HDFC Bank recently added more benefits & privileges to the already most popular Diners Black and along with it raised the annual fee to Rs.10,000. That may not work out for all and still some cardholders might need better benefits compared to Diners Club Miles at an attractive fee, so I believe that’s how HDFC Diners Privilege came to the picture.

Diners Privilege is positioned a bit above Club Miles and below Diners Black. Its basically a trimmed down version of Diners Black and comes with 1/4th of its fee. Let’s see the benefits in detail.

Table of Contents

Joining Fees

- Joining/Annual Fee: 2,500 INR+GST (First Year Free usually)

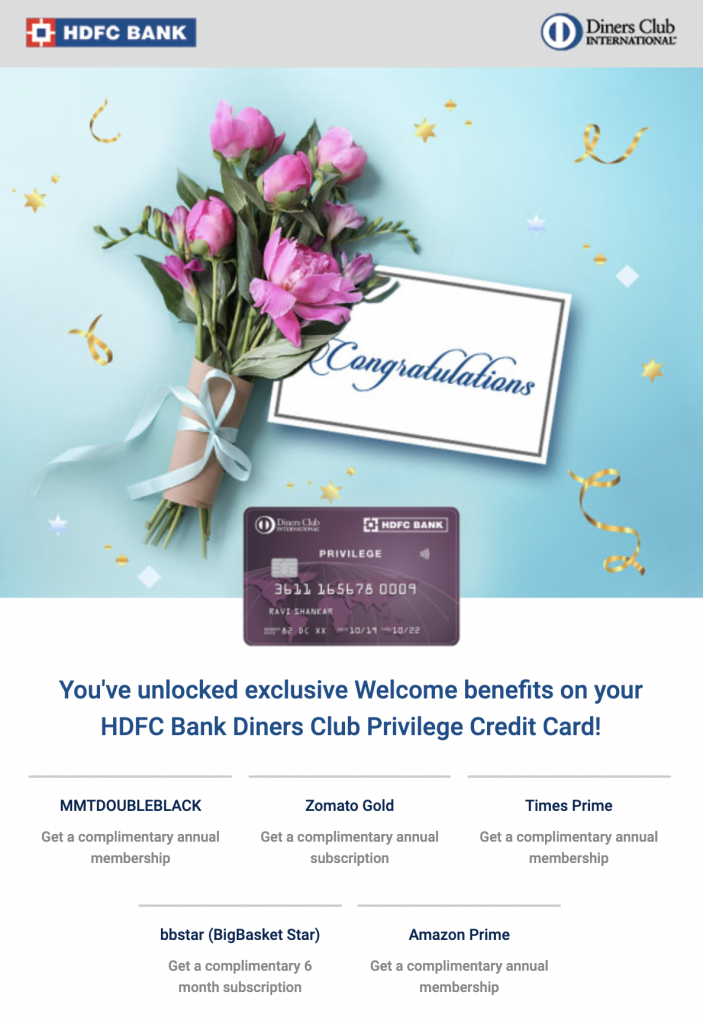

- Welcome Benefits: Complimentary memberships with Zomato Gold, Amazon Prime, Times Prime, Big Basket Star, MakeMyTrip Double Black (if fee is levied)

- Renewal Fee waiver: Spend Rs. 3L in 12 Months

Its indeed interesting to see that HDFC is moving the welcome benefit from reward points to memberships.

While Amazon Prime & Zomato gold is a good one among, rest brands aren’t attractive enough. But anyway you can get it as FYF and get renewal fee waiver based on spend.

Reward Points

Regular Rewards

- Earn 4 Reward Points for every Rs. 150/- spent

- 1 RP = Rs.0.50 for Hotels/Flights (1.3% Reward Rate)

- 2 RP = 1 Airmile (~1.3% Reward Rate)

- Accelerated Rewards: 10X Rewards – Smartbuy + Diners Partners (13% Reward Rate)

Its surprising to note that Diners Privilege – a superior card compared to Diners Club Miles has lower conversion ratio for Airmiles. Maybe HDFC decided to keep Club Miles exclusive for that reason.

Note: Max. Cap for 10X Diners Partners is 10,000 compared to 5000 for Club Miles.

Milestone Rewards

- Monthly Milestone: Complimentary choice of any 1 voucher can be availed amongst Ola Select membership or BookMyShow or TataCLiQ worth Rs. 500 every month on spends of Rs. 40,000 in a calendar month

- Yearly Milestone: Complimentary annual memberships can be availed from below partners upon achieving annual spend milestone of Rs 5 Lakhs at the time of card anniversary. Zomato Gold, Amazon Prime, MakeMyTrip Double Privilege, Times Prime, BigBasket Star.

So if you’re hitting the monthly milestone regularly, you get a net reward rate of ~2.3% which is pretty decent.

And its tough to put a % on Yearly milestone as some may or may-not use the membership benefits. So just consider it as an added advantage.

Airport Lounge Access

- Domestic & International: 12 Complimentary access / Calendar year

- Above limits are shared with add-on cards as well.

Remember that the credit card itself gives you access to lounges both within India & in foreign countries, so you don’t need to deal with another set of plastic.

Also, as Delhi & Bangalore got separate section for Diners Cardholders recently, it makes sense to hold a Diners Credit Card.

Golf Privileges

- 2 Complimentary Golf Games per Quarter

This is an unbelievable benefit to see on a credit card of this range as Golf games costs a lot for Banks that even Citi Prestige which is priced at Rs.20K annual fee had to revoke that benefit.

And given the usual restrictions in golf bookings, 2/qtr is more than enough for most people. But of-course this will stay only as long as not many uses it.

Other Benefits

- Foreign Exchange Markup fee: 1.99% + GST (get additional 1% cashback by enabling Global Value Program)

- Credit Shield: 9 Lakhs

How to Apply?

- New Application Eligibility: >6 Lakh Annual Income

- Upgrade: Limits above 2.5 Lakhs on existing HDFC card with good spends would help.

The new upgrade forms with Diners Privilege option is out, so if you need to apply for this new card, you may do so easily via branch.

Speaking about design, the card looks pretty good outdoors and bit dull indoors, similar to Axis Vistara Signature.

Note: Not to forget that the Diners Club network has acceptance issues especially outside India, so its safe to have a backup visa/mc.

Bottomline

- CardExpert Rating: 4.2/5 [yasr_overall_rating]

Overall an amazing card for a fee of this range, especially if you play golf. For those who’re unable to make it to Diners Club Black or unhappy with its high annual fee, this card makes sense as it comes with most of what Diners Black has to offer, except the higher reward rate and higher max cap. on 10X rewards.

Also, if you hold Diners Club Miles and trying to upgrade to Diners Black, this card might get you one step closer, among other parameters.

Did any of you upgrade your HDFC card to Diners privilege? Feel free to share your experiences in the comments below.

Hdfc site mentions 12 lounge access per calendar year

Updated, thanks.

Thanks for this review.

I am getting an option to get Either Regalia or Diners Club Privilege as Life time free.Which one would you recommend ?

LTF option? Interesting.

Diners Club Privilege would do in most cases. But go through both articles to make sure it fits you.

I too got regalia LTF. Been using it now for about 2 months. It was upgraded from JP Platinum.

HDFC stopped LTF since late 2019, maybe only on offline applications?

salary account holders get that benefit!

Is club privilege offered lifetime free? Can you share details on this please.

Yes, I had a Club Miles and was offered a LTF upgrade of Diners Privilege. Availed it around 2 months back (Note: I hold a Salary A/c)

How much was your credit limit when you got LTF offer for privilege card?

I got this card recently,upgraded to this from Regalia first card.I am holding Regalia first,since 6 months,and my credit limit was 2.75 lakhs,before upgrading to Diners privilege.Basically I wanted this card for the golf games,and the advantage with HDFC is that,you can book overseas golf games also.ICICI Rubyx and sapphire are other cards where you can book overseas golf games.I have Rubyx ,SBI Prime,Axis Select and Axis Flipkart cards also.But with prime and Select credit cards,you can’t book golf games in other countries.I will try to spend mainly on Diners privilege and Select credit cards and will change Prime card to Simply click credit card in the near future.

I applied for the Global value program with Diners card,but I didn’t get any response,before my trip to Dubai.I tried to use HDFC Rupay platinum debit card in Burj Al arab restaurant( Sahn Eddar),but it didn’t work,and Diners privilege card worked there.And I used my Diner’s privilege card for access to my wife,in Al Ahlan lounge in Dubai airport terminal 1 and they didn’t object.I used priority pass for myself.My wife has an add on Diner’s privilege card but I didn’t set the PIN for that,so couldn’t use that,and she forgot to bring her Diner’s club miles card with her,but the reception people were very courteous and they didn’t object when I gave my Diner’s card.The lounge is very good.

@Gopal

A lot of fellow enthusiasts including myself would like more insight on golf games, this is one benefit we may have but hardly use.

Can u please elaborate or write a small article on it.

@Sid, I request you to help all of us.

Thanks in advance.

@Sid and Gopal

I have a golf option on my two cards and I am very keen to avail this benefit as I am paying the fee for the card. Request you to kindly write a detailed article on this topic so that the entire CC users community can get the benefit.

Note:- I don’t know how to play the game but really interested to give it a try through CC.

I was offered this card as an upgrade to club miles and i agreed, without realising the air miles conversion rate. I regret it now and i probably will ask to be reverted back if they allow. I already have the JP Platinum card (jp is now intermiles) and SBI Visa Air India Signature. I only ever use my rewards for air travel and my points have been racking up with no travel because of Covid.

I decided to hold on Diners ClubMiles exclusively for the Vistara 1:1 transfers till I get a dedicated Vistara card.

Please tell us more about separate section for Diners. It used to exist few years back but seemed to have been discontinued.

On Diners/mastercard/pp , can addon user and primary user use the airport lounge on same day same time ?, given free access quota is not over? Asking mainly because mastercard gives same card number for hdfc.

Also, can I use same card for 6 hour lounge access same day ?

Thanks

Yes, it is possible for 2 people with the same card number to use the lounge at the same time.

I am not sure about Master Card, you can use same Diners and PP add on card along with primary card at same lounge in same time. It will debit 2 complimentary accesses from your card account.

I went to the Delhi T3 lounge a couple of weeks ago. There’s separate queues for Visa/Master and Amex/Diners, so people in the left queue tend to go to the left section and similar for ones on the right. I had DCB but I didn’t get the sense that only my queue was entitled to go to the new right section.

If u take the stairs or the elevator to the plaza premium in t3 3rd floor, the right one is reserved for business class and the left one is for normal/economy class. I had a economy class ticket but i asked them which card they want amex or master…they told me to give me the amex one and sent me to the right to the more premium one. The right lounge had definitely some premium feeling and sitting was also ok. They have seperate dining tables there and food was awesome. I accessed the lounge with my emralde amex card.

I have recently received my diners privilege card, but I can’t seem to add it to Uber. Does anyone else face this issue? Are diners cards not supported by Uber?

Recently I got this card as LTF. I’m a preferred baking customer since a year. 2 years back i had got a LTF moneyback card. And i used to ask for upgrade regularly at branch level. The people at branch used to tell me you’ll be eligible on the basics of ITR only. About a year back my account got upgraded to preferred because of good average balance. About a month back i just sent a mail to nodal officer requesting for upgrade. Boom within 15 days i got LTF Diners Privilege without any income docs.

I am facing an issue with this card..when i try to purchase anything through EMI option in Flipkart its showing ” This card is not supported “..but when i opt for full payment its accepting the card..Anyone facing the same issue with this card..??

I can confirm the same, but after clubmiles launch the same thing happened. Just wait before the new bin series of the Diners Privilege card gets updated in the flipkart database.

Great going, Sid! Really enjoy reading your reviews.

I’d applied for a DCP sometime in January but was declined stating “internal policy” without providing any specific information. Raised the matter further to the customer care mentioning the RBI guidelines to provide the reason for declining, but to no avail for several days, despite meeting the eligibility criteria listed on the bank’s website. Sent an e-mail thereafter to aditya.puri [at] hdfcbank.com and the priority redressal team did revert mentioning that they are re-looking into my application. It was finally approved towards the end of January.

Been reading your posts for a couple of months now and it’s indeed very informative. Keep up the good work, Sid!

HDFC has stopped issuing Regalia First and Diner ClubMiles. It also slashed the max rewards cap to 5000/month for all cards except Black. Is it now worth to get this Diners Club Privilege for 2.5k per year? Is there any other card which is better and has international lounge access in the price range of Regalia First? (1k per year annual charge).

Since when has the ClubMiles been stopped?

I just received mine a month ago. Split the limit on my regalia to get a clubmiles as well

Can you share from where you got the info regarding no fresh issuance of Regalia first card?

Both have been stopped from March,2020. I was informed from the branch as well as customer care. Right now there is no CC with international lounge access in the 1000Rs annual charge. Also DCP is devalued to give same 10x rewards as Miles card.

Times Prime subscription actually gets you complimentary 1 year of Swiggy Super + a few months of Gaana + some discounts on Uber, Insider, etc. so actually a good milestone benefit.

Extracted a very interesting information from the “Credit Card Upgrade Form” in HDFC forms centre website – just as a “Work from Home” gesture.

For renewal free waiver, the amount required to spend in a year, is actually, the Credit limit required in your existing card to get upgraded to that particular variant.

For example, for Renewal fee waiver, annual spends required are –

DCP/Regalia – 3 lakhs. The same limit is required to upgrade to DCP/Regalia.

DCB – 5 lakhs. The same limit is required to upgrade to DCB.

Infinia – 8 lakhs. The same limit is required to upgrade to Infinia.

Not necessarily they have rejected with twice the limit for upgrade. That’s my experience.

Cheers,

Kiran

Amidst the COVID-19, the guidlines by RBI to waive of Loan payment dates by 3months are applicable for Credit Card Payments as well?

Yes, but the outstanding amount will keep accruing interest and we all know how insanely high the same is for credit cards.

If at all it can’t be paid off completely, it is better to take loan at a lower interest rate and pay the CC outstanding in full

Hi KD,

Yes it’s applicable but you indirectly have to pay interest and other charges, only blackmark would not be done by credit card company,so better avoid this news and pay it as i would suggest!

It’s not applicable for credit cards as per RBI guidelines. It’s only applicable on Loans which has an EMI payable everymonth.

Credit card bills has to be cleared in full.

Cheers,

Kiran

It’s applicable for total outstanding due on credit cards also but not on the interest charged on that outstanding amount.

Thanks GT and Hardik.

I have just made the payment through debit card of my DCB Elite savings account for 1.6% cashback on Mobikwik. The sms says that the card has a payment made on account of POS transaction. My question is will this be considered for the 1.6% cashback via debit card online spends?

Yes it will be considered for the cashback KD and you will be able to verify the same in the next 5 days as DCB Bank processes cashback in the first week of the new quarter

You can load money into Kotak 811 or Airtel payments bank using DCB debit card. It will give 1.6% cashback.

Then you can pay DCB CC bill using UPI from either of bank accounts.

I am unable to pay the credit card bill via Mobikwik and Paytm for Diners Privilege using my DCB Elite Savings Account Debit Card.

Has anyone been able to pay their DCP bill via this same payment method successfully? Or is there any other option too with which I can make the bill payment using DCB Elite Debit card?

CRED stopped taking debit card payments almost 6 months back

You’re allowed to us debit card if the credit card bill is greater than 1 lakh.

Given the current situation, I am sure many of us will not be able to meet the annual spend criteria of DCB and will end up being charged the annual fee of Rs 10000. What should we do in such situations? HDFC Bank should ideally lower down the annual spend or suspend the annual charges for next 1 year at least. What should we do? Should we cancel the card that we are holding as 10000 annual charge is a huge amount .

Why dont you find som1 probably your friend who is in business. Lend him money via your credit card. It wont be that difficult to hit 8L including your spends. Im doing the same thing. Be sure to let him know about MDR charges.

New update on DCP dining RP – 1. 2X RP on dining valid only on Weekends, 2. RP capped at 500 RP per day.

Received a targetted offer on current DCP card of – Spend 69000 using your Credit Card xxXXXX from 3rd June to 30th June,2020 and get a voucher worth 2500 of your choice from Flipkart, Big bazaar, Amazon, Big basket, Myntra.

Surprise ! Credit limit on DCP is raised by a whooping 2 Lacs from the existing 3.XX Lacs straight into 5.XX Lacs territory within 6 months of upgrade from Clubmiles to DCP. Tried many things in the past to get limit enhancement like shifting to higher tax bracket, higher spends, upgrading savings account etc etc. , but making an FD & RD hits the most, as has been in my case.

ashish nikhare how did your limit go up ? what did you do ?

can you plz specify, I am being stucked with a limit for more then 4 years now tried everything, but nothing is working .. can u plz help

May be a new RD & a new FD triggered a limit increase. Also, Autopay enabling – autopay of CC total amount due + autopay (smartpay) of a new monthly insurance payment + debit card autopay (billpay) in HDFC bank website – may have helped.

Also, I noticed an interesting thing. May be, only i have noticed & is a personal/private opinion of mine. I had been offered both an Insta loan & a jumbo loan on my existing DCP card within the past 6 months. I rejected both loans & instead made an FD & an RD. This indirectly indicates an increase in funds / income and a decrease in liability. May be HDFC has such algorithm in considering limit increase. Understanding/Imagining HDFC internal algorithms is the key to limit increase & upgrades.

After limit increase in DCP by a massive > 2 lakhs within 6 months of issue of DCP card, card is now upgraded to Black today. Had sent the upgrade form to Chennai along with ITR & Computation sheet. Today in netbanking, the existing card limit on DCP is showing as Zero, and a new card is been shown starting with 3XXX in the Transferred card section. Atleast, now i am free from the curse HDFC had showered by devaluing DCP card, but 70% redemption limit still sucks !

It is insane that the one can not use their Diners privilege card for getting discounts in this year’s Prime day sale. I wonder what is the point of holding a premium card

Why? No discount for diners, it’s happening in every sale or specifically this sale?

Yeah I could also not avail the HDFC discount in the recent Amazon Prime Day Sale. I cannot still avail the HDFC discounts in Amazon but I can avail discounts in Flipkart. I dont know what the problem is. Maybe its because I just recently received the card on 2nd August.

I’m holding now hdfc moneyback credit card with 2.8lac limit,I wanted to upgrade to a better card(good rewarding one) my ITR is not more than 12lacs so I’m not eligible for regalia. Anyway my majority transactions are online so I thought of getting diner privilege card which has almost same perks as regalia (also my ITR is more than 6 lacs).so this upgradation is better move or not if anyone has other suggestions for better card than please let me know🙏,also when I downloaded hdfc credit card upgradation form it doesn’t have that diner privilege card written in that. Please reply and help me

Apply for any card even if you arent eligible. Say you apply for Regalia, suppose bank gives it to you.. nothing like that.. else on the call, u can tell them that you want Diner Privilege (for which u are anyway eligible)..

Hope it helps..

Thank you I’ll try

I am applying for HDFC Diners Privilege LTF via Alumni offer. The website doesn’t mention this, but recently seem to have offer 5% cashback via smart-buy (INR 2k per month).

how u are applying via branch or directly sending form to chennai

I have the contact of the person because of my Alumni friends who already have this card

I have applied via branch and got my card diners privilege ltf.

Hi,

I have a DInners Premium Card LTF. Is it better to upgrade to Privilage

Eligibility has been increased to 8.4L pa. for Self Employed and 70k for salaried indiduals.

how to make millennia card free for life time ?

Hi, I am currently holding Diners Premium card with a limit above 4 lakhs. HDFC Bank is offering an upgrade to “Diners Millenia” card. But I have never heard of this card before. Any idea about this ? I know about just the Millenia card. I cannot find Diners Millenia anywhere. I would like my card to get upgraded to Diners Privilege instead. How should I approach the bank for this ?

HDFC Diners privilege credit card missing from HDFC website. Any idea if HDFC stopped offering this card anymore? Is it being replaced by any other card?

Has HDFC discontinued the diners privilege card? It’s missing from the HDFC website.

How do the welcome benefits (Amazon prime, Zomato etc) get credited if i have opted this card as LTF? The T&C says i need to spend 75000 within 3 months to get those (irrespective of normal or LTF card). Can anybody using the card clarify this on how do i get the benefits

Hey Santosh, can you please tell me how did you get LTF privilege card ?

Thanks 🙂

Hi Deepak, Being an existing HDFC bank customer for few years, i got an option to choose one among 3 pre-eligible cards as LTF. Recently diners privilege also showed-up there so i opted for it. You get this option thru your netbanking login.

Is the contactless payment option working with Diners Privilege card. Coz from the last 3 months..my cards contactless feature fails to transact but chip and pin is working fine. Plz confirm as if it works for others I have to replace the card. Also I tried in Hdfc pos and icici pos too..nowhere contactless nfc is working. Thnx in advance.

you have to enable contactless transaction on net banking as per RBI guidelines

And how do I do that…I didn’t find any options for that.

Same here . My card is not working for contactless payments. I did not find an option in the netbanking portal to enable it either.

Upgraded to this card from Regalia First (2 years old). Card shown in NetBanking and likely to be delivered within 2 days.

Hi,

I have LTF diners premium CC with about 20K point. I got a offer to upgrade to diners privilege card.

Should I upgrade. They have not mentioned if it is LTF or not.

Thanks,

Alex

Read the article, compare the cards & decide for yourself. You can ask customer care whether or not it’s LTF

When do the Welcome Benefits get credited? I had already completed the eligible transactions long back, but still no intimation. HDFC Customer care is patheric, can’t connect to a human on phone, nor do they care about replying to email complaints/queries. If this continues, i would rather discontinue HDFC card

Finally HDFC implemented card management system in netbanking. Both CC and DC are included in request section under cards.

Has anybody received the Annual membership benefits,after spending more than 5 lakhs in the previous calendar year?I completed this and I have been waiting to receive the email or SMS regarding the annual membership benefits,like Amazon and Zomato but no response from HDFC.I called the customer care but they are pathetic and I am still trying to get them.

you will get annual membership benefits only at the renewal year not after spending 5L immediately.

This card has become useless. HDFC is offering it LTF to newer customers and we still have to meet the 3L annual spend criteria. Reward point accumulation has gone down as you only get cashbacks. Not worth paying the 3k annual fees.

Kidding me right???

Hi @sid I need your clarification

Spend based offers is available for diners card only hdfc direct card

Hi Sid,I did not receive Complimentary annual memberships that can be availed from below partners upon achieving annual spend milestone of Rs 5 Lakhs- Zomato Gold, Amazon Prime, MakeMyTrip Double Privilege, Times Prime, BigBasket Star. Could you please suggest what I can do ?

Hi Sid,

Received SMS stating your application processing is completed for application # 2C xxxx check after two days to track. but when i check online or their dumb EVA it says in process. Card was for LTF DCP but does not say on website. used to get SMS messages and when everi login to HDFC NEt it pops so though checking on 17th and found DCP was eligible as per data provided and below it said or as a HDFC customer DCP is Pre Approved.

Am as confused as their bank. no clear cut information . i will check on 19th and see if it is approved or not.

Thanks

How long does HDFC take for card approval? For me its been more than a week and status still shows pending. Also i haven’t got any sms/email saying the application is received. What can do further to know updated status.

Thanks

Hi Received today Diners Privilege Card with 3L Limit am suprised with limit thought they will give below 1L or 1.5L my only other card above 3L is Amazon icicipay . But i cannot see anywhere on welcome letter that this is LTF nor on Net banking. Checked it out on Dineout HDFC Cards get additional 10% for Diner Privilege over and above 25% plus if one has promo code . will ost my review on dine out again when i visit bangalore as mysore does not have many dine out restaurant but we have eazydiners tied up well in mysore restaurant.

Anyone can tell where we can find the card is LTF , so far i do not see any annual or joining fee levied on net . Yet Any way i have sent message to RM as he asked me to inform once card received. Let us see.. Amex i enjoyed it now time test Diners and Axis Vistara Visa Signature cards.

Bye for now

Hi Alok, True. Even i received this card under LTF, and it seems there’s no way to track if LTF benefit is applied , its not mentioned when we login nor on our statements. Even the RM just says it must be LTF if it was mentioned in the offer while applying.

I have kept the screenshots taken during my online application, where the eligibility criteria was mentioned to make it LTF, just in case if its required in future 🙂

Yup Me too Same taken screenshot

There is a way to track whether the card is LTF or not but might not be applicable for all. You can login to netbanking and click Redeem Reward Points and it will redirect to a different page (make sure pop up is not blocked). There you can click on My Rewards – Spend Promo details. If the annual spend criteria is mentioned, then it might not be LTF. If annual spend criteria is not mentioned (Rs 3 lakh), then it might be LTF. Spend Promo details might not be available on all accounts.

Suprising i received my first statment on 8th Feb all of a sudden and did not find any annual fee on it for the card. However am suprised they have not mentioned from when the stateent cycle starts . i always thought that from the first day of swipe is our statement cycle starts however in this case they sent within four days stating as i swiped the card first time on 26th Jan. very dicey hdfc bank no intimation nothing straight kill.

I have received the card last month, and have spent the stipulated 75000 rs and even cleared the bill. Now how do I claim the complimentary Amazon Prime Membership?

Today I also got upgrade offer from Millennia card to diners privilege card and i availed this offer.. My card’s limit is 1.96 lakhs & using HDFC card since Aug 2018.

You should update the review after HDFC’s change to lounge access. This should be bettet than Regalia now.

Hello i got diners privilige card recently but same as user stated above contactless feature is not working even though i have enabled it via netbanking. Also in payzapp wallet i m not able to load more than 2k in one attempt. Any one got a fix for this

Hello my diners privilege contactless feature is not working even though i have enabled it via netbanking what should i do?

Hi Siddarth,

I think HDFC Diners Privilage card memberships offered as a part of welcome and Annual benefits – Dineout passport phased out effective 01/02/2023 is replaced by A 3 Month Swiggy One Membership. HDFC has discontinued . Received email today as update .

Has any one received emails.

I have an HDFC Regalia card since the past 3 years. Does it make to ask for an upgrade to a DCP card or should I check for a DCB card upgrade?

Massive devalu of hdfc Diners Privilege from 1st Aug 2023