Axis Bank has been recently running some lucrative sign-up offers silently on premium credit cards applied through branch/online and here’s everything you need to know about them.

Affluent Card Offers

| Variant | Signup Offer |

|---|---|

| Select | Spend Rs.60,000 in 90 days for full joining fee waiver |

| Magnus | Spend Rs.1,20,000 in 90 days for full joining fee waiver |

| Reserve | Spend Rs.3,00,000 in 90 days and get 50K additional reward points |

Vistara Card Offers

| Variant | Signup Offer |

|---|---|

| Vistara (basic) | Spend Rs.30,000 in 90 days for full joining fee waiver |

| Vistara Signature | Spend Rs.60,000 in 90 days for full joining fee waiver |

| Vistara Infinite | Spend Rs.1,20,000 in 90 days for full joining fee waiver |

All benefits associated with the Vistara cards like welcome benefits, tier benefits and milestone benefits remains intact.

Note:

- Above offer is applicable through all channels except on “upgrade” via phone banking.

- Vistara offer applicable on upgrades as well, but may run into fulfilment issues.

- To be on the safer side you’ll have to get a confirmation before processing through any channel.

As of now the offer appears to continue through 30th September 2021 but I think it may get further extended due to Mastercard ban.

- Update: Offer extended through 31st Oct 2021. Link to Offer T&C

- Update: Offer extended through 15th Jan 2022 (for vistara cards only)

I came across this info when I was trying to apply a card for someone in family and it’s quite surprising to me that they’re not actually promoting this sweet offer.

Also this offer is applicable only on offline/online applications for now but not via phone banking as that is treated as an upgrade route. Problem with applying offline is Axis takes hell a lot of time to process applications, like ~20 days ideally and you don’t have any way to check the status either.

I wish Axis fixes all their on-boarding issues soon. Btw, it seems they’ve stopped taking Add-on card applications as reported by one of the reader. That’s actually a better decision instead of holding the request for ~6 months or more as happened to me.

Is it worthy?

Its a wonderful offer in my opinion, especially on Select, Magnus, Vistara signature & Infinite credit cards as they come with a very good value. But Magnus is on Mastercard network, so you can’t apply as long as the ban is in place.

I’m still not happy with the Reserve product proposition and even with this offer it doesn’t look good, maybe 100K points would help.

However, if you intend to play golf, access lounges and avail airport benefits especially in metro cities, it still makes sense to hold one.

So Axis Select is the easiest one to grab for free with this offer.

Final Thoughts

Joining fee waiver offers like these are rare with Axis bank and its good to see them trying out these during pandemic. It makes sense for bank as anyway most of the cardholders wont make use of the travel benefits.

So if you think you could hit the spend criteria for the joining fee waiver, its a wonderful opportunity.

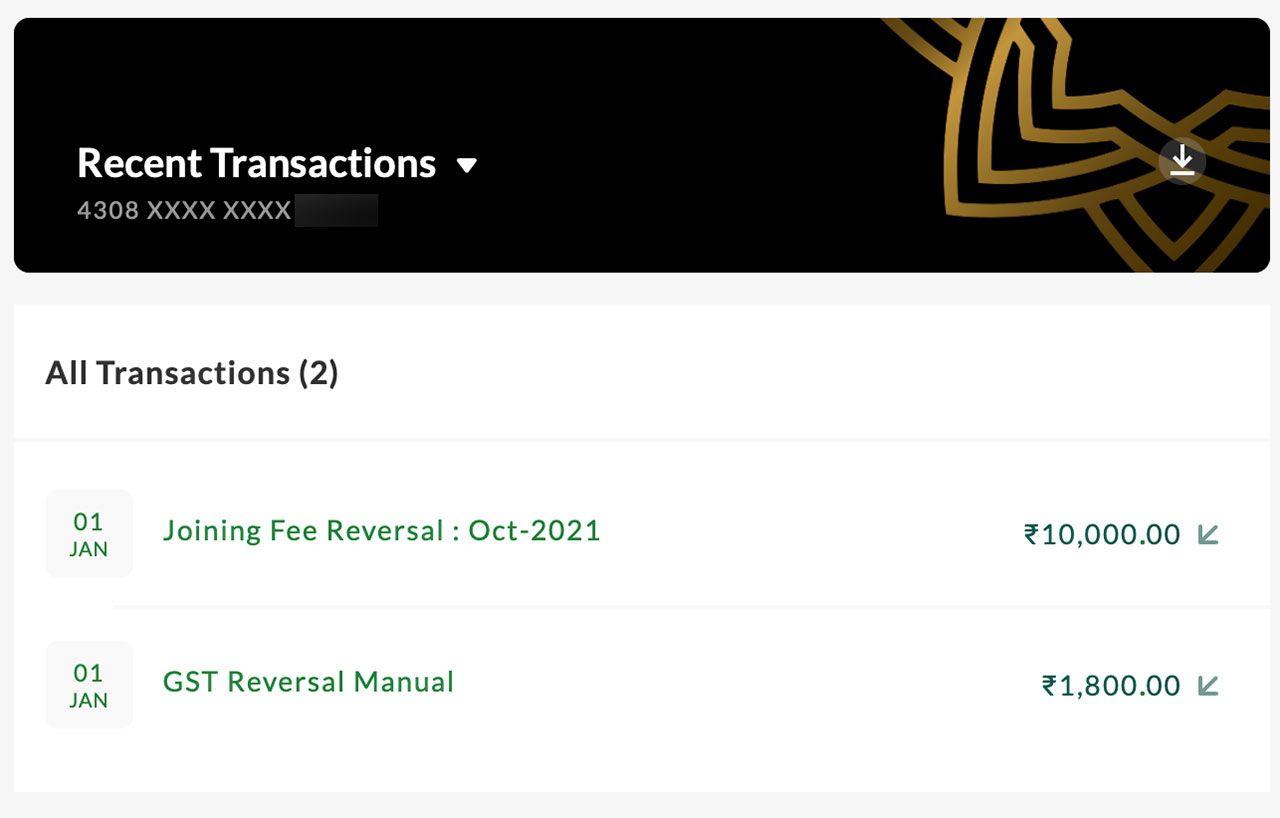

- Update: Joining fee reversal has been initiated on 1st Jan 2022 (for Oct 2021).

What’s your thoughts on the new Axis Bank Sign-up offers? Feel free to share in the comments below.

These offers are also applicable and can be seen when one applies through their online portal; the same was displayed when I tried. Further, this is applicable for their Ace cards too (spend based joining fee waiver).

Good to know. Is it showing online for existing cardholders too?

Affirmative!

I have two of their cards, privilege and Flipkart. I tired applying online and could see the spend based waiver option for their cards, as mentioned in your post.

Sid, Gaurav, Is it only joining fee waiver, based on spend criteria or does the card become LTF?

Its First Year Free only. Renewal fee waiver based on spend.

Hello sir I just got axis magnus card last week will I b able to the wave fee…

Sorry Sir, NO.

Sid have you cancelled your Select card?

Yes.

Why? You got it recently only

Myzone serves my need for now – Swiggy offer.

Does Axis give free upgrades? My wife has a MyZone card and the limit has been increasing periodically, but there is no upgrade offer. She got an upgrade offer to Select which was a paid card, hence didn’t opt.

I don’t think so. Axis is usually poor with upgrades/LE.

Any Joining fee waiver for Axis Previlege Card??

No

Yes, if you will spend 2.5 lakh in year.

Hi Sid.

Just 06days back I applied for Axis select Card through bank representative (after my attempts at online application got declined twice) and I got approval message two days back. I am expecting the card delivery in a couple of days. I was surprised and thrilled to learn fron the representative that If I spend 60k in 90 days, the joining fee would be waived off and it will be life time free. The bank rep. was quite confident. However, I am not sure, I shouod get it confirmed from the customer care once I recieve the card.

Pls anyone can provide some more insights.

everything the rep says is bullshit and plain lies. Sorry to disappoint you, but I got cheated like this only.

The Letter that card comes attached to is your actual source of information. I always store that for reference in case the banks decide to do any funny business.

I Currently hold Axis Ace card to go with my HDFC DCB and AmEx Plat Travel. I feel that Ace fills the gap (with its 2% cash back ) in the Diners and AmEx network perfectly.

Other cards held Citi Indian Oil, AmEx MRCC, Yes Premia, SBI Simply Click, HSBC Platinum, and ICICI Amazon Pay.

Hi,

As I can see the select card here, few days back i saw a post on the axis my zone card, there your axis select card was marked as inactive,

As I too have my flipkart axis card as inactive,

Can we still use the inactive card as shown in this post , you are holding select card.

I am little confused will i be charged annual fees for inactive card , as it shows inactive card in axis site, normally closed and inactive cards shouldn’t be shown in cards list right

https://www.cardexpert.in/axis-credit-card-system-upgrade/

The link where I saw the select card as inactive

Don’t get confused with the pics. Its for representation only.

I love Citi credit cards

Hi Sid,

How can I get FYF/LTF Axis (Super) Premium card? Currently have Flipkart & Ace with Axis (and Infinia as Super Premium).

Is opening a Burgundy account helps?

Do I need to maintain 5L avg balance in the account?

Also what’s the impact of MC ban on getting such card?

Thanks

Burgundy gives free select card.

burgundy requires minimum 10 lacs AQB in savings or current Ac.

Axis Select Credit Card gives 2% Value back on retail shopping. Can anybody elaborate what all it includes and what not?

Retail here it refers to offline spends.

Purchases in big basket are also treated as retail spending. Looks, company registered with retail name in billing will be treated as retails spends both online and offline spends.

Does axis still have the free meet n greet entitlement with their credit card ?

Is there any other card which gives that ?

Axis Magnus has it.

Siddharth

Nowadays we are doing so many transactions on credit card may be more then 15-20 lacs per annum. Few are fabricated like wallet loading for 10k every month on 2-3 paytm or Amazon or mobikwik which will amount to 4lacs then route same to bank account. 30k-40k rent every month even more to increase spend and may be fabricated rent spend which itself amount to 5-8 lacs. Then other spends to meet spend criteria such as travel or online shopping or grocery shopping etc. Sometimes buying vouchers from smartbuy or payzapp. Paying utility bills. Spending in NPS tier1&2 and then redeeming NPS. Also paying insurance bills car insurance fuel and maintenance etc. Sometimes we buy on Amazon or any online platform for our family or friends. Total spends may go upto 15-20 lacs. In which actual spend is mostly 5-6 lacs and rest is mostly fabricated spends to earn reward points or to reach milestones of each card or to encash spend based offer.

Don’t we expect to get income tax for all such high spending. However this spend may be less then our ITR. But still it may raise eyebrows of income tax department. Please have some article in the same. Any views of readers in the same.

Will cover shortly, thanks.

looking forward for this article.

Really looking forward to this article. I tried to summarise the same. But your post will be appreciated.

Sir i just upgraded to axis vistara infibite but they charged me 10000 2 times and 1800 gst two times as well where should i conplain

Hi Manoj

Curious to know how are you able to do wallet load on mobikwik and Amazon and route it back to bank account

Also, is it possible to load more.than 10k on paytm by single credit card?

I mean for Paytm only to do wallet load upto 10000 for 4 members in family. Then route back to bank.

Just now I realised that you can load your Paytm wallet for 10000 rs per day via Citibank citimobile app . If you have 2 Citi cards which is quite normal then you can have 20k cash each day routed to account through wallet.

For Amazon and others you can’t route back to account.

Rent agreement is not asked by no broker and cred and many other apps. So on Diner black or infinia you can earn rewards along with milestone benefits or spend targets.

My post was much on various ways to increase spend on credit card and get reward points along with liquidity. Which can be problem in future to get income tax notice.

Infact I want to highlight here that there are many spends such as wallet rent nps vouchers etc we are doing just got 2-3% benefits on reward or to achieve milestone or fee waiver or to achieve spend target or to get some liquidity in some case. Which infact income tax department don’t know that it’s just rotation of our money from one pocket to another. They will treat it as annual spend.

Interesting why you would think that high spenders fabricate their spends 😀

Don’t think it is true for the larger segment as such…I have a 25 lac + spends on the 2-3 cards I hold and none is made with an eye to how to play the system !

I agree to you that top spenders normally don’t fabricate their spends.

Let us do some maths

Rent payment 30-35k per month = 4 lacs in year

NPS=50k per annum to be conservative

Paytm loads for Amex MR card =20k x 12=2.4 lacs

Paytm loads for BOB Eterna card =10k x 12=1.2 lacs

Insurance =approx 1 lac a year

Kids tution fees = per kid 1.5 lacs if 2 then 3 lacs approx

Fuel 5k-8k pm = 1lac per annum

Car service=20k

car insurance =20k

Smartbuy vouchers 5kpm =60k

Mobile DTH BB Recharges and other bill 6-7k pm for family =84k

Groceries pm =30-40k pm =4.8lacs

Other shopping as clothes and other luxury items 8-10k pm=1.2lacs

Dining and party with friend and family 20-30 k pm=3.6lacs

Buying for friends and relatives on your card 20-30k pm=3.6lacs

Medicines 3-4k for family = 48k

Yearly travel with family=1-2 lacs pa

Sometime office expenses by personal credit card which we claim back=1-2 lacs

Overall is approx 25-30 lacs per annum & 2-2.5 lacs pm we spend. Is it justified if we spend approx 50-80% of after tax salary by credit card. Income tax won’t send notice to us for the same. Anyone experienced any IT notice for the same in past.

Siddharth

Please have article on this topic. It’s really much relevant in nowadays scenario

per IT rules, repayment of 10L/more should be reported and would be on ITR

My Select card is coming up for renewal. What is better?

1) Upgrade to Magnus

2) Switch to Ace

I hold the ICICI Amazon Pay, HDFC Regalia and Standard Chartered Platinum Rewards besides the Select.

Better switch to ace card

Switch to Ace.

Till yesterday, the Axis (app/net banking) didn’t allow me to apply for a new credit card as I already have 3 cards (Neo, Flipkart, MyZone).

Till recently, axis allowed an upgrade option for Neo and Myzone cards.

Today, axis app allowed me to apply for a new card and I applied for Ace (4th card). At the same the upgrade option for Neo and MyZone is disabled.

Have to see, whether Axis process the 4th card.

Hi,

Have you got any update on 4th Card? Is it approved or declined?

Axis says 3 max, lucky if you get the 4th one 🙂

I just got the axis magnus card through the online app portal 20 days ago was not made aware of any such offers when i got the card and the 10k joining shows an unbilled amount. Should i call and check to avail? I have spent 8L+ since i got the card.

I am happy i even got a credit card without FD or showing income documents. I have no credit history at all so I am thankful enough for getting a card in the first place but getting the joining fees off would be cool in the first month 🙂

Didn’t you notice the offer while applying? Few others have mentioned that they do see this waiver criteria while applying online.

You’re likely eligible anyway, so consider emailing them reg. the same.

surprised to see axis bank kiosk at hyd airport where they were offering vistara branded and other premium axis bank credit cards , exactly located at the place where Amex used to be, sbi too offering their premium range cards diagonally..

Oh yeah, the Axis Hyderabad airport Kiosk looks pretty good.

I applied for this card today through the mobile app. Don’t remember seeing this offer as such and can’t go back to that page now. Will talking to somebody in the bank help? I have a priority account at this point of time but my relationship with Axis is about 60-70L shouldn’t I be eligible for Burgundy? How do I go about that?

Applied online for Select.

Received a call next day for documents collection. Bank executive visited home and asked for payslips. I told him I’ll like to apply card-on-card, he agreed. Sent him last 2 months’ Infinia statements over WhatsApp.

2 days later, received mail mentioning ‘Final decision will be communicated within 72 hours’. After 3 days, no such communication received. Thought, it was declined due to the bummer in my CIBIL score. Next 2 days, I started receiving communications on changes of mail id, office address, residential address (which I provided to the executive) of both my existing cards.

What’s going on?

Axis is known for such weird things.

This happened with me as well few yrs back and I assumed they are updating the address on old/closed card a/c that’s triggering this. Ideally means its in the processing stage.

Just after the last post, I found Select card in my mobile banking (which wasn’t there before my post). Today received the mail confirmation as well.

But the sad part is, it’s credit limit is same as my existing 2 cards’ limit (160K only) though I got this card with Infinia 1.5M limit (Card on Card).

But it’s also looks like standalone limit as the existing outstanding balance (after the joining fees of ₹3.54K) is greater than 160K.

Hope I won’t be greeted with overdraft charges for the first time in 17 years of credit card world.

after upgrading axis credit card will i use both cards or only new card?

With regards to the fee waiver are there any categories which are not considered in the spends while calculating eligibility for fee waiver?

No. But be aware that EMI may cause issues.

Hi Sid,

Understand that no CV points are given on category MCC 5944 which is watches, jewellery etc. With regards to the 10K bonus points on joining (on achieving 100K of spends in 90 days) does this category inclusion apply to spends in this category as well?

These excluded spends usually doesn’t interfere with Milestone/waiver targets.

Hi Sid,

Which card is he talking about (10K bonus points on 100K spend)?

Vistara infinite milestone benefit.

Any idea about renewal on Vistara Infinite? I’m up for renewal next month. Is the spend of 1.2 L offer valid on renewal as well?

It’s only for fresh applications, not for renewals.

I received this offer on email and called up an Axis Bank representative who I knew handles these cards. He was really helpful and came and took the card application at home, which was really easy.

I applied for the Axis Vistara Infinite variant. The guy told me to just give him my HDFC card statement, which has a limit of 10.54 lakhs and based on that, it would be approved.

I got the confirmation of card approval in a few days and have received the card in around 10-12 days. Imagine my shock when I saw the limit they have given me, 52000! I couldn’t believe it, it is almost bordering on insulting. I have a lot of credit cards (based off reading this website :)) and all of them have a limit between 5-15 lakhs.

Giving a limit of 52,000 and then charging 11,800 as joining fee is like a joke 😀 I called up the guy and he was surprised himself. What is the point of a Visa Infinite version if Infinite means “upto 52000”.

Sadly, I will end up keeping the card due to the other benefits but it really has soured my experience with Axis. This is just to let other people know, who may be applying under the same offer.

That’s weird. Axis is usually generous with limits during the issuance. LE is very rare later though.

Have any other low end Axis cards open by any chance?

No, this is my first and only relationship with Axis and it’s been a poor start, to say the least. I’ve managed to download their app and login to it, after multiple calls to their IVR (as it kept giving me an activation code that didn’t work).

The customer ID I got on sms just doesn’t work on their website at all, keeps saying Invalid. So it seems like their systems are being really weird.

I was reading comments on this post and another one about the new system, seems like there are lots of issues and oddities that exist.

I did read your post as well about how Axis gave you a very generous limit, perhaps one of the best ones so I was eagerly waiting to see what I would get. The person who did the application for me did say that these days he has been getting a lot of complaints from customers around low limits – told me about one guy who opened an account with 5L and got a card with limit of 31,000. Strange times!

Try calling them multiple times to fix. My weird net-secure code issue was not solved by ~10 executives but one guy finally fixed it in matter of few seconds. Their executives are equally weird as their systems.

But this new move on credit limit sounds strange. Sad to know!

Thanks for the advice, will do! Right now they’ve advised me to go to a branch, which I will if it doesn’t work by tomorrow.

Regarding the card limits, I’d rather they put a stop to issuing new cards than give such limits. Makes the card useless, as I can’t use it, and if I don’t use it, they won’t see usage and enhance limit.

I can co-relate. I also applied against my HDFC Infinia (15L limit) and received select card with ‘Zero limit’! It’s sharing my existing limit of Flipkart & Ace.

Also they were denying me the joining fees waiver several times (over phone & twitter). After much fight, finally they mentioned ‘Hi, we take due cognizance of matter highlighted for further review and as per the update received, we wish to inform you that Joining Fee will be reversed within 90 days from offer ending. The offer ending date is 30th September, 2021 and you are eligible for reversal of INR 3000/-. Further, the credit limit is assigned as per bank’s internal policy & norms’.

Looks like something is definitely up with Axis, specially with Pranab’s corelation below.

HDFC today messaged me, increasing my limit from 10.54L to 13.17L 🙂 The limit increase itself is 5 times the limit I got on my Axis card. And to add, my customer ID still is not working on the Axis website so I have been asked to go to the branch to get it fixed.

There is such a stark contrast between the two!

Axis is definitely weird.

I got the Axis Flipkart CC in Feb this year – and somehow they tagged it to a wrong mobile number (last number was different). Post application, I would regularly get updates on the status of the application, and one day they stopped. A week later, I had the card in my hand, with incorrectly tagged phone number !

What a havoc can that create ! You can’t set your phone banking PIN, you can’t even reach a phone banking executive since it asks for your RMN, and that’s the wrong one.

Went to a local Axis branch, and after some verifications, they took a manual KYC change request, which got processed after 48 hours.

Not a good first experience.

Similar thing has happened to me, although it is with my customer ID. When I got the card, I sent the SMS to know my customer ID so I could setup my Internet banking. I got the customer ID but couldn’t login so I was told to wait for a few days.

When I tried again after a few days, it still did not work so I just sent the SMS again to double check. And this time when I sent it, my customer ID was changed! So the mobile app that earlier showed my card details was blank too.

There was no intimation of any change or anything, my mobile app just stopped working and I could not login to anything on the site.

I had to go to the branch and they have taken a physical form to setup my customer ID to enable internet banking and I deleted the app and reinstalled and fortunately, things seem to be working.

But it just is turning out to be a nightmare experience with Axis. Also, the branch guys said they don’t have any access so cannot do anything from their end. The phone banking guys said I will have to visit a branch to set it up.

How does this impact limit on new cards? I am planning to apply for Vistara Infinite card and I currently have a Axis Flipkart card which I am planning to close once the Vistara Infinite card gets issued. Should I expect to get a shared limit capped at my current limit for Axis Flipkart card or a higher limit.

I am planning to giving my Citibank card statement which has a limit of ~12 lakhs..my Axis Flipkart card on the other hand has a limit of only 2.25 lakhs.

Limit will be shared with Flipkart card in that case.

Sid, is this the case even if you apply for the second card via branch? Have an Ace and planning to apply for Vistara card.

Yes it is. Might rarely get better limit if the floor limit of the new card is higher than the current limit.

Received shared limit

Last Aug I got the Flipkart card and after a few montsh got the ACE card. Ace card had a shared limit with Flipkart card. Last month I got the Vistara Infinite card. The limit was same as Flipkart – so initially I thought it was shared. But actually Vistara card has a separate limit which I came to know during usage. Also the billing cycle is different.

Well, I had a similar case like you.

I previously held flipkart card for 2 yrs and I applied for Vistara infinite card.

I shared my regalia card statement for good limit. My infinite card was approved and received but I got the same limit as my flipkart card which is the lowest of all my cards. Limit was separate for both cards.

The maximum amount that I can spend in a year is 12 lakhs only.

I have axis NEO LTF card. Not using since many months as AMEX MR( LTF) , HDFC DCB( LTF) etc frequently used Today checked and found Priviledge upgrade offer. But fee showing “NA” for joining as well as renewal. But no where mentioned LTF. was wondering whether NA rightly mentioned or Not?. Then checked for 2nd card it was showing many cards except priviledge but with fee. Finally applied for upgrade…let’s see it is LTF or not…anyone having similiar experience??

Dear Friends

I hold a priority account with Axis Bank. I am interested in Axis Bank Ace Credit Card but I was rejected by Axis Bank for Privilege Credit Card in July 2021. I have a IndusInd Iconia Amex approved in Jan 2021 and a HDFC Business Regalia approved on 31st Aug 2021 in my card portfolio. Can my RM help me in any way to get this card? Please explain me the process or trick if anyone can

Axis bank is the worst in terms of banking service and so are their So called RM.

RM is nothing but bunch of liers and they are interested in cross selling products and don’t even send u yearly tax certificate even if u call them 10 times for that but when there is system generated offer for credit card or something they will call u n will lie to you that you have entered wrong details and he will reprocess manually and when applying online would ask to put their name and in that process would lie to you on ur face , tell that u will get low credit limit like 10K if they dnt intervene or even application would be rejected n negative entry in cibil

Never trust them. Had 15 lac FD removed it pre-maturely when RM flasely tried to cross sell product in name of credit card and insurance

Had a bad experience with Axis Bank on debit card renewal. Escalated till Principal Nodal Officer. However they too dont want to help. A simple query, if my current debit card is no more offered, then which card will you send me as replacement and what will be its yearly charges.

No one wanted to commit. Stating its automatic. As if GOD decides their process.. lol.

Closed my 16 year old relationship with them

What is the best way to apply for someone who doesn’t have an account with axis.

I applied online a week back and there is no response from them. There is no way to track whether it’s even in process or declined and the customer care just give canned responses which aren’t helpful.

Would going through branch or phone banking better? Or is axis not keen on non saving account customers?

My cibil is 780+, sufficient income and other card limits for select variant

The service is pathetic to say the least..i am an existing credit card holder (Axis Bank Flipkart Card) with Axis…applied on the 2nd September for Axis Vistara Infinite..no update so far…application ID given by Axis doesn’t work….customer care has no clue and while my app is working…the net banking login doesn’t recognise my customer id or mobile number for me to login

Only reason I have applied is the fee waiver offer…plan to close the Flipkart card once Vistara card is issued and then the Vistara card before next year renewal… Hoping that SBI card launches a Infinite version which i can take later on.

Card visible in Axis app..waiting for physical card now

Seems like the join fee waiver offer is withdrawn all of a sudden (atleast for Vistara cards) I saw it maybe yesterday but today there is no offer showing up either on Axis or Vistara site. I missed it again, just got my address update, was waiting to get the signature update (last year they rejected Ace for signature mismatch on 15-16 year old account. Not sure why they need signature for existing customer and if they do need, why match it with what is on record with savings account. CC could be all together different.)

It is there on the Vistara website

airvistara.com/in/en/club-vistara/about-cv/current-offers/axis-fee-waiver

Thanks, let me check out.

Vistara gold no longer carries lounge vouchers ?

Yes. No lounge vouchers, as their delhi lounge is no more.

I have Magnus and Ace. After upgrading to Ace, Magnus is hardly used. Also have Amex Plat, DCB LTF and Indus Legacy LTF. Is it worth retaining Magnus or should I change to Select ?

I applied for Axis Vistara card through Vistara website. Axis guy came to collect documents, that idiot also applied Axis Select card for me. Two cards at the same time. Now Axis has approved one card I dont know which one yet.

Also a query, does Axis offer add-on cards for free and do they send OTP on add-on cards to secondary numbers? HDFC sending otp to primary card makes it difficult for my wife to use at times

Its waived off for Vistara cards and Select card at least…not sure about Axis in General..but applying for add on cards is painful

I also wanted to apply for an add on card for my wife at the time of applying for Vistara Infinite..the guy who came from Axis insisted on only one address and ID proof for her (as she is not an existing Axis customer)- her driving license with address being of the current place we were staying at and where the card was to be delivered…the address in her DL is different and the Axis guy was not ready to accept any other ID proof..so couldn’t apply for the add on card

Finally the card came with just 4 lakh limits. One of the lowest i have.

Just for confirmation does axis consider rent pay through redgiraffe in milestone spends or not?

I can get a lot of vouchers through milestone if its allowed.

Same question from my side. Also, will we get CV points on rent payments or not?

Yours is still good Rahul. I got a limit of 1 lac on select 😂. It’s not even a fraction of the lowest I have on other cards. I had applied card on card basis with a DCB limit of 15 lacs. Don’t know what algorithm axis uses.

As per my understanding, all spends except cash withdrawal etc. would be considered for milestone spends, but others can weigh in.

is there any clarity whether rent can be paid on redgirraffe.com using axis bank credit cards. moreover, can rent be paid on gpay using credit cards?

Axis has sent me one Vistara Infinite card and two Axis Select cards. This is hilarious. Limits on all three cards are the same though.

The biggest problem is Axis Mobile banking shows just one card at a time. Then why do they even issue two cards for one person.

I will ask them to cancel one of the Selects. Pretty poor internal processes at Axis I must say.

Hello

I am planning to apply for the Vistara Infinite card and want to know if the Gold membership is applicable for every card renewal year or only for first year and then further based on my flight activity?

Thanks

It’s applicable as long as the card is renewed.

Every year upon card fee payment of 11.8K

Its applicable as long as you hold the card

Every year till you hold the card.

Gold membership is applicable on renewal and not based on flight activity

Gold is applicable every year.

On renewal as well.

Yor Vistara Gold Membership will keep renewing every year as long as you keep the Vistara Infinite card and keep paying its annual fees. It is not dependent on flight activity or spends on the card.

Thank you everyone for your response/confirmation – this is super helpful.

One last question – does Axis offer renewal fee waivers on any target spends or based on relationship with the bank (Priority/Burgundy)?

I hold DCB currently and I don’t want to spend more than 5L/year on it because I have accumulated lot of points on it currently (>3L) – this is a risk I want to diversify 🙂

Thanks

My understanding is that for co branded cards such as Axis Vistara card fee waiver are very difficult (and practically impossible). Not very sure about Axis in general but remember seeing in one of the posts from Sid that he has got the fee waived for one of his cards (think it was Axis Magnus)

Hello Sagar

Gold is renewed every year on payment of annual fee which is 10k.

Also on flight activity, if you cross threshold for gold membership.

Thanks

Hi Sid,

I heard the complementary ticket issues has 6 month validity only. Is that correct? Is there a way this can be converted to CV points or anything at all?

Complementary ticket is now based on redeem functionalty enabled by vistara in the website. So total you can have is 9 month validity.

Beware guys, don’t give you existing CV ID. Let them create a new one. In case of existing CV, it will be an upgrade and you’ll get only 2 upgrade voucher. For a new CV you should get 3. No matter how idiotic it may sound, that is how it is.

For card, the numbers are printed on back side and not embossed. My card number is fading, within few days, it is already difficult to read the numbers. I thought it maybe due to my habit of cleaning card with sanitizer after collecting from someone. However, I saw the same is happening to my wife’s card as well which hardly is even used… Strangely the most expensive card I have is most cheap quality.

Hello – do we get the 3 one-class upgrade vouchers at time of new card issuance? Or do we only get it only when the card/Gold membership is renewed after one year?

Can anyone tell me if the Vistara infinite FYF offer is still on. Can’t see it anywhere, either on Axis or Vistara website. Showing joining fee both sites.

Yes, extended through Oct 2021.

Hi Sid

I have HDFC Infinia,

Amex metal,

Amex Travel,

SBI Vistara Prime,

Axis Vistara Infinite,

indusind legend,

Citi premiere miles,

ICICI Amazon pay credit cards

and I would like to shed off all other cards except Amex travel and HDFC infinia.

The decision is due to many cards not able to manage finances and miles etc doesn’t matter thanks to HDFC smart buy rewards and redemption options.

While I am meeting all milestone criteria I don’t see reason to hold many as infinite and Amex give more than enough rewards and offers.

Can you share any thoughts around this ?

What a time for my application to be under process. It’s the first time I liked any axis card. They readily gave me an invite to apply for the Reserve Credit card. Additional 50000 Edge points are a sweet bonus against the hefty joining fee.

Their Airport services, Bookmyshow 1+1 ticket off (10 times a month!), low forex markup, Guests can avail of lounge access too and some hotel chain memberships make it a sweet deal.

And on top of that, they approved my “fresh” application in under 72 hrs.

Mind blowing experience, given that they usually take ~20 days to process fresh applications for other Axis cards.

@Siddharth: After Axis approved your application within 72 hours, can you please let us know within what time Axis sent the card details or is expected to send the card details? In my case, had received a SMS stating that my application is approved and card details will follow shortly. However, it is already 5 days hence and no further updates by SMS or email from Axis.

They usually take 5-7 working days to deliver, post approval message.

Hi Sid

Thanks for sharing this.A few questions:

1. What is the best way to apply for the FYF card?

2. Would rent payment be a qualifying spend to achieve the 30k threshold for fee waivers, and other spend milestones in the Vistara co-brands

Thanks

I think this offer ended by Sept 30 ?

Regards

Extended.

if someone can confirm that what is the joining fee for Axis Reserve 30k or 50k ? I have read in few forums that people have been charged 30k instead of 50k

50K+GST

Is it worth to pay 59000/- for reserve credit card?

Make a new post about reserve.

Experience has been pathetic to say the least when applying for Axis Vistara CC. Submitted details on the webpage, but no one ever calls back to proceed with the application.

Submitted request for call back last month – no response. Did not follow up as I though the offer was over by 30 Sept.

Submitted request for call back last week – no response so far.

Can anyone please tell me how can we apply for Axis cards online? I see their website offering only call back option. I don’t have any existing relationship with Axis and plan to apply for Vistara Infinite.

I have query regarding reporting of credit card data by axis bank to credit information bureaus. I have upgraded my My Zone card in 2020 to Axis Privilige card.Card opening date of My Zone card is Aug 2015 and I have upgraded in 2020.Card opening date of Upgraded Axis Privilige card is reported as Jan 2020.As far as I know If the card is upgraded date of card opening or account opening should be of the old card and not the date of upgrading.I have upgraded my HDFC card from Value plus in 2007 to Diners black in 2020 but HDFC reports only my most recent upgraded card.Axis reports multiple card accounts ,old card with with its opening date and new upgraded card with new card opening date.This effects the credit score as the age of credit card aslo effects the score.Is this normal?Can anyone comment on this?

Same happen with me. I report dispute in cibil as marking duplicate the new card. Later it was fixed. Make sure your old card is closed now.

Got a sms from axis bank vistara infinite card where on spending 150000 there is a complimentary accor plus membership and on opening the terms and conditions it states there offeres of itc and taj for magnus and reserve cards respectively. I have 2 cards in my family got the sms for 1 card while none on the other.On speaking to axis they are saying offer given only to selected card holders.Have others got similar offers??Or is it for selected people

Hello! Do we get any one-class upgrade vouchers (that are issued with CV Gold membership) at the time of card issuance? Also, do we get these vouchers at the time of card renewal as well?

Thanks

I had vistara infinite which i cancelled in 2020 due to covid related restrictions. Tried applying twice now for the same card however axis keeps on rejecting the application. Anybody else facing the same issue?

Does anyone know if axis add on card number is given as same as primary card number like hdfc or different one?

Axis gives a different no.

Does this mean that for HDFC, we cannot avail a discount offer on Amazon/Flipkart on add-on card once it has been availed on Primary card?

Does this also apply to Smartbuy vouchers as well?

Looking for clarification on this from other who used HDFC add-on with same no.

I think it’s only HDFC Bank that gives same no to add on cards. Most bank give different card no to add on cards

Can someone post the link to see these offer on Axisbank website

Well the strangeness continues with Axis! My 52,000 limit remains the same, while other cards have a limit of >10L. I got charged the joining fee on the 24th of August, but till now I have not received the complimentary business class ticket. I have now called them up multiple times and have finally written to the nodal officer – hopefully it can be sorted out soon. I also have a refund for a transaction pending that has not been credited but am hoping it all happens this week.

I hold cards from HDFC, ICICI, StanChart, Amex, Onecard, Zomato and Citibank and have never had so many issues and problems with any of them.

Hi Siddharth

Please can you post the direct bank link from where you sourced the Offer T&C document mentioning offer end date as 31st October. I searched this everywhere on the bank website/google but could not find it anywhere.

Thank you & great work as always!

I don’t have the axis link Sagar, as I got it via whatsapp from the rep.

But why do you need one?

I’ve applied for Vistara Infinite card last week, and the only official confirmation for the offer I have is the executive’s words on the phone call. I’ve tried searching everywhere on the website but all official offer documentations say the offer ended on September 30. Needed the direct link as a backup in case I run into any offer fulfillment issues later on.

Thanks

Is the offer renewed for Nov?

My application is not processed as I have 3, I want the confirmation before I cancel, Bank says they are to extend, waiting before I cancel Select to get Vistara Infinite. Considering Explorer gives Gold just 1st year, this is better – just that Axis do not honour wallet spends, unsure if treatment is different for Vistara.

Processed yesterday basis offer extension

Approved today after 3rd attempt, lost limit rise that I got after 1-2 yrs as I cancelled the Select for Vistara

Received today!

Applied online on 22 Oct

Documents verified on 25th Monday- No history with Axis. They rejected the previous application for ace saying internal policies but approved select. No salary or other card statement was taken. He said I was pre-approved somehow.

Messages received application being reviewed on -26th

Card approved1 30th

Ref number received- 31st

Card dispatched by blue dart on 2nd Nov

Hi

Mine also on similar lines of application

Applied online October 27th

Received acknowledgement Oct 28th

Documents collected Oct 29th

Approval sms and email October 30th

Still waiting for despatch details of card, application status not of any use.

wonder when am i going to get on hand,,,

I had applied for this card on 28th Oct, got an SMS that its processing, but haven’t heard anything , their online application status check portal is a disaster and doesn’t work

any ideas on how i can check the status , the RM at Axis bank is useless and doesn’t help.

I applied for it on 21st, documents were collected same day and got application id by sms on 22nd september. Since then no update on application it’s almost 50 days. Everytime customer care guys from call n twitter are saying ‘wait for 5~6 working days’

Hi siddharth, Recently I got axis select credit card which I applied after seeing this post.

In the card, they printed the name with spelling mistake. So is this a big issue or can ignore that?

You may ignore it. This happened to me as well recently. Basically the sales guy typed it wrong on the tab/mobile while taking the application.

But its better to get it changed if you fly international, as some duty paid shops will expect the name match.

Axis has the worst approval experience and customer service. Most RM are clueless about their products and have outsourced most of their onboarding process.

I received my card today, worst internet banking experience as my login is not working and no one in their Customer service seems to have a clue.

also , i spoke 2 to 3 reps, all of them are saying different things with regards to FYF offer on spending 1.2 / 90 Days.

i have written an email to them, i will not pay the fee till i have it in writing that fee waiver will be honored, else will cancel the card.

If you dont have axis netbanking it is difficult for you to login it is crazy how it works.

Today as my second monthly bill has been generated. Business class ticket voucher has been issued. Apart from not being able to see my card in mobile banking rest all is quite fine with Axis

Has anyone got their joining fees reversed yet?

I havent got the 10k bonus points and joining fee reversal despite reaching the spend threshold

I’m said that fee reversals can be expected by Jan 2022

The bonus points will show in the upcoming bill. Fee reversal likely only in 2022.

Yes I received the joining fee waiver including the GST. But nothing yet on 10k points.

Have gotten the 10k points but not the joining fee reversal

Axis has restarted issuing Magnus with Visa. Any chances of getting it in fee waiver option? (Fee waiver on spend of 1.2L in 90 days)

That fee-waiver option for Magnus has ended in October and not being offered anymore as of now. I have gotten this paid Magnus Visa 10 days back.

Is this offer extended ???

Yes, only on Vistara cards, through mid Jan.

Hi Sid, Could you please share the link for fee waiver extension till 15 Jan 22 for Vistara cards?

I have it as an emailer snapshot. Will try to upload it sometime.

I recently got the axis vistara infinite card.(last week) However, I was not informed of this offer. Is it still applicable to me?

Yes, applies to all.

Hi guys, My joining fees on Axis select was reversed on 1st Jan

Are wallet reloads counted towards spends for fee waiver?

Yes

@sid – applied axis flipkart 5 months back and got ace through phone banking 2 months back. Can I get vistara infinite now or will it be rejected as 3 months from last card has not been passed ?

I am even ready to apply online by submitting ITR

Any idea if axis vistara cards can be issued against fd as secured cc? If yes, please tell fd needed with them

// Above offer is applicable through all channels except on “upgrade” via phone banking.//

This is not correct, I got 2 cards Vistara infinite via the upgrade phone banking route in September and got fee reversal if anyone wants, try via phone banking upgrade within a day u get the card approved and a card will be received within 5 days.

are wallet loads and insurance payments counted towards spends for fee waiver?

Sid, is the first year free offer still on?

No, Vivek. It’s over!

Let’s hope they redo such promos again.

Applied for the V infinite on 12th Jan based on my Regalia card to card.

Received the card in hand on 19th Jan with 85% of my Regalia limit. That’s really fast compared to a few other experiences here!

Hope I am eligible for the FYF offer.

Did you apply through branch?

Hi Vijay,

Can you please let me know how you applied vistara basis card on card as I’m also trying for same but axis executive is of no help.

I had a pretty bad experience while applying. I had applied for Vistara Infinite on 5th January (already have Ace) & it got approved on 6th. I could see the card on mobile banking on 7th, along with the joining fees + GST credit. It took them 17 days to deliver the card – that too after the first billing cycle. I had to complain several times to different times even get this after 17 days. I will basically pay the bill for not even having the card with me. I am not sure if the joining fee reversal offer is still valid, as the card was not activated before 15th. I just hope that Citi Bank relationship will not be taken over by Axis Bank.

BTW, how do you link your card with your Club Vistara account? Also, has anyone tried merging 2 Club Vistara accounts?

Hi Gautam and Anoop, I applied through the Axis website. The website offered me some other card, but when the executive contacted me for verification I told I need V infinite. Then they send an executive to my home to help me fill the application. (I have no banking relation with Axis)

Siddharth, can you share the screenshot of the extension till 15th Jan. My application was entered into system on 14th Jan, will I be eligible for the offer?

Just got my joining fee reversal SMS and on checking my account, can confirm that it’s done. I had applied during the 15th Jan extension.

For vistara signature, Joining fee reversed on April 2nd, 2022