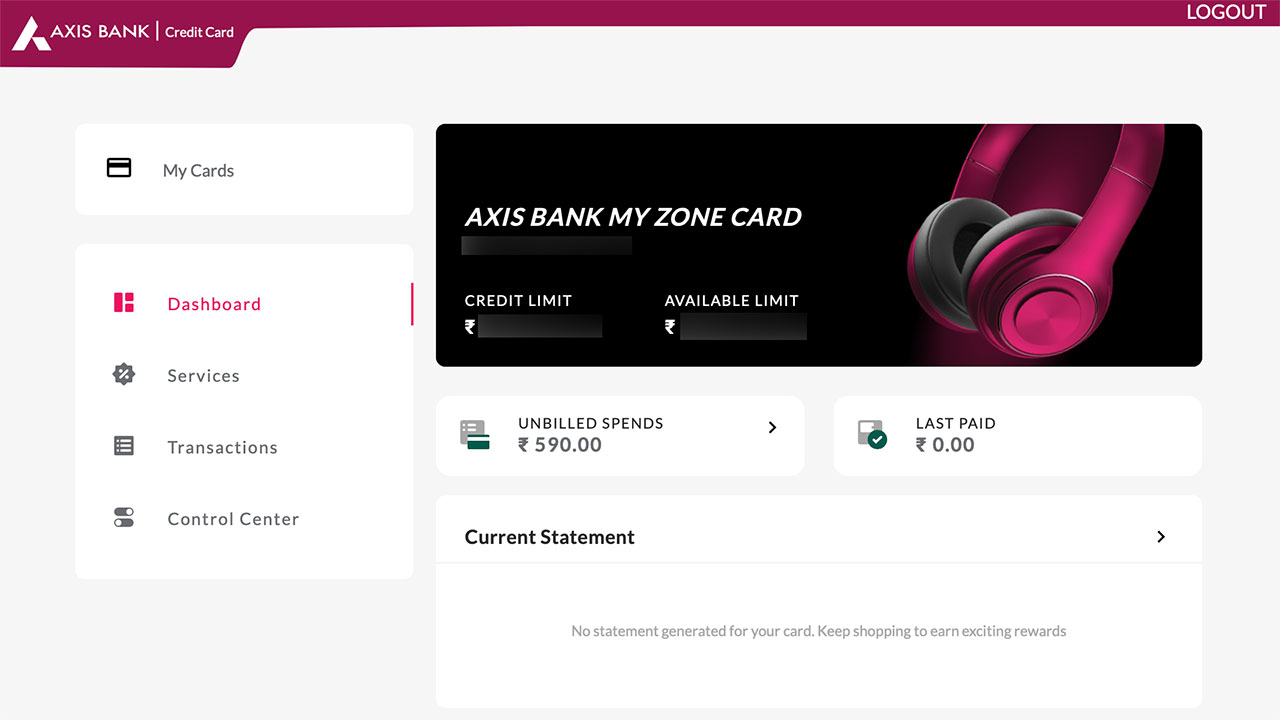

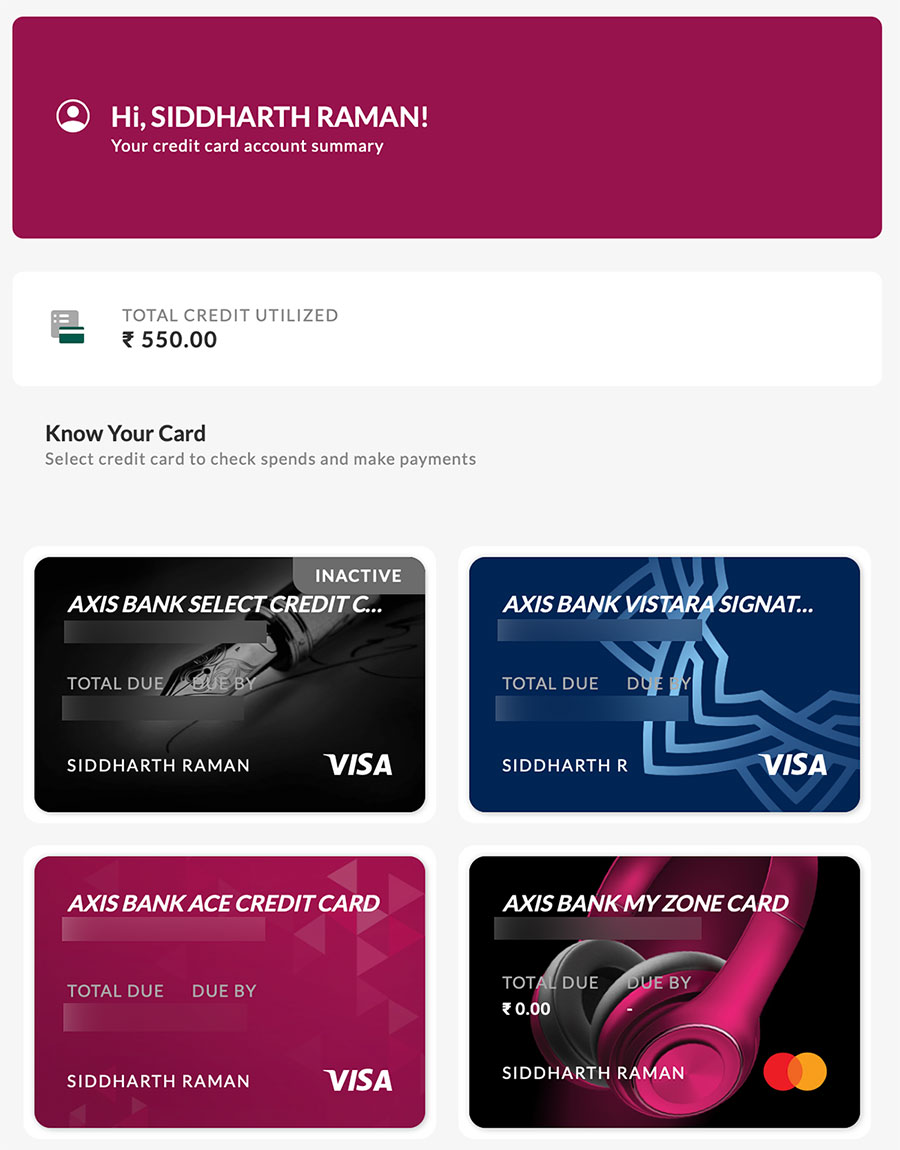

New Interface

As you might have seen, Axis Bank now has a new interface (since ~May 2021) for managing credit cards and can be accessible both on mobile and desktop. This new interface is sleek, simple and right to the point. It displays your card with its own design – nice touch (tile missing for ACE card though).

Overall it’s good and we can expect new features to be added soon. However this interface has a small problem. If you want to make a payment, you’ll get redirected to the old interface. That’s bit inconvenient but hope it gets fixed soon.

New Application system

New card for existing axis cardholders: I recently applied for the new Axis Myzone credit card (40% Swiggy offer is cool) and the card was instantly generated and added to the online card Ac on taking the request. That was mind blowing. The card got delivered in 5 days.

But before that happened, three requests failed previously. It seems the application system is not properly in sync with the old one which was causing some issues. But once that’s sorted it went smooth. So if the request fails, don’t give up!

New axis credit card: I recently faced a weird issue while trying to apply for a new primary credit card for a family member who has an add-on card on my axis credit card.

The application was instantly approved but later rejected stating that the applicant cannot have an add-on card with someone. Hmm, silly issue.

So cancelled the add-on and tried again. And now too it’s on hold and on escalation I’m asked to send another form to “remove” the add-on card from the Ac as cancellation alone is not sufficient. Hmm, Wonderful system!!

That aside, as you might have known, Axis has one of the worst system to handle add-on cards. Getting one is harder than getting a seat for the upcoming flight to Mars.

One of my add-on credit card application is pending for 6 months and no one has any clue where it went. Managing the axis add-on card is another headache!

Final thoughts

Apart from fixing the new application issues, I wish axis improves the add-on card application system. They could perhaps learn from HDFC wherein you can apply for an add-on card in one click (if they have HDFC AC) and they usually deliver the card in 3 days, whereas axis takes almost ~20 days to even process add-on cards.

And I hope axis someday gets rid of all the weird tech glitches, like one day it showed my credit limit ~50k higher than usual on one of my axis credit cards. And not to mention, axis never increased my credit limit since past 3 years or so despite decent usage on Vistara cards.

And unfortunately the RM at branch usually have close to no power on credit card operations. Axis Priority Ac is of NO use lately.

How is your experience with Axis bank credit card system? Feel free to share your thoughts in the comments below.

Hi Sid,

Do you mind share the weblink ? I am unable to find one.

Its the same login url. You just need to click on the card number from “snapshot” page to access it.

Hey Sid, how did you applied card? Is there any online way?

Over a call. You may apply online too, just follow the links on the site.

For customers who have closed axis account in the past and now want to apply for a credit card, its very difficulty. They have deactivated my account but somehow my customer ID is active so it takes as existing customer but then as no savings account is present application is getting rejected. Anyone facing same issue?

@Sid any suggestions what to do here?

Take SR to fix this. Try multiple times, escalate multiple routes. Eventually it will get fixed.

Applying for a primary credit card with Axis whilst being an add-on cardholder on any of your family member’s credit card is a headache indeed.

I applied for the Magnus card 4 months back, it was approved in less than 48 hours but then received a notification that the application has been rejected. It’s silly how an application for a credit card can got rejected after being approved. The agent who took my application, not knowing about it, swerr-talked me into reapplying while I was reluctant to do that (owing to the fear at the back of my mind that multiple enquiries would pop up for no reason). So applied for the same card again, new CIBIL enquiry popped up as was expected, the card got approved this time in just 2 hours 🙂 but then very next day, received a similar rejection SMS.

Agent looked into this and realised where the problem was. Had to get my add-on Axis card cancelled not just by calling the customer service department but also by signing some form for permanently doing away with. Once it was done, the same application (the 2nd one) went to the underwriter again and 2 days later saw the card pop up on the app, with a surprisingly grand limit of 8.91L. I wasn’t even expecting card approval based on how the whole application experience had been by this point of time let alone being onboarded onto AXIS cards with this big of a limit. Moreover, the reason why it was surprising is because Axis isn’t really known for giving huge credit limits and I know this for a fact.

There’s this one friend of mine having not only a Burgundy relationship, but a solid deposit and other relationships, and still got a 94000 credit limit (on a pre-approved card). Couldn’t do much about it despite sharing ITRs for revising the limit. All he got in response was to check again in 6 months. His RM couldn’t do anything either. He has eventually moved to HDFC Imperia.

Coming back to Axis’ application process, it still is extremely pathetic.

That’s exactly what am going through, yet to sign the papers to clear it.

Axis is good with Initial limits usually. Just that they don’t do LE easily.

Btw, the issue your friend is facing is likely because he could have taking the low end pre-approved cards like Flipkart card. Better to stay away from that card while taking the first Axis card.

Yes. Friend took the pre-approved offer for Flipkart card. But that is a really bad credit limit to start with for someone who has a good relationship with the bank.

True, they need to improve the Machine learning system.

Same thing happened with me. But I’m yet to apply an axis card. As agent is asking me to wait for 3 months coz my last application was in mid April which was declined despite canceling the add-on card because the add on card was still linked with my cust ID.

Customer care tells me that web based access is only available for customers having bank accounts. I only have a credit card relationship with Axis.

Yes. Same thing happened with me. An add-on card holder is not eligible to apply as primary holder . One has to cancel the add on card and after that submit application to remove card from their cust id as well. Other wise all your applications will be declined forever.

I do not think this is true. Atleast not in my case.

I have Axis Vistara Infinite card with my wife having add-on card. Then my wife applied for her own Axis Vistara Infinite card with me as add-on. Her application (including my add-on card) was processed successfully without any issue. We now both hold primary cards with both of us also having add-ons of each other’s card.

This could have happened before they upgraded/changed their system.

Yes, I had applied in Sep 2019. My wife applied in Feb 2020.

Hi. After cancelling my add-on card and requesting the bank to remove the card from my Customer ID I have applied once again and they processed my fresh application and approved it in less than 20 hours. That is really fast.

Sid, how do I get the add-on card for Axis credit cards? I’ve already requested twice over call and chat support but no representative has turned out yet. It’s been 6 months already 🙁

Offline application via tab – cumbersome process.

So, I need to visit the branch and ask them to process my add-on card request from the tab, or does the representative visit my place?

Either way works.

Same thing had happened to me .. contact them on Twitter, it will surely help

How do you apply for the second credit card as every time I tried on app by apply now it says you already have a credit card and also what’s the max number of credit cards one can have from Axis Bank?

Max: 2 axis cards + 1 co-branded card.

Try calling them

Ace is not a cobranded credit card with Gpay?

They consider only Vistara cards as co-branded for this purpose.

I had Axis MyZone, Axis Neo, Axis Neo (2nd card being converted from Axis MyChoice card), Axis Flipkart card

All 4 cards together

I infact had Axis Privilege card too which had closed due to fees

But they doesn’t seem to allow more than 3 lately, as far as I know. Maybe your cards are very old?

@sid This is not the case.

Max 4 cards allowed. They divide the cards into 2 segments.

1. Retail – Max allowed 3

2. Premium – Max allowed 1

So total you can have 4 cards

Just called support to check if anything changed. But they denied to take my new request for Neo card, stating 3 as max limit.

Right. Even I hold 3 . Axis priority customer since 8 yrs . When u hold 3 cards from axis , u can’t even upgrade because during this process 4th card is issued even till the cancelled card is not cancelled but it is not allowed. Very illogical.

Yeah, I agree. There are some strange glitches in the website. For some reason, I cannot apply online for Axis My Zone Credit Card. It just gives me a choice between pre-selected credit cards. Wonder why!!!

I had an account with Axis Bank earlier and since there was no use of an ongoing account with Axis based on my Relationship with Other bank, I closed it about 2 years back.

I also had 2 Axis Credit Cards and had closed out one along with closing the account.

When I try to apply for a new Card now it always shows up in my Cibil Enquiry but without any progress whatsoever beyond this stage.

Any clue if the cards will be processed if I open another account with Axis for Short Term

Raise a request and keep escalating. You’ll get some solution.

Sid any comment on these CIBIL enquiries that keep adding for applications that never get processed. Any idea if that will affect my profile/score?

Also would love you to review Slicepay and Uni cards.

Not to care much about these enquiries, they will recover much faster than expected, if affected. Will try to cover them in future, thanks.

Please see Sid’s comment above for a similar situation of mine.

P.S.: I guess if some axis bank employee sees this forum he will easily fulfill his targets for acquiring CC customers. So many people facing issues with getting a new axis CC.

One of the biggest tech glitch is the wrong cashback processing after this system upgrade.

Transactions done on Flipkart using Flipkart Axis card were getting 1.5% cashback instead of 5% cashback. The issue was escalated upto Principal Nodal Officer and he also has no clue about what to do.

Finally, RBI Ombudsman was the only option left which came to my rescue.

Now, as per their confirmation I should get the remaining cashback in my next statement.

Same thing happened for FreeCharge card for transaction done on FreeCharge App. Instead of 5%, got only 2% cashback.

But after all this escalation, got remaining cashback.

The support is so clueless that after all nodal authorities, I have made 2 RBI Ombudsman complaints in last 3 months against Axis Bank.

Which axis bank is good? Is it worth to have axis bank credit card which has annual charges whereas cards from ICICI and hdfc are free for lifetime..

Depends on your needs.

I took FLIPCART Axis card with annual charges.Is it possible to convert the FLIPCART Axis card LTF. Recently I see FLIPCART page says it’s LTF. Will cancelling and applying again do the trick?

I have been using the Axis Select card since December 2020, and sorry to say the new website is a huge downgrade than the previous one. So is the app – features like the monthly Spend Analyzer have disappeared from the app, and desktop logins to the Edge Reward portal are broken. Along with the new Income Tax portal etc. I start to shudder whenever any entity that I deal with announces an upgrade of any sort – they clearly don’t have the chops to do it smoothly.

The statement is not showing correctly on both the platforms.

Is there any issues going on?

Thanks

I recently applied for Axis Bank Flipkart card. For which i was getting continuous message from Flipkart.

I did E-KYC yet an agent visited my premises to take copy of pan card. Card was delivered within 3days but i was not able to set card pin.

1) Tried using mobile app but on clicking set/reset pin, app was asking for one time validation in which i need to enter card details along with card pin.

2) Tried calling on toll free numbers 18605005555 and 18604195555 for 3 days but was unable to connect.

3) Tried getting Customer ID by sending sms on 56161600 for using netbanking option but sms were not getting delivered on this number.

Finally wrote mail to axis bank card support team on 3rd along with screenshots of call record and sms. Today pin was delivered to my residence.

This is my first card with Axis bank yet i got CL of 2L+. Some reviews above suggested Flipkart card has low CL.

“Some reviews above suggested Flipkart card has low CL.” – This was underwritten differently (poorly) as its pre-approved – an “instant” card available in few clicks.

Hey Siddharth,

As you already have 2 Axis card. Is this card with separate limit or is it combine limit.

Is this given as LTF?

I already have ACE card. But I don’t have account.

Which is the best way to apply ?

Combined, paid variant.

Not very sure of this as I have experience only with ac. Try calling and check what they say.

Hi Siddharth,

I have a small question. Can I request for the reactivation of a recently closed Axis Credit Card? Customer service guys are of no help and I get different answers/solutions to my query everytime I call them.

I don’t think Axis has this system. Better to go with a fresh application.

Hi Siddharth,

Does this work with ICICI?

Few months ago I closed all my ICICI cards with 8.15L limit after getting multiple ‘fake’ trick posts for LTF ICICI Sapphiro/Rubyx.

Now I can see ‘Credit card with Pre-approved limit of 1.3L’ in netbanking means I need to go through the application process once again and also it’s not LTF or FYF at least.

My 17 years old salary account was upgraded to WM approx 8 months ago.

Can I reactivate my closed cards?

Haven’t heard of reactivation concept with anyone except Amex. I see many have followed the method and got LTF without any issue. Not sure if they changed anything lately.

The very next day, 9th July I got LTF Sapphiro MC with ₹5.3L limit (other options to choose were FYF Manchester United & Paid MMT).

Applied and the card was instantly generated. Though it’s still approx ₹3L less limit than earlier, but works for me.

There is also no clarity on which cards can be applied by calling customer care and which ones need a repeat of the KYC process.

@Ankit Agarwal – How to raise issues with RBI ombudsman? Please explain.

I have had worse experience with Acis application process. My Magnus is approved for over 3 weeks but I still haven’t received the card and apparently there is no way to track the application process either. The bank representatives keep saying that the status will be communicated only via email directly to the customer. I find their service quite inadequate.

A little off track query. How do I check my till date annual spend on the Axis credit card?

Can someone please share a response on this?

Download the statements and add the sum. Or if you are paying your card with single app, netbanking/cred etc then add the values to get your approx spends.

Why u have applied for MyZone as we know that ACE is best? My card application rejected twice even after having 750+ score and good salary

I don’t actually use ACE as 5% thing works only for android users.

Sid, which is your go-to card? And which one is the second most used among the ones you hold?

1. HDFC Infinia

2. Depends, for now its Amex Plat Charge

Interesting to see plat travel taking precedence over plat charge.

Hi Siddharth,

I’m also not using Ace that much (iOS user). Thinking about upgrading the card to Select but don’t know whether its a good move. Also I’m not very sure whether I want to continue with Axis Bank as my experience with them has been very bad. Please guide me through this. I also have Infinia, Emeralde, MRCC, Citi Rewards, Amazon Pay and SBI Prime.

I will check and let you know.

But usually I have noticed that Account Holder has LFT Variant. My sister has LTF as she has an account

I’m unable to pay my credit card due amount through pay my dues webpage as per this new interface and OTP doesn’t get generated on my mobile number which I otherwise get for other funds.

Axis bank credit card and banking services getting bad to worst first of all giving excuses of RBI advisory they directly merged 3 of my credit cards individual cards limit into 1

Where I given them example of my other credit cards provider where they hard done 5000 to 10000 decreased in total limits but this axis bank people don’t have customer service at all on call in bank anywhere I am around 5 years old customer of them but they ditch me and i am waiting for right time to revert them with all legal action from my end a big hands down to hand axis bank for their recent services to me

Hey, Sid. You already had axis select which has higher discount on swiggy upto 200rs and on myzone only 120rs. So why have you opted for my zone? Is there something else

Select was up for renewal and so swapped 🙂

Plus – Select only offers it twice a month. MyZone offers it 4 times. 120 x 4 > 200 x 2.

My son had Priority Savings Account with Axis Bank. Despite contacting branch, RM several times and even after seven months of registering a complaint no resolution was provided. Eventually he had to close the account which too took much time.

I was offered My Zone Credit Card with the condition that no fee would be charged on spending Rs 40000 in a year. But after that one year they refused.

Their presentation is very nice but service is poor.

True, their products are very good. Service is very poor.

Does axis bank allow to keep multiple credit cards with a single account??

Hmm yes

I applied for flipkart axis bank via flipkart since i was getting extra 500 rs voucher.

Limit they gave was 94000 inspite of good cibil and income.

How to get it increased after few months?

Will have to settle with it for few yers, unless Axis wakes up and fixes their system.

Axis is poor on their customer care side, instead u can term them as cheater.

Was their priority customer because I was told u can’t get credit card as success ratio would be less, hence opened the account but for 6 months nothing happened and that guy opened account with asking money in SB account

Then tried to cross sale other product

RM was total waste, won’t pick call or revert even after leaving SMS WhatsApp message. Even the SBI never did this to me.

System offered me free credit card which their employee in the name of wrong procedure tried to do manually even though system informed me approved and showed in app my CC no, so u can think Bad ass employees were ( there were 6 employees who called me n tried to defraud me)

Then in the name

Of CC upgrade they tried me to turn into burgundy customer and cross selling other products , which I refused.

Some charges were applied which were free to priority customer and when asked to remove them RM never did n tried to cross sale again in the name of removal of charges, so had to close down the SB account as there was lot of harassment , had to prematurely remove the FD of Rs 9 lac from account and close all relation except CRedit card.

Axis banking is other name of harassment and getting Blood pressure issue.

Had also applied axis bank flipkart card – flipkart showed would be first year free and but was charged, called CC team and they told to

Wait 90 days but nothing happened, then after 90 days was told to wait for new statement generation n then CC team asked why I didn’t reverted back as I forgot for 6 months after CC generation ( 2 months after I last complained)

Didn’t took my complaint , not a single docket no raised for it after arguing for 30 mins ( I think it would be easier to lodge FIR in police station than lodging complaint in Axis bank customer care, they never honour their spend based , or amount maintenance promo- )

So asked for canceling the card which they never did n statment is getting generated.

Axis bank banking is horrible and never ever recommended, SBI is best.

I had two cards before with shared limits before upgrade, Now I have two cards with individual limits.

They appear to be but its shared in the backend, with higher limit being the actual limit, ICICI too works the similar way.

The only way to prove individual limits is by checking if the lower limit card allows you to spend after higher limit card is maxed out.

@Siddharth

Not sure why you are not posting correct information that I have submitted at least 4 times so far.

Anyway, I will try one or two more times, then say bye bye to this site.

==

I have 3 axis cards.

Flipkart and Myzone cards have same limit, but the limit is not shared. I am sure about it. Neo card have a separate higher limit.

==

I have 3 ICICI cards.

Amazon have separate limit, while Platinum and HPCL cards share the limit.

Because this info is wrong from my experience and from other credible sources. Yet, would be happy to hear how you decided that they’re separate?

@Sid I too have a separate limit for myzone credit card and my Flipkart and ace card have a shared limit. This I can confirm as my Myzone card got a LE last month to 5L and my Fk and ace card still has the old limit of 4L

So yes they have shared as well a separate limit.

P.S.: Don’t know on what logic the limits works

I also have seperate limits for my axis my zone and privilege credit cards I believe. It reports the same in Cibil report also. One other reason I think it is seperate is because the available limit(Orig CC limit – current usage) is different for both. I guess will never actually know unless we spent more than the CC limit of one card..

Oh and the axis internet banking also got updated… New UI and stuff.

I had a decent credit score of 780+.

I applied for Axis Bank credit card and agent collected the details and got approved message but after two days I received mail that your application has rejected with out mentioning any reason.

Try to contact the bank but it is not available.

After six months again applied the same story.

I don’t know the Axis bank’s attitude.

The other banks after us to the card.

Definitely it ha to improve the system.

We might also need an article on credit line cards like Slice, uni, stashfin. They are coming with different and amazing fintech products.

Had posted about the inaccessibility of the Axis Mobile app the other day, complete nightmare for a visually impaired user to use it on Android as the Axis Tech Team doesn’t even seem to know about Google TalkBack or ScreenReaders.

Today I have noticed another issue, as my Axis Mobile had stopped working, I had struggled and got my InternetBanking registration done. Now when I checked, it is saying incorrect details when logging in, and when trying to reset password, they are saying sorry, this request can’t be processed at this point. Good credit card products, pathetic mobile app and netbanking, and even overall customercare for that matter.

Try with upper case login id.

The Axis user ID for netbanking is the Customer ID and it is in numerics.

Personalized login ID not working for me also, works with numberic customer ID

Reaching out to support on Twitter might help. When I called customer care I was told that netbanking is not for credit card customers and that I can only use mobile app. Axis support on twitter could sort it out.

Same was told to me.

I will also try to reach them via twitter

See the concept of shared limit might be different from bank to bank.

e.g. HDFC does not provide more than 1 card. But as an exception cases the bank can issue 2nd card if the limit of 1st card is high. And generally the franchisee would be not the same. If you have Visa/Master so the 2nd card would be Diners OR vice versa.

And the second card limit is restricted to certain percentage of the total limit.

Suppose if a person has Regalia with 6lakh limit. And he gets 2nd card approved Diners club. The limit usable would be around 3lakh.

He can use entire 6 lk on regalia but on diner he can use maximum 3 lk.

It’s just like setting limit for add-on card

That’s right. But replace HDFC with Axis/ICICI as HDFC gives separate limit.

One day I was planning to apply ICICI Amazon pay. Since I already have a card with the bank. I noticed that the card was pre-approved. No documentation. But when I read the T&C it was mentioned that the limit wi be combined.

So I didn’t proceed further.

Later I realised that APay card provides 5% cb. And I am buying online very occasionally from Amazon. As I also like Siddharth even I have multiple Banks card. So 10% offer is better for me.

I actually had different experience in ICICI. Initially, I had Amazon Pay. I was looking for some other ICICI card as during most of the sales, ICICI was starting to put Amazon Pay in the exception list. In the beginning, we used to get offers in other platforms also. In one of the sales, I got 10% off in Flipkart + 1% unlimited cashback, it was a bang for a buck. The bank must have realized it and nowadays Amazon Pay card is excluded in ICICI credit card offers or might have separate offers for it. Anyways coming back to application, I visited the branch and I got LTF Coral card through corporate offer. I even mentioned that I hold the Amazon Pay one, they informed that it would be processed separately. They’ve got a separate team for Amazon Pay cards. When my application got approved, I got a separate limit for Coral. Recently, I also got limit enhancement offer for the Amazon Pay one. So far, I had a very pleasant experience with ICICI credit cards although I don’t have savings account in ICICI.

I actually had different experience in ICICI. Initially, I had Amazon Pay. I was looking for some other ICICI card as during most of the sales, ICICI was starting to put Amazon Pay in the exception list. In the beginning, we used to get offers in other platforms also. In one of the sales, I got 10% off in Flipkart + 1% unlimited cashback, it was a bang for a buck. The bank must have realized it and nowadays Amazon Pay card is excluded in ICICI credit card offers or might have separate offers for it. Anyways coming back to application, I visited the branch and I got LTF Coral card through corporate offer. I even mentioned that I hold the Amazon Pay one, they informed that it would be processed separately. They’ve got a separate team for Amazon Pay cards. When my application got approved, I got a separate limit for Coral. Recently, I also got limit enhancement offer for the Amazon Pay one. So far, I had a very pleasant experience with ICICI credit cards although I don’t have savings account in ICICI.

From other comments also, it seems that ICICI treats Amazon Pay and other ICICI credit cards separately. If you have more than one ICICI cards except Amazon Pay your limits would probably be shared. For Amazon Pay you probably would have separate limit with higher or lower or same amount.

It was horrible experience for getting third card despite closing one of them earlier – system was treating already three cards exist and the folks at their end are equally bad – mainly RM. Customer does some magic and the card requests vanish. More surprising is their Nodal officers, they don’t seem to read email nor bother to respond properly. Only after escalating to MD ID some movement happened and card was issued.

I recently got axis ace card and trying to add it to gpay app it isn’t getting attached saying call on 18004190013 but after calling it isnt getting verified. Any tips guys what to do???

Were you not getting an option to verify via OTP? I have been able to add other Axis Bank Visa cards on Google Pay by verification using OTP.

I had same issue. Set your Pin first and then try again. If still facing issue contact customer care

Is it possible to get Axis Ace Credit Card without having any relationship with Axis Bank. I tried applying online twice both times it got rejected stating ‘inability to process the same, as it does not meet the bank’s prevailing card issuance guidelines’.

I have a good cibil score and have credit cards from almost all other top players(Hdfc,Icici,sbi,amex ….)

Any thoughts on how to get Ace without opening a SA with Axis?

Yes. It’s definitely possible. I got my Axis Ace last month and I don’t have a savings account with them.

Yes. Ofcourse it is possible. I have ACE without any account or any other relation with Axis.

Usually if you have good limit of othe Banks card , should have applied Card to Card basis.

% of approval is maximum is this method

Thanks Pramtesh. How to apply card to card basis. Do we have to visit branch and do it or is it possible to do online ?. Sorry I am not aware of this process.

Both method works online and branch

My experiences with Axis Bank overall have been extremely poor overall.

I applied for an Axis Ace Credit card in November 2020 and the application process took about two and a half weeks overall, with next to no updates during the process.

When the card arrived, they managed to mangle up my name on the card front. How they arrived at that specific combination I have no clue; all my other cards have the same name and never any problems at all. When I asked them to replace it, they wanted to charge me for it.

Next, the worst onboarding and activation process I’ve ever been through with any card/bank so far. My number wasn’t registered so couldn’t set a PIN, nor activate the card. After jumping through multiple hoops in their shitty mobile app and their not so shitty (at the time) customer service, I finally managed to get everything working.

Fast forward to June 2021, my company switches salary accounts from Citibank to Axis. Once again, application for a Priority Savings account was done in one day. Account was activated over the weekend, and then came an even worse onboarding experience than before. Took about 5 days calling the RM and later customer care for one or the other issue before I was able to login to the account in the browser, and then set a PIN.

To make things worse, this salary account wasn’t reflected in the mobile app, and after another call with the customer care, I had to reset the app from scratch and login again. This time, I was able to register the salary account and then both the accounts showed up. Nowhere in the app or their FAQ mentions this as a mandatory step for existing customers.

Tl;Dr – Avoid Axis for anything as much as you can. Their horrible, horrible setup and shitty service isn’t worth the frustration, no matter how good their products may be.

@Mugunthan & Kushal,

Siddharth is right. You may have separate limits on your Axis/ICICI cards, but they’re ‘Actually’ shared.

Till few months ago I had (why closed is a separate story) 4 ICICI cards with a shared limit of 8.15L and APay card with 2L limit. It was tried and tested that I couldn’t go beyond 8.15L cumulatively on these 5 cards.

Coming to Axis, I’ve Flipkart & Ace with 1.6L mentioned on both cards but it’s also shared. Few days ago, when I had balance of 1.33L on Ace and 5K on Flipkart, a transaction of 24K on Ace got declined. Tried with flipkart, also got declined.

So, please do test it yourselves before jumping on Siddharth.

Minus your avl balances from the credit limits, you transacted for 155,000 from flipkart and 27,000 from Ace ? That is 182,000 in total transaction volume, combing both card together on a 160,000 shared limit !! So Axis does allow spending over assigned limit then.

‘Balance’ means due here, not available limit.

Hi Siddharth,

You have rightly called out the Axis Bank’s poor IT systems. It was already bad and after the recent upgrade, it has become worse. I have called customer care, visited branch office, written emails to ‘privilege’ support team and all the times the response is similar conveying their inability to help the customers.

I feel bad for the Customer Care and folks working at the Branch as they have to bear the flake of disgruntled customers and they are pretty help less.

Most of my transactions are declined on existing ACE Card for ‘security reason’ while transacting on reputed websites. The Add-on card status is unknown, Axis Bank App has its own set of glitches and the list goes on and on.

Very Bad experience with Axis, after I applied. I got all n process done, agent came home and verified all details and took photo and other details.

Then finally this came.

Your Credit Card application for Axis Bank Ace Credit Card with reference no 220***** has been declined. Pls call 18604195555 if you did not apply

Waste of time with very silly bank. No savings acct with them so far.

Axis Myzone Credit card Swiggy coupon AXIS40 not working anymore.

Yeah, says “coupon expired” since past 2 days. Have escalated it, let’s see.

The problem is at swiggy’s end.

Instead of saying you have reached coupon usage Limit that is Maximum 4 times in a Month , Swiggy app is saying Coupon expired.

Yes, I assumed the same.

Hi All,

Just want to share my experience regarding Axis Bank Credit Card Application and limit upgrade. I had been trying to apply Flipkart Axis Card around the end of 2019. Initially, I applied it through offline tab process via credit card agents, my application was rejected twice not sure for what reason even though I had savings account. Not that it should matter as I applied it using salary slip. Even agents were not sure of the rejection reason. Incidentally, I got pre-approved offer for Flipkart Axis Card in the late 2020. I thought it might be an opportunity to grab this even though the limit was low. That’s probably because they set it based on the average bal. from savings account. This time I applied it through the branch. But even during this application, multiple application ids were generated, I wasn’t sure which one to check. Eventually, it got approved. On top of it, I was being offered another Neo or some other card after couple of days which I declined. I actually knew this beforehand as I was close with of the employees at the branch, I was informed that I might get such offers. Sid, you’re right about their add-on card application, they straight away refused to take any application for it after I tried it couples months later. They did not even ask what card I had. Not sure they even issue add-on cards for Flipkart Axis or similar cards like ACE. Has anyone got both cards? I was thinking of getting the ACE card too but not sure if they issue both cards to single person.

I actually waited for more than 6 months before applying for limit upgrade and by that that time their system got upgraded. When I was trying to check for limit upgrade from the option from the app/netbanking, I was informed that I was not eligible. Then I found the link from their website to chat/email. I opted for chat as I did not want to send email and risk of getting rejected for no reason whatsoever. Their chat interface has some technical issues, it won’t take special characters, it won’t take more than 5 documents with size limit and so on. I was not able to upload the documents in time for the same issues. By the time I was ready with the merged salary slips and bank statements chat service got disconnected, you really need to keep sending something in chat probably once in every minute to the keep session active. Anyways I tried again the chat service the next day, then I was informed that I was not eligible for limit enhancement and asked to try after 6 months. This was really testing patience level so insisted that I was eligible but due to the technical issue I was not able to upload the documents earlier. He waited for a few moments and informed he was taking the application as an exception. After couple of other details, he asked how much limit I want. That took me by surprise, I was not expecting this question, I had applied various credit cards but never faced this question(really seemed like an exception). So, I told the limit which most of my credit cards had and did not want to be seen too greedy. I even mentioned if that cannot be approved then I would take whatever increase was possible(rather than a rejection). After couple of days, the limit got enhanced to the amount I had mentioned. Then I thought I should have asked higher, it’s kind of like your salary hike for a new job offer. It’s a dicey question. Anyways, the main thing is that Axis credit services – be it new card/add-on card application or limit enhancement they definitely have got some glitches and issues in general even though their system got upgraded. I would keep any other bank over Axis in terms of credit card applications and related services. That’s all from me. Let me know if anyone of you got such ‘exceptional’ service from Axis.

I have both Flipkart and Ace credit card. Also, I do have2 add on cards for Flipart too. You need to go through the painful process of Tab to get the addon cards.

But I had a very pleasant experience while applying for credit cards on axis..

My first card was flipkart one which I applied offline in 2019. I approached the bank but they were trying to open a savings account first before issuing a credit card.. I showed no interest in opening any accounts and after that they send their card agent to my house to scan my documents. The agent arrived at scheduled time and scanned my documents and took my photo and completed the process.. I applied card on card basis…

The surprise was my card was approved in 3 hours… I got the sms in my mobile.. I confirmed with the agent and he was totally shocked as it was his first time that a card was approved in such a short time…

15 days ago I applied for the Vistara infinite card and I received the same 3 days ago.. This time however the card approval took 4-5 days with no confirmation calls from axis.

Hi Guys,

Does anyone how to avail the complimentary Amazon Prime subscription offer for MY ZONE card or where I can find T&Cs for the same? I saw the offer while applying card from the mobile app but could not find any details neither in the app nor in their website.

@Nirmalya

I got the same offer for Axis Neo card. An SMS will be sent by axis bank with a code. You have to use it in Amazon.

You can very much call Axis CC and ask for the code.

For my latest Flipkart card, Axis didnt sent me the joining benefit – Flipkart voucher. So I have called CC and got the voucher immediately via SMS.

Mugunthan

CBE

Hi.. I have a long relationship with axis but my credit card application got rejected every time. My cibil is around 800 and no payment defaults. I am having othe bank credit cards. I have no idea what could be the possible reason so that I could fix it and apply.

Did you get the card number, CVV etc after online activation, or only after delivery?

I have activated my MyZone card, but cannot see card details in the app, except for the first and last 4 digits. It was like this for my Flipkart Axis Bank card too; was it the same for you?