Axis Bank has recently added the ability to transfer Edge Reward points to Partner points and miles which is one of the major move taken by Axis Bank to serve the affluent customers of the bank.

Below transfer rate from Edge Rewards to Partner points & miles are applicable for Affluent / HNI cards only: Magnus, Reserve & Burgundy Private. Axis Atlas is dealt separately.

Other cards transfer at 10:1, which is poor and not worth transferring, hence not covering them in this article.

Table of Contents

Airline Partners

| Airline | Loyalty Program | Transfer Ratio (Atlas Miles:Partner Miles) | Transfer Ratio (Edge Rewards: Partner Miles) |

|---|---|---|---|

| Singapore Airlines | Krisflyer | 1:2 | 5:4 |

| Qatar | Privilege Club | 1:2 | 5:4 |

| Etihad | Etihad Guest | 1:2 | 5:4 |

| United | Mileage Plus | 1:2 | 5:4 |

| Ethiopian Airlines | Sheba Miles | 1:2 | 5:4 |

| Turkish Airlines | Miles & Smiles | 1:2 | 5:4 |

| Air France KLM | Flying Blue | 1:2 | 5:4 |

| Spice Jet | Spice Club | 1:2 | 5:4 |

| Air Asia | Air Asia Rewards | 1:2 | 5:4 |

| Air Canada (New) | Aeroplan | 1:2 | 5:4 |

| Japan Airlines (New) | JAL Mileage Bank | 1:2 | 5:4 |

| Qantas (New) | Frequent Flyer | 1:2 | 5:4 |

- Expected turnaround time to transfer: 1 Day for Etihad, Air France, united (instant) & Spice Jet (others: 10 Days)

Hotel Partners

| Hotel | Loyalty Program | Transfer Ratio (Atlas Miles:Partner Miles) | Transfer Ratio (Edge Rewards Miles:Partner Miles) |

|---|---|---|---|

| Marriott | Marriott Bonvoy | 2:1 | 5:4 |

| ITC | Club ITC | 1:2 | 5:4 |

| IHG | IHG Rewards | 1:2 | 5:4 |

- Expected turnaround time to transfer: 1 Day for Marriott & IHG / 10 Days for ITC

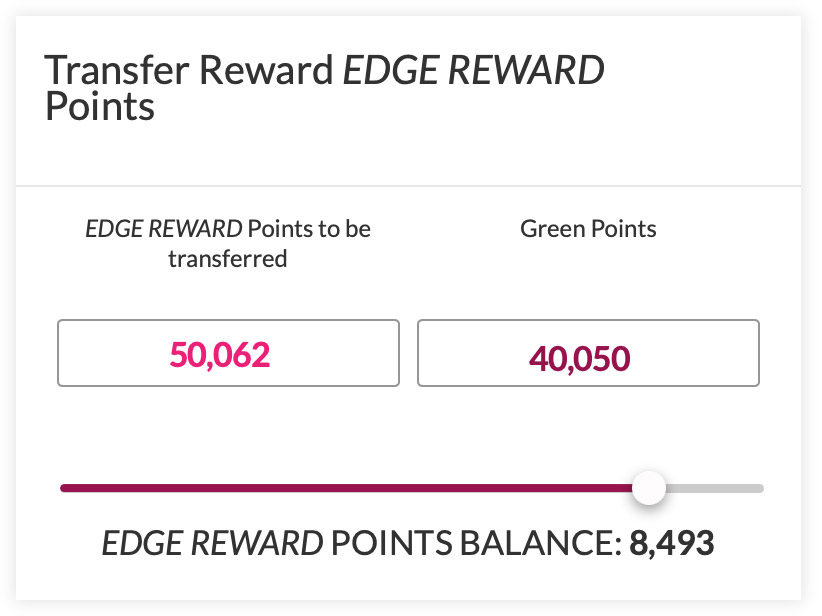

Note: Axis systems were having an issue initially when it went live a day back. So while transferring make sure you’re seeing the proper “transfer ratio” in the slider.

What’s the reward rate?

If you spend 1 Lakh on Axis Magnus and Reserve, this is what you get:

- Magnus: 4800 +20,000 (milestone benefit) = 24,800 partner Miles

- Reserve: 6000 Partner Miles

Magnus is indeed a MIND BLOWING card for spends upto 1L, for spends higher than a lakh, Reserve is better. For international spends, reserve is the only card you ever need going forward, as it gives 2X rewards.

So if you look at the reward rate angle on regular domestic spends, it turns out to 2.4% – 4.8% on Magnus (~24% on 1L spend) and 3% to 6% on Reserve assuming a conservative value of 0.50 INR to 1 INR on select partner points and miles.

But it’s indeed not an easy game if you do-not know what you’re doing. For most cardholders, Marriott & ITC points transfers are simple to begin with. And for the experts the airline transfer may come handy.

With this addition American Express Credit Cards looses its major USP (Marriott transfer) and so spends will move to Axis Premium Cards, as reward rate is lot better with Axis.

I mean why would anyone use Amex Platinum charge to earn 2.5K Marriott Bonvoy points (1L spend) while you can earn 4.8K(Axis magnus) or 6K(Axis reserve) instead?!

How to Transfer?

It’s super simple and you can do it in matter of few clicks.

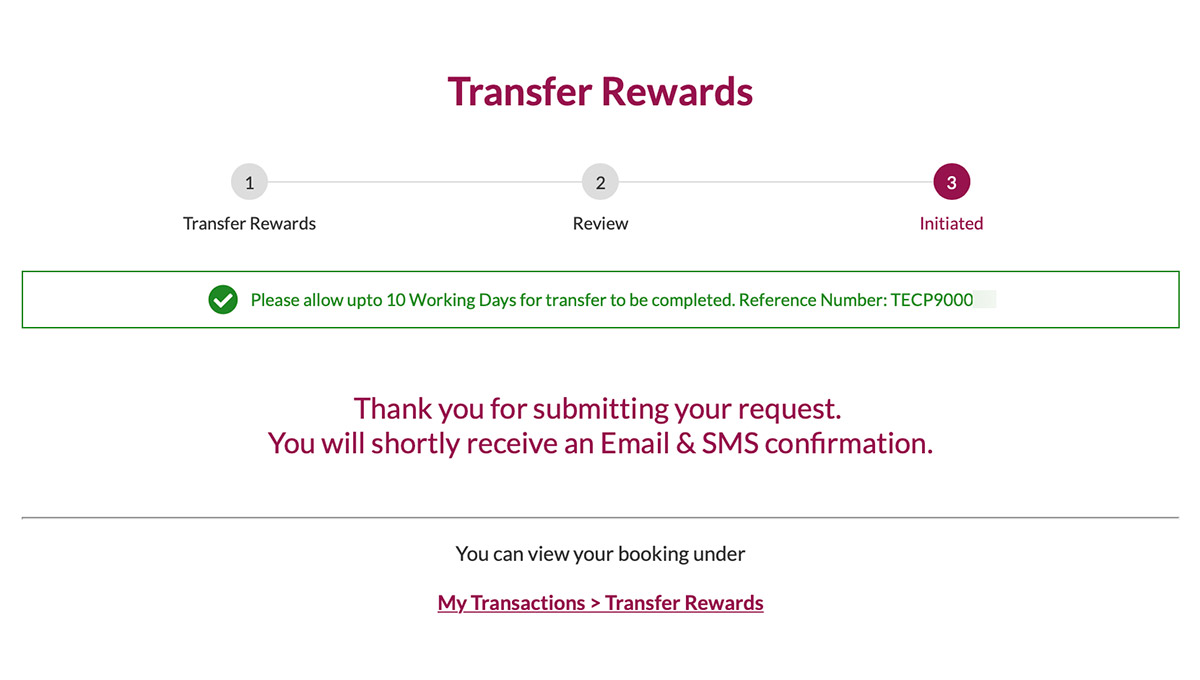

- Login to Travel Edge portal (use the same login credentials you use for Axis a/c login)

- Choose “Link Member” on the top right. Fill the details of the transfer partner.

- Once done, choose “Transfer Rewards” on top right, choose the program and points required to transfer using the slider and submit.

- It takes anywhere between 1-10 days for the transfer to happen.

Time taken to transfer Points

Here are the average time taken to transfer your Axis points to respective loyalty programs in real life:

- Marriott Bonvoy & IHG – Upto 1 working day (sometimes Instant)

- United, Etihad, Qantas – Upto 1 working day (sometimes Instant)

- Turkish & Ethiopian – 2 days

- Krisflyer & Club Vistara – Upto 3 days

- Aeroplan & Flying Blue – 1 day (sometimes instant)

- Club ITC – 3 to 5 Days (Used to take 1-2 weeks before)

- Spice Club & Air Asia – 5 to 7 days

- JAL – 7 to 10 days

Feel free to report the time taken to transfer to other partners, just incase if you’ve tried these transfers.

Final Thoughts

What can I say! The golden age of Indian credit cards has just begun. Enjoy the complimentary flight ticket redemptions and hotel stays as long as you wish.

Make hay while the sun shines!

Not to forget that the sun is shining for the second time in recent times and you know how long it lasts.

So we might see some changes on conversion ratio in future as more and more cardholders explore the points transfer option, just as always which happens with any lucrative program.

But I hope we will have sufficient time to enjoy the benefits and perhaps that helps us to eventually explore the Life beyond Credit Card Rewards.

*** Happy days ahead ***

31000 points (25000 air miles) for 1 lakh of spend seems to be too good to be true.

Further, the you can earn accelerated reward points on grab deal, travel edge and gift edge.

For example, if you buy Rs 1 lakh voucher of Kalyan jewellers for axis gyftr portal (this is running at 10x currently) will fetch up a whopping 60000 points which is 48000 air miles! Is there any catch here? Is there any capping on max reward points on axis grab deal, axis gift edge and axis travel edge?

Never tried it as Kalyan is not a trusted brand as heard so. But note that you can’t purchase gold coins with it.

For grab deals they’ve added 10K a month capping, not sure if they did it for Gift Edge as well.

Hello,

Is the 10k per month capping on grab deals applicable basis billing cycle or basis calendar month?

Can anyone confirm about the maximum limit on gyftr edge portal? Has any one received more than 10000 edge points in a month.

Accelerated EDGE REWARDS: Earn 5X/10X EDGE REWARD Points whenever you make a purchase from this voucher portal. The Axis Bank EDGE REWARDS Points depend on the brand you choose. There is no upper limit on points you can earn. Get 10X Reward Points on over 100 brand vouchers and 5X Reward Points on many major brands such as Uber, Ola, Big Bazaar, Mobile Recharge, Flipkart, Spencer‘s Retail, Grofers, Croma etc.

Above from GYFTR page

well, I am not sure, about the part you are mentioning there.

There must be a cap or a catch. Otherwise, if my maths is right you would be getting benefits which are nearly equal to the amount you are spending.

1 Lac voucher of Kalyan Jewellery on Magnus

Base points: 6,000

Milestones point: 25,000

10 x point(6K*9) 54,000

Total points: 85,000

As per Siddharth’s comment:

Marriot: 50 Ps to 1 INR

ITC: 1 INR to 1.2 INR (sometimes even better)

Krisflyer: 80ps to 1 INR (sometimes even better)

So the above points are almost equivalent to Rs.1 if used right. Which makes it Rs. 68,000 Worth.

If I am missing anything here please correct me.

Well 10x is capped at 10k edge points a month so your calculation are wrong and it seems like to good to be true

Archit, I meant the same thing Rehotorically. When I put across that calculation but thanks for sharing your two bits of wisdom. Much Appreciated!

Not sure 10x is capped at 10K or 9x is capped at 10K. Unlike the attention that hdfc smartbuy received not much is clear about grabdeals/giftedge/traveledge

Hi Siddharth milestone benefit for magnus is 25000 reward points

I converted it to partner points/miles for calculation.

Hi thank u for this article please tell me about magnus 4800 points part and 2.4% to 4.8%. The 1 lakh 25000 points 5:4 converts to 20000 points is clear.

4.8% if we keep 1 partner point = 1 INR (assume ITC)

2.4% if we keep 1 partner point = 0.50 INR (assume Marriott)

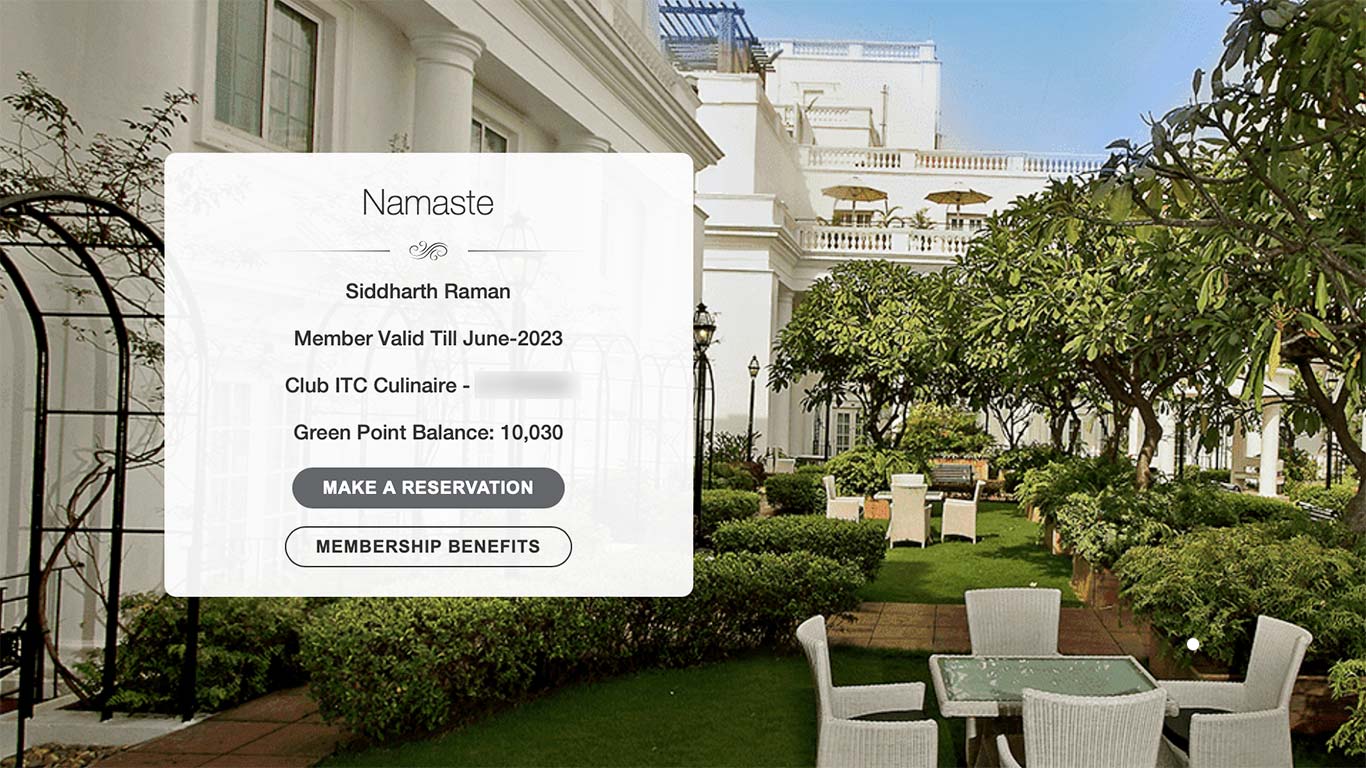

so we get better benefit by transferring edge rewards to ITC membership. is ITC culinaire membership free? or it comes at some cost? I got magnus approved today and I am a high spender

How is magnus reward rate 24% with point transfer? Can you explain more on this?

Multiply points earned by 0.80 and you get the value.

Hi. Thanks for the detailed post. Can you explain the logic behind assigning value of Rs.0.80 for 1 Edge point.

Please fo give us details of these frequent flyer programs as i am a newbie. Air asia and spicejet are 2 domestic airlines i use. Air asia is linked to tata neu coins please advive about the reward program

How did you get 5:4 ratio? I am still seeing 5:1 or 10:1 ratio.

No idea, I was shown 10:1 before but by mid-day it got fixed for me along with many.

thanks for this wonderful news article Sid.

converting edge rewards to which loyalty partner is most cost effective?

Most go for Marriott / ITC / Krisflyer. It all depends on the needs!

Hi Sid,

If I convert 75000 Edge Rewards to 60000 ITC Green Points (5:4 ratio).

ITC allows annually max 60000 Green Points to be converted to Mariott Bonvoy points in 2:3 ratio. So, if I do that I will get 90,000 MB points.

So, for 75,000 Edge Points I will get 90,000 Mariott points (Ratio of 5:6) which will better than 5:4 ratio that I get if I transfer directly from Axis Edge to Mariott Bonvoy points.

Is my understanding correct? Kindly advise.

I was hoping no one says this here. It will be gone soon now.

I converted about 1.4 lac Edge points to 1.10 lac ITC Green Points (5:4 ratio).

Have now given request for transfer of 60,000 ITC Green Points (max allowed in year) to 90000 Marriott Bonvoy points (under process).

So indeed we are getting 5:6 ratio for Axis Edge to MB points through this method.

I don’t see the option to convert axis points to ITC. Is it removed

in marriot bonvoy if you book by points cost is twice. A hotel costing INR 10k needs 20k points.

Hi Rajiv,

How long does it take for conversion of axis edge points to club itc points and then from club itc to marriot?

However Marriot bonvoy points at their current rate of redemption can be valued at around .57ps Most peak days are less than 50ps. overall since the change to dynamic pricing it’s hard find the old 1 rp deals anymore . With marriot value at .57ps you get just 0.90ps value for 1 ITC Green point.

The airlines at .80ps point still give a better value than Marriot Bonvoy

Dear Siddharth, I may be wrong but I remember Marriot transfer is @2:1 in Atlas card. They have also taken off Vistara transfer

Sorry for the confusion, yes, you’re all right. Updated.

We anyway have vistara cards, maybe Vistara wants to take their cards instead so maybe discouraging transfers otherwise.

Vistara is back. I think they are working on the website so hang on.

Transferred around 4K to vistara, I will keep you all posted.

Hi Pranav,

Are the points transferred in Vistara

Yes on Sep 2. So took around 4 days.

I won’t transfer to Vistara henceforth. This was test transaction. I am searching for the right partner to make free Europe trips

i can see vistara @5:4

Looks very promising after the 10 x HDFC program. Fingers crossed as a magnus user !!!

Nice Sid.. have you done analysis of points value under different programs like what each point is worth in their respective memberships like ITC vs Marriott etc.? Please share the link if it’s already there. Thank you!

Marriot: 50 Ps to 1 INR

ITC: 1 INR to 1.2 INR (sometimes even better)

Krisflyer: 80ps to 1 INR (sometimes even better)

These are the most used ones. I’ll let others share their findings.

Thanks Sid! Why is there a range and not fixed value as you mentioned above? Does it have to do with time to time offers or selection of hotels category?

One can get a better rate on the Bonvoy transfer by routing the transfer through ITC first, and then to Bonvoy, as ITC to Bonvoy ratio is 2:3. So if this route is used then the actual ratio for Bonvoy becomes 5:6 for Magnus, Reserve etc., and 1:3 for Atlas.

Please mention the time taken for this route. Also I saw a limit of 60000 green points is it per calendar year

ITC is not showing now on the list. They may have removed it

ITC Points can be transferred to Marriott as 2:3. So Edge Rewards -> Marriott would be 5:6 instead of direct 5:4(via ITC)

Even I just noticed that ITC green points is not there any more. Have they removed it Sidharth?? That was the best hotel deal conversion compared to Marriott or IHG. Can you shed some light on it?

It will come back, except that we don’t know if they’ll come with any new terms & conditions. We’ll have to wait.

Club vistara is added now as new partner. But aren’t the flights more expensive than say SpiceJet or air Asia. I tried air Asia big points but since merging with Tata neu some error is there. I transferred to club marriot in evening at 7pm and points already in bonvoy app by morning

All of a sudden Vistara seems to have lowered the prices for flights (in CV miles) for example I booked 2x PE seats from Chandigarh (IXC) to BLR which was showing price at 11K+ each for just 7.5K miles+700Rs. Similarly a 25K+ business class seat for BLR to IXC, I got for 17K miles + 1000 or 1200 Rs. At the same time economy tickets, available for revenue rate around 9K were being given for 4.5K + 600-700Rs. So overall at this sector it was giving upto 2Rs/CV mile (mabe 1.8-1.9 with tax/fee in cash)

Looks like Vistra is on a roll. Not to mention the superb red carpet feeling their customer care gave. With the closed eyes, decided to renew my Vistara Infinite.

Great news! Just got my Magnus approved. Have about 24,000 Edge Points existing in my Axis rewards account. Would I be able to get the higher 5:4 ratio on these pre-existing points?

Yes

@Nitish, Thanks for confirming the same.

I have one query which Ive mailed to Axis bank but no revert (been 15 days)

Query:

Is it possible to transfer edge to air mile where the names do not match on both accounts ?

If the names don’t match will the edge points be reimbursed or lapsed ? 🤔

PS:Axis CC T&C states both names should match.

Backstory: I would wish to accumulate all air miles in my account. I will be transferring edge to airmiles from my family members respective account to mine.

Also, any changes in the transfer conversion ratio to Club Vistara points?

I am seeing a lot of interest in Axis mileage transfer. Based on my previous experience with ITC and Krsflyer, I would recommend that don’t transfer the points until you are sure of travelling and can see reward nights/seats.

Many times I have seen that such redemption is not available easily (nothing beats Vistara on this though. They are super transparent). So instead of getting stuck in another programme, wait until you are sure of travel and availability.

Also, I am seeing 24%, 30% numbers in many places but based on my conservative estimate, we should not value edge reward points more than INR 0.5 or 0.6. If you take that as a case, this would mean around 3.5% return on regular spending and 15-18% return on 1 L spend which reduces once you spend more.

This is also very similar to HDFC DB and Infinia when 10x offers were live.

Hence, while this is a fantastic offer, please be cautious when transferring.

I have recently converted my edge reward points to spice club points and came to know that they give 50p value for one point. Can you tell what value other airlines are providing for their points?

Great update Sid. Had a query:

Do rent payments, wallet top-ups, insurance payments, utility payments, etc. count towards INR 1 L monthly milestone?

rent payments, wallet top-ups – No

insurance payments, utility payments – Yes

Hi Sid please write an article on marriot bonvoy. I read one article at kochi marriot where for 12500 u got breakfast and lounge plus upgraded room. Were all 3 part of gold elite. Because I tried booking now and it says point booking for room only. No complimentary breakfast.

@Sid,

Axis Magnus 25K Edge points = 20K Bonvoy right ? So on 1L spend, we get 20K marriott points vs 2500 on Amex plat ?

Is this math correct or something is amiss

~Neo

Hi Sid, Super Article as always. Can I apply for Axis Magnus (Card on Card) via My HDFC Infinia (11 Lacs Limit)?? Currently, I’m holding Axis Ace with 2.5 Lacs Limit but they are denying for Upgrade. Thank you.

Till date Axis has not been able to fix my login issue. I have 3 cards from Axis but I cannot login to internet/mobile banking despite escalating multiple times..

They all keep asking the same thing – uninstall and reinstall app..

How will i use the edge rewards 😂😂😂😂

Witj renewal date coming two of the cards will be closed.. will continue with Vistara Infinite for another year..

Was this resolved? If yes,how?

Hi Siddharth, it looks like clubITC gives the best value for these points, is that what you recommend everyone transfer points to?

Also, for some reason I cannot find a way to see how many points per night are required by ITC hotels, is it something hidden only to be shown much later?

Lastly, is there any card here in India given option to transfer to Hyatt?

Thanks!

Try looking for other hotel. ITC does not allow points booking for some hotels (especially the grand ones 🙂 )

This is a good way to get the maximum benefit out of your one’s Magnus credit card. But this essentially renders Vistara Infinite useless when it comes to the reward system.

Do you know when this above offer is going to end?

Secondly, are they issuing add-on cards on Magnus?

Thirdly, If anyone could share the Airmiles game and how that work it would be great.

Cheers,

Does anyone know how exactly do we use mikes between airlines for ex Singapore airlines and air india are part of star alliance but how do I use kris flyer miles in air india

I have the same question. Can we transfer kris flyer miles to any of the star alliance flights like air India united etc .? Did you get any insights on this

We have currently no Axis Bank relationship other than Flipkart Axis Bank card. Given the Citibank conversion to Axis still has about 6 months, I’m keen to apply for an Axis Bank Credit card looking at the decent offers and redemptions they’re coming with.

So my question is assuming I’m eligible for the highest category cards as well, which card should I apply for? Key purpose is to get maximum rewards % on spends as for other benefits like Golf or Lounge I have various other cards that take care of it.

Thanks in advance!

what is he value of spicejet point? 1 point = 1 rs?

.50 paisa

What is the value of 1 airasia points?

Seems rental payment using all axis cards has been stopped. Any updates?

Rental payments or the points on rental payments ?

Heard rental payments are stopped. My rental payment through payzapp was declined

Thats is bad.

I paid rent using Axis Vistara Infinite through Payzapp using Redgirraffe on 7th. Worked fine, faced no issues at all.

But it seems that these arent counted for 1L spends, confirmed with Axis CC yesterday

Doesnt payzapp rentals get classified as Insurance and thus no CV points on Vistara Infinite?

Thanks

Hello,

Any idea if we can purchase club marriot membership using marriot bonvoy points?

I don’t see any other Air miles conversion options other than just Vistara, is this just me?

You got look at TRAVEL EDGE then you will find it on a tab on that site .

I had the same problem

For Europe trips try Turkish airline. Book with star Alliance partner, it will give you best value atleast for europe.

I like United better. Its a Star Alliance partner too, plus the taxes are very low.

I don’t know how you calculate the same. I m travelling to paris this october from 12-18. If you book the same flight from united it will cost you (63,000 miles+ USD 75.74) but for turkish airline it will cost you (38,000 Miles + USD78.44). Almost 25000 less miles required in case of turkish air line.

I am getting the same at 60,000 miles. Am I missing something? TIA

Hope you are using the bonus of mile transfer on united right now 🙂

Currently one promotion is going for transferring hotel points to united miles.

for 30% bonus. I haven’t found any credit card transfer promotion. If any please let us know as I planning a trip to tokyo using partner booking on united for ANA.

Convert Amex to Marriot at 30% and then Marriot to United with 30% offer. Make sure you transfer 60000 Marriot points to united for maximum benefit.

For ~46k Amex points you get 35k United miles which is very good conversion value for Amex

Marriot to United offer ends Sep 30.

would you please be kind enough to elaborate how to go about it ?

Would love to learn something about the mile games.

Thankyou

Hello,

If we do rent payment using nobroker kr any other platform, is it counted towards 1 lac milestone? Could not find anything in T&C.

Yes Anuj, the rent payment counts in 1 lac milestone, and only wallet load is not count in achieving milestone points.. except everything included.

But point to note down, rent payment will not the regular points, i confirmed with axis Bank customer care. Thanks!

After reading this I wanted to upgrade to magnus card and I called customer care and asked them for upgrade and they told me axis Bank stopped taking upgrade requests or card type change requests completely.If I want magnus card I have to apply for it via fresh card application.Is there any other way to get magnus card other than fresh application? And yesterday I saw there was an upgrade offer from Privilege card to Select BGD card with no joining fee and no annual fee and upgrade to atlas card with 5000 fee.Should I get the select card with zero fees or apply for fresh magnus card?

How to check the milestone amount left on axis magnus ?

rent payment paid through paytm or freecharge will be counted or not ?

CLUB ITC IS MISSING FROM HOTEL PARTNERS LIST. POINTS TRANSFER TO ITC CLUB IS NOT AVAILABLE. BUT WHY?

Seems it is now at 20 paisa , the benefit is gone now. You get 1 point for every five points in miles conversion – did anyone check now? damp squib.

Seems the issue is sorted now.

Yes,but i found it a bit shady though , the correction happened immediately after i mailed them or its just serendipity.

Yes, I converted my points to ITC in the ratio 5:4, last night.

Yes, the issue is sorted. I am new to Magnus, got it this month. I was able to convert the acquired reward points today (30/09/2022) to Flying Blue miles at a ratio of 5:4.

Was it instant?

It was instant

Which airmiles are good to redeem? I have close to 68000 miles

Not able to transfer edge point to United miles.. keep failing. I tried multiple times. Customer care don’t seem to have an answer. Anyone facing the same issue??

For Club Vistara , does 1 CV points is equivalent to Rs. 1 while booking a flight using the CCV points ?

Hi what is the value of 1 airmile of AIRFRANCE . Is it equal to 1 rs?

Hi Siddharth! Technical question: How soon does one get the milestone benefit of 1 lakh spend on the Magnus card? As soon as the transactions cross a lakh or once statement is generated or some other day?

it will take 90 days , most cases it will get credited between 70 to 90 days

After 3 months

There are ongoing discussions about merging Vistara with Air India (ofcourse airasiaIndia and airIndiaExpress as well). Wonder what will be the impact on CV miles. And if Axis will provide Air India as a transfer partner.

Nevertheless, it’s not looking lucrative if Tatas continue with existing points ratio, because DEL-BOM one way requires 5000 CV miles compared to 10080 AirIndia FR miles. A mile in AI is worth a lot less than in Vistara, across routes. Similarly, flying international requires lot more miles in AI compared to Vistara for a given route. Vistara was one of the best transfer partners until now but points value will go down severely if AI merges it without improving its redemption chart (which it most likely won’t).

Vistara is showing at 5:4 which is good ! What other airlines are better for transfers in people’s experience? Please advise.

The Conversion ratio for Magnus to Vistara is given as 5:4 on axis bank site which means 25000 edge mile will give 20000 partner miles, however, on the vistara website, it is written that “ As part of this association, you can convert 5 Axis eDGE Rewards Points to 1 CV Point” what does it mean?? Does it mean Axis will give you 20000 partner mile & when you convert this to vistara CV, they will give you 4000 CV?? I also wrote a mail to Axis bank regarding this today and waiting for their response.

That conversion is via edgerewards portal (old system for CV conversions). 5:4 is via the new traveledge portal.

Did you ever tried this? Its crazy 24.4% return if we spend 1 lac on magnus if we can get 5:4 CV points in Vistara…

Vistara is the least crazy I would say.. there are many more options to transfer to that gives such sweet ~24% return. 🙂

Please enlighten us… i checked marriot but that is not a good option.. for Rs.5000 hotel, they charge 16000 points or so… what are the other options? Please share..

HI Sid, can you suggest some options. IMO, ITC is very good for the transfer.

Hey Siddharth,

There is a lot of confusion when it comes down to transferring of points.

You mentioned in one of your comments” Vistara is the least crazy I would say.. there are many more options to transfer to that gives such sweet ~24% return”

I see only vistara as a viable option to transfer my points. I request to make an article on the mile transfer. As you are the most experienced user of cards here and knows what would give maximum value.

It would really help this community to know which is the best partner airline to go with.

Thanks in Advance.

I have Axis Magnus Credit Card. I checked Axis Edge Rewards portal recently. The points transfer option was available only for Club Vistara and the transfer ratio shown was 3:1. I couldn’t locate 5:4 ratio. Has this been discontinued? If so it will be a big setback.

Pls check “Travel Edge” portal and not “Edge Rewards” portal for points transfers.

Hey Sid,

Did you got a chance to redeem airmiles through Magnus on any airlines? If yes, can you tell us how many miles u have incurred. If you some time, please give a latest hotel booking as well.

I am setting the targets and keep on accumulating the points, so wanted to be sure, if this is really worth it!

Hi Sid,

I have been following this article and the comments and applied for it. I got my card on 2nd Dec, but the expiry is nov/27. Does it mean i will be eligible for 1L spend bonus in dec too. With your calculation of expiry month + 1 , it does , but seems I am on a fence here, as the card was printed (as per cc tracker) on 30th Nov.

Your guidance will be really helpful.

Thanks,

Saurabh.

“With your calculation of expiry month + 1 , it does , but seems I am on a fence here, as the card was printed (as per cc tracker) on 30th Nov.”

I’m sure you’re not on a fence as per your stmt. 🙂

Cool, thanks Sid for the prompt reply.

@Siddharth “expiry month + 1 ” – is this mentioned anywhere in the T&C. I couldn’t find it. Can you please share the link to the page?

I’m the source for that tip. 🙂

Yes you will get milestone rewards for December month if u spent 1L above, as your card generated in November… same for me my card also delivered on feb 2nd but generated date is 29th jan and expiry date on card is jan, so i did 1L above translation on feb month i got my milestone rewards on may after completing 90 days….

For booking flights to Europe, transfer of edge points to which Airlines would be most beneficial? Does lufthansa make sense

is redgiraffe rent payments counted for reaching 1 lac threshold? or any other rent website?

I called up the customer service to specifically check this. They said it will be counted. But I am unable to use Redgirraffe with the Magnus. Tried adding the card to Payzapp and it doesn’t get added. I have raised a complaint 2 months back but it is not resolved yet.

I am using Nobroker and freecharge for now (the platform charges are slightly higher, but the returns are higher as well)

How are you planning to use Redgirraffe with your Axis card?

Hi,

I have got 50K points in my Axis Edge. I am using Axis Magnus. Wanted to know whether I should transfer these points or just keep it in my account. Is there a possibility that Axis might change the reward ratio or rollback the whole transfer of point thing in future without notice?

Any suggestions or opinion on the same would be great.

Thanks in Advance

Hi,

Can anyone confirm if Club ITC green points can be used for entire room rent, meaning can we use green points to pay taxes, complimentary breakfast and extra bed etc? or these should be paid out of pocket?

Yes, can use for anything!

How do you register on Travel Edge ? I just received by Magnus card today , and I’ve my customer id. However, I can’t wrap my head around the password as I can’t seem to register it anywhere to get the password.

Any help will be appreciated.

25K magnus points = 20K Vistara points. if spend 5L (1 lakh each every month) you get 100000 Vistara points. you can get 20 Vistara tickets on Del-Mumbai sector for that or 13 Delhi goa one way tickets. Is this True why would someone ever take Vistara Axis cards?

CV Gold tier.

Ppl also need points for ITC/Marriott as well. So some diversification. 🙂

Hi,

How many days does it take to transfer points to Qatar privilege program?

Anyone tried it?

Thanks in advance.

Hi Rohan

Can you let me know how many days it finally took

Hi everyone,

Is there any monthly limit on bonus edge points through Grabdeals or Giftedge ?

Plz respond !

IHG point transfer was done within 1 day.

Thanks for sharing Piyush.

Do you see any sweet spots with IHG redemptions? I hardly see hotels that gives value >50ps per point.

I alreday had some points earned organically. Transferred only a few edge points to be able to book a stay. Otherwise, you are correct. The usual value of IHG is ~0.50

Can you overall rank the below mentioned airlines in terms of value of miles, ease of redemption, flexibility (conversion/partner airlines/domestic redemption/expiry date/payment of taxes).

Qatar

Turkish

Etihad

Singapore

Also, what’s the best way to convert to miles? Direct Edge to Miles or Edge to Green to Bonvoy to Miles.

Turkish miles and smiles takes T+1 days.

Hello, Has anyone transferred points to Qatar(Avios) or British Airways? Any idea about their surcharges and taxes. Siddarth it would be nice to have an article to know the best airline value to transfer points and hotel from Magnus card. Can anyone provide tricks and get more value on this please?

Linking of partner Id is not working from app . As I have Magnus card but not axis Saving Account , I am not able to Link Partner Id like Marriott and Vistara for point transfer from Axis app at my iPhone . I do not have axis internet banking as I do not have saving account with Axis . Has anyone else also faced this issue . There is link button in app but it does not work . Is there any resolution of this issue

Hey Abhishek did you find a solution.

Hi Tanuj , I opened digital saving account and then use net banking . Now it’s resolved

You can go online on axis Bank website and do your registration with customer ID then you can access all features but only on computer not on mobile

is there any good deal going on with Turkish miles ?

Specially with 55k points

Converted air asia points. got points in airasia in 7 days. value of 1 airasia point is too low at 0.23 Rs.

Just transferred from Axis travel edge to Flying blue and it was instant.

Also transferred from HDFC to Lifemiles and that was instant too.

Booked 3 business class seats from Paris to Delhi on Air France for 192500 miles + 55000 INR which was a reward conversion of around 2.5 for each reward point. Good investment in my view!

3 seats at a time is nice!

And 192500 miles of what program and how’s the biz class availability in that program for this route from your experience?

How did you transfer HDFC to lifemile ? I see only CV, Kris & Intermiles for my DCB transfer. Which card allows Avianca Lifemile ?

I transferred from Magnus (Edge rewards) to Flying Blue – instant transfer.

It was showing availability all through May and June but only a few days had the lowest mile requirement of 70,000 per person.

For the date I booked, it was saying that 7 seats were available so thats great availability. The revenue rate for the three tickets was 5.5-6 lakhs so approx. value of 2.4-2.5 per reward point.

Out of all the travel partners of Axis (Qatar – stopover+higher number of miles, Turkish – lower miles but higher fees), Flying Blue had the most availability and balanced miles and cost requirement.

What route? Am assuming you are talking Business class

For these Hotel Transfers, Eg : ITC, Should we book the hotel through their channel to redeem it ? What is the best way to use the hotel transfer in case of ITC and Marriot?

Thats brilliant. Thanks Sidharth for sharing and thanks Pranav for sharing your very recent experience. Indian travellers experience is about to be elevated for sure. That too nicely ha*ked.

Accrued 2.4 Lac Edge reward points in 9 months of getting the card . Redeemed them for 1.5 lac Kris flyer miles for SQ 3 economy class return tickets Mum- Hong Kong and 2 One way tickets . Ended up getting 5 tickets with 1.8 lac points +Rs 20 K surcharge … This year’s travel plans made!! Started earning miles for Mauritius trip for 2024 🙂 🙂 keep the miles coming

I recently did a transfer of ~100k points to Krisflyer and booked scoot flights to australia. The value I got was ~60p per Edge Reward point. Its about 12.5% return.

Compared to infinia this is a less(16.33% or 5X based on spends) but need more analysis to see if per day redemption limits of infinia interfere with overall value.

60 paise per magnus point or per krisflyer points ?

As in, say you have 1000 magnus points so conversion into 800 krisflyer points…now did you get value of Rs. 480 or Rs. 600 on it ?

In any case, all this is purely subjective and would differ from case to case…i have till now been able to garner more than a Re returns from magnus points

from vistara,ITC & bonvoy..one of my friends got more than re 2.5 per magnus points by booking a ticket to europe..conversely..one of my friends got value of 40 paise per magnus points through bonvoy ( 5:4 conversion & then 50 paise approx per bonvoy point ! ) cause sometimes its more important for people not to spend from own pocket.

So you see, we need to gauge where we may maximise our return

Its 60p per Krisflyer point(1 cent essentially) which I guess translates to 54p per magnus point. Yes, it depends a lot on how we are redeeming as we get much higher when we travel to europe in flying blue(2-3 rs based on comments). I was looking to minimize spends from my pocket.

Guys can someone tell me if marriot , IHG and ITC points expire and if so after how much time?

Also, what is the point to rupees conversion for all these 3.

I am new to the premium card game so wanted to know since air miles conversion for domestic partners doesn’t look as lucrative with axis magnus.

Hi Sid,

If a ITC hotel is not bookable using ITC green points, can you reserve it with a credit card and then pay for it using Club ITC green points at check-in?

Yes, during check-out.

Anyway of knowing , how many Green points we would need at the time of check out ? Please respond

It’s 1:1 INR

Cool ! thankyou.

Normally , if we pre-book , the green points are worth more that a Re.

In this case , we need to pre book the room say for 10k and then settle the resultant bill of Rs. 11.8k ( GST included) by paying 11.8k green points or 10k points + GST separately ( as is the norm while booking through the green points ) ?

11.8K points but few hotels may not allow points for settling GST part even-though technically the system allows.

better get ITC elite culinare membership , for 24000 points , you can get 2 nights (redeemable , most of hotels) , along with lot of discount coupons for 1 year

ITC Culinaire is probably best way to waste money. If you see their exclusion list it is 2x or 3x the list of participating hotels. Most of the luxury hotels are excluded, most hotels at tourist destination are excluded. So for 24k (or 16.5K for 1 night) you can book at only the hotels which you’d otherwise get for 8-10k.

Taj epicure is much better value for money (That is if you see the pricetag of most Taj properties justified.) For 24K you can book 2nights at hotels which can otherwise cost you upto 15-18k per night. (sadly luxury once like Taj Mahal Mumbai are excluded)

I hope Axis adds Hyatt as a points transfer parner. No Indian credit card has been able to partner with them yet.

That’s not true, in the past HDFC Diners card rewards could be transfered to Hyatt. Though that partnership ended somewhere in 2016/2017.

Hi,

How do you calculate, the monetry value of a particular airline, Line in magnus we get 80% points of any airline or hotel partner, so do you have something like one can calculate how much return he or she will get if we are converting into this or that airline, for example if we are calculating for Club vistara, we get a good value of around 52% just calculated for a particular flight but i am not exactly sure if it gives that as an average, bt what specifically i am looking for is that do we have some maths and calc to which airline its the best to redeem points?

Its not 1 size fit all and every equation is different so u cannot put ur finger that this is the fixed rate of return..like for bonvoy points , i have experienced 80 paise and Rs. 2.5 rs…both at different times…same as vistara..once it was equivalent to Rs.1.2 & other time it was Rs. 1.9..both on delhi -kolkata sectors !

I hope u get the gist…its quite dynamic.

Example:

Flight you want to book price: Rs. 10,o00

Reward points required for that flight: 5000

Value per point: Rs. 2

It has to be searched flight specifically and there is no one size fits all.

Any travel partners allowing to do shopping purchase using points instead of travel.?

Any suggestions on which would be the ideal airline to explore using points to fly from Mumbai to Male?

Is there a way to book Indigo flights using Edge Miles through any partner airlines? Indigo has good domestic connectivity however I dont know of anyway to redeem our edge reward points

Hi Sid, Thanks for the great review guides on Krisflyer and Virgin Blue. Looking forward to Flying Blue as well 🙂

Amazing news, now 10% bonus in transferring 25k or more edge points to clubITC

Till when is this club itc bonus offer valid?

Couple with the fact that we need to transfer minimum 25k points ( translating into 20K ITC points) to get the benefit , 10% increase is hardly worth getting excited about buddy 😀

Hi! Axis magnus is in the name of my wife and I have CLUB ITC membership in my name. Can I transfer Edge points to my club ITC account. Is the linking possible or I have to make a new account in her name?

Same for other transfer partners also.

Please reply..

The name ought to match !

Create a Account in ur Wife name in Club ITC which is free. Then transfer the ER points from axis to ITC account. Then Request for TRansfer from ur Wife account to your ITC account to ITC Customer care.

Hi, Can Someone help me !!!

I transferred Axis Edge to Accor and purchased the Membership Accor Plus and the New Membership Number was provided but I am unable to transfer the Axis Edge Points to New Accor Membership Number.

Even if you transfer the points to the old accounts it will be credited to the new account. Try with 500-1000 points. It will work.

The subscription ratio of 5:4 is absolutely crazy for Accor group of hotels. Recently I exchanged 100k edge points to Accor all points. I received 80k Accor points.

Now in Accor, each 2k points are worth 40 Euro. Which is standard rate. Which translates to Rs 147k. Using them you can book any Accor group hotel.

It’s too good to be true. That why I feel now they are devaluing the card exchange ratio from 5:4 to 10:1 specially for Accor

Accor is a top transfer partner, it’s no secret. Only drawback with Accor is 12 month expiry if there’s no activity in account.

Dear Sid,

Any chance of accor itself devaluing the 2000 points = 40 euro in the future seeing the flood of Indian customers via magnus using points in Lakhs?

Can you purchase accor membership via points ??

Hi Siddharth, some of the axis bank credit cards have been devalued including Reserver credit card. I am able to find the revised T&C for those credit cards but not for Magnus. Is there any news on Magnus Credit card?

Just putting below some of the BIG changes/withdrawal of offers which used to make Magnus standout in the crowd. Changes are w.e.f. 1st September 2023:

Spends done on government institutions and utilities will not be eligible for EDGE REWARDS and annual fee waiver spend threshold.

The annual fee will be updated from INR 10,000 + GST to INR 12,500 + GST for customers on-boarded from 1st September 2023

Annual benefit of Tata CLiQ / Yatra Voucher worth INR 10,000 on renewal, will be discontinued

You can transfer EDGE REWARD Points to 19+ domestic and international partners* across airlines and hotels as per the revised transfer ratio of 5:2 (5 EDGE REWARD Points = 2 Partner Point/Mile).

Monthly milestone benefits of 25,000 EDGE REWARD Points on monthly eligible spends of INR 1,00,000 will be discontinued from 1st September 2023. Spends done in August 2023 will be eligible for monthly milestone, 25,000 EDGE REWARD Points for eligible customers in August 2023 will be posted within 90 days as per normal process.

Hi all,

I created a new ITC Club account and already had an old IHG One account(1 year old)

I requested a transfer of points from Axis Edge to ITC Club and IHG one rewards on 11th July.

I still haven’t received my points in either of these accounts, been 3 days already. As I read IHG should have been done in a day.

Is anyone else facing this issue?

Thanks

Hi Siddharth

I discovered your site last year when I started exploring the world of credit cards. Hats off to your painstaking research & insider tips which are difficult to find anywhere else!!

Whenever I want to know the true value of a credit card, its your blogs I peruse first.

I have conducted some research on Axis Bank Atlas credit card. The EDGE Miles feature seems lucrative, but it has an expiry date of 36 months.

The same is with the partner airlines, eg: Singapore Airlines. Krisflyer miles expire after 36 months.

Now my query is :

Assume I have accumulated 50000 points since Jan 2023, set to expire in Jan 2026. I also want to convert these to Krisflyer miles so that I get 50000*2= 1 lakh Kris miles. I want to then use these to get cheap business class ticket (cash+points).

If I wait till Dec 2025, one month before expiry, and then transfer all these points to Krisflyer, will my Krisflyer take that into account and expire all my miles in Jan 2026? Or will Krisflyer look at it as new miles earned & expire them in Dec 2028 (i.e Dec 2025 + 3 years)?

Kindly clarify as it is my dream to fly business or first class in Singapore Airlines one day, and this seems the best method to get there without burning a hole in my pocket!