they still give 50K points on renewal if one the renewal fee is waived?

Also are any spends excluded in calculating the Rs25L annual spends?

So sad to see may mail box

Finally the bad news is in.

1. They started suspending accounts with commercial txns(Good Move)

and

2. Reduced redemption ratios to 5:2 instead of 5:1 on reserve (Bad Move)

Hi Sid, How do you have 4 Axis cards? I thought the limit per user was 3.

I never had 4 Axis cards at a time.

Might need to revise the description, Accor complimentary night is 1 now, not 2. And the transfer ratio of 5:2 for ordinary Reserve holders means 3000 partner miles per lac spent, down from 6000. Yet I believe ordinary Reserve is better than non-burgundy Magnus now, despite their fees.

Sure about Accor night as 1?

Mine got renewed with 2 nights just few weeks back.

Going by Axis website, it shows 1 night. Last year it showed 2.

I have CITI Prestige credit card where Rs 100 spent gives One reward point which is equivalent to Four Airmiles on Qatar Air and many other international airlines.

Please advise if there are any other credit card which would give me better conversion of airmiles assuming my average monthly credit card spending is about Rs 2.50 Lacs. Please do not bother about joining and renewal fees.

They just told me that the complementary airport transfer is now discontinued. I didnt get any email about it. They are saying they emailed everyone. but i dont see this notified anywhere. Did anyone get this email?

Yes, it was sent to all.

Mid march they had sent

Does it make sense to keep the card after two rounds of devaluation? I am due for renewal, and I am not sure what to do. Please advise.

Everyone has dropped Reserve lately, not worth renewing at the current value proposition.

Thanks Siddharth, I will discontinue with this card.