Axis Bank not only has so many entry-level and super premium credit cards but also has a pretty good set of Premium Credit Cards like Axis Privilege Credit Card targeted for the cardholders who’re evolving from the entry-level segment.

Axis Privilege Credit Card used to be the secret sauce for many back in time when Axis Magnus wasn’t this aggressive. But even now it continues to be a card to hold as it’s being issued as First Year FREE for a limited period (31st March).

Table of Contents

Overview

| Type | Premium Credit Card |

| Reward Rate | 1% to 2% |

| Annual Fee | |

| Best for | Shopping Voucher Redemptions |

| USP | Multi-brand Voucher redemption |

Axis Privilege Credit Card is a premium credit card that gives reward rate of 2% easily without any complex earning/redemption rules.

And now that it’s being issued for free, it makes sense to hold one, as long as you’ve a free slot with Axis, as Axis allows only 3 credit cards per individual.

Fees

| Joining Fee | – Paid Card: – FREE Card: for Priority A/c holders |

| Welcome Benefit | – 12,500 Points on PAID cards (5,000 INR worth) – 6,250 Points on FREE cards (2,500 INR worth) |

| Renewal Fee | 1,500 INR+GST |

| Renewal Benefit | 3,000 Edge Rewards |

| Renewal Fee waiver | on spends of 2.5L in previous year |

The welcome benefit is amazing even on paid cards, as you just pay 1.5K INR and get 5K INR worth of vouchers.

The value of points are assumed as 40ps/point (in above calculation) because of the ability to redeem for multi-brand vouchers. We’ll see other options later below.

*** Limited Period Offer: First Year FREE ***

Design

The design looks neat and simple but I continue to wonder why they didn’t refresh Axis privilege credit card’s design while they refreshed the design of almost every other credit card.

Maybe they want to discontinue? I assumed so, but now after seeing them going aggressive with Zero Joining Fee offer on this card, it’s only surprising!

Rewards

- 10 Points per Rs.200 Spend (Domestic & international)

The earn rate is simple and straightforward. To make the math simple, you earn about 5000 Edge Rewards on every 1L spend, which is pretty good because of the redemption options, as you can see below.

You may as well use Axis Privilege Card on Axis Gift Edge (or) Axis Grab Deals portals to earn 5X/10X rewards.

Redemption

There are multiple options to redeem edge rewards, broadly divined into two (+1), as below:

| Redemption Type | Product Type | Point Value (Per Point) | Reward Rate |

|---|---|---|---|

| Edge Rewards | Catalog Vouchers | 20Ps | 1% |

| Edge Rewards | Multi-Brand Vouchers | 40Ps | 2% |

As you can see above, the point value is pretty good with multi-brand voucher redemption. Here are the multi-brand redemption options:

- 6250 Points worth 2500 INR multi-brand voucher

- 12500 Points worth 5000 INR multi-brand voucher

If you’re wondering about the brands that are redeemable under Multi-brand voucher, here is the list of available brands as seen few months ago. The list might keep changing from time to time.

But remember that you’ll need to have either 6.25K/12.5K points to be able to redeem for these options as this behaves more like Amex Gold Collection.

That said, if you’ve other Axis super premium cards like Axis Magnus, you may as well transfer these points to variety of points transfer partners to increase the value even further.

Airport Lounge Access

- Complimentary Access: 2 per Quarter (domestic only)

The complimentary lounge access benefit on Axis Privilege Credit Card is limited to only domestic lounges with above limits.

While it doesn’t give access to iconic lounges like Bangalore 080 lounge, the card is accepted at across 29 lounges across the country, which is pretty great given the fee point at which it’s issued.

My Experience

I was using the Axis Privilege Credit Card for quite sometime until the launch of Axis Points Transfer program and I did get pretty good value out of it.

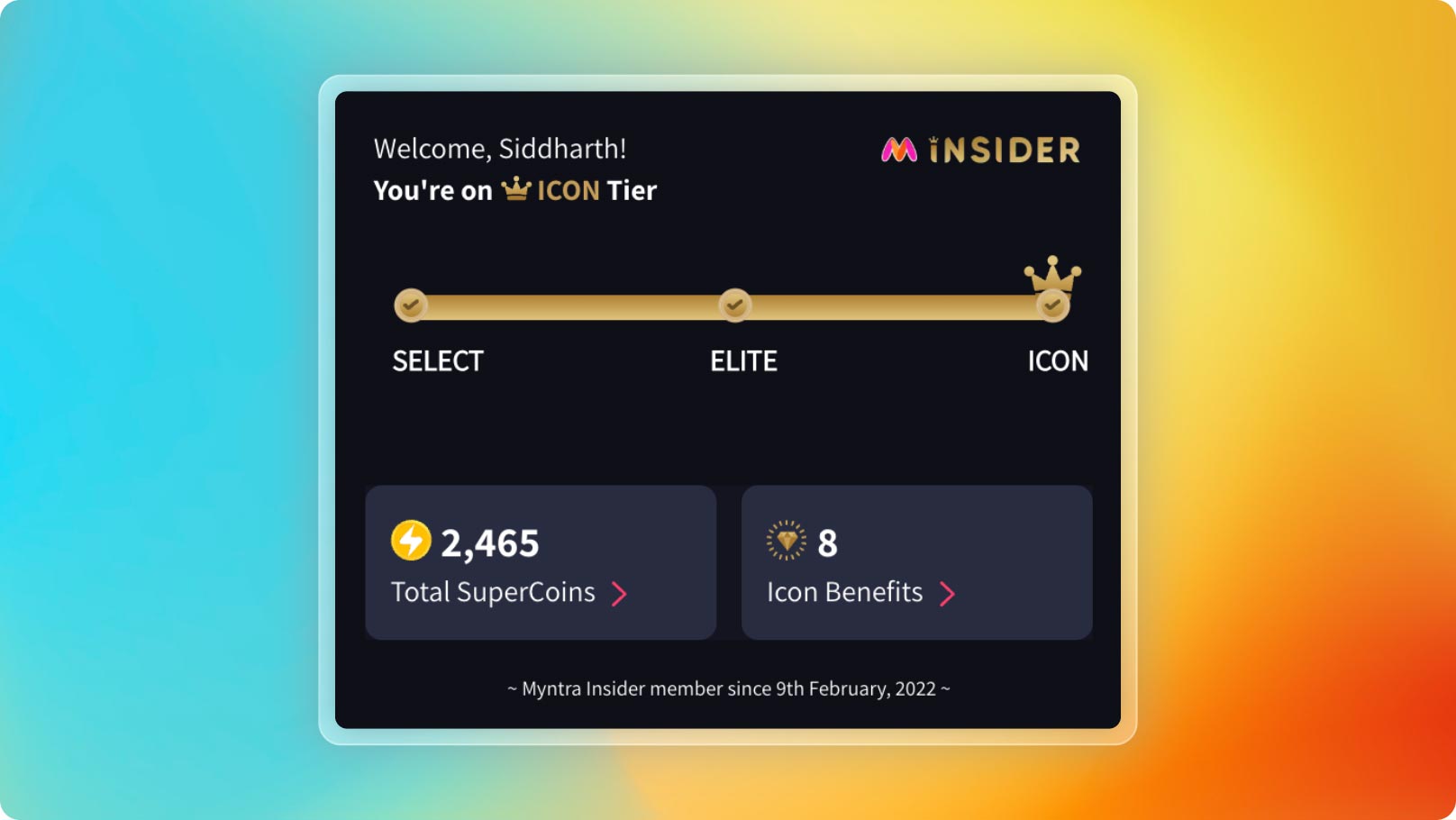

For example, I used to redeem edge rewards for Myntra Vouchers (Multi-brand voucher option) and get to Myntra Icon tier faster, which has decent benefits.

This further helped me to earn even more “super coins” and redeem them for vouchers & memberships.

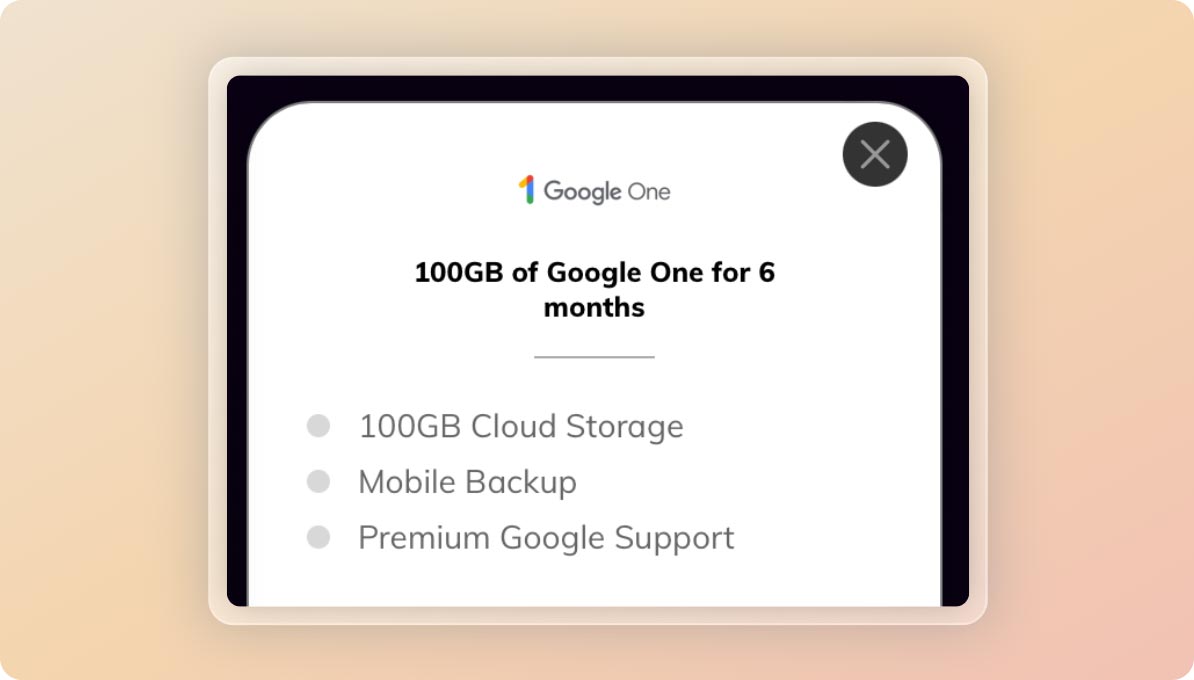

For example, I redeemed some of the Super Coins for “Times Prime membership” which gave me access to a complimentary 6 months “Google One” subscription plan, which gives 100 GB space on Gmail.

That’s a great value to me as I was in need of additional space.

While these may not sound like much value in front of today’s Magnus Credit Card benefits, it was indeed fun back in time to use Axis Privilege Credit Card.

That said, the benefits are still there and would continue to make sense to those who don’t want to pay a fee to hold super premium credit cards or don’t prefer travel redemptions.

Eligibility

- Eligibility via ITR: >6L INR income p.a. (or)

- Eligibility via other bank credit card: Credit limit >1L INR

If you’re facing any issues (or) if you prefer to have a smooth ride into Axis Credit Card Ecosystem, do check out this beginners guide to Axis Bank Credit Cards: Maximizing Axis Bank Credit Cards.

How to Apply?

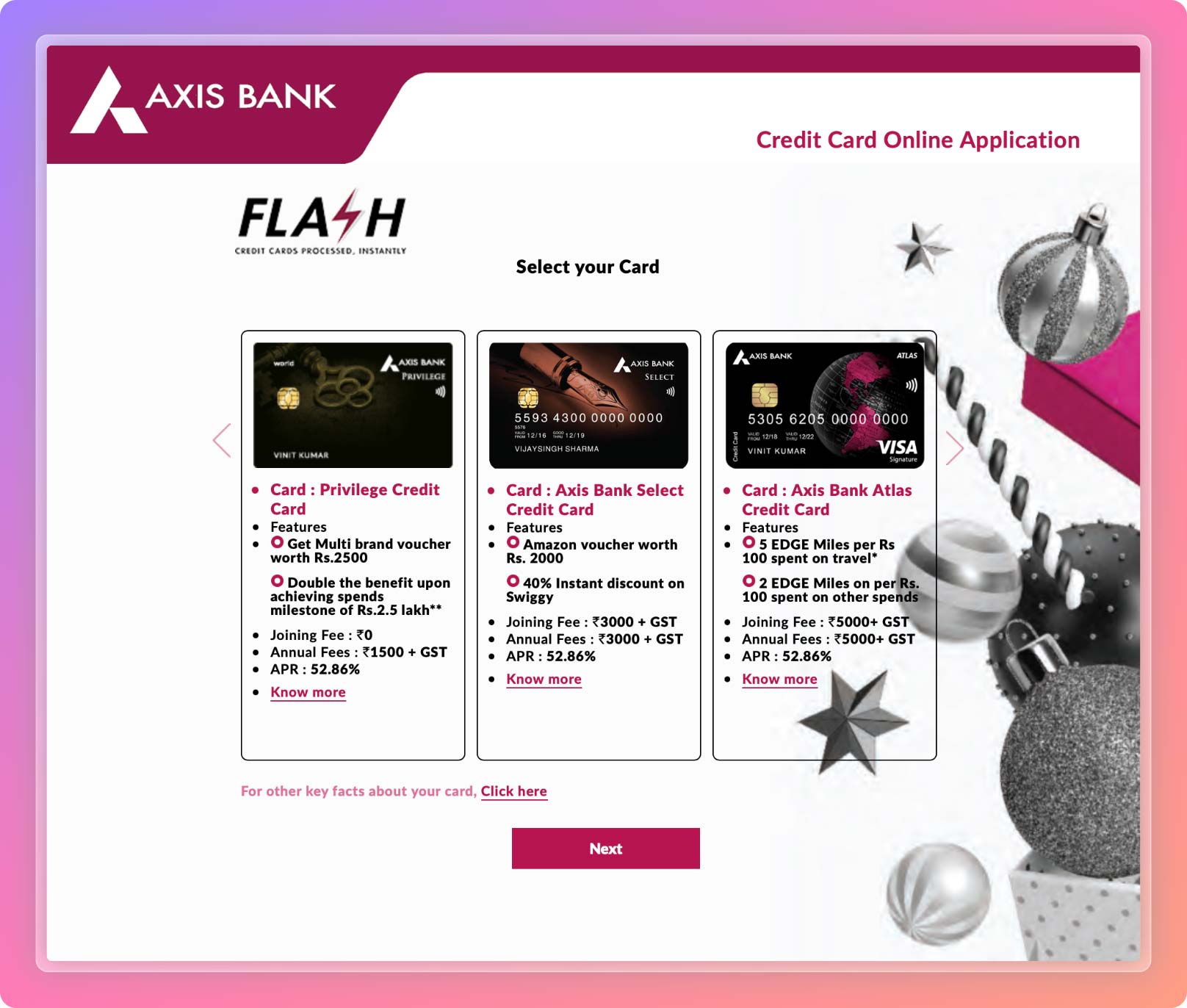

You may apply online on Axis Bank website in a matter of few clicks. Axis Bank is recently known for processing fresh credit card applications pretty fast.

The card is currently offered as first year free, but whether you’ll get 6,250 points as welcome benefit is a mystery. Most likely you’ll get, as that’s how it’s ideally designed.

But the “First Year Free” (till 31st March 2023) benefit is a confirmed one, as I can see it displaying on the website as well, as below:

Generally Axis Bank takes about a week to approve the application. If the profile has healthy credit report, you may as well get the card in hand in under a week, as some profiles may go through VKYC and faster processing.

*** Limited Period Offer: First Year FREE ***

If you’re new to bank, not to worry, you don’t need to open a fresh Axis Bank Savings A/c to get an Axis Bank Credit Card.

Bottom line

- Cardexpert Rating: 4.2/5

Overall Axis Privilege Credit Card is indeed a decently rewarding credit card for those who prefer shopping vouchers over travel redemptions.

But if you’re into Axis travel edge redemptions and already hold Super Premium Credit Cards from Axis Bank, then it’s no wonder that Privilege does add a good value with it’s welcome benefit.

Have you ever held an Axis Privilege Credit Card? Feel free to share your experiences in the comments below.

Any reference for it being LTF for priority account holders. I have a priority account, but it is showing with annual fee.

I guess it’s FYF for priority a/c holders too. I got the card when I was holding priority a/c but still charged because the pricing was not updated while processing the application. So need to verify with sales/KYC guy before processing it.

Not as of last quarter. I am also a Privilege A/C holder and was offered this card FYF but they refused to budge on the renewal (they offered edge reward points which I wasn’t interested in)

Ultimately, I asked to cancel but retentions offered the Myzone Card for LTF.

In retrospect, was a better tradeoff as Myzone has given me more value in terms of Movies+Swiggy etc.

I think axis ace is a much better option. Minimum 2% cashback and 5% on bill payments via Google pay.

Since it is cashback no hassle of point redemption or selecting vouchers etc. Even the annual fees is lower.

Am I missing something?

Yes ACE is ace. I too don’t see a point where this privilege card is better than ace.

Hi Sid, How Many Active Axis Credit Card you have. please mention it. Branch official say one person 3 credit card allow.

I never had more than 3 at a time.

Thanks Sid, good to see you cover one of the old decent credit card from Axis Bank.

BTW, do you know if Axis Bank encourages/approves of any credit card consolidation wherein I have multiple Axis Bank cards (all LTF, in premium category) to something LTF super premium (Magnus/Reserve etc.).

Perhaps asking for lot 🙂

I don’t think anyone does it in the industry. Nice out-of-box thinking though. 😉

Glad to pour in one idea in the melting pot 🙂

Hi

Any idea if the limit on grab deals if per card or per mobile number or per PAN/account holder?

To elaborate, if I have magnus and previlige, can i use both to max the grab deals offer separately or is it a collective limit?

thanks

Very important question, for which I don’t have an answer either. Let’s see if someone has hand-on experience in using multiple cards on Grab Deals.

I’ve been holding 2 Axis cards. So far it’s been separate accounts. Used to max out grab deals cash back on both cards separately

Thank you for this confirmation, Kannan.

Insurance spends will not be eligible for EDGE REWARD from 5th March 2023 onwards. Hence it’s not a must have card for me. Will discard in coming months.

Magnus & Reserve does get points on insurance, only wallet & rent are excluded. So I guess Privilege too would get it.

Are you sure Magnus gets rewards on Insurance? I called axis customer care today and he told otherwise

Is this card better than SBI Prime, in your opinion?

Prime is bit different. Privilege serves multiple segments.

With Privilege you’re on profit just for getting the card. And if you link with Magnus and transfer to miles, that’s huge value and can’t be compared with Prime.

Grab deals offers are separate for separate cards.

Even I got the privilege of applying privilege cards two times and got joining benefits 2 times (2nd card after an year of closing 1st card but with very valid reasons accepted by the CC/bank). Thinking of applying again. BUT have no reason to close existing one, while my MyZone card is eligible for upgrade to Privilege card for long time now.

Axis launched Flipkart super elite card. May be a review is useful.

Do you have a reason as to why you would go for it?

16 supercoins (12+4) per 100 spent, capped at 400 supercoins (300+100), for plus customers. Maybe ok for large number of small purchases i.e. upto Rs2500 . Considering supercoin value as 0.75 to 1, the benefit is 12-15%. Axis has come up with so many entry level cards. There’s already unlimited 5% cashback of Axis flipkart card (which also fetches 4 supercoins capped at 100). Then there’s myzone card. There’s airtel axis card which is FYF at the moment, with 25% cashback on airtel payments (cap 300pm), 10% on utility bills (cap 300pm), 10% on swiggy, zomato, bigbasket (cap 500pm), with extra 5% neucoins in case of bigbasket, and lounge benefit. Generally all these cards come with annual fee of 590.

This is card is underrated. 16 super coins are worth for 16 rupees if you book flight/hotel tickets via ClearTrip. That means 16% cashback.

Sadly, they won’t issue this card if you already hold Flipkart axis credit card

Hi Siddharth,

I hold 3 Axis credit cards:-

1. Axis Bank MY Zone-LTF,

2. Axis Bank ACE- chargeable &

3. Axis Bank Signature Credit Card with Lifestyle Benefits-LTF. I am getting an offer to upgrade this card to Axis Bank Privilege with a Joining & an Annual fee-Rs. 1500/- Is it worth an upgrade?

Axis Bank Signature Credit Card with Lifestyle Benefits features:-

1. BMS movie tickets BOGO upto Rs. 250/-, twice a month with an additional 50% cashback on amt. paid.(Cashback limit upto Rs. 2000 per/yr.)

2. Domestic Airport Lounge access- 2 per/qtr.

3. 10/20 points for every Rs. 200 spent on Domestic/International spends.

4. Swiggy offer- AXIS200, 40% discount up to Rs 200, twice a month.

5. This card was issued by an Invite & is LTF.

I do not see any major difference apart from being a chargeable card with few coupons for which we are only paying. What do you suggest?

Hi Siddharth,

What do you suggest on Axis Bank Privilege card upgrade from Axis Bank Signature Credit Card with Lifestyle Benefits as mentioned by me?

It’s a old product but Swiggy offer looks good on it. So you may stay with it if it’s LTF.

Thanks Sid & Darsh.

If I was in your position, I would stay with Signature Card and that too it’s LTF. Apply Privilege for family member if you get FYF next time.

4. Milestone benefits doesn’t have utilities and insurance as exclusion but ER points earning has. Now assume I spent 2.5L on utilities and insurance only so I won’t get any points. Without points how can I redeem against the multi brand vouchers?

I have this card under pre-approved section, however i have 3 AXIS cards MyZone, ACE & Flipkart mostly these cards are giving more or less same benefits. Over and above the pre-approved offer comes with both Annual & Joining fees of 1.5K – Do you suggest having this card in my wallet.

I closed this card last week. It wasn’t free for me. I use Amex Travel Plat (L1), Diners(L2), and then SBI simplyclick(L3). I didn’t find any benefits worth paying the fee for. I do use Axis MyZone on Swiggy which is LTF.

Which credit card would you suggest for approx 7-8 lakh annual spend. Out of this 3 lakh is school fees spend. Till now i was using SBI cashback card which was giving 5% cashback. Now that cashback is discontinued. So i looking for alternatives.

hi!

Whats the reward rate for privilege card. At many forums I see as 4% but I see it at as a meagre 2%. Rs.2500 voucher on spends of Rs.125000 or Rs.5000 voucher at spends of Rs.250000. And 2% is not that great…

Am I missing something?

4% when transferred to points, works when you’ve other super premium cards linked to the ac. But ideally you wouldn’t do this way, as you would anyway get 4.8% or more with Magnus if you spend directly on respective cards.

Received today for PRIVILEGE Credit Card holders:

from 1st September 2023:

Annual benefit of 3,000 EDGE REWARD Points on spends of INR 2,50,000 will be discontinued. You will continue to receive fee waiver of INR 1,500 on spends of INR 2,50,000 in the preceding card anniversary year.

This card is now launched in Amex. What is the take on this? Is it the worst of both worlds with very limited acceptance