This is an article contributed by one of our reader Praveen Katiyar.

We all pay for some or the other insurance (Vehicle/ Health/ Life Insurance etc) annually, and this is one expenditure that’s there and who would not like to earn Reward Points (RPs) and free credit period for this necessary expenditure.

Lot of credit cards do not provide RPs on insurance payment, some do provide but with upper caps. In this article my attempt is to summarize the strategies for earning maximum RPs for insurance payments. Feel free to share your experiences of earning RPs for insurance payments.

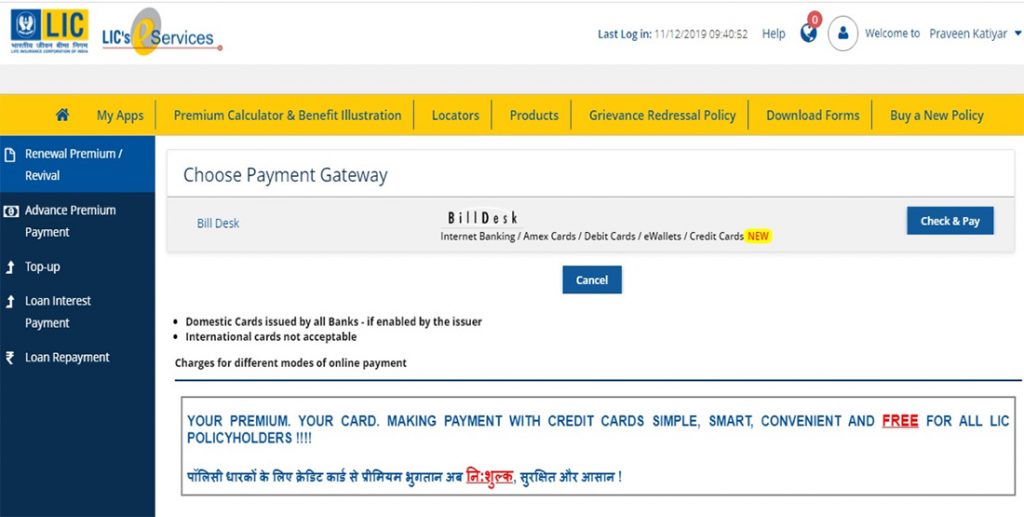

Before we get into the list, do note that beginning 1st Dec 2019, LIC removed all the upper payment limit (on a single transaction) and convenience fee on payments, made using credit cards as seen below,

I have not encountered any convenience fee on payment made to other insurance provider (Barti Axa/ Sriram Gen Insurance etc.) as well when using Credit Cards.

So now this brings us to the question that if no convenience fee is levied on insurance payment, which are the best credit cards to pay insurance premium to earn maximum RPs.

I would like to simplify the answer to this question by categorising it, by credit card ‘Issuing bank’ wise and also card-wise (important ones) wherever possible,

Table of Contents

HDFC Bank

- Diners Black/ Infinia: Maximum cap of 2000 RPs per txn & 5000 RP’s per day for Insurance payments.

- Other HDFC Cards: Maximum cap of 2000 RPs per day for Insurance payments.

Apart from this, they also run 2X/5X Reward Points promo on insurance once in a while.

SBI Cards

- ELITE: 2 Reward Point/100 spent (0.5% in value)

- Prime: 2 Reward Point/100 spent (0.5% in value), you can earn 20 Reward points/100 on Standing Instruction (capped at 3000 points/ month)

- IRCTC Card: 1 Reward Point/125 spent (0.8% in value)

Elite & Prime may make sense as it also helps to reach milestone rewards which raises the reward rate.

Axis Bank

- Vistara Credit cards: as per the card variant, which is as grand as ~10% on Vistara Infinite credit card

- Axis Privilege Credit Card: 2% as Travel vouchers

- Axis Flipkart Credit Card: 1.5% as cashback without any capping.

For most regular & premium credit card users, Axis gives the best returns on insurance spends as these cards are linked with handsome milestone rewards.

ICICI Bank

- EMERALDE / CORAL / RUBYX / SAPPHIRO: 1 PAYBACK Point/100 spent (0.25% in value)

- Amazon Pay Credit Card: 1 % back as Amazon Pay balance (1% in value)

While Amazon Pay credit card might seem the best, Emeralde also may work out good for some as the annual fee is waived on 15L spend. Good for those who have high insurance spends.

Standard Chartered

- Ultimate: 5 reward points/150 spent (3.3% in value)

Yes Bank Credit Cards

Yes Bank gives RPs for Insurance payments based upon respective card earn rate. For example

- Yes First Exclusive: 6 RPs/100 spent (1.5% in value)

- Yes First Preferred: 4 RPs/100 spent (1% in value)

Both comes with milestone rewards as well, so that may help to raise the return a bit.

American Express

Amex does not give RPs on Insurance payment but you get milestone rewards for example with Amex Platinum Travel Card. They also sometimes come up with offers like 5X Reward Points with caps on Insurance spends.

You may also use Amex cards to load wallets and pay insurance from there. This way you get points even with Amex Cards. Feel free to load in multiples of 1000’s and grab the monthly bonus on Amex MRCC.

Bottomline

As you see, you’ve a lot of options to choose from the list. However this may keep changing every year for various reasons. Ideally most of the credit cards with Milestone benefit may still be there so you may avail those benefits even if a bank removes the default earning rate.

That said, which credit card do you use for Insurance payments? Feel free to share your experiences in the comments below.

Great info…

A couple of points one can get points on Amex cards by simply routing the payment through wallets (PhonePe, PayTM and the like).

Also isn’t HDFC’s cap on a per month basis rather than a per day basis?

Updated the info reg. Amex.

HDFC – used to be like that but they changed it a bit few moths ago on few cards I guess.

Axis bank flipkart card 1.5% return with no capping on insurance payment.

Thanks, added to list.

Great article.

Sid, won’t SBI Simply click also give 1.25% in value?

@MrNightStar

Correct SBI SimplyClick does provide 1.25% on online transaction.

DCB/Infinia has 5k RP upper cap, what is the source for this?

I have gone through MITC on website (Dec 2019 version). This comes from there.

Cheers 👍

“Reward Points/JP Miles accrued for insurance transactions will have a maximum cap of 5000 per day for Infinia & Diners Black credit cards and 2000 per day for all other credit cards.”

Guys, please which is best value card(in terms of rp or cashback) to pay annual insurance premium of around 65000. Please suggest? Many thanks in advance.

@Deepak

HDFC Diners Club Black(DCB), HDFC Infinia & Stan. Chartered Ultimate tops the list with 3.33% reward in form of RPs.

Go through the articles on individual cards to know more about how to redeem RPs for max. reward %.

Hope it helps.

Hi,

Does policy holder & card holder need to be same for rewards/cashback? Will i get reward points for family members payments?

Regards

There is no link between the policy holder and card holder for RPs.

Yes you would get RPs for payment made for family member policies too.

Major issue with HDFC Diners is acceptance on portals :/

Tried paying my Tata health insurance yesterday itself but not able pay. Any work around it? (Around 40k)

Planning to use SCB Ultimate for same now I guess. (Have yfe, amex MRCC, sbi irctc, icici amazon, etc but DCB is best by far)

SCB Ultimate is giving u same RPs. Redemption may be a different story though.

What are current redemptions on SC Ultimate like ?

@Praveen,

Yep, base benefit of RP same on SCB vs DCB.

But DCB has bonus of 5k + monthly rewards.

Anyway, doubt can do much about it

SCB redemption options not that great these days. No amazon vouchers or such.

Some readers suggested using PhonePe/Paytm/Amazon for insurance payment.

As far as I can see, Amazon.in works fine for Insurance payment.

Do give it a try and let us know.

Hope it helps.

Sid,

Wasnt DCB/Infinia capped at 2k ? If its 5k then awesome.

Also, you could mention Citi PM/Prestige ( same way as Amex).

Esp Prestige with Citigold 30% bonus would make it a sweet deal.

@Neo

Citi Premier Miles does not give RPs on insurance payment.

Citi Prestige gives 1RP/Rs 100 on insurance.

@ Praveen,

You could always route it thru Paytm.

Also regarding Prestige, its 1 RP / 4 miles per 100. With a citigold relationship there is 30% bonus which means 5.2 miles /100. Depending on how you redeem , getting a value of min 1Re /mile isnt that difficult.

For eg, you could a DEL/BOM- Bali on SQ RT Business class for 78K miles. Assuming the cash price for this is 1.5L, you are getting close to 2X value.

Cheers

@Neo

Since 1 Jan 2020, Loading more than 10K in a month using credit cards attracts 1.75%+GST (= 2.065%) charges. This lowers the overall return.

Insurance payment over 10K gets into trouble.

@Praveen,

Citi has stopped giving any RP’s on Insurance spends on any of their Credit Cards.

@Aayush

Thanks for the input.

Nope… Removed a few weeks ago… You can pay insurance premia thro’ Paytm, but if you pay direct, no reward points (except for citi paytm card I think)

They discontinued giving rewards on Insurance, Transportation & Tolls, Utilities, Education and Government from 12th October 2019.

Hdfc infinia and db limits are 2k not 5k

@AK

MITC on HDFC website (Dec 2019 version) says it’s 5,000 RPs for Infinia/Diners Club Black.

2,000 RPs for other cards.

And this is per day limit.

Diners Black website says 2K. Will confirm with CC though I am sure they will be clueless as always

Dear sir,

In Infinia card max cap is 2000 points per day on insurance premium. Please check as you have mentioned 5000 points per day.

Regards,

Vipul

2000 points per transaction..not per day

It’s per day now, just not updated on the site. I have doubled checked with customer care.

Kotak is giving 10x offer on some of its variants:

Pay your Insurance

& Earn 10X* Reward Points!

With your Kotak Credit Card

Minimum Spends:

Rs. 5,000 and more

Maximum Reward:

5,000 Points

Starting from 15th Dec’19 to 31st March’20

Hi Jeevi

I have Kotak Royal card and I did got the offer of 5x. I have also HDFC infinia. I have to make the payment of 40k for lic insurance. Which one do you think will be profitable.

I guess it was 10x only on Kotak royal.

Sir,

It depends on your point usage. Kotak point is valued @0.20 and HDFC Infinia is @1.00.

Nipun

Got amex offer for paying insurance last year.

Waiting for it this year too. Hope to get it soon, add most insurance payments take place at year end. (FY)

There is this card called LIC CARD,(powered by AXIS) for signature variant it offers 2rp/100 spent on insurance payments for LIC

I received a mail today from sbi prime customer care wherein they have omitted to mention 20 RP/100 on utility bills on SI.

I have asked them again about it. I will confirm once I get any mail from them.

They called up and apologised for miscommunication. The reward points are still being given at 2rp/100

Best way to do insurance payments is to pay with your Amex platinum travel card, you get your closer to your milestone rewards 7000 MR for 2 lakhs and 10000 MR for 4 lakh spends. Also remember if you spend 4 lakhs you get 10000 rs worth Taj voucher which is a great win additional to the Bonus MR.

Just wanted to confirm whether NPS payment is also counted as insurance spends? If not, which card would be the best for the same?

I used HDFC Millenia Credit Card which gives 2.5% CB

I called up axis bank customer care and they told me that there is no such travel voucher scheme on my privilege credit card and that I will get 1 edge reward point on every 200 rupees spent so that is 0.25% return

No need to call CC , if you have privilege credit card, you can redeem the yatra travel voucher from axis mobile app itself. 6250 edge points for 2500 RS voucher.

Got this offer on ICICI today. Like always, need to register for this offer.

Pay insurance premium with ICICI Bank Credit Card & Get 2.5% cashback up to ` 1,000.

To participate in the offer, give a missed call on 7435005555 from your registered mobile

number.

Offer details:

Offer valid from Jan 10, 2020 to Mar 31, 2020

Received offer for 10X rewards on AMEX Plat Travel car, maximum one can acquire 5K rewards.

AMEX sent 10X rewards for insurance payments till March 2020 and capped as 5000 points which is equivalent to 25k spendings.

10 points per 100. Not 10x. So 5000 points on 50000

could you please share the link for amex 10X rewards for insurance payments

Paytm has started charging 2% on loading wallet using credit card. ☹️

5x promo on insurance spends going on with hdfc cards.

“Offer Valid from 16th Jan’ 2020 till 31st March 2020

Minimum Spend Amount in Insurance Rs 10,000/-

Max Cap of 2000 RPs per month per card”

Cheers

yes I got this offer. on payment of approx 60000/- they gave me 3600 rps. I would like to know from where you check these kind of offers so in future I can check it and will do my payment in the offer period.

I recharged it today morning and didnt got charged anything extra.

@Raj

These charges are applicable if u load beyond 10k. Indeed a bad move for RPs lovers. We can ask friends to add money in their wallets and transfer to help us and help them when they need.

@praveen Paytm has made a new card number tracking system , so if you use same card like suppose you have to spend 40k on amex card in a month so 10 k you did on your account and try to use in another Paytm account it reject the card by giving error like we have found this card being used in another Paytm account for usage, Paytm sucks now so mobikwik is better option to load upto 1lac and use their services same as paytm!

@ Hardik,

With recent paytm limiting max 10k wallet loading without charging ‘convenience’ fee it has become very difficult to make big payments with paytm.

Now that you mentioned that paytm tracks card usage on account, I will use a new card with only new paytm account only.

Hi Raj,

This is after crossing 10k limit and this was bound to happen sooner or later.

ICICI credit card offers 2.5% cashback capped at Rs.1000/- for insurance spends. Also, Amex has rolled out 10x reward points on insurance spends.

@Sid

Received 5x RPs on insurance spends (tagetted on one card with last 4digit mentioned), with minimum 10k trxn.

@Sid

Received SMS for 5x RPs on HDFC Regalia on Insurance spends (targeted with last digits mentioned), with minimum 10K spends, 2K max RPs per month, valid from 16 Jan – 31 Mar 2020, this makes return on my Regalia a sweet 6.5% in value.

I dont understand the Infinia Program. Did’t it end last month?

I believe that YFE / YFP / YFB offers the best RP on insurance payments. 1000 RP on regn and 5% cash back. This is followed by SBI prime which offers 20 points per INR100 (5% net) on registered bill payments. This is assuming no offers are in place. Your thoughts please.

@ S Padmanabhan,

As far as I get emails on my YFE, I would get Rs.250 Amazon voucher and 1000RPs on registering any payment, insurance in this case. Where does 5% cash back on YFE comes from ?

It’s just normal RPs after registration. @Sid am I missing something?

Praveen,

I am sharing relevant extract from their webpage.

Benefits :

Bonus Reward Points / Cashback

– 1000 Bonus Reward Points on each bill registered on YES FIRST Exclusive, YES FIRST Preferred and YES FIRST Business Credit Cards

– 500 Bonus Reward Points on each bill registered on YES Prosperity Edge, YES Prosperity Rewards Plus, YES Prosperity Rewards and YES Prosperity Business Credit Cards

– 5% Cash back on YES PayNow transaction of value INR 500 and above with a max cap of Rs 100 per statement cycle on YES Prosperity Cashback Plus & YES Prosperity Cashback Credit Cards

@ S Padmanabhan

What we are looking here is small returns, I will turn it into value and max payment for benefit all three category, (remember you would probably have one Yes card only)

– 1000 RPs = Rs 250 only

– 500 RPs = Rs 125 only

-5% capped at Rs 100 (not unlimited)

What point Iam trying to make is, you get max only 1.5%(YFE) or lesser using Yes Cards. Registration benefits are one time hence Iam not counting them. Also they r very less.

Hope it helps..!!

Praveen,

Thank you for your comments. I wanted to check the same. Going by the wordings the rs.100 capping is only for YES Prosperity Cashback Plus & YES Prosperity Cashback Credit Cardsandn ot YFE / YFP, which i believe should be 5% without capping.

Is NPS considered as insurance payment? Can someone please confirm?

Nope, I paid NPS using my Amex ( hoping for 5x promo), but got the usual points.

Thnaks for the blog

Thanks. It’s @Sid’s effort and such encouragement that help him keep this blog going.

Do we need to pay any convinience fee when using credit card for insurance payments?

I think amex charges some. This will not be mentioned on lic site. This fees Just gets added to our statement Just like reward point redemption fee gets added.

Can anyone confirm this?

Also, how to avail the 5x rewards points on hdfc using smartbuy offer?

There is no convenience fee when you use your card on LIC. Fee if any will be charged during the payment, not afterwards.

Since 1Dec 2019 there is no fee, I can confirm that. No fee even for Amex.

Time-to-time banks run 2x/3x/5x promo.. there is no such offer for insurance through smartbuy. Can you please tell where have you read about 5x through smartbuy for insurance payment??

Hope it helps.

Are there are any offers still going on (month of April)?

If an LIC agent makes payment using credit card.get 2%back.it can be a jackpot for them as they pay lot of premiums.

Your LIC agent is looking for 25% premium with new bakras for “jeevan ke saath bhi, jeevan ke baad bhi” 🙂 lol, for them 2% returns for paying bills may not be so attractive – they will spend that time instead minting the 25% commission (I’ve heard it’s 25% commission first year and 5-10% following years)

Can someone suggest which is the best card now for LIC payment considering LIC has zeroed all the credit card charges ? HSBC is running 5x reward points capped at 2000. Any other cards / thoughts ? Amazon ICICI card doesn’t provide that bandwidth (it’s limited to 1L in my case) ?

Better card suggestions?

@Vineeth

This article was written post ‘zeroing’ of all the charges by LIC.

The best card for LIC/Insurance depends on what card u have. If u wanna apply for a new card, this article can be a pointer to that as well.

Easy ones that I like are Axis Flipkart/ ICICI Amazon Pay (easy to get, no-hassle redemption).

HDFC Infinia/SC Ultimate are the best options. (Assuming u don’t breach 5000 RPs limit in case of Infinia, SC Ultimate has no such problem but comes with poor redemption choices).

Hope it helps.

How about using SBI SimplyClick to pay insurance on Amazon? does that yield 10x?

Yes, using Simply Click card to pay insurance using Amazon pay does yield 10x reward points (~2.5%). This makes it on par if not better than the premium cards! Definitely makes this card worth so much more.

Are you sure? I thought it said no 10x points for wallet/gateway spends done on partner sites?

I have max life term insurance with monthly payments. Amazon allows insurance payments with amazon pay balance. Does it make sense to use my DCB to buy amazon instant vouchers and do the insurance payments every month to earn 33%?

Yes, I feel it is worth ,taking the time and making the payment ,through the method you have suggested.

@Bhanu

Yes, it does make a lot of sense.

Only thing is that you cannot purchase more than 5K amazon vouchers from your DCB on Smartbuy, but even 5k from DCB is a handsome reward.

Others having large payments (yearly/half-yearly) can also think about buying 5k Amazon vouchers every month and accumulating it for such huge reward rate.

The 1% reward rate for ICICI Amazon Pay card is an under-estimation? You can earn 2% reward points by paying for insurance on Amazon? As of now, only Amazon Pay wallet / UPI is visible. So, this higher reward rate can be availed only within wallet limit of say 10000 Rs. But still within this limit, there seem to be more rewards than listed here. Ideally an additional payment option could also be listed – Amazon co-brand cards like the ICICI AmazonPay card. Would make it even better for card-holders

Any latest offers for insurance payments this month?

Amazon site now allows insurance premium payment. Can we use Amazon pay card to pay premium and earn 5% cashback in Amazon wallet for prime members ?

5% on ICICI Amazon card is applicable on orders(goods) on Amazon, not on insurance payments.

Recently i got Axis Ace card with very low limit like 40K this card gives 2% on spends, i am searching for a card which suits for me which can give the best rewards is there any card which wont charge more than Rs.1000/- as annual charge and get more rewards than above card which is good on insurance spends.

I have some upcoming insurance payments.. what are the best options for both credit and debit card ?

paytm citibank credit card gives 3% cashback on payment of insurance premium via paytm app.

@nsy

Paytm app charges above 2% for using credit cards, so it is not counted anyways

What about SBI air india card ?

What are the returns on insurance payments ? Is there any cap on sbi cards for payments ?

Does my Axis Vistara card give miles for insurance payments ? I though Axis had a cap or limit for insurance payment based rewards

there is an urgent need to update this article for present time considering many changes undergone so far.

thanks in advance.

It would be really great if this article is updated to today’s cards and returns

Thanks in advance