HDFC Bank was having the Diners Premium Credit card for a while before which they decided to replace it with a superior version and brand it more of the frequent traveller’s card by adding the badge “miles” to it. That’s how Club Miles was born.

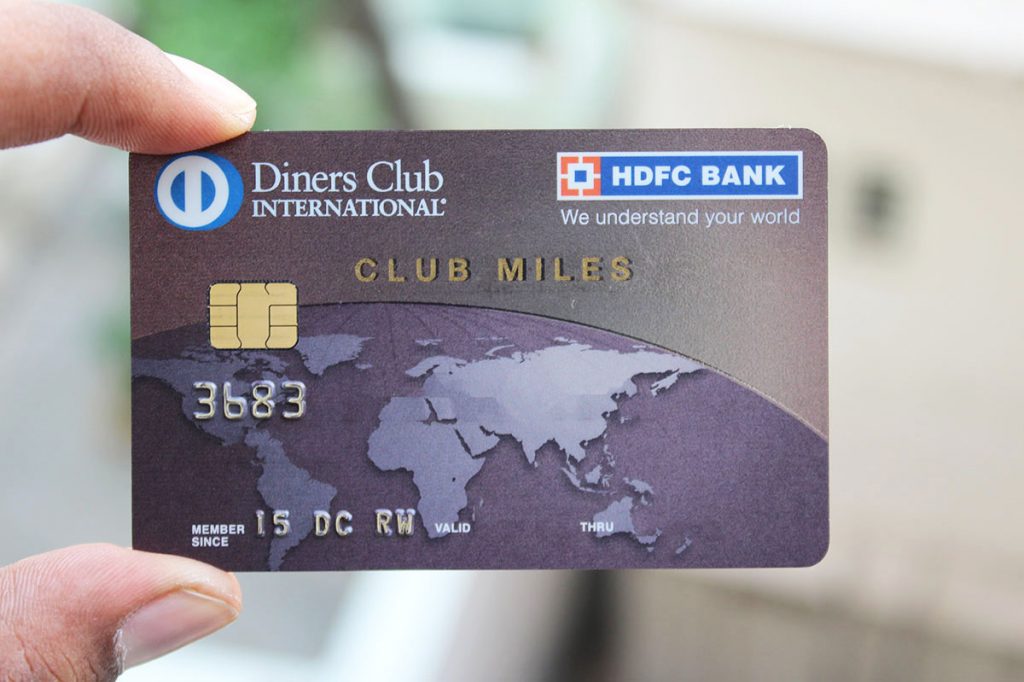

Before we get into the review, I should say, it is one of the best good “looking” cards around. Its design, along with the numbers printed in golden colour makes it looks elegant. Now, let’s see if the card rewards as good as it looks,

Table of Contents

Joining Fees

- Joining/Annual Fee: 1,000 INR+GST (First Year Free usually)

- Welcome Bonus: 1000 Points (if fee is levied)

- Renewal Fee waiver: Spend Rs. 1L in 12 Months

Almost everyone I know of got the card as either First Year Free or Lifetime Free but as HDFC no longer issues LTF cards, you may expect First Year Free offer without welcome bonus.

Reward Points

- Earn 4 Reward Points for every Rs. 150/- spent

- 1 RP = Rs.0.50 for Hotels/Flights (1.3% Reward Rate)

- 1 RP = 1 Airmile with Singapore Airlines, British Airways, Vistara (~2.6% Reward Rate)

- Accelerated Rewards: 10X Rewards (13% Reward Rate)

The major advantage of the card is its ability to convert reward points to Airmiles at 1:1 ratio which doubles your reward rate as long as you know how to get Rs.1 or more value out of the reward points.

Ideally, converting to Vistara is the easiest option as you get min. of Rs.0.75/Mile and if you redeem the CV points during offer period, you can get much more value.

Airport Lounge Access

- Domestic & International: 6 Complimentary access / Calender year

- Above limits are shared with add-on cards as well.

Remember that the credit card itself gives you access to lounges both within India & in foreign countries, so you don’t need to deal with another set of plastic.

Also, as Delhi & Bangalore got separate section for Diners Cardholders recently, it makes sense to hold a Diners Credit Card.

Other Benefits

- Foreign Exchange Markup fee: 3% + GST (get additional 1% cashback by enabling Global Value Program)

- Credit Shield: 9 Lakhs

How to Apply?

- New Application Eligibility: >3.6 Lakh Annual Income (Branch/Online)

- Upgrade: Limits above 1.5 Lakh on existing HDFC card with good spends would help.

Its relatively easy to get approved compared to the Visa/MC equivalent variant Regalia.

Note: Not to forget that the Diners Club network has acceptance issues especially outside India, so its safe to have a backup visa/mc.

Bottomline

- CardExpert Rating: 4/5 [yasr_overall_rating]

Overall an amazing card for a fee of this range. For those who’re unable to make it to Diners Club Black, this card serves the purpose and if you’re someone exploring airmiles, this gives you amazing return, almost close to a super premium card.

If you think this doesn’t meet your needs, you may check out the newly launched HDFC Diners Club Privilege which betters the Club Miles variant in few aspects.

I’m sure many of you here are holding this card, how are you redeeming the points: regular hotel/flights or Airmiles?

Siddharth brother:

1) Even Dinners black has the option to transfer to Vistara,Krisflyer,Avios right!

2) is Intermile still a transfer partner for Dinners black?

3) “Also, as Delhi & Bangalore got separate section for Diners Cardholders recently, it makes sense to hold a Diners Credit Card” Can you say little more on this bro ?

4) If possible write about what is the difference of benefits we get on club Marriott membership when we buy it for 12k and when we use it via Diners black. Is a lowered version and those stuff. Will be helpful.

1. Yes

2. Forget it as intermiles value is as low as ~30Ps

3. Haven’t personally been there, so I’ll let others to share

4. Let me see if I can gather some info on this. Or maybe others can comment

Nandri brother 👍🏻👍🏻

3. The Plaza Premium Lounge at Delhi T3 is expanded and now divided into 2 sections.

One section is for Visa/ master Cards.

Other One exclusively for PP/Diners/ Amex with bigger food spread than the first one.

Good to hear. The Plaza Premium had been getting way to crowded lately.

Hi Sid,

A little correction, Club miles has 3% as forex charge compared to privilege card’s 2%.

Updated, thanks.

Is it worth if i have the Regalia card?

Yes, I think so. Diners ClubMiles is same level as Regalia but has 1:1 transfer to airlines and 10X. Just have a backup Visa/MasterCard giving similar level rewards.

I have regalia first and hdfc preferred banking, however having a hard time upgrading to regalia. Thinking if I should upgrade to club miles, as I pay rent via red giraffe. Hdfc said it’s possible but only as paid card if I’m opting for diners cards. Will upgrading to club miles increase chances of getting regalia? Or is it only useful in going up in diners cards like diners privilege /diners black

There is no strict rule on this, but generally not suggested to get into Diners if you need Regalia.

Hi Sid

Started my credit card journey with the HDFC Moneyback card with a credit limit of 75 k in 2017 upgraded it Diners club miles after 9 months with the same limit in 2018 . Recently before 2 months my credit limit was increased to 1.5 lcs . Quick question I received my first credit card without any income proof till date since i hold a savings account from the past 6 years. What are my options to upgrade to higher variant card if possible ? I do not have a source income in India because I’m based abroad would that prevent me to upgrade to a higher variant card like DCB ?

PS : I hardly use my credit card & even when i do it’s usually 5 – 10 % of credit limit & have a CIBIL score of 830 + consistently since 2 years .

Cheera

Hi Anna ,

I have regalia first , salary account with hdfc.

I figured out that Clubmiles(1.3) had relaxed eligibility but better rewards than RF(0.8)

And Diners 10X is also catching my eyeballs.

I had a belief that CM was in same pool as Regalia and reached out to the bank guy.

He said RF cannot be “downgraded” to CM . But CM gives better value.

Any idea on how to get CM from RF?

And Thanks for this wonderful blog anna.

My Best Wishes to You!!

Its funny when in Nov 2019, I accessed the new lounge section for a morning flight, had to switch between the lounges since ‘Live Egg Station’ was only in the Visa/Master holders section. 😛

Hope this has changed now !

Last week when i accessed Lounge for International terminal at Chennai I was denied access at I Guess Gate 11 TFS holding Diners Black. It was way too big very Posh,as well as was a business class lounge for some airlines. Person at reception said that credit card swipes are not allowed and is only for priority pass holders and business class ticket. I was asked to go to some basement next to gate 16 which was 1/4th of the size . Even though food was good I am not happy since diners site still mentions that gate 11 lounge. People even with Rupay platinum has access to gate 16. So what exactly is special with Diners Black when it is made equal to Infinia.

Did any one else had this experience with International terminal in India other than chennai ?

Hi Siddharth,

Holding Citi, AMEX, ICICI& SBI with decent limits and Cibil of 775. I want to try my hands on a HDFC Card confused between Regalia First and Diners Club Miles. Can you suggest which will be better in terms of rewards.

Thanks

Hi Siddharth,

I dont think with DC miles you get lounge access for add on card holders. Ignoring that aspect, this is still a very good card.

Hi Sid,

I’ve just been approved for diners club miles card on LTF with conditions on transactions for the first few months, so yes HDFC is still passing on these cards as LTF.

As long as you keep spending more than 1 Lakh in an anniversary year , it will be LTF for you , same goes with 5 lakh spending on DCB and 8lakh on infinia

I also got it and the executive told me that if I spend Rs 500*4 for the first 3 months it will be converted to LTF.

Hi Siddharth, thanks for the write up. I have spent 3lac in a year but trying hard to get upgraded to diners black 🙁 any suggestions on how to get it done, it got rejected ever after request through RM. And additionaly will it make sense to transfer miles to krisflyer instead of vistara if travelling in SE Asia? Because even club Vistara allows miles to be redeemed for singapore airline flights

CV points for SQ miles would be too expensive. You could look at the award charts & decide.

SQ miles have easily 1-1.2 Rs/mile value. Vistara miles have very low when redeeming for Vistara flights after the August 2019 de-valuation. Vistara miles have terrible value when redeeming for SQ flights. If you are flying SQ, it will be much better to buy those tickets using SQ miles. You can look at the charts & decide.

Great that makes sense, I just researched and compared the fare charts, club vistara redemption on SE Asia routes are decent say 30k miles because krisflyer needs 18k for economy saver(where seats are less) and 37500 for economy advantage fares. In vistara its constant for 30k miles. In krisflyer if you redeem any fares for economy advantage you are entitled for a complimentary stopover in layover is more than 6hours.

I have an HDFC Diners Clubmiles.

And I want the same for my wife too.

As she’s not working, we’re unable to apply via regular process.

Is it possible If we apply with either an FD or opening an account with HDFC bank ?

If yes, what amount of FD can help ?

Or which Savings account ?

If any other way, also welcome !

The local branch people don’t guide clearly.

Your advice would help.

Regards.

The FD requirement for this was 150k.

How much fd is required for dinners black.having club mile with 3lac limit.

FD for DCB maybe in the range of 625k-670k.

Hi,

I own a diner club miles credit card for past 6 months. I don’t travel a lot. I redem my reward points for cash redemption and products. Which is the best card suited for me in hdfc. I use mostly for purchase in online and offline. Suggestions please.

This card is no longer available. The change has been confirmed in 2 HDFC branches in Delhi.

Dincer Club Miles and Regalia First are no more available (as told by bank guy).

Diner Club Miles is also removed from hdfc diners portal.

Yup you are right.

then what are the alternatives?

Hi

Does contactless feature work on Diners Club miles? It does not seem to work even on HDFC machines. it does not work for primary or supplementary cards. I even got the card replacced, it still does not work,

Anyone experienced this?

It doesn’t work even on Diners Privilege ! I ask everytime to make CL payment but it doesn’t buzz at all. Finally i need to dip !

It all started from last monday16th when RBI issued fresh directives regarding credit/debit cards usage.

I have HDFC credit card. Very bad customer care service. I Call many time but not talk with customer care executive. No response about my query. But they call for extra paid services.

I have HDFC credit card. Very bad customer care service. I Call many time but not talk with customer care executive. No response about my query. But they call for extra paid services.

Can anybody pl elaborate on sharing lounge access with add on card holders?

1. I have one add on card. Does it mean we both can take compl lounge access together?

2.whether total sealing limit is 6 per year per each card or 6 pee year altogether.

Whether renewal fee waiver spending min requirement of rs 1 lakh per annum is per card basis or altogether?

Yes .. please elaborate on this point if possible.

Hi Sid & other Frequent Users! I have a LTF Millennia Card which I don’t use at all. I mainly use Axis Ace and Amex MRCC. The rewards system of Millennia is convoluted and I think my points will end up expiring before I accumulated enough (2500) for Statement Credit. I was wondering if I should switch to Club Miles instead. Please share your opinion on this… I also have a Preferred Account with HDFC but they aren’t giving Regalia LTF.